9 Market Risk - Monte

Carlo Simulation, XVA and PFE

The Market

Risk-Monte Carlo Simulation module enables you to derive counterparty risk

measures and Monte-Carlo Value at Risk (VaR) at the counterparty level and

self-counterparty level. The module enables the application to calculate

counterparty risk, which provides a measure of the

adjustments that should be made to the value of deals, to predict the

possibility of a defaulting counterparty.

Valuation (XVA)

adjustments such as Credit Valuation Adjustment (CVA), Debt Valuation

Adjustment (DVA), Funding Valuation Adjustment (FVA). CVA, DVA, and FVA provide

a single value which can be used as an adjustment to the total value of a set

of positions in a portfolio, considering collateral that can be posted between

the counterparties as determined by the Credit Support Annex (CSA) agreements.

Future exposures

such as Potential Future Exposure (PFE), Expected Positive Exposure EPE,

Expected Negative Exposure (ENE), and Expected Exposure (EE). They provide a measure of the potential loss or gain due to

future market changes and are reported as a table of values for user-specified

future observation dates.

Counterparty risk

values are portfolio-level measures such as values for groups of trades instead

of single quantities for each trade. Future exposures are

computed using American Monte Carlo techniques, for a user-specified

number of Monte Carlo paths and set of future observation dates. To do this, a

global hybrid model must be constructed and used by

all the trades in the simulation. The hybrid model consists of a set of

individual factor models that simulate the dynamics of underlyings of the

selected trades.

The inputs required

to set up a calculation of counterparty risk are:

· Definitions for all the counterparties

and self-counterparties that will be used by the

trades in the calculation.

· Each trade must identify

which counterparty and self-counterparty, netting set and which CSA (that is,

sub-netting set) it is associated with, and be able to identify the list of

underlyings used by that trade.

· Counterparties and self-counterparties

must be organized into the following hierarchy:

§ Parent counterparty: At the top level

of the hierarchy, there is a list of separate counterparty entities. Each

counterparty is considered as a separate entity.

§ Child counterparty (Legal entity):

Within each parent counterparty, there is a list of one or multiple child

counterparties. Each child has a unique name within that parent counterparty.

§ Netting Agreement or Sets: Under each

child counterparty there are one or multiple netting sets. Each netting set has

a unique name within that counterparty, and defines

the level at which all the counterparty risk measures are calculated directly

from the results of netting exposures from different trades, after accounting

for the collaterals. At least one netting set must be defined

for each counterparty.

§ Sub-Netting Agreement or Margin Set or

CSA: At the lowest level of the hierarchy, under each netting set there can be

a set of margin sets. Each margin set has a unique name within that netting set,

and at this level the individual parameters that define the CSA used to

calculate collateral exchange are defined. This allows

you to define separate parameters for subsets of trades that must have

specialized collateral calculation rules, although allowing the net result of

exposures and collateral from those trades to be offset or netted with

exposures from other sets of trades under the same netting set.

§ It is also possible to define a margin

set to consider those trades that are not collateralized.

These trades should be placed in a margin set named Residual.

Topics:

· Navigate

to the Monte Carlo Simulation Summary Window

· Search

for a Business Definition

· Create

and Execute a Business Definition

· Export a

Business Definition

· Approve

or Reject a Business Definition

· Delete a

Business Definition

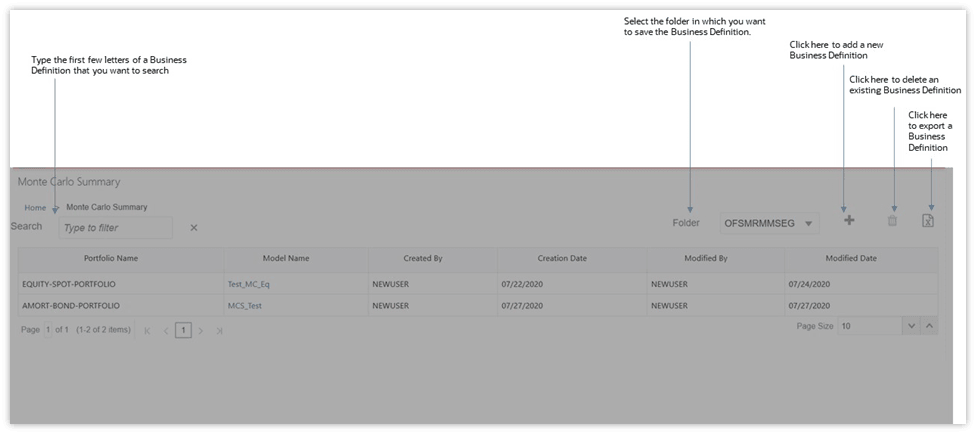

Navigate to the Monte Carlo Summary window

From the MRMM Home page,

select Market Risk Measurement and Management, click Navigation Menu ![]() ,

select Simulation and then select Monte Carlo Simulation.

,

select Simulation and then select Monte Carlo Simulation.

Figure 55: Monte

Carlo Summary Window

Search for a Business Definition

In the Search

field, type the first few letters of the business definition name that you want

to search. The summaries whose names consist of your search string are displayed in a tabular format.

Figure 56: Monte

Carlo Simulation Summary Window – Search Box

![]()

From the breadcrumb

on top, click the Monte Carlo Summary link to return to the summary window

after viewing details of the business definition.

Page View Options

See the Page View Options section

for details.

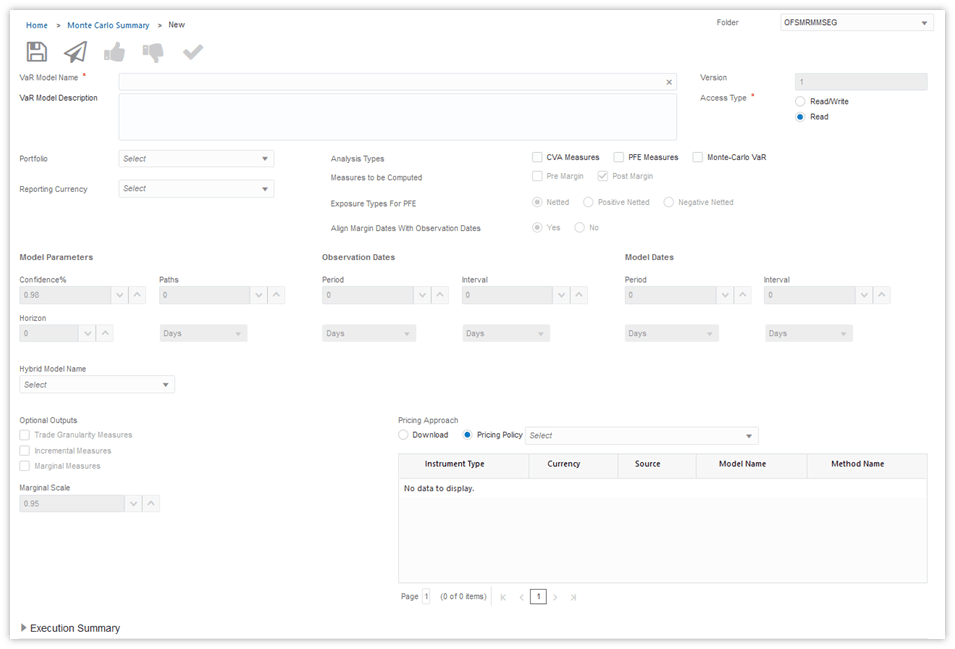

Create and Execute a New

Business Definition

A business

definition allows you to set business specific parameters required for

analysis. To define a new Monte Carlo Simulation - business definition, follow

these steps:

1. In the Monte

Carlo Summary window,

click Add

![]() . The

definition window is displayed.

. The

definition window is displayed.

Figure 57: Monte Carlo Simulation Definition Window

2. Populate the details mentioned in the

following table. Fields marked in red asterisk (*)

are mandatory.

|

Table

29: Monte Carlo Simulation Definition Window – Fields and Descriptions |

|

|

Fields |

Description |

|

VaR Model

Name* |

Enter the

name of the business definition. |

|

VaR Model

Description |

Provide a description of the business

definition. |

|

Version |

Displays the

workflow version of the business definition. |

|

Access Type |

Displays the

access type |

|

Folder |

Select the

folder. |

|

Portfolio* |

Select the

Portfolio from the drop-down list. |

|

Reporting

Currency* |

The currency

in which all the output for a given definition will be

computed. Select the currency code from the drop-down list. |

|

Analysis

Types |

Select the

various computation measures for the business definition. You can select one

or multiple purposes. You can

select both CVA and PFE or Monte Carlo VaR. Each of the subsequent

inputs will be enabled or disabled based on the selected purpose. · CVA Measures · PFE Measures · Monte-Carlo VaR |

|

Measures to be Computed |

Select

pre-margin exposure or post-margin exposures to calculate the counterparty

measures. The default value is Post-Margin. |

|

Exposure

Types for PFE |

Select the

types of exposures to be used for calculating PFE

from the following options: · Netted: It is the sum of pre-margin

or post-margin exposures. · Positive Netted: It is the sum of

positive exposures calculated at the netting set level. · Negative Netted: It is the sum of

negative exposures calculated at the netting set level. |

|

Align Margin

Dates with Observation Dates |

This option enables you to specify whether the Margin (Model)

Dates and Observation Dates should be same. Select Yes or No. If you

select Yes, the Model Date field becomes non-editable. |

|

Model

Parameters |

Specify the

values for the following fields: · Confidence:

Specify the Confidence. Confidence level is required

for PFE calculations. · Paths:

Specify the Number of paths. This is the number of Monte-Carlo paths to be used for the simulations. · Horizon: It

is the time horizon over which the VaR is computed.

This option is available if you select the Analysis

Type as Monte-Carlo VaR. Specify the

horizon in terms of days, months or years. For example, if the horizon is specified as 10 Days then the run will be executed for

VaR outputs with observation date as 10 Days: 10 Days. |

|

Observation

Dates |

Observation

dates are the future dates on which you want to calculate PFE and use for the

exposures to capture the future behavior during CVA computation. Specify the

observation date in Period <Days, Months, Year>: Interval <Days,

Months, Year> format. For example, 30Y:1M, indicates

that one observation date will be generated every month till 30 years. |

|

Model Dates |

Model dates

are additional dates that are used in the simulation

internally, but not used for the final reporting, to obtain better simulation

results and capture more behavior of the deals during their schedules. Specify the

model date in <Period> :< Interval> format. For example, 30Y:30D

which indicates that observation dates are to be

generated, every day for the next 30 years. |

|

Hybrid Model

Name |

The hybrid

model is a set of models to be used for individual

risk factor for generating the paths under Monte Carlo simulation. Select the

strategy from the drop-down menu. See Hybrid Model for

details. |

|

Optional

Outputs |

Specify the

desired optional outputs: · Trade Granularity Measures: Select

this check box to calculate measures at the trade level (in addition to the

counterparty level). This is set to false by default. · Incremental Measures: Select this

check box to calculate incremental measures. This is only available for XVA

and PFE and is set to false by default. · Marginal Measures: Select this check

box to calculate marginal measures. This is only available for XVA and is set

to false by default. |

|

Marginal

Scale |

The scaling

value used for marginal XVA calculations. The default value is 0.95. |

|

Pricing

Policy |

It allows

you to select the pricing policy models and methods to be

used for instrument pricing. You can either download or

define the pricing policy. See section Pricing Policy

for details. For the

selected Pricing Policy, the details such as Instrument

Type, Currency, Source, Model Name, Method Name are displayed. |

3. Click Submit ![]() to save and submit

the definition for approval. A confirmation dialog box is

displayed.

to save and submit

the definition for approval. A confirmation dialog box is

displayed.

Or,

Click Save ![]() to

update the definition before submitting it for

approval.

to

update the definition before submitting it for

approval.

4. If you want to execute the business

definition, follow the steps in the Execute

a Business Definition section.

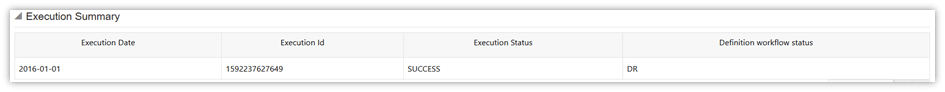

5. Execution Summary

displays the execution history of the business scenarios. Select the execution

to be marked as EOD execution. You can view details of

the execution, such as Execution Date, Execution ID, Execution

Status, and Definition Workflow

Status

in the Execution Summary table.

6. The definition can be

viewed in the Summary window. They are further

used for in the analytics to generate reports.

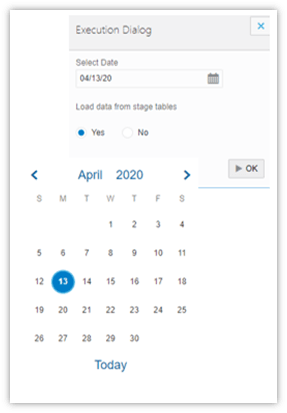

Execute a Business Definition

To execute a

business definition, follow these steps:

1. Click the business definition name in

the Summary page. The definition window is displayed.

2. Click Edit ![]() .

.

3. Click Execute ![]() to trigger an Ad hoc run. A message

with a date-time editor dialog box is displayed.

to trigger an Ad hoc run. A message

with a date-time editor dialog box is displayed.

4. Specify the date on which the execution

must be performed.

5. If you want to load trade and market

data from stage tables, select Yes in the field Load

Data From Stage Tables,

else select No. Click OK ![]() . The execution is triggered.

. The execution is triggered.

Figure 58: Monte Carlo Simulation Execution - Date-Time Editor

6. Click OK. A confirmation dialog box is displayed.

7. Click OK to confirm.

8. Execution Summary

displays the execution history of the business scenarios. Select the execution

to be marked as EOD execution. You can view details of

the execution, such as Execution Date, Execution ID, Execution

Status, and Definition Workflow

Status

in the Execution Summary table.

Figure 59: Monte

Carlo Simulation Execution Summary

Edit a Business Definition

See the Edit a

Business Definition section for details.

Export a Business

Definition

See the Export a

Business Definition section for details.

Approve or Reject a Business Definition

See the Approve

or Reject a Business Definition section for details.

Delete a Business Definition

See the Delete a

Business Definition section for details.