This chapter details the Insurance Claims tables in the Oracle Insurance Data Foundation application.

Topics:

· About Insurance Claims Dimension Tables

· About Insurance Claims T2Ts (Result Tables)

· Deploying Insurance Claims Tables on Hive

· Populating Insurance Claims Dimension Tables

· Populating Insurance Claims T2Ts (Result Tables)

An insurance claim is a formal request to an Insurance Company for coverage or compensation for a covered loss or policy event. The Insurance Company validates the claim and, after approval, issues payment to the insured or to an approved interested Party on behalf of the insured.

The OIDF application sources data from the claim systems after the claim is generated.

The Claims tables store the claim process performed to date including the claim dates, status, and amounts.

The following table depicts the difference between the Statutory Insurance and the Non-statutory Insurance:

Statutory Insurance |

Non-statutory Insurance |

|---|---|

This is a type of insurance, which the insured is required to buy under a country, state, or federal law. |

This is a type of insurance, which is up to the buyer to purchase or not. |

This section contains an illustration of the Insurance Claims process flow in chronological order.

This is an example of the Insurance Claims process after the fire occurrence in a technology park.

Assume that, in a Tier I city, in a technology park, in a company building of four floors, there is a fire incident on the second floor. Due to the extent of the fire, the building has collapsed into its underground parking area. As a result, there are damages and destruction caused to the equipment and furniture inside the building, a few injured people, and a few fire-related deaths. In addition, the vehicles inside the building parking area are damaged or destroyed. During the building collapse, the adjacent building is damaged. As the collapsed building, the adjacent damaged building, and the technology park are insured, they apply for the Insurance Claim for recovery.

The Insurance Company checks their reserve and the details of the Insured. The Insurance Company Assessor is sent to the collapsed building location to assess the extent of damage and destruction in detail. The Assessor analyzes the fire incident location, the injured, and the deceased lives. Then the Assessor creates a detailed report, which also includes the damage due to the water used to put out the fire and the disabilities caused. The Assessor cross-verifies the report with the Insurance Policy terms. All these damages, destructions, and loss of lives are caused due to one fire incident. For an incidence to be an occurrence, there must be common traits across multiple claims, same date, same location, and then the traits are grouped together for future use. The insurer can set aside a calculated amount of money for a similar incidence that can occur the next time.

Even though the Insurance Company focuses on completing the claims process on time, there can be possible flaws in the process due to human error or undiscovered reasons. For example, the Nominee is not the Beneficiary, or an employee was not even in the incident premises, however, that employee was hurt outside due to some other reason and is claimed as injured by the insured company, and so on.

Based on the assessment of the policy terms, report, and claim terms, the claim is processed or rejected.

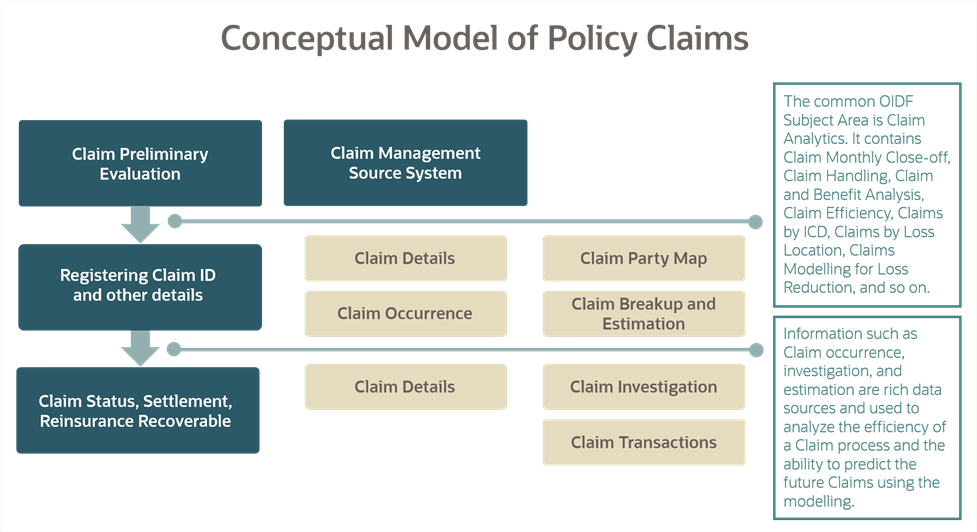

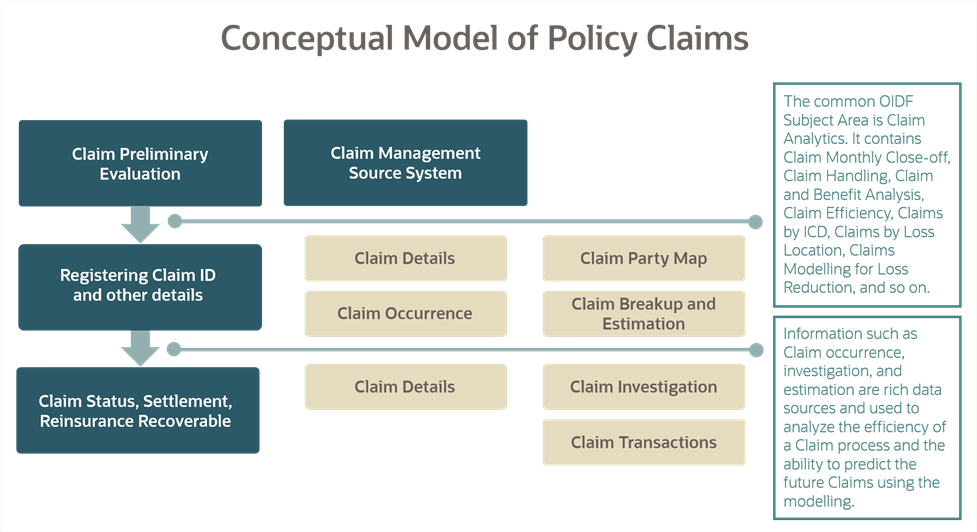

This is the representation of the conceptual model of Insurance Policy Claims.

Figure 130: The representation of the conceptual model of Insurance Policy Claims

The process flow of an Insurance Policy Claim is as follows:

1. A Claim is created and the data is stored in the Claim Dimension table.

2. The claim policy map is used to store the relationship between the claim and the policy for which it is created. The mapping details are stored in the Claim Party Map table.

3. The details of a claim from the policyholder, the amount paid by the insurer, and the summary of the claim’s transactions to date are stored in the Claim Details table.

4. The insurer must conduct the claim investigation. The insurer obtains information to evaluate an insurance claim. The investigators look for evidence whether a claim is legitimate or illegitimate. The investigation details are stored in the Claim Investigation Details table.

5. After the claim investigation is complete, the claim amount is estimated and the claim breakup is done. The claim breakup is where an insurer sets aside a claim amount for a policy.

6. The transactions related to a claim are stored in the Claims Transactions table.

NOTE:

The Claim Identifier column is added to the tables FCT_PARTY_MEDICAL_CONDITN_DTLS, FCT_PARTY_MEDICAL_TREATMENTS, and FCT_PARTY_DISABILITY_DETAILS to link the party medical attributes to the insurance claims.

This section provides mapping details and descriptions of the Insurance Claims Dimension tables.

The Insurance Claims Details Dimension table names and their description are as follows.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Dimension Claim Status |

Stores the list of all status codes and descriptions that are applicable for a claim transaction. |

Claim Dimension |

Stores the list of all claims. |

Catastrophe Events Dimension |

Stores the catastrophic event details for a claim. |

Claim Feature Status Dimension |

Stores the status of a claim, based on which several calculations change. |

Premium Plan Type Dimension |

Stores the premium plan type details. Sample values: AUDIT and EST. |

Claim Offer Dimension |

Stores details of the offer given on a claim. |

Claim Risk Category Dimension |

Stores the category details of the claim

risk. This table is used to specify the situations, where the

claim risk category may be based on several criteria such as the

claim amount, the manner of loss, length of the time policy is

in force, contestability or other investigative issues, and many

other factors. |

Claim Status Reason Dimension |

Stores details of the claim status reason.

This table provides additional details about the reason for the

current claim status. |

Claim Type Dimension |

Stores details of the types of claims types. |

International Statistical Classification Of Diseases Dimension |

Stores classification details of the international statistics of diseases. The ICD is the International Statistical Classification of Diseases and Related Health Problems. The ICD is a medical classification list maintained by the World Health Organization (WHO). The list contains codes for diseases, signs, and symptoms, abnormal findings, complaints, social circumstances, and external causes of injury or diseases. |

The mapping details for the Insurance Claims Details Dimension tables are as follows.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

234 |

STG_CLAIM_STATUS_MASTER |

Stage Claim Status Master |

DIM_CLAIM_STATUS |

Dimension Claim Status |

239 |

STG_CLAIM_DETAILS |

Stage Claim Details |

DIM_CLAIM |

Claim Dimension |

241 |

STG_CATASTROPHE_EVENTS_MASTER |

Stage Catastrophe Events Master |

DIM_CATASTROPHE_EVENTS |

Catastrophe Events Dimension |

605 |

STG_CLAIM_FEATURE_STTS_MASTER |

Stage Claim Feature Status Master |

DIM_CLAIM_FEATURE_STATUS |

Claim Feature Status Dimension |

784 |

STG_PREM_PLAN_TYPE_MASTER |

Stage Premium Plan Type Master |

DIM_PREM_PLAN_TYPE |

Premium Plan Type Dimension |

792 |

STG_CLAIM_OFFER_MASTER |

Stage Claim Offer Master |

DIM_CLAIM_OFFER |

Claim Offer Dimension |

793 |

STG_CLAIM_RISK_CATEGORY_MASTER |

Stage Claim Risk Category Master |

DIM_CLAIM_RISK_CATEGORY |

Claim Risk Category Dimension |

794 |

STG_CLAIM_STATUS_REASON_MASTER |

Stage Claim Status Reason Master |

DIM_CLAIM_STATUS_REASON |

Claim Status Reason Dimension |

795 |

STG_CLAIM_TYPE_MASTER |

Stage Claim Type Master |

DIM_CLAIM_TYPE |

Claim Type Dimension |

812 |

STG_INT_CLSFCTN_DISEASE_MASTER |

Stage International Statistical Classification Of Diseases Master |

DIM_INT_CLASSIFICTION_DISEASES |

International Statistical Classification Of Diseases Dimension |

The Insurance Claims Investigation Dimension table names and their description are as follows.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Claim Investigation Dimension |

Stores the Claim Investigation details. The claims investigation is a process in which the insurance companies, insurance examiners, or investigators obtain information to evaluate an insurance claim. The investigators look for evidence whether a claim is legitimate or illegitimate. |

Investigation Status Reason Dimension |

Stores details of the Investigation Status

Reason. |

Claim Investigation Reason Dimension |

Stores details of the claim investigation

reason. This table is used to identify the aspect of the claim

that leads the submitter to doubt the validity of a claim and

refer the claim for further investigation. The source of this

code list is the National Insurance Crime Bureau (NICB). |

Claim Review Reason Dimension |

Stores details of the reason for which the

claim review took place. These reasons are appended at the end

of the review. |

Claim Submission Method Dimension |

Stores details of the means through which

the claimant informs the Insurance Company of any loss. |

Claim Reopening Reason Type Dimension |

Stores the reopening reason type. Sample values: R1 - Mathematical or computational mistake, R2 - Inaccurate data entry, D0 - Changes in-service date, E0 - Change in patient status, and so on. |

Claim Handling Type Dimension |

Stores the claim handling type details.

This table is used to specify the situations, where claim handling

can differ based on the claim amount, underwriting needs or other

extenuating circumstances, or at the request of the claimant. |

The mapping details for the Insurance Claims Investigation Dimension tables are as follows.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

788 |

STG_CLAIM_INVESTIGATION_DTLS |

Stage Claim Investigation Details |

DIM_CLAIM_INVESTIGATION |

Claim Investigation Dimension |

805 |

STG_INVSTGN_STAT_REASON_MASTER |

Stage Investigation Status Reason Master |

DIM_INVSTGN_STAT_REASON |

Investigation Status Reason Dimension |

797 |

STG_CLM_INVSTGN_REASON_MASTER |

Stage Claim Investigation Reason Master |

DIM_CLM_INVSTGN_REASON |

Claim Investigation Reason Dimension |

799 |

STG_CLM_REVIEW_REASON_MASTER |

Stage Claim Review Reason Master |

DIM_CLM_REVIEW_REASON |

Claim Review Reason Dimension |

800 |

STG_CLM_SUBMSN_METHOD_MASTER |

Stage Claim Submission Method Master |

DIM_CLM_SUBMSN_METHOD |

Claim Submission Method Dimension |

648 |

STG_CLM_REOPEN_RSN_TYPE_MASTER |

Stage Claim Reopening Reason Type Master |

DIM_CLM_REOPEN_RSN_TYPE |

Claim Reopening Reason Type Dimension |

787 |

STG_CLAIM_HANDLING_TYPE_MASTER |

Stage Claim Handling Type Master |

DIM_CLAIM_HANDLING_TYPE |

Claim Handling Type Dimension |

The Insurance Claims Estimation Dimension table names and their description are as follows.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Claim Loss Type Dimension |

Stores the codes that identify the type

of loss that occurred. This table uses the Loss Kind code list. |

Human Body Parts Dimension |

Stores details of the injured human body

parts. |

Injury Nature Type Dimension |

Stores details of the injury nature type. |

Liability Loss Control Event Dimension |

Stores details of the code that signifies

the Loss Control Event category. Here, the event is the occurrence

categorization that initiates the claim and uses the Liability

Loss Control Event code list. |

Claim Basis Dimension |

Stores the code that signifies the basis

for the claim, where the claim relates to the Coverage Kind of

Loss payment. This table uses the Liability Claim Basis code list. |

Claim Estimate Type Dimension |

Stores details of the type of claim estimate

that is being provided. |

The mapping details for the Insurance Claims Estimation Dimension tables are as follows.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

789 |

STG_CLAIM_LOSS_TYPE_MASTER |

Stage Claim Loss Type Master |

DIM_CLAIM_LOSS_TYPE |

Claim Loss Type Dimension |

803 |

STG_HUMAN_BODY_PARTS_MASTER |

Stage Human Body Parts Master |

DIM_HUMAN_BODY_PARTS |

Human Body Parts Dimension |

804 |

STG_INJURY_NATURE_TYPE_MASTER |

Stage Injury Nature Type Master |

DIM_INJURY_NATURE_TYPE |

Injury Nature Type Dimension |

806 |

STG_LIAB_LOSS_CTRL_MASTER |

Stage Liability Loss Control Event Master |

DIM_LIAB_LOSS_CTRL |

Liability Loss Control Event Dimension |

813 |

STG_CLAIM_BASIS_MASTER |

Stage Claim Basis Master |

DIM_CLAIM_BASIS |

Claim Basis Dimension |

814 |

STG_CLAIM_ESTIMATE_TYPE_MASTER |

Stage Claim Estimate Type Master |

DIM_CLAIM_ESTIMATE_TYPE |

Claim Estimate Type Dimension |

The Insurance Claims Occurrence Dimension table names and their description are as follows.

Logical Dimension Table Name |

Dimension Table Description |

|---|---|

Claim Outside Authority Condition Dimension |

Stores the codes that define the outside

authority conditions applicable to the claim. This table uses

the Outside Authority Condition code list. |

Claim Occurrence Dimension |

Stores the Claim Occurrence. An Occurrence policy covers claims made for injuries sustained during the life of an insurance policy, even if the claim is filed after the policy is canceled or lapsed. The policy must be active when the incident occurred. An Occurrence is an event that can result in the filing of an insurance claim. |

Claim Cause Of Loss Dimension |

Stores details of the cause of the loss

or the peril triggering the loss for a claim. |

Claim Occurrence Type Dimension |

Stores details of the claim occurrence type. |

The mapping details for the Insurance Claims Occurrence Dimension tables are as follows.

Map Reference Number |

Source Table Name |

Logical Stage Table Name |

Dimension Table Name |

Logical Dimension Table Name |

|---|---|---|---|---|

790 |

STG_CLAIM_OA_CONDITION_MASTER |

Stage Claim Outside Authority Condition Master |

DIM_CLAIM_OA_CONDITION |

Claim Outside Authority Condition Dimension |

791 |

STG_INS_OCCURRENCE_DETAILS |

Stage Insurance Occurrence Details |

DIM_CLAIM_OCCURRENCE |

Claim Occurrence Dimension |

796 |

STG_CLM_CAUSE_OF_LOSS_MASTER |

Stage Claim Cause Of Loss Master |

DIM_CLM_CAUSE_OF_LOSS |

Claim Cause Of Loss Dimension |

798 |

STG_CLM_OCCR_TYPE_MASTER |

Stage Claim Occurrence Type Master |

DIM_CLM_OCCR_TYPE |

Claim Occurrence Type Dimension |

This section provides mapping details and descriptions of the Claims T2Ts Result tables.

NOTE:

The Claim Identifier column is added to the FCT_PARTY_MEDICAL_CONDITN_DTLS, FCT_PARTY_MEDICAL_TREATMENTS, and FCT_PARTY_DISABILITY_DETAILS tables to link the Party Medical attributes to the Insurance Claims.

The Insurance Claim Details T2T and its description are as follows.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_CLAIM_DETAILS |

Stores all the attributes of a policy claim paid until date along with the summary of transactions. |

The mapping details for the Insurance Claim Details T2T is as follows.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_CLAIM_DETAILS |

Stage Claim Details |

FCT_CLAIM_DETAILS |

Fact Claim Details |

T2T_FCT_CLAIM_DETAILS |

The Insurance Claim Party Map T2T and its description are as follows.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_CLAIM_PARTY_MAP |

Stores the mapping information between the Claim, Party, and Insurance. |

The mapping details for the Insurance Claim Party Map T2T is as follows.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_CLAIM_PARTY_MAP |

Stage Claim Party Map |

FCT_CLAIM_PARTY_MAP |

Fact Claim Party Map |

T2T_FCT_CLAIM_PARTY_MAP |

The Insurance Claims Occurrence T2T and its description are as follows.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_INS_OCCURRENCE_DETAILS |

Stores the insurance occurrence details. An Occurrence policy covers claims made for injuries sustained during the life of an insurance policy, even if the claim is filed after the policy is canceled. An occurrence is an event that can result in the filing of an insurance claim. |

The mapping details for the Insurance Claims Occurrence T2T is as follows.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_INS_OCCURRENCE_DETAILS |

Stage Insurance Occurrence Details |

FCT_INS_OCCURRENCE_DETAILS |

Fact Insurance Occurrence Details |

T2T_FCT_INS_OCCURRENCE_DETAILS |

The Insurance Claims Investigation T2T and its description are as follows.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_CLAIM_INVESTIGATION_DTLS |

Stores the Claim Investigation details. The claims investigation is a process in which the insurance companies, insurance examiners, or investigators obtain information to evaluate an insurance claim. The investigators look for evidence whether a claim is legitimate or illegitimate. |

The mapping details for the Insurance Claims Investigation T2T is as follows.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_CLAIM_INVESTIGATION_DTLS |

Stage Claim Investigation Details |

FCT_CLAIM_INVESTIGATION_DTLS |

Fact Claim Investigation Details |

T2T_FCT_CLAIM_INVESTIGATION_DTLS |

The Insurance Claims Estimation T2T and its description are as follows.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_CLAIM_BREAK_UP_DETAILS |

Stores reserve details of the claim break up. A claims reserve is the money set aside by the insurance companies to pay the policyholders, who have filed or are expected to file legitimate claims on their policies. Insurers use the fund to pay out incurred claims that are yet to be settled. |

The mapping details for the Insurance Claims Estimation T2T is as follows.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_CLAIM_BREAK_UP_DETAILS |

Stage Claim Break Up Reserve Details |

FCT_CLAIM_BREAK_UP_DETAILS |

Fact Claim Break Up Reserve Details |

T2T_FCT_CLAIM_BREAK_UP_DETAILS |

The Insurance Claim Transactions T2T and its description are as follows.

T2T Name |

T2T Description |

|---|---|

T2T_FCT_CLAIM_TRANSACTIONS |

Stores all the transactions related to claims reported with the entity. |

The mapping details for the Insurance Claim Transactions T2T are as follows.

Source Table Name |

Logical Stage Table Name |

Fact Table Name |

Logical Fact Table Name |

T2T Name |

|---|---|---|---|---|

STG_CLAIM_TXNS |

Stage Claim Transactions |

FCT_CLAIM_TRANSACTION |

Fact Claim Transaction |

T2T_FCT_CLAIM_TRANSACTIONS |

All RDBMS related Result tables can also be deployed on Hive (Stage and Results). Deploy the Hive T2Ts using the Rules Run Framework. For more information, see the Rules Run Framework section in the Oracle Financial Services Advanced Analytical Applications Infrastructure User Guide Release 8.1.1.0.0.

NOTE:

In general, Stage and Result tables are also supported in Hive. However, there are some exceptions. For a list of tables that are not supported in Hive, see List of Unsupported T2Ts

Follow this SCD process to populate data into a Dimension table:

NOTE:

You can also follow this SCD process to populate data into any Hive-related Dimension table.

1. To populate data into a Dimension table, execute the SCD batch. For a detailed procedure, see the Slowly Changing Dimension (SCD) Process.

2. To check the SCD batch execution status of a Dimension table, follow the procedure Check the Execution Status of the SCD Batch.

3. To verify log files, and check the error messages (if any), follow the procedure Verify Log Files and Check Error Messages.

Follow this T2T process to populate data into any T2T Result table:

NOTE:

Only RDBMS T2Ts can be executed using the PMF.

1. To populate data into any T2T Result table, execute the PMF process for that T2T. For a detailed procedure, see the following sections:

a. Prerequisites for loading T2T.

b. Select the Run Parameters and Execute the Run.

2. To check the T2T execution status and verify the log files of any Result table, follow the procedure in the Verify the Run Execution section.

3. To check the error messages, if any, follow the procedure in the Check Error Messages section.

You can see the following topics related to other function-specific tables:

· Insurance Underwriting Entities