Producing and Filing 1098-T Tax Forms

This section lists prerequisites and discusses:

Before you begin generating and transmitting 1098-T information, you must complete these setup tasks in your PeopleSoft Student Financials system:

Set up a TIN under which your institution files 1098-T tax information to the IRS.

Determine which of your item types to designate as qualified tuition and related expenses.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Generate 1098-T |

RUNCTL_SF_SFP1098P |

|

Generate 1098-T data. |

|

Review 1098–T Messages |

SSF_1098T_INQ |

|

Review 1098–T messages. |

|

1098-T Data |

SF_1098_DTL |

|

Edit or review 1098-T data by student. |

|

1098-T Student Address |

SF_1098_STUADDR_PB |

Click the Student Address link on the 1098-T Data page. |

View the address of the student whose 1098-T data you are reviewing or overriding. |

|

1098-T Audit Report |

RUNCTL_SF_SF1098VP |

|

Validate and audit 1098-T data. |

|

Print 1098-T Form |

SSF_RUNCTL_1098PRT |

|

Mass print 1098-T forms into PDF. |

|

1098-T Print |

RUNCTL_SF_SF1098RP |

|

Print 1098-T forms and create electronic transmission files. |

|

1098-T File Info |

SF_1098_FILE_PB |

Click the File Parameters link on the 1098-T Print page. |

Enter the file path and file name of the electronic file that you want to create and send to the IRS. |

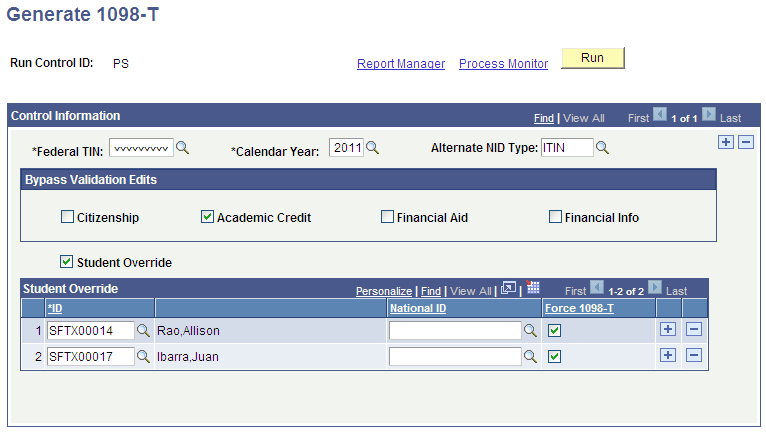

Access the Generate 1098-T page ().

Image: Generate 1098–T page

This example illustrates the fields and controls on the Generate 1098–T page. You can find definitions for the fields and controls later on this page.

Control Information

|

Field or Control |

Definition |

|---|---|

| Federal TIN (federal taxpayer identification number) |

Enter the Tax Payer ID number for the reporting institution. |

| Calendar Year |

Enter the calendar year for which you are reporting. |

| Alternate NID Type (alternate national identification type) |

Enter another NID type to generate 1098-Ts for students who do not have a valid SSN without using individual student overrides. If there is a value in the Alternate NID Type field, the 1098-T generation program looks first for an ITIN (Individual Taxpayer ID Number). If that lookup has no result then the National ID Type of PR (for Social Security Number) is used. This value is populated in the SSN field in the 1098-T data tables and is transmitted to the IRS. Note: You must provide an alternate NID type so that the SSN field can be populated with an alternate national ID value, such as an ITIN. This is the only way for the 1098-T generation program to look for an alternate value to the SSN. The National ID Type is set up at: |

Bypass Validation Edits

|

Field or Control |

Definition |

|---|---|

| Citizenship |

Select to bypass the Citizenship edit, so that a 1098–T is produced for all students with eligible charges regardless of citizenship status. |

| Academic Credit |

Select to bypass the Earned Academic Credit edit, so that a 1098–T is produced for all students with eligible charges, even if they are enrolled in classes that earn no academic credit. |

| Financial Aid |

Select to bypass the Financial Aid edit, so that a 1098–T is produced for students who have eligible charges paid entirely by Financial Aid. |

| Financial Info (financial information) |

Select to produce a 1098–T for students who have no financial information in boxes one through six. If the students are currently enrolled, the 1098-T is produced. |

Note: Each edit bypass work independently—an institution can choose one, all, or none of the edit bypasses.

Student Override

|

Field or Control |

Definition |

|---|---|

| Student Override (check box) |

Clear the Student Override check box to generate data for all applicable students who fall under the federal TIN and calendar year that you select. Select to use the fields in the Student Override group box to specify the students for which the process generates 1098-T data. |

|

Field or Control |

Definition |

|---|---|

| ID |

Select an ID to generate 1098-T data for the student. |

| National ID |

Use this field to produce a 1098-T for a student who does not have a Social Security Number (SSN). If you use the Alternate NID Type field, then individual students may not have to be overridden. |

| Force 1098-T |

The Generate 1098-T process generates 1098-T data for all students who meet the following criteria:

If you select the Force 1098-T check box, the system generates a 1098-T record for the student specified in the ID field, even if the student does not meet the previous criteria. |

The 1098-T (SFP1098P) process retrieves the necessary data from Campus Community and Student Records to populate and update the PS_SF_1098_DTL table in Student Financials. The system generates new 1098-T data for students who have no existing 1098-T records. In addition, the process compares the new 1098-T data it retrieves to any existing 1098-T data. When the process detects differences in an existing row of 1098-T data that has never been printed or included in an electronic transmission file, it updates all the affected fields in the record with the new information. However, if you have already printed a 1098-T record or included it in an electronic transmission file, the process does not update the existing record. Instead, it inserts a new row of updated 1098-T information for the student.

Access the Review 1098–T Messages page ().

Image: Review 1098–T Messages page

This example illustrates the fields and controls on the Review 1098–T Messages page. You can find definitions for the fields and controls later on this page.

Use this page to view the messages that are created when 1098–T data is not generated for a student during the Generate 1098–T process.

Messages from only the most recent run of the Generate 1098–T process appear.

The Generate 1098–T process stores the message header values in the SSF_1098_MSGHDR table and stores the message details in the SSF_1098_MSGDTL table. You can access these tables in SF Query Tree.

ID is an optional search criteria when you enter criteria to access this page.

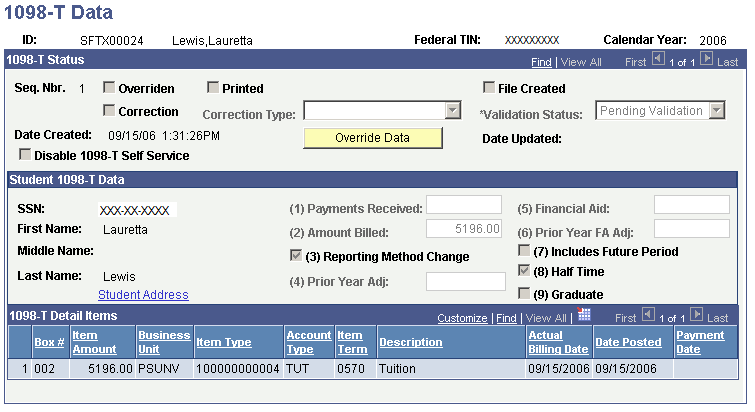

Access the 1098-T Data page ().

Image: 1098-T Data page

This example illustrates the fields and controls on the 1098-T Data page. You can find definitions for the fields and controls later on this page.

1098-T Status

|

Field or Control |

Definition |

|---|---|

| Overridden |

Indicates whether either you or the system has overridden a record. The system designates any records created using the Force 1098-T check box on the Generate 1098-T page as Overridden. When you click the Override Data button, the system automatically selects the Overridden check box for the resulting new row. The Generate 1098-T process updates existing overridden records only if it detects a change in the student's name or SSN. When editing a record, you can clear this check box. |

| Printed |

Indicates whether you have printed a 1098-T form for this record. When you run the 1098-T Form Print report, the system selects this check box for all the records it prints. The date and time that the system printed the record appears to the right of the field. To reprint a 1098-T form for a student, use the Override Data button to clear the Printed check box. Then use the 1098-T Print process to reprint the form. |

| File Created |

Indicates whether you have included a 1098-T record in an electronic transmission file. When you run the 1098-T Form Print report, the system selects this check box for all the records it includes in the transmission file. The date and time that the system created the transmission file appears to the right of the field. |

| Correction |

If you create a transmission file to send to the IRS and then discover an error in one of the records, you must submit a correction for that record. If you run the Generate 1098-T process and it inserts a new row for a record already included in a transmission file, the system selects this check box for the inserted row. Note: If you manually edit a record that is already included in a transmission file, select the Correction check box. The transmission of the file to the IRS will not occur until the 1098-T forms have been printed or permission has been granted to receive the forms electronically. |

| Validation Status |

Indicates whether the data in the record is valid. The 1098-T Audit report automatically sets the validation status to one of the following values. When you run the 1098-T Form Print report, the system uses this field to determine whether to pick up the record.

|

| Disable 1098-T self-service |

Select to prevent the current record from appearing on the 1098–T Year Select page. By default, this check box is cleared. |

| Override Data |

Click if you want to edit any of these fields: Overridden, Printed, File Created, Validation Status, and Correction. You can also override data such as financial information and the SSN in the Student 1098-T Data group box. When you click the Override Data button, the system inserts a new row for the student and selects the Overridden check box by default. If a Social Security Number is not entered in the National ID field on the Campus Community Biographical Details page, the system enters a value of all X's (XXX-XX-XXXX) in that field. This value appears by default in the SSN field on the 1098–T pages. When the Audit or Validation report is run, the 1098-T Detail record is updated with a blank SSN, and a message is printed on the 1098-T Audit Report. The Overridden flag on the 1098-T Data page is selected, the Date Updated Date/Time Stamp value is updated, and the Validation Status is set to Validation Overridden. The IRS does not accept invalid SSNs (for example, all nines, ones, zeroes). If no valid SSN exists, the SSN can be recorded as blank, which the IRS accepts. When you click the Override Data button, the SSN field becomes available for edit. You can then enter a valid SSN or delete the invalid SSN and leave the field blank. Updating the SSN field on the 1098–T page does not update data in Campus Community. |

Student 1098-T Data

|

Field or Control |

Definition |

|---|---|

| (1) Payments Received |

Displays the value that prints in Box 1 on 1098-T forms. (Payments received that applied to eligible tuition and fee charges.) |

| (2) Amount Billed |

Displays the value that prints in Box 2 on 1098-T forms. (Billed eligible tuition and fee charges.) |

| (3) Reporting Method Change |

Selects this check box if you have changed your reporting method on the TIN Setup page. |

| (4) Prior Year Adj (prior year adjustment) |

Displays the value that prints in Box 4 on 1098-T forms. Indicates adjustments made for a prior year to payments received - reimbursements or refunds of qualified tuition and related expenses - OR amount billed - reductions in charges for qualified tuition and related expenses (adjustments to Box 1 or 2 for prior year). |

| (5) Financial Aid |

Displays the value that prints in Box 5 on 1098-T forms. Indicates receipt of scholarships or grants. |

| (6) Prior Year FA Adj (prior year financial aid adjustment) |

Displays the value that prints in Box 6 on 1098-T forms. Indicates adjustments (reductions) to the amount of scholarships or grants reported for a prior year. |

| (7) Includes Future Period |

Displays the value that prints in Box 7 on 1098-T forms. The system selects this check box during the Generate 1098-T process if any of the amounts reported in Boxes 1 or 2 (Payments Received or Amount Billed) were related to an academic period that last from January through March of the following year. |

| (8) Half Time |

Displays the value that prints in Box 8 on 1098-T forms. The system selects this check box during the Generate 1098-T process if the student's academic load was at least half-time during any term within the tax-reporting year. |

| (9) Graduate |

Displays the value that prints in Box 9 on 1098-T forms. The system selects this check box during the Generate 1098-T process if the student was enrolled as a graduate student during any term within the tax-reporting year. |

| Student Address |

Click to access the 1098-T Student Address page. |

Note: The inquiry version of this page (Student Financials, Taxes, Review 1098–T Data, 1098–T Data) displays the same information as the (Edit 1098-T Data) 1098-T Data page. However, the inquiry page has no Override Data button, so you cannot edit any of the information that appears.

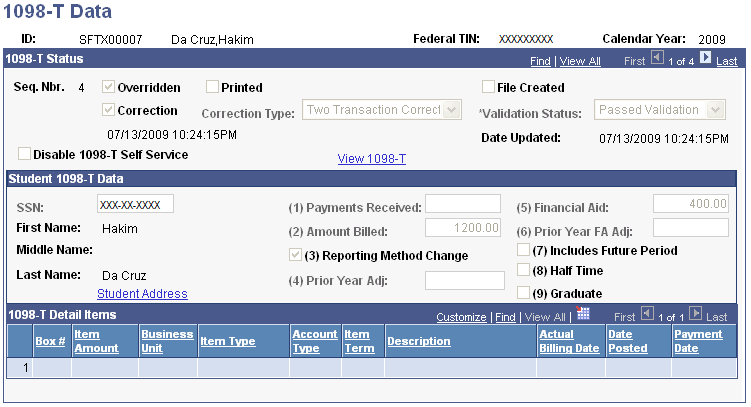

Viewing a 1098-T Form

Click the View 1098-T link on the (Review 1098-T Data) 1098-T Data page to access a 1098-T form (PDF) and print it for a student.

You can also access the View 1098-T link on this page by clicking the 1098-T link on the finances page in the Student Service Ctr (Student).

Image: 1098-T Data example page

This example illustrates the fields and controls on the 1098-T Data example page. You can find definitions for the fields and controls later on this page.

The View 1098-T link appears only if the Use Electronic Statements check box on the 1098-T TIN Detail setup page is selected. The link appears whether or not the Display 1098-T Self Service check box on the setup page is selected.

The link is enabled only when the value in the Validation Status field is Passed Validation or Validation Overridden.

If the record fails validation because of an invalid SSN, you can use the Override Data button on the (Edit 1098-T Data) 1098-T Data page to update the value in the SSN field to blank (a blank SSN can be submitted to the IRS) or to use a valid SSN. When the Audit/Validation process is run again, blanks are treated as a valid SSN so the record does not fail validation. Records will no longer fail validation because of an invalid SSN. There are edits in Campus Community that prevents the use of invalid SSNs (for example, 999-99-9999 or 123-45-6789). If the default SSN value is used (XXX-XX-XXXX), during the validation process the SSN is changed to blank, a message is given on the Audit Validation report, and the record passes validation with a status of Validation Overridden.

See the documentation about the Override Data button earlier in this section.

Click the link to retrieve a 1098-T PDF of the most recent 1098-T data.

The link is sensitive to the context in the 1098-T Status scroll area—that is, the PDF is generated using the data in context (the example 1098–T page has 4 rows of data).

Note: The View 1098-T link does not appear on the (Edit 1098-T Data) 1098–T Data page.

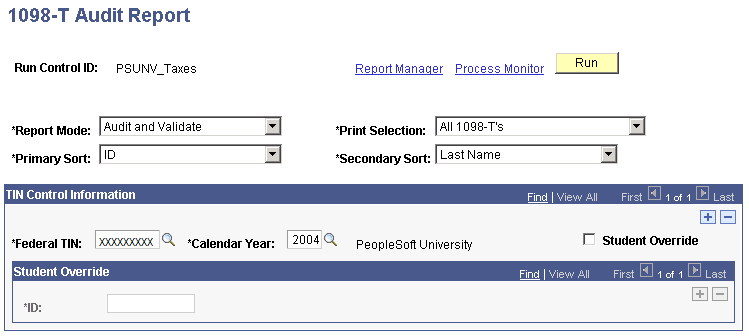

Access the 1098-T Audit Report page ().

Image: 1098-T Audit Report page

This example illustrates the fields and controls on the 1098-T Audit Report page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Report Mode |

Select the report mode. Values are:

|

| Print Selection |

Determine which types of 1098-T records the system includes in the 1098-T Audit Report. Values are. All 1098-T's: Select to include all types of 1098-T records. Not Filed Corrected 1098-T's: Select to include only those 1098-T records that were included in a transmission file and have the Correction check box selected. Not Filed Original 1098-T's: Select to include only those 1098-T records that were not included in a transmission file and do not have the Correction check box selected. Not Printed Corrected 1098-T's: Select to include only those 1098-T records that you have not printed and that have the Correction check box selected. Not Printed Original 1098-T's: Select to include only those 1098-T records that you have not printed and that do not have the Correction check box selected. |

| Primary Sort and Secondary Sort |

Use these fields to determine the fields on which the system sorts when printing the report. It sorts first by the primary sort and then by the secondary sort value. Both fields have the following available values: Country, ID, Last Name, Postal Code, SSN, and State. |

TIN Control Information

|

Field or Control |

Definition |

|---|---|

| Student Override |

Clear to run the report for all applicable students who fall under the Federal TIN and calendar year that you select. Select to use the ID field to run the report on only the students that you specify. |

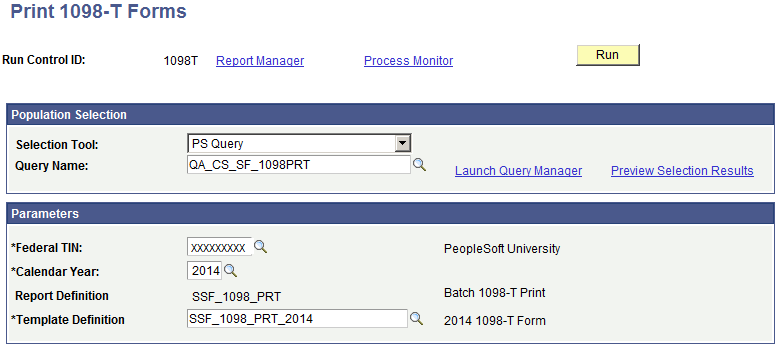

Access the Print 1098–T Forms page ().

Image: Print 1098-T Forms page

This example illustrates the fields and controls on the Print 1098-T Forms page. You can find definitions for the fields and controls later on this page.

Use the Print 1098-T Forms page to mass print 1098-T forms to PDF. Each student’s 1098-T form is printed into unique PDF reports. This option is specified on the report definition, SSF_1098_PRT, in the Bursting option. All generated 1098-T PDF forms are sent to the Report Manager.

Population Selection

Population selection is a method for selecting the IDs to process for a specific transaction. The Population Selection group box is a standard group box that appears on run control pages when the Population Selection process is available or required for the transaction. Selection tools are available based on the selection tools that your institution selected in the setup of the Population Selection process for the application process and on your user security. Fields in the group box appear based on the selection tool that you select. The fields act the same from within the group box no matter what run control page you are on or what transaction you are processing.

|

Field or Control |

Definition |

|---|---|

| Query Name |

The following query is delivered: QA_CS_SF_1098PRT. If you create your own queries, you must include the bind record SSF_1098PRT_BND. |

Parameters

|

Field or Control |

Definition |

|---|---|

| Federal TIN |

Select the tax payer ID number for the reporting institution. |

| Calendar Year |

Select the calendar year record to print for each student. |

| Report Definition |

This is always set to SSF_1098_PRT, which identifies Batch Print 1098-T report templates. |

| Template Definition |

Select the template to use for printing. |

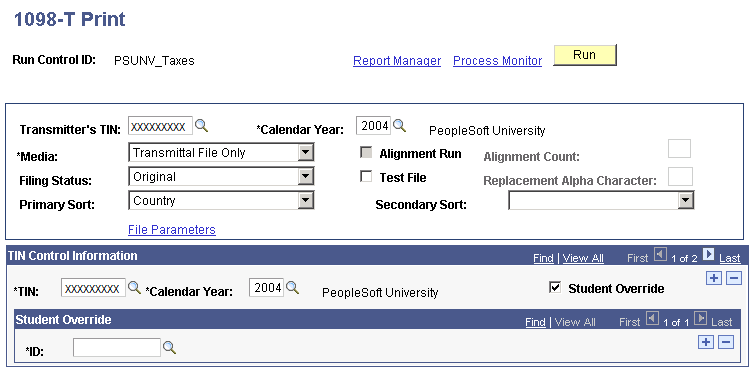

Access the 1098-T Print page ().

Image: 1098-T Print page

This example illustrates the fields and controls on the 1098-T Print page. You can find definitions for the fields and controls later on this page.

Transmitter Information

|

Field or Control |

Definition |

|---|---|

| Calendar Year |

Select the calendar year for which you are reporting. |

| Media |

Select what you want the report to produce. Values are:

|

| Alignment Run |

Select to run a print job that helps you align your print stock in the printer. When you select this check box, the report prints X instead of characters and 9 instead of numbers in the data fields of your 1098-T print stock. This field is available only if you select Print Only in the Media field. Note: Because printer definitions vary, you may have to modify the SQR (Structured Query Report) for printer alignment purposes. |

| Alignment Count |

Enter the number of dummy 1098-T forms that you want to print in your alignment run. This field is available only if you select the Alignment Run check box. |

| Filing Status |

Select the type of records that you want to include in the report and specify the type of file that you intend to transmit to the IRS. Correction: The report includes only those records that have the Correction check box selected. In addition, the system designates the file as containing only corrected records. Original: The report includes only those records that do not have the Correction check box selected. In addition, the system designates the file as containing only original records. Replacement: Select if the IRS rejected the file that you originally sent. The report includes only original records in the replacement file. Note: The filing status that you select applies to the entire file. The IRS does not allow a transmitting TIN to mix original information and correction information within the same file. Note: The 1098-T Form Print process always includes all 1098-T forms, even if they were previously printed or included in a transmission file. Use caution when running the 1098-T Form Print process after its initial run for a tax year. You should use the Student Override option with subsequent runs so that only those students whose information needs to be processed are included in the process. |

| Test File |

Select to set a test file flag in the transmission file that is sent to the IRS. This selection indicates to the IRS that the file is for testing purposes only. Note: You should participate in the IRS test electronic filing program. This program enables you to submit an electronic file containing 1098-T returns so that the IRS can confirm that the file is in a valid, readable format. |

| Replacement Alpha Character |

If the IRS rejects your original file, it requests a replacement and assigns you a two-character replacement alpha character to include with your file. Enter it here. This field is available only if you select Replacement in the Filing Status field. |

| Primary Sort and Secondary Sort |

Use these fields to determine the fields on which the system sorts when printing the report. It sorts first by the primary sort and then by the secondary sort. Both fields have the following available values: Country, EmplID, Last Name, Postal Code, SSN, and State. |

| File Parameters |

Click to access the 1098-T File Info page. |

1098-T File Info Page

|

Field or Control |

Definition |

|---|---|

| File Path |

Enter the location where the system sends the transmission and extract files. |

| Transmission File Name |

Enter the name of the transmission file. If you do not specify a name for the file, the default name is IRSTAX.001. |

| Extract File Name |

If you are using another system to print your 1098-T forms, enter the name of the extract file that the system uses to print the forms. If you do not specify a name, the default name is SF1098RP.dat. |

TIN Control Information

|

Field or Control |

Definition |

|---|---|

| TIN |

Select the TIN for which you want to report 1098-T information. You transmit the information generated by the report using the Transmitter's TIN. |

| Student Override |

Clear to run the report for all applicable students who fall under the federal TIN and calendar year that you select. Select to use the ID field to run the report for only the students that you specify. |