Preparing for Session Posting

This section provides an overview of session posting and discusses how to:

Set up item types.

Complete item type initial setup.

Define a GL interface.

Note: You must set up both a journal source and a journal generator template for Contributor Relations.

SeePeopleSoft FSCM: Application Fundamentals

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Initial Setup |

ITEM_TYPE_TBL |

|

Set up item types at your institution. |

Before processing transactions to an institution's financial system, you must set up designations, item types, and journal sets properly.

When you set up institution defaults using the Institution Installation page, you select the setID used to link to PeopleSoft Student Financials. This setID is used to retrieve detail calendars and item types from Student Financials.

In simple terms, designations are a representation of accounts or fund codes at your institution. When a gift or pledge payment is applied to a designation, that designation updates the actual account associated with it through the GL Interface.

Designations are tied to an item type in Student Financials. You define chartfields and item types using the Student Financials system, and then associate them with designations in Contributor Relations when you define designation funds using the Designation Funds page.

In PeopleSoft Financials, you must:

Set up budget periods.

Define journal entry definitions.

Define a journal source.

Define journal generator template defaults.

Note: You must set up both a journal source and a journal generator template for Contributor Relations.

Item types are classifications of charges and credits. Specifying item types differentiates the various debits and credits when you apply them to an account. Your institution's policies govern how item types are defined. The item type also contains the General Ledger Interface information, which is used to transmit the transaction from Contributor Relations to the General Ledger system.

An item type may have multiple journal sets. Journal sets enable you to generate a set of balanced entries into your journals.

Journal sets may be defined for Gift, Pledge, Pledge Payment, or Tender/Clearing account transactions. Each journal set requires different debit and credit definitions. For Contributor Relations, journal set fields must be defined with a specific value based on the type of transaction for which you are setting up the GL Interface. This table defines the values that must exist; otherwise, the posting process will not work:

|

Journal Set |

Data Entry Type |

DB/CR Indicator |

|---|---|---|

|

0 |

Tender and AP Clearing Account |

Always Debit to tender and CR to clearing account |

|

1 |

Gift |

Always Credit to designation account |

|

2 |

Pledge |

Always Debit to accounts receivable/Credit to designation account |

|

3 |

Pledge Payment |

Always Credit to accounts receivable |

For example, when you enter a gift transaction into the system, you select a tender type that is tied to an item type with a journal set of 0, which represents the debit side of the transaction. Then, you select one or more designations that are each tied to an item type with a journal set of 1 (Gift), which specifies the credit side of the transaction.

If your institution plans to feed pledges, a pledge transaction has a debit to accounts receivable with a journal set of 2 and a credit to a designation account with a journal set of 2 (requiring two rows in the GL interface record).

If your institution plans to feed pledges, a pledge payment has a credit to accounts receivable with a journal set of 3. The tender entered during gift entry provides the debit side of the transaction.

Note: If you do not intend to feed pledges to the financial system, you do not need to create journal sets 2 and 3 for Contributor Relations item types. In this instance, an item type for a designation would have only a single row with a journal set of 1 and Credit in the DB/CR field.

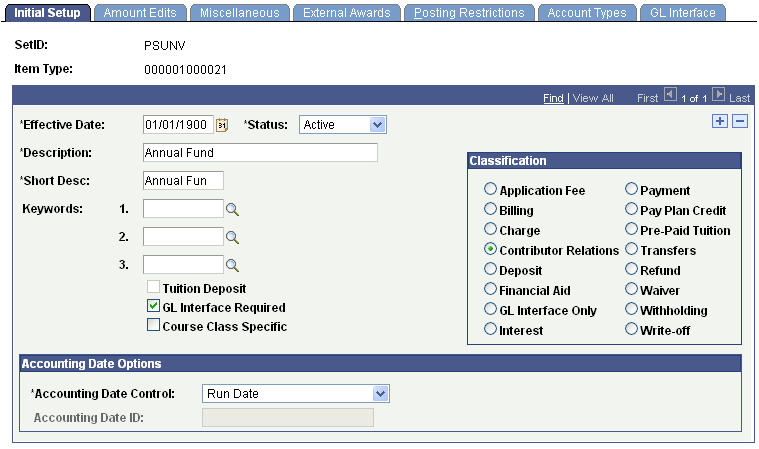

Use the Initial Setup page (ITEM_TYPE_TBL) to begin the process of setting up item types at your institution. The Initial Setup page is part of PeopleSoft Student Financials

Image: Initial Setup page

This example illustrates the fields and controls on the Initial Setup page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| G/L Interface Required |

Select this check box to indicate that both a credit and debit side of each transaction are required. |

| Accounting Date Control |

If you select the GL Interface Required check box, this field becomes active. Specify the accounting date of the item type. Select from the following values: Run Date: Select to use the current date as the accounting date. Item Effective Date: Select to use the applicable gift date, pledge effective date, or membership start date as the accounting date. The Accounting Date Control value that you select affects the Journal Line Date field on the Accounting Line page as generated by the Contributor Relations GL Interface process. Note: For both sides of your institution's dual line accounting to be generated correctly in the GL Interface process, you must select the Accounting Date Control for both tender and designation item types on the Item Type Setup page. |

| Classification |

Make sure the Contributor Relations classification is selected. This selection enables the specific processing of item types as required by the system and enables the GL Interface page to save with journal sets that do not have both a debit and credit. |

Use the GL Interface page to map an item type to a specific General Ledger account. When the General Ledger interface process is run, the transactions for the item type are entered in the GL Accounts you define on this page.

Enter an effective date. You must insert a new effective-dated row to change the budget period associated with this item type. The effective date must fall on or after the effective date for the associated budget period.

Note: To change the setID for which values the system displays on this page, select and then change the setID for FS-05 to the setID for which to view values.

The Term and Session fields are unavailable for input when the item type classification is set to Contributor Relations.

Contributor Relations uses the Journal Sets on the GL Interface page in combination to create dual-line accounting entries. Tender and clearing account item types should always be created with a journal set of 0 and one debit row for the tender account or clearing account. Gift designation item types should always be entered with a journal set of 1 and a credit row or rows for the designation account or accounts. Pledge designation item types should always be entered with a journal set of 2 and should have one debit row for the Accounts Receivable account and one credit row for the designation account. Pledge payment item types should be created with a journal set of 3 and one credit row to the Accounts Receivable account.

The following scenarios illustrate what occurs in GL Interface when the various journal sets are called.

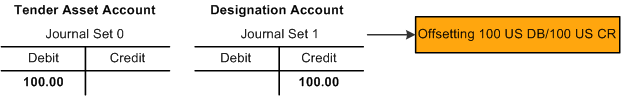

Scenario 1

Donor makes a gift of 100 USD to a single designation:

Image: Scenario 1, in which the gift results in a Tender Asset Account debit of 100.00 USD and a Designation Account credit of 100.00 USD

This graphic illustrates Scenario 1, in which the gift results in a Tender Asset Account debit of 100.00 USD and a Designation Account credit of 100.00 USD:

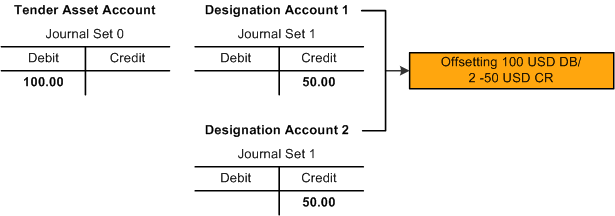

Scenario 2

Donor makes a gift of 100 USD to two designations:

Image: Scenario 2, in which the gift results in a Tender Asset Account debit of 100.00 USD and two Designation Account credits of 50.00 USD each

This graphic illustrates Scenario 2, in which the gift results in a Tender Asset Account debit of 100.00 USD and two Designation Account credits of 50.00 USD each:

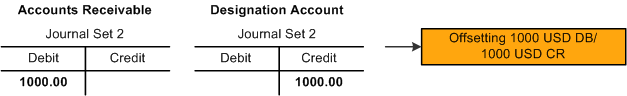

Scenario 3

Donor makes a semiannual pledge of 1000 USD to a single designation that is fed to the GL (multiple designations would be credited, as in Scenario 2):

Image: Scenario 3 (1 of 3), in which the pledge results in an Accounts Receivable debit of 1000.00 USD and a Designation Account credit of 1000.00 USD

This graphic illustrates Scenario 3 (1 of 3), in which the pledge results in an Accounts Receivable debit of 1000.00 USD and a Designation Account credit of 1000.00 USD:

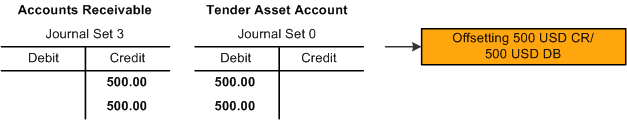

Donor makes a semiannual pledge payment of 500 USD for the previous pledge:

Image: Scenario 3 (2 of 3), in which the pledge payment results in two Accounts Receivable credits of 500.00 USD each and two Tender Asset Account debits of 500.00 USD each

This graphic illustrates Scenario 3 (2 of 3), in which the pledge payment results in two Accounts Receivable credits of 500.00 USD each and two Tender Asset Account debits of 500.00 USD each:

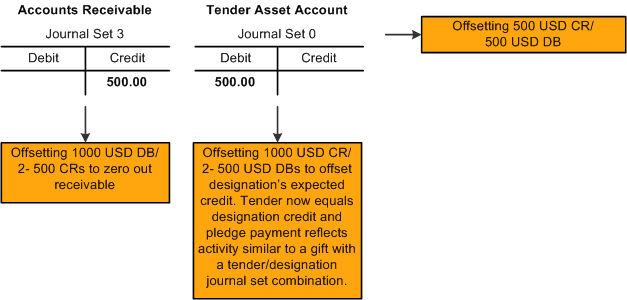

Donor makes final pledge payment of 500 USD for the previous pledge:

Image: Scenario 3 (3 of 3), in which the pledge payment results in an Accounts Receivable credit of 500.00 USD and a Tender Asset Account debit of 500.00 USD

This graphic illustrates Scenario 3 (3 of 3), in which the pledge payment results in an Accounts Receivable credit of 500.00 USD and a Tender Asset Account debit of 500.00 USD:

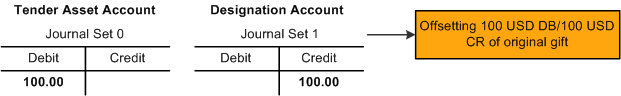

Scenario 4

The donor's gift in Scenario 1 is adjusted because the gift should have been 10 USD not 100 USD:

Image: Scenario 4 (1 of 4), in which the gift results in a Tender Asset Account debit of 100.00 USD and a Designation Account credit of 100.00 USD

This graphic illustrates Scenario 4 (1 of 4), in which the gift results in a Tender Asset Account debit of 100.00 USD and a Designation Account credit of 100.00 USD:

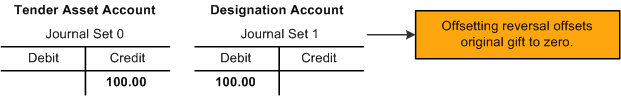

Original gift is backed out with offsetting reversal entries that takes the original gift to zero:

Image: Scenario 4 (2 of 4), which the reversal results in a Tender Asset Account credit of 100.00 USD and a Designation Account debit of 100.00 USD

This graphic illustrates Scenario 4 (2 of 4), which the reversal results in a Tender Asset Account credit of 100.00 USD and a Designation Account debit of 100.00 USD:

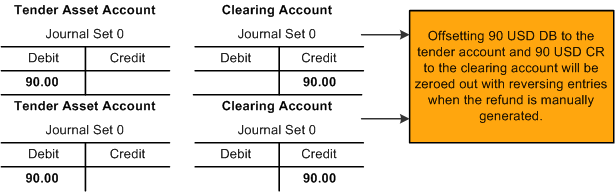

The refund amount is entered to be offset when a refund is generated manually:

Image: Scenario 4 (3 of 4), in which the offsetting 90.00 USD debit to the tender account and the 90.00 USD credit to the clearing account will be zeroed out with reversing entries when the refund is manually generated

This graphic illustrates Scenario 4 (3 of 4), in which the offsetting 90.00 USD debit to the tender account and the 90.00 USD credit to the clearing account will be zeroed out with reversing entries when the refund is manually generated:

The new corrected gift is created:

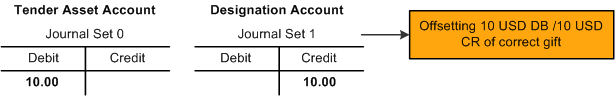

Image: Scenario 4 (4 of 4), in which the corrected gift results in a Tender Asset Account debit of 10.00 USD and a Designation Account credit of 10.00 USD

This graphic illustrates Scenario 4 (4 of 4), in which the corrected gift results in a Tender Asset Account debit of 10.00 USD and a Designation Account credit of 10.00 USD: