Understanding Multiple Jobs

Many organizations have employees who work in more than one job at the same time. Calculating benefit deductions and determining benefit eligibility requires special considerations. When an employee is hired into another position, use the Add New Assignment page in PeopleSoft HRAdminister Workforce. Each job is assigned an employee record number and a benefit record number.

A benefit record number is used to group several jobs together for benefit purposes. Each employee record number is unique. However, a benefit record number can be assigned to multiple employee record numbers.

If the new job entitles the employee to a new set of concurrent benefits, use a new benefit record number.

If the job does not entitle the employee to new benefits, use an existing benefit record number.

Each benefit record number must have a designated primary job. The primary job is used to process benefit information.

Service and termination dates are pulled from the primary job and used by the deduction processes.

During deduction processing, the primary job determines when to take a deduction from an employee's check.

Warning! Do not confuse the benefits-related primary job with the primary/secondary job indicator found on the Job Data pages. These are separate fields with very different functionality.

For PeopleSoft Benefits Administration, the primary job is used to:

Supply company and BAS (Benefits Administration) group data to the processing schedule. If a schedule specifies a particular BAS group ID, then the BAS group ID of the primary job within a benefit record number determines whether that employee's benefit record number is processed by the schedule.

Determine how credits (additional pay) for benefits are paid.

You need to determine how to group jobs for calculating benefit deductions or determining benefit eligibility. For example, suppose a professor has three jobs:

A dean at a college.

A faculty member at the college.

A physician at a hospital associated with the college.

When the professor's job data is entered in Administer Workforce, the system updates the Primary Jobs Table with information regarding the relationships between jobs and their benefit groups. For example, the following attributes might result:

|

Job Description |

Employee Record Number |

Benefit Record |

Primary Job Indicator |

Include for Eligibility |

Include for Deductions |

|---|---|---|---|---|---|

|

Professor |

0 |

0 |

Yes |

Yes |

Yes |

|

Dean |

1 |

0 |

No |

Yes |

Yes |

|

Physician |

2 |

1 |

Yes |

Yes |

Yes |

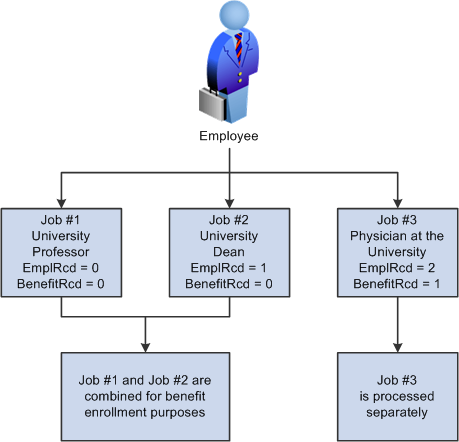

Image: An employee with three jobs and two benefit records

The following diagram shows the employee's three jobs and two benefit records. The first two jobs as a university professor and university dean share the same benefit record number for benefit enrollment purposes. However, the third job as a physician at the university has its own unique benefit record number and therefore the job is processed separately from the other jobs. Each benefit record corresponds to a set of benefits enrollments:

You can set default rules on the Multiple Jobs Options page to determine the setting and management of these options automatically for hires, rehires, and terminations.

You should not change the benefit record number of an existing job. Doing so invalidates primary job indicators on the effective-dated Primary Jobs Table and can result in erroneous processing within PeopleSoft Benefits Administration and PeopleSoft Payroll for North America, which may lead to abnormal termination of some processes.

Whenever changes are made through the Job Data, Assign Additional Jobs, or Current Job components, the system verifies that only one job within a given benefit record is designated as the primary job. If the system finds a problem, such as no primary job or multiple primary jobs, a worklist entry tells the benefits administrator to run the Primary Jobs Audit Report.

To calculate deductions for multiple jobs, the system needs to know the job or jobs that contribute salary information for calculating the deduction or coverage amount for salary-based plans.

To keep track of this information, the system uses the:

Primary Jobs Table, which is automatically maintained whenever a job is added using the Add New Assignment page or whenever a job is terminated or rehired. This table indicates whether a job is:

Included for Benefits Administration eligibility processing.

Included in the deduction calculation.

The primary job.

Multiple Jobs Options Table, which holds the rules that are used to automatically set the flags in the Primary Jobs Table in response to a hire, rehire, or termination. You can override these flags on the Primary Jobs Maintenance page.

Calculation rules, which specify how to add the employee's jobs together during the deduction calculation process.

Even if Multiple Jobs processing is not enabled, the system populates the Primary Jobs Table whenever employees are hired; you then have a base of primary job data if you later decide to enable multiple jobs.

The calculation rules specify how to group jobs when calculating deductions based on an employee's salary. The following fields determine deduction or coverage amounts for salary-based plans:

Combine Salaries check box on the Calculation Rules Table.

Grouping Method on the Calculation Rules Table.

Deductions check box on the Primary Jobs Table.

The primary job indicator controls the frequency of benefit deductions. Nonearnings-based benefit deductions (for example, rate-based deductions) are taken only when the primary job for the enrollment's benefit record is part of the payroll calculation. Benefit deductions that are based upon actual employee earnings, such as savings, retirement, or pension plans, are taken according to how those plans are set up, or in some cases, according to the contribution method—either percentage of earnings or a flat amount—that the employee selects upon enrollment.

If the contribution is based on a percentage, the deduction is taken on every check that the employee receives for all jobs for the benefit record associated with the enrollment.

If the contribution is based on a flat amount, the deduction is taken only when the primary job for the enrollment benefit record is paid.

Summary of Calculating Deductions by Plan Type

Here's how these fields are used to calculate coverage and deductions for each plan type series:

|

Plan Type |

Basis/Type |

Usage |

|---|---|---|

|

Health (1x) |

Flat amount or compensation rate based |

To calculate the premium if a Salary Rate Table is specified, salaries are combined using the Include flag for each job along with the combination parameters on the Calculation Rule Table. |

|

Life/AD&D (2x) |

Flat amount or compensation rate based |

If the coverage is based upon a factor of salary, salaries are combined using the Include flag for each job along with the combination parameters on the Calculation Rule Table. If a Salary Rate table is specified, salaries are combined using the Include Flag along with the combination parameters on the calculation rule to calculate the premium. |

|

Disability (3x) |

Flat amount or compensation rate based |

To determine coverage, salaries are combined using the Include flag for each job along with the combination parameters on the Calculation Rule Table. To calculate the premium if a Salary Rate table is specified, salaries are combined using the Include flag for each job along with the combination parameters on the Calculation Rule Table. |

|

Savings (4x) |

Flat amount or earnings-based |

The combination parameters on the Calculation Rules Table, as well as the Include for Deductions flag, are ignored: all jobs within the benefit record contribute earnings to the deduction and limits. Savings plans contributions can be expressed as either a flat amount or a percentage of eligible earnings (controlled by special accumulators). Contributions expressed as a percentage of eligible earnings are calculated based upon the earnings from all jobs in the enrollment's benefit record number in the current check, without regard to the setting of the Include flag for each job. Limits are determined using year-to-date deductions across all benefit record numbers. |

|

Leave (5x) |

NA |

Not applicable. No coverage amount or deduction exists with these plans. |

|

FSA (6x) |

Flat amount |

Not applicable. No coverage amount exists, and deductions are not based upon salary or earnings. |

|

Retirement (7x) |

Earnings-based |

The combination parameters on the Calculation Rules Table, as well as the Include for Deductions flag, are ignored: all jobs within the benefit record contribute earnings to the deduction. Contributions are expressed as a percentage of eligible earnings (controlled by a special accumulator), and are calculated based upon the earnings from all jobs in the enrollment's benefit record number, in the current check. Limits (if any) are determined using year-to-date deductions across all benefit record numbers. |

|

Pension (8x) |

Earnings-based |

The combination parameters on the Calculation Rules Table, as well as the Include for Deductions flag, are ignored: all jobs within the benefit record contribute earnings to the deduction. Contributions expressed as a percentage of eligible earnings are calculated based upon the earnings from all jobs in the enrollment's benefit record number, in the current check. Limits (if any) are determined using year-to-date deductions across all benefit record numbers. |

|

Vacation Buy/Sell (9x) |

CompRate-based |

Calculation rules are not used for these plans, and the Include flag is ignored. The cost is calculated by adding compensation rates across all active jobs in the enrollment's benefit record number. |