Creating Final Check Paysheets

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_TERM |

Run the Final Check Build process to create final check paysheets. |

|

|

Request Final Check Page |

TERM_RQST |

Run the online or batch Final Check Request process. |

|

RUNCTL_PAY056 |

Generate the PAY056 report that lists final check requests for which an employee's final check processing status is either N (not processed) or P (loaded to paysheets). |

|

|

Final Check Reconciliation Report Page |

RUNCTL_PAYINIT |

Generate the PAY057 report that reconciles employees who have final checks processed, based on pay calendar information that you specify with data from their Employment records. A warning message appears in the report when an employee is not really terminated, but has a final check produced. |

Before you can review paysheet and payline information for final check requests, run the Final Check Build process to create final check paysheets that are associated with the final check requests. You can create final check paysheets only for existing final check requests. You must enter at least one final check request before creating final check paysheets. You can create final check paysheets in either on-cycle or off-cycle processes.

Warning! If you create final check paysheets in an off-cycle process, create your regular paysheets before creating your final check paysheets. The Final Check Build process obtains important information from the regular paysheets.

The Final Check Build process runs three batch processes to create final check paysheets for the Pay Calculation and Pay Confirmation processes:

The Create Final Check Paysheet process creates final check paysheets for the employee.

The Final Check Extract process extracts:

Leave accruals and deduction refunds to pay to the employee.

Deductions to collect from the employee.

The Final Check Load Paysheets process loads the extracted leave accruals and deductions to the paysheets.

To ensure that the balance records reflect correct information, PeopleSoft recommends that you complete manual checks, reversals, or adjustments before processing a final check. Because the Final Check Build process uses information from regular paysheets, PeopleSoft also recommends that you first run the regular Create Paysheet process.

The Create Final Check Paysheet process:

Creates new final check paysheets.

In creating the new final check paysheets, the system calls the Create Paysheet process to generate the standard paysheets with prorated regular earnings.

Validates earnings on the new paysheets.

Applies all validated earnings from preexisting paysheets onto the new final check paysheets.

This batch process creates the final check paysheets. It prorates regular earnings for all employees (salaried, exception hourly, and hourly) based on the pay period begin and end dates and the termination date on final check requests.

After creating the new final check paysheets, the system determines whether the earnings on the new paysheets are defined in the employee's final check program. The system deletes from the paysheet earnings that are not defined in the employee's final check program and generates a warning message.

Note: It is your responsibility to verify the regular earnings for hourly employees and to update the paysheets to reflect the actual hours worked.

After verifying the new final check paysheets, the system determines whether the employee has any preexisting uncalculated, or unconfirmed, OK to Pay paysheets (either on-cycle or off-cycle).

If so, the system determines whether the pay end date on the paysheet equals the current final check pay end date for any earnings codes that are not on the newly created final check paysheets (but are in the preexisting paysheets such as Time and Labor, Retro Pay). If these earnings codes are defined on the final check program, the system copies them to the final check paysheet and marks the preexisting paysheet as Not OK to Pay.

If the pay end date on the existing paysheet is earlier than the current pay end date of the final check paysheet, and the earnings code is defined on the final check program, the system copies all appropriate earnings from the preexisting paysheets to the final check paysheet and marks the preexisting paysheet as Not OK to Pay. If the pay end date on the paysheet is later than the current pay end date, the system generates a warning message.

Note: The system generates a warning message for every earnings code on the preexisting paysheets that is not defined in the final check program, and marks the existing paysheets as Not OK to Pay.

The Create Final Check Paysheet process copies all one-time garnishments and one-time taxes that are associated with the processed, preexisting paysheets to the final check paysheets. The system verifies one-time deductions against the final check program and copies only those one-time deductions that are in the final check program.

After creating the final check paysheets and copying the preexisting paysheets, the system validates all the earnings codes on the paysheets to determine the correct earnings amount. Depending on the payout option on the Program Earnings Definition page of the final check program, the payout amount is either the flat earnings amount on the paysheet or the difference between the goal amount and the goal balance.

If you defined a dollar override limit for an earnings code on the Earnings Definition page of the final check program and the payout amount is greater than the dollar override limit, the system overrides the payout amount with the dollar override limit and displays a message to inform you. If there are multiple occurrences of the same earnings code associated with a dollar override limit, the system prorates the dollar override limit proportionately among those earnings.

The system deselects the Job Pay check box at the earnings level on all final check paysheets. On all preexisting paysheets where the system modified information through validation when copying it to the final check paysheets, the system also deselects the Job Pay check box at either the earnings level or the other earnings level, depending on the level at which the modification was applied.

Warning! All final check paysheets are created with OK to Pay activated, regardless of how you defined the Pay Group Table - Process Control page or the Additional Pay table. Even if an earning was defined as Not OK to Pay, that earnings becomes OK to Pay when you create the final check paysheet.

Special Considerations for Time and Labor Paysheets

These processes are generally the rule for handling preexisting paysheets in the Final Check Build process. Preexisting paysheets that are created by Time and Labor, however, require special considerations.

Time and Labor enters all pay information onto the payroll paysheets as other earnings. Therefore, for salaried employees whose pay end date equals the current pay end date, the system does not enter Time and Labor REG other earnings from the current pay period into the new final check paysheets as regular earnings.

However, when processing Time and Labor REG other earnings for exception hourly and hourly employees when the pay end date equals the current pay end date, the system uses those REG other earnings and overlays the regular earnings on the new final check paysheet.

The system copies Time and Labor prior period adjustments (represented as Other Earnings records with identical earnings begin and end dates) as they are, if the earnings codes are identified in the final check program.

The system adds to the final check paysheet any earnings codes (other than regular or holiday) from preexisting, unconfirmed Time and Labor paysheets, if the pay end date is the same for both the Time and Labor paysheet and the final check paysheet. The system does not replace the earnings code amount if it already exists on the final check paysheet, but adds to it.

The system does replace holiday pay and hours earnings codes on the final check paysheet with the information from preexisting, unconfirmed Time and Labor paysheets, if the earnings code is for holiday and the Time and Labor paysheet and the final check paysheet have the same pay end date.

When copying Time and Labor paysheets onto the final check paysheets, the system selects the TL Records check box on the paysheets.

After copying preexisting Time and Labor pay earnings onto final check paysheets, the system marks the Time and Labor paysheets as final check paysheets. It does this by changing the paysheet source on the paysheets to either Batch Final Check or Online Final Check. Additionally, it marks the Time and Labor paysheet as Not OK to Pay. Any paysheet marked Not OK to Pay is an original—it was copied from a prior Time and Labor upload.

After creating the final check paysheets and copying onto them the preexisting paysheets, the system validates the earnings codes on the paysheets to arrive at the correct earnings amount.

Depending on the payout option in the final check program earnings definition, the payout amount is either the flat earnings amount as defined on the paysheet, or the difference between the goal amount and the goal balance.

If you defined a dollar override limit for an earnings code in the earnings definition of the final check program, and the payout amount is greater than the dollar override limit, the system overlays the payout amount with the dollar override limit and generates a message to inform you.

If the dollar override limit applies to multiple occurrences of the same earnings code, the system prorates the dollar override limit proportionately among those earnings.

Manual Check and Reversal Paysheets

The system does not copy manual check paysheets onto final check paysheets, and it does not mark them as Not OK to Pay. If they meet all the conditions described in this section, the system copies reversal and reversal/adjustment paysheets to the final check paysheets, marks the original paysheets Not OK to Pay, and generates a message to inform you.

PeopleSoft recommends that you complete all manual check, reversal, and reversal/adjustment processing for an employee before processing a final check paysheet. Otherwise, the balance records might not contain the correct information. This could be a problem for items that have limits, such as FICA.

The Final Check Extract process:

Extracts leave accruals

Extracts deductions

This batch program extracts all leave accruals and deductions for an employee's final paycheck. The system checks the processing status on the final check request and processes only those employees whose status is Created. The system writes the extracts to a work table, which it loads to the paysheets. After extracting an employee's deductions and accruals, the system sets the processing status in both the final check request and final check extracts to Extracted. When the system loads the extracts to paysheets in the Final Check Load Paysheets process, it deletes the extracts in the work table and updates the final check request processing status to Loaded to Paysheets.

Extract Leave Accruals

The system extracts all leave accruals for which the plan type and benefit plan are defined in the final check program. The payout hours include either or both:

Fully earned and awarded leave accruals.

These are always paid if they are defined in the final check program. The system uses the following formula to determine the number of available hours to be paid:

hours carried over from previous year

+ earned year-to-date

− taken year-to-date

+ adjusted year-to-date

+ bought year-to-date

− sold year-to-date

− unprocessed hours taken

+ unprocessed hours adjusted

+ unprocessed hours bought

− unprocessed hours sold

Accrued, but not awarded, leave accruals.

Pay from these accruals (the months or hours incurred from the last leave accruals run until the present) is optional. If you do this, define a proration method for the system in the Final Check Program table.

Extract Deductions

You can refund or collect all deductions, both general and benefit, for an employee upon termination. Specify a processing rule for each deduction that you include on the Deduction Definition page of a final check program. The final check processing rule that you specify for a deduction determines whether the system refunds or collects that deduction. The processing rule also specifies how the system calculates this deduction.

If the plan type and deduction code are not defined in the final check program, the system creates a one-time deduction override extract row with a zero amount to override the deduction that it collects in the Pay Calculation process.

Final check processing extracts all deductions in which an employee is enrolled and processes each according to the final check program, regardless of whether the deduction is scheduled for processing.

The Final Check Load Paysheets process:

Loads other earnings.

Loads deductions to collect to one-time deductions.

Loads deductions to refund to one-time deductions.

This batch program loads all the extracted leave accruals, deduction refunds, and deduction collections to paysheets. This process is driven by the processing status in the Final Check Extract table. It selects only those rows from the extract table for which the status is Extracted. The system adds all deductions and accruals from the Final Check Extract process to the final check paysheets. Leave accruals are added as other earnings. Deductions are added as one-time deductions (overrides or refunds).

If the system copied a one-time deduction override from a preexisting paysheet onto the final check paysheets, and the Final Check process creates another one-time deduction override for the same deduction, you receive a message informing you of the amount calculated for the deduction. In this case, make adjustments before you run the Pay Calculation process, because multiple one-time deductions for the same deduction are not allowed.

The system performs all FLSA distributions, job earnings distributions, and tax distributions for the paysheets created in the Create Paysheet process. However, for earnings associated with leave accruals that were extracted in the Final Check Extract process, this program performs only the tax distributions as defined on the Update Tax Distribution page. The system does not perform FLSA distributions and job earnings distributions. It is your responsibility to perform distributions.

After loading the paysheets for an employee, the system sets the processing status in the final check request to Loaded and deletes final check extracts from the worktable.

If a preexisting paysheet displays a company or pay group that differs from the one currently in effect for the employee, the system uses the currently effective company and pay group when copying that paysheet to the final check paysheet. It also displays a message to inform you. You can change any final check component before running the Pay Calculation process.

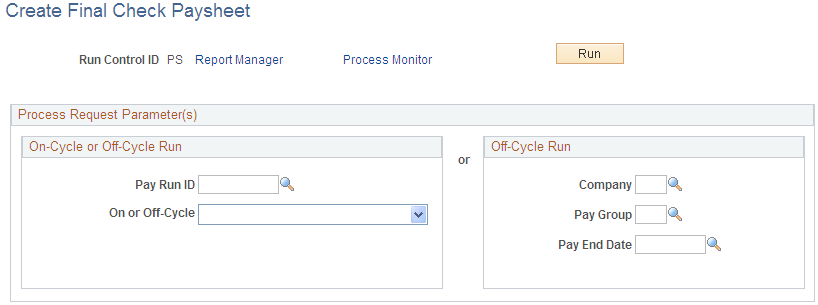

Use the Create Final Check Paysheet page (RUNCTL_TERM) to run the Final Check Build process to create final check paysheets.

Navigation

Image: Create Final Check Paysheet page

This example illustrates the fields and controls on the Create Final Check Paysheet page.

On-Cycle or Off-Cycle Run

If you use this group box, the Off-Cycle Run group box becomes unavailable for entry.

|

Field or Control |

Definition |

|---|---|

| Pay Run ID |

Select a pay run ID to create final check paysheets for the pay calendars that are associated with the ID. |

Off-Cycle Run

If you use this group box, the On-Cycle or Off-Cycle Run group box becomes unavailable for entry.

Note: The Final Check Build process gathers information from system tables about the employees for whom you processed final check requests and generates the pay earnings information for each payline.

Note: After creating final check paysheets, run the normal Pay Calculation and Pay Confirmation processes.

To rerun the Final Check Build process:

Select the Reprocess check box on the Request Final Check page.

Note: This check box does not appear on the page unless the employee has an unconfirmed final check paysheet.

Mark preexisting paysheets as OK to Pay.

Run the Final Check Build process again.

After reprocessing the request, the system hides the Reprocess check box.

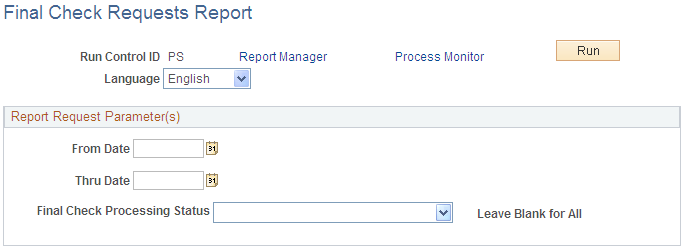

Use the Final Check Requests Report page (RUNCTL_PAY056) to generate the PAY056 report that lists final check requests for which an employee's final check processing status is either N (not processed) or P (loaded to paysheets).

Navigation

Image: Final Check Requests Report page

This example illustrates the fields and controls on the Final Check Requests Report page.

|

Field or Control |

Definition |

|---|---|

| Final Check Processing Status |

Select one of these options:

|