This section provides information about Insurance Contracts tables such as Common Policy Summary tables, Reinsurance Contract Held tables, Reinsurance Contract Issued tables, other Reinsurance tables, Insurance Coverage tables, Insurance Policy, and Fund tables, and Policy Schedules tables in the Oracle Insurance Data Foundation application.

Topics:

· How to Load Insurance Contracts in OIDF?

· Insurance Participation Tables

· Reinsurance Contracts Tables

· Deploying Insurance Contracts Tables on Hive

· Populating Insurance Contracts Dimension Tables

· Populating Insurance Contracts T2T Result Tables

Accounting standards define insurance contract as a contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder.

This section provides information about how to load the Insurance Contracts in OIDF.

Topics:

· Direct Insurance Contract Structure

This diagram elaborates on the OIDF design for Direct Insurance Contracts. The base contract is loaded in the contract table, and coverages or riders are loaded to the coverages tables. One policy can contain more than one coverage. Depending on the applicability, a policy can consist of a fund associated with it and (or) a loan associated with it.

Figure 89: Direct Insurance Contracts in OIDF

To load an Insurance Contract in OIDF, follow these steps:

1. The key components in contract structure are Product, Party, and Contract itself. Under the contract component, the user must choose one of the Product Processors from Life, Annuity, Property and Casualty, Retirement, and Health.

2. Load Policy Coverages with Product Processor for multiple benefits or coverages.

3. Some contracts such as Annuity requires funds where market risk is with the policyholder. Load this information to Policy Funds. This is an optional step and is dependent on the product structure.

4. Some contracts specify Adhoc or varying Policy Schedules such as Credit Life Insurance, varying premium policies, and so on, where the sum insured and premium amounts vary depending on the outstanding debt or other criteria. In such cases, customers can choose to load Policy Schedules in Stage Policy Schedules.

5. In the case of Group Insurance Contracts, the contract between the insurance provider and a company or group must be stored in either Life, Health, or applicable product processor. Stage Group Insurance Beneficiary Details hold details of each member such as individual limits, individual usage, and identifiers such as card numbers, annual and per condition deductibles. Another type of Group Insurance Contracts is the Worker's Compensation, which offers compensation to the employees for sustaining injuries or disabilities because of their employment. There are two ways to populate the data in the Fact Group Insurance Policy Summary table. They are:

§ The data population through the T2T_FGPS_STG_GRPINS_POLICY_SUMMARY, which is at the Policy Summary level.

§ The data population through the T2T_FGPS_STG_GRPINS_POL_BENFCIARY_DTLS, where the data can be populated for the count at the policy or beneficiary level.

6. For loans issued under a given policy, load contracts into one of the Insurance product processor, and load every loan contract issued under a given policy to stage loan contracts. See the Policy Loans section.

7. Contracts, which are convertible from one insurance product to another with or without changing the insurance carrier, require additional conversion details. For more details, see Policy Conversion.

In OIDF, Direct Insurance Contracts comprise of the following important components:

· Contract

· Coverage

In OIDF, Reinsurance is also a part of Contracts.

Party, which means a beneficiary, producer and agent, underwriter, and so on, are expected to be created and available for reference in the Party set of tables based on the related role. For details, see the Party Subject Area section.

Contract attributes cover contract identifier, product identifier, the sum insured, origination date, purchase date, maturity date, policy status, and so on. A group insurance contract must also be stored in one of the relevant tables mentioned below.

Contracts, as defined earlier, is a record in one of the following stage tables, called as a product processor comprising of a set of attributes relevant to a particular Insurance Contract. They are outputs sourced from policy administration systems.

This is the list of entities covered under Direct and Indirect Insurance or Reinsurance Contracts to elaborate OIDF design for Insurance Contracts.

Source Logical Table Name |

Source Table Name |

|---|---|

Stage Annuity Contracts |

STG_ANNUITY_CONTRACTS |

Stage Health Insurance Contracts |

STG_HEALTH_INS_CONTRACTS |

Stage Life Insurance Contracts |

STG_LIFE_INS_CONTRACTS |

Stage Property and Casualty Contracts |

STG_PROP_CASUALTY_CONTRACTS |

Stage Retirement Accounts |

STG_RETIREMENT_ACCOUNTS |

Stage Reinsurance Contracts Held |

STG_REINSURANCE_CONTRACTS_HELD |

Stage Reinsurance Contracts Issued |

STG_REINSURANCE_CNTRCTS_ISSUED |

For the list of tables and the mapping details, see Contract Tables.

Coverage is an individual contractual obligation incurred by the contract provider. Aggregation of all such obligations within the terms and conditions defined must be equal to contractual liability of a contract. Consider these two examples:

· A Life Insurance contract offering a normal death benefit, accidental death benefit, and critical illness benefits to the insured.

· An Auto Insurance policy with auto liability, medical payment liability, personal injury protection, and third-party liability.

In the above example, a single row is created in the life insurance contract entity and property and casualty insurance contract entity. And the policy coverage entity stores three rows for the life insurance contracts and four rows for auto insurance contracts. In many insurance contracts, certain coverages, known as riders, are optional, and some are bundled as a part of the contract itself. All such coverages must be stored in stage policy coverages. Different coverages may have effective dates having different maturity periods and may have to vary different terms and conditions limiting to the main contract. Stage Policy Coverage entity allows the end-user to handle this flexibility. In the case of group insurance, policy coverages refer to the single aggregated benefit or rider bundled as a part of the product across all group members.

Riders or optional benefits must be loaded as coverages in Oracle Insurance Data Foundation. Coverage option or a component, which is dependent on the existence and continuation of another component and its effect or attributes is limited to a specific parent, then it must be modeled as a Coverage. Therefore, this relationship defines an association between the Coverage Option and its parent, where if the parent lapses or is no longer in effect for any reason, the Coverage Option under it also lapses or terminates or ends.

For the list of tables and mapping details, see Coverage Tables.

Guaranteed Benefits:

Guaranteed Benefits is a component of insurance policy or contract, which provides for either part of the full benefit amount is guaranteed by the Insurer.

Examples for illustration (These examples are not limited to this illustration):

· Scenario 1: On death during the policy term, the nominee receives a guaranteed lump sum payout with an option to convert it into monthly income for 10 years. On the death of the Life Insured during the Policy Term, lump sum Death Benefit equal to Guaranteed Sum Assured on Death (GSAD) is payable to the nominee.

· Scenario 2: On retirement, the plan may payout in monthly payments throughout the lifetime of the employee, or as a lump sum payment. If the employee dies, some plans distribute any remaining benefits to the beneficiaries of the employee.

Embedded Options:

An Embedded Option is a special condition attached to an Insurance Contract, which gives the policyholder or the issuer the right to perform a specified action at some point in the future. An Embedded Option is an inseparable part of an Insurance Contract, and therefore, it cannot trade by itself. However, it can affect the value of the Insurance Contract of which it is a component.

To separate an Embedded Option from the Insurance Contract, the following conditions must be met:

· The economic characteristics and risks of the Embedded Option are not closely related to the economic characteristics and risks of the host (the remaining Insurance Contract).

· A separate instrument with the same terms as the Embedded Option meets the definition of an Option.

· The contract, which is not measured at fair value with changes in fair value recognized in profit or loss.

Examples for illustration (These examples are not limited to this illustration):

· Example 1: A Death Benefit that is linked to equity prices payable only on death (and not on surrender or maturity), or the greater of the unit value of an investment and a guaranteed amount.

In this scenario, the existing benefit, which is the Death Benefit option, is in the contract and is linked to the market. Therefore, Embedded Option is not separated and it falls under IFRS 17.

· Example 2: An option to take a Life-Contingent Annuity at a guaranteed rate.

In this scenario, the existing benefit is given out as an additional benefit option to the contract in the form of Embedded Option. This benefit is not separated from the Insurance Contracts.

· Example 3: A minimum annuity payment, if the annuity payments are linked to the investment returns. Additionally, the guarantee is related only to Life-Contingent Payments, or the policyholder can choose to receive a Life-Contingent Payment or a fixed amount of payments at predetermined terms.

In this scenario, the minimum annuity payment, which is made by the insured is periodically linked to the investment returns of the contract with an additional benefit option to the contract as an Embedded Option. Therefore, it is not separated from the Insurance Contracts.

Both Guaranteed Benefits and Embedded Options must be loaded to stage policy coverages covering specific attributes such as Guarantee Type, Option Dates, and so on. For the list of tables and mapping details, see Embedded Options Tables.

When multiple carriers share the insurance risk, it is called as Insurance Participation. In OIDF, load the participation data to Stage Insurance Participation Details. In this participation entity, the Contract Code refers to the Insurance Contract.

For the list of tables and mapping details, see Insurance Participation Tables.

Supplemental Data refers to the additional and contextual information applicable to only certain specific insurance contracts. This consists of group insurance details, policy schedules, policy funds, policy loans, and policy conversions.

A group insurance contract is one that is agreed between the insurance company and entity which sponsors the policy. This contract must be stored in one of the seven product processors. However, in general, stage life insurance and stage health insurance, contracts will be referred to in most of the use cases of group insurance.

Details of members of group insurance are stored in stage group insurance beneficiary details. This entity holds details of each member such as individual limits, individual usage, and identifiers such as card numbers, annual and per condition deductibles. In cases where such details are not available, aggregated numbers must be loaded in main contract entities. For the list of tables and mapping details, see Group Beneficiary Tables.

Policy Schedules refers to the agreed non-linear premium and benefit schedules associated with the insurance contracts. For the list of tables and mapping details, see Policy Schedules Table.

This holds investment of funds data of a given insurance contract where the market risk of investment rests with Policyholders. There are two entities: policy fund details and policy fund allocation. Policy Funds provide funds-wise investment snapshot in time when policy fund allocation provide changes over time. When there is technically no restriction as these entities are connected by policy code to the main contract table, they are most commonly applicable to annuity contracts, life insurance contracts, and retirement accounts. For the list of tables and mapping details, see Policy and Funds Tables.

Some insurance policies allow policyholders to borrow from policy accumulations in terms of loans as per the terms and conditions laid in the contract. Such loans are considered as a contract by itself in OIDF and must be loaded in stage loan contracts. This entity holds policy identifiers to link multiple loans taken under a given insurance policy. For the list of tables and mapping details, see Policy Loans Tables.

Policy Conversion refers to the privileged provisions provided in an insurance contract whereby a policyholder to convert a term policy to a permanent policy that provides insurance for the rest of life.

For the list of tables and mapping details, see Policy Conversion Table.

An Insurer can insure their special event such as sports, film shooting, concerts, and so on under the Policy Coverages against the liabilities.

Any Party that needs insurance coverage against the liquor liabilities can obtain insurance using the Policy Coverages. The liquor liabilities coverage may be applicable as a part of the Special Event Insurance if the liquor is served at the special event venue.

The STG_POLICY_COVERAGES and FCT_ POLICY_COVERAGES tables are enhanced to store the special events-related information. For information about the Policy Coverages tables, see the section Coverage Tables.

A special event can consist of multiple Policy Coverages. Therefore, the Policy Coverage Special Event Map tables are added in the Oracle Insurance Data Foundation Application Pack. The Policy Coverage Special Event Map table is used to save the special event and policy coverage mapping details such as the Policy ID, Coverage ID, and Special Event ID, and Liquor License Reference. As a result, when a special event consists of multiple Policy Coverages, the special event information is mapped to the Policy Coverages using this Policy Coverage Special Event Map table. For more information about the Policy Coverages tables, see the Coverage Tables section.

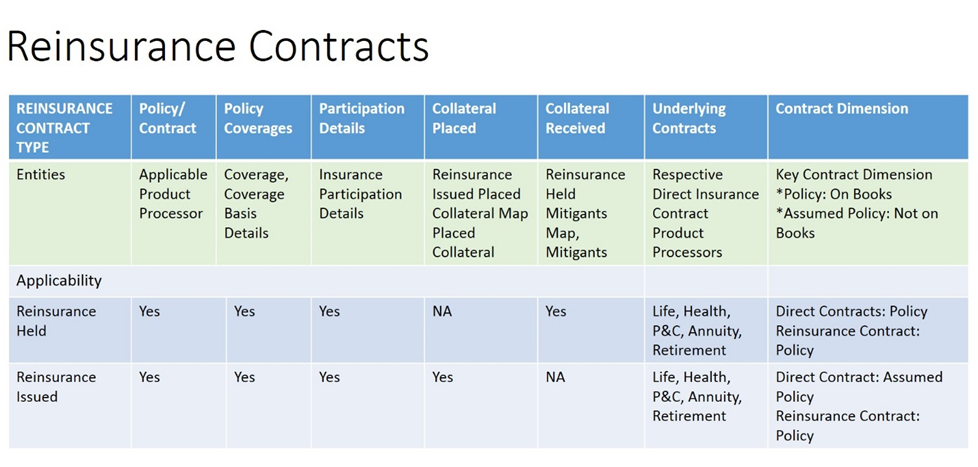

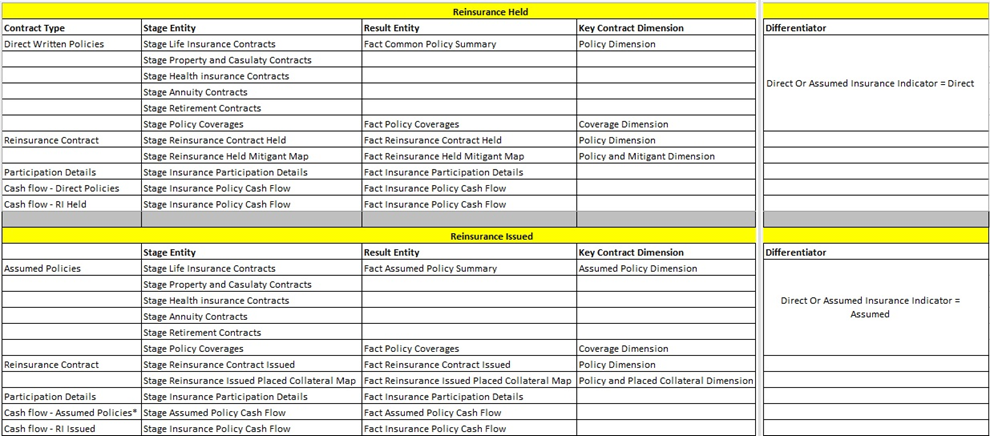

Reinsurance contract refers to an insurance contract issued by one entity (the reinsurer) to compensate another entity for claims arising from one or more insurance contracts issued by that other entity (underlying insurance contracts). Reinsurance Contracts consists of two types of contracts:

· Reinsurance Contracts Issued: This is a contract entered into by a reinsurance company when they sell the reinsurance contract to an insurance company. Often, this is called as a reinsurance contract written by a specific reinsurer to differentiate between purchased and sold.

· Reinsurance Contracts Held: This is a contract entered into by an insurance company when they purchase a reinsurance contract to mitigate the claims or losses.

Reinsurance Contracts Issued and Held

Reinsurance Contracts Issued and Held is depicted through the following diagram.

Figure 90: Reinsurance Contracts Issued and Held in OIDF

For the list of tables and mapping details, see Reinsurance Contracts Tables.

Reinsurance Contract structure consists of a set of entities, primarily Direct Contracts, Assumed Contracts, Reinsurance Contract, Collateral Placed, Collateral Received, Participation Contracts. This is the representative diagram of the Reinsurance Contract and its entities.

Figure 91: Reinsurance Contract structure

Reinsurance Contract entities are explained in the following sections.

In the case of Reinsurance Held, Direct Insurance Contracts are those, which are on the books of the insurance carrier and covered through a given reinsurance contract. These Direct Contracts are loaded through the same insurance contract structure, as mentioned earlier. They are product processors for Life, Health, Annuity, Retirement, and Property, and Casualty contracts. However, Direct and Assumed Indicators in each product processor must be marked as D to convey that they are on the books.

For the list of tables and mapping details, see Common Policy Summary Tables.

In the case of Reinsurance Issued, Reinsurance Contract is on the books of the carrier whereas insurance contracts covered belong to another carrier. These underlying Insurance Contracts must be loaded through some insurance contract structure as mentioned earlier. They are product processors for Life, Health, Annuity, Retirement, and Property, and Casualty contracts. However, Direct and Assumed Indicators in each product processor must be marked as A to convey that they are not on the books and are assumed ones.

For the list of tables and mapping details, see Assumed Policy Summary tables in the Contract Tables section.

Reinsurance Contracts, as mentioned above earlier, must be loaded to Stage Reinsurance Contracts Issued or Stage Reinsurance Contracts Held. Underlying Direct Insurance Contracts, which are on the book or marked as D for Direct in Direct or Assumed Indicator, are moved to Policy Dimension. In addition, those, which are not on the book or marked as A for Assumed in Direct or Assumed Indicator, are moved to Assumed Policy Dimension to differentiate contracts effectively.

For the list of tables and mapping details, see Reinsurance Contracts Tables.

When multiple reinsurers come together to share the insurance risk, said contract becomes eligible for Reinsurance Participation. OIDF holds this data in Stage Insurance Contract Participation Details. In this participation entity, the Contract Code refers to the Reinsurance Contract.

For the list of tables and mapping details, see Insurance Participation Tables.

In the case of reinsurance contracts Issued, the reinsurance carrier provides the collateral to insurance companies for safety. This is called a Reinsurance Issued Placed Collateral. OIDF provides a map entity to map a given Reinsurance Contract and collateral placed. Actual investment contracts, which are placed as collateral can be loaded to investment product processors such as Stage Investment or Stage Money Market Contracts and (or) Stage Placed Collateral depending on whether investment assets have been transferred as actual physical transfer or not.

For the list of tables and mapping details, see About Reinsurance Contracts T2Ts (Result Tables).

In the case of Reinsurance Contracts Held, the insurance carrier holds the collateral provided by reinsurance companies for safety. This is called as Reinsurance Held Mitigants. OIDF provides a map entity to map a given reinsurance contract and collateral received or mitigants.

For the list of tables and mapping details, see About Reinsurance Contracts T2Ts (Result Tables).

This section provides information about the Contract tables.

Topics:

· Common Policy Summary Tables

· Long Duration Contracts Table

· Life Insurance Contract Tables

· Health Insurance Contract Tables

· Property and Casualty Contract Tables

Common Policy Summary stores the detailed information elements of insurance policies directly written or issued by the insurance companies.

Common Policy Summary Dimension table names and their descriptions are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Insurance Notice Type Dimension |

This table stores the details of the type of notice sent. Sample values are OTHER, UNKNOWN, CONFIRM, PREM1, and so on. |

Insurance Sponsoring Plan Type Dimension |

This table stores the type of sponsored benefit plan to which this holding belongs. Sample values are OTHER, UNKNOWN, ESLTC, and SEWBP. |

Policy Status Reason Dimension |

This table stores the details of policy reasons for status. Sample values are OTHER, UNKNOWN, APPEAL, APPDECLINE, BACKPROC, and so on. |

Policy Exchange Reason Dimension |

This table stores the Exchange Reason Code details. It is used only when a single exchange reason is required. For multiple reasons for the exchange, use Exchange Reason aggregate. Sample values: OTHER, UNKNOWN, BROKERSDIR, COMM, FEES, and so on. |

Policy Replacement Type Dimension |

This table stores the details of the proposed policy replacement type and reflects in aggregate the replacement types of all existing contracts that will be replaced. Sample values: OTHER, UNKNOWN, BOTH, EXTERNAL, FINPURCH, GROUPCONV, and so on. |

Premium Offset Status Dimension |

This table stores the details about premium offset status. In situations where a Premium Offset Method is specified, this is the status of that method. Sample values: REQACT, NONE, REQINACT, UNKNOWN, and OTHER. |

Non-Forfeiture Provision Type Dimension |

This table stores the details of the Non-Forfeiture Provision type. The several ways in which a policy owner may apply the cash value of a life insurance policy if the policy lapses. Sample values: ANNRID, APLANNRID, APLEXTTERM, OTHER, and so on. |

Insurance Test Type Dimension |

The table stores the details of the life insurance test type. Sample values: CVTEST, DEFRACVTEST, GPTEST, and TEFRAGPEST. |

Tax Rebate Exchange Type Dimension |

This table stores the details of the tax rebate exchange type. Sample values: IRREVOC, OTHER, REVOC, and so on. |

Grandfathered Tax Regulation Type Dimension |

This table stores the details of the Grandfathered Tax Regulation Type and specifies if a policy or contract is grandfathered under certain tax regulations. Sample values: DEFRA, ROTHIRA, TAMRA, NO, OTHER, and UNKNOWN. |

Premium Basis Dimension |

Stores the details of the Premium Basis. An insurance premium is based on the type and amount of risk, or exposure, involved in operating a business. Sample values: 1000CubicMeters, 1000Liters, ADMIS, AREA, Basic, Building, Court, and so on. |

Worker Compensation Business Line Dimension |

Stores the details of the Worker’s Compensation business line. |

The mapping details for the Common Policy Summary Dimension tables are given here.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

685 |

STG_INS_NOTICE_TYPE_MASTER |

Stage Insurance Notice Type Master |

DIM_INS_NOTICE_TYPE |

Insurance Notice Type Dimension |

686 |

STG_INS_SPON_PLAN_TYPE_MASTER |

Stage Insurance Sponsoring Plan Type Master |

DIM_INS_SPON_PLAN_TYPE |

Insurance Sponsoring Plan Type Dimension |

687 |

STG_POLICY_STATUS_RSN_MASTER |

Stage Policy Status Reason Master |

DIM_POLICY_STATUS_RSN |

Policy Status Reason Dimension |

691 |

STG_POL_EXCHANGE_REASON_MASTER |

Stage Policy Exchange Reason Master |

DIM_POL_EXCHANGE_REASON |

Policy Exchange Reason Dimension |

692 |

STG_POL_REPLACEMNT_TYPE_MASTER |

Stage Policy Replacement Type Master |

DIM_POL_REPLACEMNT_TYPE |

Policy Replacement Type Dimension |

730 |

STG_PREM_OFFSET_STATUS_MASTER |

Stage Premium Offset Status Master |

DIM_PREM_OFFSET_STATUS |

Premium Offset Status Dimension |

732 |

STG_NONFOREFT_PROV_TYPE_MASTER |

Stage Non Forfeiture Provision Type Master |

DIM_NONFOREFT_PROV_TYPE |

Non Forfeiture Provision Type Dimension |

734 |

STG_INSURANCE_TEST_TYPE_MASTER |

Stage Insurance Test Type Master |

DIM_INSURANCE_TEST_TYPE |

Insurance Test Type Dimension |

735 |

STG_TAX_REBATE_EX_TYPE_MASTER |

Stage Tax Rebate Exchange Type Master |

DIM_TAX_REBATE_EX_TYPE |

Tax Rebate Exchange Type Dimension |

736 |

STG_GF_TAX_REGLTN_TYPE_MASTER |

Stage Grandfathered Tax Regulation Type Master |

DIM_GF_TAX_REGLTN_TYPE |

Grandfathered Tax Regulation Type Dimension |

780 |

STG_PREMIUM_BASIS_MASTER |

Stage Premium Basis Master |

DIM_PREMIUM_BASIS |

Premium Basis Dimension |

786 |

STG_WC_BUSINESS_LINE_MASTER |

Stage Worker Compensation Business Line Master |

DIM_WC_BUSINESS_LINE |

Worker Compensation Business Line Dimension |

For information about the Common Policy Summary T2Ts, see the following sections:

· About Life Insurance Contract T2Ts (Result Tables)

· About Health Insurance Contract T2Ts (Result Tables)

· About Annuity Contract T2Ts (Result Tables)

· About Property and Casualty Contract T2Ts (Result Tables)

· About Retirement Contract T2Ts (Result Tables)

Long Duration Contracts (principally life and annuity contracts) table stores the calculation of the liability of future policy benefits, a simplified amortization method for deferred acquisition costs, recording market risk benefits at fair value, and enhanced disclosures.

Long Duration Contracts Dimension table name and its description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Insurance Guarantee Type Dimension |

This table stores the details of the Insurance guarantee type. |

The mapping details for the Long Duration Contracts Dimension table are given here.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

701 |

STG_INS_GUARANTEE_TYPE_MASTER |

Stage Insurance Guarantee Type Master |

DIM_INS_GUARANTEE_TYPE |

Insurance Guarantee Type Dimension |

Life insurance is a contract between an insurer and a policyholder in which the insurer guarantees payment of a death benefit to the named beneficiaries when the insured dies. The insurance company promises a death benefit in exchange for premiums paid by the policyholder.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For the description of Policy Dimension, see the section Policy Dimension Table.

Assumed Policy Summary stores the detailed information elements of insurance policies that are not directly written or issued by the insurance company. In the Contracts table, if the value of the Direct Assumed Indicator column is A, then Fact Assumed Policy Summary tables are populated.

Life Insurance Contract Dimension table names and their description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Policy Dimension |

This table stores the list of all policies issued by the insurer. |

Assumed Policy Dimension |

This table stores the assumed policy details. |

The mapping details for the Life Insurance Contract Dimension tables are given here.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For mapping information about Policy Dimension, see the chapter Policy Dimension Table.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

401 |

STG_LIFE_INS_CONTRACTS_V |

Stage Life Insurance Contracts View |

DIM_POLICY |

Policy Dimension |

616 |

VW_STG_LIFE_INS_CONTRACTS |

Stage Life Insurance Contracts View |

DIM_ASSUMED_POLICY |

Assumed Policy Dimension |

NOTE:

In the Fact Common Policy Summary tables, if the value of V_DIRECT_ASSUMED_RI_IND is D or NULL or any other value apart from A, then Fact Common Policy Summary T2Ts are populated. Here, D is Direct Contracts, and A is Assumed Contracts.

NOTE:

In the Contracts tables, if the value of V_DIRECT_ASSUMED_RI_IND is A, then Fact Assumed Policy Summary T2Ts are populated. Here, A is Assumed Contracts.

Life Insurance Contract T2Ts and their description are given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCPS_STG_LIFE_INS_CONTRACTS |

This T2T stores details of policy related to life insurance contracts. |

T2T_FAPS_STG_LIFE_INS_CONTRACTS |

This T2T stores the details of policy related to life insurance contracts. |

The mapping details for Life Insurance Contract T2Ts and their description are given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_LIFE_INS_CONTRACTS |

Stage Life Insurance Contracts |

FCT_COMMON_POLICY_SUMMARY |

Fact Common Policy Summary |

T2T_FCPS_STG_LIFE_INS_CONTRACTS |

STG_LIFE_INS_CONTRACTS |

Stage Life Insurance Contracts |

FCT_ASSUMED_POLICY_SUMMARY |

Fact Assumed Policy Summary |

T2T_FAPS_STG_LIFE_INS_CONTRACTS |

Health insurance is a contract between the insurer and the policyholder or an individual's sponsor in which the insurer provides the payments of the complete or a part of the risk that the policyholder (or registered beneficiaries) incurs in the form of medical expenses in exchange for premiums paid by the policyholder or by the individual's sponsor.

An insurer develops a routine finance structure, such as a monthly premium or payroll tax by estimating the overall health risk and health system expenses over the risk pool and provides the money to pay for the health care benefits specified in the insurance agreement.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For the description of Policy Dimension, see the chapter Policy Dimension Table.

Assumed Policy Summary stores the detailed information elements of insurance policies that are not directly written or issued by the insurance company. In the Contracts table, if the value of the Direct Assumed Indicator column is A, then Fact Assumed Policy Summary tables are populated.

Health Insurance Contract Dimension table names and their description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Policy Dimension |

This table stores the list of all policies issued by the insurer. |

Assumed Policy Dimension |

This table stores the assumed policy details. |

The mapping details for the Health Insurance Contract Dimension tables are given here.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For mapping information about Policy Dimension, see the chapter Policy Dimension Table.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

402 |

STG_HEALTH_INS_CONTRACTS_V |

Stage Health Insurance Contracts View |

DIM_POLICY |

Policy Dimension |

617 |

VW_STG_HEALTH_INS_CONTRACTS |

Stage Health Insurance Contracts View |

DIM_ASSUMED_POLICY |

Assumed Policy Dimension |

NOTE:

In the Fact Common Policy Summary tables, if the value of V_DIRECT_ASSUMED_RI_IND is D or NULL or any other value apart from A, then Fact Common Policy Summary T2Ts are populated. Here, D is Direct Contracts, and A is Assumed Contracts.

NOTE:

In the Contracts tables, if the value of V_DIRECT_ASSUMED_RI_IND is A, then Fact Assumed Policy Summary T2Ts are populated. Here, A is Assumed Contracts.

Health Insurance Contract T2Ts and their description are given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCPS_STG_HEALTH_INS_CONTRACTS |

This T2T stores details of policy related to health insurance contracts. |

T2T_FAPS_STG_HEALTH_INS_CONTRACTS |

This T2T stores details of policy related to health insurance contracts. |

The mapping details for Life Insurance Contract T2Ts and their description are given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_HEALTH_INS_CONTRACTS |

Stage Health Insurance Contracts |

FCT_COMMON_POLICY_SUMMARY |

Fact Common Policy Summary |

T2T_FCPS_STG_HEALTH_INS_CONTRACTS |

STG_HEALTH_INS_CONTRACTS |

Stage Health Insurance Contracts |

FCT_ASSUMED_POLICY_SUMMARY |

Fact Assumed Policy Summary |

T2T_FAPS_STG_HEALTH_INS_CONTRACTS |

Annuity tables store the details of annuity contracts, which are defined as a written agreement between a financial institution and a customer outlining obligations of each Party in an annuity coverage agreement.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For the description of Policy Dimension, see the chapter Policy Dimension Table.

Assumed Policy Summary stores the detailed information elements of insurance policies that are not directly written or issued by the insurance company. In the Contracts table, if the value of the Direct Assumed Indicator column is A, then Fact Assumed Policy Summary tables are populated.

Annuity Contract Dimension table names and their description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Policy Dimension |

This table stores the list of all policies issued by the insurer. |

Assumed Policy Dimension |

This table stores the assumed policy details. |

Annuity Payout Type Dimension |

This table stores the details of the annuity payout type. Sample values: FIX, VAR, and so on. |

Annuity Type Dimension |

This table stores the details of the annuity type for the policies. Sample values: LOA, LAPC, LAGT, JSA. |

The mapping details for the Annuity Contract Dimension tables are given here.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For mapping information about Policy Dimension, see the chapter Policy Dimension Table.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

403 |

STG_ANNUITY_CONTRACTS_V |

Stage Annuity Contracts View |

DIM_POLICY |

Policy Dimension |

618 |

VW_STG_ANNUITY_CONTRACTS |

Stage Annuity Contracts View |

DIM_ASSUMED_POLICY |

Assumed Policy Dimension |

702 |

STG_ANNUITY_PAYOUT_TYPE_MASTER |

Stage Annuity Payout Type Master |

DIM_ANNUITY_PAYOUT_TYPE |

Annuity Payout Type Dimension |

703 |

STG_ANNUITY_TYPE_MASTER |

Stage Annuity Type Master |

DIM_ANNUITY_TYPE |

Annuity Type Dimension |

NOTE:

In the Fact Common Policy Summary tables, if the value of V_DIRECT_ASSUMED_RI_IND is D or NULL or any other value apart from A, then Fact Common Policy Summary T2Ts are populated. Here, D is Direct Contracts, and A is Assumed Contracts.

NOTE:

In the Contracts tables, if the value of V_DIRECT_ASSUMED_RI_IND is A, then Fact Assumed Policy Summary T2Ts are populated. Here, A is Assumed Contracts.

Annuity Contract T2Ts and their description are given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCPS_STG_ANNUITY_CONTRACTS |

This T2T captures the details of annuity contracts, which are defined as a written agreement between a financial institution and a customer outlining obligations of each Party in an annuity coverage agreement. |

T2T_FAPS_STG_ANNUITY_CONTRACTS |

This T2T stores annuity contract details, which are defined as a written agreement between a financial institution and a customer outlining the obligations of each Party in an annuity coverage agreement. |

The mapping details for Life Insurance Contract T2Ts and their description are given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_ANNUITY_CONTRACTS |

Stage Annuity Contracts |

FCT_COMMON_POLICY_SUMMARY |

Fact Common Policy Summary |

T2T_FCPS_STG_ANNUITY_CONTRACTS |

STG_ANNUITY_CONTRACTS |

Stage Annuity Contracts |

FCT_ASSUMED_POLICY_SUMMARY |

Fact Assumed Policy Summary |

T2T_FAPS_STG_ANNUITY_CONTRACTS |

This section details the Property and Casualty Contract tables in the Oracle Insurance Data Foundation application.

In the Property and Casualty Contract category, the Auto Insurance tables store details of the policy related to the auto insurance contracts. The OIDF application supports auto insurance contracts for individual vehicles and a fleet of vehicles.

To load an Auto Insurance Contract in OIDF, follow these steps:

1. The key components in the Auto Insurance Contract structure are the details related to the vehicle, inspection, inspection report, driver, driver’s license, and the Contract itself. Under the Contract component, the user must choose the Property and Casualty Product Processor.

2. Based on the Policy ID, load Dimensions for the vehicle, and the type of the vehicle body, seat belt, engine, lease, tire, interior material, and the vehicle purpose.

3. Inspection is done based on whether the policy is new or if it must be renewed, or is it a claim request. The policy renewal is additionally based on the extent of the vehicle damage. Now, load the vehicle inspection details. If a vehicle is exempt from inspection, then load the Vehicle Inspection Exempt Reason Dimension with the reasons for exemption. The inspection progress must be monitored and therefore, load the vehicle inspection status details.

4. The vehicle inspection details and the vehicle inspection status are used to rate the vehicle. Load the vehicle rating information.

5. Load the Driver Dimension details.

6. Load the driver's license and driver’s license status details.

7. Use the mapping table to find the relationship between the claim, driver, and vehicles.

8. Use the mapping table to find the relationship between the policy, driver, and vehicles.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For the description of Policy Dimension, see the chapter Policy Dimension Table.

Assumed Policy Summary stores the detailed information elements of insurance policies that are not directly written or issued by the insurance company. In the Contracts table, if the value of the Direct Assumed Indicator column is A, then Fact Assumed Policy Summary tables are populated.

Property and Casualty Contract Dimension table names and their description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Policy Dimension |

This table stores the list of all policies issued by the insurer. |

Assumed Policy Dimension |

This table stores the assumed policy details. |

Vehicle Dimension |

Stores the vehicle details included in the policies and claims. |

Vehicle Type Dimension |

This table stores the vehicle type details. Sample values are SUV, Car, Truck, and so on. |

Vehicle Body Type Dimension |

Stores the vehicle body type details. There are different sets of values for different types of vehicles. For example, values can be a two-door sedan, two-door hatchback, five-door sedan, and so on. |

Vehicle Rating Dimension |

Stores the vehicle rating details. Even when the vehicle ratings are prepared internally, they are handled through a common underwriter or rating agencies. |

Vehicle Tonage Capacity Dimension |

Stores the tonnage capacity rating details. For different jurisdictions, there are different ratings and groupings of tonnage capacity. |

Vehicle Seat Belt Type Dimension |

Stores the seat belt details available in the vehicle. Sample values: Active, None, PassBoth, PassDrv, and SeatAir. |

Vehicle Damage Type Dimension |

Stores the nature or type of vehicle damage as provided by the inspection conducting party. Sample values: BUMPF, RFELF, RFERF, RGRIL, RHOOD, ROOF, and so on. |

Vehicle Engine Type Dimension |

Stores the engine type details. Sample values: D, E, G, H, N, O, P, TD, and TG. |

Vehicle Lease Type Dimension |

Stores the ownership or leased status details of the vehicle. Sample values: L, N, and O. |

Vehicle Purpose Dimension |

Stores the code details that identify the predominant use of the vehicle. Sample values: AC, BU, CL, CM, COM, CP, DC, DO, DU, DW, E, FH, FM, G, OT, PL, PS, and so on. |

Vehicle Tyre Type Dimension |

Stores the code details that identify the tire suitable for the vehicle. Sample values: Basic, Discount, and Surcharged. |

Driver Dimension |

Stores the basic details of the vehicle driver such as name, date of birth, gender, and so on. |

Driver License Dimension |

Stores the license and eligibility details of the driver with the type of goods in the carriage. |

Driving License Status Dimension |

Stores the license status details of the driver. Sample values: A, N, P, AP, and T. |

Insurance Driver Status Dimension |

Stores the insurance driver status code details. Sample values: DD, E, N, and U. |

Inspection Status Dimension |

Stores the code details that indicate the vehicle inspection status. Sample values: 3 is inspection completed on a timely basis, damage; 4 is inspection not completed on a timely basis resulting in a gap in coverage, damage, and so on. |

Vehicle Inspection Exempt Reason Dimension |

Stores the code details that indicate the reason the vehicle was exempt from inspection. Sample values: A is a new vehicle from a dealer with a bill of sale or RMV1, B if the Applicant qualifies as an existing customer, and so on. |

Vehicle Interior Material Type Dimension |

Stores the code details that indicate the material type used in the vehicle. Sample values: CLOTH, LEATH, OT, and VINYL. |

Vehicle Operator Experience Dimension |

Stores the code details that describe the experience required for the vehicle operators or drivers. Sample values: NOLL, NONE, NPLL, and POLL. |

Vehicle Performance Type Dimension |

Stores the code details that indicate the vehicle performance level. Sample values: BASIC, H, INMDT, P, and S. |

The mapping details for the Property and Casualty Contract Dimension tables are given here.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For mapping information about Policy Dimension, see the chapter Policy Dimension Table.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

224 |

STG_PROP_CASUALTY_CONTRACTS_V |

Stage Property Casualty Contracts View |

DIM_POLICY |

Policy Dimension |

620 |

VW_STG_PROP_CASUALTY_CONTRACTS |

Stage Property Casualty Contracts View |

DIM_ASSUMED_POLICY |

Assumed Policy Dimension |

256 |

STG_VEHICLE_MASTER |

Stage Vehicle Master |

DIM_VEHICLE |

Vehicle Dimension |

366 |

STG_VEHICLE_TYPE_MASTER |

Stage Vehicle Type Master |

DIM_VEHICLE_TYPE |

Vehicle Type Dimension |

688 |

STG_VEHICLE_BODY_TYPE_MASTER |

Stage Vehicle Body Type Master |

DIM_VEHICLE_BODY_TYPE |

Vehicle Body Type Dimension |

689 |

STG_VEHICLE_RATING_MASTER |

Stage Vehicle Rating Master |

DIM_VEHICLE_RATING |

Vehicle Rating Dimension |

690 |

STG_VEH_TONAGE_CAPACITY_MASTER |

Stage Vehicle Tonage Capacity Master |

DIM_VEHICLE_TONAGE_CAPACITY |

Vehicle Tonage Capacity Dimension |

774 |

STG_VEH_SEAT_BELT_TYPE_MASTER |

Stage Vehicle Seat Belt Type Master |

DIM_VEH_SEAT_BELT_TYPE |

Vehicle Seat Belt Type Dimension |

775 |

STG_VEHICLE_DAMAGE_TYPE_MASTER |

Stage Vehicle Damage Type Master |

DIM_VEHICLE_DAMAGE_TYPE |

Vehicle Damage Type Dimension |

776 |

STG_VEHICLE_ENGINE_TYPE_MASTER |

Stage Vehicle Engine Type Master |

DIM_VEHICLE_ENGINE_TYPE |

Vehicle Engine Type Dimension |

777 |

STG_VEHICLE_LEASE_TYPE_MASTER |

Stage Vehicle Lease Type Master |

DIM_VEHICLE_LEASE_TYPE |

Vehicle Lease Type Dimension |

778 |

STG_VEHCILE_PURPOSE_MASTER |

Stage Vehicle Purpose Master |

DIM_VEHICLE_PURPOSE |

Vehicle Purpose Dimension |

779 |

STG_VEHICLE_TYRE_TYPE_MASTER |

Stage Vehicle Tyre Type Master |

DIM_VEHICLE_TYRE_TYPE |

Vehicle Tyre Type Dimension |

765 |

STG_PARTY_MASTER |

Stage Party Master |

DIM_DRIVER |

Driver Dimension |

766 |

STG_DRIVER_LICENSE_MASTER |

Stage Driver License Master |

DIM_DRIVER_LICENSE |

Driver License Dimension |

767 |

STG_DRIVING_LIC_STATUS_MASTER |

Stage Driving License Status Master |

DIM_DRIVING_LIC_STATUS |

Driving License Status Dimension |

768 |

STG_INS_DRIVER_STATUS_MASTER |

Stage Insurance Driver Status Master |

DIM_INS_DRIVER_STATUS |

Insurance Driver Status Dimension |

769 |

STG_INSPECTION_STATUS_MASTER |

Stage Inspection Status Master |

DIM_INSPECTION_STATUS |

Inspection Status Dimension |

770 |

STG_VEH_INSP_EXMPT_RSN_MASTER |

Stage Vehicle Inspection Exemption Reason Master |

DIM_VEH_INSP_EXMPT_RSN |

Vehicle Inspection Exempt Reason Dimension |

771 |

STG_VEH_INTRR_MAT_TYPE_MASTER |

Stage Vehicle Interior Material Type Master |

DIM_VEH_INTRR_MAT_TYPE |

Vehicle Interior Material Type Dimension |

772 |

STG_VEH_OPERATR_EXPRNCE_MASTER |

Stage Vehicle Operator Experience Master |

DIM_VEH_OPERATR_EXPRNCE |

Vehicle Operator Experience Dimension |

773 |

STG_VEH_PERFRMANCE_TYPE_MASTER |

Stage Vehicle Performance Type Master |

DIM_VEH_PERFRMANCE_TYPE |

Vehicle Performance Type Dimension |

NOTE:

In the Fact Common Policy Summary tables, if the value of V_DIRECT_ASSUMED_RI_IND is D or NULL or any other value apart from A, then Fact Common Policy Summary T2Ts are populated. Here, D is Direct Contracts, and A is Assumed Contracts.

NOTE:

In the Contracts tables, if the value of V_DIRECT_ASSUMED_RI_IND is A, then Fact Assumed Policy Summary T2Ts are populated. Here, A is Assumed Contracts.

Property and Casualty Contract T2Ts and their description are given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCPS_STG_PROP_CASUALTY_CONTRACTS |

This T2T stores details of policy related to property and casualty contracts. |

T2T_FAPS_STG_PROP_CASUALTY_CONTRACTS |

This T2T stores details of policy related to property and casualty contracts. |

T2T_FCT_CLAIM_DRIVER_VEHICLE_MAP |

Stores the relationship details between the claim, driver, and vehicles. |

T2T_FCT_POLICY_DRIVER_VEHICLE_MAP |

Stores the relationship details between the policy, driver, and vehicles. |

T2T_FCT_POLICY_VEHICLE_RATING_DTLS |

Stores the vehicle rating details. Even when the vehicle ratings are prepared internally, they are handled through a common underwriter or rating agencies. |

T2T_FCT_DRIVER_LICENSE_DETAILS |

Stores the basic details of the vehicle driver. |

T2T_FCT_DRIVER_DETAILS |

Stores the license details of the driver. |

T2T_FCT_VEHICLE_INSPECTION_DETAILS |

Stores the vehicle inspection details for the purpose of insurance renewal, cancellation, or for any claims made. |

The mapping details for Life Insurance Contract T2Ts and their description are given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_PROP_CASUALTY_CONTRACTS |

Stage Property Casualty Contracts |

FCT_COMMON_POLICY_SUMMARY |

Fact Common Policy Summary |

T2T_FCPS_STG_PROP_CASUALTY_CONTRACTS |

STG_PROP_CASUALTY_CONTRACTS |

Stage Property Casualty Contracts |

FCT_ASSUMED_POLICY_SUMMARY |

Fact Assumed Policy Summary |

T2T_FAPS_STG_PROP_CASUALTY_CONTRACTS |

STG_CLAIM_DRIVER_VEHICLE_MAP |

Stage Claim Driver Vehicle Map |

FCT_CLAIM_DRIVER_VEHICLE_MAP |

Fact Claim Driver Vehicle Map |

T2T_FCT_CLAIM_DRIVER_VEHICLE_MAP |

STG_POLICY_DRIVER_VEHICLE_MAP |

Stage Policy Driver Vehicle Map |

FCT_POLICY_DRIVER_VEHICLE_MAP |

Fact Policy Driver Vehicle Map |

T2T_FCT_POLICY_DRIVER_VEHICLE_MAP |

STG_POLICY_VEHICLE_RATING_DTLS |

Stage Policy Vehicle Rating Details |

FCT_POLICY_VEHICLE_RATING_DTLS |

Fact Policy Vehicle Rating Details |

T2T_FCT_POLICY_VEHICLE_RATING_DTLS |

STG_DRIVER_DETAILS |

Stage Driver Details |

FCT_DRIVER_DETAILS |

Fact Driver Details |

T2T_FCT_DRIVER_DETAILS |

STG_DRIVER_LICENSE_DETAILS |

Stage Driver License Details |

FCT_DRIVER_LICENSE_DETAILS |

Fact Driver License Details |

T2T_FCT_DRIVER_LICENSE_DETAILS |

STG_VEHICLE_INSPECTION_DETAILS |

Stage Vehicle Inspection Details |

FCT_VEHICLE_INSPECTION_DETAILS |

Fact Vehicle Inspection Details |

T2T_FCT_VEHICLE_INSPECTION_DETAILS |

Retirement contracts are insurance and savings plans that help an individual to create a corpus for their future during the policy term. On maturity (retirement), a percentage amount of the accumulated corpus can be withdrawn as a lump sum and the rest in parts in the form of a pension.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For the description of Policy Dimension, see the chapter Policy Dimension Table.

Assumed Policy Summary stores the detailed information elements of insurance policies that are not directly written or issued by the insurance company. In the Contracts table, if the value of the Direct Assumed Indicator column is A, then Fact Assumed Policy Summary tables are populated.

Retirement Contract Dimension table names and their description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Policy Dimension |

This table stores the list of all policies issued by the insurer. |

Assumed Policy Dimension |

This table stores the assumed policy details. |

The mapping details for the Retirement Contract Dimension tables are given here.

Common Policy Summary is also a part of the Policy Dimension table (DIM_POLICY). For mapping information about Policy Dimension, see the chapter Policy Dimension Table.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

634 |

STG_RETIREMENT_ACCOUNTS_V |

Stage Retirement Accounts View |

DIM_POLICY |

Policy Dimension |

619 |

VW_STG_RETIREMENT_ACCOUNTS |

Stage Retirement Accounts View |

DIM_ASSUMED_POLICY |

Assumed Policy Dimension |

NOTE:

In the Fact Common Policy Summary tables, if the value of V_DIRECT_ASSUMED_RI_IND is D or NULL or any other value apart from A, then Fact Common Policy Summary T2Ts are populated. Here, D is Direct Contracts, and A is Assumed Contracts.

NOTE:

In the Contracts tables, if the value of V_DIRECT_ASSUMED_RI_IND is A, then Fact Assumed Policy Summary T2Ts are populated. Here, A is Assumed Contracts.

Retirement Contract T2Ts and their description are given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCPS_STG_RETIREMENT_ACCOUNTS |

This T2T stores details of policy related to retirement accounts. |

T2T_FAPS_STG_RETIREMENT_ACCOUNTS |

This T2T stores investment details of retirement savings, which is used by individuals to earn and earmark funds. |

The mapping details for Retirement Contract T2Ts is given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_RETIREMENT_ACCOUNTS |

Stage Retirement Accounts |

FCT_COMMON_POLICY_SUMMARY |

Fact Common Policy Summary |

T2T_FCPS_STG_RETIREMENT_ACCOUNTS |

STG_RETIREMENT_ACCOUNTS |

Stage Retirement Accounts |

FCT_ASSUMED_POLICY_SUMMARY |

Fact Assumed Policy Summary |

T2T_FAPS_STG_RETIREMENT_ACCOUNTS |

The Policy Coverage table stores the list of all coverages and amounts set by the Insurer.

Topics:

· About Policy Coverage Dimension Tables

· About Policy Coverage T2T (Result Table)

Policy Coverage Dimension table names and their description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Insurance Age Amount Product Dimension |

This table stores the details of the insurance age amount product code. This table is used to define any age ranges supported, and minimum or maximum amounts, units or percentages that are available for that particular age range. The minimum and maximum ages represented in the collection of Age Amount Products at this level must follow certain defined rules. |

Age Amount Product Measure Dimension |

This table stores the details of Age Amount Product Measures. |

The mapping details for the Policy Coverage Dimension tables are given here.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

727 |

STG_INS_AGE_AMT_PRODUCT_MASTER |

Stage Insurance Age Amount Product Master |

DIM_INS_AGE_AMT_PRODUCT |

Insurance Age Amount Product Dimension |

728 |

STG_AGE_AMT_PROD_MESR_MASTER |

Stage Age Amount Product Measure Master |

DIM_AGE_AMT_PROD_MESR |

Age Amount Product Measure Dimension |

Policy Coverage T2Ts and their description are given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_POLICY_COVERAGES |

This T2T stores policy coverages details. A policy can have multiple coverages. |

T2T_FCT_POLICY_COVERG_BASIS_DTL |

This T2T stores the coverage basis value for a given policy. |

T2T_FCT_INS_AGE_AMT_PRODUCT_DEF |

This T2T stores the details of the Insurance Age Amount Product. This table is used to define any age ranges supported, and minimum or maximum amounts, units or percentages that are available for that particular age range. The minimum and maximum ages represented in the collection of Age Amount Products at this level must follow certain defined rules. |

T2T_FCT_INS_AGE_AMT_PRODUCT_TABLE |

This table stores the details of the Insurance Age Amount Product. This table is used to define any age ranges supported, and minimum or maximum amounts, units or percentages that are available for that particular age range. This table holds the values defined as per the insurance age amount product definition table. |

The mapping details for the Policy Coverage T2Ts are given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_POLICY_COVERAGES |

Stage Policy Coverages |

FCT_POLICY_COVERAGES |

Fact Policy Coverages |

T2T_FCT_POLICY_COVERAGES |

STG_POLICY_COVERG_BASIS_DTL |

Stage Policy Coverage Basis Detail |

FCT_POLICY_COVERG_BASIS_DTL |

Fact Policy Coverage Basis Detail |

T2T_FCT_POLICY_COVERG_BASIS_DTL |

STG_INS_AGE_AMT_PRODUCT_DEF |

Stage Insurance Age Amount Product Definition |

FCT_INS_AGE_AMT_PRODUCT_DEF |

Fact Insurance Age Amount Product Definition |

T2T_FCT_INS_AGE_AMT_PRODUCT_DEF |

STG_INS_AGE_AMT_PRODUCT_TABLE |

Stage Insurance Age Amount Product Table |

FCT_INS_AGE_AMT_PRODUCT_TABLE |

Fact Insurance Age Amount Product Table |

T2T_FCT_INS_AGE_AMT_PRODUCT_TABLE |

This section provides information about the Embedded Options table.

Embedded Options T2T and its description is given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_EMBEDDED_OPTIONS_SCHEDULE |

This T2T stores the details of schedule embedded options of interest rate instruments. An embedded option is an inseparable part of another instrument and does not trade on its own. |

The mapping details for the Embedded Options T2T is given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_EMBEDDED_OPTIONS_SCHEDULE |

Stage Embedded Options Schedule |

FCT_EMBEDDED_OPTIONS_SCHEDULE |

Fact Embedded Options Schedule |

T2T_FCT_EMBEDDED_OPTIONS_SCHEDULE |

This section provides information about the Insurance Participation tables.

The Party Insurance Policy Role Map table stores information related to different policies that are taken by a Party.

NOTE:

Load STG_PARTY_INS_POLICY_ROLE_MAP with all customer records and Party Role must be ‘CUSTOMER’.

The mapping details to populate the Party Insurance Policy Role Map T2T is given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_PARTY_INS_POLICY_ROLE_MAP |

Stage Party Insurance Policy Role Map |

FCT_PARTY_INS_POLICY_ROLE_MAP |

Fact Party Insurance Policy Role Map |

T2T_FCT_PARTY_INS_POLICY_ROLE_MAP |

Insurance Participation T2T and its description is given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_INSURANCE_PARTCPTN_DTLS |

This T2T stores the details of multiple insurers who come together to provide reinsurance to Insurance companies. Their respective details of sharing and participation are stored in this table. |

The mapping details for the Insurance Participation T2T is given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_INSURANCE_PARTCPTN_DTLS |

Stage Insurance Participation Details |

FCT_INSURANCE_PARTCPTN_DTLS |

Fact Insurance Participation Details |

T2T_FCT_INSURANCE_PARTCPTN_DTLS |

Supplemental Data refers to the additional and contextual information applicable to only certain insurance contracts. This consists of primarily two information sets namely group insurance details and policy schedules.

Topics:

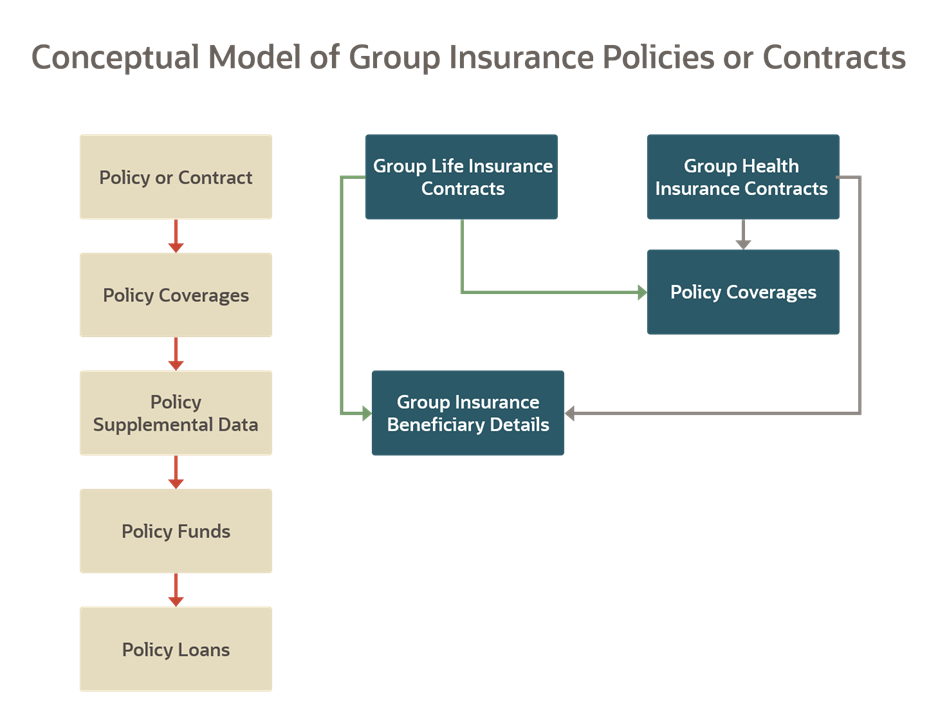

Group Insurance refers to insurance that covers a defined group of people, such as employees of a company or members of a particular profession, typically against illness or death.

This is the conceptual model of the Group Insurance Policies or Contracts.

Figure 92: The conceptual model of the Group Insurance Policies or Contracts

Group Beneficiary Dimension table name and its description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Beneficiary Dimension |

This table stores beneficiary details. |

The mapping details for the Reinsurance Contracts Dimension table is given here.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

672 |

STG_PARTY_MASTER |

Stage Party Master |

DIM_BENEFICIARY |

Beneficiary Dimension |

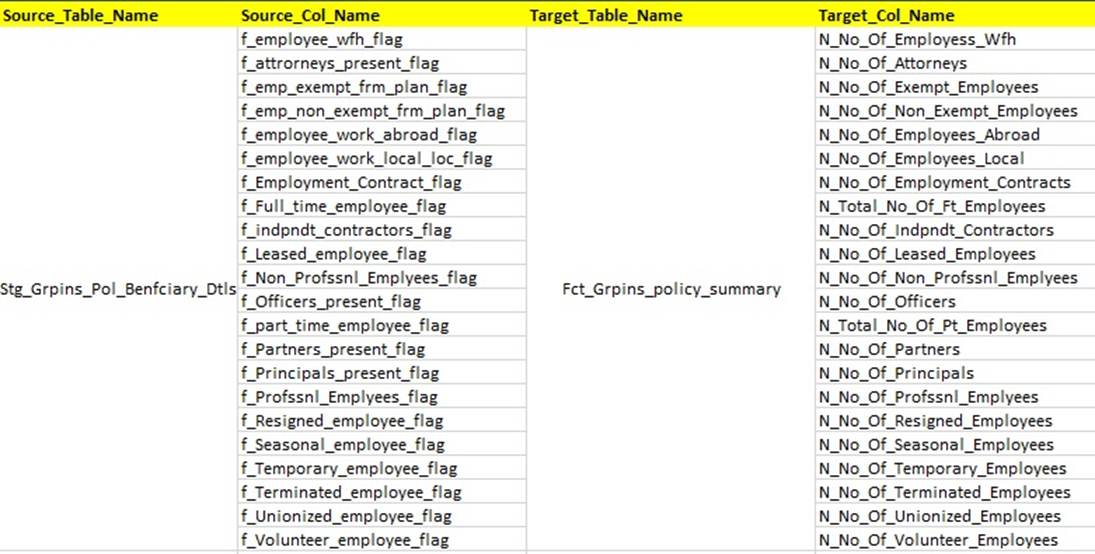

The Group Policy Beneficiary T2Ts with descriptions are as follows.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_GRPINS_POL_BENFCIARY_DTLS |

Stores group insurance policy beneficiary details. |

T2T_FGPS_STG_GRPINS_POLICY_SUMMARY |

Stores the Group Insurance plan details. |

T2T_FGPS_STG_GRPINS_POL_BENFCIARY_DTLS |

Stores the count of the beneficiaries based on the value in the source flag column. |

The mapping details for the Group Policy Beneficiary T2Ts are as follows.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_GRPINS_POL_BENFCIARY_DTLS |

Stage Groupings Policy Beneficiary Details |

FCT_GRPINS_POL_BENFCIARY_DTLS |

Fact Groupings Policy Beneficiary Details |

T2T_FCT_GRPINS_POL_BENFCIARY_DTLS |

STG_GRPINS_POLICY_SUMMARY |

Stage Group Insurance Policy Summary |

FCT_GRPINS_POLICY_SUMMARY |

Fact Group Insurance Policy Summary |

T2T_FGPS_STG_GRPINS_POLICY_SUMMARY |

STG_GRPINS_POL_BENFCIARY_DTLS |

Stage Groupings Policy Beneficiary Details |

FCT_GRPINS_POLICY_SUMMARY |

Fact Group Insurance Policy Summary |

T2T_FGPS_STG_GRPINS_POL_BENFCIARY_DTLS |

The two ways to populate the data in the FCT_GRPINS_POLICY_SUMMARY table are:

· The data population through the T2T_FGPS_STG_GRPINS_POLICY_SUMMARY, which is at the Policy Summary level.

· The data population through the T2T_FGPS_STG_GRPINS_POL_BENFCIARY_DTLS. The data can be populated for the count at the policy or beneficiary level.

Figure 93: The FCT_GRPINS_POLICY_SUMMARY table and its source

This is an illustration of data population in the FCT_GRPINS_POLICY_SUMMARY table:

Input |

|

|

|

|

|

|

|

|

|---|---|---|---|---|---|---|---|---|

Table Name |

STG_GRPINS_POL_BENFCIARY_DTLS |

|

STG_GRPINS_POLICY_SUMMARY |

STG_LIFE_INS_CONTRACTS |

|

STG_HEALTH_INS_CONTRACTS |

|

|

Column Name |

V_ACCOUNT_NUMBER |

F_EMPLOYEE_WFH_FLAG |

V_GROUP_INS_POLICY_ID |

V_ACCOUNT_NUMBER |

V_GROUP_POLICY_ID |

V_ACCOUNT_NUMBER |

V_GROUP_POLICY_ID |

|

Policy 1 |

Life001 |

Y |

Oracle001 |

Life001 |

Oracle001 |

- |

- |

|

Policy 2 |

Life002 |

Y |

Oracle001 |

Life002 |

Oracle001 |

- |

- |

|

Policy 3 |

Health001 |

N |

Oracle002 |

- |

- |

Health001 |

Oracle002 |

|

Policy 4 |

Health002 |

Y |

Oracle002 |

- |

- |

Health002 |

Oracle002 |

|

Input:

For each Policy, the data for the input column STG_GRPINS_POL_BENFCIARY_DTLS.V_ACCOUNT_NUMBER is retrieved from the source column (Policy type) STG_LIFE_INS_CONTRACTS. V_ACCOUNT_NUMBER or STG_HEALTH_INS_CONTRACTS.V_ACCOUNT_NUMBER, based on the Policy ID column V_GROUP_INS_POLICY_ID.

The total count of different policies is retrieved from different source columns STG_LIFE_INS_CONTRACTS.V_GROUP_POLICY_ID and STG_HEALTH_INS_CONTRACTS. V_GROUP_POLICY_ID into the input column STG_GRPINS_POLICY_SUMMARY.V_GROUP_INS_POLICY_ID.

Output |

|

|

|---|---|---|

Table Name |

STG_GRPINS_POLICY_SUMMARY |

FCT_GRPINS_POLICY_SUMMARY |

Column Name |

V_GROUP_INS_POLICY_ID |

N_NO_OF_EMPLOYESS_WFH |

Summation of WFH employees (only Y) |

Oracle001 |

2 |

Oracle002 |

1 |

Output:

For the data in the input column STG_GRPINS_POL_BENFCIARY_DTLS.V_ACCOUNT_NUMBER, when the flag STG_GRPINS_POL_BENFCIARY_DTLS.F_EMPLOYEE_WFH_FLAG is Y then the counter N_NO_OF_EMPLOYESS_WFH increments by 1 in the target column FCT_GRPINS_POLICY_SUMMARY.N_NO_OF_EMPLOYESS_WFH for different Policy IDs V_GROUP_INS_POLICY_ID.

For example:

Input:

For Policy 1, the data Life001 for the input column (STG_GRPINS_POL_BENFCIARY_DTLS.V_ACCOUNT_NUMBER) is retrieved from the source column STG_LIFE_INS_CONTRACTS. V_ACCOUNT_NUMBER (Life001), based on the Policy ID Oracle001 (STG_LIFE_INS_CONTRACTS.V_GROUP_INS_POLICY_ID). This procedure is repeated for Policy 2, Policy 3, and Policy 4.

The total count (1+1+0+1) of different policies (Policy 1, Policy 2, Policy 3, and Policy 4) is retrieved from different source columns Oracle001 (STG_LIFE_INS_CONTRACTS.V_GROUP_POLICY_ID) and Oracle002 (STG_HEALTH_INS_CONTRACTS.V_GROUP_POLICY_ID) into the input column STG_GRPINS_POLICY_SUMMARY.V_GROUP_INS_POLICY_ID (Oracle001, Oracle001, 0, Oracle002).

Output:

For data (Life001, Life002, Health001, Health002) in the input column (STG_GRPINS_POL_BENFCIARY_DTLS.V_ACCOUNT_NUMBER), when the flag (STG_GRPINS_POL_BENFCIARY_DTLS.F_EMPLOYEE_WFH_FLAG) is Y, then the counter (N_NO_OF_EMPLOYESS_WFH) increments by 1 in the target column FCT_GRPINS_POLICY_SUMMARY.N_NO_OF_EMPLOYESS_WFH (2+1) for different Policy IDs V_GROUP_INS_POLICY_ID (Oracle001, Oracle002).

Policy Schedules refers to the agreed non-linear premium and benefit schedules associated with the insurance contracts. For example, step up Annuity Contracts, and Term Life Insurance, where benefits are increasing or decreasing with the remaining term of the contract. Agreed schedules can be stored in this entity.

Policy Schedules T2T and its description is given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_POLICY_SCHEDULES |

This T2T stores the details of policy schedules. Policy Schedules refer to the premium and sum insured for each policy year until policy maturity. This is used in case of increasing or decreasing the benefit or Premium payments associated with a policy. |

The mapping details for the Policy Schedules T2T is given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_POLICY_SCHEDULES |

Stage Policy Schedules |

FCT_POLICY_SCHEDULES |

Fact Policy Schedules |

T2T_FCT_POLICY_SCHEDULES |

Policy Funds refers to the investment made by the policyholder as part of the insurance contract and significant market risk is borne by the policyholder.

Policy and Funds T2Ts and their description are given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_POLICY_FUNDS |

This T2T stores the policy-wise fund details. This covers units invested for each fund, total amount invested (current value of an investment as of today), and so on. |

T2T_FCT_POLICY_FUND_ALLOCATION |

This T2T stores the investment allocation for a given policy, fund, and investment bucket combination. The investment amount is allocated to different funds and during different periods, which is stored in this entity. This covers the premium amount invested in each bucket, running total premium, and cash surrender value for each bucket. |

The mapping details for the Policy and Funds T2Ts are given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_POLICY_FUNDS |

Stage Policy Funds |

FCT_POLICY_FUNDS |

Fact Policy Funds |

T2T_FCT_POLICY_FUNDS |

STG_POLICY_FUND_ALLOCATION |

Stage Policy Fund Allocation |

FCT_POLICY_FUND_ALLOCATION |

Fact Policy Fund Allocation |

T2T_FCT_POLICY_FUND_ALLOCATION |

Some insurance policies allow policyholders to take the loans based on the amount accumulated to date as per the terms and conditions laid in the contract. Such loans are considered as a contract by itself in OIDF and must be loaded in stage loan contracts. This entity holds policy identifiers to link multiple loans taken under a given insurance policy.

A network of loan entities cover Stage Loan Contracts, Stage Mitigants, Stage Account Mitigant Map, Stage Account Write off Details, Stage Account Recovery details.

Policy Loans T2Ts and their description is given here.

T2T Name |

T2T Description |

|---|---|

T2T_FLAS_STG_LOAN_CONTRACTS |

This T2T stores the details of loans. This table includes mortgage and vehicle loans. |

T2T_STG_LOANS_CAS |

This T2T stores the details of loans lent by the Insurance Company to its customers. |

The mapping details for the Policy Loans T2Ts are given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_LOAN_CONTRACTS |

Stage Loan Contracts |

FCT_LOAN_ACCOUNT_SUMMARY |

Fact Loan Account Summary |

T2T_FLAS_STG_LOAN_CONTRACTS |

STG_LOAN_CONTRACTS |

Stage Loan Contracts |

FCT_COMMON_ACCOUNT_SUMMARY |

Fact Common Account Summary |

T2T_STG_LOANS_CAS |

This table is used to store the policy details when converting one policy to another. The policy can be converted from one to multiple policies or multiple to one policy. An insurance policy with this type of provision allows the insured to switch to a different type of policy.

Policy Conversion T2T and its description is given here.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_POLICY_CONVERSION_DETAILS |

This T2T stores the details of conversion policies. If the policy is converted from one to multiple, or vice versa. |

Policy Conversion T2T and its description is given here.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_POLICY_CONVERSION_DETAILS |

Stage Policy Conversion Details |

FCT_POLICY_CONVERSION_DETAILS |

Fact Policy Conversion Details |

T2T_FCT_POLICY_CONVERSION_DETAILS |

Any social event such as sports, film shooting, concerts, and so on are considered as a special event. An Insurer can insure their special event under the Policy Coverages against the liabilities occurring because of the event cancellation, terrorism, liquor, the artist not showing up, and so on.

Any Party that needs insurance coverage against the liquor liabilities can obtain insurance using the Policy Coverages. The liquor liabilities coverage may be applicable as a part of the Special Event Insurance if the liquor is served at the policy covered special event venue.

Special Events Dimension table name and its description are mentioned in the following table.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Special Event Dimension |

This table stores information about the special events such as event ID and event description. Some of the examples of special events are social events such as concerts, film shooting, weddings, sports, and so on. |

The mapping details for the Special Events Dimension table are mentioned in the following table.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

987 |

STG_SPECIAL_EVENT_MASTER |

Stage Special Event Master |

DIM_SPECIAL_EVENT |

Special Event Dimension |

Special Events T2T and its description are mentioned in the following table.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_POLICY_COVERED_EVENT |

This T2T stores the details of the event, artist, and the liabilities arising in the policy covered special events such as sports, film shooting, concerts, and so on. The liabilities can be due to the event cancellation, terrorism, liquor, the artist not showing up, and so on. |

T2T_FCT_POL_COV_SPECIAL_EVENT_MAP |

This T2T stores the relationships between the Policy, Coverages, and Special Events insured by the Insurer. |

The mapping details for Special Events T2T are mentioned in the following table.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_POLICY_COVERED_EVENT |

Stage Policy Covered Event |

FCT_POLICY_COVERED_EVENT |

Fact Policy Covered Event |

T2T_FCT_POLICY_COVERED_EVENT |

STG_POL_COV_SPECIAL_EVENT_MAP |

Stage Policy Coverage Special Event Map |

FCT_POL_COV_SPECIAL_EVENT_MAP |

Fact Policy Coverage Special Event Map |

T2T_FCT_POL_COV_SPECIAL_EVENT_MAP |

A reinsurance contract is defined as an insurance contract issued by one entity (the reinsurer) to compensate another entity for claims arising from one or more insurance contracts issued by that other entity. The requirements for the assessment of significant insurance risk in a reinsurance contract are the same as for an insurance contract. However, a reinsurance contract transfers significant insurance risk if it transfers substantially all of the insurance risk resulting from the insured portion of the underlying insurance contract, even if it does not expose the reinsurer to the possibility of a significant loss.

Reinsurance Contracts Dimension table names and their description are given here.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Insurance Reserve Function Method Dimension |

This table stores the method used to calculate reserves and defines the mortality function used to calculate reserves and net premiums for valuation. |

Consequence Of Loss Dimension |

This table stores the code that identifies the consequences of losses. |

Tax Reimbursement Calculation Method Dimension |

This table stores the Tax Reimbursement Calculation Method Code details and the information about the method for calculating the portion of the Premium Taxes reimbursed to the direct insurer. |

Insurance Reserve Calculation Basis Dimension |

This table stores the Insurance Reserve Calculation Basis Code details, in which, the basis is used in calculating the standard GAAP reserve. |

Reinsurance Contract Type Dimension |

This table stores the Reinsurance Contract Type details. |

Insurance Sub Standard Policy Reserve Method Dimension |

This table stores the Insurance Sub Standard Policy Reserve Method Code details, a code list from Life Reinsurance Activity Report LREACT UGP, UPP, and so on. Describes the actuarial methodology used to calculate the substandard policy reserves. For example, Net Level. |

Reinsurance Accounting Basis Dimension |

This table stores the Reinsurance accounting basis details, which specifies the basis of accounting for the contract. |

Insurance Reserve Calculation Method Dimension |

This table stores the information about the reserve’s calculation method on this coverage and is used by valuation programs to find the correct reserves for this coverage. |

Insurance Sub Standard Reserve Calculation Basis Dimension |

This table stores the Insurance Sub Standard Reserve Calculation Basis Code details. The substandard GAAP reserve factor is applied to the amount indicated to calculate the substandard GAAP reserve amount. |

Contract Limit Retention Basis Dimension |

This table stores the code identification details of the basis of the contract limits and retentions applicable to the claim that is reported. |

Insurance Reserve Valuation Type Dimension |

This table stores Reserve Valuation Type details. |

Insurance Retention Level Type Dimension |

This table stores the Insurance Retention Level Type details and the level of retention on the coverage. |

Reinsurance Business Origin Dimension |

This table stores the Reinsurance Business Origin Code details, in which, codes specify whether the contract was directly or indirectly ceded. |

Policy Dimension |

This table stores the list of all policies issued by the insurer. |

The mapping details for the Reinsurance Contracts Dimension tables are given here.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

621 |

STG_INS_RES_FUNC_MTHD_MASTER |

Stage Insurance Reserve Function Method Master |

DIM_INS_RES_FUNC_MTHD |

Insurance Reserve Function Method Dimension |

622 |

STG_CONSEQUENCE_OF_LOSS_MASTER |

Stage Consequence Of Loss Master |

DIM_CONSEQUENCE_OF_LOSS |

Consequence Of Loss Dimension |

623 |

STG_TAX_REIMB_CAL_MTHD_MASTER |

Stage Tax Reimbursement Calculation Method Master |

DIM_TAX_REIMB_CAL_MTHD |

Tax Reimbursement Calculation Method Dimension |

624 |

STG_INS_RES_CAL_BASIS_MASTER |

Stage Insurance Reserve Calculation Basis Master |

DIM_INS_RES_CAL_BASIS |

Insurance Reserve Calculation Basis Dimension |

625 |

STG_RI_CONTRACT_TYPE_MASTER |

Stage Reinsurance Contract Type Master |

DIM_RI_CONTRACT_TYPE |

Reinsurance Contract Type Dimension |

626 |

STG_INS_SS_POL_RES_MTHD_MASTER |

Stage Insurance Sub Standard Policy Reserve Method Master |

DIM_INS_SS_POL_RES_MTHD |

Insurance Sub Standard Policy Reserve Method Dimension |

627 |

STG_RI_ACCOUNTING_BASIS_MASTER |

Stage Reinsurance Accounting Basis Master |

DIM_RI_ACCOUNTING_BASIS |

Reinsurance Accounting Basis Dimension |

628 |

STG_INS_RES_CAL_MTHD_MASTER |

Stage Insurance Reserve Calculation Method Master |

DIM_INS_RES_CAL_MTHD |

Insurance Reserve Calculation Method Dimension |

629 |