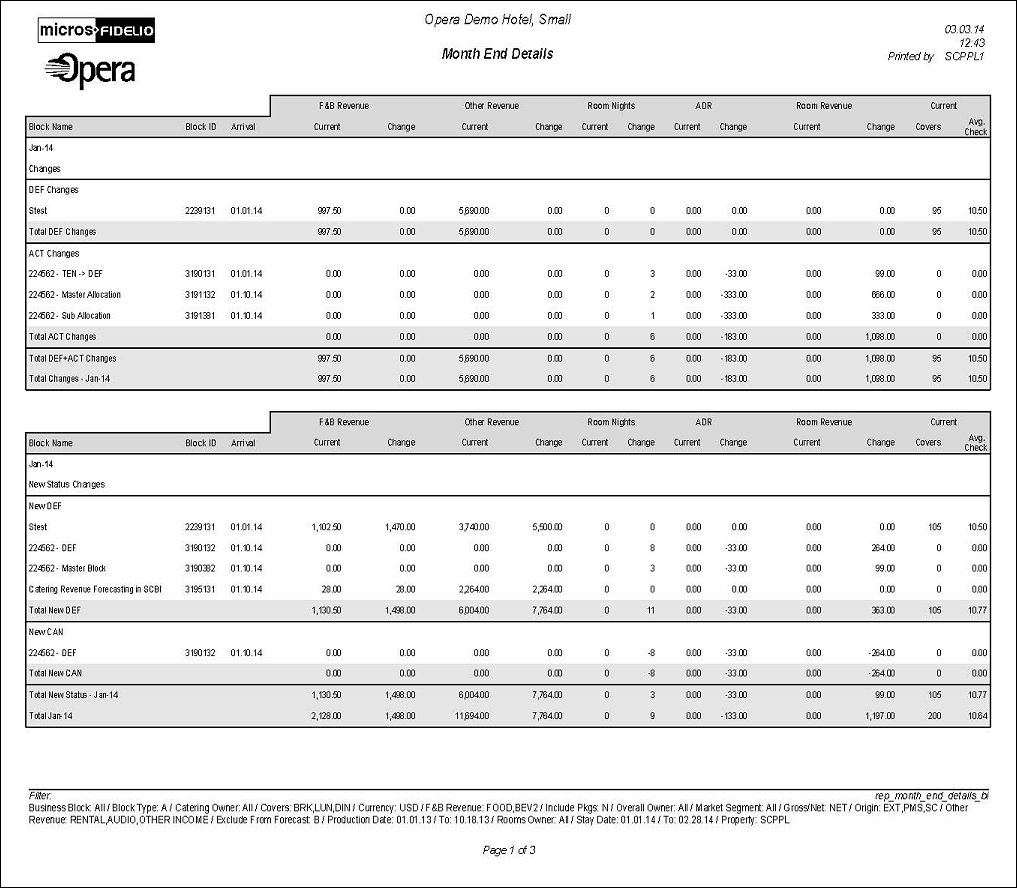

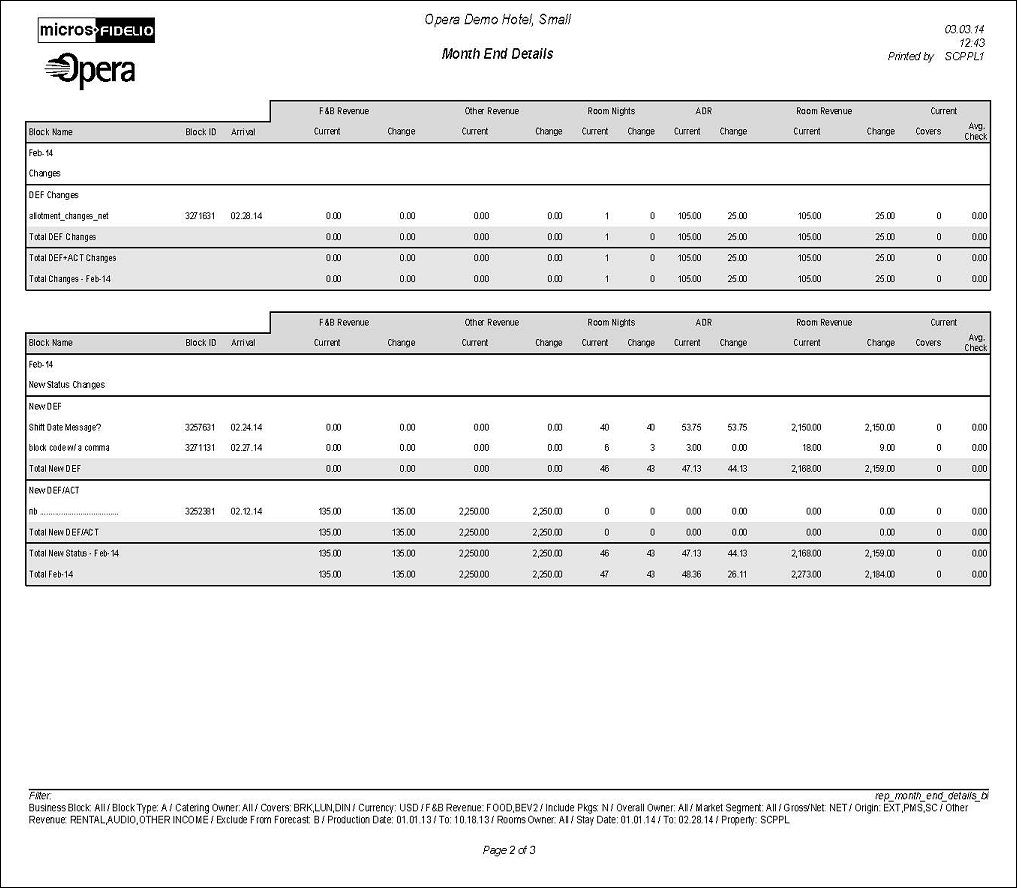

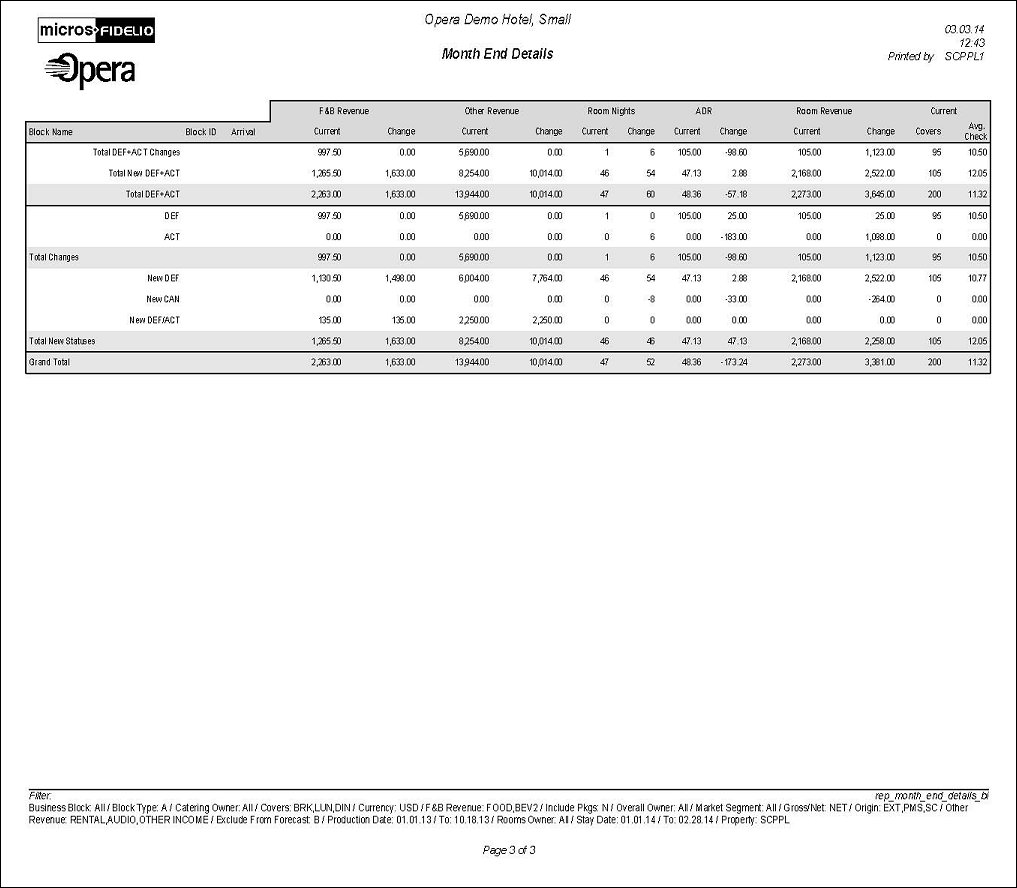

Month End Details (BI) (REP_MONTH_END_DETAILS_BI with REP_MONTH_END_DETAILS_BI_FMX)

The Month End Details reports business block sales and catering production changes during the dates requested. The report can be grouped by Stay Month or Owner and has many filtering options including business blocks with the Catering Only check box = Y or the Catering Only check box = N.

Note: When printing this Report help topic, we recommend printing with Landscape page orientation.

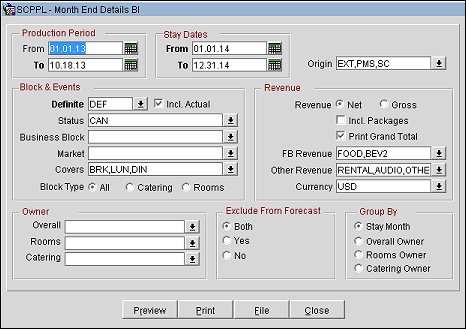

Production Period

Each change to Room and Event Revenue or Status is recorded in production change logs. When dates are entered in the Production From and To Date fields, those dates are used as filters when querying the logs. To illustrate, a business block that is created on status TEN in April 2003 with a start date in October 2003 turns to DEF in June 2003. In this scenario there would be two entries in the status change log for this business block: one for the creation of the business block on status TEN in April 2003 and one for the status change to DEF in June 2003. If revenue is added to the DEF business block in July 2003, another change log entry will be written to record that revenue. Because they filter on a date when something has already happened in OPERA, the dates entered here should be for today’s date or earlier. Separate change log entries are written for room and event status and revenue changes.

From. Enter the calendar date to indicate the beginning of the Production Period for which the report is to be filtered. Room Revenue is filtered on the business block change date and Catering Revenue is filtered on the event change date.

To. (Mandatory) Enter the calendar date to indicate the end of the Production Period for which the report is to be filtered.

Stay Dates. These are the calendar periods that will be displayed in the report.

From. (Mandatory) Enter a start date range on which the report will filter events by their start date and the business blocks by allotment date.

To. (Mandatory) Enter an end date range on which the report will filter events by their start date and business blocks by allotment date.

Property. Available when the OPS_MHT2 license is active. Choose the property for which the events in this report should be filtered.

Origin. Select one or more Origins. This LOV lists all of the possible values from the internal field allotment_origion. When an Origin is selected, only events from business blocks with this Origin will be considered. If no Origin is selected, all business blocks will be considered. Possible options are:

ORS (business blocks created in the ORS application)

SFA (business blocks created in the SFA application)

PMS (business blocks created in the PMS application)

SC (business blocks created in the S&C application)

EXT (business blocks created in an External system)

Block & Events

Definite. (Mandatory) Select one status code from the list of all status codes that can turn to an Actual status.

Incl Actual. (Enabled when a Status is selected in the Definite field) Select this check box to include business blocks and events in an Actual status with the status selected in the Definite LOV.

Status. Select one or more Status Codes from the list of all status codes except the ACTUAL status and the status selected in the Definite LOV.

Business Block. Select one or more specific business blocks from the Business Block Search screen for which to print the report. If none are selected, the report will print all business blocks that meet the other criteria on the report parameter screen.

Market. Select one or more market segments by which the business blocks should be filtered. If none are selected, business blocks will not be filtered by market segments.

Covers. Select one or more Event Type(s) to indicate which will be included in the Covers calculation in the reports. If no value is selected, all event types will be considered.

Block Type (1 of the 3 options must be selected)

All. Select if all business blocks will be considered.

Catering. Select if only business blocks marked as Catering Only will be considered.

Rooms. Select if only business blocks not marked as Catering Only will be considered.

Revenue

Revenue. One of the options must be selected, Net or Gross. The Incl Packages and/or Print Grand Total check box can be selected if either Net or Gross is selected. The Incl Packages option is described with Net and Gross examples below.

The Print Grand Total check box, when selected, will print a final summary page which includes the Totals for each subtotal (Changes and New) and a Grand Total. If not selected, no summary page will print.

Net. When selected, Room and Catering Revenue will be calculated as:

Net Catering is calculated based on the Transaction Codes mapped in Revenue Type Cross Reference configuration (Configuration>Cashiering>Rev Type Cross Reference):

Gross. When selected, Room and Catering Revenue will be calculated as:

Gross Room Rate is calculated as:

Gross Catering Price is calculated based on the Transaction Codes mapped in Revenue Type Cross Reference configuration (Configuration>Cashiering>Rev Type Cross Reference):

Note: Net and Gross calculations are only done for the Current figures. Change revenue is reported as seen in OPERA.

Print Grand Total. If selected, a final summary page will print which includes the Totals for each subtotal (Changes & New) and a Grand Total.

FB Revenue. Select one or more active Revenue Type(s) to include in the F&B Revenue calculations in the report. If none are selected, no F&B Revenue calculation will be done.

Other Revenue. Select one or more active Revenue Type(s) to include in the Other Revenue calculations in the report. If none are selected, no Other Revenue will be calculated.

Currency. Select the one currency for which all revenue figures will be reported. If no value is selected, the report will be calculated using the Base Currency of the logged in Property.

Owner. (Select one or more Owners. If no value is selected, then all Owners listed in the LOV will be considered.)

Overall. Only business blocks with this Overall Owner will be considered.

Rooms. Only business blocks with this Rooms Owner will be considered.

Catering. Only business blocks with this Catering Owner will be considered.

Exclude from Forecast. (1 of the 3 options must be selected)

Both. All events will be considered regardless of the Exclude from Forecast check box.

Yes. Only events marked as Exclude from Forecast will be considered.

No. Only events not marked as Exclude from Forecast will be considered.

Group By (1 of the 4 options must be selected)

Stay Month. If selected, the report will be grouped by business block stay month. For room nights and room revenue, the business blocks will be grouped based on which night the room is reserved. For event revenue, the business blocks will be grouped based on the event start date.

Overall Owner. If selected, the report will be grouped by the Business Block Overall Owner.

Rooms Owner. If selected, the report will be grouped by the Business Block Rooms Owner.

Catering Owner. If selected, the report will be grouped by the Business Block Catering Owner.

Business Block Owner

The 1st grouping may be by Owner (Rooms Owner, Catering Owner, or Overall Owner) as selected as a Group By in the report parameter screen.

If, for example, the report is Grouped by Rooms Owner and filtered by Catering Owner, the grouping will continue to list each of the Rooms Owners that qualify based on the other filters, as well as having the selected Catering Owner on the business blocks.

Business Block Changes

If there are business block or event production changes for the Owner for the requested production period, the ‘Changes’ heading displays and the changes are listed in that grouping under the appropriate Status.

Status Code

In the Status Code section the following columns display.

Current and Change rules apply to each of the sections in this report.

Current – Revenue and room nights at the time the report is printed and only including business block and events currently in that status.

A (see example below) -If a business block or event turned to Actual (and not DEF) during the production period and did not have a room night or revenue change during the period, that business bock will not be listed in this report.

B (see example below) - If a business block or event turned to DEF and ACT during the production period, it will be listed in the New DEF/ACT grouping. The Current revenue will be calculated from statistics for rooms and room revenue and from billed revenue for events.

C (see example below) - If a business block or event turned to Actual (but not DEF) and had a change during the production period, that business block will be listed in the ACT Changes grouping.

D (see example below) - If a business block turned to DEF and Cancel during the production period, that business block will be listed in the New DEF and New CAN groupings.

Change – Revenue and room nights that changed during the requested production period for this status.

E (see example below) - Last status changes to room nights and revenue during the production period.

Examples: Report generated for Production Dates July 1 – July 31, 2013

A - Business block turned to DEF on June 15th, 2013.

Business block turned to ACT on July 2nd, 2013.

No other changes in July 2013.

That business block would not be included in the report.

There will never be a New ACT grouping in the report.

B - Business block turned to DEF on July 2nd 2013 with 100.00 Catering Revenue / 3450.00 Room Revenue / 30 Room Nights.

All rooms picked-up at 3450.00 room revenue / 30 room nights.

Business block turned to ACT on July 5th, 2013.

No other changes in July 2013.

That business block will be included in the New DEF/ACT grouping with the following figures:

C - Business block turned to DEF on June 15th, 2013.

Business block turned to ACT on July 2nd, 2013 with 36,000.00 Catering Revenue / 1000.00 Room Rev.

Business block added 300.00 catering revenue on July 2nd, 2013 / No Room changes Business block will be included in the ACT Changes grouping in this report with the following figures:

D - Business block turned to DEF on July 15th, 2013 with 100.00 Catering Revenue / 3450.00 Room Revenue / 30 Room Nights.

Business Block will be included in the New DEF grouping in this report with the following figures:

Business Block will be also included in the New CAN grouping in this report with the:

E - Business block turned to TEN on July 2nd, 2013 with 20 room nights / 2000.00 room revenue.

Business block added 10 room nights / 1500.00 on July 3rd, 2013

Business block turned to DEF on July 7th, 2013

Business block added 3 room nights / 450.00 on July 20th, 2013

Business block will be included in the New DEF grouping with Current & Change the same:

FB Revenue – Revenue Types to consider determined by the values selected in the FB Revenue filter in the report parameter screen. If no values have been selected in the parameter screen, no calculation will be done for these fields.

Other Revenue - Revenue Types to consider determined by the values selected in the Other Revenue filter in the report parameter screen.

Room Nights

ADR

Rooms Revenue

If a business block turned to a Return-to-Inventory Status during the production period, the Change Revenue is the full value of the room revenue and will be reported as a negative.

Current

At the end of each Status Changes grouping is a Total Status Changes line totaling each of the columns above.

New Status Changes Grouping

Grouped By Stay Month

This option prints when Stay Month is selected as a Group By in the report parameter screen.

The 1st grouping is by Business Block Stay Month.

Note: Current Catering figures are calculated using the standard calculation for catering forecasting.

If the application parameter Catering>Use Forecast Value Only is active:

- If the Use Forecast Revenue Only check box is selected in the main Events screen, only Forecast Revenue for that Event will be reported. If the Use Forecast Revenue Only check box is not selected in the main Events screen, the Expected Revenue for that Event will be reported.

- If the Event is in an Actual status, the Billed Revenue for that Event will be reported.

If the application parameter Catering>Use Forecast Value Only is not active, the report will evaluate each Revenue Type for each Event.

- If there is Guaranteed Rev, it will be reported.

- If there is no Guaranteed Rev but there is Expected Rev, Expected Rev will be reported. If there is no Expected Rev but there is Forecast Rev, Forecast Rev will be reported.

- If the Event is in an Actual status, it will be reported as Billed Revenue.

- Once Expected Revenue is added to the event, Forecast Revenue will be ignored for that Event and Revenue Type. So, even if the Resource is deleted, Forecast Revenue will no longer be reported.

Note: When currency values are too long to fully display in the allotted space in the report columns, (i.e. for values in the thousands with four digits or more and for values in the millions with seven digits or more, these values can be abbreviated so they can be accurately viewed. The application setting General>Currency Divisor Value can be configured to set the currency divisor value to K for values over 1,000 and to M for values over 1,000,000. For example, if the record is 354,000, when the currency divisor value is set to K, the value will display as 354K. If the record is 5,750,000.00, and the currency divisor value is set to M, the value will be rounded up and displayed, as in this example to 6M.