Defining Currency Mapping Rules

This section discusses how to:

Establish currency rules

Establish currency groups

Note: The system does not support multiple base currencies for a consolidation ledger. To process consolidations in multiple base currencies, create additional scenarios for each base currency.

Pages Used to Define Currency Mapping Rules

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Currency Rule |

GC_CURR_RULE |

|

Define which exchange rate type to use to convert specified account balances to those of the consolidation base currency. |

|

Currency Rule - Notes |

GC_CURR_NOTES |

|

Enter notes about the currency rule. |

|

Currency Group |

GC_CURR_GRP_TBL |

|

Define the group of currency rules to use to convert account balances to the consolidation base currency and specify if you want to record adjustments to balance the ledger after conversion. |

|

Currency Group - Adjustment |

GC_CURR_GRP_ADJ |

|

Specify the account used for posting any adjustments, if needed, to balance the ledger business unit after currency conversion. |

|

Currency Group - Notes |

GC_CURR_GRP_NOTES |

|

Enter notes about a currency group. |

Converting to a Common Base Currency

PeopleSoft Global Consolidations can consolidate data from source ledgers that use currencies other than the consolidation currency. Currency mapping rules translate amounts from source ledgers into a common consolidation reporting currency. You can also consolidate in more than one reporting currency by creating a scenario for each currency.

Subsidiary ledgers are converted to a base consolidation currency prior to the consolidation process as part of ledger preparation processing. This occurs after the ledgers are converted to the common consolidation calendar and the common consolidation chart of accounts. This means that you can set up currency conversion rules that are based on the common consolidation chart of accounts. The mapped ledger (MLED) stores ledger amounts in multiple currencies, so you can audit and track the translated account balances; the original account balance and currency are preserved. The source ledger's base currency amounts are converted to the consolidation currency using the defined currency mapping rules and exchange rates.

Currency conversion is computed by using this method:

The system obtains the number of decimal positions for the consolidation base currency from the Currency Code table (CURRENCY_CD_TBL).

This is used for rounding.

The Source Base Currency Amount is multiplied by the RATE_MULT amount from the Market Rate table (RT_RATE_TBL).

The result of the multiplication is divided by the RATE_DIV amount from the Market Rate table.

The result is rounded to the number of decimals defined for the currency in the Currency Code table.

Potentially, as a result of currency conversion, the ledger may be out of balance due to rounding or due to using different exchange rates for balance sheet accounts versus equity accounts. If so, the system generates the appropriate translation adjustments automatically. To balance the ledger, the system sums together all the account balances for a specific ledger business unit combination. If the result is not zero, then an adjustment is recorded to the account specified in the associated currency mapping rule.

Each ledger business unit is balanced independently of the other ledger business units that comprise the consolidation ledger. Each ledger business unit is adjusted separately as needed. The adjustment is recorded directly into the consolidation ledger with a source code of (02) Currency Conversion Adjustment for source data (01). The adjustment is recorded with source code of (2A) Currency Adjust - Manual Entry for manual source data (1A),

This table lists required fields for currency conversion. The system uses these fields to generate an audit trail and to navigate to the source data:

|

Required Field Within the Mapped Ledger (GC_MLED_MGT_TBL) |

Description |

Populated By |

|---|---|---|

|

GC_SRC_TRAN_CURR |

The currency in which the source ledger transaction amount is recorded. |

Ledger Mapping |

|

GC_SRC_TRAN_AMT |

The source ledger transaction amount. |

Ledger Mapping |

|

GC_SRC_BASE_CURR |

The source ledger base currency. |

Ledger Mapping |

|

GC_SRC_BASE_AMT |

The transaction amount converted into the base currency. |

Ledger Mapping |

|

GC_CONSOL_BASECURR |

The consolidation ledger base currency. |

Currency Conversion |

|

GC_CONSOL_BASE_AMT |

The source ledger's base currency amount converted to the consolidation base amount. |

Currency Conversion |

|

RT_TYPE |

The currency rate type. |

Currency Conversion |

|

RATE_MULT |

The currency exchange rate multiplier. |

Currency Conversion |

|

RATE_DIV |

The currency exchange rate divisor. |

Currency Conversion |

|

GC_CURR_RULE_ID |

The currency conversion rule ID. The audit utility uses this ID to navigate to the rule that was used to convert monetary amounts for this account. |

Currency Conversion |

Regardless of how many transaction currencies the source ledger contains, the system moves only two currencies into the consolidation ledger after the ledger preparation process is complete:

The consolidation ledger's base currency and its corresponding amount.

The source ledger's base currency and its corresponding amount.

This table lists the fields for currency conversion for the consolidation ledger:

|

Currency Field within the Consolidation Ledger (CLED) |

From the Mapping Ledger (MLED) (For the row where currency code is equal to the source base) |

From the Mapping Ledger (MLED) (For the base currency row if the source base not equal to consolidation base) |

|---|---|---|

|

CURRENCY_CD |

Source currency |

Consolidation currency |

|

BASE_CURRENCY |

Consolidation currency |

Consolidation currency |

|

POSTED_TOTAL_AMT |

Sum of source base PERIOD amount |

Sum of consolidation base amount (Source base PERIOD amount converted) |

|

POSTED_BASE_AMT |

Sum of consolidation base amount (Source base PERIOD amount converted) |

0 |

|

POSTED_TRAN_AMT |

Sum of source base PERIOD amount |

0 |

The system requires that the structure of all source ledgers follow these standards:

Debits are stored as positive numbers (+) and credits are stored as negative numbers (–).

Specifically for trial balance format source ledgers, there should not be an equity account that stores YTD retained earnings.

Instead, the system derives YTD retained earnings on the balance sheet from the total of the revenue and expense accounts.

Period 0 (beginning balances) must be supplied for trial balance format source ledgers.

When ledger preparation is run for the common consolidation business unit for accounting period 1, period 0 (beginning balances) is also prepared and loaded into the consolidation ledger. The currency conversion and balancing of period 1 is done separately from period 0. For other accounting periods, only that specific accounting period is processed.

Currency Mapping Example

In this example, the subsidiary ledger contains multiple currencies—including entries for the consolidation currency—but the base currency of the source ledger is not the same as the consolidation currency. The consolidation currency is USD. The base currency of the source ledger is EUR. The fields within the source ledger, mapped ledger, and consolidation ledger appear in these tables.

This table depicts a trial balance-based source ledger (SLED):

|

Business Unit |

Account |

Foreign Currency Code |

Foreign Currency Amount |

Base Currency Code |

Base Currency Amount |

|---|---|---|---|---|---|

|

SUB1 |

100002 |

CAD |

250.00 |

EUR |

202.50 |

|

SUB1 |

100002 |

EUR |

120.00 |

EUR |

120.00 |

|

SUB1 |

100002 |

USD |

80.00 |

EUR |

79.96 |

|

SUB1 |

100003 |

CAD |

-250.00 |

EUR |

-202.50 |

|

SUB1 |

100003 |

EUR |

-120.00 |

EUR |

-120.00 |

|

SUB1 |

100003 |

USD |

-80.00 |

EUR |

-79.96 |

First, ledger mapping takes place, and these fields are mapped:

The source Foreign Currency Amount field maps to Source Tran Amount.

The source Foreign Currency Code field maps to Source Tran Currency.

The source Base Currency Amount field maps to Source Base Amount.

The source Base Currency field maps to Source Currency.

Note: The Foreign Currency Amount is from the POSTED_TRAN_AMOUNT field, and the Base Currency Amount is from the POSTED_BASE_AMT field.

Next, currency conversion converts the source base amount to the consolidation currency, and stores these details for each row in the mapped ledger (MLED):

Consolidation currency.

Consolidation base amount.

Rate type, rate multiplier, and rate divisor used to convert.

The source base amount is converted even when the Source Tran Currency field value is the same as the consolidation currency.

This table depicts the mapped ledger (MLED):

|

Source Tran Currency |

Source Tran Amt |

Source Base Cur |

Source BaseAmt |

Cons Base Cur |

Cons Base Amt |

Market Rate Type |

Rate Multiplier |

Rate Divisor |

|---|---|---|---|---|---|---|---|---|

|

CAD |

250.00 |

EUR |

202.50 |

USD |

198.52 |

Average |

0.980332 |

1.000000 |

|

EUR |

120.00 |

EUR |

120.00 |

USD |

117.64 |

Average |

0.980332 |

1.000000 |

|

USD |

80.00 |

EUR |

79.96 |

USD |

78.39 |

Average |

0.980332 |

1.000000 |

|

CAD |

-250.00 |

EUR |

-202.50 |

USD |

-198.52 |

Average |

0.980332 |

1.000000 |

|

EUR |

-120.00 |

EUR |

-120.00 |

USD |

-117.64 |

Average |

0.980332 |

1.000000 |

|

USD |

-80.00 |

EUR |

-79.96 |

USD |

-78.39 |

Average |

0.980332 |

1.000000 |

During the consolidation ledger load phase, these actions occur:

An aggregation process creates the consolidation ledger. This process summarizes on these fields: ChartFields, source base currency, and consolidation currency.

The source ledger's account balances are identified in the consolidation ledger with the addition of a unique source code.

The source ledger's base currency is recorded as follows for each account or ChartField:

Currency Code contains the source ledger's base currency code.

Base Currency contains the consolidation base currency code.

Posted Tran Amt is the sum of all Source Base Amount values.

Posted Base Amt is the sum of all Cons Base Amount values.

Posted Total Amt is the sum of all Source Base Amount values.

The consolidation base currency is recorded in a unique row for each account or ChartField, only if the consolidation base currency is different from the source ledger's base currency.

Currency Code and Base Currency both contain the consolidation base currency code.

Posted Tran Amt is zero, and Posted Base Amt is zero.

Posted Total Amt is the sum of all Cons Base Amount values.

This table depicts the rows that are added to the consolidation ledger (CLED):

|

Scenario |

Source Code |

Account |

Cur Cd |

Base Cur |

Posted Tran Amt |

Posted Base Amt |

Posted Total Amt |

|---|---|---|---|---|---|---|---|

|

USCONS |

01 |

10002 |

EUR |

USD |

402.46 |

394.55 |

402.46 |

|

USCONS |

01 |

10002 |

USD |

USD |

0 |

0.00 |

394.55 |

|

USCONS |

01 |

10003 |

EUR |

USD |

-402.46 |

-394.55 |

-402.46 |

|

USCONS |

01 |

10003 |

USD |

USD |

0 |

0.00 |

-394.55 |

Currency Rule Page

Use the Currency Rule page (GC_CURR_RULE) to define which exchange rate type to use to convert specified account balances to those of the consolidation base currency.

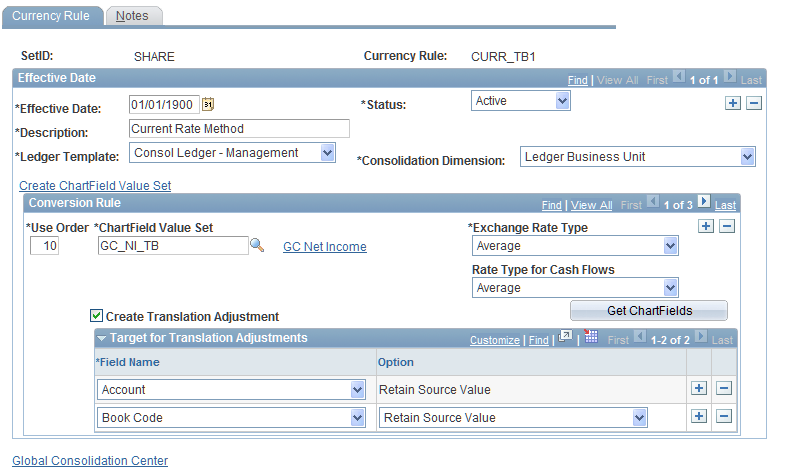

Image: Currency Rule page

This example illustrates the fields and controls on the Currency Rule page. You can find definitions for the fields and controls later on this page.

Insert rows as needed into the Conversion Rule grid to define the exchange rate type used for a particular set of ChartField values (accounts) during currency conversion. For each row, complete these fields:

The rate type selections allow you to track flows for both cash flow reporting and footnote disclosures. For example, you might record fixed asset acquisitions at a current rate for footnote disclosure purposes and at an average rate for cash flow. Global Consolidations records the flow amount at both rates for reporting purposes.

Click the Edit/View ChartField Value Set link to review or modify the associated ChartField value set definition.

Specifying Targets for Translation Adjustments

Currency Group pPage

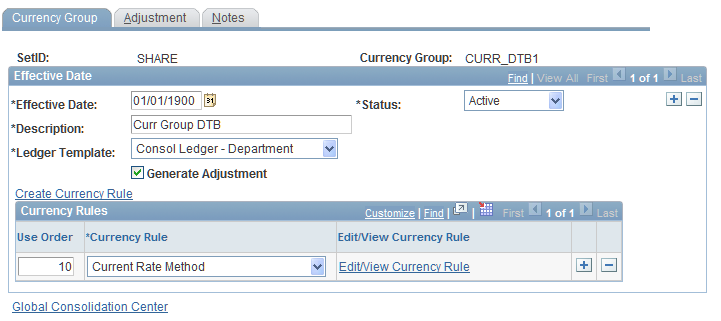

Use the Currency Group page (GC_CURR_GRP_TBL) to define the group of currency rules to use to convert account balances to the consolidation base currency and specify if you want to record adjustments to balance the ledger after conversion.

Image: Currency Group page

This example illustrates the fields and controls on the Currency Group page. You can find definitions for the fields and controls later on this page.

Specifying Where to Record Adjustments

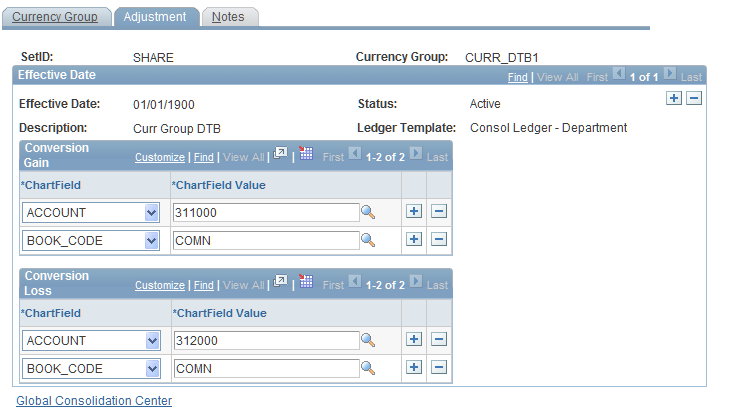

Use the Currency Group - Adjustment page (GC_CURR_GRP_ADJ) to specify the account used for posting any adjustments, if needed, to balance the ledger business unit after currency conversion.

Image: Currency Group - Adjustment page

This example illustrates the fields and controls on the Currency Group - Adjustment page. You can find definitions for the fields and controls later on this page.

If you select the Generate Adjustment option on the Currency Group page, use the fields on this page to indicate where to record any adjustments. Each business unit-ledger combination is balanced independently of the other business unit ledgers that are being consolidated, and each ledger business unit receives a separate adjustment as needed.

The conversion gain and conversion loss accounts specified on the Currency Group page are really used as a way to capture all out-of-balance entries. The various situations that could case entries into the accounts specified on the Currency Group - Adjustment page include:

True translation gain/loss.

Per FASB52 requirements, some accounts are translated at the average rate, some at the closing rate, and some at an historic rate. Because of this, an adjustment is needed to balance the ledger after translation.

Rounding.

Theoretically, even if all accounts were translated at the same rate, there could be a small rounding adjustment needed to balance the final ledger.

Out of balance.

If the ledger is out of balance to begin with, or if the currency rules do not pick up all accounts, then the resulting ledger may need an adjusting entry to bring it into balance. This could occur even if no currency translation takes place (for example, the source base currency and the consolidation currency are the same).

Any combination of the above.