(USA) Viewing Federal and State Tax Tables

To view federal and state tax tables, use the Federal/State Tax Table component (STATE_TAX_TABLE).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

STATE_TAX_TABLE1 |

View standard deductions, allowance amounts, and supplemental rates. |

|

|

STATE_TAX_TABLE2 |

View information needed for tax calculations. The page for the Federal Tax Table differs from the one for specific states. |

|

|

STATE_TAX_TABLE3 |

View wage bracket information. Contains data from Connecticut Table B - Withholding Tax. |

|

|

STATE_TAX_TABLE3_A |

(Available only when the state entered is CT.) View the tax status, low gross, and exemption amount, from Connecticut Table A - Exemptions, that are used for calculating Connecticut state tax exemptions. |

|

|

CT Credits Page |

STATE_TAX_TABLE3_B |

(Available only when the state entered is CT.) View the tax status, low gross, and credit percent, from Connecticut Table E - Personal Tax Credits, that are used for calculating Connecticut state tax credits. |

|

CT Phase Out Page |

STATE_TAX_TABLE3_D |

(Available only when the state entered is CT.) View the tax status, low gross, and low tax amount, from Connecticut Table C - 3% Phase-Out, that are used for calculating the phase out of the Connecticut 3% state tax rate. |

|

CT Recapture Page |

STATE_TAX_TABLE3_E |

(Available only when the state entered is CT.) View the tax status, low gross, and recapture tax amount, from Connecticut Table D - Tax Recapture, that are used for calculating the recapture of Connecticut state taxes from taxpayers over certain income brackets. |

|

STATE_TAX_TABLE3A |

(Available only when the state entered is Federal, $U.) View the withholding adjustment rate to use for nonresident alien wages. |

|

|

STATE_TAX_TABLE4 |

View wage limits for unemployment and disability taxes. |

|

|

Federal/State Tax Report Page |

PRCSRUNCNTRL |

Run TAX702 to print information from the State Tax Table and the State Other Tax Table, which store the most current tax rates and other parameters used in calculating state and federal withholding, disability, and unemployment taxes. |

|

State Tax Rate Report Page |

PRCSRUNCNTRL |

Generate TAX707 that lists information from the State Tax Rate Table, which contains bracket rates needed for calculating state and federal taxes. |

|

STATE_FUTA_CR_RED |

View and define official FUTA credit reduction states. |

Use the Federal/State Tax Table pages to view the tax data that PeopleSoft Payroll for North America uses to calculate U.S. federal, state, and certain local taxes. These pages supply the following information:

Identify the general type of withholding tax calculation employed by each jurisdiction and provide all the constants needed by the calculation routines for income tax withholding and unemployment and disability taxes.

Contain the wage bracket tax rate data used by the taxing authorities for implementing graduated taxes.

Special State Codes for Localities Using Graduated Tax Tables

In addition to the rules for state withholding, the rates for calculating federal withholding, FICA, and federal unemployment are defined on this table, primarily because the method of calculation is similar. Localities that use graduated tax tables are also included. These entries are identified by special state codes such as Z1 and Z2. Here are some of these special codes:

|

Code |

Description |

|---|---|

|

$E |

Earned income credit |

|

$U |

U.S. federal tax |

|

$UAS |

American Samoa federal tax |

|

$UGU |

Guam federal tax |

|

$UPR |

Puerto Rico federal tax |

|

$UVI |

Virgin Islands federal tax |

|

Z1 |

New York City, New York local tax |

|

Z2 |

Yonkers, New York local tax |

|

Z3 through Z9 |

MD local tax |

|

ZA through ZL |

MD local tax |

On the Federal/State Tax Table - Additional Rates page, the Tax Class LS Tax represents the Local Services Tax (LST) for Pennsylvania employees. The total LST paid by any individual in a calendar year is limited to 52 USD, regardless of the number of political subdivisions in which the individual works during the year.

LST Localities

The LST can be imposed by both municipalities and school districts. Certain LST processing requirements relate to the combined LST rate for municipalities and school districts. Therefore, you must implement the LST using Local Tax Table entries that represent combined LST tax rates. These entries have the letter "C" in position 8 of the Locality Code.

For example, the locality code O430212C for Farrel City is used to process the LST at the combined tax rate of the Farrel City municipality and the Farrel City School District.

Lump Sum and Prorated LST Deductions

When the LST is levied at a combined rate of 10 USD or less annually, it is deducted as a lump sum from the employee's first paycheck of the year in the taxing jurisdiction.

If the LST is levied at a combined rate exceeding 10 USD annually, the tax is divided equally across the number of pay periods in the employee's pay frequency. When calculating prorated pay period deductions, employers are required to round down to the nearest cent. For example, a 52 USD annual combined tax rate is deducted at 1 USD per week from employees paid weekly, or at 4.33 USD per month from employees paid monthly.

Maximum Annual Deduction

If an employee pays LST of less than 52 USD to the first municipality where the employee works during a calendar year and transfers to one or more municipalities that impose the LST, the additional tax is withheld as long as the combined LST deductions are equal to or less than 52 USD. If the combined LST deductions exceed 52 USD, only the difference between 52 USD and the total of any previous LST is withheld from the employee.

For example, an employee who is paid weekly works in locality A, which imposes a 10 USD combined LST. At this rate, the entire LST is deducted in the employee's first paycheck. The next week, the employee works in locality B, which imposes a 52 USD combined LST. Locality B is entitled to a maximum of only 42 USD because the employee has already paid 10 USD of the 52 USD annual maximum tax.

The system deducts 1 USD per week from the employee's weekly paycheck (because locality B's entire 52 USD rate is prorated across 52 pay periods in the year) until 42 USD has been collected for locality B. At this point, the employee has reached the 52 USD annual maximum, and no further deductions are taken in locality B or in any other locality where the employee subsequently works in the same year.

The state-level Pennsylvania LST Memo tax record keeps track of how much Pennsylvania LST an employee has paid for the year. During the LST calculation, the system checks this state memo tax balance before computing the LST.

When you hire an employee whose LST for the current tax year has been fully or partially withheld by another employer, you can load the amount already withheld into the employee's state tax memo balance to prevent the system from exceeding the annual maximum for that employee. Alternatively, you can leave it to the employee to file for a refund of overpaid LS tax at year end.

Rules For Employees Working in Multiple Jurisdictions

Employees are not subject to LST at more than one place of employment during a payroll period. Pennsylvania indicates that the "priority of claim" to collect the LST is as follows:

Where the employee "maintains his or her principal office or is principally employed."

Where the employee "resides and works."

Where the employee is employed that is "nearest in miles" to the employee's home.

Because the system is not able to determine which jurisdiction has the highest priority when an employee has active LST deductions set up for multiple jurisdictions, it is your responsibility to determine which LST jurisdiction has priority and to structure the employee's Local Tax Data so that the employee has only one active LST deduction set up for the correct jurisdiction.

If you fail to do this, and an employee has active LST deductions set up for multiple jurisdictions, the system deducts the tax for the first jurisdiction encountered in the processing sequence. For multiple job employees with multiple active LST deduction setups, the tax is deducted for whichever job is the first one calculated in the primary pay group.

Important! Although the system takes the LST deduction for only one jurisdiction per pay period, it is your responsibility to structure the employee's Local Tax Data to ensure that the deduction is taken for the correct jurisdiction.

If you must set up Local Tax Data records for multiple LS Tax jurisdictions for an employee to clear Payroll Error 92 (Local Tax Not Found: The local tax record for the locality cannot be found for this employee.), then you can limit the employee to one active LST by setting all but one of the employee's Local Tax Data records for LST to the Special Tax Status of "Do Not Maintain Taxable Gross and Do Not Withhold Tax".

Low Income Exemption

A jurisdiction that levies the LST at a combined rate greater than 10 USD is required to exempt from the tax employees whose total income within the jurisdiction is less than 12,000 USD for the calendar year.

To receive an up front exemption from LST deductions, an employee must provide the employer with a completed Local Services Tax Exemption Certificate. To record the employee's exemption from the tax, enter 999 as the number of Local Withholding Allowances in the employee's Local Tax Data page for the locality imposing the LST.

Entering 999 as the number of Local Withholding Allowances suspends deduction of the LST from the employee's paychecks. If the employee's YTD taxable gross for the locality reaches or exceeds 12,000 USD, then regular paycheck deductions of the tax will begin, and a catch-up lump sum tax deduction will be taken equal to the amount of tax that was not previously withheld from the employee as a result of the employee's exempt status.

Important! Once you set up an employee as exempt from a jurisdiction's LST for a particular calendar year, do not change that exempt status for the remainder of that calendar year. If an employee's exempt status is changed mid-year, the system will not take the catch-up lump sum tax deduction from the employee.

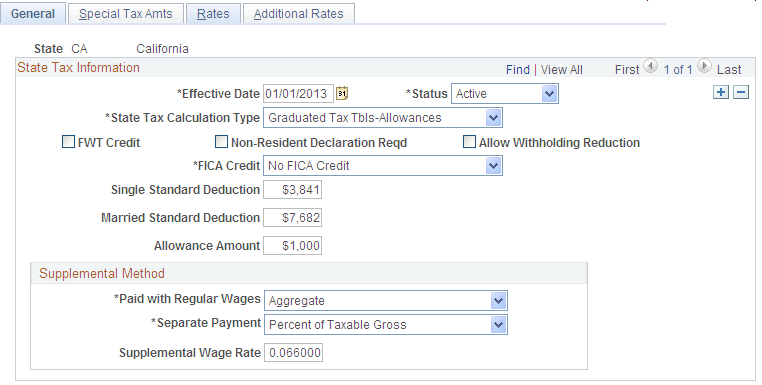

Use the Tax Table - General page (STATE_TAX_TABLE1) to view standard deductions, allowance amounts, and supplemental rates.

Navigation

Image: Tax Table - General page

This example illustrates the fields and controls on the Tax Table - General page.

Note: You shouldn't need to modify this table, but if you must, you can make changes if you have the appropriate security authorization. This applies to all pages in this component.

|

Field or Control |

Definition |

|---|---|

| State Tax Calculation Type |

Indicates the type of withholding tax calculation required by the state. |

| FWT Credit |

This check box indicates whether credit is given for FWT during calculation of state income tax withholding. |

| Non-Resident Declaration Required |

This check box indicates whether the state requires a Non-Resident Declaration for non-resident employees. |

| Allow Withholding Reduction |

This check box indicates whether the state allows a reduction amount to be computed in the state withholding calculation. Currently, this only applies to Connecticut. |

| FICA Credit |

This check box indicates whether credit is given for FICA during calculation of state income tax withholding. |

Supplemental Method

Details of the values available for selection in this group box and examples of calculations are provided in this product documentation.

See Supplemental Tax Calculations.

|

Field or Control |

Definition |

|---|---|

| Paid With Regular Wages |

PeopleSoft delivers the required selection: Aggregate − No Annualize, Aggregate, Aggregate-No Tax else Percent, Non-Resident Supplemental, Not Applicable, Percent of Taxable Gross, Special Table with Exemptions, and Special Table. |

| Separate Payment |

PeopleSoft delivers the required selection: Aggregate − No Annualize, Aggregate, Aggregate-No Tax else Percent, Non-Resident Supplemental, Not Applicable, Percent of Taxable Gross, Special Table with Exemptions, and Special Table. |

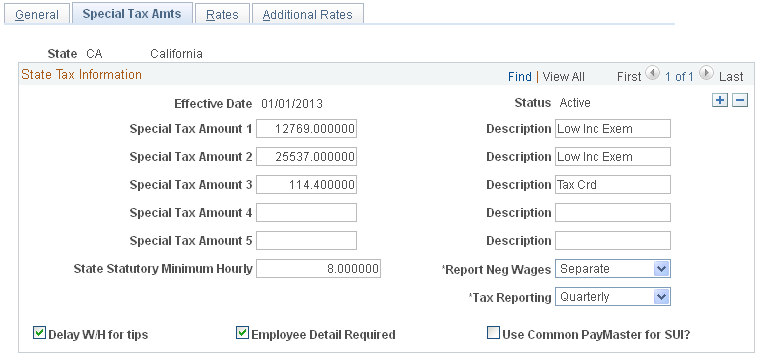

Use the Special Tax Amts page (STATE_TAX_TABLE2) to view information needed for tax calculations.

Navigation

Image: Special Tax Amts page

This example illustrates the fields and controls on the Special Tax Amts page.

Note: The page for the Federal Tax Table differs from the one for specific states.

|

Field or Control |

Definition |

|---|---|

| Special Tax Amount |

This field is used to store parameters or values used in withholding tax calculations for the selected state or federal jurisdiction. |

| Special Tax Amount 2 |

When the selected state is Federal ($U), the amount displayed in Special Tax Amount 2 is the YTD wage threshold that triggers withholding of the federally required Additional Medicare Tax . Once the YTD maximum threshold income is reached, additional medicare will be calculated. There is no limit on the amount of wages subject to the Additional Medicare Tax during the remainder of the tax year. |

| Special Tax Amount 5 |

When the selected state is Federal ($U), the amount displayed is the amount that the system adds to the annualized wages of the nonresident alien (NRA) solely for purposes of NRA tax withholding calculation. This amount does not add to the employee's federal taxable gross balance. |

| State Statutory Minimum Hourly |

The system uses this field to calculate tip credit to pay overtime for tipped employees. The minimum hourly rate required by that state appears here. The system also uses this field to retrieve the state minimum wage that is required when the state hourly minimum wage is required for garnishment as set on the Calculation Formula Page. |

| Report Neg Wages |

Options are include or separate. |

| State Tips W/H Threshold |

This field appears if the value in the State field is $U. This field is used in conjunction with state regulations for delaying the withholding of taxes on tips until the employee reports monthly tips in the amount equal to the threshold amount. This field displays the monthly threshold amount from the federal regulations and as of now all states use that threshold amount. For states that allow you to delay withholding on tips, you can specify by Pay Group whether you delay withholding on tips. |

| Tax Reporting |

Options include Annual, Monthly, or Quarterly. |

| Delay Withholding for Tips |

On this page, this check box refers to state income tax. For each state, PeopleSoft selects or deselects this check box, depending on whether the state allows employers to delay withholding on tip income until the monthly threshold amount is reached. For states that allow you to delay withholding on tips, you can specify by Pay Group whether you'll delay withholding on tips. |

| Employee Detail Required |

This field is informational only and indicates whether a state requires the quarterly reporting of individual employee wage data. All states currently require such reporting. |

| Use Common PayMaster for SUI |

This check box is selected if the state recognizes common paymaster status between companies for purposes of state unemployment insurance taxes. |

Use the Tax Table - Rates page (STATE_TAX_TABLE3) to view wage bracket information.

Contains data from Connecticut Table B - Withholding Tax.

Navigation

Image: Tax Table - Rates page

This example illustrates the fields and controls on the Tax Table - Rates page.

|

Field or Control |

Definition |

|---|---|

| Tax Status |

The appropriate Federal/State tax status (Married, Single, and so on). Note: Puerto Rico: Head House is not a valid tax status for wages paid on or after January 1, 2012. See Employer’s Guide to Withholding of Income Tax at Source on Wages paid after Dec 31, 2011 but before Jan 1, 2013 published by Departamento de Hacienda. |

| Low Gross |

The minimum taxable gross for the bracket. |

| Low Tax |

The tax to be withheld on the corresponding minimum gross. |

| Tax Rate |

The rate to be applied until the next bracket is reached. |

| Credit Amount |

Not currently used by PeopleSoft Payroll for North America. |

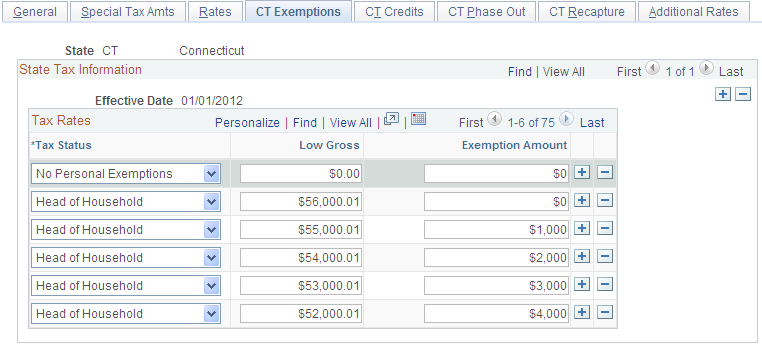

Use the CT Exemptions page (STATE_TAX_TABLE3_A) to view the tax status, low gross, and exemption amount, from Connecticut Table A - Exemptions, that are used for calculating Connecticut state tax exemptions.

Navigation

Image: CT Exemptions page

This example illustrates the fields and controls on the Connecticut Exemptions page.

Note: The CT Exemptions page is Available only when the state entered in the Tax Table search dialog is CT.

When you access the Federal/State Taxes, Tax Table component for the state of CT (Connecticut), CT-specific data and pages appear. The CT-specific pages store values used in the calculation of Connecticut state taxes.

The Rates page contains values from Connecticut Table B - Withholding Tax.

The CT Exemptions page contains values from Connecticut Table A - Exemptions.

The CT Credits page contains values from Connecticut Table E - Personal Tax Credits.

The CT Phase Out page contains values from Connecticut Table C - 3% Phase-Out.

The CT Recapture page contains values from Connecticut Table D - Tax Recapture.

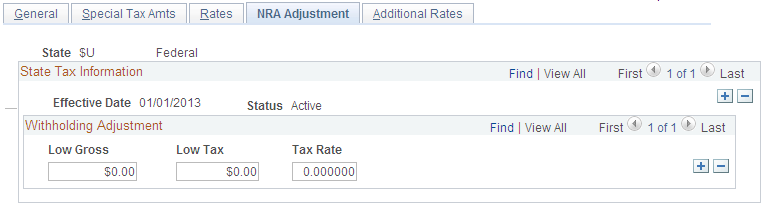

Use the NRA Adjustment page (STATE_TAX_TABLE3A) to view the withholding adjustment rate to use for nonresident alien wages.

Navigation

Set Up HCM, Product Related, Payroll for North America, Federal/State Taxes, Tax Table, NRA Adjustment

Image: NRA Adjustment page

This example illustrates the fields and controls on the Nonresident Alien Adjustment page.

Note: The NRA Adjustment page is available only when the State = $U (Federal).

View the income, tax, and withholding rate to use to calculate the additional withholding adjustment amount required by IRS for nonresident alien wages.

|

Field or Control |

Definition |

|---|---|

| Low Gross |

The minimum taxable gross income for the bracket. |

| Low Tax |

The tax to be withheld on the corresponding minimum gross. |

| Tax Rate |

The rate to apply until the next bracket is reached. |

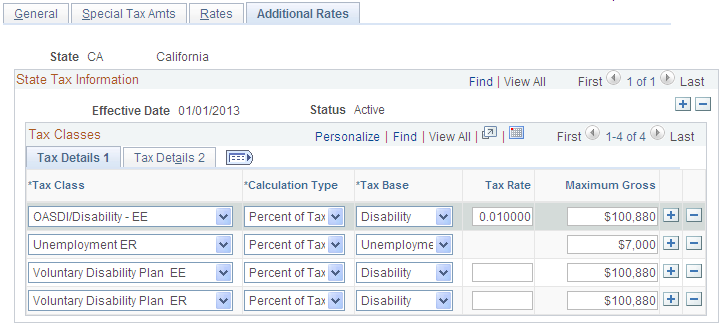

Use the Tax Table - Additional Rates page (STATE_TAX_TABLE4) to view wage limits for unemployment and disability taxes.

Navigation

Image: Tax Table - Additional Rates page

This example illustrates the fields and controls on the Tax Table - Additional Rates page.

|

Field or Control |

Definition |

|---|---|

| Tax Class |

Tax classes identify different taxes that share certain characteristics. Local Services Tax represents Local Services Tax (LST) for Pennsylvania employees. See |

| Calculation Type |

Options are % Tax Grs, %ER Wage, and N/A. |

| Tax Base |

Options are Disability, Unemployment, and Withholding. |

| Tax Rate |

The tax rate for employer unemployment or disability contributions is blank on this page. The rate used during payroll calculations comes from the Company State Tax table. |

| Maximum Gross |

If a tax applies only to a portion of an employee's annual wages up to a specified limit, such as employer unemployment taxes, that limit amount appears in this field. An entry of all 9s, as with Medicare taxes, indicates a tax without limit. |

| Maximum Tax |

If there is an annual limit on a particular type of tax, such as Pennsylvania's Local Services Tax, enter that limit amount here. |

| Taxability |

Select Employee Tax Only, Employer Tax Only, Empl and Emplr Tax, or Memo Tax Only to indicate whether a tax is paid by the employee, paid by the employer, or paid in equal matching amounts by both. |

| Period Maximum |

If selected, this option indicates that the tax is calculated for a period other than annual. Two examples of this are SDI in New York and Hawaii, both of which have weekly maximums. |

| Self Adjust (self-adjusting) |

This check box is for information only and does not affect processing. |

| Delay W/H for Tips (delay withholding for tips) |

On this page, this check box is selected or deselected for each additional tax the state may impose. For each state, PeopleSoft selects or deselects this check box, depending on whether the state allows employers to delay withholding on tip income until the monthly threshold amount is reached. For states that allow you to delay withholding on tips, you can specify by Pay Group whether you'll delay withholding on tips. |

Voluntary Disability Plans

Of the states that provide disability insurance plans (currently California, Hawaii, New Jersey, New York, Rhode Island, plus Puerto Rico), all but Rhode Island allow employers to provide voluntary disability plans in place of the state plan. PeopleSoft maintains the Tax Class rows on the Federal/State Tax Table - Additional Rates page for the Employer and Employee paid tax for voluntary disability plans for each of these states.

Note: If you implement a voluntary disability plan for California, Hawaii, New Jersey, New York, or Puerto Rico, you must set up the appropriate tax rates on the Company State Tax table and the VDI/FLI Administrator table.

State Unemployment Insurance (SUI) Tax

You must make sure that the unemployment insurance taxable gross and tax balances transferred during the conversion process are consistent with the unemployment tax rates that have been entered for each quarter on the Company State Tax Table page.

Warning! If these amounts are not consistent and in balance, the system will either charge or refund additional unemployment tax amounts to account for the difference in the quarterly unemployment insurance tax balances.

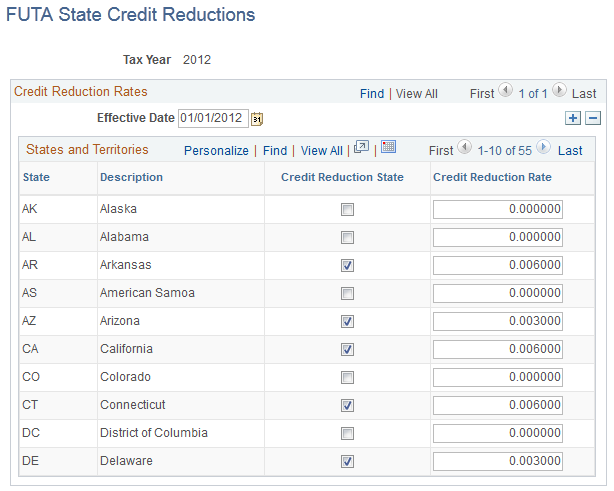

Use the FUTA State Credit Reductions page (STATE_FUTA_CR_RED) to define official FUTA credit reduction states.

Navigation

Image: FUTA State Credit Reductions page

This example illustrates the fields and controls on the FUTA State Credit Reductions page.

The standard net effective FUTA tax (Unemployment ER) rate is defined on the Tax Table - Additional Rates Page. You can calculate any additional U.S. Federal unemployment tax for which you may be liable as a result of paying wages to employees in credit reduction states. .

An employer calculates additional FUTA tax liability for credit reduction states on Form 940 Schedule A , and the total calculated credit reduction for all states is transferred to line 11 on Form 940, the Employer’s Annual Federal Unemployment Tax (FUTA) Return.

Important! PeopleSoft does not maintain this page. If you intend to use the FUTA credit reduction functionality, then your organization must update the page to keep it current. Credit reduction states are determined by the U.S. Department of Labor. Each November, the U.S. Department of Labor publishes a list of credit reduction states (and their respective credit reduction rates) for the tax year which is about to conclude. See “Subject Data Available” on the US Government website http://workforcesecurity.doleta.gov/unemploy/finance.asp .The list is also included in the PeopleSoft December tax update each year.

|

Field or Control |

Definition |

|---|---|

| Credit Reduction State |

Select this check box to indicate that the state is an official FUTA credit reduction state. Once you have confirmed a payroll with a particular state identified as a Credit Reduction State , do not deselect the Credit Reduction State check box for that state until after the final payroll for the tax year has been calculated and confirmed. Warning! To end a state’s status as a Credit Reduction State mid-year, change the value in the Credit Reduction Rate field to zero; do not deselect the selected Credit Reduction State check box. This point is critical to maintaining the self-adjusting feature of the FUTA Credit Reduction Tax. When selected, FUTA Credit Reduction (additional FUTA) is calculated as follows for employees whose UI Jurisdiction state is that state:

If the Credit Reduction State check box is not selected, FUTA Credit Reduction (additional FUTA) taxable wages are calculated, but tax is not calculated, even of a value is specified in the Credit Reduction Rate field . The Credit Reduction State check box must be selected for FUTA Credit Reduction (additional FUTA) tax to be calculated. |

For more information on FUTA Credit Reduction States and how they affect an employer’s unemployment taxes, refer to the Internal Revenue Service website, which as of the date of this publication is: http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/FUTA-Credit-Reduction.