The Run Management screen of the LRS pack allows you to define, approve, and execute Runs. All Runs except stress Runs are defined in the Run Management window of LRM application. The Run, once saved and approved, is registered in the Rules Framework select Run in Oracle Financial Services Analytical Applications Infrastructure.

NOTE:

· Every SKU in the Liquidity Risk Solution (LRS) application pack leverages this common user interface. Run management parameters specific to the SKUs licensed will be displayed in the user interface.

Topics:

· Understanding Run Management Summary

· Run Definition Approval Process

· Adding a Custom Task to a Run

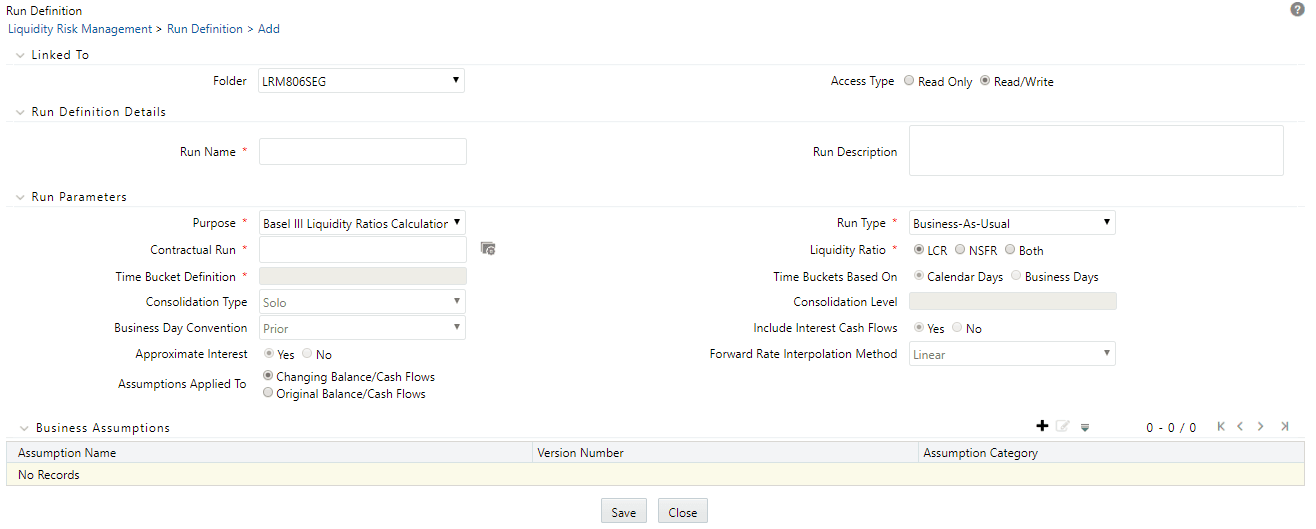

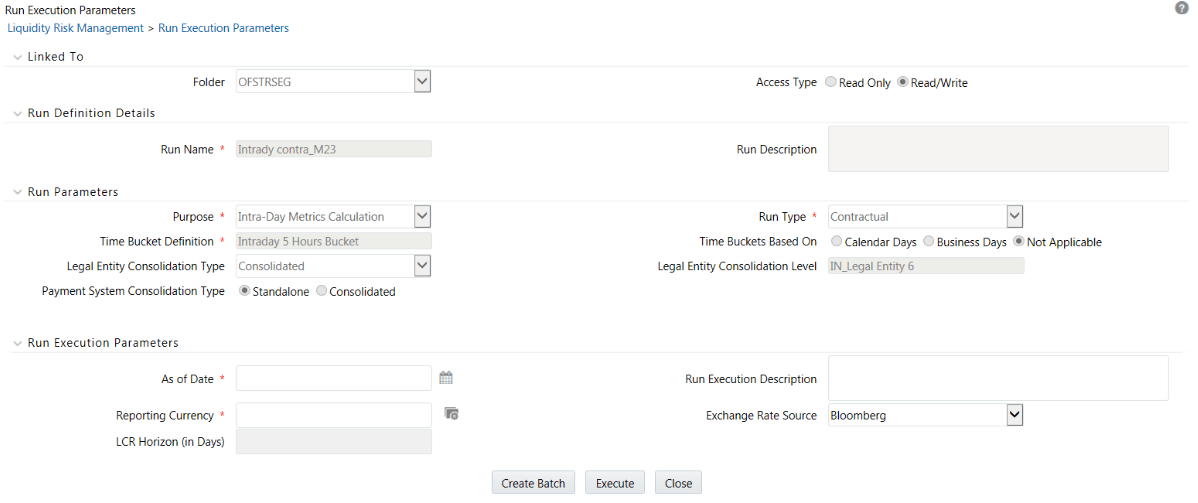

The Run Definition window has the following sections for defining parameters:

The details must be specified as follows:

· Folder: Select the Folder which is specific to the Run definition.

· Access Type: Choose the access type option, Read/Write or Read-Only.

The details for each Run definition are entered here as follows:

· Run Name: Specify the Run name.

· Run Description: Enter the Run description.

The parameters for each Run definition are entered here as follows:

· Purpose

· Run Type

· Payment System Consolidation Type

· Forward Rate Interpolation Method

· Include Forward Date Calculations

· Forward Balance Method Mapping Rule

· Forward Cash Flow Method Mapping Rule

· Balance Sheet Adjustment Method

· Balance Sheet Adjustment Rule

· Number of Forward Calculations

The purpose is the reason for executing each Run. Each purpose has a set of specific calculations associated with it that require different pre-packaged rules and processes to be executed. On selection of a purpose, the relevant rules to support that computation are selected and executed.

Select the Purpose from the drop-down list. The drop-down list displays the following:

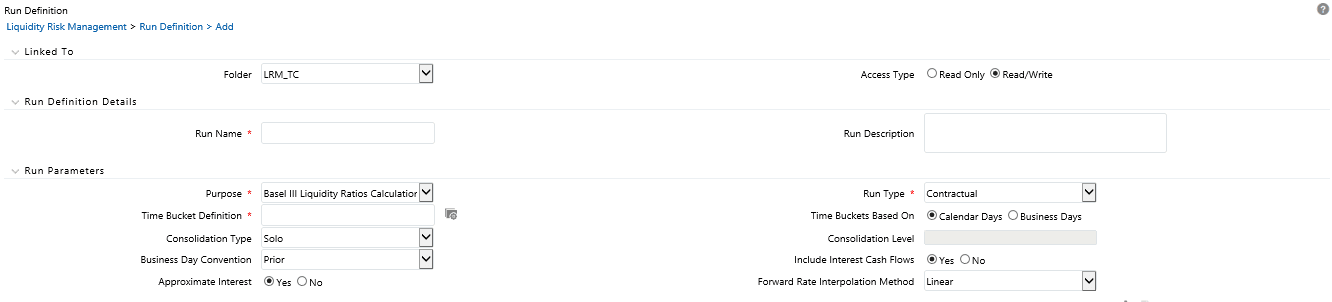

· Basel III Liquidity Ratios Calculation: Selection of this purpose enables the calculation of the Liquidity Coverage Ratio and Net Stable Funding Ratio in accordance with BIS guidelines.

· EBA Delegated Act Liquidity Ratio Calculation: Selection of this purpose enables the calculation of the Liquidity Coverage Ratio in accordance with EBA Delegated Act guidelines

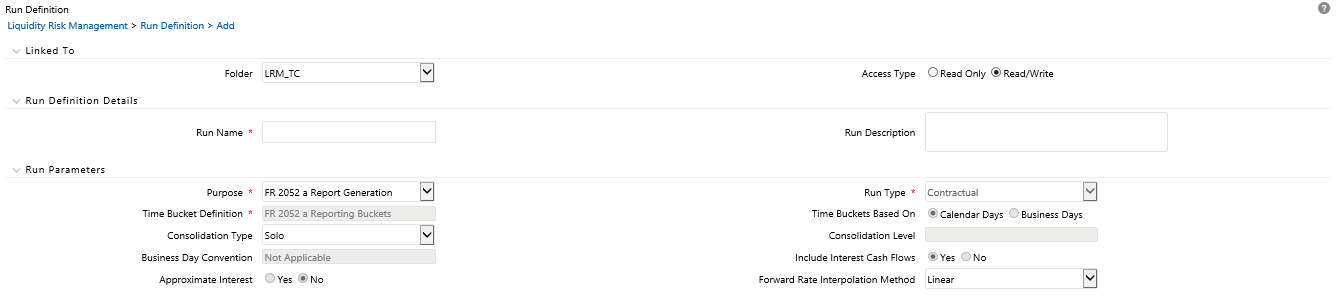

· FR 2052a Report Generation: Selection of this purpose enables re-classification of accounts into the regulatory reporting lines required to generate the FR 2052a report of US Federal Reserve

· FR 2052b Report Generation: Selection of this purpose enables the re-classification of accounts into the regulatory reporting lines required to generate the FR 2052b report of the US Federal Reserve.

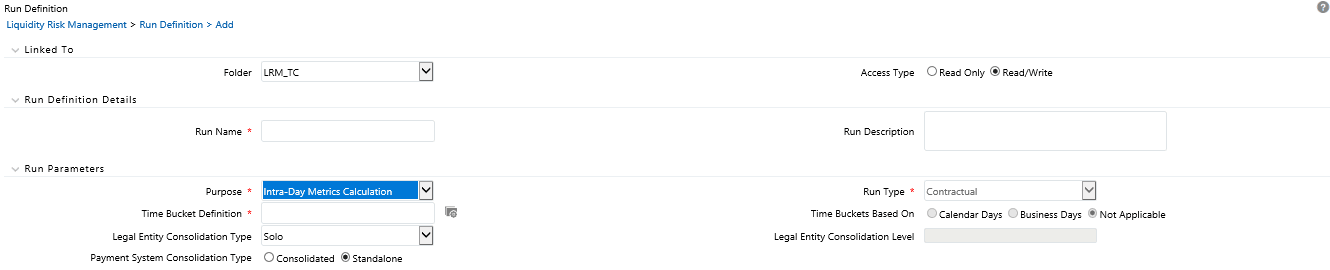

· Intra-Day Metrics Calculation: Selection of this purpose enables the calculation of the intraday metrics based on the actual payment transaction data received from the bank.

· Long Term Gap Calculation: Selection of this purpose enables the calculation of liquidity gaps.

· RBI Basel III Liquidity Ratio Calculation: Selection of this purpose enables calculation of the RBI Liquidity Coverage Ratio which caters to the final guidelines on the LCR, Liquidity Risk Monitoring Tools, and LCR Disclosure Standards.

· RBI Short-Term Dynamic Liquidity Report Generation: Selection of this purpose enables calculation of the RBI Liquidity Coverage Ratio which caters to the final guidelines on the LCR, Liquidity Risk Monitoring Tools, and LCR Disclosure Standards.

· RBI Structural Liquidity Report Generation: Selection of this purpose enables calculation of the RBI Liquidity Coverage Ratio which caters to the final guidelines on the LCR, Liquidity Risk Monitoring Tools, and LCR Disclosure Standards.

· U.S Fed Liquidity Ratio Calculation: Selection of this purpose enables the calculation of the Liquidity Coverage Ratio in accordance with the guidelines of the US Federal Reserve. The FR502a (5G liquidity report) is also generated as part of this Run. The 5G report gets generated when you execute the LCR Run.

· Regulation YY Liquidity Ratio Calculation: Selection of this purpose enables the calculation of the Liquidity Coverage Ratio in accordance with the Regulation YY guidelines.

· BOT Liquidity Ratio Calculation: Selection of this purpose enables the calculation of the Liquidity Coverage Ratio, LCR Disclosure Standards, and Net Stable Funding Ratio in accordance with BOT guidelines.

· BNM Liquidity Ratio Calculation: Selection of this purpose enables the calculation of the Liquidity Coverage Ratio, LCR Disclosure Standards, and Net Stable Funding Ratio in accordance with BNM guidelines.

· MAS Liquidity Ratio Calculation: Selection of this purpose enables the calculation of the Liquidity Coverage Ratio, LCR Disclosure Standards, and Net Stable Funding Ratio in accordance with MAS guidelines.

· Minimum Liquidity Asset Calculation: Selection of this purpose enables the calculation of the Minimum Liquidity Asset Ratio in accordance with MAS guidelines.

· Deposit Insurance Calculation: Selection of this purpose calculates the Insurance amounts for all deposits in accordance with FDIC guidelines.

· HKMA Liquidity Ratios for Category 1 Institutions: Contains out of box Rules and Scenarios as prescribed by the Hong Kong Monetary Authority pertaining to Liquidity ratios for Category 1 institutions. The selection of this purpose enables the user to calculate the Liquidity Coverage Ratio in accordance with HKMA guidelines.

· HKMA Liquidity Ratios for Category 2 Institutions: Contains out of box Rules and Scenarios as prescribed by the Hong Kong Monetary Authority pertaining to Liquidity ratios for Category 2 institutions. The selection of this purpose enables the user to calculate the Liquidity Maintenance Ratio in accordance with HKMA guidelines.

NOTE:

· The list of purposes is available to execute the relevant rules and processes required to achieve a specific computation. The business assumptions are applied over and above these rules and can be selected as part of a BAU or stress run for each purpose.

· FR 2052 a Report Generation and FR 2052 b Report Generation purposes are available only in Contractual Run.

· For Intra-Day Metrics Calculation, the Run Type can be either a Contractual or a Stress Run.

There are three types of Runs supported by Liquidity Risk Solution (LRS):

This is the first Run defined using the Run Management window of the LRM Application and carries out the data preparation, aggregation and reclassifications required for computation of liquidity risk metrics under multiple scenarios. Contractual Run computes the as-of-date liquidity position of the organization without considering any behavioral conditions and forms the base for all subsequent calculations.

A contractual Run allows you to estimate liquidity gaps based on the contractual cash flows received as a download from the bank. It aggregates cash flows based on user-specified aggregation dimensions, identifies HQLA, allocates insurance and identifies deposit stability and so on. All cash inflows and outflows are assumed to be generated under contractual terms. Contractual execution caters to the as of date liquidity status of the organization without the application of any business assumption.

In BAU execution one or multiple business assumptions under normal conditions are applied to the contractual cash flows and the cash inflows and outflows are modified accordingly. A BAU Execution allows you to estimate and analyze the liquidity gaps under normal business conditions. The liquidity gap report (after BAU Execution) provides the liquidity status of the organization based on the impact of these business assumptions on the contractual cash flows. Additionally, liquidity ratios are estimated based on cash flows adjusted for normal conditions in accordance with the Basel III liquidity ratio guidelines prescribed by BIS (See section BIS Basel III Liquidity Ratios Calculation) as well as LCR based on US guidelines (See Liquidity Risk Regulatory Calculations for US Federal Reserve User Guide Release 8.1.0.0.0 on OHC documentation Library.)

The features of BAU Run are as follows:

· One or multiple business assumptions are applied to the cash flows and other interim metrics computed as part of the underlying contractual Run. These assumptions and defined as part of the Business Assumption window and selected in a BAU Run for execution.

· All BAU Run parameters are the same as those specified for the underlying contractual Run except for Assumptions Applied To.

· Assumptions are applied on original balance or cash flows or changing balance or cash flows across business assumptions based on user selection.

· Contractual Run is a pre-requisite for defining a BAU Run.

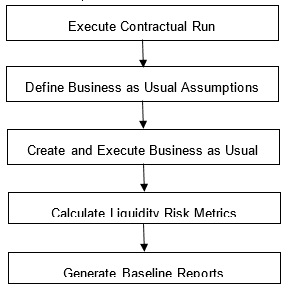

Figure 35: Process Flow of a Business-as-Usual Run

1. Executing BAU or Baseline Run: A Contractual Run is executed before the Business As Usual Run. Once the liquidity gaps are estimated under contractual terms, the changes in cash flows during the normal course of business due to consumer behavior are to be estimated. This involves defining business assumptions based on multiple rules and specifying assumption values. The assumptions include, drawdown, prepayments, rollovers, asset or liability book growth, run-offs, asset value changes, recovery from delinquent accounts, available stable funding factors, required stable funding factors, and so on. Assumption values specified for each dimension member combination is selected from predefined business hierarchies or dimensions. Once these assumptions are defined, they are grouped together and applied to contractual cash flows as part of the BAU Run or Baseline Run execution process. The impact of these business assumptions on liquidity gaps, ratios, and other metrics is estimated.

2. Baseline Reports: LRM generates the Baseline reports that enable a detailed view of the liquidity risk metrics.

Stress testing is now an integral part of a bank’s risk measurement system and plays an important role in estimating the effects of potential financial crises on a bank’s operations. Stress testing, from a liquidity risk management perspective, refers to the process of assessing the liquidity position of a financial institution under adverse conditions. It involves defining stress assumptions and applying them to baseline results to obtain stressed results.

The application leverages the stress testing module of Oracle Financial Services Advanced Analytical Applications Infrastructure to carry out stress testing in an enterprise-wide consistent manner. The stress testing module is an integrated framework of OFSAAAI which supports the stress testing requirements across the entire suite of OFS analytical applications.

Stress Runs are defined as part of the Stress Testing module of OFSAAAI by selecting the baseline Run that is, the LRS BAU Run in the Stress Definition screen and replacing the BAU assumptions which are part of the baseline Run with stress business assumptions. Stress assumptions are business assumptions with adverse values and are defined as part of the Business Assumption screen of LRS. The replacement of BAU assumptions with the stress assumptions constitutes the stress scenario. Once defined and saved, the Stress Run can be viewed, approved, and executed from the Run Management screen of LRS.

The Stress Run defined appears in the list of Runs in the Run Management Summary window. You can approve the definition and then execute it. BAU Run is a pre-requisite for defining stress Runs.

On execution, the stress business assumptions are applied to the contractual cash flows to assess the impact of the adverse scenario on the liquidity position of the institution.

NOTE:

· Contractual and BAU Run are defined in the Run Management window and are automatically registered in OFSAAAI.

· Stress Runs are defined in the Stress Testing module of OFSAAAI and registered in OFSAAAI and appear in the Run Management window. The stress Runs appear in Draft status with a Run type as Stress in the Run Management window of LRS. You are allowed to approve and execute these Runs.

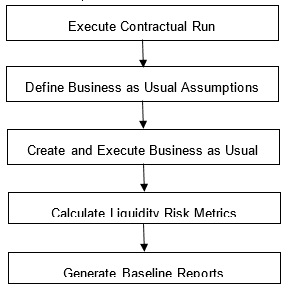

Figure 36: Process flow of a Stress Run

1. Executing Stress Run: The Contractual Run is executed first. The BAU Run is executed next. For executing Stress Runs, the Contractual or BAU cash flows are stressed. A combination of stressed assumptions or a stress value of higher magnitude becomes a stress scenario. The values can be applied as absolute values, or they can be percentages. The liquidity gaps under the given stress scenario are calculated. The impact of the stress scenario is assessed on Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR,) and Funding Concentrations.

2. Stress Reports: LRS generates the Stress reports that enable a detailed view of the liquidity risk metrics like Liquidity Gaps across time buckets, Cumulative Gaps, Gaps across time, Comparison across scenarios, LCR, NSFR, Funding Concentrations, and so on.

This run is available only for Liquidity Risk Regulatory Calculations for European Business Authority (LRRCEBA). See the Liquidity Risk Regulatory Calculations for European Banking Authority User Guide for details.

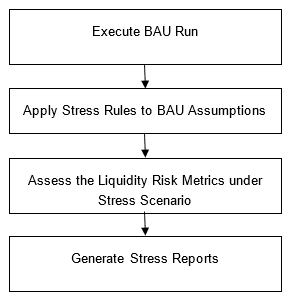

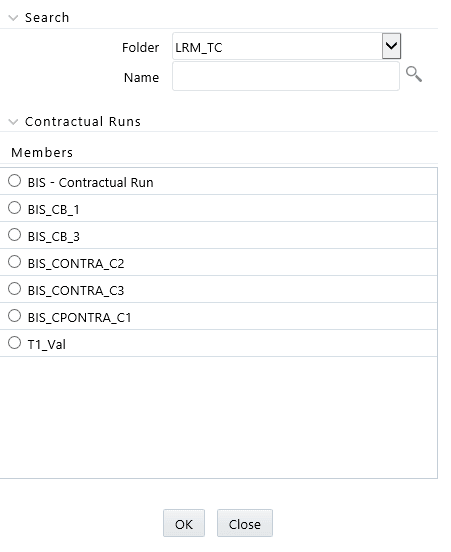

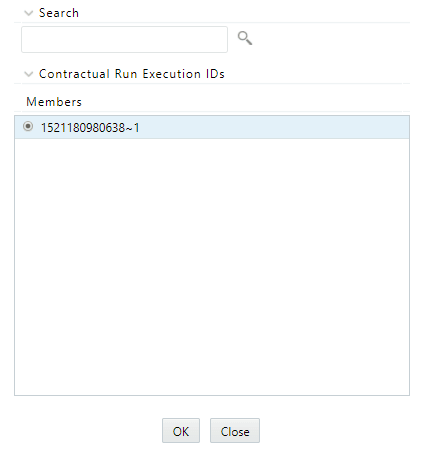

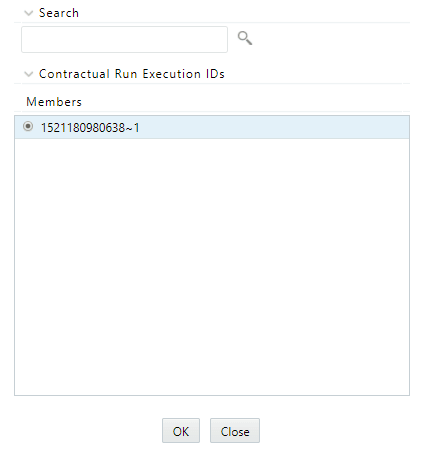

When the Run type is selected as Business-As-Usual, the Contractual Run is required to be selected from the Contractual Run browser. The Contractual Run browser displays a list of contractual Runs. The list is filtered by the purpose selected. For example, if the purpose is selected as Basel III Liquidity Ratios Calculation for a BAU Run, it displays only those Contractual Runs which are specified with that purpose. You are allowed to select a single Contractual Run.

Figure 37 Run Definition - Contractual Run window

When the purpose is selected as Basel III Liquidity Ratios Calculation and the Run type is selected as BAU the Liquidity ratio button is enabled for selection in the Run Definition window. Select either of the following options:

· LCR: If you select LCR, only LCR is calculated.

· NSFR: If you select NSFR, then only NSFR is calculated.

· Both: If you select Both, both NSFR and LCR is calculated in the same Run.

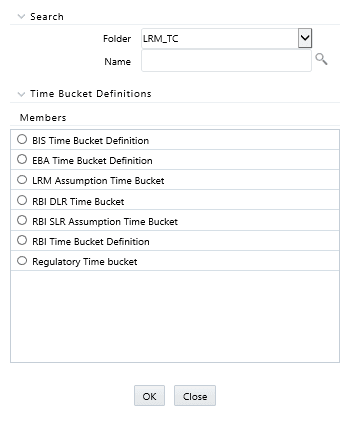

When the Run type is selected as Contractual, the Time Bucket Definition is available for selection from the Time Bucket Definition browser. The Time Bucket Definition browser displays the list of computational time buckets defined as part of the Time Bucket window. You are allowed select a single time bucket definition.

NOTE:

· When the Run purpose is selected as Intraday Metrics Calculation, only intraday buckets are listed under the list time bucket definitions section.

Figure 38 Run Definition - Time Bucket Definition window

When the Run type is selected as Contractual, Time Buckets Based On selection is allowed in the Run Definition window. Select either of the following options:

· Calendar Days: The start and end date of each time bucket are computed based on the number of calendar days when this parameter is selected. The time bucket dates are in running calendar day sequence. The time bucket dates are consistent across multiple legal entities each with different holidays.

· Business Days: The start and end date of each time bucket is computed based on the number of business days when this parameter is selected. The time bucket dates are not continuous calendar days in this case but will exclude holidays. The time bucket dates will be different for each legal entity based on its respective holiday calendar.

NOTE:

· The default option is calendar days in the case of Business-as-Usual.

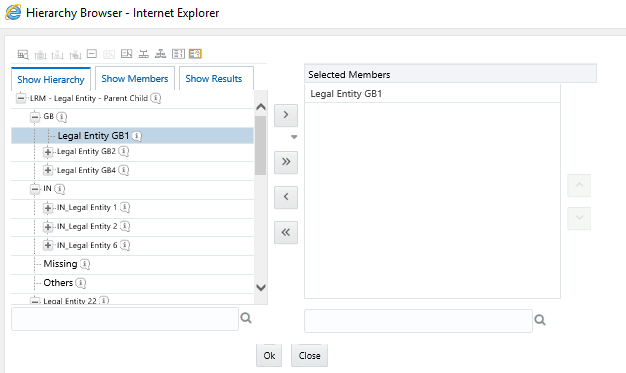

When the Run type is selected as Contractual, Consolidation Type selection is allowed in the Run Definition window. This parameter determines if the calculations are to be executed on a standalone basis for one or multiple selected legal entities or on a consolidated basis at the level of the selected legal entity. Select either of the following options from the drop-down list:

· Solo

· Consolidated

NOTE:

· The liquidity gaps, ratios and other metrics are estimated on a standalone (Solo) basis for each selected legal entity or on a consolidated basis at the level of the selected legal entity based on this selection.

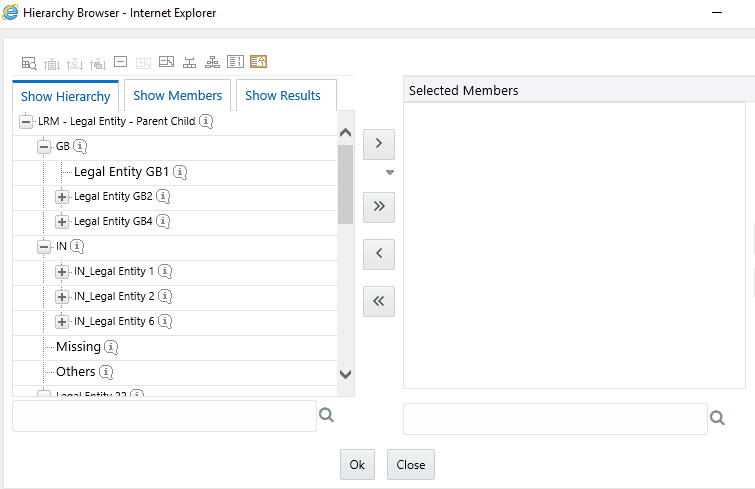

In case you have selected Consolidation Type as Consolidated, you must select in the Consolidation Level to launch the Legal Entity browser for selecting the consolidation level. Select a single legal entity, at which the consolidated liquidity risk measures are to be calculated, from the list of legal entities available in the Legal Entity browser.

NOTE:

· This selection is applicable only when the Run Type is selected as Contractual Run and Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then Consolidation Level field is disabled, and the solo legal entities are to be selected as part of the Legal Entity Selection section.

When the Run type is selected as Contractual and the purpose is selected as Intra-Day Metrics Calculation Payment System Consolidation Type is allowed for selection.

This parameter determines if the calculations are to be executed on a consolidated or standalone basis for one or multiple payment systems. Select either of the following options:

§ Consolidated

§ Standalone

NOTE:

· By default, the Payment System Consolidation Type is selected as Standalone.

When the Run type is selected as Contractual, Business Day Convention selection is allowed in the Run Definition window for the purpose of bucketing cash flows. Select either of the following options from the drop-down list:

· Conditional Following

· Conditional Prior

· Following

· No Adjustment

· Prior

When the Run type is selected as Contractual, Include Interest Cash Flows selection is allowed in the Run Definition window. Select either of the following options:

· Yes: In case you select Yes, both principal and interest cash flows are considered for calculations.

· No: In case you select No, only principal cash flows are considered, and interest cash flows are ignored.

When the Run type is selected as Contractual and when Include Interest Cash Flows are selected as Yes, Approximate Interest selection is allowed in the Run Definition window. Select either of the following options:

· Yes: When Approximate Interest is selected as Yes, the business assumption is applied only to the principal cash flows, and the interest cash flows are approximated based on changes to the principal.

· No: If you select No, the business assumption values are applied to both principal and interest cash flows. However, this application depends on how the business assumption is defined as follows:

§ If you have selected Cash Flow Type as a dimension in the business assumption and the dimension member as Principal, then the assumption is applied only to the principal cash flows.

§ If you have selected Cash Flow Type as a dimension in the business assumption and the dimension member as Interest, then assumption impacts only Interest cash flows.

§ If you have selected Cash Flow Type as a dimension in the business assumption and the dimension member as Principal and Interest, then the assumption is applied to both principal and interest cash flows.

§ If you have not selected Cash Flow Type as a dimension in the business assumption, then the assumption is applied to both principal and interest cash flows.

When the Run type is selected as Contractual, Forward Rate Interpolation Method selection is allowed in the Run Definition window. Select either of the following options from the drop-down:

· Linear

· Log Linear

When the Run type is selected as Business-As-Usual, Assumptions Applied To selection is allowed in the Run Definition window. Select either of the following options:

· Changing Balance/Cash Flows: In this case, the change in the cash flows or balances due to the previous assumption will be considered while applying subsequent assumptions.

· Original Balance/Cash Flows: In this case, the assumptions are always applied to the original cash flows or balances without considering the effect of the previous business assumption.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled. Select either of the following options:

· Yes: If you select Yes, the below parameters are enabled to calculate forward date liquidity risk calculations. You can select one or multiple rules, defined as part of the Rule-Run Framework.

· No: If you select No, the current spot calculations are carried out.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled.

This selection has LRM - Balance Method Reclassification - Forecast selected by default which is a single selection from a list of forward balance calculation method mapping rules defined in the Rule-Run Framework. This option helps to calculate forward balances for each dimensional combination.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled.

This selection has LRM - Cash Flow Method Reclassification - Forecast selected by default which is a single selection from a list of forward cash flow calculation method mapping rules defined in the Rule-Run Framework. This option helps to calculate forward cash flows for each dimensional combination.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled.

This option helps to determine if holidays are included or excluded in Forward Date Liquidity Risk Calculation. This is determined at the time of defining the forward run. Select either of the following options:

· Yes: If you select Yes, holidays are included in Forward Date Liquidity Risk Calculations at the time of defining a forward Run. For each legal entity, the entity-specific holidays are considered if this option is selected.

· No: If you select No, holidays are excluded in Forward Date Liquidity Risk Calculations.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled. Select either of the following options:

· Yes: If you select Yes, then the application calculates post balance calculation for each forward date and the balance sheet adjustments are made.

· No: If you select No, then there is no balance sheet adjustment and no “post balance calculation”.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled.

When the Balance Sheet Adjustment is selected Yes, this method is enabled. From the drop-down list select one of the following balance sheet adjustment methods:

· Current Profile Based Increase

· Current Profile Based Decrease

· Cash Adjustment

· Manual Adjustment

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled.

When the Balance Sheet Adjustment is selected Yes, and the Balance Sheet Adjustment Method is selected as Manual Adjustment this option is enabled. This selection has LRM - Manual Balance Adjustment - Forecast is selected by default.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled. Select either of the following options:

· Yes: If you select Yes, then the parameters First Forward Date Interval, Forward Date Frequency and Number of Forward Calculations are displayed for selection.

· No: If you select No, then the Ad Hoc Forward Date Selection section is enabled. You must provide the ad-hoc forward Run details and select one or multiple dates from the calendar.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled.

This is the interval between the as of date and the first forward date for forward balance and cash flow calculations. You must enter the value in terms of days.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled.

This is the interval between each forward date in terms of days, weeks, and months. You must enter the value which is a whole number greater than 0. From the drop-down list choose Days, Months, or Weeks.

NOTE:

· This field is available only for the jurisdictions - US Federal Reserve and Reserve Bank of India. Refer to the capabilities in the respective user guides on OHC Documentation Library for more information.

When the Run purpose is selected as U.S. Fed Liquidity Ratio Calculation and the Run type is selected as Contractual this parameter is enabled.

This determines the number of forward starting days for which forward balances, cash flows, and liquidity metrics are calculated as part of the forward date contractual Run. You must enter the value which is a whole number greater than 0.

When the Run purpose is selected as the EBA Delegated Act Liquidity Ratio and the Run type is selected as Contractual this parameter is enabled.

The options available are:

Actual: This option allows for time buckets to be based on a fixed, user-specified number of days. The end-date for a bucket is computed as these many days from the start date.

Calendar Based: This option for generating time buckets is introduced in Release 8.0.8.1. This option allows for time buckets to be based on actual calendar dates and months. Under this option, a 1-month time bucket goes from dd/mm (MIS Date) to (dd-1)/(mm+1). For instance, when running the process for 21-Oct-2019, a 1-month bucket will end on 20-Nov-2019. Necessary adjustments are made in case the end date is in February. The attached example provides details on this new option for the time bucket.

NOTE:

· The calendar-based approach is available only for OOTB Time Bucket definitions.

When Run type is selected as Contractual and the consolidation type is selected as Solo, the Legal Entity Selection is enabled. You are allowed to select one or multiple legal entities from the Hierarchy browser. The selected legal entities are listed under the Legal Entity Selection section of the browser.

Figure 39 Run Definition - Hierarchy window

NOTE:

· The parameters Contractual Run and Assumptions Applied to are applicable only when BAU Run is defined. All other parameters of the BAU Run are the same as those of the underlying contractual Run.

· All parameters of the Stress Runs are the same as those of the underlying BAU Run.

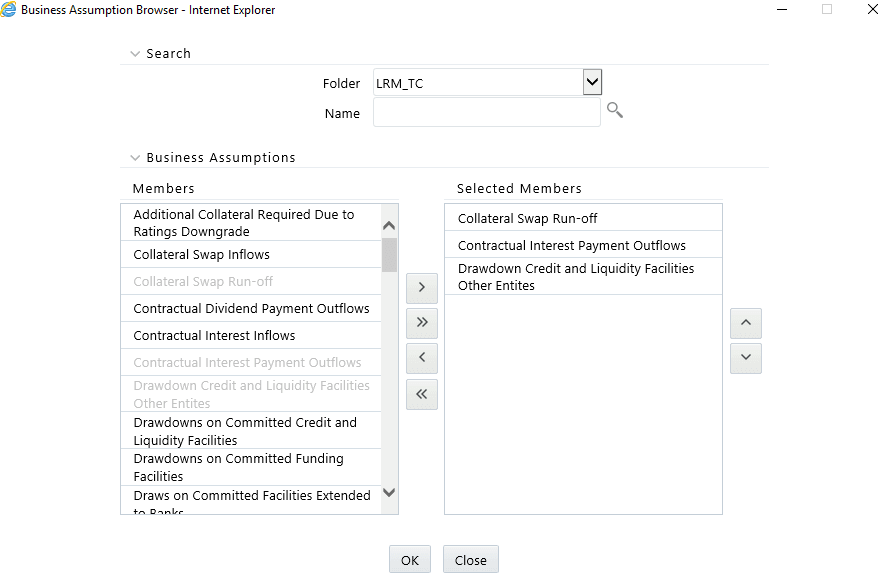

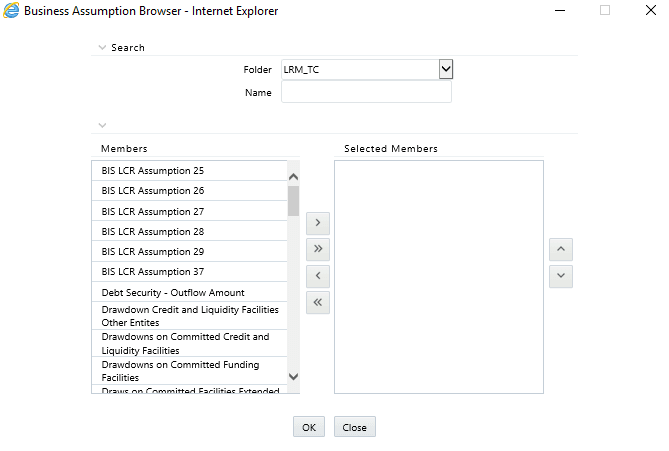

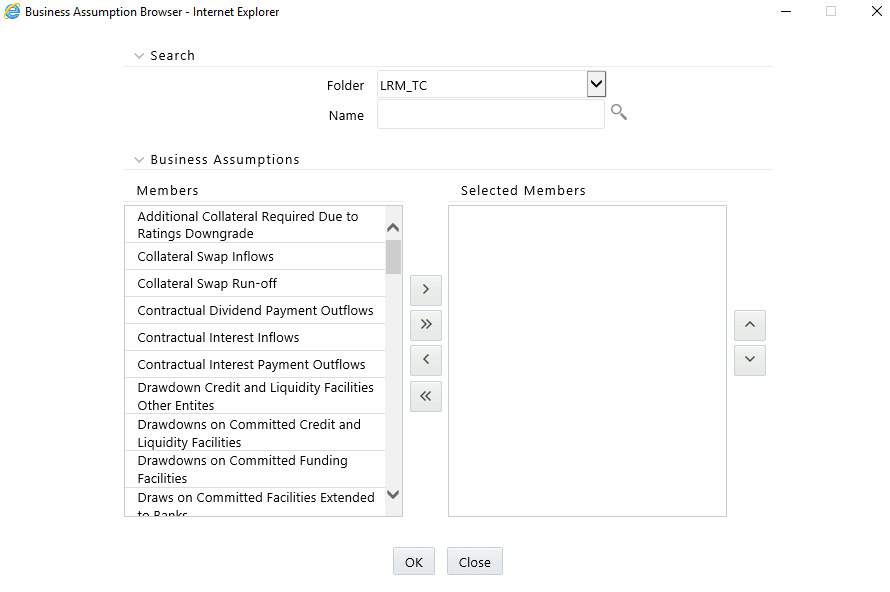

When the Run type is selected as Business-As-Usual, you are required to select one or multiple business assumptions to be applied to contractual calculations. The Business Assumptions browser displays a list of all approved business assumptions which have a time bucket definition that corresponds to the definition selected as part of the Run Parameters section. Select one or more business assumptions that you want to apply.

Figure 40 Run Definition - Business Assumption window

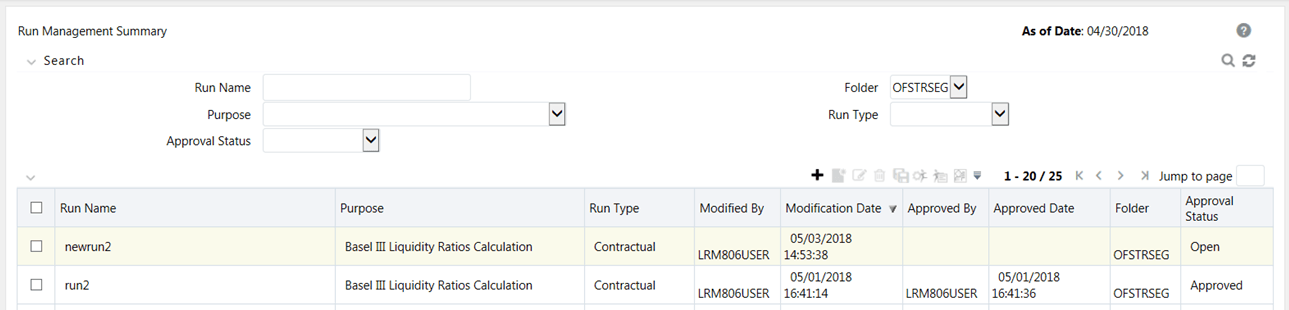

In Oracle Financial Services Analytical Applications Infrastructure home screen select, Financial Services Liquidity Risk Management.

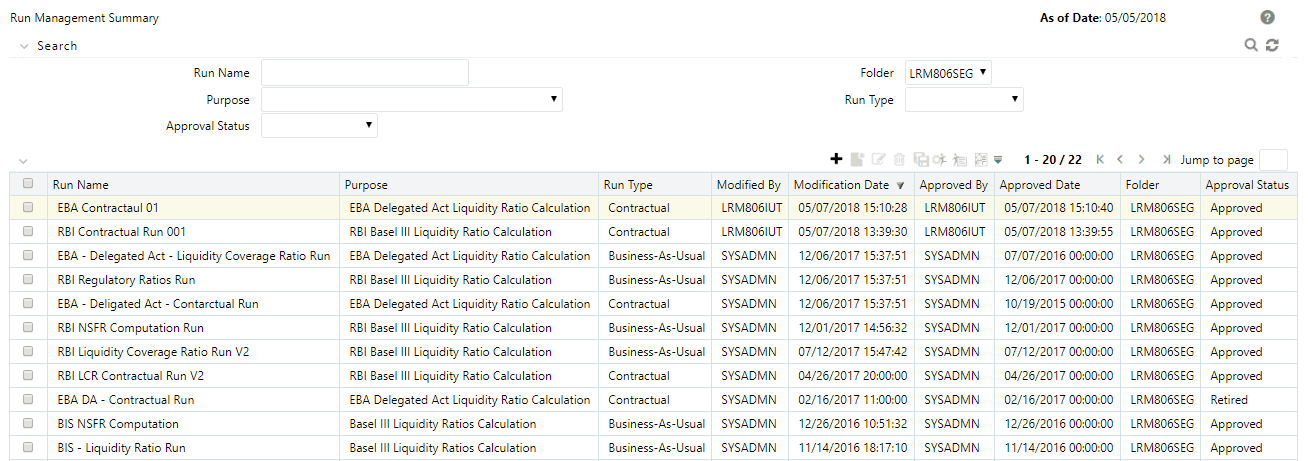

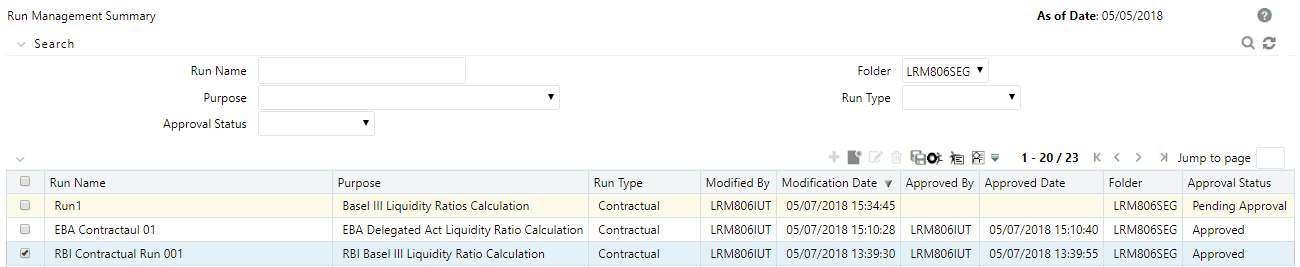

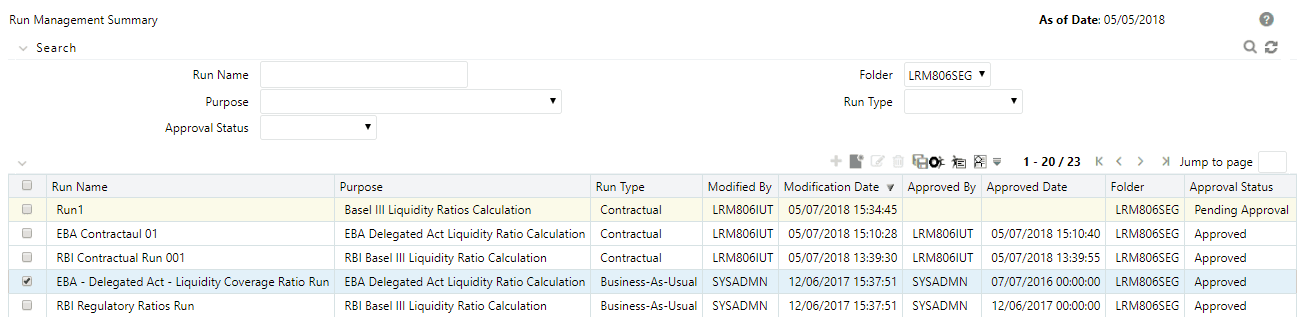

To open the Run Management window, select Liquidity Risk Management then select Run Management on the Left-Hand Side (LHS) menu.

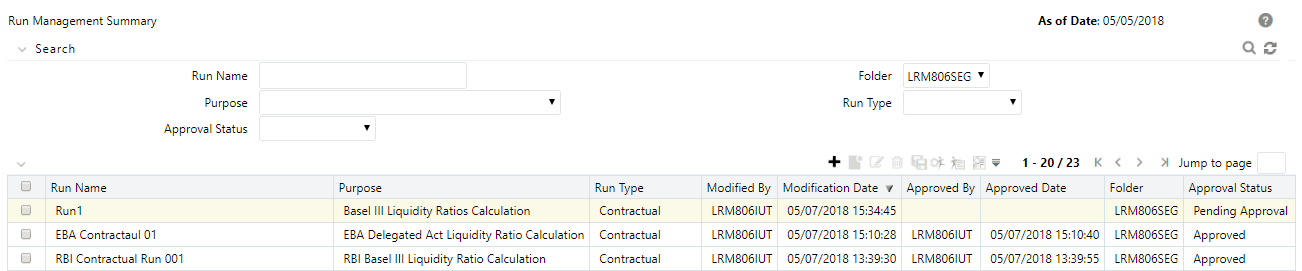

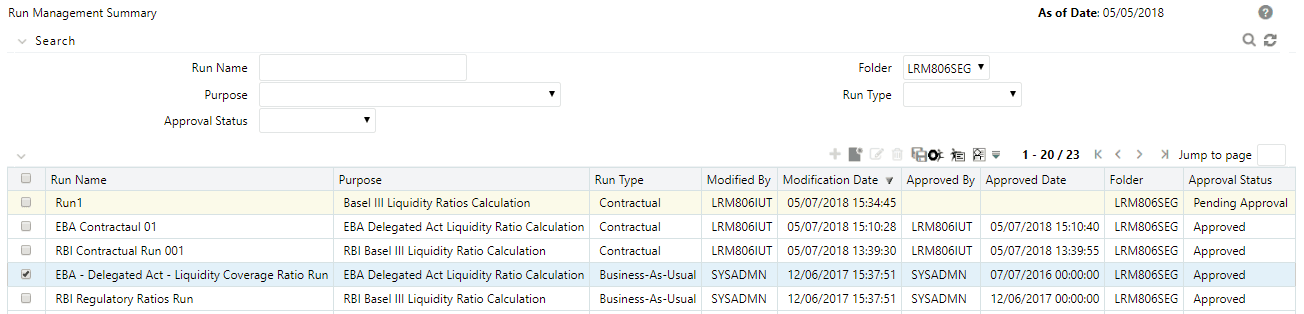

Figure 41 Run Management Summary

The Run management summary window of the LRMM application allows you to define, approve and execute Run or Runs.

This is the search section which contains multiple parameters. You can specify one or multiple search criteria in this section. When you click the search icon, depending upon the search criteria, this filters and displays the relevant search combination parameters under the Run Management Summary as a list.

Search Field or Icon |

Description |

|---|---|

Search |

This icon allows you to search the Run definition based on the search criteria specified. Search criteria include a combination of Run Name, Folder, Approval Status, and Run Type. The Run definitions displayed in the Run Management Summary table are filtered based on the search criteria specified on the clicking of this icon. |

Reset |

This icon allows you to reset the search section to its default state that is, without any selections. Resetting the search section displays all the existing Run definitions in the Run Management Summary table. |

Run Name |

This field allows you to search the pre-defined Run based on the Run name. Enter the Run name. |

Folder |

This field allows you to search for the pre-defined Run definitions based on the selected folder. This field displays a list of folders that you have access to as a drop-down. The selection of a folder from the drop-down list displays only those Run definitions that have been defined within the selected folder/segment in the Run Management Summary table. |

Run Type |

This field allows you to search the pre-defined Run based on Run Type (Contractual, BAU, or Stress Run). You need to specify the Run Type here for searching pre-defined Run. |

Approval Status |

This field allows you to search the pre-defined Run based on approval status. This field displays a list of statuses that you have access to as a drop-down that is, Approved, Draft, In Review, Open, Pending Approval or Retired. Click the drop-down list to select Approved or Rejected status. The selection of a status from the drop-down list displays only those Run definitions that have been defined within the selected status in the Run Management Summary table. |

Runs Icon Name |

Icon |

Description |

|---|---|---|

Add |

|

This icon allows you to define a new Run. |

View |

|

This icon allows you to view the selected Run definitions. |

Edit |

|

This icon allows you to edit the selected Run definition. Once the definition is approved, it cannot be edited in the case of Run definitions. |

Delete |

|

This icon allows you to delete the selected Run definition. |

Copy |

|

The icon allows a definition to be copied and resaved as a new definition. |

Run Execution Parameters |

|

This icon allows you to specify execution parameters and execute the Run from the Run Execution Parameters screen. Select the check-box against a Run definition and click the Run Execution Parameters icon to view the Run Execution Parameter Specification window. |

Run Execution Summary |

|

This icon displays the Run Execution Summary window. The Run parameters specified as part of the Run Definition window are displayed in an un-editable form in the Run Parameters window. The entire list of executions and their details are displayed for the selected definition in this screen. |

Workflow Summary |

|

The icon displays the approval summary for the definition. |

This section includes information about the runs that can be defined in the application.

Topics:

· Defining a Business-As-Usual (BAU) Run

The Run Management window allows you to define a new Run or create a new Run definition.

Figure 42 Run Definition - Contractual Run

To define a Contractual Run, follow these steps:

1. Click Add

on the Run Management

window.

on the Run Management

window.

The Run Definition window is displayed where you can define a Run.

2. In Linked To section, follow these steps:

a. Select the Folder from the drop-down list, which is specific to the Run definition. The Run definitions are linked to a segment.

b. Select Access Type. It is either Read/Write or Read Only option

3. In Run Definition Details section, follow these steps:

a. Enter the Run Name which is unique across infodoms.

b. Enter the Run Description.

NOTE:

Both the Run Name and Run Description fields allow special characters.

4. In Run Parameters section, follow these steps:

a. Select the Purpose from the drop-down list. The drop-down list displays the following:

— Basel III Liquidity Ratios Calculation

— EBA Delegated Act Liquidity Ratio Calculation

— FR 2052a Report Generation

— FR 2052b Report Generation

— Intra-Day Metrics Calculation

— Long Term Gap Calculation

— RBI Basel III Liquidity Ratio Calculation

— RBI Short-Term Dynamic Liquidity Report Generation

— RBI Structural Liquidity Report Generation

— Regulation YY Liquidity Risk Calculation

— U.S Fed Liquidity Ratio Calculation

— BOT Liquidity Ratio Calculation

— BNM Liquidity Ratio Calculation

— MAS Liquidity Ratio Calculation

— Minimum Liquid Asset Calculation

— HKMA Liquidity Ratios for Category 1 Institutions

— HKMA Liquidity Ratios for Category 2 Institutions

NOTE:

Run purposes for the SKUs licensed only, will be displayed.

b. Select the Run Type as Contractual from the drop-down list. The drop-down list displays the following:

— Contractual

— Business-as-Usual

NOTE:

If the Purpose is selected as Intra-Day Metrics Calculation, Run Type is selected as Contractual by default.

5. When the Run type is selected as Contractual and the purpose is selected as Basel III Liquidity Ratios Calculation or Long Term Gap Calculation follow these steps:

a. In the Time Bucket Definition field, click  to select the time bucket definition. The Time

Bucket Definition browser displays the list of computational time buckets

defined as part of the Time Bucket screen. Select the required time bucket

definition and then click OK.

to select the time bucket definition. The Time

Bucket Definition browser displays the list of computational time buckets

defined as part of the Time Bucket screen. Select the required time bucket

definition and then click OK.

b. In the Time Bucket Definition Based On field, select either Calendar Days or Business Days.

c. Select Consolidation Type from the drop-down list. It is either Consolidated or Solo.

If you have selected Consolidation Type as Consolidated,

in the Consolidation Level field, click  to

launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures

are to be calculated, from the list of legal entities available in the

Legal Entity browser.

to

launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures

are to be calculated, from the list of legal entities available in the

Legal Entity browser.

This selection is applicable only when the Run Type is selected as Contractual Run and Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then the Consolidation Level field is disabled.

d. Select the Business Day Convention from the drop-down list. The drop-down list displays the following:

— Prior

— Conditional Prior

— Following

— Conditional Following

— No Adjustment

This is applicable only when Run Type is selected as Contractual Run.

e. Select the Include Interest Cash Flows as either Yes or No.

NOTE:

· The Approximate Interest field is disabled if you select Include Interest Cash Flows as No.

· Select the Forward Rate Interpolation Method from the drop-down list. It is either Linear or Log Linear. This is applicable only when the Run type is selected as Contractual.

6. When the Run type is selected as Contractual and the purpose is selected as FR 2052a Report Generation or FR 2052b Report Generation, follow these steps:

a. Select the Consolidation Type from the drop-down list. It is either Consolidated or Solo.

b. If you have

selected Consolidation Type as Consolidated, in the Consolidation Level

field, click  to

launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures

are to be calculated, from the list of legal entities available in the

Legal Entity browser. This is selection is applicable only when the Run

Type is selected as Contractual Run and Consolidation Type is selected

as Consolidated.

to

launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures

are to be calculated, from the list of legal entities available in the

Legal Entity browser. This is selection is applicable only when the Run

Type is selected as Contractual Run and Consolidation Type is selected

as Consolidated.

c. If you have selected the Consolidation Type as Solo, then the Consolidation Level field is disabled.

d. Select the Include Interest Cash Flows as either Yes or No.

NOTE:

· The Approximate Interest field is disabled if you select Include Interest Cash Flows as No.

· Select the Forward Rate Interpolation Method from the drop-down list. It is either Linear or Log Linear. This is applicable only when the Run type is selected as Contractual.

7. When the Run type is selected as Contractual and the purpose is selected as Intra-Day Metrics Calculation, follow these steps:

a. In the Time Bucket Definition field, click  to select the time bucket definition. The Time

Bucket Definition browser displays the list of computational time buckets

defined as part of the Time Bucket screen. Select the required time bucket

definition and then click OK.

to select the time bucket definition. The Time

Bucket Definition browser displays the list of computational time buckets

defined as part of the Time Bucket screen. Select the required time bucket

definition and then click OK.

NOTE:

Only intraday buckets are listed under the list time bucket definitions section.

b. Select the Legal Entity Consolidation Type from the drop-down list. It is either Consolidated or Solo.

c. If you have

selected Legal Entity Consolidation Type as

Consolidated, in the Legal Entity Consolidation Level

field, click  to

launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures

are to be calculated, from the list of legal entities available in the

Legal Entity browser.

to

launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures

are to be calculated, from the list of legal entities available in the

Legal Entity browser.

This selection is applicable only when the Run Type is selected as Contractual Run and Legal Entity Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then the Legal Entity Consolidation Level field is disabled.

d. Select Payment System Consolidation Type as either Consolidated or Standalone.

By default, Standalone is selected.

8. When the Run type is selected as Contractual and the purpose is selected as RBI Basel III Liquidity Ratio Calculation or RBI Short-Term Dynamic Liquidity Report Generation or RBI Structural Liquidity Report Generation, follow these steps:

a. In the Time Bucket Definition field, click  to select the time bucket definition. The Time

Bucket Definition browser displays the list of computational time buckets

defined as part of the Time Bucket screen. Select the required time bucket

definition and then click OK.

to select the time bucket definition. The Time

Bucket Definition browser displays the list of computational time buckets

defined as part of the Time Bucket screen. Select the required time bucket

definition and then click OK.

NOTE:

· When RBI Short-Term Dynamic Liquidity Report Generation is selected as the purpose, RBI DLR Time Bucket is selected as the default time bucket.

· When RBI Structural Liquidity Report Generation is selected as the purpose, RBI SLR Assumption Time Bucket is selected as the default time bucket.

b. In the Time Bucket Definition Based On field, select either Calendar Days or Business Days.

NOTE:

· When RBI Short-Term Dynamic Liquidity Report Generation is selected as the purpose, Calendar Days is selected as the default.

· When RBI Structural Liquidity Report Generation is selected as the purpose, Calendar Days is selected as the default.

c. Select the Consolidation Type from the drop-down list. It is either Consolidated or Solo.

d. If you

have selected Consolidation Type as Consolidated, in the Consolidation

Level field, click  to launch

the Legal Entity browser for selecting the consolidation level. Select

a legal entity, at which the consolidated liquidity risk measures are

to be calculated, from the list of legal entities available in the Legal

Entity browser.

to launch

the Legal Entity browser for selecting the consolidation level. Select

a legal entity, at which the consolidated liquidity risk measures are

to be calculated, from the list of legal entities available in the Legal

Entity browser.

This selection is applicable only when the Run Type is selected as Contractual Run and Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then the Consolidation Level field is disabled.

e. Select the Business Day Convention from the drop-down list. The drop-down list displays the following:

— Prior

— Conditional Prior

— Following

— Conditional Following

— No Adjustment

This is applicable only when Run Type is selected as Contractual Run.

NOTE:

· When RBI Short-Term Dynamic Liquidity Report Generation is selected as the purpose, this field is not applicable.

· When RBI Structural Liquidity Report Generation is selected as the purpose, this field is not applicable.

f. Select the Include Interest Cash Flows as either Yes or No.

NOTE:

· The Approximate Interest field is disabled if you select Include Interest Cash Flows as No.

· When RBI Short-Term Dynamic Liquidity Report Generation is selected as the purpose, Include Interest Cash Flows is selected as Yes by default.

· When RBI Structural Liquidity Report Generation is selected as the purpose, Include Interest Cash Flows is selected as Yes by default.

g. Select the Forward Rate Interpolation Method from the drop-down list. It is either Linear or Log Linear. This is applicable only when the Run type is selected as Contractual.

9. When the Run type is selected as Contractual and the purpose is selected as EBA Delegated Act Liquidity Ratio Calculation or Regulation YY Liquidity Risk Calculation or U.S Fed Liquidity Ratio Calculation, BOT Liquidity Ratio Calculation, BNM Liquidity Ratio Calculation, MAS Liquidity Ratio Calculation, or Minimum Liquid Asset Calculation follow these steps:

a. In the Time Bucket Definition field, click  to

select the time bucket definition. The Time Bucket Definition browser

displays the list of computational time buckets defined as part of the

Time Bucket screen. Select the required time bucket definition and then

click OK.

to

select the time bucket definition. The Time Bucket Definition browser

displays the list of computational time buckets defined as part of the

Time Bucket screen. Select the required time bucket definition and then

click OK.

b. In the Time Bucket Definition Based On field, select either Calendar Days or Business Days.

c. Select the Consolidation Type from the drop-down list. It is either Consolidated or Solo.

d. If you have

selected Consolidation Type as Consolidated, in the Consolidation

Level field, click  to

launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures

are to be calculated, from the list of legal entities available in the

Legal Entity browser.

to

launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures

are to be calculated, from the list of legal entities available in the

Legal Entity browser.

This selection is applicable only when the Run Type is selected as Contractual Run and Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then Consolidation Level field is disabled.

e. Select the Business Day Convention from the drop-down list. The drop-down list displays the following:

— Prior

— Conditional Prior

— Following

— Conditional Following

— No Adjustment

This is applicable only when Run Type is selected as Contractual Run.

f. Select the Include Interest Cash Flows as either Yes or No.

NOTE:

The Approximate Interest field is disabled if you select Include Interest Cash Flows as No.

g. Select the Forward Rate Interpolation Method from the drop-down list. It is either Linear or Log Linear. This is applicable only when the Run type is selected as Contractual.

h. When the Purpose is selected as U.S Fed Liquidity Ratio Calculation, select Include Forward Date Calculations as either Yes or No. In case you select Yes, the following options are enabled:

i. The Forward Balance Method Mapping Rule displays LRM - Balance Method Reclassification - Forecast selected as default.

ii. The Forward Cash Flow Method Mapping Rule displays LRM - Cash Flow Method Reclassification - Forecast selected by default.

iii. Select the Exclude Holidays as either Yes or No.

iv. Select the Balance Sheet Adjustment as either Yes or No.

v. When you select Balance Sheet Adjustment as Yes, the Balance Sheet Adjustment Method option is enabled. Select one of the following from the drop-down list, Current Profile Based Increase, Current Profile Based Decrease, Cash Adjustment, Manual Adjustment.

vi. The Balance Sheet Adjustment Rule displays LRM - Manual Balance Adjustment - Forecast is selected by default when the Balance Sheet Adjustment Method is selected as Manual Adjustment.

vii. Select the Fixed Interval Forward Date as either Yes or No.

viii. In First Forward Day Interval field, enter a value in terms of days.

ix. In the Forward Date Frequency field, enter a value which is a whole number greater than 0. From the drop-down list choose Days, Months or Weeks.

x. In the Number of Forward Calculations field, enter a value which is a whole number greater than 0.

If you have selected consolidation type as Solo, in the Legal Entity Selection section, click

to select one or multiple legal entities from

the Hierarchy browser and then click OK. The

selected legal entities are listed under the Legal Entity Selection section.

If you wish to add or edit the legal entities click

to select one or multiple legal entities from

the Hierarchy browser and then click OK. The

selected legal entities are listed under the Legal Entity Selection section.

If you wish to add or edit the legal entities click  .

.

Figure 43 Run Definition - Hierarchy Browser

i. When the Purpose is selected as EBA delegated Act Liquidity Ratio, the field Time Bucket Type is displayed. Select either Actual or Calendar Based.

10. When the Purpose is selected as U.S Fed Liquidity Ratio Calculation or BIS III Liquidity Ratio Calculations and you have included the Include Forward Date LCR Calculations, perform these additional steps:

a. When the Fixed Interval Forward Date is selected as No, the Ad Hoc Forward Date Selection section is available for selection. Follow these steps:

i. Click

to add one or multiple dates.

to add one or multiple dates.

ii. Click  to select the calendar dates.

to select the calendar dates.

NOTE:

This section is enabled only when the Fixed Interval Forward Date is selected as No.

b. When Include Forward Date Calculations is selected as Yes, and all the other parameters are selected the Forward Cash Flow Calculation Business Assumptions section is available for selection. Follow these steps:

i. Click

to select one or multiple business assumptions

from the Business Assumptions browser and then click OK. The selected

business assumptions are listed under the Forward Cash Flow Calculation

Business Assumptions section. If you wish to add or edit the business

assumptions click

to select one or multiple business assumptions

from the Business Assumptions browser and then click OK. The selected

business assumptions are listed under the Forward Cash Flow Calculation

Business Assumptions section. If you wish to add or edit the business

assumptions click .

.

11. For Purpose HKMA Liquidity ratios for Category 1 institutions, Deposit Insurance scheme selection is available with one option Hong Kong Deposit Protection Board. The selection is optional. If you select it, then no DIC prerequisites selection is required during execution. If not selected, then during execution, select DIC Run and DIC Run Execution ID as a prerequisite.

12. Click Save. The Run is saved in the Run Framework of Oracle Financial Services Analytical Applications Infrastructure. A Run is available for execution only after it has been approved. Once approved, Run parameters cannot be edited.

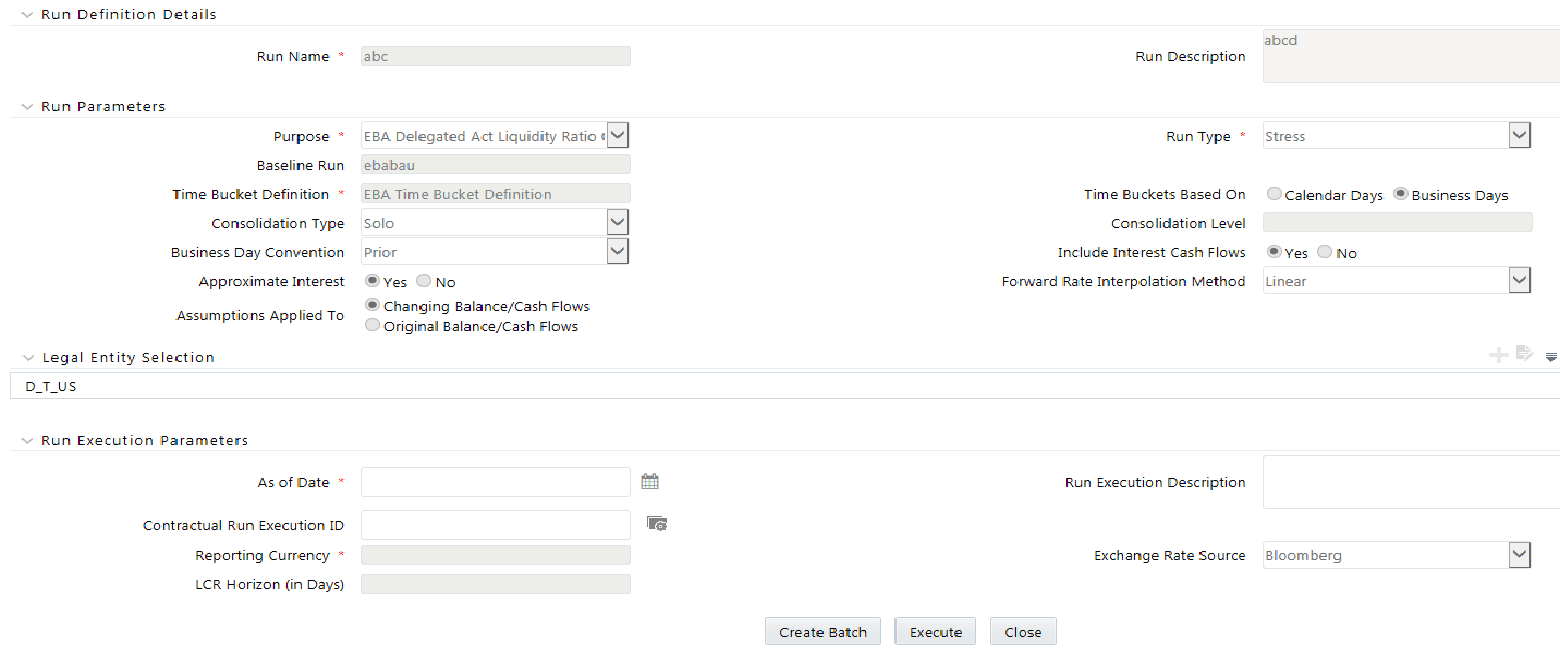

The Run Definition window in the LRS application allows you to define a new Run.

Figure 44 Run Definition - Business-As-Usual Run

To define a BAU Run, follow these steps:

1. Click the icon on the Run Management

window. The Run Definition window is displayed

where you can define a BAU Run.

icon on the Run Management

window. The Run Definition window is displayed

where you can define a BAU Run.

2. In the Linked To section, follow these steps:

a. Select the Folder from the drop-down list, which is specific to the Run definition. The Run definitions are linked to a segment.

b. Select Access Type. It is either Read/Write or Read Only option

3. In Run Definition Details section, follow these steps:

a. Enter the Run Name which is unique across infodoms.

b. Enter the Run Description.

NOTE:

Both the Run Name and Run Description fields allow special characters.

4. a. In Run Parameters section, select the Purpose from the drop-down list. The drop-down list displays the following:

— Basel III Liquidity Ratios Calculation

— EBA Delegated Act Liquidity Ratio Calculation

— FR 2052a Report Generation

— FR 2052b Report Generation

— Intra-Day Metrics Calculation

— Long Term Gap Calculation

— RBI Basel III Liquidity Ratio Calculation

— RBI Short-Term Dynamic Liquidity Report Generation

— RBI Structural Liquidity Report Generation

— Regulation YY Liquidity Risk Calculation

— U.S Fed Liquidity Ratio Calculation

— BOT Liquidity Ratio Calculation

— BNM Liquidity Ratio Calculation

— MAS Liquidity Ratio Calculation

— HKMA Liquidity Ratios for Category 1 Institutions

— HKMA Liquidity Ratios for Category 2 Institutions

NOTE:

Run purposes for the SKUs licensed only, will be displayed.

5. Select the Run Type as Business-As-Usual from the drop-down list. The drop-down list displays the following:

§ Contractual

§ Business-As-Usual

6. When the Run type is selected as Business-As-Usual and the purpose is selected as Basel III Liquidity Ratios Calculation or Long Term Gap Calculation or RBI Basel III Liquidity Ratio Calculation or Regulation YY Liquidity Risk Calculation or U.S Fed Liquidity Ratio Calculation, BOT Liquidity Ratio Calculation, BNM Liquidity Ratio Calculation, or MAS Liquidity Ratio Calculation, follow these steps:

a. In the Contractual Run field, click  to

select from the list of contractual Runs available in the contractual

Run browser.

to

select from the list of contractual Runs available in the contractual

Run browser.

b. When the Purpose is selected as Basel III Liquidity Ratios Calculation, RBI Basel III Liquidity Ratio Calculation, BOT Liquidity Ratio Calculation, BNM Liquidity Ratio Calculation, or MAS Liquidity Ratio Calculation the ‘Liquidity Ratio’ field is enabled. This field has three options: LCR, NSFR, Both.

§ When the LCR option is selected, the Run computes the Liquidity Coverage ratio only.

§ When the NSFR option is selected, the Run computes the Net Stable Funding ratio only

§ When Both is selected, the Run computes both ratios that is, Liquidity Coverage Ratio and Net Stable Funding Ratio.

NOTE:

All other fields in the Run parameters section are consistent with the parameters specified as part of the selected Contractual Run. These fields are in un-editable form based on the Contractual Run selected.

For details on how to add a new custom Run Purpose, and enable NSFR, see Adding a Custom Run Purpose.

Select the Assumptions Applied To. It is either Changing Balance/Cash Flows or Original balance/Cash Flows. This field is applicable only when the Run type is selected as BAU.

For information on Changing Balance/Cash Flows or Original balance/Cash Flows, see the Assumption Supported section.

c. When the Purpose is selected as HKMA Liquidity Ratios for Category 2 Institutions the ‘Liquidity Ratio’ field is enabled, with LMR option

7. In the Business Assumptions section, click  . The

Business Assumptions browser is displayed. All the approved business assumptions

with the latest record indicator Y are listed. These have a time bucket

definition that corresponds to the definition selected as part of the

Run Parameters section.

. The

Business Assumptions browser is displayed. All the approved business assumptions

with the latest record indicator Y are listed. These have a time bucket

definition that corresponds to the definition selected as part of the

Run Parameters section.

8. Click  to select one or click

to select one or click  to

select multiple business assumptions that you want to apply to the contractual

cash flows and move them to the Selected Members section.

to

select multiple business assumptions that you want to apply to the contractual

cash flows and move them to the Selected Members section.

9. Using  up

or down arrows, you can view the sequencing of assumptions.

up

or down arrows, you can view the sequencing of assumptions.

Figure 45 Run Definition - Business Assumption window

The application saves the assumptions on the BAU Run definition window.

10. If you wish

to add or edit the business assumptions click  . If

you do not wish to save the assumption, click Close.

. If

you do not wish to save the assumption, click Close.

11. The details are displayed under the Business Assumption section for each selected business assumption as follows:

§ Assumption Name

§ Version Number

§ Assumption Category

NOTE:

· Only the approved business assumptions appear in the list.

· For information on Assumption Category, refer section Assumption Category.

· The assumptions are executed as per the sequence in which they are selected in the Run Definition screen. This sequence is stored for the purpose of reporting.

12. Click Save. The Run is saved in the Run Framework of Oracle Financial Services Analytical Applications Infrastructure. A Run is available for execution only after it has been approved. Once approved, Run parameters cannot be edited.

A stress Run is created in the Stress Definition window of the Stress Testing module of Oracle Financial Services Advanced Analytical Applications Infrastructure (OFSAAAI). A business-as-usual Run or Contractual Run is selected as the baseline Run and one or multiple BAU assumptions that are part of the selected baseline Run can be replaced or inserted by stress business assumptions to create a stress Run.

Each stress definition created in the Stress Testing module of OFSAAAI appears as a line item in the Run Management Summary window with the Run type as Stress. You can view, approve, and execute a stress Run from the Run Management screen of the LRM application.

There are two ways of defining a Stress Run:

· Contractual Run: When the purpose is selected as Intra-Day Metrics Calculation.

· BAU Run: For all the purposes other than Intra-Day Metrics Calculation which is Basel III Liquidity Ratios Calculation, FR 2052a Report Generation, FR 2052b Report Generation and U.S Fed Liquidity Ratio Calculation, EBA Delegated Act Liquidity Ratio Calculation, RBI Basel III Liquidity Ratio Calculation, BOT Liquidity Ratio Calculation.

Topics:

· Defining a Stress Run on Contractual Run

· Defining a Stress Run on BAU Run

For a Contractual Run, insertion of a set of BAU assumptions with another set of stress assumptions constitutes a scenario for stress testing within LRM. Stress business assumptions are similar to BAU assumptions, but with adverse or stressed values. On execution of the stress Run, the stress assumptions are applied to BAU cash flows to assess the impact of the stress scenario on the liquidity metrics.

NOTE:

The following procedure is applicable for Stress Testing of Intraday Monitoring Metrics.

For Intraday, when Run Purpose is selected as Intra-Day Metrics Calculation and the Run type is Contractual Run follow these steps:

1. Create a Stress Run in Oracle Financial Services Advanced Analytical Applications Infrastructure window through Stress Definition window under Enterprise Modeling, after selecting baseline as Contractual Run.

2. Remove the first 4 processes from the base line run one by one:

a. LRM - Intraday - Party and Product Type Reclassification

b. LRM - Intraday - Time Bucket Population

c. LRM - Intraday - Instrument Data Population

d. LRM - Intraday - Transaction And Aggregated Transaction Data Population

e. LRM - Intraday - Available Intraday Liquidity Classification

3. Select the process as LRM - Intraday - Bucketed Transactions Data Population and then click Insert Task.

4. In the Task window, select the new process that is, LRM - Intraday Stress Data Preparation and LRM - Intraday - Propagating Effect Of Assumptions On Outflows And Inflows.

5. Set the precedence of the processes in the following order:

a. LRM - Intraday - Stress Data Preparation

b. LRM - Intraday - Propagating Effect Of Assumptions On Outflows And Inflows

c. LRM - Intraday - Bucketed Transactions Data Population

6. Click OK.

The data preparation processes are stitched in the Stress Run.

7. Select the process LRM - Intraday Stress Data Preparation and then click Insert.

8. In the Task window, select the defined assumption processes.

All the versions of the defined assumptions are displayed (Assumption name and version number. You can select the latest one).

The selected assumptions appear after the process LRM - Intraday Stress Data Preparation.

9. Click OK. The assumptions are stitched in Stress Run.

10. Click Save. The definition is saved.

For a BAU Run, replacement or insertion of a set of BAU assumptions with another set of stress assumptions constitutes a scenario for stress testing within LRM. Stress business assumptions are similar to BAU assumptions, but with adverse or stressed values. On execution of the stress Run, the stress assumptions are applied to BAU cash flows to assess the impact of the stress scenario on the liquidity metrics.

NOTE:

For more details on the step-by-step creation of a stress Run see the Stress Testing chapter in the Advanced Analytical Applications Infrastructure module in the OFSAAI User Guide.

This feature is available only for European Business Authority SKU.

See section Home-Host Configuration in the OFS Liquidity Risk Regulatory Calculations for European Banking Authority, Release 8.1.0.0.0 User Guide, for details.

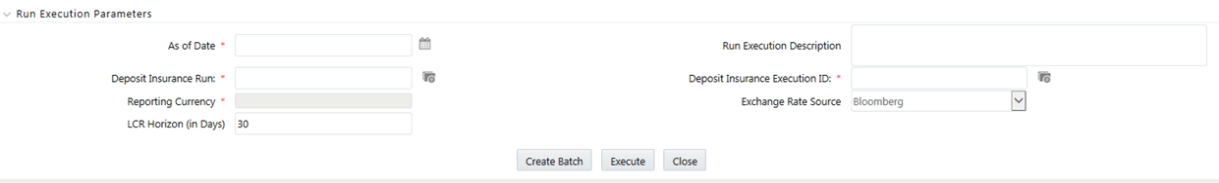

See section Defining a DIC Run in the OFS Deposit Insurance Calculations for Liquidity Risk Management, Release 8.1.0.0.0 User Guide, for details.

OFS LRMM supports approval workflows based on user roles. Run definitions that are defined within the application are required to be approved which are defined within the application before they can be used for computations. The user who creates the Run definition sends it for approval after finalizing it. Run definitions can be approved only by users with the required access levels. For more information refer to the User Roles and Access section.

Topics:

· Sending Run definitions for approval

To send a definition for approval, follow these steps:

1. Click Run Management on the LHS menu of the LRS application to open the Run Management Summary window.

NOTE:

Run definitions in the following stages can be sent for approval:

· A new definition which in Draft status.

· A version of a definition that is rejected and is in “Open” status.

2. Click  to select a definition with the status Draft,

Open from the list of business assumptions and then click

to select a definition with the status Draft,

Open from the list of business assumptions and then click  .

.

Figure 46 Run Management Summary - Draft Status

Figure 47 Run Management Summary - Open Status

3. The Run Definition window is displayed with all the parameters defined.

NOTE:

Stress Runs cannot be edited. The definition is opened in the view mode. To edit the Stress Runs, go to Stress Testing Framework in Advanced Analytics Infrastructure module. If you have any changes, edit the parameters and click Save.

4. To send a definition for authorization, click Send for Approval. This changes the status of the definition to Pending Approval. The definition is successfully sent for approval and the status changes to Pending Approval.

NOTE:

Stress Runs can be sent for approval only when the Time Bucket Definition under Run Parameters section and the Time Bucket Definition under the Business Assumptions section in Run Definition match.

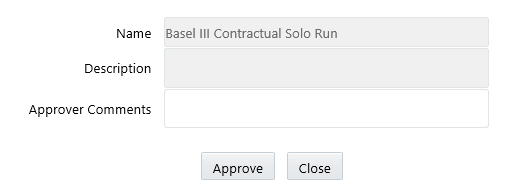

To approve a Run definition, follow these steps:

1. Click Run Management on the LHS menu of the LRS application to open the Run Management Summary window. Only definitions that are in Pending Approval status can be approved or rejected by the approver.

2. Click  to select a definition with the status Pending

Approval from the list of Run definitions and then click

to select a definition with the status Pending

Approval from the list of Run definitions and then click  .

.

3. To view the definition in the approval summary window, click Approval Summary. You can view the status changes for the definition created.

Figure 48 Run Management Summary - Pending Approval

You cannot edit the values in the view window.

4. To approve the definition that is sent for authorization, click Approve.

The Approve dialog box is displayed with the assumption name and description.

Figure 49 Run Definition - Approve

5. Enter Approver Comments and then click Approve.

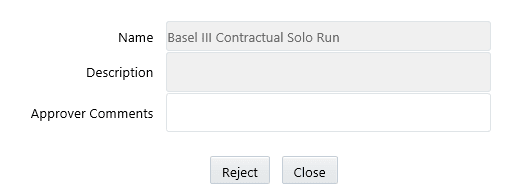

6. To reject the definition that is sent for authorization, click Reject.

The Reject dialog box is displayed with the assumption name and description.

Figure 50 Run Definition - Reject

7. Enter Approver Comments and then click Reject.

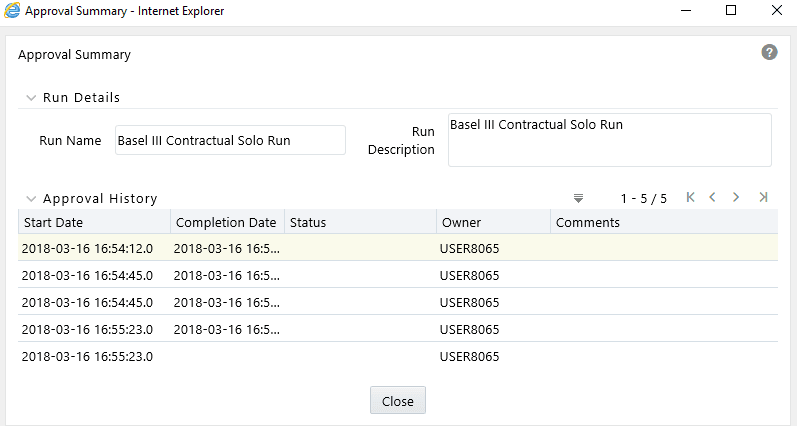

8. Click  to

view the summary of the entire approval workflow. It displays approval

history showing the start date, completion date, status owner, and comments

if any.

to

view the summary of the entire approval workflow. It displays approval

history showing the start date, completion date, status owner, and comments

if any.

Figure 51 Run Management - Approval Summary

NOTE:

· The Approve or Reject buttons are present only for the users who have the right to approve or reject the definition.

· If the definition is rejected, it changes back to ‘Open’ status. When the definition is in open status, click View to view the definition. You cannot edit the values in the view window.

· Once the definition is approved, it cannot be edited in the case of Run definitions.

You can retire a Run definition when a definition is no longer valid and not required to be included in the selection of a new run calculation. To retire a definition once it is approved, follow these steps:

1. To retire

a definition, click  to select a definition

from the list of Run definitions and then click the

to select a definition

from the list of Run definitions and then click the  .

The Run Definition window is displayed.

.

The Run Definition window is displayed.

Figure 52 Run Management Summary - Retire

2. Click Retire. A retired definition will not be available for selection as part of a new Run definition.

NOTE:

· The approval status field in the Run Management Summary window allows you to search the pre-defined Run based on approval status. This field displays a list of statuses that you have access to as a drop-down that is, Approved, Draft, In Review, Open, Pending Approval or Retired. The selection of a status from the drop-down list displays only those Run definitions that have been defined within the selected status in the Run Management Summary table.

· Assumption definitions can be approved only by those mapped to the LRM role who has defined the assumption. Multiple levels of approvals are supported.

· The Run definition, once saved and approved, is registered as a Rule in the Rules Framework of Oracle Financial Services Analytical Applications Infrastructure.

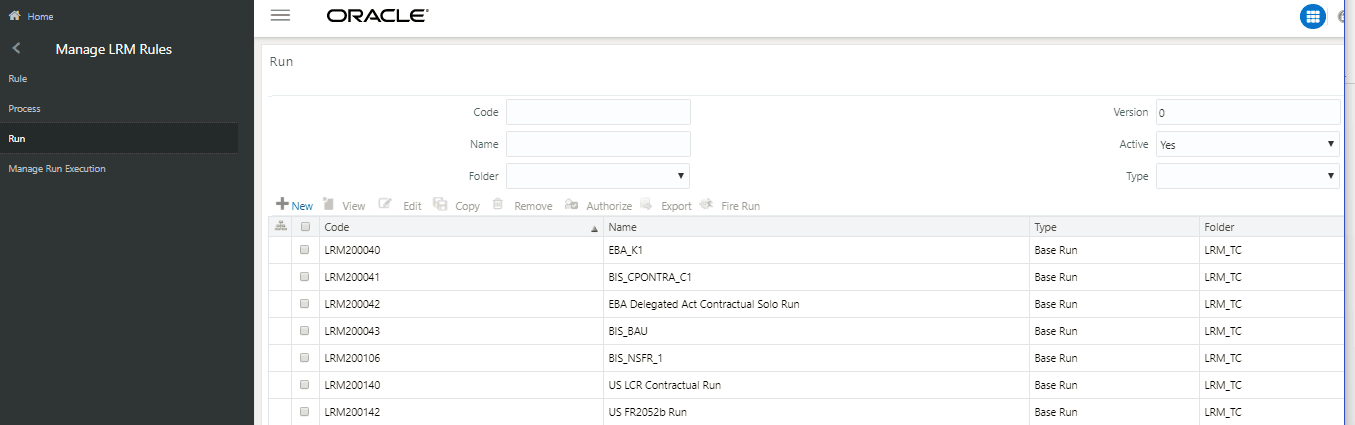

When a Run is defined from LRS Run Management window, it is also registered in the Run window of Rules Framework under the Oracle Financial Services Analytical Applications Infrastructure window.

To add a task to a Run, follow these steps:

1. On the Oracle Financial Services Analytical Applications Infrastructure home screen, select Liquidity Risk Management select Manage LRM Rules then select Run on the LHS menu.

NOTE:

For Deposit Insurance Calculation, navigate to Liquidity Risk Management select Manage DIC Rules then select Run on the LHS menu.

On the RHS menu, you can view all the processes which are used and the tasks in the process. You can decide which process needs an additional custom task.

Figure 53: Processes Used

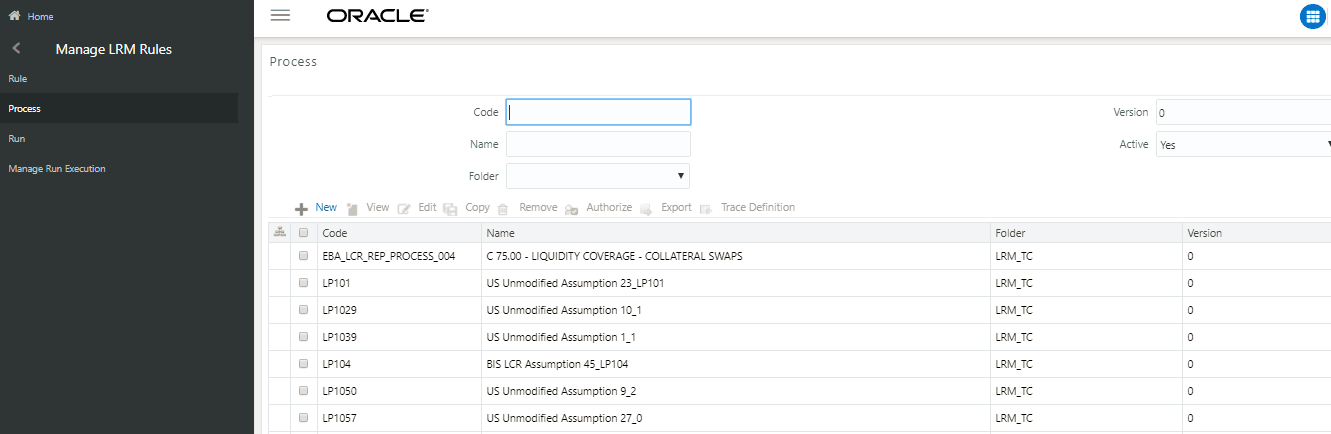

2. Select Manage LRM Rules and then select Process on the LHS menu.

Figure 54: Process Selection

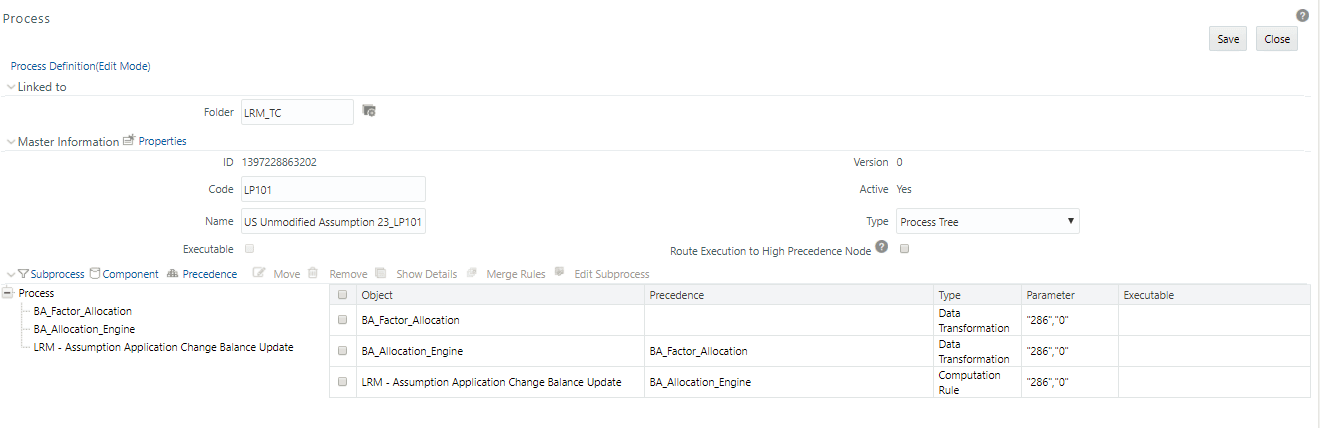

3. Select  the process you wish to edit and then click Edit

the process you wish to edit and then click Edit

.

.

The Process window is displayed.

Figure 55: Process Window

4. In the Process window, you can add a Custom Task. For more information on how to add a task to the process, see the Edit Process Definition section in the OFSAAI User Guide.

5. Click Save. You must save it to the existing version.

NOTE:

· Only Process can be edited and this is a custom change that may get overwritten when subsequent product patches are applied. Run must not be edited from the RRF window if it is created through the OFS LRS Run Management window.

· You can make the required edits to additionally include custom tasks. For more information, see the OFSAAI User Guide.

· To execute this Run, you must go to the Run Management window of LRM. The Run must be approved before execution.

This section aims to detail the important activities that you must perform before executing Contractual, Business As Usual (BAU) or Stress Runs. It aims to provide details on the data required to be populated in the LRS application and the steps to be followed to define business assumptions which will help identify liquidity gaps.

Topics:

· Defining Business Assumptions

Configuring data into the LRS application is the basic and most important activity to commence working on the LRS application. Data to be configured in the LRMM application can be divided into three types:

· Setup Role Management

· Setup Data Management

· Run Data Management

Under Setup Role Management, you are requested to create specific roles to access the respective functionality of the screens and map these roles to user groups.

Setup data is a set of dimension tables which does not change frequently and can be categorized as a onetime setup activity required to be populated in OFS LRMM.

Run or Execution data management details the staging data to be populated that change with each execution.

To maintain the integrity and accuracy of the data populated into the OFS LRMM application, certain data quality checks have been pre-configured under the Data Quality Framework link in OFSAAI.

For information on out-of-box Data Quality checks, refer the following LRMM DQ Checks excel sheet:

For more information, see the OFS Analytical Applications Infrastructure User Guide section ‘DQ framework usage’ on OHC Documentation Library.

After configuring setup data and Run or staging data in the LRMM application, the next step is to define the time buckets. Time Buckets can be defined by you in the Time Bucket Definition window of the LRMM application. Refer to the Time Buckets section for more information.

Before executing Runs as part of dimension maintenance, you must execute the <INFODOM>_SCD_COMPONENT and <INFODOM>_DimAccountPop batch. See the OFS Liquidity Risk Solution V8.1.0.0.0 Run Chart for more information on the batch.

Further some of the staging data which moves to processing area on MIS date basis have to be executed through ICC batches. See the OFS Liquidity Risk Solution V8.1.0.0.0 Run Chart for further details.

NOTE:

If ALM-LRM is integrated, then you must execute only one batch either, <INFODOM>_DIMENSION_ACCOUNTS at ALM or <INFODOM>_DIMACCOUNTPOP at LRM.

After configuring setup data and dimension maintenance as well as defining time buckets in the LRS application, the next step is to define the parameters of the business assumption before executing a Run. Business Assumptions can be defined by you in the Business Assumptions Definition window of the LRS application. Refer to the Business Assumptions section for more information.

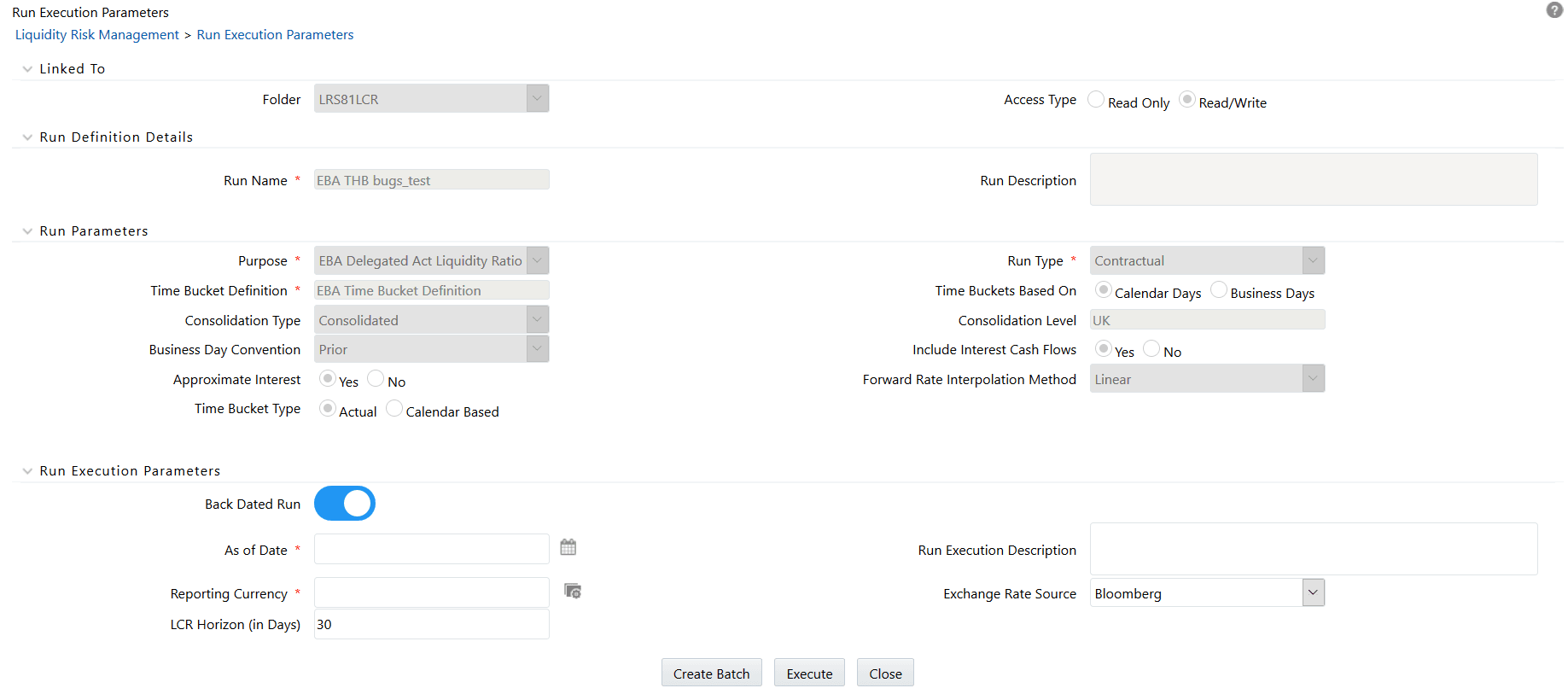

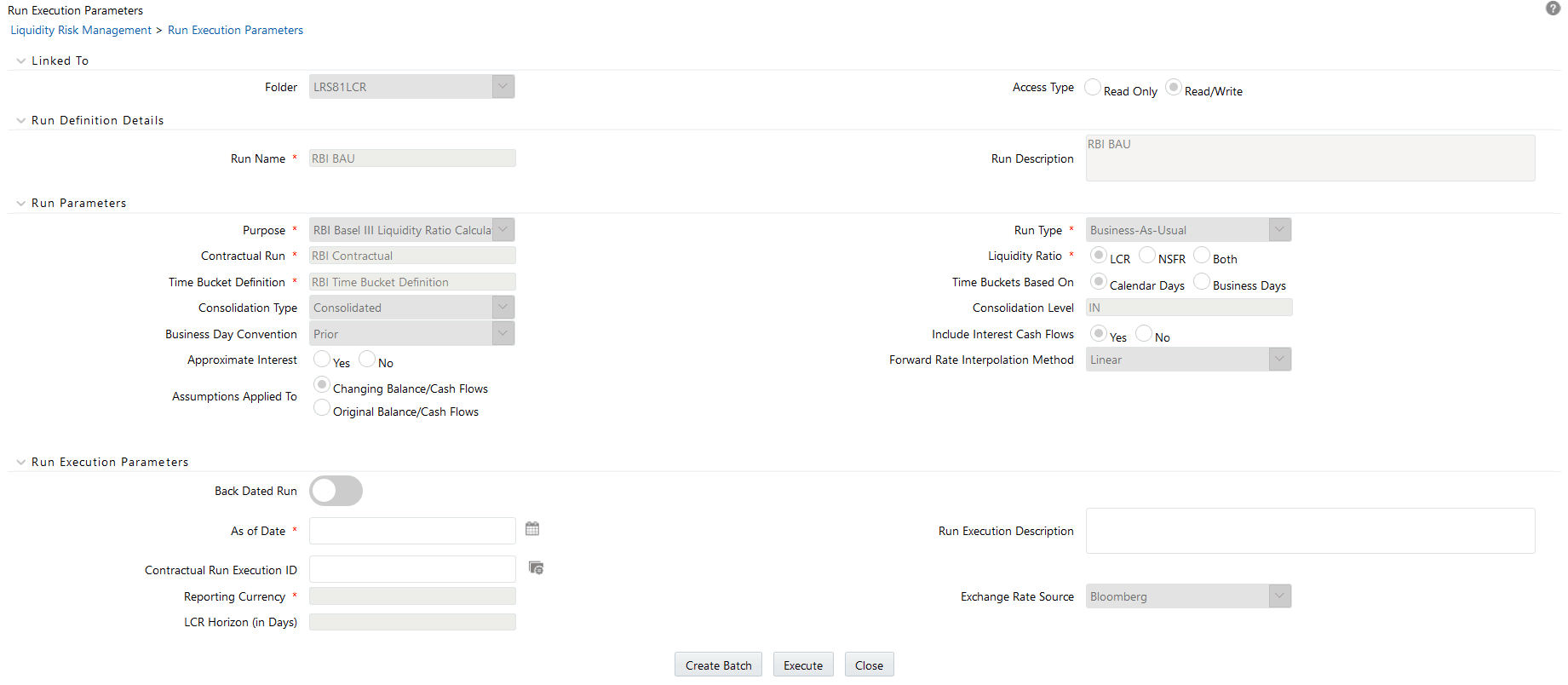

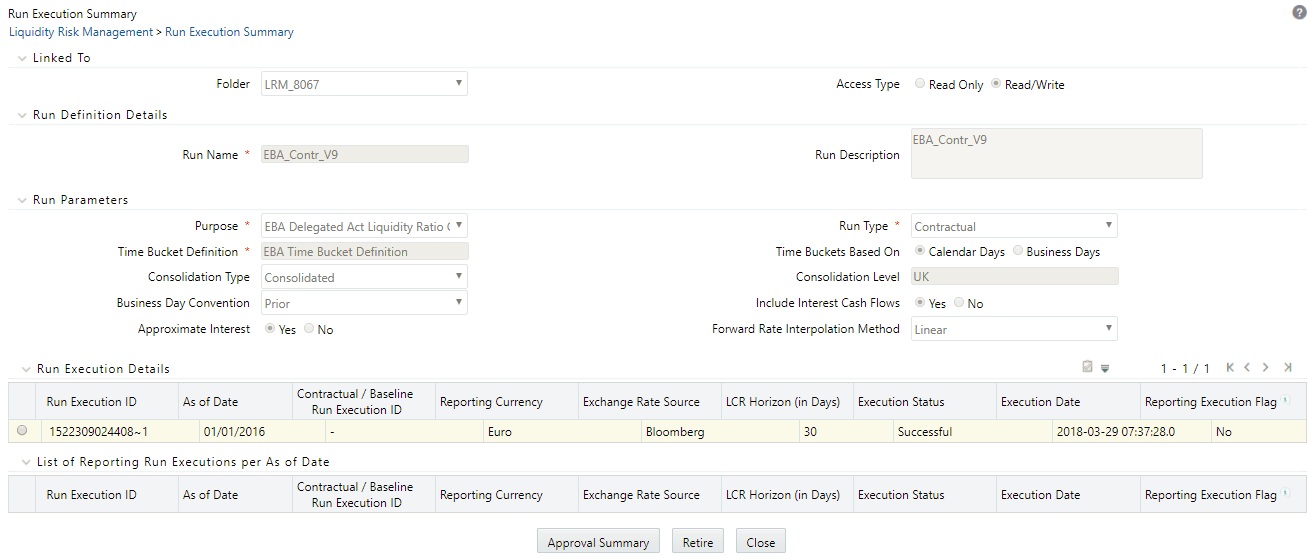

In the Run Management Summary

window, select a Run from the list of Runs and click  .

The Run Execution Parameters window appears.

.

The Run Execution Parameters window appears.

The Run Execution Parameters window has the following sections:

This field displays the information about Linked To, which is selected as part of Run definition window. The details are displayed as follows:

· Folder: The folder which is specific to the Run definition.

· Access Type: Read/Write or Read-Only is selected.

This section displays the details which have already been specified for the selected Run as part of Run Definition window. These details may not be edited. The details are displayed as follows:

· Run Name: Displays the Run name.

· Run Description: Displays the Run description.

This section displays the parameters which have already been specified for the selected Run as part of Run Definition window. These parameters are not allowed to be edited. The parameters displayed include the following:

· Purpose

· Run Type

· Contractual Run (only in case of a Business-as-Usual Run)

· Baseline Run (only in case of Stress Run)

· Time Bucket Definition

· Consolidation Type

· Legal Entity Consolidation Legal Entity Consolidation Level Payment System Consolidation Type (only when the purpose is selected as Intraday Metrics Calculation)

· Business Day Convention

· Include Interest Cash Flows

· Approximate Interest

· Forward Rate Interpolation Method

· Assumptions Applied To (only in case of Business-as-Usual and Stress Run)

This section displays the Legal Entity Selection which is selected as part of Run definition window.

The Run execution parameters must be specified for the selected Run.

Topics:

· Contractual Run Execution ID

This is a selection of a date from the calendar. The As of Date is with reference to the date of the input data required for computations. This is different from the execution date. The data available in the staging area which has a date corresponding to the As of Date is used for computations.

This field allows you to provide a brief description of the Run execution. It is optional.

When the Run type is selected as Business-As-Usual or Stress Run, execution ID of the underlying contractual Run is required to be selected from the Contractual Run Execution ID browser in the Run Execution Parameters window. Business assumptions, both BAU, and stress, are applied to the cash flows aggregated as part of the selected contractual Run execution, and further computations are carried out based on these aggregated cash flows and other interim metrics.

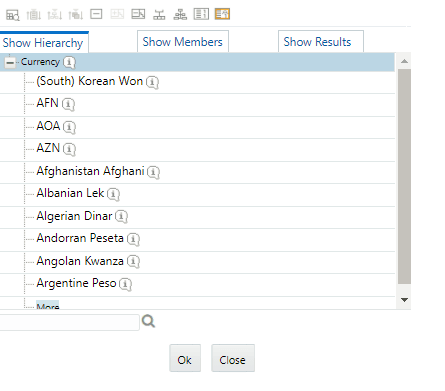

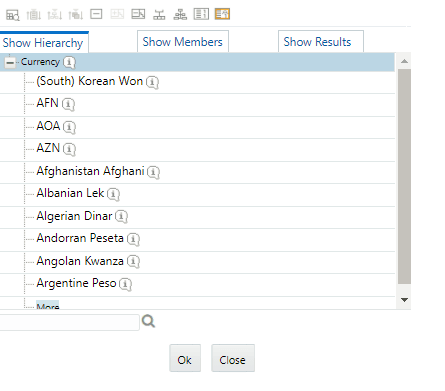

When the Run type is selected as Contractual, Reporting Currency is allowed for selection from the browser in the Run Execution Parameters window.

When the Run type is selected as Business-As-Usual, this field displays the reporting currency selected as part of the Contractual Run execution.

When the Run type is selected as Stress Run, this field displays the reporting currency selected as part of the Contractual Run execution.

For the first execution of a run, you must select the reporting currency. For subsequent executions, the previously executed reporting currency is automatically displayed but can be edited for each execution.

All the cash flows and balances in natural currency are converted to the reporting currency selected as part of this section for computation and reporting. Additionally, the application also supports conversion to the local currency of each legal entity in a single Run execution.

This field allows you to select the source from which the exchange rate is obtained.

When the Run type is selected as Contractual, exchange rate source is allowed for selection from the drop-down in Run Execution Parameters window. The selection is as follows:

· Bloomberg

· Internal

· Reuters

If you have different exchange rates, follow these steps to add a new exchange rate source:

1. Add a LOOKUP_CD in the table FSI_LRM_LOOKUP_B for the CATEGORY_ID = 19 (Exchange Rate Source).

2. Add a description for LOOKUP_CD added in the above mentioned table (FSI_LRM_LOOKUP_B) in the table FSI_LRM_LOOKUP_TL.

When the Run type is selected as Business-As-Usual or Stress Run, this field displays the reporting currency selected as part of the Contractual Run execution.

This field allows you to enter the LCR Horizon (in days) for liquidity coverage ratio calculation. By default, this value is displayed is 30, which is the regulatory horizon for LCR. This can be edited. This parameter determines the number of days to which the LCR scenario applies that is net cash outflows will be calculated.

When the Run type is selected as Business-As-Usual or Stress Run, this field displays the LCR Horizon selected as part of the Contractual Run execution.

NOTE:

· You have the option of defining and executing any number of Runs.