(USA) Entering U.S. Employee Tax Data

Note: (USF) All pages in this topic apply to both the generic Payroll for North America and U.S. federal government functionality, unless stated otherwise. The only difference between the two is their corresponding navigation.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_DATA1 |

(USA, USF) Enter and maintain the federal tax information that the system uses to calculate federal taxes for employees. |

|

|

TAX_DATA3 |

(USA, USF) Enter and maintain state tax information that the system uses to calculate state taxes for employees. |

|

|

TAX_DATA5 |

(USA, USF) Enter employee tax data for each locality in which an employee lives or works. |

|

|

Employee Tax Information Report Page |

RUNCTL_TAX019 |

(USA, USF) Run Employee Tax Information Report (TAX019) to print employee tax withholding information. |

If the employee is a resident of a state other than the primary work state, you must create an additional State entry and select only one of the states as the state of residence.

Use the Non-Residency Statement Filed check box to record whether the employee has completed the necessary nonresidency certificate that some states require when an employee lives in one state and works in another.

For example, employees who reside in Wisconsin but work in Minnesota must file a certificate of nonresidence for Minnesota with their employer to avoid having both Minnesota and Wisconsin income taxes withheld from their wages. When employees do not file this certificate, their wages must be fully taxed in both Wisconsin and Minnesota. Employees who fail to file this certificate when required are supposed to be fully taxed in both resident and work states.

For employees who work in multiple states, most states have adopted a set of rules to determine a state of jurisdiction for unemployment and disability purposes. The employee's state of jurisdiction is indicated by the UI Jurisdiction check box.

The system performs the following edits to determine state of jurisdiction:

If an employee has only one state (the resident state), that state is the default state of jurisdiction.

If an employee has two states (one resident, the other nonresident), the nonresident state is the default state of jurisdiction.

If an employee has multiple nonresident states, and no state is indicated as the state of jurisdiction, the system issues a message requiring you to select the UI Jurisdiction check box on one record.

Other Factors Affecting State Tax Calculation

Enter the employee's SWT marital/tax status in the SWT Marital/Tax Status field for each state where the employee pays taxes. This is the marital status that is used for calculating SWT in each state for the employee. It indicates which tax rates the system should use for the SWT calculation. SWT marital status options are located on the SWT Marital Status table, which is maintained by PeopleSoft.

Note: For Guam (GU), Virgin Islands (VI), and American Samoa (AS): Employees in these territories are subject to territory withholding at the same rate as federal. You must enter the marital status and withholding allowances claimed on their withholding certificates on this page and on the Federal Tax Data page.

The interaction of the Tax Location table, the employee's Local Tax Data table and the employee's Tax Distribution table enables employees to be paid in any of the tax locations comprising a chain of linked localities. When an employee is paid in such a locality, the employee's earnings are included in the taxable grosses of all localities further down the chain. The Other Work Locality field on the following pages provides the links in the chain of localities.

Tax Location Table

The Tax Location table associates any number of states, localities and linked localities with a tax location code. The tax location code is used on the Job Data - Payroll page and automatically generates information on the employee's State Tax Data page and Local Tax Data page when the Automatic Employee Tax Data check box has been selected on the Installation table.

In the absence of (or to override) automatic employee tax data, state, locality and locality-link data may be set up directly on the employee's State Tax Data and Local Tax Data pages. The use of the Other Work Locality field described below is identical on both the Tax Location table and the Local Tax Data pages.

Local Tax Data

The Other Work Locality field on the Local Tax Data table is used where one or more taxes apply to a single location. A school district within a city within a county is such an example. In this case, there would be one chain with three rows. Row one would have the school district as the locality and the city as a link; row two would have the city as the locality and the county as a link; and row three would have the county as the locality only.

The Other Work Locality field on the Local Tax Data table may also be used where one or more taxes apply to multiple locations. Several cities within a county is such an example. In this case, there could be several chains. There would be a separate row for each city with the county as the link. The county, however, would appear only once in the Locality field of a row without a link.

Note: Linked localities may have either the same (congruent) or different (noncongruent) physical boundaries.

When linked localities have the same physical boundaries, there should be earnings in only one locality in a chain—namely, the locality at the beginning of the chain (the school district in the above example). Likewise, if the employee is a resident of any one locality, he/she should be a resident of all the localities. Unless the earnings are taxable to residents only, and the employee is not a resident, then all of the localities should have the same taxable earnings.

Note: We recommend that a chain of linked localities with the same physical boundaries start with a locality that taxes both residents and nonresidents.

When linked localities have different physical boundaries, there could be earnings in any locality in a chain. Likewise, an employee may be a resident of only some of the linked localities (and all of the localities down the chain). Unless the earnings are taxable to residents only, and the employee is not a resident, any earnings in locality with a link will be included in the taxable earnings of all localities further down the chain. They will not be included in the taxable earnings of localities further up the chain.

Important! A chain of linked localities with different physical boundaries should start with the smallest locality and progressively work up to the largest locality.

Employee Tax Distribution

The Employee Tax Distribution table allocates the work-location earnings of salaried and exempt hourly employees. Using this table, 100 percent of total earnings are allocated to states and localities during the Create Paysheet process.

When earnings are allocated to linked localities having the same physical boundaries, the allocation should be to the locality at the beginning of the chain. When earnings are allocated to linked localities having different physical boundaries, the allocation may be to any or all localities in the chain. As stated earlier, when earnings are allocated to linked localities, the earnings will be included in the taxable earnings of all localities further down the chain.

Example of Special City and County Withholding Tax Situations

In some states, such as Kentucky, both cities and counties can impose payroll withholding taxes on wages for work performed within their jurisdictions. If an employee works in a city that imposes a tax, and that city is located within a county which also imposes a tax, the employee is subject to payroll withholding for both the city and county taxes.

For example, the city of Covington, Kentucky is located within Kenton County, Kentucky. Both the city of Covington and Kenton County impose payroll taxes. In all three of the following situations, the employee is subject to the withholding taxes imposed by both the city of Covington and Kenton County:

A resident of Covington who also works in Covington.

A resident of Kenton County (outside of Covington) who works in Covington.

A resident of another county who works in Covington.

To ensure that both the city and the county local taxes are correctly calculated and withheld in these situations, you must set up the city as the first or primary work locality, and the county as the secondary/linked work locality on both the Tax Location table and in the employee local tax data setup.

Employee tax data needs update from time to time and when it happens, it needs to be done in a certain order so that payroll can be calculated properly using the correct data. Suppose that an employee moved to a new state on June 10 after the end of the last pay period (May 29 – June 9), and a few days later, the payroll calculation process was run for that pay period with June 15 as the check date. To ensure correct payroll calculation in this example, the employee’s tax data (the new state value) should be updated with June 10 as the effective date after the payroll with the June 15 check date has been confirmed.

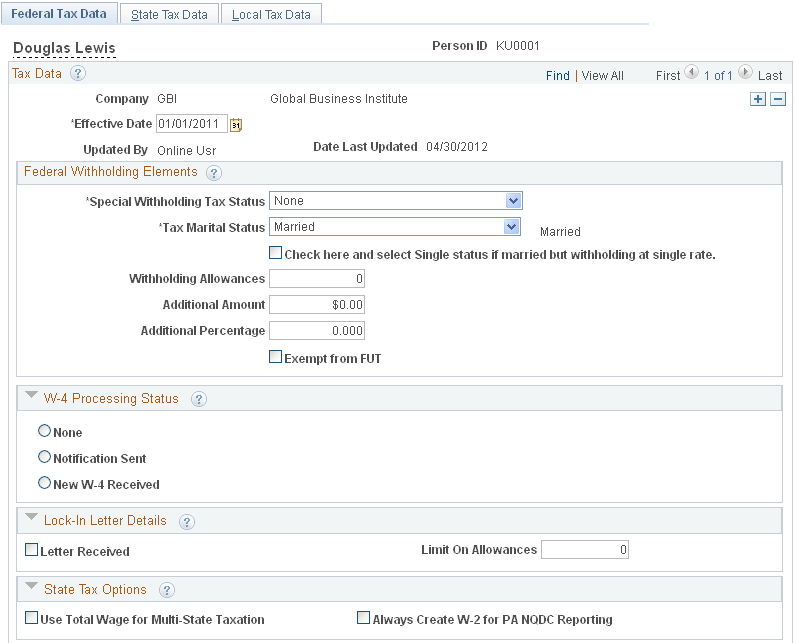

(USEA, USF) Use the Federal Tax Data page (TAX_DATA1) to enter and maintain the federal tax information that the system uses to calculate federal taxes for employees.

Navigation

Image: Federal Tax Data page (1 of 2)

This example illustrates the fields and controls on the Federal Tax Data page (1 of 2).

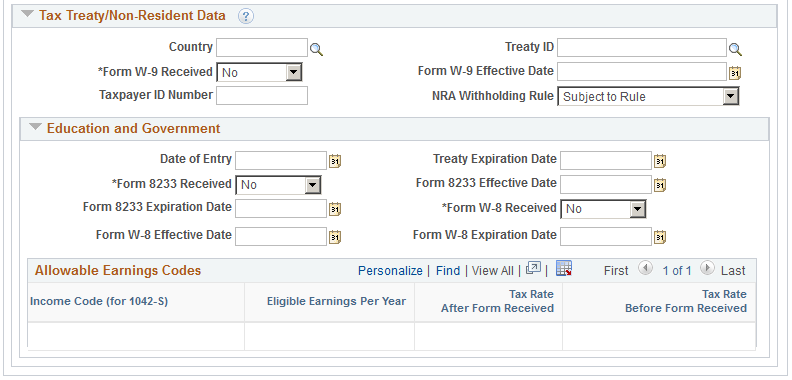

Image: Federal Tax Data page (2 of 2)

This example illustrates the fields and controls on the Federal Tax Data page (2 of 2).

Federal taxes include federal income tax and FUT. If the employee works for multiple companies, the tax data is defined by company.

Note: Federal, state, and local taxes are implemented as a set of chained pages. To add a new effective-dated row for state or local tax data, you must insert a row on the first page in the chain, the Federal Tax Data page.

Note: For Guam (GU), Virgin Islands (VI), and American Samoa (AS): Although employees in these territories are not subject to federal withholding, they are subject to territory withholding at the same rate as federal. The system uses the tax marital status and withholding allowances information on the Federal Tax Data page to calculate the territory withholding required by each of these territories.

|

Field or Control |

Definition |

|---|---|

| Date Last Updated |

This display-only field indicates whether the employee's federal tax data was last updated by an online system user or by a web user, using the PeopleSoft self-service web application. The date of the most recent update appears. |

Federal Withholding Elements

|

Field or Control |

Definition |

|---|---|

| Special Withholding Tax Status |

Specify the employee's special withholding tax status. The system calculates the withholding tax based on the value you select here and other factors. See Special Withholding Tax Status.

|

| Tax Marital Status and Check here and select Single status if married but withholding at single rate |

Select the appropriate tax marital status for federal withholding taxes as indicated on the employee's completed Form W-4. If the employee has selected "Married but withhold at single rate" on the W-4 form, you must select both the Single option and the check box marked "Check here and select Single status if married but withholding at single rate." This setting results in the employee being reported with marital status W. Note: If you select the check box, the tax marital status automatically becomes Single when you save. |

| Withholding Allowances |

Enter the number of allowances that the employee claims for FWT purposes. This number should match the number on the employee's W-4 form. |

| Additional Amount and Additional Percentage |

Use these fields to indicate that additional FWT taxes are to be taken. You can specify both an amount and a percentage, if appropriate. When you enter an additional percentage, the additional withholding is calculated by taking a percentage of the taxable wages. The effect of this field depends on the option that you select in the Special Withholding Tax Status field. |

| Exempt from FUT |

Select this check box if the employee is exempt from FUT (Federal Unemployment tax). The default value comes from the FICA/Tax Details (Federal Insurance Contributions Act/tax details) page. You can override the default from the Company table for an employee. |

W-4 Processing Status

The system resets this indicator automatically when the employee's status is updated through the Determine W-4 Exempt Renewal Application Engine Process (PY_W4_EE) or the Reset W-4 Exempt List process (TAX103). You can also update this status manually.

See(USA) Processing Forms W-4 .

|

Field or Control |

Definition |

|---|---|

| None |

Select this option if W-4 processing does not apply to the employee. This is the default value, which TAX103 resets automatically for those who fail to resubmit the W-4. |

| Notification Sent |

Indicates that the employee has been notified to submit a new Form W-4. This option is set by PY_W4_EE or manually. |

| New W-4 Received |

Indicates that a new Form W-4 has been received. This option is set manually or through the W-4 Tax Information self-service transaction in PeopleSoft ePay. |

Lock-In Letter Details

|

Field or Control |

Definition |

|---|---|

| Letter Received |

Select this check box if a letter has been received from the Internal Revenue Service (IRS) specifying the allowances an employee is allowed to take. |

| Limit on Allowances |

Enter the maximum number of allowances possible. The value that you enter in the Withholding Allowances field cannot exceed the value that you enter in this field. |

State Tax Options

|

Field or Control |

Definition |

|---|---|

| Use Total Wage for Multi-State Taxation |

Select this check box to use taxable wages from all work states in the calculation of state taxes. For states, such as Arizona, that base their calculation on a percentage of federal withholding tax (FWT):

For states, such as Alabama, Iowa, Missouri, and Oregon, that include a credit for FWT in their SWT calculation:

|

| Always create W2 for PA NQDC Reporting (always create W-2 for Pennsylvania nonqualified deferred compensation reporting) |

Select this check box if the employee has Pennsylvania W-2 reportable nonqualified deferred compensation amounts but does not have any Pennsylvania state taxable wages or state tax withheld for the tax year being reported. Selecting this check box ensures that the system reports the Pennsylvania nonqualified deferred compensation on the employee's W-2 even though the employee doesn't have any reportable Pennsylvania earnings. See Year End Processing: U.S., Puerto Rico, and the U.S. Territories Guide |

Tax Treaty/Non-Resident Data

Use these fields to enter information for nonresident alien employees. All nonresident alien employees (including those not governed by tax treaties) must be identified as nonresident alien employees on the Federal Tax Data record to invoke the nonresident alien withholding tax calculation.

|

Field or Control |

Definition |

|---|---|

| Country |

Select a country from the list, or select one of the generic entries that are prefixed with $ that you may have established on the NR Alien Tax Treaty table (nonresident alien tax treaty table). Note: You must set up countries that do not have treaties with the U.S. on the NR Alien Tax Treaty table. See (E&G) Setting Up 1042 Processing for Non-resident Aliens. |

| Treaty ID |

Select the appropriate treaty ID. If the employee is from a country with which the U.S. does not have a treaty, select NO TREATY. |

| Form W9 Received and Form W9 Effective Date |

If the NRA employee is a resident for tax purposes and files a W9, select Yes and enter the appropriate date in the Form W9 Effective Date field. Employees who file a Form W9 that takes effect before the end of the current pay period are processed as if they did not have a treaty; their earnings are taxed as W-2 earnings instead of 1042 earnings. Select No if the employee is from a country with which the U.S. does not have a treaty. |

| Taxpayer ID Number |

Enter the taxpayer ID number of the employee. If you enter a value here, the system uses this value instead of the social security number when producing the 1042 forms/magnetic media. |

| NRA Withholding Rule |

Select from these options:

|

(E&G) Education and Government

The information in this group box enables the eligible employee to be subject to a reduced tax treaty rate. To claim benefits of a treaty, an employee must have a visa and be a resident of one of the treaty countries. An employee can claim benefits for only one treaty at any particular time. Employees who want to claim benefits under a tax treaty must submit a written statement to their employer, along with applicable forms.

Use the Form 8233 Received and Form W8 Received options to determine the employee's eligibility for reduced tax treaty rates. You must mark the correct form for the specified income code by the end of the current pay period. Otherwise, the affected earning will be taxed as W-2 earnings instead of 1042 earnings.

|

Field or Control |

Definition |

|---|---|

| Treaty Expiration Date |

The treaty expiration date appears. The system calculates the date based on the date of entry and rules that are established on the Tax Treaty/NR Data table. |

| Form 8233 Received |

If the NRA employee filed a Form 8223, select Yes and enter the appropriate dates in the Form 8233 Effective Date and From 8233 Expiration Date fields. Form 8223 is required for all income codes except 12 (royalties) and 15 (scholarships and fellowships). |

| Form W8 Received |

If the NRA employee filed a Form W8 for scholarship and fellowship income or royalties, select Yes and enter the appropriate dates in the Form W8 Effective Date and Form W8 Expiration Date fields. |

(E&G) Allowable Earnings Codes

The system populates the Allowable Earnings Codes grid with information entered on the Treaty/NR Alien Table page according to the country and treaty ID that you specify.

|

Field or Control |

Definition |

|---|---|

| Eligible Earnings Per Year |

The earnings caps that apply to each earnings type as per the tax treaties for nonresident aliens. |

| Tax Rate After Form Received |

For nonresident aliens, whose forms (8223 or W8-BEN) have been completed and are in effect, this is the tax rate that is applied to their income until the income exceeds the maximum earnings specified. |

| Tax Rate Before Form Received |

The tax rate that is applied to the nonresident alien employee's income if their forms (8223 or W8) have not been received. When the Form 8233 Received field value is No, and Tax Rate Before Form Received is 0.999900, the system taxes the payment as Form W-2 earnings. When the Form 8233 Received field value is No, and Tax Rate Before Form Received is any value other than 0.999900, the system taxes the payment as Form 1042-S earnings using the rate specified in Tax Rate Before Form Received field. |

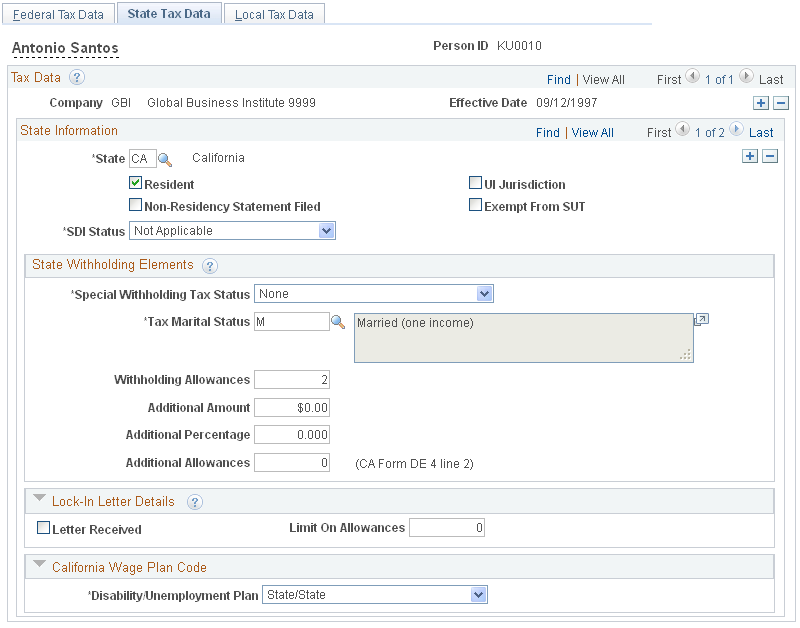

(USEA, USF) Use the State Tax Data page (TAX_DATA3) to enter and maintain state tax information that the system uses to calculate state taxes for employees.

Navigation

Image: State Tax Data page

This example illustrates the fields and controls on the State Tax Data page .

Enter state tax data on this page. State taxes include state unemployment tax (SUT), state disability insurance (SDI), and Family Leave Insurance (FLI), if applicable.

If an employee works for multiple companies, tax data is defined by company. If the employee works in multiple states or lives in a state other than the state of employment, each state must be identified on these pages. State taxes are calculated for the employee’s residence and work locations based on Reciprocity Rules, the resident flag value on employee tax data, and the state(s) entered on the paylines.

Note: For Guam (GU), Virgin Islands (VI), and American Samoa (AS): Although employees in these territories are not subject to federal withholding, they are subject to territory withholding at the same rate as federal. The system uses the marital status and withholding allowances information on the Federal Tax Data page to calculate the territory withholding required by each of these territories.

State Information

|

Field or Control |

Definition |

|---|---|

| State |

Select the state. Certain state-specific page elements are shown or hidden depending on the state that you select. |

| Resident |

Select this check box if the state selected in the State field is the state of residence. |

| Non-Residency Statement Filed |

Select this check box if the employee has completed the necessary nonresidency certificate. |

| UI Jurisdiction (unemployment insurance jurisdiction) |

Select this check box if the state selected in the State field is the state of jurisdiction for unemployment insurance tax. Note: State unemployment tax (SUT), and state disability insurance (SDI) if applicable, are usually calculated for the employee's primary work state. |

| Exempt from SUT (exempt from state unemployment taxes) |

Select this check box if the employee's earnings are exempt from SUT. This field reflects the value entered in the Company Exempt from SUT (company exempt from state unemployment taxes) field on the Company table. |

| SDI Status (state disability insurance status) |

This field reflects the value of the SDI deduction on the State Tax table and is derived from the employee's SDI status entered on the Company table. Select Exempt if the employee's earnings are exempt from SDI or Voluntary Disability Insurance tax. Select Not Applicable if the state does not have state disability or does not require employers to carry private disability plans. Select Subject if the employee's earnings are subject to SDI tax. Select Voluntary Disability Plan if the company has a voluntary disability plan that covers the employee. |

State Withholding Elements

Use these fields to enter state-specific withholding information.

|

Field or Control |

Definition |

|---|---|

| Special Withholding Tax Status |

Specify the employee's special withholding tax (SWT) status. The system calculates the withholding tax based on the value you select here and other factors. See Special Withholding Tax Status.

|

| Tax Marital Status |

Select the appropriate tax marital status for SWT. The system displays the associated description. Note: Depending on the state that you selected in the State field, different field values for this field appear. To prevent state taxes from being withheld, the combination of Special Withholding Tax Status = Maintain taxable gross and Tax Marital Status = X must be selected. When Maintain taxable gross is selected, the system automatically sets the Tax Marital Status field to X when you select Save. If you select a Tax Marital Status of X and the Special Withholding Tax Status field is not set to Maintain taxable gross, an error message appears saying that X is not allowed if Maintain taxable gross is not selected. Note: For Connecticut, the description of the Tax Marital Status field value X is Connecticut Withholding Code E, indicating that the employee selected Withholding Code E on Connecticut Form CT-W4. For all other states, the description is Claiming exemption from withholding. |

| Withholding Allowances |

Enter the number of allowances that the employee claims for SWT purposes. This number should match the number on the employee's state withholding allowance certificate. For states that have their own withholding allowances form, the system displays informational text explaining where this information appears on the state form. |

| Additional Amount |

Enter an additional flat amount to withhold. The effect of this field depends on the option that you select in the Special Tax Status group box. |

| Additional Percentage |

Enter an additional percentage to withhold. The additional withholding is calculated by taking a percentage of the taxable wages. |

| Additional Allowances |

If applicable, enter any additional allowances that the employee claims for SWT purposes. For states that have their own withholding allowances form, the system displays informational text explaining where this information appears on the state form. |

Arizona-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| AZ Withholding Percent |

Enter the percentage of taxable gross that constitutes the Arizona state withholding. |

California-Specific Page Element

The California Wage Plan Code group box appears only when the state is CA.

The California Wage Plan Code is used only by employees of the California Public Employees Retirement System (PERS) to identify a wage continuation plan for employees in the public sector - such as schools and government - or religious organizations that are exempt from state unemployment or disability plans, or have voluntary plans instead.

|

Field or Control |

Definition |

|---|---|

| Disability/Unemployment Plan |

Leave the value set at the default State/State (state disability plan and state unemployment) unless otherwise instructed by your organization's tax professionals. Values are: DI Exempt/State (disability unemployment exempt/state), None/None, None/State, State/Exempt, State/State, Voluntary/Exempt, and Voluntary/State. |

Connecticut-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| CT Only |

Indicate whether the withholding adjustment amount is an Increase or Decrease amount. The system increases or decreases the employee's CT withholding only on payments of regular wages. If regular and supplemental wages are paid concurrently, the system applies the increase or decrease to the regular earnings only, and not to the supplemental wages. |

Louisiana-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| LA Only |

Indicate whether the withholding adjustment amount is an Increase or Decrease amount. The system increases or decreases the employee's Louisiana withholding only on payments of regular wages. If regular and supplemental wages are paid concurrently, the system applies the increase or decrease to the regular earnings only, and not to the supplemental wages. |

Mississippi-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| MS Annual Exemption Amount |

Enter an annual exemption amount for the employee from the employee's completed Mississippi withholding exemption certificate. This exemption amount reduces the employee's taxable gross before the SWT calculation for each pay period. |

New Jersey and New York-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| FLI Status (family leave insurance status) |

Indicate the employee's status for the New Jersey Family Leave or New York Paid Family Leave Insurance tax: Select Exempt if the employee's earnings are exempt from the FLI tax. Select Subject if the employee's earnings are subject to FLI tax. Select Voluntary Plan if the company has a voluntary family leave insurance plan that covers the employee. |

Puerto Rico-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| PR Retirement Plan |

(E&G) This check box is visible only if Education and Government is selected on the Installation table - Products page. Select to indicate that the employee is a participant in a government pension or retirement plan of the Commonwealth of Puerto Rico. The employee's government or retirement plan contribution is factored into the withholding calculations. |

Vermont-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| VT Health Coverage Indicator |

Select from the following values:

|

Wisconsin-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| WI WT-4A Filed |

This check box appears only if the state is WI and the Special Tax Status is Maintain Taxable Gross. Select this check box if you want the amount entered in the Additional Amount field to be treated as a flat withholding amount and used in reciprocity calculations. For example, if an employee lives in California and works in Wisconsin and files a WI WT-4A indicating that $100 be deducted as a Wisconsin additional amount, then selecting this check box ensures that employee's California withholding is reduced by $100 as required by the reciprocity rules. |

Lock-In Letter Details

|

Field or Control |

Definition |

|---|---|

| Letter Received |

Select this check box if a letter has been received from the state taxing authority that specifies the allowances an employee is allowed to take. |

| Limit On Allowances |

Enter the maximum number of allowances possible. The value that you enter in Withholding Allowances field cannot exceed the value that you enter in this field. |

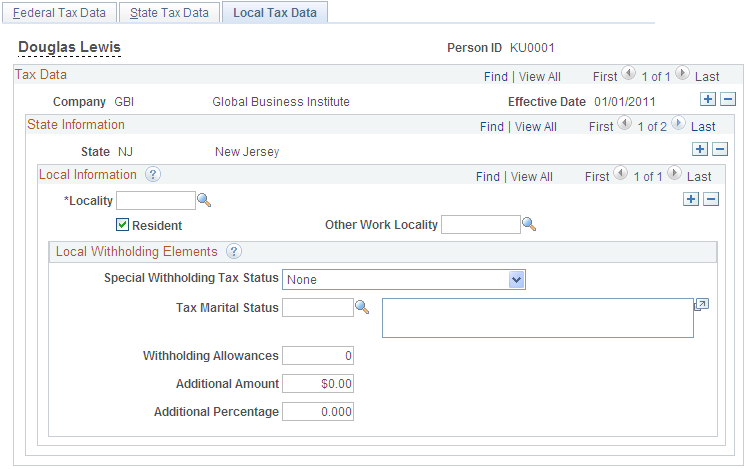

(USEA, USF) Use the Local Tax Data page (TAX_DATA5) to enter employee tax data for each locality in which an employee lives or works.

Navigation

Image: Local Tax Data page

This example illustrates the fields and controls on the Local Tax Data page.

Local Information

|

Field or Control |

Definition |

|---|---|

| Locality |

Select the locality that the employee lives or works in. If the employee lives or works in multiple localities, enter a row for each different locality an employee pays taxes in. Define localities on the Company Local Tax Table page. |

| Resident |

Select this check box if the locality selected in the Locality field is a resident locality. An employee can have more than one resident tax locality. You may need more than one resident locality entry in cases where two different taxes exist for the same locality, such as a municipality tax and a school district tax. Note: (IN) In Indiana, the employee's county of residence is the first determining factor for tax withholding. If the county in which an employee resides on January 1 of any year imposes a tax, you must withhold that tax. The employee is liable for the tax for the entire year, even if he or she moves to a nontaxing county. If the county of residence does not impose a tax, but the county in which the principal place of work is located does, you must withhold at the appropriate nonresident rate. For employees moving from out of state into a taxing Indiana locality, withholding does not begin until the next January 1, when residence determination is made. |

| County of Principal Employment |

(IN) This check box appears only when the state selected is Indiana and the Resident check box is deselected. For a nonresident employee working in Indiana, county tax must be calculated and withheld for the entire year based on the Indiana County of Principal Employment as of January 1 entry that is specified on the employee’s completed Indiana Form WH-4 for the current year. For a nonresident employee, select the County of Principal Employment check box to identify this locality as the Indiana County of Principal Employment that is specified on the employee’s Form WH-4. Note: You can select the check box for only one Indiana county in an employee’s tax data record. |

| Other Work Locality |

Select another work locality if you have more than one work tax for a given locality. The entry in this field is used to link to another local work tax code. See Understanding Split Local Tax Distribution for KY, AL, and OR. |

Local Withholding Elements

|

Field or Control |

Definition |

|---|---|

| Special Withholding Tax Status |

Specify the employee's special withholding tax status. The system calculates the withholding tax based on the value you select here and other factors. See Special Withholding Tax Status.

|

| Tax Marital Status |

Enter the marital tax status for local withholding taxes. Depending on the locality that you selected, different field values appear. |

| Withholding Allowances |

Enter the number of allowances that the employee claims for local withholding tax purposes. |

| Additional Amount and Additional Percentage |

Use these fields to indicate that additional LWT taxes are to be taken. You can specify both an amount and a percentage, if appropriate. The effect of this field depends on the special tax status option that you select. |