Processing Close

This section provides an overview of the close process and discusses how to run the close process (GC_CLOSMGR).

Page Used to Process Closing Rules

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Close Process run control |

RUN_GC_CLOSE |

|

Run the closing process. |

Understanding the Closing Process

Use the Close Process run control to page to close the income statement account balances to retained earnings and roll forward balance sheet account balances. In order to use this feature, you must set up closing rules and rule sets, roll forward rules and rule sets, a close process group, and associate the close process group with the consolidation model.

See Understanding Close Process Rules.

When running the close process, you either run year-end or period-end processing. Trial balance-based consolidations use year-end processing, and financial statement-based consolidations use period-end processing.

When you enter the business unit and scenario on the run control page, an edit checks the consolidation model, consolidation ledger, and the ledger template to determine whether the business unit and scenario combination is a trial balance or financial statement based consolidation.

If the consolidation method is trial balance, the period input field is display-only, and the system selects a close process type of Year End Processing. In addition, the request type options are limited to Close/Roll Forward or Delete. The Delete request type enables you to clear out the previous run data and reset the close and roll forward amounts to zero.

If the consolidation method is Financial Statement, enter the fiscal year and period in which you want to perform the close processing. If the period selected is not the last period of the fiscal year (typically, period 12), then you may only select Roll Forward Only or Delete. If the period selected is the last period, then you may select Close/Roll Forward or Delete.

The closing process does not update flow amounts. You will have to enter the closing amounts on a manual flow template.

See The Global Consolidations red papers on My Oracle Support.

Here is an overview of the steps performed for each Consolidation Dimension value/Tree Node in the Close Process group when the closing process is run:

Resolves data from the consolidation CLED, based on the Close Process group for the consolidation model, the fiscal year, and the period that you specify in the run control, and Ledger Template associated with the consolidation Model.

If processing the Close Option, the system creates a target entry in the next fiscal year/accounting period based on the ChartField value sets andxource input option specified on the close rule.

For elimination entities in Financial Statement-based ledger, only non-system-generated entries are closed.

If processing the Roll Forward Option, the system rolls forward balances in the next accounting period based on the ChartField value sets and source input option specified on the roll forward rule.

For elimination entities in Financial Statement-based ledgers, only non-system generated entries are rolled forward.

The closing process creates ledger entries with following Global Consolidations source values:

After the close process has run, you can review the results on the Ledger Inquiry page.

To view the amounts closed to retained earnings or balances rolled forward for trial balance-based consolidations, specify the period of zero for the next fiscal year.

For financial statement-based consolidations, select the fiscal year and period in which the balances were rolled forward.

View this inquiry after the roll forward process has been run but before the next period is processed. You can also view these entries through the consolidation audit, and filter by the source process on the roll forward processing entries.

See Reviewing Ledger Balances.

See Auditing Consolidation Data.

Closing Processing and Elimination Business Units

If you want to roll forward manual journal entries that are recorded to elimination entities, be sure that the Include Elimination Entities check box is selected for each applicable close rule set.

For trial balance-format ledgers, both system-generated and manual journal entries will be rolled forward.

The trial balance roll forward engine closes and rolls forward the entries to the elimination entity to period zero with an auto reversal in period one for system-generated entries. Manual journal entries to the elimination entity are not reversed.

For financial statement-format ledgers, only manual journal entries booked to the elimination entity are rolled forward. System-generated entries are not rolled forward.

Manual journal entries are not reversed.

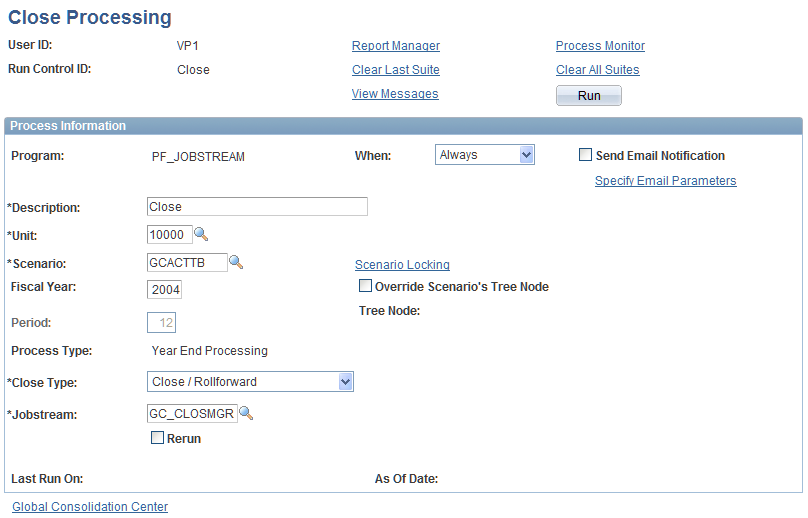

Close Process Run Control Page

Use the Close Process run control page (RUN_GC_CLOSE) to run the closing process.

Image: Close Processing run control page

This example illustrates the fields and controls on the Close Processing run control page. You can find definitions for the fields and controls later on this page.

If you need to undo the year-end or period-end process, the system provides you with two options. First, if you incorrectly ran the close process and need to reset the posted amounts to zero, then set the close request type to Delete. If you want to replace the amounts that have been posted, then rerun the run control. The application engine deletes the entries from the previous run and replaces the amounts to retained earnings and roll forward balances with the current posting.