Reviewing and Adjusting Pay Limit Balances

Use the Adjust Pay Limit Balances (GVT_ADJ_PAY_LIMIT), Review Pay Limit Balances (GVT_BAL_PAY_LIMIT), and Extract Pay Limit Payout (GVT_LIMIT_PAYOUT) components to review and adjust pay limit balances.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_ADJ_PYLIM_BAL1 |

(USF) Identify the pay limit balance to adjust. |

|

|

GVT_ADJ_PYLIM_BAL2 |

(USF) Enter the pay limit adjustment. |

|

|

GVT_BAL_PAY_LIM1 |

(USF) View an employee’s current year pay limit balance. |

|

|

GVT_BAL_PAY_LIM2 |

(USF) View adjustments made to an employee’s pay limit balances. |

|

|

GVT_BAL_PAY_LIM3 |

(USF) View a summary of an employee’s lifetime pay limit balances and determine a terminated employee’s payout. |

When an employee transfers from one federal agency to another, leaves federal service or otherwise terminates employment, or is deceased, the employee’s lifetime balance of deferred earnings must be paid out in a lump sum.

If an employee transfers from one federal agency to another, the deferred earning must be transferred with the employee. If you are an employer from which the employee transfers, you must provide the gaining agency with documentation regarding the employee’s excess amount and fund a transfer equal to the total cost of the lump-sum payment to the gaining agency through the Department of Treasury’s Intra-Governmental Payment and Collection System. If you are the receiving agency you must create employee lifetime balances in the system to track the balances.

Use the Adjust Pay Limit Balance 1 and Adjust Pay Limit Balance 2 pages in the Pay Limit Balance Adjustment (GVT_BAL_PAY_LIMIT) component to adjust pay limit balances.

To find the lifetime balances for the current year, navigate to the Pay Limit Balances page for the most current year for a specific earnings code, or to the Lifetime Balances page for a summary of all Lifetime Balances in the Review Pay Limit Balances component (GVT_BAL_PAY_LIMIT).

Balance records in the Payroll for North America system are cumulative totals of pay limits. If an employee works for more than one agency, the system maintains separate balance records for each. The system creates a new balance record for each month, updates all balances when you run the pay confirmation, and maintains monthly, quarterly, YTD, and lifetime totals. The system automatically updates information on the Pay Limit Adjustments page each time you confirm a payroll or make an online adjustment.

For information on earnings payouts with lifetime balances, see Understanding Lifetime Balance Payouts.

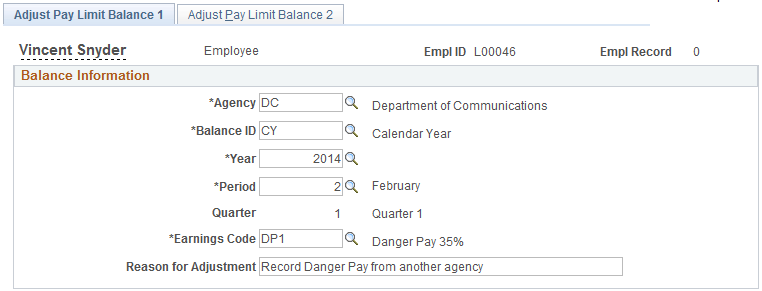

(USF) Use the Adjust Pay Limit Balance 2 page (GVT_ADJ_PYLIM_BAL1) to identify the pay limit balance to adjust.

Navigation

Image: Adjust Pay Limit Balance 1 page

This example illustrates the fields and controls on the Adjust Pay Limit Balance 1 page.

Enter and save data on the Adjust Pay Limit Balance 1 page to access the Adjust Pay Limit Balance 2 page with relevant balance adjustment data displayed.

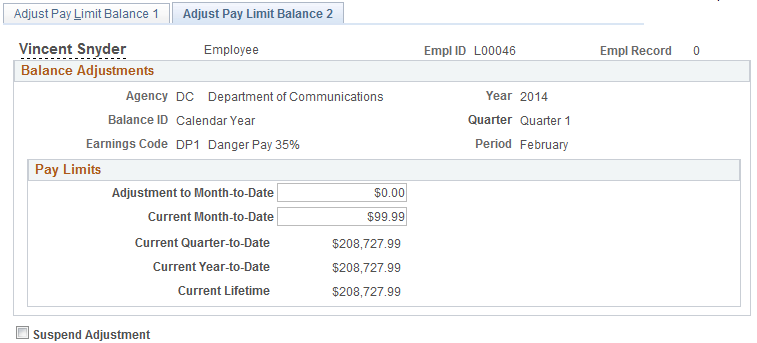

(USF) Use the Adjust Pay Limit Balance 2 page (GVT_ADJ_PYLIM_BAL2) to enter the pay limit adjustment.

Navigation

Image: Adjust Pay Limit Balance 2 page

This example illustrates the fields and controls on the Adjust Pay Limit Balance 2 page.

To access the Adjust Pay Limit Balance 2 page with relevant balance adjustment data displayed, you must enter and save data on the Adjust Pay Limit Balance 1 page. When you save the Adjust Pay Limit Balance 1 page, the system updates the employee’s pay limit balance record and displays data on the Adjust Pay Limit Balance 2 page. You can then make multiple adjustments to the employee’s balances without having to retype information.

|

Field or Control |

Definition |

|---|---|

| Adjustment to Month-to-Date or Current Month-to-Date |

Enter the month-to-date pay limit adjustment to make for this employee, or enter the current cumulative month-to-date pay limit adjustment total for this employee. When you enter a value in either field and tab out of that field, the system updates all the other fields in the Pay Limits group box based on the value that you entered. |

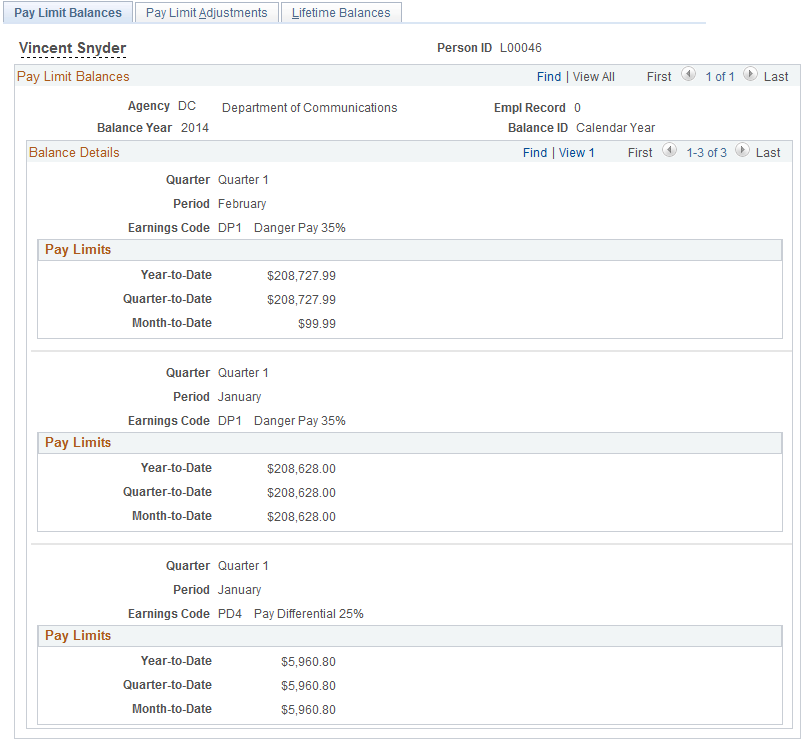

(USF) Use the Pay Limit Balances page (GVT_BAL_PAY_LIM1) to view an employee’s current year pay limit balance.

Navigation

Image: Pay Limit Balances page

This example illustrates the fields and controls on the Pay Limit Balances page.

Functionality in the Review Pay Limit Balance component is similar to functionality described in Understanding Employee Balance Adjustments.

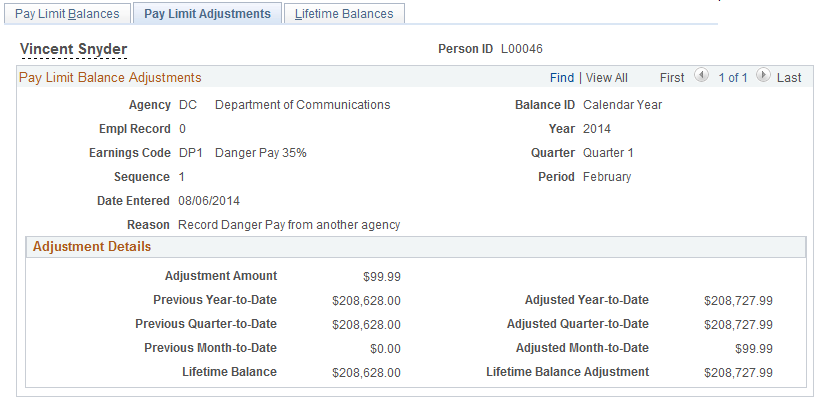

(USF) Use the Pay Limit Adjustments page (GVT_BAL_PAY_LIM2) to view adjustments made to an employee’s pay limit balances.

Navigation

Image: Pay Limit Adjustments page

This example illustrates the fields and controls on the Pay Limit Adjustments page.

Note: No correlation exists between the scroll areas on the Pay Limit Balances page and its associated Pay Limit Adjustments page in the Review Pay Limit Balances (GVT_BAL_PAY_LIMIT) component. For example, if you're viewing a particular monthly pay limit balance on the Pay Limit Balances page, the Pay Limit Adjustments tab takes you to the employee's pay limit balance adjustments, but not necessarily the adjustments of that particular monthly pay limit balance.

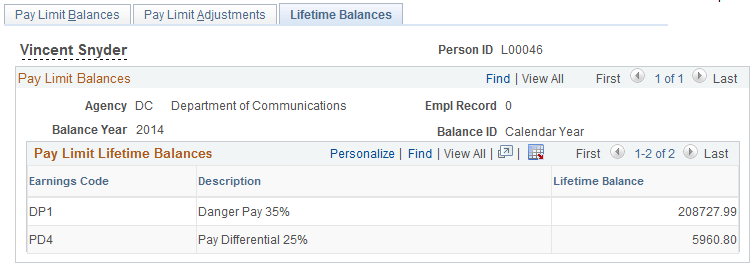

(USF) Use the Lifetime Balances page (GVT_BAL_PAY_LIM3) to view a summary of an employee’s lifetime pay limit balances and determine a terminated employee’s payout.

Navigation

Image: Lifetime Balances page

This example illustrates the fields and controls on the Lifetime Balances page.

A running total of all lifetime balances for the calendar year appears in the Pay Limit Lifetime Balances grid on the Lifetime Balances page. If these balances were available for the first payroll of the year, or the employee was terminated, the employee is entitled to a payout of the sum all of the Lifetime Balance rows.

The employee may have lifetime balances of YTD deferred earnings for several calendar years in the database, for which payout is due. Consider using the download option to download all of the employee’s lifetime pay limit balances to a spreadsheet to determine to total payout amount.