Business assumptions are behavior patterns exhibited by a bank’s customers or by the bank itself, which result in a change in the cash flows that occur purely under contractual terms. These include run-offs, prepayments, rollovers, drawdowns, asset sale, delinquencies, recoveries, haircuts, and so on. The application allows business assumptions to be defined under normal conditions. That is, business-as-usual or under multiple stress conditions, through a parameterized and flexible graphical user interface.

The assumptions defined under multiple conditions differ in the magnitude of the behavior exhibited, which results in either change in the cash inflows and outflows. For instance, the run-off rate under normal conditions for certain deposits maybe 2%, under a mild stress scenario it maybe 8%, and under a severe and prolonged stress scenario, it maybe 20%. The application allows you to define and maintain a library of such business assumptions of varying magnitudes and with different parameters. Once saved and approved, a business assumption is registered as a Process in the Rules Framework of Oracle Financial Services Analytical Applications Infrastructure, and can be used across multiple scenarios, Runs, and time periods for computing liquidity risk metrics.

The assumptions can be used to compute liquidity gaps and liquidity ratios under BAU and stress scenarios. LRS supports pre-packaged business assumptions required for computing liquidity coverage ratio in accordance with the BIS Basel III guidelines.

On execution of a BAU or stress Run, one or multiple business assumptions are applied to the contractual cash flows whose attributes correspond to the dimensions specified in the assumption. The application of an assumption results in an increase or decrease in cash flows, movement of cash flows from one bucket to another, change in the value or the encumbrance status of an account depending on the type of business assumption.

NOTE:

Every SKU in the Liquidity Risk Solution (LRS) pack leverages this common user interface.

Topics:

· Business Assumptions Supported

· Intraday Business Assumptions Supported

· Impact of Assumptions on Interest Cash Flows

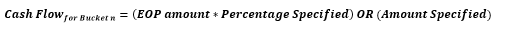

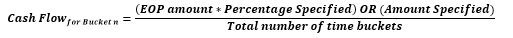

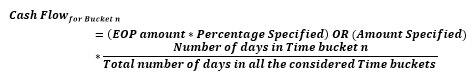

· Cash Flow Assignment Methodologies

· Business Assumption Definition

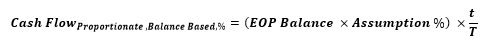

· Understanding Business Assumption Summary

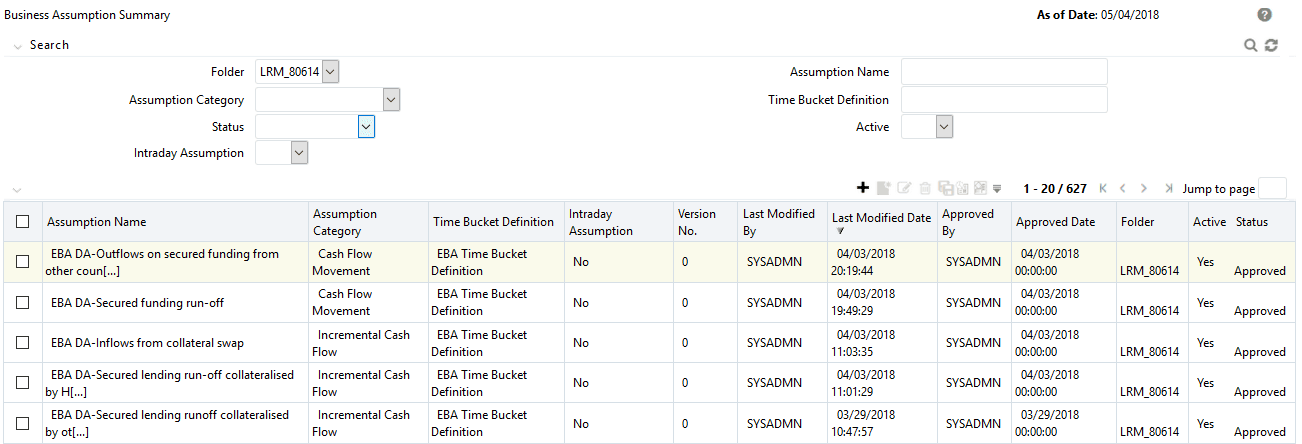

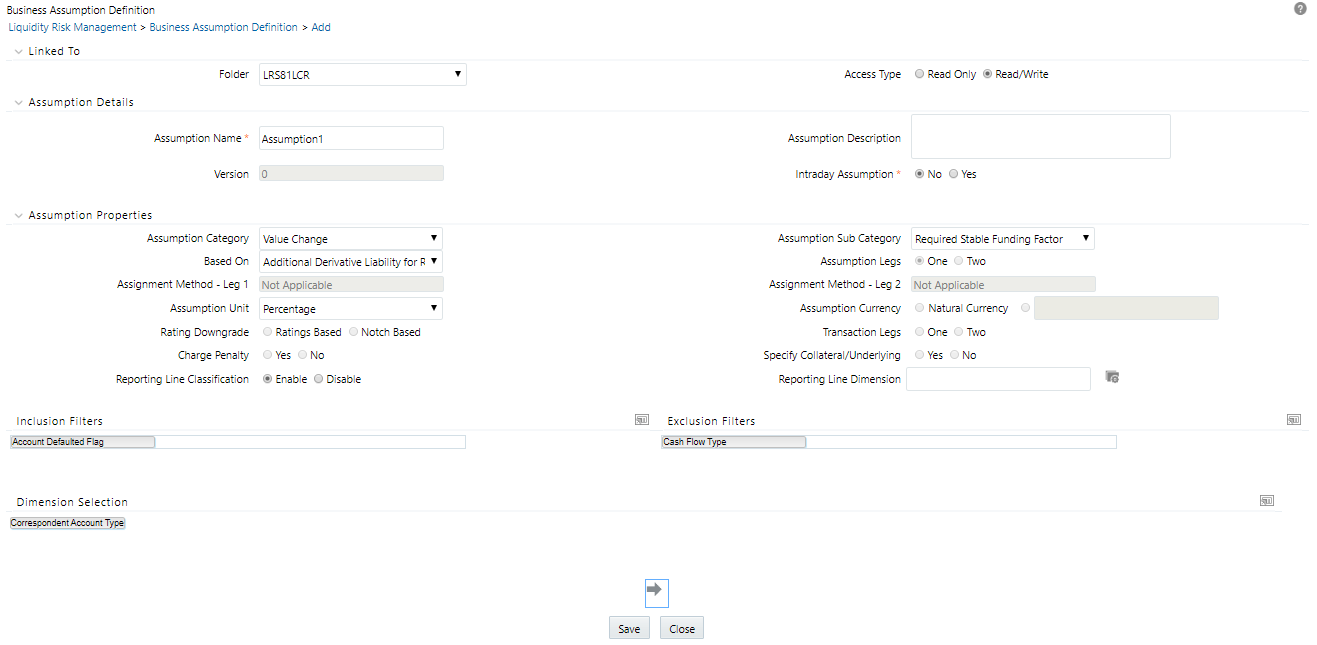

· Defining a New Business Assumption

· Business Assumption Approval Process

· Editing a Business Assumption

The application supports the following types of business assumptions:

Sl. No. |

Assumption Category |

Assumption Sub-category |

|---|---|---|

1 |

Cash Flow Movement |

Cash Flow Movement Asset Sale Cash Flow Delay Delinquency Prepayment Recovery Rollover Run-off |

2 |

Encumbrance |

Encumbrance Ratings Downgrade Valuation Changes |

3 |

Incremental Cash Flow |

Incremental Cash Flow Drawdown New Business Ratings Downgrade Run-off Secured Funding/Financing Valuation Changes |

4 |

Value Change |

Available Stable Funding Factor Haircut Required Stable Funding Factor |

The computations related to each assumption category and sub-category are explained in detail in the following sections.

Topics:

Cash Flow Movement is a category of Business Assumptions that moves the cash flows move from the original time bucket to a prior bucket or a subsequent time bucket, based on the selected Assumption Sub Category.

Topics:

· Recovery

· Rollover

· Run-Off

This is a generic assumption, which enables you to define cash flow movements based on all combinations available as part of the Cash Flow Movement category. That is, it is a superset of all functionality supported by each subcategory in this assumption category.

This assumption moves the cash flows occurring in the original time bucket to a new user-specified time bucket, occurring before or post the original time bucket, based on the assumption value specified.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

This assumption is a specific case of cash flow movement category where cash flows posted in the original maturity bucket of an asset are moved to a prior bucket due to a sale.

· This assumption allows you to specify a sale of unencumbered marketable, fixed, or other assets to advance the cash inflows. Sale can be specified on each individual asset or as a combination of dimensions.

· This assumption allows you to specify a partial sale of assets by specifying the sale amount.

· The assumption reverses all original cash flows that occur between the sale bucket and maturity bucket and posts the market value less haircut in the sale bucket.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the asset sale assumption to cash flows:

1. New inflows are calculated due to sale based on the current market or fair value (in case of marketable and fixed assets) or current outstanding balance (in case of other assets such as loans) and haircut.

2. For instance, if the face value of a bond is 100, the market value is 120, and the sale is specified as 50%, then new inflows are 60 (i.e. 120*50%). Similarly, if the outstanding balance of a loan is 10000 and sale is specified at 75% with a haircut of 5%, the new inflow is 7125 [10000*75 % *(1 - 5 %)].

3. The original time bucket(s) are identified in which the asset(s) matures and the original cash inflows, both principal and interest, in each time bucket.

4. The original cash inflows to be reversed are calculated. This is proportionate to the sale amount and is calculated based on the original value.

5. In the example of the bond, it will be 50 (that is, 100*50%). In the example of the loan, it will be 75% of the original principal and interest payments.

6. The cash inflows are assigned due to sale to the sale bucket and reverse the proportionate original cash flow in the respective original buckets.

7. The number of units held is updated post-sale in case of marketable assets and the outstanding balance in case of other assets. For all further computations, the revised asset balance is used.

If a sale is specified as an amount or in terms of units, it is converted into a percentage of the market value or outstanding balance to reverse the original cash flows. For instance, a bank has 10 bonds whose total market value is $1200 and the original value is $1000.

a. When the sale is specified as $900 pre-haircut value, the percentage sold is 75% (that is, 900/1200). The original cash flow to be reversed is $750 (1000*75%).

b. When the sale is specified as 5 units, the percentage sold is 50% (that is, 5/10). The original cash flow to be reversed is $500 (1000*50%).

NOTE:

· Assets can only be sold in buckets that are before the original bucket. That is, their maturity bucket.

· If an asset is currently encumbered but its encumbrance period is less than its maturity, it can be sold in the time bucket occurring between the last day of encumbrance and its maturity.

· Other assets include unencumbered loans and other non-marketable assets.

· A sale of assets removes all future cash flows, both principal and interest and results in a new inflow at the sale bucket.

· The haircut is applied to the sale value only that is, market value in case of marketable and fixed assets and outstanding balance in case of other assets. Original cash flow reversal will not include haircut.

· If the sale is specified as an amount, it is considered as the pre-haircut amount.

· When converting the sale amount to a percentage, the pre-haircut amount is to be considered.

The following example illustrates the asset sale business assumption. This example is based on the equal cash flow assignment methodology. The original value of the asset in the 1-5 year bucket is 48000 and the greater than 5-year bucket is 32000. The current market value is 1245 per unit and the number of units held is 100.

Business Assumption Definition |

Cash Flow Assignment |

||||||

|---|---|---|---|---|---|---|---|

Product Type |

Rating |

Sale Amount / Percentage |

Haircut |

Time Bucket |

Contractual Cash Flow |

Time Bucket |

Revised Cash Flow |

Bond |

BBB |

40% |

10% |

8-15 Days |

10000 |

Overnight |

24940 [= 10000 + {(1245*100*40%*90%)/3}] |

5000 |

1-7 Days |

19940 [= 5000 + {(1245*100*40%*90%)/3}] |

|||||

8000 |

8-15 Days |

22940 [= 8000 + {(1245*100*40%*90%)/3}] |

|||||

119870 |

1-5 Years |

100670 [=119870 - (48000*40%)] |

|||||

200907 |

> 5 Years |

188107 [=200907 - (32000*40%)] |

|||||

Due to market conditions, the payments or receipts that are expected at a particular time are delayed, thereby giving rise to liquidity risk. In such a scenario, the payments or receipts that were expected as on date will now be available at a future date. This assumption moves the expected cash flows in a particular time bucket to one or multiple future time buckets based on a percentage of the cash flow occurring in that bucket. In a cash flow delay assumption, cash flow movement happens from previous buckets to the future buckets.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption. This is the delayed payment or receipt amount excluding penalty which is reversed.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties on the delayed payments or receipts, if any.

In cash flow delay assumption, the cash flow movement is always to a future time bucket. Therefore, 0% is assigned to the previous buckets for Increasing or Decreasing assignment as illustrated in the table:

Illustration: Delays assigned to a selected time bucket.

Business Assumption Definition |

Computation Assignment |

||||||||

|---|---|---|---|---|---|---|---|---|---|

Product |

Currency |

From Bucket |

To Bucket |

Delayed Amount |

Penalty |

Contractual Cash flow (From Bucket) |

Contractual Cash flow (To Bucket) |

Revised Cash flow -(From Bucket) |

Revised Cash flow(To Bucket) |

Vehicle Loan |

US Dollars |

10-10 Days |

12-12 Days |

10% |

5% |

30000 |

23000 |

27000 |

26150 |

This assumption caters to large and non-large customers. This assumption is based on the anticipation of the bank that there can be an emergency loss due to the delinquency of its customers which will affect the future cash flows. When a customer becomes delinquent, the cash flows of the delinquent buckets (as specified in percentage and amount) are moved to the overnight bucket. To specify delinquency on large customers, select a large customer dimension; however, the computation of cash flows is the same for both large and non-large customers. In a delinquency assumption, the cash flow movement happens from the forward bucket/s to the previous bucket (Overnight).

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

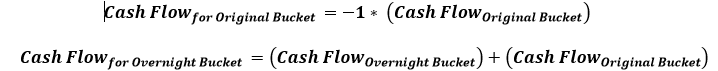

Cash flow assignment is done in the following manner:

An example of the assumption applied to product type (Business loan), and currency (USD) for Large and Non-Large Customers is illustrated in the table:

Illustration 1: Delays assigned to a selected time bucket.

Business Assumption Definition |

Computation Assignment |

|||||||

|---|---|---|---|---|---|---|---|---|

Product |

Customer |

From Bucket |

Delinquent Value |

Contractual Cash Flow |

Contractual Cash Flow |

Delinquent (Value) |

Revised Cash flow |

Revised Cash flow |

Business Loans |

Large Customer |

8-8Days |

10% |

30000 |

23000 |

3000 [= (30000* 10%)] |

27000 |

40600 [=(23000+3000+5000+9600)] |

9-9Days |

20% |

25000 |

5000 [= (25000*20%)] |

20000 |

||||

10-10Days |

30% |

32000 |

9600 [= (32000*30%)] |

22400 |

||||

Illustration 2: Delays assigned to a selected time bucket

Business Assumption Definition |

Computation Assignment |

|||||||

|---|---|---|---|---|---|---|---|---|

Product |

Customer |

From Bucket |

Delinquent Value |

Contractual Cash Flow |

Contractual Cash Flow |

Delinquent (Value) |

Revised Cash flow |

Revised Cash flow |

Home Loans |

Non- Large Customer |

3-3 Days |

15% |

15000 |

23000 |

2250 [= (15000*15%)] |

12750 |

27350 [=(23000+2250+2100)]

|

4-4 Days |

10% |

21000 |

2100 [= (21000* 10%)] |

18900 |

||||

|

|

|

|

|

||||

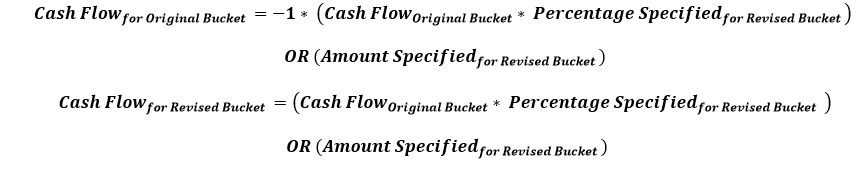

Prepayment is a situation where the customer repays the loan in part or full, at any time before the maturity of the loan. Prepayment would lead the bank to lose out on the interest component that it would have received if the loan was not pre-paid. Prepayment results in a cash inflow in a time bucket before the original time bucket and reduced cash inflow in the original time bucket. The percentage of prepayment is to be specified by you and the balance is payable only when it is due.

The prepayment supports prepayments on liabilities as well as assets in a single business assumption definition.

If a prepayment is specified on an asset or liability backed by collateral, the encumbrance period of the underlying collateral is re-calculated based on the time bucket in which the asset or liability is completely paid up.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

Cash flow assignment is done in the following manner:

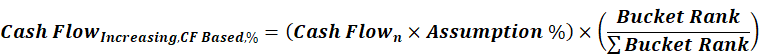

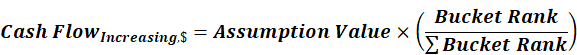

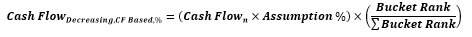

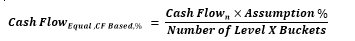

The following example explains the Assumption Value Based on Original Cash Flows across Business Assumptions.

A prepayment of 10% from 8-15 Day bucket to 1-7 Day bucket and a 20% rollover is defined from 1-7 Day bucket to 8-15 Day bucket. The contractual cash flow in the 1-7 Day bucket is 5000 and the 8-15 Day bucket is 8000. The impact on the 1-7 Day bucket based on original cash flows is illustrated below:

Cash Flow Assignment |

|||

|---|---|---|---|

Assumption |

Contractual Cash Flow in 1-7 Day Bucket |

Impact of Assumption |

Post-Assumption Cash Flow |

No Assumption |

5000 |

0 |

5000 [=5000 - 0] |

Prepayment |

5000 |

800 [= (8000*10%)] |

5800 [=5000 + 800] |

Rollover |

5800 |

- 1000 [= - (5000*20%)] |

4800 [= 5800 - 1000] |

In this case, even though the cash flow has changed after applying the prepayment assumption, the original cash flow is used for estimating the impact of the rollover assumption.

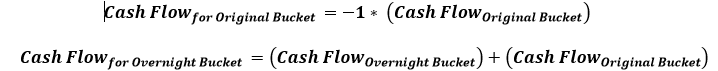

Recovery assumes the part/full amount is recovered from delinquent/ defaulted accounts. In this assumption, the contractual cash flows assigned to the overnight time bucket is considered. Even though contractually it is due immediately, the actual recovery takes place only over a period of time. In this assumption, the contractual cash flows assigned to the overnight time bucket is considered. You are allowed to specify the percentage of recovery in each time bucket based on past experiences. The balance percentage which is not specified by you is placed in the unspecified time bucket. Therefore, the contractual cash flow is first deducted from the overnight time bucket and assigned to various other time buckets based on the defined percentages.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

Cash flow assignment is done for delinquent/defaulted cash flows in the following manner:

The following example shows the assumption applied to product type (loan), legal entity (LE 1), and currency (USD):

Business Assumption Definition |

Cash Flow Assignment |

||||||||

|---|---|---|---|---|---|---|---|---|---|

Product Type |

Legal Entity |

Currency |

Loan Status |

Time Bucket |

Business Assumption |

Time Bucket |

Default Cash Flow |

Business Assumption |

Adjusted Cash flow |

Product 01 |

LE 1 |

USD |

Default |

1 - 30 days |

10% |

Overnight |

10000 |

|

0 [=(10000-10000)] |

1 - 30 days |

|

10% |

1000 [= (10% *10000)] |

||||||

30 - 60 days |

15% |

30 - 60 days |

|

15% |

1500 [=(15%* 10000)] |

||||

60 - 180 days |

25% |

60 - 180 days |

|

25% |

2500 [=(25% * 10000)] |

||||

|

|

|

|

|

|

Unspecified that is, 180 - |

|

|

5000 [=(10000-1000-1500-2500)] |

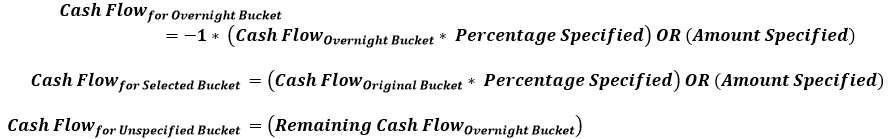

Rollover refers to the rescheduling of a certain percentage of cash flows to a future time bucket. This occurs when an asset/liability is renewed for an additional term. The amount of cash flow rolled over is thus reduced/increased from the original time bucket and assigned to the new time bucket in the future.

The assumption specification and computation method for this subcategory remain unchanged. This subcategory allows rollovers to be specified even on repos, reverse repos and swaps. In the case of rollover of swaps, the user is required to select the transaction legs option as two.

If a rollover is specified on an asset or liability that has underlying collateral, then the availability of the underlying should be determined. Only if the underlying collateral is available during the extended period, the assumption should be allowed to be saved

Rollover of assets impacts the inflow amount and rollover of liabilities impacts the cash outflow amount. The signage and computation depends on the product type selected. In a rollover assumption, cash flow movement happens from previous bucket/s to the forward buckets.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

Rollover of Assets refers to the rescheduling of a certain percentage of cash flows to a future time bucket. This occurs when an asset is renewed for an additional term. The amount of cash flow rolled over is thus reduced from the original time bucket and assigned to the new time bucket. The effect of this assumption would be an altered final cash flow in the affected time buckets. The rollover of assets impacts the inflow amount.

Cash flow assignment is done in the following manner:

For instance, Rollover of Assets is explained in the following example of the assumption applied to product type (Loan), legal entity (LE 1), and currency (USD).

Business Assumption Definition |

Cash flow Assignment |

|||||||

|---|---|---|---|---|---|---|---|---|

Product Type |

Legal Entity |

Currency |

Original Maturity Bucket |

Revised Time Bucket |

Rollover % |

Contractual Cash flow |

Time Bucket |

Revised Cash flow amount |

Loan |

LE 1 |

USD |

15-30 Days |

60-90 Days |

10% |

10000 |

15-30 Days |

3000 [= 10000 - (10%* 10000) - (60% * 10000)] |

5000 |

60-90 Days |

6000 [(= 5000 + (10* 10000)] |

||||||

180-360 Days |

60% |

7000 |

180-360 Days |

13000 [= 7000 + (60%* 10000)] |

||||

Rollover of liabilities refers to the rescheduling of a certain percentage of cash flows to a future time bucket. It occurs when the liabilities are renewed for an additional term. The amount of cash flow rolled over is thus increased in the original maturity time bucket and assigned to the new maturity time bucket. The effect of the business assumption would be an altered final cash flow in the various time buckets. Rollover of liabilities impacts the cash outflow amount.

Cash flow assignment is done in the following manner:

In a Run-off assumption, the bank assumes that a certain percentage of deposits/liabilities will be withdrawn by their customers before the scheduled maturity of the deposit. This business assumption would result in an additional outflow in an earlier time bucket and a reduction in the contractual cash outflow in the original time bucket. The assumption can also be applied to assets as well, where the impact on cash flows will be opposite to that specified for deposits above.

The cash flow movement happens from forward bucket/s to the previous bucket/s since cash flows which were expected to be withdrawn at a future date are getting withdrawn as on date.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

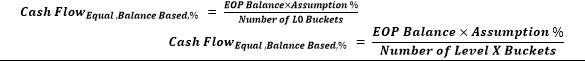

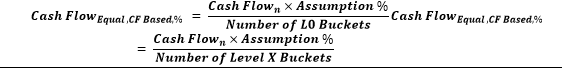

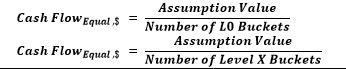

Cash flow assignment is done in the following manner:

An illustration is as follows:

Business Assumption Definition |

||||||||

|---|---|---|---|---|---|---|---|---|

Legal Entity |

Customer |

From Bucket |

To Bucket |

Assumption Unit |

Run-off |

Assignment Method |

Assumption Category |

Based On |

Legal Entity 1 |

Customer 2 |

6-6Days |

3-3Days |

Percentage |

10% |

Equal |

Cash Flow Movement: Run - off |

Cash Flows |

Cash flow Assignment |

|||||

|---|---|---|---|---|---|

To Bucket |

Contractual Cash Flow (From Bucket) |

Contractual Cash Flow (To Bucket) |

Run-off |

Revised Cash flow (From Bucket) |

Revised Cash flow (To Bucket) |

Overnight |

20000 |

10000 |

500 |

18000 |

10500 |

|

|

[=(20000*10%)/4] |

[=(10000+500)] |

||

1-1 Day |

11000 |

500 |

11500 |

||

|

|

[=(20000*10%)/4] |

[=(11000+500)] |

||

2-2 Days |

22000 |

500 |

22500 |

||

|

|

[=(20000*10%)/4] |

[=(22000+500)] |

||

3-3 Days |

12000 |

500 |

12500 |

||

|

|

[=(20000*10%)/4] |

[=(12000+500)] |

||

This section provides information about Encumbrance.

Topics:

This is a generic assumption that can be defined and caters to the different combinations available as part of rating downgrade and valuation changes of collateral.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

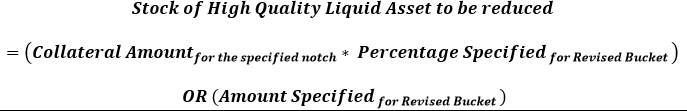

Some financing transactions or derivatives with embedded downgrade triggers, downgrade a bank’s rating by a recognized credit rating institution, requiring the bank to post additional collateral. This assumption impacts the numerator of LCR that is, a decrease in the market value of HQLA.

For some financing transactions or derivatives with embedded downgrade triggers, downgrade in a bank’s rating by a recognized credit rating institution will require the bank to post additional collateral. The encumbrance assumption category assumes that the asset required to be posted as additional collateral is already available with the bank and will be encumbered. This results in the deduction of the relevant amount from the stock of high quality liquid assets as it is now no longer unencumbered.

NOTE:

The assumption specification and computation method for this subcategory correspond to that available as part of the Additional Collateral - Rating Downgrade Decrease in Asset assumption type. This assumption is renamed as Ratings Downgrade in this version.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

New Stock of HQLA assignment is done in the following manner:

Assuming a downgrade trigger of 3-Notches, this assumption is specified as follows:

Business Assumption Definition |

Cash Flow Assignment |

|||

|---|---|---|---|---|

Asset Level |

Downgrade Impact Value |

Downgrade Impact Amount |

Downgrade |

Decrease in HQLA |

Level 1 Asset |

80% |

11000 |

1 Notch |

8800 [= (11000*80%)] |

Level 1 Asset |

100% |

9000 |

2 Notches |

9000 [= (9000*100%)] |

Level 1 Asset |

80% |

80000 |

3 Notches |

64000 [= (80000*80%)] |

This assumes that a bank would require posting additional collateral because of a decrease in the value of current assets.

This assumption impacts the numerator of LCR, which results in a decrease in the stock of HQLA.

In this assumption, the additional collateral posted will result in the selected assets being marked as encumbered. The relevant amount is deducted from the stock of high quality liquid assets where applicable. These assets will not be available for the purpose of counterbalancing or for estimating the cash inflows for LCR.

This assumption supports changes in the value of the collateral posted due to changes in the market valuation of transactions or changes in the contract value. This further leads to cash outflow.

This assumption impacts the denominator of LCR that is, increase in the outflow for the Legal Entity.

Some derivatives are secured by collateral to cover losses arising from changes in mark-to-market valuations. For changes in the value of the derivative, additional collateral is posted, resulting in a cash outflow. The valuation changes can be with Natural currency or Selected Currency. Valuation changes can be specified in Amount or Percentage. Here, both ratings and notches downgrade are not applicable.

The time buckets selected as part of the assumption parameters are the impacted time buckets.

NOTE:

The assumption specification and computation method for this subcategory correspond to that available as part of the Additional Collateral - Valuation Changes - Asset Value Decrease assumption type. This assumption is renamed as Valuation Changes in this version.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

For example:

Based On |

Assumption Unit |

Assignment Method |

|---|---|---|

Market Value |

Percentage |

Selected |

Legal Entity |

Product |

Valuation Change Impact |

|---|---|---|

LE 1 |

P4 |

100% |

LE 2 |

P5 |

50% |

LE 3 |

P4 |

20% |

LE 4 |

P5 |

30% |

Legal Entity |

Product Type |

Original Market Value |

Revised Market Value |

|---|---|---|---|

LE 1 |

P4 |

520000 |

0 [=520000-(100% * 520000)] |

LE 2 |

P5 |

610000 |

305000 [610000- (50%*610000)] |

LE 3 |

P4 |

160000 |

128000 [160000-(20% * 160000)] |

LE 4 |

P5 |

120000 |

84000 [120000-(30% * 120000)] |

This section provides information about Incremental Cash Flow.

Topics:

· Drawdown

· Run-off

This is a generic assumption which enables you to define and caters to the different combinations available as part of Incremental Cash Flow.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

The Drawdown of Unutilized Credit and Drawdown of Funding Line of Credit assumption types have been merged as part of the drawdown subcategory. The assumption specification and computation method for this subcategory remain unchanged. This subcategory allows drawdown to be specified on lines of credit extended as well as received by banks in a single business assumption.

There is an amount line given to the bank or received by the banks which are allowed to drawdown. This allows drawdown to be specified on lines of credit extended as well as received by Banks.

· Drawdown of Unutilized Credit: Banks generally allow customers to withdraw a certain amount which is a percentage of the value specified as the limit. This business assumption is applied to the undrawn portion, the assumption being that a certain portion of the undrawn amount is drawn by the customer at the specified time bucket thus leading to additional cash outflows. This assumption also allows you to specify the corresponding cash inflow for the specified cash outflow.

· Drawdown of Funding Line of Credit: Banks also receive lines of credit from other banks and financial institutions. The bank can drawdown these lines as per its requirement at any time during the tenure of the facility. A percentage of the total undrawn amount is assumed to be drawn down over each time bucket. Drawdown of funding line of credit results in cash inflow first and outflow at a later date. This assumption also allows you to specify the corresponding cash outflow for the specified cash inflow

Additionally, this assumption allows you to specify the corresponding cash inflow for the specified cash outflow.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

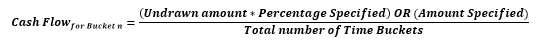

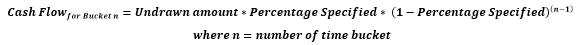

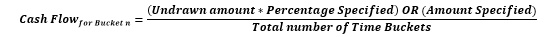

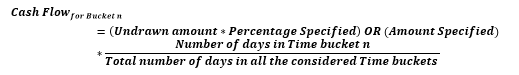

Various options for cash flow assignments are available. Refer section Cash Flows.

Following is an illustration for drawdown:

Business Assumption Definition |

Cash Flow Assignment |

||||||

|---|---|---|---|---|---|---|---|

Product Type |

Primary Bucket |

Off-Set Bucket |

Undrawn amount |

Drawdown Value |

Contractual Cash Flow |

Time Bucket |

Revised Cash Flow |

Loan |

1-7 Days |

8-15 Days |

10000 |

30% |

5000 |

1-7 Days |

8000 [= 5000 +30%* 10000] |

|

|

|

|

|

8000 |

8-15 Days |

5000 [=8000 - 30%*10000] |

Here,

Primary bucket = Inflow bucket

Offset bucket = Outflow bucket

When the markets are inaccessible to the banks due to several reasons, the cash flows continue to run-off contractually. However, no new business is allowed due to market inaccessibility. Banks are required to maintain a pre-defined level of balance at all times. In some cases, due to market inaccessibility, the balance goes down and banks are required to restore the balance to the pre-defined levels over a period of time, called the restoration period.

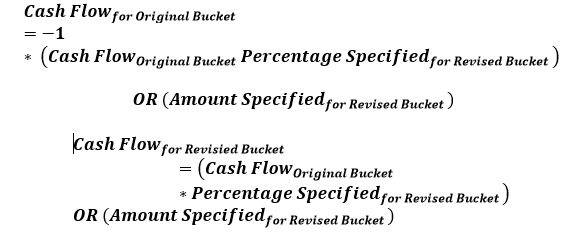

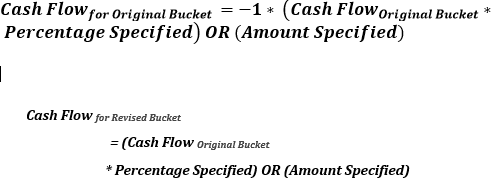

The following steps are for calculating cash flows based on the liability run-off business assumption:

1. Run-off the contractual cash flows until the end of the market inaccessibility period.

2. The sum of cash outflows during the market inaccessibility period is computed.

3. The balance to be maintained at the end of the portfolio restoration period is computed as follows:

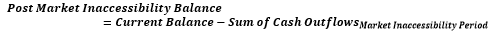

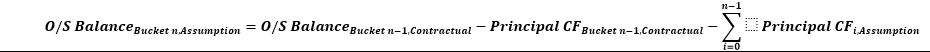

4. The balance at the end of the market inaccessibility period is computed as follows:

5. The total re-issue amount is computed as follows:

6. If the re-issue amount is positive, the following occurs:

a. All contractual cash flows occurring after-market inaccessibility period are removed.

b. The re-issue allocation days as the number of business days in the portfolio restoration period is calculated.

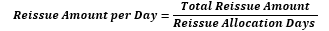

c. The re-issue amount per business day is calculated as follows:

d. The reissue amount per day as a cash inflow on each business day during the portfolio restoration period is posted.

7. If re-issue amount is negative, the following occurs:

a. If the outstanding contractual balance at the end of the portfolio restoration period is greater than the post-restoration target balance.

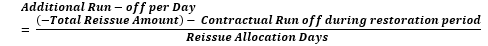

i. The additional run off during per business day is computed as follows:

ii. The additional run off per day as a cash outflow on each business day during the portfolio restoration period in addition to contractual cash outflow is posted.

b. If the contractual balance at the end of the portfolio restoration period is less than the post-restoration target balance.

i. The contractual cash outflows on each business day following the market inaccessibility period, until the outstanding balance is equal to the post-restoration target balance is posted.

ii. All contractual cash outflows after the day on which the outstanding balance is equal to the post restoration target balance are removed.

See the following example for Liability Run-off:

As of Date |

13-Apr-14 |

|---|---|

EOP Balance |

4698.24 |

Inaccessibility End Bucket |

9-9 Day |

Restoration End Bucket |

20-20 Day |

Minimum Balance |

100 |

Restoration % |

1% |

Market Inaccessibility End Date |

22-Apr-14 |

|---|---|

Restoration End Date |

3-May-14 |

Market Inaccessibility Period |

9 |

Portfolio Restoration Period |

11 |

Contractual Cash Outflows during Inaccessibility Period |

2321.93 |

Post Restoration Target Balance |

100.00 |

Post Market Inaccessibility Balance |

2376.30 |

Contractual Run-off during Restoration |

2056.58 |

Post Restoration Outstanding Contractual Balance |

319.72 |

Total Reissue Amount |

-2276.30 |

Reissue Allocation Days |

8 |

Reissue Amount per Day |

0.00 |

Additional Run-off per Day |

27.47 |

The following example shows the cash flows when re-issue amount is negative and post-restoration outstanding contractual balance and post-restoration target balance.

Inputs |

Calculation |

||||||

|---|---|---|---|---|---|---|---|

Calendar Date |

Contractual Cash Outflow |

Contractual Cash Inflow |

Day from As of Date |

Holiday Indicator |

Cumulative Cash Outflow (Post Inaccessibility Period) |

Post Assumption Cash Outflow |

Post Assumption Cash inflow |

4/14/2014 |

919.85 |

0.00 |

1 |

|

0.00 |

919.85 |

0.00 |

4/15/2014 |

341.48 |

0.00 |

2 |

|

0.00 |

341.48 |

0.00 |

4/16/2014 |

320.37 |

0.00 |

3 |

|

0.00 |

320.37 |

0.00 |

4/17/2014 |

291.37 |

0.00 |

4 |

|

0.00 |

291.37 |

0.00 |

4/18/2014 |

131.73 |

0.00 |

5 |

|

0.00 |

131.73 |

0.00 |

4/19/2014 |

0.00 |

0.00 |

6 |

Y |

0.00 |

0.00 |

0.00 |

4/20/2014 |

0.00 |

0.00 |

7 |

Y |

0.00 |

0.00 |

0.00 |

4/21/2014 |

198.15 |

0.00 |

8 |

|

0.00 |

198.15 |

0.00 |

4/22/2014 |

118.98 |

0.00 |

9 |

|

0.00 |

118.98 |

0.00 |

4/23/2014 |

33.59 |

0.00 |

10 |

|

0.00 |

61.05 |

0.00 |

4/24/2014 |

295.54 |

0.00 |

11 |

|

33.59 |

323.00 |

0.00 |

4/25/2014 |

329.09 |

0.00 |

12 |

|

329.12 |

356.56 |

0.00 |

4/26/2014 |

0.00 |

0.00 |

13 |

Y |

658.22 |

0.00 |

0.00 |

4/27/2014 |

0.00 |

0.00 |

14 |

Y |

658.22 |

0.00 |

0.00 |

4/28/2014 |

440.79 |

0.00 |

15 |

|

658.22 |

468.25 |

0.00 |

4/29/2014 |

266.20 |

0.00 |

16 |

|

1099.01 |

293.66 |

0.00 |

4/30/2014 |

112.62 |

0.00 |

17 |

|

1365.20 |

140.08 |

0.00 |

5/1/2014 |

289.16 |

0.00 |

18 |

|

1477.82 |

316.63 |

0.00 |

5/2/2014 |

289.60 |

0.00 |

19 |

|

1766.98 |

317.06 |

0.00 |

5/3/2014 |

0.00 |

0.00 |

20 |

Y |

2056.58 |

0.00 |

0.00 |

5/4/2014 |

0.00 |

0.00 |

21 |

Y |

2056.58 |

0.00 |

0.00 |

5/5/2014 |

319.72 |

0.00 |

22 |

|

2056.58 |

0.00 |

0.00 |

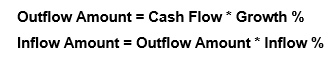

The new business assumption accounts for both the initial outflows as well as corresponding inflows occurring due to growth in the business represented by Leg 1 and Leg 2. This assumption also accounts for both the outflows and corresponding inflows occurring due to the growth in business represented by Leg 1 and Leg 2.

The New Business assumption category supports the following assumptions:

· Deposit Balance Growth (when Based on = Cash Flows)

· Asset Book Growth (when Based on = Cash Flows)

· Liability Book Growth (when Based on = Cash Flows)

· EOP Balance Growth of Assets (when Based on = EOP Balance)

· EOP Balance Growth of Liabilities (when Based on = EOP Balance)

The change in the earlier deposit balance growth assumption is now the new business assumption. If you select the assumption type as Deposit Balance Growth, select Based On is selected as Cash Flows under this assumption.

The following five assumptions have been merged into a single assumption. This is how you can cater to each assumption:

· Deposit Balance Growth (Based on = Cash Flows)

Deposits balance refers to the cash in hand and the deposits maintained by the bank with other institutions including the central bank. Increase in deposit balance results in an increased cash inflow in the maturing time bucket.

NOTE:

Deposits Balance Growth can either be positive or negative.

· Asset Book Growth (Based on = Cash Flows)

Asset book refers to the balances of loans and advances given by the bank. An increase in the asset balance results in increased cash outflow in the selected time bucket and corresponding inflows in future time buckets. This assumption accounts for both the initial outflows as well as corresponding inflows occurring due to growth in the business represented by Leg 1 and Leg 2.

· Liability Book Growth (Based on = Cash Flows)

Liability Book Growth refers to the growth in the value of deposits which are maintained by the bank’s customers or borrowings that have been taken by the bank. The growth in the value of deposits results in additional cash outflow in the maturing time bucket. This assumption also accounts for both the outflows and corresponding inflows occurring due to the growth in business represented by Leg 1 and Leg 2.

· EOP Balance Growth of Assets (Based on = EOP Balance)

EOP Asset Balance of Growth assumption estimates new businesses based on the EOP balance of assets. It accounts for both legs of the transactions, that is, inflows as well as outflows.

· EOP Balance Growth of Liabilities (Based on = EOP Balance)

EOP Liability Balance Growth assumption estimates new businesses based on the EOP balance of liabilities. It accounts for both legs of the transactions, that is, inflows and outflows.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

Various options for cash flow assignments are available. See the Cash Flows section.

See the following example for Asset Book Growth:

Business Assumption Definition |

Cash Flow Assignment |

||||||||

|---|---|---|---|---|---|---|---|---|---|

Product Type |

Legal Entity |

Primary Bucket |

Off-set Bucket |

Growth |

Off-set Value |

Contractual Cash Flow |

Revised Contractual Cash Flow |

Contractual Cash Flow |

Revised Contractual Cash Flow |

Loans |

LE1 |

3-3 Days |

60-60 Days |

15% |

60% |

20000 |

17000 |

25000 |

26800 [= |

90-90 Days |

20% |

27000 |

27600 [=(20000*15%*20%)+27000] |

||||||

120-120 Days |

20% |

32000 |

32600 |

||||||

Here,

An example of Liability Book Growth is as follows:

Business Assumption Definition |

Computation |

||||||||

|---|---|---|---|---|---|---|---|---|---|

Product Type |

Legal Entity |

Primary Bucket |

Off-set Bucket |

Growth |

Off-set Value |

Contractual

Cash Flow |

Revised

Contractual Cash Flow |

Contractual

Cash Flow |

Revised

Contractual Cash Flow |

Deposits |

LE1 |

3-3 Days |

4-4 Days |

25% |

60% |

20000 |

25000 [= |

25000 |

22000 |

5-5 Days |

40% |

32000 |

30000 |

||||||

Here,

NOTE:

1. Regarding columns titled “Cash Flow”, if the value is positive, it is a cash inflow. If the value is negative, it will be a cash outflow.

2. ‘Contractual cash flow- Primary' and 'Contractual cash flow- Secondary' refers to cash flows that are already present in the respective buckets. Similarly, the revised column represents cash flows after the application of this business assumption.

3. The cash flow signage explanation provided before holds good for both asset growth and liability growth.

4. For a liability

growth, such as deposits, a growth from the bank's perspective means that

there will be an inflow of funds first (bank receives deposits from customers

first) and then there will be a corresponding outflow later (Bank returns

deposit proceeds on maturity to the customer). The converse holds good

for asset growth. Note that the first transaction bucket is always the

primary bucket.

In the example above on deposits, 3-3 days is defined as a primary bucket

(the first bucket). In this case, since it is a liability, it would result

in an inflow in this bucket. The offset bucket will have an outflow.

5. The growth amount (delta) in the primary buckets and the offset buckets would be the same. For example: In the example of deposits above, the growth amount in the primary bucket is 5000 (25% of 20000). The offset buckets have an amount of 5000 which is the sum of 3000 and 2000.

This assumption supports both rating based, and notch-based downgrade. These downgrades are specified for each legal entity within the bank’s organizational structure. This can come from multiple sources such as Moody’s, S&P, and can be both short term and long term or a combination thereof. Since these rating downgrades are defined at a legal entity level, the legal entity is a mandatory dimension for this assumption. If the downgrade is the same across all legal entities, no individual legal entity is required to be selected.

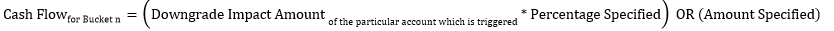

For some financing transactions or derivatives with embedded triggers for downgrade, a downgrade of the bank’s rating by a recognized credit rating institution requires the bank to post additional collateral. This will increase the cash outflow for all the accounts that are triggered based on the corresponding downgrade impact amount and downgrade impact value specified by the bank. The downgrade trigger and the corresponding downgrade impact amount are available as part of the account information. For calculation of downgrade impact amount see the Modified Liquidity Coverage Ratio Calculations, section Other Calculations in the OFS Liquidity Risk Regulatory Calculations for US Federal Reserve User Guide Release 8.1.0.0.0.

NOTE:

The assumption specification and computation method for this subcategory correspond to that available as part of the Additional Collateral - Rating Downgrade Cash Flow Increase assumption type. This assumption is renamed as Ratings Downgrade in this version.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

Cash flow assignment is done in the following manner:

The following example illustrates the impact of a notch-based downgrade. Suppose legal entity 1 has 3 accounts whose downgrade triggers are specified as follows:

Account |

Rating Type |

Rating Source |

Downgrade Trigger |

Trigger Type |

Impact Amount |

|---|---|---|---|---|---|

Account 1 |

Short Term |

Moody’s |

P-3 |

And |

1000000 |

Long Term |

Moody’s |

A3 |

Or |

|

|

Long Term |

S&P |

A- |

|

|

|

Account 2 |

Short Term |

Moody’s |

P-2 |

And |

250000 |

Long Term |

S&P |

BBB+ |

|

|

|

Account 3 |

Short Term |

Internal |

A-3 |

Or |

3000000 |

Long Term |

Moody’s |

Baa2 |

|

|

|

Account 4 |

Long Term |

Moody’s |

Baa1 |

|

750000 |

Account 5 |

Short Term |

Moody’s |

P-2 |

|

1250000 |

The downgrade assumption is specified as follows:

Rating Type |

Rating Source |

Downgrade Trigger |

Impact % |

Time Bucket |

|---|---|---|---|---|

Short Term |

Moody’s |

2-Notches |

100% |

7 Days |

Long Term |

Moody’s |

3-Notches |

The new rating post downgrade is assessed as follows:

Rating Type |

Rating Source |

Current Rating |

Rating Post Downgrade |

|---|---|---|---|

Short Term |

Moody’s |

P-1 |

P-3 [= P-1 - 2 Notches] |

Long Term |

Moody’s |

Aa3 |

A3 [= Aa3 - 3 Notches] |

The impact of the downgrade assumption, considering weekly time buckets, is calculated as follows:

Account |

Applicability of Assumption |

Reason |

Cash Outflow / Encumbrance |

Outflow Bucket |

|---|---|---|---|---|

Account 1 |

Applicable |

Both parts of the first condition are fulfilled. The second condition is Or, hence not required to be fulfilled if the first one is. |

1000000 [=1000000*100%] |

5 - 5 Week [=(7+15 Days)/5 Business Days] |

Account 2 |

Not Applicable |

The second part of the condition is not fulfilled. |

|

|

Account 3 |

Not Applicable |

Either of the conditions is not fulfilled. |

|

|

Account 4 |

Not Applicable |

The condition is not fulfilled. |

|

|

Account 5 |

Applicable |

The condition is fulfilled as the quantum of downgrade specified as part of the assumption is greater than the downgrade trigger set for this instrument. |

1250000 [=1250000*100%] |

3 - 3 Week [=(7+5 Days)/5 Business Days] |

The total impact of this assumption is a cash outflow or asset encumbrance of 2250000.

Incremental Cash Flow Run-off is applied to the End of Period (EOP) balances, indicating the amount that is withdrawn before their scheduled maturity. The computation methodology has one additional step; if cash flows exist for the dimension combination for which Run-off is specified, they are deleted, and then the new cash outflows are generated.

See the Defining a New Business Assumption, section for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

For instance, incremental cash flow Run-off is applied to Time Deposits whose EOP balance is $ 10000. The assumption is applied on the original balance to selected time buckets as follows:

Business Assumption Definition |

Cash Flow Assignment |

||||

|---|---|---|---|---|---|

Product Type |

To Bucket |

Run-off |

Contractual Cash Flow |

Time Bucket |

Revised Cash Flow |

Time Deposits |

1-7 Days |

10% |

5000 |

1-7 Days |

1000 [=5000 - 5000 +10000*10%] |

|

8-15 Days |

20% |

8000 |

8-15 Days |

2000 [=8000 - 8000 +10000*20%] |

This assumption is based on debt backed or secured by collateral securities associated with lending. This assumption category refers to the generation of secured funding or creation of secured financing transactions including secured loans, repos, and so on. For example, in a mortgage, your house is considered collateral towards the debt. If you default on repayment, the bank seizes your house, sells it and uses the proceeds to pay back the debt.

Functionally, this assumption is similar to the new business assumption except for the inclusion of the underlying collateral and encumbrance status into the picture.

NOTE:

· Assets can only be posted as collateral or specified as underlying only if they are unencumbered during the period between the Primary and Off-set bucket.

· The ability to filter assets based on their encumbrance period is supported.

The following steps are involved in applying the secured funding/financing assumption to cash flows:

1. Map inflows and outflows of the transaction to respective time buckets.

2. Calculate the corresponding interest amount.

3. Mark the assets selected as collateral or underlying as encumbered and update the encumbrance period.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

For example: If a bank is giving out an additional loan with reference to an existing loan by taking in some collateral. This is an example of a secured funding transaction, as the bank receives collateral in exchange for the cash given out. Assume that the outstanding end of period balance of the original loan is 10,000. The bank extends another 10% of the loan by taking in collateral against it, Borrow_1. Further, the 10% being extended is completely offset as a bullet payment in a single bucket (100% in offset bucket).

This scenario is defined in the business assumption as follows:

Business Assumption Definition |

|||||||

|---|---|---|---|---|---|---|---|

Standard product type |

Primary bucket |

Primary value-leg 1 |

Offset bucket |

Offset value- leg 1 |

Collateral/underlying |

Encumbered value |

|

Loans |

7-7 days |

10 |

15-15 days |

100 |

Borrow_1 |

50% |

|

NOTE:

The encumbered value represents the portion of the collateral which is used to secure the loan .

The cash flow computation for this definition is explained as follows:

Buckets |

Cash flow |

||

|---|---|---|---|

Contractual |

BaU |

||

Primary bucket |

7-7 days |

5000 |

4000 (5000- (10%*10000) |

Offset bucket |

15-15 days |

8000 |

9000 (8000+(10%*10000) |

Given that the example is based on loans, the primary leg involves a deduction in cash and the secondary leg involves an addition in cash flow. The deduction/addition will be reverse in nature if the product type is an asset. The application identifies whether to deduct/add a primary bucket and offset bucket based on the product type chosen.

This assumption supports changes in the value of the collateral posted due to changes in market valuation of transaction or changes in the contract value. This further leads to cash outflow.

This assumption impacts the denominator of LCR that is, increase in the outflow for the Legal Entity.

Some derivatives are secured by a collateral to cover losses arising from changes in mark-to-market valuations. For changes in the value of the derivative, additional collateral is posted resulting in a cash outflow. The valuation changes can be with Natural currency or Selected Currency. Valuation changes can be specified in Amount or Percentage. Here, both ratings and notches downgrade are not applicable.

The time buckets selected as part of the assumption parameters are the impacted time buckets.

NOTE:

The assumption specification and computation method for this subcategory correspond to that available as part of the Additional Collateral - Valuation Changes assumption type. This assumption is renamed as Valuation Changes in this version.

See the Defining a New Business Assumption, section for information on the steps involved in specifying this assumption.

The following steps are involved in applying the delay in cash flow timing assumption to cash flows:

1. Identify the original time bucket and calculate the cash outflow occurring in it due to the assumption.

2. Identify the corresponding revised time buckets and the cash inflow occurring in it, including penalties, if any.

3. If time-specific or critical obligation, record the delay and indicate a breach.

For example:

Based On |

Assumption Unit |

Assignment Method |

|---|---|---|

Market Value |

Percentage |

Selected |

Legal Entity |

Product Type |

Time Bucket |

Valuation Change Impact |

|---|---|---|---|

LE 1 |

PT 1 |

6-6 Days |

100% |

LE 2 |

PT 1 |

6-6 Days |

80% |

Account |

Legal Entity |

Product Type |

Market Value |

Valuation Change Impact |

|---|---|---|---|---|

Account 1 |

LE 1 |

PT 1 |

100000 |

100000[=100% *100000] |

Account 2 |

LE 2 |

PT 1 |

200000 |

160000[=80%*200000] |

Account 3 |

LE 1 |

PT 1 |

300000 |

300000[=100%*300000] |

Account 4 |

LE 2 |

PT 1 |

400000 |

320000[=80%*400000] |

Legal Entity |

Product Type |

Outflow |

|---|---|---|

LE 1 |

PT 1 |

400000[=100000 + 300000] |

LE 2 |

PT 1 |

480000[=160000 + 320000] |

Each of these does not calculate the impact of interest and has been explained in a principle perspective.

The examples provided for the business assumption do not illustrate the impact of interest cash flows.

For information on interest cash flow calculations from the perspective of assumptions, refer to the Impact of Assumptions on Interest Cash Flows section.

The example depicted in the section depicts only the additional outflow (delta) in the respective buckets due to the application of the assumption.

This section provides information about Value Change.

Topics:

· Available Stable Funding Factor

· Haircut

· Required Stable Funding Factor

Available stable funding (ASF) factors are the multiplication factors specified for liabilities and equities to calculate the Net Stable Funding Ratio (NSFR). This business assumption allows you to specify the ASF factor in percentage terms only. The percentage specified is applied to the selected combination to calculate the NSFR.

See the Defining a New Business Assumption, section for information on the steps involved in specifying this assumption. In the following example, ASF factor is applied on EOP balances for a selected list of products and the resulting ASF amounts are calculated.

Business Assumption Definition |

Balance Assignment |

||

|---|---|---|---|

Product |

ASF Factor |

EOP Balance |

Available Stable Funding |

P1 |

85% |

10000000 |

8500000 |

P 2 |

100% |

200000 |

200000 |

Term deposits from retail |

90% |

320000 |

288000 |

Unsecured funding from non-financial corporates |

50% |

21000 |

10500 |

Haircuts are applied to high quality liquid assets to determine the stock of high quality liquid assets. This assumption does not affect the cash flows. Haircuts are allowed to be specified in percentage terms only. The haircut percentage specified will be applied to all assets with the dimensional attributes specified to calculate the stock of high quality liquid assets to compute the Liquidity Coverage Ratio (LCR).

See the Defining a New Business Assumption, section for information on the steps involved in specifying this assumption.

Business Assumption |

||

|---|---|---|

Product Type |

Asset Level |

Haircut |

Cash |

Level 1 |

0% |

Covered bond |

Level 1 |

0% |

Covered bond |

Level 2A |

15% |

Common Equity |

Level 2B |

50% |

The assumption stores these haircuts at the account level granularity for further use while calculating the stock of HQLA for the purpose of LCR computation. The application then computes the haircut adjusted values of assets for inclusion in the stock of HQLA as follows:

Product Type |

Asset Level |

Haircut |

Market Value |

Haircut Adjusted Market Value |

|---|---|---|---|---|

Cash |

Level 1 |

0% |

3000000 |

3000000 |

Covered bond |

Level 1 |

0% |

220000 |

187000 |

Covered bond |

Level 2A |

15% |

550000 |

412500 |

Common Equity |

Level 2B |

50% |

110000 |

55000 |

Required stable funding factors are the multiplication factors specified for assets to calculate the NSFR. This assumption allows you to specify the amount in percentage only. The percentage specified is applied to the selected combination to calculate the Net Stable Funding Ratio (NSFR).

See the Defining a New Business Assumption, section for information on the steps involved in specifying this assumption. In the following example, RSF factor is applied on EOP balances for a selected list of products and the resulting RSF amounts are calculated.

Business Assumption |

Computation |

||

|---|---|---|---|

Product |

RSF Factor |

EOP Balance |

Required Stable Funding |

Non-renewable loans to financial entities and financial corporates |

0% |

200000 |

0 [= (200000*0%)] |

Gold |

50% |

150000 |

75000 [= (150000*50%)] |

Corporate bonds rated A+ to A- |

40% |

220000 |

0 [= (220000*40%)] |

The application supports the following types of intraday business assumptions:

1. Cash Flow Movement

§ Time Shift in Payments

§ Payments Default

2. Encumbrance

§ Withdrawal of Credit Lines

3. Incremental Cash Flow

§ Intraday Drawdown

§ Large Unexpected Payments

4. Value Change

§ Intraday Valuation Changes

The computations related to each assumption category and subcategory are explained in detail in the following sections.

This section provides information about Cash flow Movement.

Topics:

When a bank is under financial stress, customers and counterparties defer payments, leading to a reduction in Intraday liquidity. The delayed payments affect other payments in the pipeline and also affect the fulfillment of time-specific obligations.

Similarly, when certain obligations of the bank are brought forward in time during the day, this leads to a stressed situation as well. The assumption supports a time shift in payments- either a forward or backward shift.

The application supports a time shift of payments from one time bucket to another. You can apply this assumption to both payments made and payments received.

NOTE:

All payments within the time bucket are affected and shifted according to the assumption definition.

The following is an example for Time Shift in Payment assumption category:

The Time buckets are defined as follows:

Level 2 |

Level 1 |

Level 0 |

|---|---|---|

09:00:00 to 09:24:00 |

09: 00:00 to 09:12:00 |

09:00:00 to 09:06:00 |

09:06:01 to 09:12:00 |

||

09:12:01 to 09:24:00 |

09:12:01 to 09:18:00 |

|

09:18:01 to 09:24:00 |

When a Business Assumption is defined:

· Dimensions: Legal entity - Payment system

· Based on: Payments received

· Time buckets from : 09:00:00 to 09:12:00

· Time buckets To: 09:12:01 to 09:24:00

· Percentage of delay: 60%

The payments made and received are as follows:

Time bucket (Level 0) |

Payments Received (Inflows) |

Payments Made (Outflows) |

|---|---|---|

Amount |

Amount |

|

09:00:00 to 09:06:00 |

990 |

675 |

09:06:01 to 09:12:00 |

550 |

234 |

09:12:01 to 09:18:00 |

130 |

167 |

09:18:01 to 09:24:00 |

100 |

389 |

When the assumption is defined at level 1, the same is translated to level 0 buckets when the assignment method is selected.

In this example, the selected time bucket option as an assignment method is chosen. In this case, Inflows in the time period 09:00:00 to 09:12:00 moves to the time bucket 09:12:01 to 09:24:00. Since the ‘to’ bucket has two level 0 buckets, the assignment of the total amount, that is,(990 +550) must be done to both the buckets. After the assignment, the payments received and made are as follows:

Time bucket |

Payments Received (Inflows) |

Payments Made (Outflows) |

|---|---|---|

Amount |

Amount |

|

09:00:00 to 09:06:00 |

396 |

675 |

09:06:01 to 09:12:00 |

220 |

234 |

09:12:01 to 09:18:00 |

592 |

167 |

09:18:01 to 09:24:00 |

562 |

389 |

Here, 60% of (990 +550) is delayed and is allocated equally between the level 0 buckets in the to bucket.

In this assumption, certain risky counterparties are assumed to default on their payments. Here, incoming payments from the respective counterparty type reduces to an extent as specified in the assumption definition. The counterparty is chosen through a dimensional selection.

For example, consider the following payments made and received for a legal entity - payment system combination.

Time Stamp |

Payments Received |

Payments Made |

||

|---|---|---|---|---|

Payments |

Counterparty Type |

Payments |

Counterparty Type |

|

9:00 |

100 |

A |

|

|

9:15 |

30 |

A |

40 |

C |

9:30 |

|

|

90 |

C |

9:45 |

60 |

A |

150 |

B |

10:00 |

30 |

C |

100 |

B |

10:15 |

90 |

B |

300 |

A |

10:30 |

45 |

|

|

|

10:45 |

89 |

B |

70 |

D |

11:30 |

90 |

C |

100 |

B |

12:00 |

56 |

C |

90 |

E |

12:15 |

|

|

70 |

E |

12:30 |

78 |

A |

100 |

B |

13:15 |

|

|

20 |

C |

13:30 |

96 |

E |

|

|

14:30 |

200 |

E |

200 |

D |

15:00 |

250 |

A |

|

|

15:15 |

300 |

B |

87 |

D |

15:30 |

60 |

B |

40 |

E |

15:45 |

|

|

|

|

16:00 |

50 |

E |

99 |

A |

16:15 |

|

|

60 |

B |

16:30 |

40 |

D |

|

|

16:45 |

|

|

|

|

17:00 |

|

|

|

|

Assume that one of the counterparty types A is in complete default (100%). This means that the incoming payment from A reduces to zero. The payments to be received by A flows normally. The new set of Inflows and Outflows are as follows:

Time Stamp |

Payments Received |

Payments Made |

||

|---|---|---|---|---|

Payments |

Counterparty Type |

Payments |

Counterparty Type |

|

9:00 |

|

A |

|

|

9:15 |

|

A |

40 |

C |

9:30 |

|

|

90 |

C |

9:45 |

|

A |

150 |

B |

10:00 |

30 |

C |

100 |

B |

10:15 |

90 |

B |

300 |

A |

10:30 |

45 |

|

|

|

10:45 |

89 |

B |

70 |

D |

11:30 |

90 |

C |

100 |

B |

12:00 |

56 |

C |

90 |

E |

12:15 |

|

|

70 |

E |

12:30 |

|

A |

100 |

B |

13:15 |

|

|

20 |

C |

13:30 |

96 |

E |

|

|

14:30 |

200 |

E |

200 |

D |

15:00 |

|

A |

|

|

15:15 |

300 |

B |

87 |

D |

15:30 |

60 |

B |

40 |

E |

15:45 |

|

|

|

|

16:00 |

50 |

E |

99 |

A |

16:15 |

|

|

60 |

B |

16:30 |

40 |

D |

|

|

16:45 |

|

|

|

|

17:00 |

|

|

|

|

In this example, the counterparty is in complete default.

However, a partial default in payments can also be defined. This can be defined by using the Assumption Unit in the Business Assumptions window. This consists of two options, Percentage and Value.

In case of a partial default, the remaining payments need to be shifted to a ‘Residual’ time bucket. If this bucket is specified at a higher level, the remaining payments are dispersed equally among the lower level buckets.

Examples: If the Assumption unit is in %, and 70% is the specified value, then 70% of the payments of the particular counterparty type is defaulted. The remaining 30% of payments are redistributed in the residual time bucket equally.

NOTE:

1. The assignment method in payments default is only the Selected time bucket.

2. When Assignment unit= value, the value specified is the value defaulted by the specific dimensional combination

3. By default, if no value or percentage is given, the assumption unit appears as 0 for the possible dimensional combinations.

4. The Residual time bucket is within the from time bucket or outside it.

For example, from 11:00:00 to 12:00:00; residual bucket: 11:45:00- 12:00:00

Or from bucket: 12:00:00 to 13:00:00; residual bucket: 14:15:00-14:30:00

The metrics affected by this assumption are as follows:

· Daily Maximum Intraday Liquidity Usage

· Total Payments

· Throughput

This section provides information about Encumbrance.

This assumption is a specific case when a bank is under financial stress, counterparties and correspondent banks may withdraw intraday credit lines, thus reducing the intraday liquidity available to the bank. The direct impact of this assumption is on non-committed credit lines; since they can be withdrawn completely.

This withdrawal of Credit Lines is expected at the start of the day. When credit lines are withdrawn, the available intraday liquidity at the start of the day reduces by the same extent.

The metric which impacts due to this effect is ‘Available Intraday Liquidity at the start of the business day’.

Sl. No. |

Sources |

|---|---|

1 |

Central Bank reserves |

2 |

Collateral pledged at central bank |

3 |

Collateral pledged at ancillary systems |

4 |

Unencumbered liquid assets on the balance sheet |

5 |

Total credit lines available |

5a |

Of which secured |

5b |

Of which committed |

6 |

Balances with other banks |

7 |

Other |

In this assumption, depending on the dimension selected, the intraday credit lines are reduced by the extent of the withdrawal.

Topics:

This assumption enables banks to provide correspondent banking services only. The payment system participants value intraday credit on electronic funds transfer networks because payments and receipts are not perfectly synchronized. In addition, it eliminates the necessity of holding clearing balances large enough to cover all expected outflows of funds.

When a customer bank is in stress, to maintain adequate liquidity, the customer may resort to excessive drawdown of Intraday credit lines.

In the following example, the correspondent bank has 5 customers. Under normal conditions, credit lines extended to customers and usage are as follows:

Normal Conditions |

||||||

|---|---|---|---|---|---|---|

Financial Institution Customer |

Intraday Credit Line Extended |

Intraday Usage |

Secured |

Committed |

Usage of Secured |

Usage of Committed |

Bank O |

85 |

70 |

40 |

50 |

31 |

21 |

Bank E |

80 |

60 |

25 |

10 |

26 |

30 |

Bank M |

45 |

30 |

30 |

40 |

21 |

6 |

Bank G |

35 |

25 |

30 |

30 |

12 |

13 |

Bank Z |

30 |

20 |

15 |

20 |

12 |

17 |

TOTAL |

275 |

205 |

140 |

150 |

102 |

87 |

One or more of the customer banks may be under stress, due to which maximum drawdown of Intraday credit lines may occur. The application supports the following dimensional inputs:

· Percentage of Drawdown

· Respective Customers

In this example, two customer banks are assumed to be under stress-Bank E and Bank O. Under this example, a 100% drawdown of credit lines by the customer is assumed. Hence the credit lines extended and used under stressed conditions are as follows:

Stress Conditions |

||||||

|---|---|---|---|---|---|---|

Financial Institution Customer |

Intraday Credit Line Extended |

Intraday Usage |

Secured |

Committed |

Usage of Secured |

Usage of Committed |

Bank O |

85 |

85 |

40 |

50 |

40 |

50 |

Bank E |

80 |

80 |

25 |

10 |

25 |

10 |

Bank M |

45 |

30 |

30 |

40 |

21 |

6 |

Bank G |

35 |

25 |

30 |

30 |

12 |

13 |

Bank Z |

30 |

20 |

15 |

20 |

12 |

17 |

TOTAL |

275 |

240 |

140 |

150 |

110 |

96 |

Similarly, the application computes ‘Peak Usage’ for both normal conditions and stressed conditions.

When a drawdown assumption is applied at a higher level of time buckets, a single assignment within any level zero buckets of the said amount is considered. An example is as follows:

· Primary bucket (level 3): 08:00 - 09:00, level zero buckets being minutes

· Offset Bucket (Level 3):16:00- 17:00

· Available balance: 1000, assumption value= 40%

An amount of 400 is the outflow in the primary bucket and an inflow in the offset bucket for banks providing credit lines to its customers. This amount is allocated as a single amount in any level zero time bucket which constitutes primary and offset buckets; like 08:03( outflow 400) and 16:06( inflow 400); or 08:44 (outflow 400) and 16:02 (inflow 400).

This assumption allows the introduction of unforeseen large payments in the usual working day. The large payments can be either receipts or obligations or both. The introduction of large payments suddenly within the bank’s payment system causes a scenario of liquidity stress whereby the bank has to arrange such funds in very short notice. The assumptions allows the user to specify the payment system affected, the time bucket at which the payment(s) is introduced, and the amount. The amounts introduced are included in the time buckets as specified in the assumption.

As with other intraday assumptions, all the intraday metrics are calculated post-application of the assumption through a Stress Run.

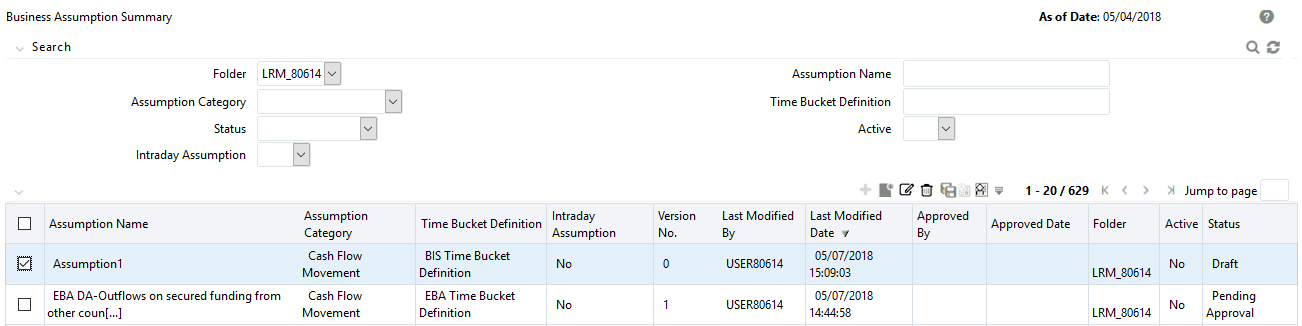

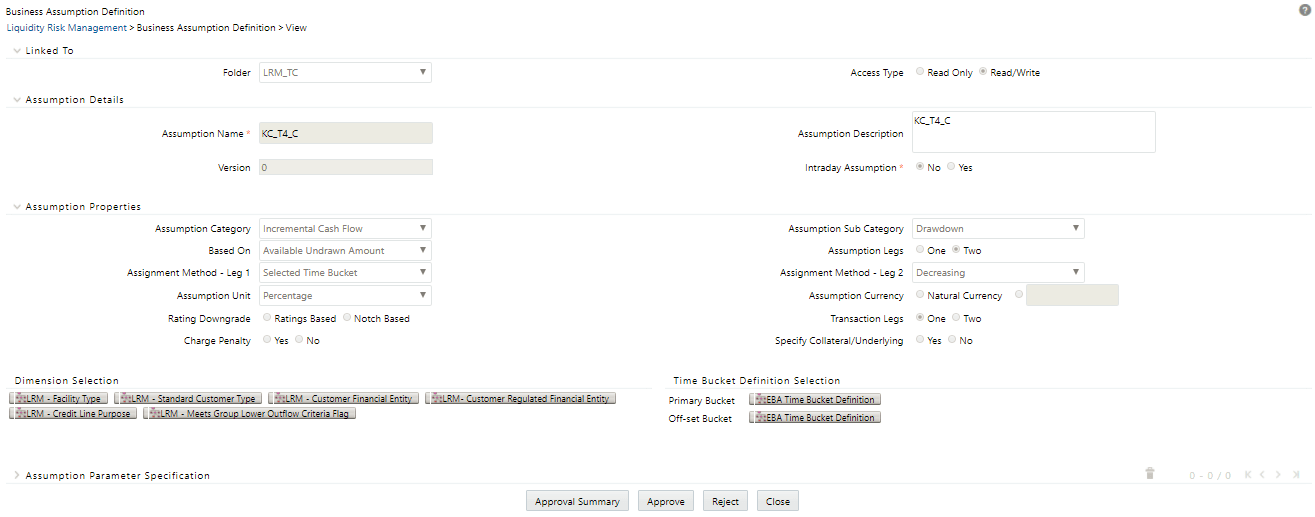

The following is an example of this assumption: