Defining Close Process Rules

This section provides an overview of close process rules and discusses how to:

Establish close rules.

Establish roll forward rules.

Establish closing sets.

Establish roll forward rule sets.

Establish close process groups.

Pages Used to Define Close Process Rules

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Close Rule |

GC_CLOS_RUL_PG |

|

Define a close rule and specify which ChartField value sets to close, and the ChartField values to which the closed amounts will be posted |

|

Close Rule - Notes |

GC_CLOS_RUL_NOTE |

|

Record details about a close rule. |

|

Close Rule Set |

GC_CLOS_SET_PG |

|

Define a set of close rules and specify the order in which they are processed. |

|

Close Rule Set - Notes |

GC_CLOS_SET_PG2 |

|

Record details about a close rule set. |

|

Roll Forward Rule |

GC_RFWD_RUL_PG |

|

Define roll forward rules to specify the accounts for which the system rolls forward balances. |

|

Roll Forward Rule - Notes |

GC_RFWD_RUL_NOTE |

|

Record details about a roll forward rule. |

|

Roll Forward Rule Set |

GC_RFWD_SET_PG |

|

Assign roll forward rules to a roll forward rule set and specify the order in which they are processed. |

|

Roll Forward Rule Set Notes |

GC_RFWD_SET_PG2 |

|

Record details about a roll forward rule set. |

|

Close Process Group |

GC_CLOS_GRP_PG |

|

Assign close rule sets and roll forward rule sets to consolidation tree nodes and specify the order in which the tree nodes are processed. |

|

Close Process Group - Notes |

GC_CLOS_GRP_NOTE |

|

Record details about a close group. |

Understanding Close Process Rules

The closing process closes accounts and rolls their balances forward.

The close process uses the following rules:

Close rules are used to close the account balance to a different target account.

Some examples include: closing net income into retained earnings, closing a year-to-date account into an inception-to-date account.

Roll forward rules are used to roll forward the account balances to the next period or year without changing any dimension values.

Similar to the way in which other consolidation rules are established, you define the individual rules, combine the rules into rules sets, and then define a group, which comprises one or more rule sets. You then associate the group with the consolidation model. In the case of close processing, the consolidation model uses the close process group to specify which ChartField values are involved in the close process.

If you are using flows, please note that close processing does not generate flow activity. The necessary flow amounts need to be entered manually using the journal flow input template. System-generated entries in elimination units that are either closed or rolled forward in trial balance modes should be placed onto manual flow templates—even if there is only one flow code needed—rather than on a system template.

Consolidation Ledger Format

When running the close process, you either run year-end or period-end processing, depending on the format of the consolidation ledger. Trial balance consolidation ledgers use year-end processing, whereas financial statement consolidation ledgers use period-end processing. Consequently, the consolidation ledger format determines how you set up the rules for close processing.

For trial balance-based consolidations, close processing is run at year-end only.

Balances are closed and rolled forward to the next year as period zero.

For financial statement-based consolidations, close processing is run at each period-end.

Balances are rolled forward to the next period. When processing the last period of the year, balances are closed and rolled forward to the first period of the next year.

Note: The ledger format option is established on the Ledger Template- Consolidation Variables page (either trial balance or financial statement). The ledger format determines which fields are available for entry in the close rule process pages.

This table summarizes the setup required depending on the consolidation ledger format:

|

Consolidation Method |

Close Process Rule Setup |

Elimination Entries |

Run Control Options |

|---|---|---|---|

|

Trial Balance |

Compete both the roll forward and close rule setup. |

Select the Include Elimination Entities check box for roll forward balances on the Close Process Group page if you are tracking flow activity on the elimination entities. For elimination entities, only system-generated entries are reversed in the following period. |

Enter fiscal year. You can perform year end processing only. No period processing. You have a request type choice of Close/Roll Forward or Delete. |

|

Financial Statement |

Typically only the roll forward rules are setup. Use the Close rule setup if you want to close certain accounts. For example, you may want to close current year investment account into prior year investment account. |

Do not select the Include Elimination Entities check box on the Close Process Group page. Warning! You should not roll forward elimination entities balances for Financial Statement based consolidation models. For elimination entities, only non-system-generated entries are processed. |

Enter the period and fiscal year. You have a request type choice of Close/Roll Forward, Roll Forward Only, or Delete. |

Source Values Related to Close

Ledger entries that the system generates when you run the close process are identified by the GC_SOURCE field values of 9A, 9B, 9C, or 9D.

The following table describes these GC_SOURCE field values:

|

GC_SOURCE |

Description |

|---|---|

|

9A |

Closing Entry The data originates from the closing process. These entries represent the balances that are closed into the target accounts by the close process. |

|

9B |

Roll Forward Entry The data originates from the closing process. These entries represent the balances that are rolled forward by the close process. |

|

9C |

Elimination Reversal – Closing The data originates from the closing process. These entries represent the reversal amounts booked to period 1 for elimination entity amounts closed during year-end close process. These entries are only created for system-generated amounts in the trial balance ledger format. |

|

9D |

Elimination Reversal – Roll Forward The data originates from the closing process. These entries represents the reversal amounts booked to period 1 for elimination entity amounts rolled forward during year-end close process. These entries are only created for system-generated amounts in the trial balance ledger format. |

Rolling Forward Elimination Entities

For the Trial Balance ledger format, when processing eliminations for period 1, both the period 0 (beginning) balance and the period 1 activity are eliminated with a single entry booked to period 1. The end result is that everything is properly eliminated when looking at consolidated period 1 balances. But, when examining just the activity/flow for period 1, the consolidated amounts do not net to zero.

Consider the following example, where a pair of business units has a 1,000 EUR intercompany payable/receivable balance at year end, and an additional intercompany activity of 500 EUR in period 1 of the next year.

Note: GC Source codes are listed next to each number: 01 = Source Ledger, 04 = InterCo Elims, 9x = Close processing.

See Global Consolidations Source Codes.

This is what the ledger looks like if the elimination entries are NOT rolled forward:

|

Intercompany Payables |

Intercompany Receivables |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Period 0 |

Source Code |

Period 1 |

Source Code |

YTD |

Period 0 |

Source Code |

Period 1 |

Source Code |

YTD |

|

|

BU 1 |

-1000 |

01 |

-500 |

01 |

-1500 |

|||||

|

BU 2 |

1000 |

01 |

500 |

01 |

1500 |

|||||

|

Elim |

1500 |

04 |

1500 |

-1500 |

04 |

-1500 |

||||

|

Total |

-1000 |

1000 |

0 |

1000 |

-1000 |

0 |

Note that the total nets to zero when viewed as a year-to-date balance, but the period 1 activity does not net to zero.

This example displays the ledger with elimination entries that are rolled forward:

|

Intercompany Payables |

Intercompany Receivables |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Period 0 |

Source Code |

Period 1 |

Source Code |

YTD |

Period 0 |

Source Code |

Period 1 |

Source Code |

YTD |

|

|

BU 1 |

-1000 |

01 |

-500 |

01 |

-1500 |

|||||

|

BU 2 |

1000 |

01 |

500 |

01 |

1500 |

|||||

|

Elim |

1000 |

9B |

-1000 1500 |

9D 04 |

1500 |

-1000 |

9B |

1000 -1500 |

9D 04 |

-1500 |

|

Total |

0 |

0 |

0 |

0 |

0 |

0 |

Both the year-to-date and period 1 activity amounts are completely eliminated.

Steps for Setting Up and Processing Closing and Roll Forward Rules

The steps for setting up and viewing close process rules:

Define close rules.

Assign close rules to close rule sets.

Set up roll forward rules.

Assign roll forward rules to roll forward sets.

Assign close rule sets and roll forward rule sets (tied to a consolidation dimension, such as ledger business unit) to a close process group.

Assign the close process group to a consolidation model.

Run the close process application engine.

Year end processing (trial balance based consolidations).

Period end processing (financial statement based consolidations).

Period locking available from the run control page.

Review the close process status with the consolidation manager.

Review close amounts and roll forward balances with reports.

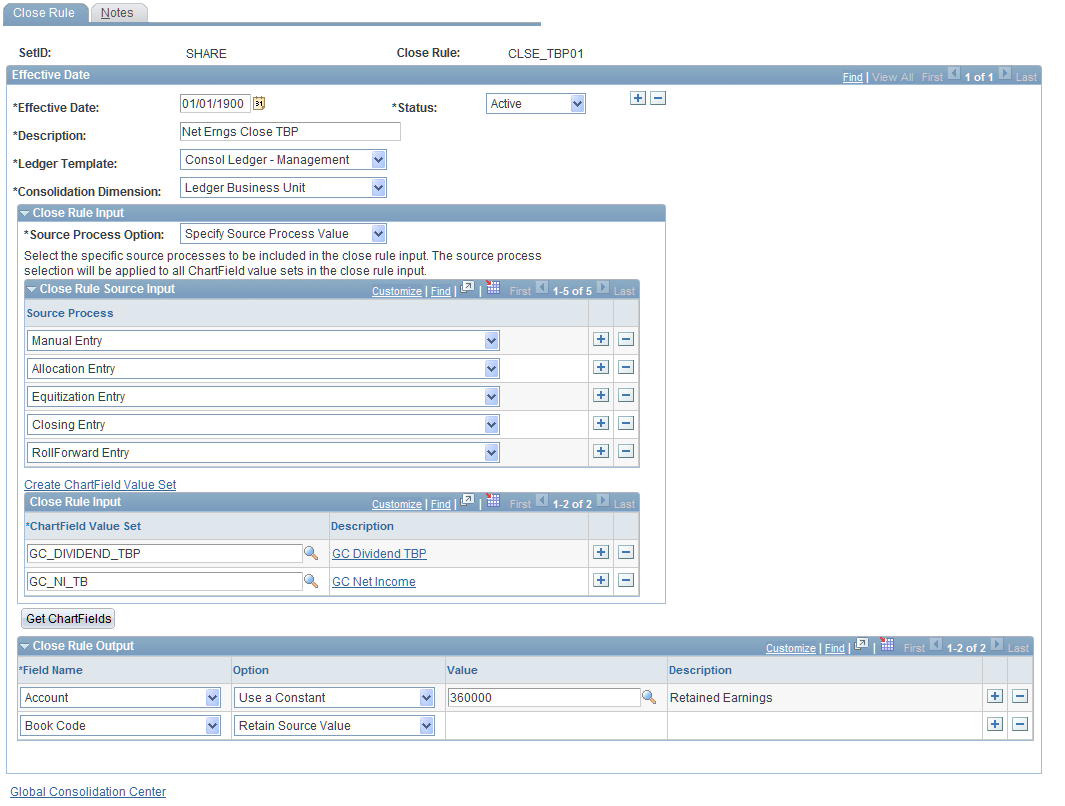

Close Rule Page

Use the Close Rule page (GC_CLOS_RUL_PG) to .define a close rule and specify which ChartField value sets to close, and the ChartField values to which the closed amounts will be posted

Image: Close Rule page

This example illustrates the fields and controls on the Close Rule page . You can find definitions for the fields and controls later on this page.

Close Rule Input

Close Rule Source Input

The Close Rule Source Input grid is active if you select to Specify Source Process Value as your source process option.

You can identify the consolidation source processes (data sources) that you want to use as input for the closing process rule setup. Add a row for each source process you want to add as input for the close rule. For example, you may want to specify Manual Entry as a source process to include as input for any manual journal entries you want to capture in your closing rule.

Close Rule Input

Define the set of accounts to close by specifying one or more ChartField Value Sets from the prompt table. Typically, the ChartField value sets you select are based on income statement accounts because this is a close rule. However, the close rule can also be used for balance sheet accounts, such as closing a year-to-date account into an inception-to-date account.

If the ChartField value set you want is not available from the prompt table, click the Create ChartField Value Set link to access the ChartField Value Setup page and create the ChartField value set you require for your close rule setup.

Close Rule Output

The Close Rule Output grid defines which specific dimensions (ChartFields) will receive the closed amounts. Specify the field names (ChartField values), the output options, and the value for the selected field names (ChartField values). Insert a row for each ChartField value that you want include in your rule; Account is required.

Click Get ChartFields to populate the Close Rule Output grid with all of the valid ChartField values.

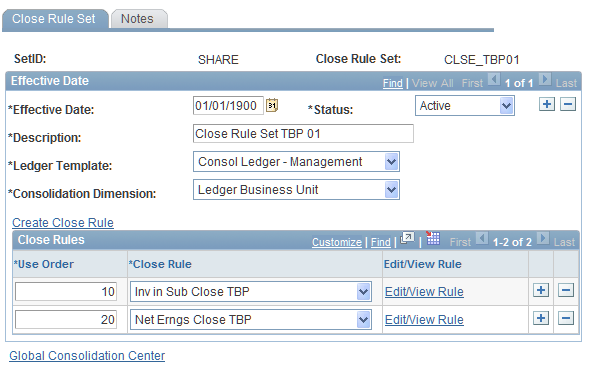

Close Rule Set Page

Use the Close Rule Set page (GC_CLOS_SET_PG) to define a set of close rules and specify the order in which they are processed.

Image: Close Rule Set page

This example illustrates the fields and controls on the Close Rule Set page. You can find definitions for the fields and controls later on this page.

Rules

Use the Rules grid to assign close rules to the closing set and specify their processing order.

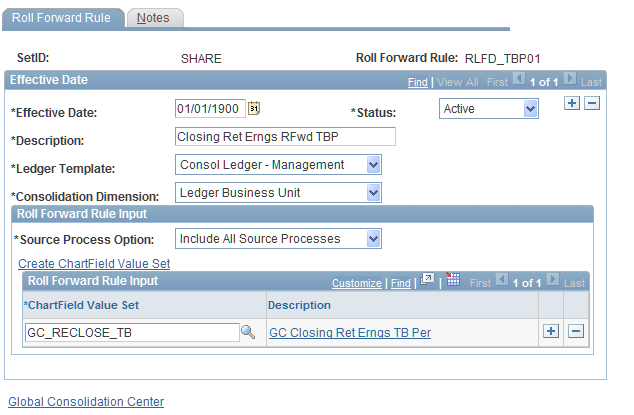

Roll Forward Rule Page

Use the Roll Forward Rule page (GC_RFWD_RUL_PG) to define roll forward rules to specify the accounts for which the system rolls forward balances.

Image: Roll Forward Rule page

This example illustrates the fields and controls on the Roll Forward Rule page. You can find definitions for the fields and controls later on this page.

Roll Forward Rule Input

Specify the global consolidations source data processes and ChartField Value sets to be included in the roll forward rule process.

Specify the source processes you want to include for the rule in the Roll Forward Rule Source Input grid if you use the Specify Source Process Value option.

Roll Forward Rule Source Input

The Roll Forward Rule Source Input grid is active if you select Specify Source Process Value as your source process option.

You can identify the source processes you want to use as input for the roll forward process rule setup. Add a row for each source process you want to add as input for the roll forward rule. For example, you may want to specify Manual Entry as a source process to include as input for any manual journal entries you want to capture in your roll forward rule.

Roll Forward Rule Input

Define the set of accounts to use as input for the roll process rule by specifying one or more ChartField Value Sets from the prompt table. Typically, the ChartField value sets you select are based on income statement accounts because this is a part of the closing process.

If the ChartField value set you want is not available from the prompt table, click the Create ChartField Value Set link to access the ChartField Value Setup page and create the ChartField value set you require for your close rule setup. Alternatively, you can click the Description link to edit or view the existing ChartField value set.

| ChartField Value Set |

Select the ChartField Value Set for your roll forward rule input. |

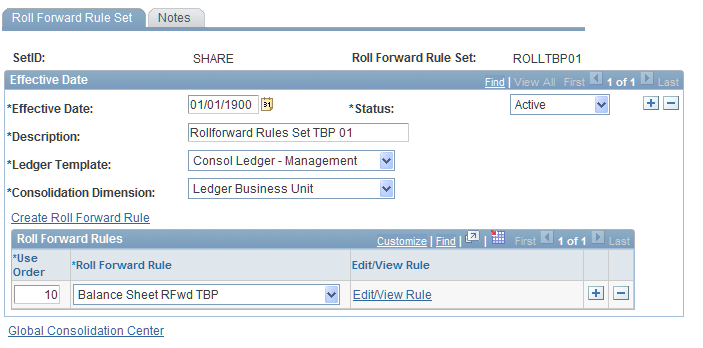

Roll Forward Rule Set Page

Use the Roll Forward Rule Set page (GC_RFWD_SET_PG) to assign roll forward rules to a roll forward rule set and specify the order in which they are processed.

Image: Roll Forward Rule Set page

This example illustrates the fields and controls on the Roll Forward Rule Set page. You can find definitions for the fields and controls later on this page.

Roll Forward Rules

Use the Roll Forward Rules grid to assign your roll forward rules to the roll forward rule set.

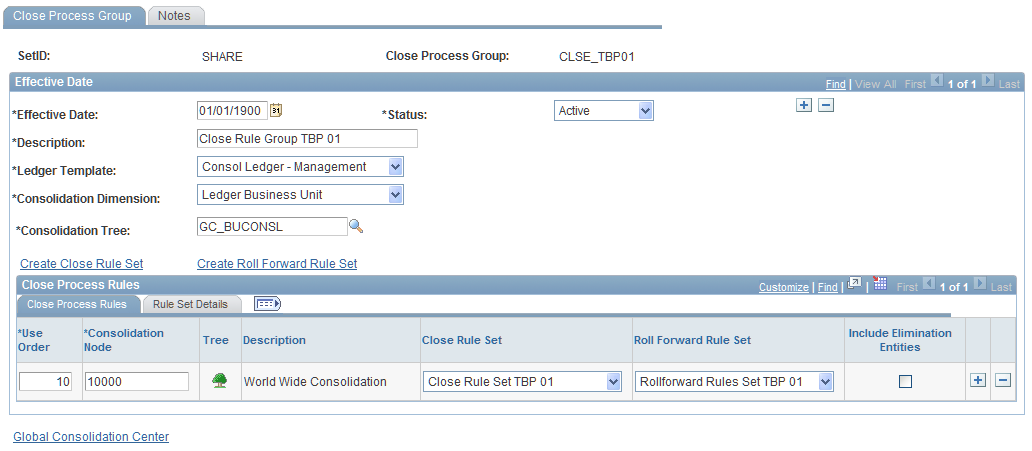

Close Process Groups Page

Use the Close Process Group page (GC_CLOS_GRP_PG) to assign close rule sets and roll forward rule sets to consolidation tree nodes and specify the order in which the tree nodes are processed.

Image: Close Process Group page

This example illustrates the fields and controls on the Close Process Group page. You can find definitions for the fields and controls later on this page.

Close Process Rules

Use the Close Process Rule grid to assign close rule sets and roll forward rule sets to a consolidation tree node and to specify the order in which the nodes should be processed. Insert rows if you need to include multiple tree nodes and their close rule sets and/or roll forward rules. The close process group is assigned to the consolidation model.

Note: If the close rule set or roll forward rule set is left blank, then no rules are assigned to that tree node. The system has edits in place to prevent a close rule set from being input without specifying a roll forward rule set. A roll forward rule set can stand alone, but a close rule set cannot.

Set Details

Select the Set Details tab to view and edit the selected close rule and roll forward rule sets.