Understanding the Processing Framework

The Global Payroll core application is a common foundation and structure that organizations in every country use to build their own calculation rules. The core application determines the basic framework for your payroll and absence processing. This framework supplies the normal processing sequence, organizational structure, and processing structure for calculating a payroll or an absence.

this topic discusses:

The processing sequence

The organizational structure

The processing structure

Calendars

A payroll or absence process consists of several processing phases, some of which you can run together. The typical processing sequence (the order in which Global Payroll executes phases of a batch process) for a payroll or absence run consists of these phases:

Identification (payee selection)

Calculation

Finalization

You can also run Cancel, Freeze, Unfreeze, and Suspend phases as needed and modify processing instructions by payee.

When you first launch the batch process, Global Payroll determines which payees are to be selected and calculated for the payroll or absence run, based on the selection criteria that you have specified. This identification phase is executed only once for each calendar group ID.

During the calculation phase, payroll or absence calculations are performed. Each payee is processed sequentially. As the system encounters each payee, it processes each element that is identified in the process list. Various criteria such as eligibility and generation control are considered in selecting which elements to process.

The calculation process can be repeated any number of times; only the payments that are appropriate to calculate are processed. When a calculation is first executed, all payments are processed. During subsequent calculations, only the following payments are processed:

Payments resulting from iterative triggers.

Payments for which you have entered recalculate instructions.

Payments that encountered errors during the previous run.

An iterative trigger can be produced when data changes for a payee. For example, a change to a payee's rate of pay might create an iterative trigger. Or the addition of a new hire to the calendar group ID can produce iterative triggers.

Finalizing an absence or payroll run closes and completes the process.

The Global Payroll core application determines the organizational structure for payroll processing.

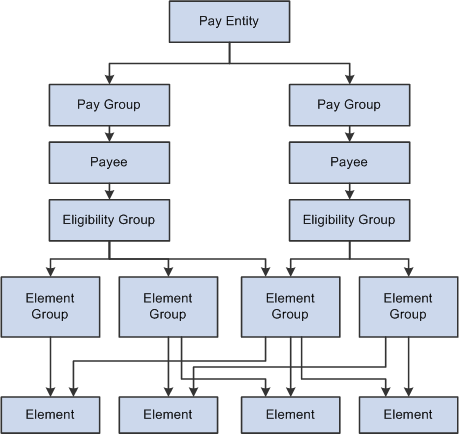

Image: Organizational structure of Global Payroll

This diagram shows the hierarchy of components in the organizational structure.

Pay Entity

Pay entity defines the organization making payments to payees. It also defines the type of currency to be used as the processing currency for every calculation.

Only one processing currency can be defined in Pay Entity. However, you can have multiple types of currency used as input and output. For example, you could enter your data in one type of currency and have 50 percent paid in one currency and 50 percent in another currency, regardless of the processing currency defined in pay entity.

The processing currency defined in pay entity is the currency that is used to generate reports.

A pay entity can be linked to one or more pay groups. However, each pay group is linked with only one pay entity.

You associate a specific country with each pay entity. This country designation is important for many features in Global Payroll such as the groups of calendars with a single calendar group ID, retroactive methods, and trigger definitions.

Pay Group

Global Payroll uses a logical grouping, called pay group, to qualify individuals for payment. Typically, all individuals in a pay group have something in common that causes them to be processed at the same time in the payroll system.

Common examples of pay groups are salaried and hourly pay. You can assign a payee's default earnings and deductions based on pay group if you select this option at installation time. A pay group can be associated only with a single pay entity.

Each pay group has a default eligibility group associated with it. This is traditionally the default earnings and deductions for the pay group population. The default eligibility group that is associated with a pay group is used as the payee level default. You can override these defaults.

Pay groups are ultimately associated with pay calendars to process a payroll. It is important to group payees who are paid with the same pay frequency—weekly, monthly, and so on—as well as payees who typically receive the same type of earnings and deductions.

Payee

Payees are the people in your organization that you want to pay.

Payees who are included in a pay group definition can be members of different eligibility groups. The only link between pay groups and eligibility groups is from a default perspective. The eligibility group that is defined on the Pay Group page is used as an initial default for the payee. You can override the default.

Eligibility Group

An eligibility group is a grouping of element groups. Eligibility groups indicate the specific elements for which a certain payee population is eligible. The default eligibility group is defined at the pay group level. A payee is assigned to an eligibility group through the default that is defined at the pay group level. You can override the default value.

For example, let's say that you have a pay group for all payees who are paid monthly. Of those payees, 99 percent are regular, salaried payees who are eligible for regular earnings. However, you also have 10 executives whom you want to pay in that same pay group. These executives are eligible for a slightly different set of earnings and deductions. You can override their eligibility group and assign them to the EXEC EARNINGS eligibility group. You can have only one default eligibility group for each pay group.

Element Group

Element groups provide a method of assigning a large number of elements (like taxes) to many eligibility groups without repeating the elements in each and every eligibility group. Element groups provide a means for grouping these elements. You can assign any number of element groups to an eligibility group.

Elements

Elements are the basic building blocks of Global Payroll. The organizational structure of the system begins with the definition of these basic payroll components.

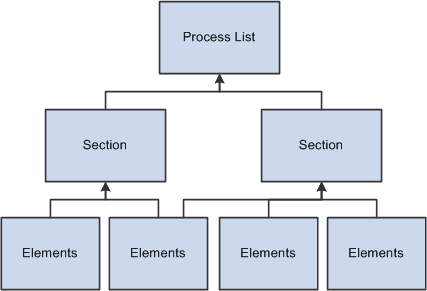

Image: Processing structure of Global Payroll

This diagram shows the components of the Global Payroll processing structure.

Process List

A process list specifies the order in which gross and net pay elements are processed and resolved. You add these elements to the process list by using sections. You add sections to your process list; the sections are processed in the order in which you insert them into the list. You can also execute sections conditionally.

The process list is where you indicate whether you are calculating an absence or a payroll. You use separate calendars for absence and payroll processing runs, so you must create separate process lists for absence and payroll runs.

On the Process List - Definition page you indicate what type of calculation is taking place. If the calculation type is absence, then the gross, net pay, and minimum net element name fields are not available. If the calculation type is payroll, then the gross and net pay element name fields are required. The minimum net element is optional. If the minimum element is not entered, the minimum net amount is considered to be zero. When you enter the gross and net pay element names, you are referencing the gross and net accumulators.

The net pay element and minimum net element are used during deduction arrears processing. The deduction amount is compared to the net plus minimum to see if the deduction can be taken. If the net plus minimum is less than the deduction, the system follows its own set of rules to process the deduction.

The net and gross element numbers and values are stored in output tables so that you can access this data for reporting and online inquiries.

Section

A section is a grouping of elements and controls the order that those elements are processed on the process list. Five types of sections are used for different types of processing:

Standard sections are used during an absence run, a payroll run, or both.

Sub process sections are used for payroll runs and can be used for gross-ups.

Payee sections are used for payroll runs.

Payee sections are used for garnishments or any other element that needs to provide the flexibility to distinguish which elements should be processed, and the order, at the payee level.

Generate Positive Input sections are used during an absence run, a payroll run, or both.

This type of section can be used to create positive input for different calendars.

Absence Take section are used for absence runs.

You can use this type of section to process absences in date sequence.

Once you have defined a section, you can reuse it in multiple process lists.

Elements

Elements are the basic building blocks in Global Payroll. Some stand alone while others use several simple elements (called supporting elements) that are combined to form more complex elements.

During a payroll or absence processing run, the system resolves each element in the process list for each payee. The elements that are resolved depend on a payee, so the resolved value of an element depends on which payee is under consideration.

To run a payroll or absence process, the relevant components of the system are linked together through the use of calendars. A calendar controls who is to be paid, what amounts are to be paid, and the period of time for which the payment is being made.

Only one pay group can be associated with a calendar. Through the use of various selection criteria, you can define who is going to be paid:

Calendar run types enable you to define what is being paid.

Calendar period IDs define the period of time for which the payment is being paid.

Calendar group ID groups the calendars that you want to process at the same time.

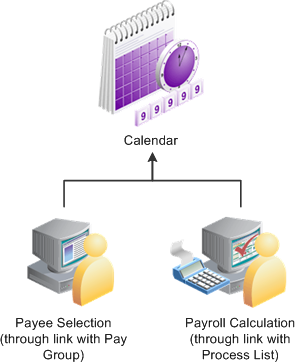

Image: Calendar links the entire process together

This diagram shows how calendars tie together the components of a payroll or absence run.