PeopleSoft Global Consolidations Components

This section describes:

The consolidation model.

The common consolidation business unit.

Elimination entities and the consolidation tree.

Mapping rules and ledger preparation.

Ledger preparation manager.

Consolidation rules.

Consolidation manager.

The Consolidation Model

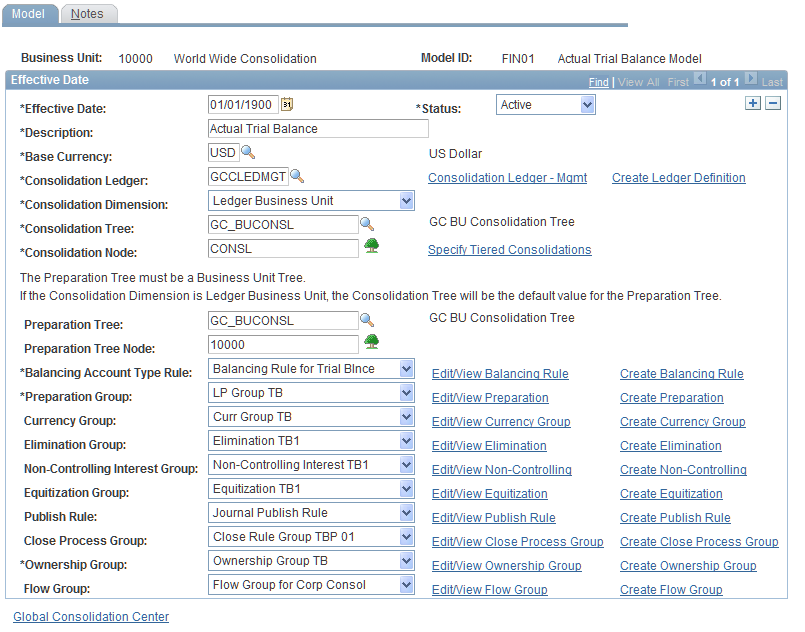

A consolidation model describes all of the components and rules used for a particular consolidation. It associates the mapping rules and business rules used for processing consolidations with the consolidation tree, the consolidation ledger, and the consolidation dimension. The Consolidation Model page contains links that enable you to review, modify, or create the supporting rules and objects that are used in a consolidation. When defining the parameters for your consolidation, you can use the Consolidation Model page as the main way to access all of the pages that are used to define a consolidation.

This screenshot shows how to enter parameters for the consolidation model:

Image: Entering parameters on the Consolidation Model - Model page

This example illustrates the fields and controls on the Entering parameters on the Consolidation Model - Model page. You can find definitions for the fields and controls later on this page.

Each consolidation model is associated with a scenario ID. When establishing scenarios for use with consolidations, select the Consolidated check box on the Scenario Definition page. You can define multiple scenarios to process multiple consolidations that use different business rules, such as different base currencies, different consolidation trees, or different consolidation rules. When you run the consolidation processes, the system derives the correct consolidation model based on the input parameters of the common consolidation business unit and scenario.

The Common Consolidation Business Unit

When processing consolidations, you run the process for a specific business unit, scenario, fiscal year, and accounting period. For consolidations, this business unit must be the "common consolidation business unit." This represents the highest level business unit to which your data is consolidated. It doesn't necessarily represent an actual business unit in your organization; it can be a "logical" business unit. You associate this business unit with the consolidation ledger, which stores the activity related to a consolidation. This business unit is the basis for your consolidation reports, processing, and inquiries.

To establish a common consolidation business unit, use the Warehouse Business Unit page, and set the business unit type to consolidated. You must associate the common consolidation business unit with the scenario IDs which you associate the consolidation model.

Elimination Entities and the Consolidation Tree

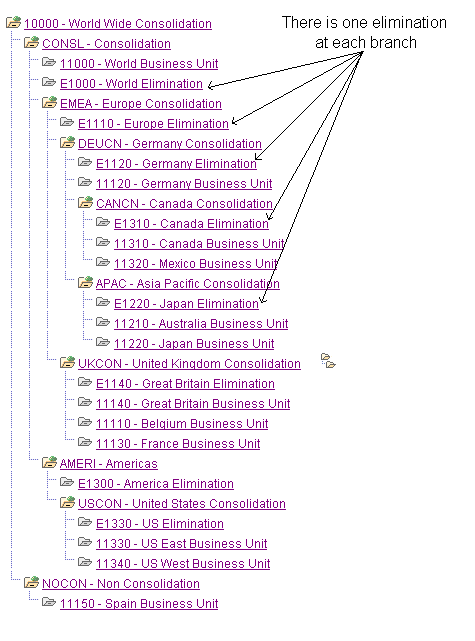

The hierarchical reporting relationships among the entities in a consolidation are defined in a node-oriented consolidation tree. Each branch of the tree must contain a single elimination entity. The journals that result from consolidation processing at each branch (eliminations for minority interest, intercompany transactions, or equitization) are booked to these elimination entities.

Image: Elimination entities

For example, World Wide Consolidation is composed of multiple business units, with consolidation occurring at several levels before ultimately consolidating to World Wide Consolidation, which is the common consolidation business unit. For financial reporting requirements, a tree that defines the legal entity relationships among these business units was created, which is the consolidation tree. Note that each branch contains an elimination entity:

If your consolidation is by business unit, the elimination entity must be a defined warehouse business unit. If your consolidation is by another dimension, such as department, then the dimension values (for example, the Dept IDs) must be defined. In either case, the elimination entity must be identified by using the Elimination Entity page. When you consolidate by a dimension other than business unit, you still need to create a business unit tree, because the ledger preparation process requires it.

Mapping Rules and Ledger Preparation

Before you process consolidations, you must move the individual subsidiary business unit ledger data into a consolidation ledger table. For this to occur, you must establish a common structure among the various ledgers by defining mapping rules for calendars, currency, and accounts (ChartFields). These rules are used to transform the subsidiaries' data into a common calendar, currency, and chart of accounts and define what the data in the individual ledgers represents with respect to the consolidation ledger.

For example, your consolidation ledger uses an accounting calendar that includes 12 periods and begins on January 1. The ledgers from your various subsidiary business units may not follow this same calendar. The calendar mapping rule defines how data is mapped from the subsidiary calendars to the consolidation ledger's accounting calendar so that the subsidiary data moves to the appropriate period of the consolidation ledger.

After you define the mapping rules, you run the Ledger Preparation process, which moves the various subsidiary ledger data into the consolidation ledger, transforming it according to the associated mapping rules. The consolidation ledger is used as input for consolidation processing. If your subsidiary ledgers are already in the same format as the consolidation ledger, then you can indicate in your mapping rules that no mapping is required.

See Loading Data Using Extract, Transform and Load (ETL) Jobs.

Ledger Preparation Manager

The Ledger Preparation Manager page conveys the status of each phase of ledger preparation processing. This interactive page enables you to quickly visualize the status of preparing your subsidiary ledger data and view details for any phase; you can configure this page to best suit your implementation.

The ledger preparation manager has two views, one for the Preparation phase (up to and including loading the consolidation ledger) which is tracked by source business unit and source ledger, and another view for enrichment (activities on consolidation ledger after ledger preparation is run, but before consolidation is processed) which is tracked only by source business unit and not source ledger.

Consolidation Rules

When you define a consolidation model, you associate several rules that are used when consolidation processes are run. You define the following rules:

Define ownership rules to establish ownership percentages.

Define elimination rules to eliminate intercompany transactions.

Define equitization rules to eliminate investments in subsidiaries and subsidiary equity and generate equitization entries.

Define non-controlling interest rules to generate eliminations due to non-controlling interest.

Define balancing account type rules to balance the consolidation ledger.

Define close processing rules to perform period-end or year-end close processing.

Define flow templates to generate and process flows.

Define publishing rules to publish journals back to the source ledger.

Consolidation Manager

The Consolidation Manager page conveys the status of each phase of consolidation processing. This interactive page enables you to quickly visualize the status of processing consolidations and view details for any phase. You can configure this page to best suit your implementation.