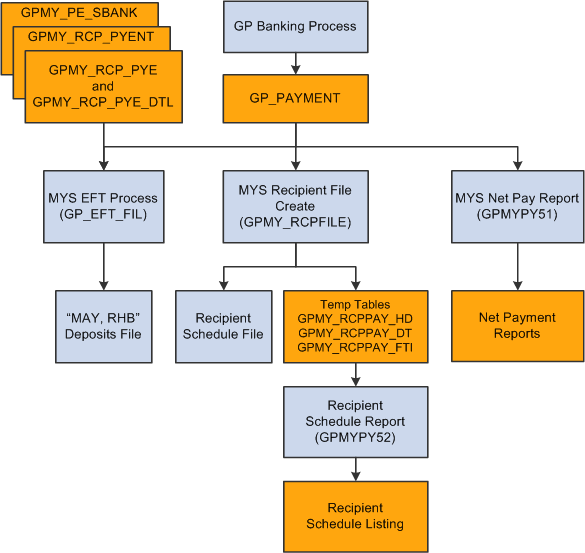

Managing the Banking Process Flow

The banking process of Global Payroll combines payroll data, pay entity source bank data, and payee or recipient bank data. The EFT file creation process extracts data that the banking process compiles according to the type of EFT file that you are creating, merges it with data that the Malaysia country extension provides, and creates the file for transmission.

To manage the banking process with Global Payroll:

Run the payroll process by using Global Payroll.

Run the Global Payroll banking process.

The core prepayment banking process calculates net amounts and recipient payments and stores them in the GP PAYMENT result table. The Global Payroll status is set to Prepared. The GP PAYMENT result table contains one entry for every net pay distribution from every payment that is included in a calendar run and provides the basis on which an organization pays its payees.

Using Global Payroll for Malaysia, run the Create EFT Payment File MYS Application Engine process (GPMY_EFT_FIL), which populates the file that is used for electronic fund transfer.

In this step, the system selects payees from GP PAYMENT with the following parameters:

Payment status: finalized.

Payment type: net pay distribution.

Payment method: bank transfer.

Currency code: MYR (Malaysian Ringgits).

Note: The source bank in the GP_PAYMENT rows that are selected must have May Bank Malaysia or Rashid Hussein Bank as its EFT domestic. Otherwise, those GP_PAYMENT rows are not selected (even though the criteria in the four preceding bullet points are met).

The payment status for the selected payees is set to Transferred in GP PAYMENT.

Note: You must run the banking process before the Bank file generation process.

Image: Malaysian banking and recipient processing flow

This diagram illustrates the process flow for banking and recipient processing: