Defining Non-Controlling Interest Rules

This section provides an overview of non-controlling interest eliminations and discusses how to:

Establish non-controlling interest rules.

Establish non-controlling interest sets.

Establish non-controlling interest groups.

Pages Used to Define Non-Controlling Interest Rules

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Non Controlling Interest Rule |

GC_NCI_RUL_PG |

|

Define a non-controlling interest rule and identify the source ChartField value sets for the subsidiary equity and parent investment accounts. |

|

Non Controlling Interest Rule - Elimination |

GC_NCI_RUL_PG6 |

|

Specify the target ChartField values that the system uses to eliminate the parent investment, eliminate the subsidiary equity corresponding to the parent investment, eliminate (or adjust) the subsidiary equity for non-controlling interest, and book (or adjust) the non-controlling interest liability. |

|

Non Controlling Interest Rule - Out of Balance |

GC_NCI_RUL_PG3 |

|

Identify to which ChartFields you want to record any out of balance amounts that result from non-controlling interest eliminations. |

|

Non Controlling Interest Rule - Tolerance |

GC_NCI_RUL_PG4 |

|

(Optional) Specify the tolerance rule to use while processing non-controlling interest eliminations. |

|

Non Controlling Interest Rule - Notes |

GC_NCI_RUL_PG5 |

|

(Optional) Record details about a non-controlling interest rule. |

|

Non-Controlling Interest Set |

GC_NCI_SET_PG |

|

Associate ownership sets with non-controlling interest rules to calculate the non-controlling interest amount and identify the set of non-controlling interest eliminations that should be generated for a group of subsidiaries. |

|

Non-Controlling Interest Set - Notes |

GC_NCI_SET_PG2 |

|

Record details about a non-controlling interest rule set. |

|

Non-Controlling Interest Group |

GC_NCI_GRP_PG |

|

Define the non-controlling interest rule sets that comprise a non-controlling interest group and the order in which to process them. |

|

Non-Controlling Interest Group - Notes |

GC_NCI_GRP_PG2 |

|

Record details about a non-controlling interest group. |

Understanding Non-Controlling Interest Eliminations

Use non-controlling interest (NCI) rules to eliminate subsidiary equity against parent investment and to account for the investment of non-controlling interests in the subsidiary. In consolidating the books of a subsidiary with those of the parent company, you credit the parent with the portion of the subsidiary that it actually owns and exclude what outside investors own. The system reports the value of non-controlling interests in terms of the aggregate net assets rather than in terms of a fractional equity in each of the assets and liabilities of the subsidiary.

When processing NCI eliminations for the controlling parent, the system records the original entries to eliminate the remaining subsidiary equity and book NCI Liability. At higher levels of the tree, you may adjust these entries if non-controlling parents are incorporated into the consolidation.

The system calculates the amount of the non-controlling interest entry by multiplying the ownership percentages of non-controlling interests in the subsidiary by the total equity of the subsidiary. How the calculation is processed depends on the ledger template that is associated with the consolidation model. When the Processing Method on the Ledger Template-Consolidation Variables page is set to Use year-to-date data, the system uses the ownership percentage at the period end date on the run control page. This ensures that the NCI liability calculation is based on the current ownership percentage for all periods processed. If the processing method is set to Use period data, only the specified period is processed for the current ownership percentage.

You set up NCI elimination rules to:

Specify the source ChartField values sets to use for subsidiary equity and parent investments.

Specify NCI elimination target ChartFields.

Specify which ChartFields to use to record out of balance amounts resulting from NCI eliminations.

Optionally, specify a tolerance rule to apply, and enter notes about the rule.

When processing NCI eliminations, the system:

Generates journal entries that eliminate the parents's investment in subsidiary account balances.

These entries eliminate 100 percent of the parent investment, the ownership percentage of the subsidiary equity, and generate an out of balance entry for the difference.

Eliminates the remaining subsidiary equity against NCI liability.

The system calculates the amount of the NCI entry by multiplying the ownership percentages of non-controlling interests in the subsidiary by the total equity of the subsidiary.

If non-controlling parents are either at higher levels in the tree or in branches other than the controlling parent, the system generates two additional sets of entries:

The first set of entries eliminates the parent investment against the portion of the subsidiary equity that corresponds to the parent ownership percentage.

The second set of entries adjust the NCI liability that was recorded for the controlling parent.

Note: Even if the parent owns 100 percent of its subsidiaries, you must define NCI rules in order for the system to eliminate the parent investment and subsidiary equity balances.

The combined result of the adjustments (journal entries, allocations) and elimination entries is to express the value of the parent investment in terms of the assets and liabilities of the subsidiary, offset by a non-controlling interest liability. The equity ownership for each subsidiary in the consolidation is eliminated, with only the parent company's equity accounts and non-controlling interest account remaining. Consolidated capital stock and retained earnings are equal to the balances of the parent.

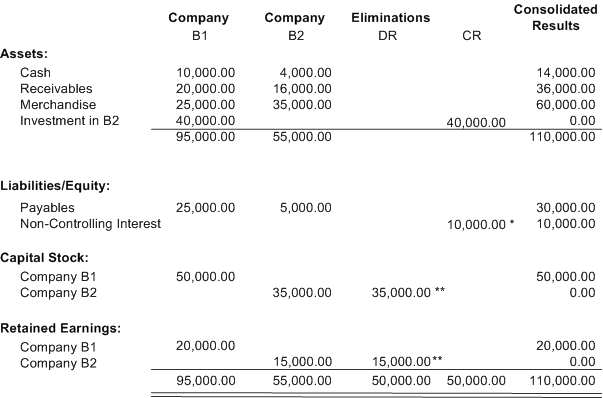

Image: Setup for non-controlling interest for 20 percent of Company B2 (0.2 x 50,000 USD)

In this example, Company B1 owns 80 percent of Company B2, and B2's total shareholder equity is 50,000 USD:

* Non-Controlling interest entry to recognize the 20 percent non-controlling interest owned by other than B1 in B2.

** Elimination of the total equity of B2 versus the investment in Company B2.

The amounts of 35,000 USD and 15,000 USD to eliminate Company B equity are recorded in multiple entries. The first set of entries (recorded with a GC_SOURCE of 6A) eliminate the total parent investment of 40,000 USD and eliminate 80 percent of the subsidiary equity (28,000 USD to capital stock and 12,000 USD to retained earnings). Then the second set of entries (recorded with a GC_SOURCE of 6B) deal with the NCI—they eliminate the remaining 20 percent of the subsidiary equity (7,000 USD and 3,000 USD, respectively) and book the offsetting 10,000 USD entry to the NCI Liability.

Non-Controlling Interest Rule Page

Use the Non Controlling Interest Rule page (GC_NCI_RUL_PG) to define a non-controlling interest rule and identify the source ChartField value sets for the subsidiary equity and parent investment accounts.

Image: Non Controlling Interest Rule page

This example illustrates the fields and controls on the Non Controlling Interest Rule page. You can find definitions for the fields and controls later on this page.

Account ChartField Value Set

Establishing Non-Controlling Interest Rule Eliminations

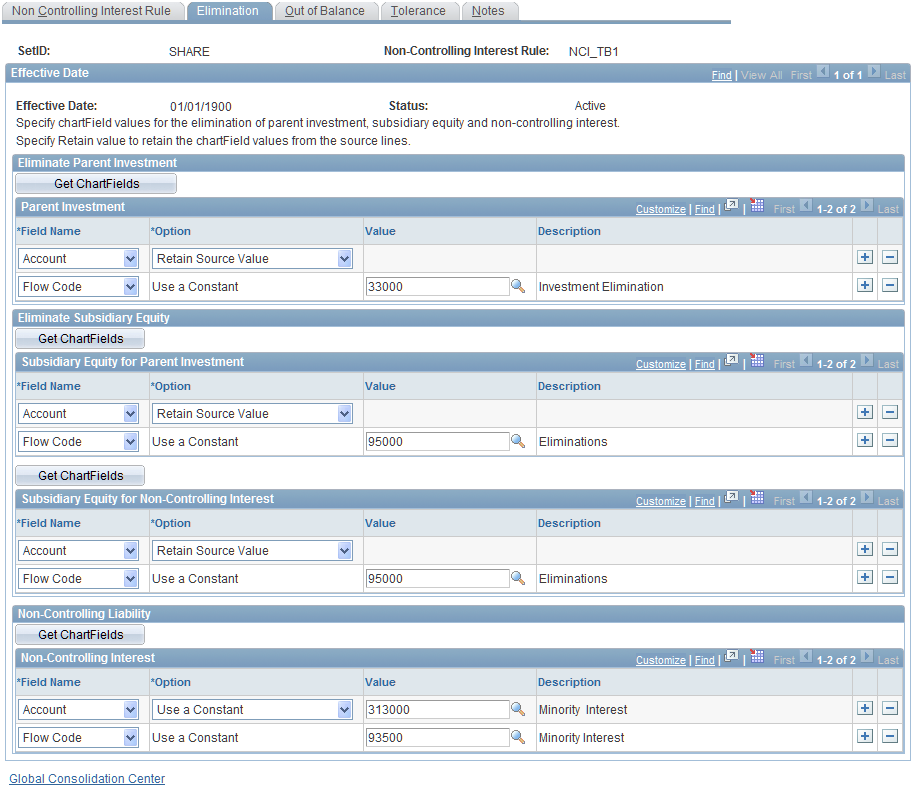

Use the Non Controlling Interest Rule - Elimination page (GC_NCI_RUL_PG6) to specify the target ChartField values that the system uses to eliminate the parent investment, eliminate the subsidiary equity corresponding to the parent investment, eliminate (or adjust) the subsidiary equity for non-controlling interest, and book (or adjust) the non-controlling interest liability.

Image: Non Controlling Interest Rule - Elimination page

This example illustrates the fields and controls on the Non Controlling Interest Rule - Elimination page. You can find definitions for the fields and controls later on this page.

Complete the fields within each of these grids to identify the target dimension or ChartField values that the system uses for NCI eliminations.

In each grid, Account is required. The default Option for each dimension specified is to Retain Source Value. . If you select the default option, the system creates NCI elimination entries that retain the dimension values of the input ledger lines, reversing the amounts, and booking them to the elimination unit. If a dimension (ChartField) is not included, then its value is left blank on the NCI elimination entry.

For each grid, complete these fields:

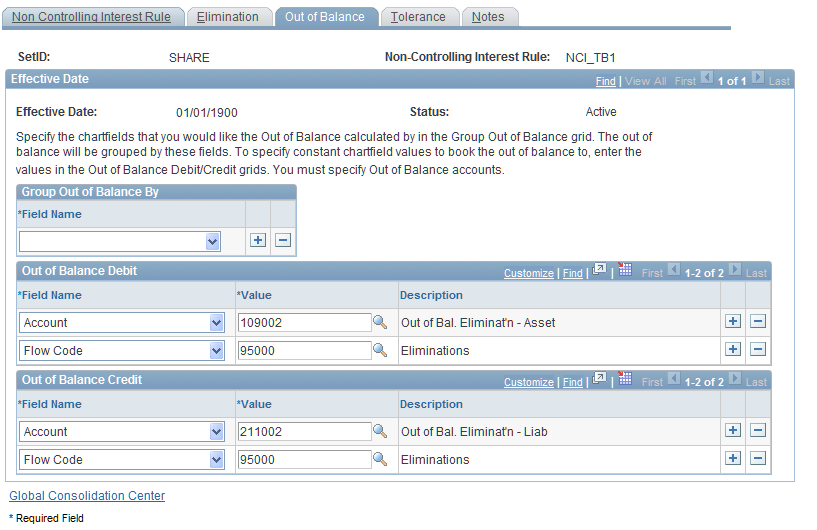

Establishing Non-Controlling Interest Rule Out of Balance Accounts

Use the Non Controlling Interest Rule - Out of Balance page (GC_NCI_RUL_PG3) to identify to which ChartFields you want to record any out of balance amounts that result from non-controlling interest eliminations.

Image: Non Controlling Interest Rule - Out of Balance page

This example illustrates the fields and controls on the Non Controlling Interest Rule - Out of Balance page. You can find definitions for the fields and controls later on this page.

If the NCI elimination does not balance, the system directs the remaining amount to the appropriate out of balance account or ChartFields that you specify on this page. You can specify special ChartFields for the out of balance amounts. For example, you can enter a department for both the Debit and Credit ChartFields in addition to an account. The out of balance amount is booked to the elimination entity attached to common node between the two entities with interunit transactions.

Complete these fields:

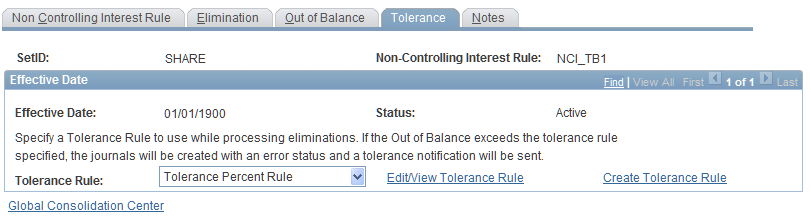

Assigning a Tolerance Rule (Optional)

Use the Non Controlling Interest Rule - Tolerance page (GC_NCI_RUL_PG4) to (Optional) Specify the tolerance rule to use while processing non-controlling interest eliminations.

Image: Non Controlling Interest Rule - Tolerance page

This example illustrates the fields and controls on the Non Controlling Interest Rule - Tolerance page. You can find definitions for the fields and controls later on this page.

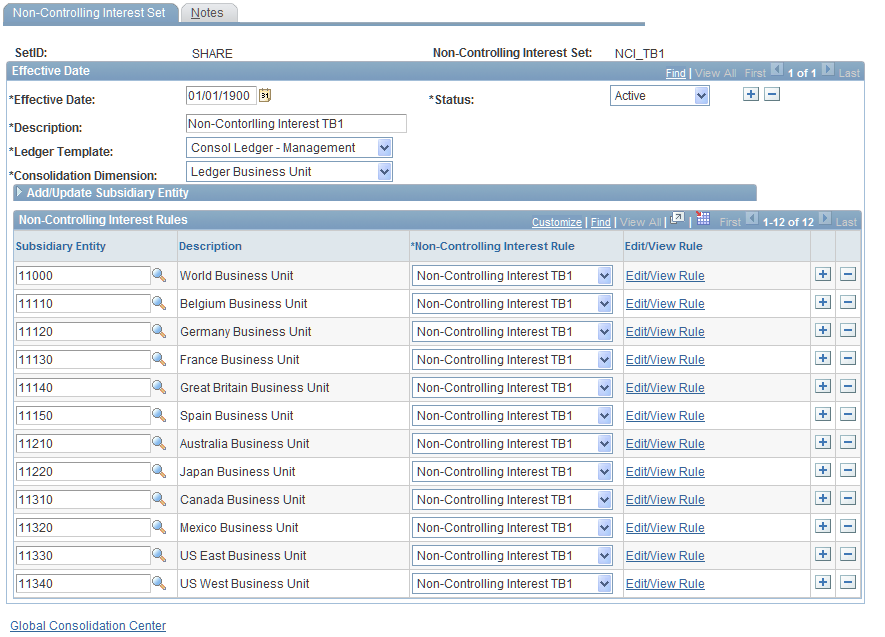

Non-Controlling Interest Set Page

Use the Non-Controlling Interest Set page (GC_NCI_SET_PG) to associate ownership sets with non-controlling interest rules to calculate the non-controlling interest amount and identify the set of non-controlling interest eliminations that should be generated for a group of subsidiaries.

Image: Non-Controlling Interest Set page

This example illustrates the fields and controls on the Non-Controlling Interest Set page. You can find definitions for the fields and controls later on this page.

Non-Controlling interest sets associate the subsidiary with NCI rules and are used to identify the non-controlling interest elimination rules that should be processed for a set of subsidiaries. The NCI rules eliminate the parent's investment in a subsidiary, eliminate subsidiary equity, and create a NCI liability amount.

Add/Update Subsidiary Entity

This group box is a work area that you can use to help you complete the Non Controlling Interest Rules grid. By specifying a business unit tree name, then clicking Get Subsidiary Entity, you can retrieve and insert all of the ownership sets for the business units with an ownership rule defined in that tree that are not currently in the Non Controlling Interest Rules grid. Similarly, if you select a non-controlling interest rule, then click Apply the Non-Controlling Rule, the selected rule is associated with the rows in the Non-Controlling Interest Rules grid that do not have an assigned non-controlling interest rule.

Non-Controlling Interest Rules

Insert rows to specify each subsidiary's ownership set and its non-controlling interest rule. The system uses this pairing to compute the non-controlling interest amount to eliminate. The consolidation process generates one journal for the entire job, composed of journal lines for each non-controlling interest set and ownership set pair. If there are any out of balance conditions, the out of balance account specified on the non controlling interest rule is debited or credited for the corresponding elimination entity.

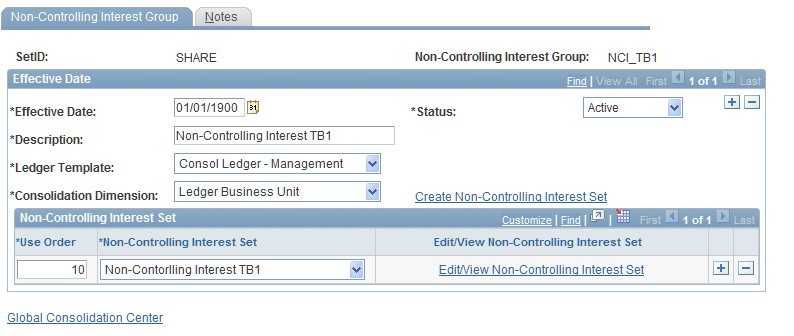

Non-Controlling Interest Group Page

Use the Non-Controlling Interest Group page (GC_NCI_GRP_PG) to define the non-controlling interest rule sets that comprise a non-controlling interest group and the order in which to process them.

Image: Non-Controlling Interest Group page

This example illustrates the fields and controls on the Non-Controlling Interest Group page. You can find definitions for the fields and controls later on this page.

Within the Non-Controlling Interest Set grid, specify all of the non-controlling interest sets to include in this non-controlling interest group. Include all of the rule sets you need to identify every subsidiary for eliminating non-controlling interests. You can only assign one non-controlling interest group to a consolidation model. The rules are processed in ascending order based on the Use Order value. If the same rule exists in multiple sets, the first rule encountered is used. In other words, only unique rules are used.