8Managing Collections

Managing Collections

This chapter provides information about standard Siebel Automotive functionality for collection management. It consists of the following topics:

About Collections

Collection is the process of collecting money from customers who are delinquent or are unable to make a payment by a specified date. Collection is a component of the lending cycle and can affect a company’s bottom line. Those accounts that a company is unable to collect on must be written off in the end, which reduces the company’s profit.

A collection application allows a company to identify delinquent accounts and arrange them into predefined lists so agents can follow up and obtain payment. Many companies group delinquent accounts into three or more buckets, for example, 30 days, 60 days, and 90 days. Each bucket results in a different series of actions. For example, accounts in the 30 days bucket might receive a letter reminding them to pay the outstanding balance. Accounts in the 60 days bucket, however, might get a call from a collection agent to discuss the balance and payment scenarios.

Using the Siebel application, administrators can query and create lists of delinquent accounts based on the number of days the account has been delinquent. Companies can also use the Siebel application in conjunction with third-party applications. For example, if a company uses a third-party application to track delinquent accounts, users can take lists generated by these applications and use the Siebel application to execute collection activities.

Administrators use the procedures in this chapter to set up collection activities, for example creating assignment rules, managing collection preferences and correspondence information, automating the cure process, and enabling workflows.

Collection agents, managers, or end users, use the Siebel application to view work summary information about delinquent accounts, execute collection tasks, and record skip trace, bankruptcy, and legal information related to delinquent accounts.

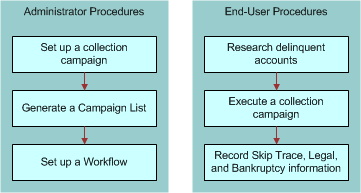

The image describes the typical administrator and end-user procedures for Collection Management. The administrator first sets up the collection task, then generates a campaign list, and finally sets up a workflow. End-user procedures include the following: the end user researches delinquent accounts, then executes a collection task, and finally manages skip trace and impound service requests.

Scenario for Collections

The following business scenario features sample tasks performed by a Siebel administrator and a collection agent. Your company may follow a different workflow according to its business requirements.

Siebel Administrator Checks for Delinquent Accounts

A Siebel administrator at a bank can use Siebel Automotive to monitor accounts that are 60 days delinquent and create a list of delinquent accounts. The administrator can then assign these accounts his team for collections follow up.

Bank Collection Agent Contacts Customers

A bank collection agent is calling customers whose accounts are 60 days delinquent. Prior to making her first call, she accesses the Collection Summary view to learn more about the customer's financial accounts and payment history. Her first call is to a customer who is 60 days delinquent on a vehicle loan. The collection agent views additional information by drilling down on the Account # link.

Using an automatic dialer, the collection agent calls the customer. After the call connects, the collection agent uses the call guide and summary information to explain the purpose of the call. The customer explains his situation to the collection agent and mentions scheduling a payment so the collection agent navigates to the Collections Promise to Pay view to record the promise. In this view, she can select several promises options, including single, two part, or long term. She can also enter the amount and date information for each promise to pay. The collection call ends.

In this scenario, an administrator is responsible for administering the Siebel Automotive application and requires administrative responsibilities to:

Generate a list of delinquent accounts from either Siebel financial accounts, legacy applications, or Oracle Business Intelligence.

End users are collection agents. They enter information to:

View summary information about delinquent accounts.

Execute collection tasks by contacting customers having accounts that are past due and recording customer responses and payment promises.

Record skip trace, bankruptcy, and legal information related to delinquent accounts.

End users are also collection managers. They review information to:

View their agent’s work summary information.

Manage collection reassignments.

Approve or reject repossession SRs.

Administering Collection Tasks

Siebel administrators can create a list of customers with delinquent accounts by querying the Siebel application database, or by importing an external list from a third-party application. In addition, the administrators define the collection assignments and reassignments, promise-to-pay preferences, and so on.

As a Siebel administrator, you can generate a delinquency list by:

Setting up a workflow. Set up a workflow to calculate the total days due based in the financial account information and assign those accounts to a specific queue or agent. For more information, see Siebel Business Process Framework: Workflow Guide.

Using Oracle Business Intelligence. Use Oracle Business Intelligence to track past due accounts and then import the list to the Siebel database. For more information, see Oracle Business Intelligence Server Administration Guide.

The following administrator procedures are described in this topic:

Activating Siebel Automotive Workflows

You can save time and reduce keystrokes by using workflows to automate steps that are repeatedly performed by end users. For more information, see the Siebel Business Process Framework: Workflow Guide.

The following table describes the workflow types: repossession, promise-to-pay (PTP), cure process, skip trace, and impound. You can enable them for the Siebel Automotive application. Administrators activate the workflows from the Administration - Business Process, then the Workflow Deployment view.

Table Siebel Automotive Workflows and Workflow Types

| Workflow Names | Repossession | PTP | Cure | Skip Trace | Impound |

|---|---|---|---|---|---|

Auto CF Collection - Update Cure Status |

No |

No |

Yes |

No |

No |

Auto CF Collection - Calculate DueDate Process |

No |

Yes |

Yes |

No |

No |

Auto CF Collection - Update PTP Broken Flag Process |

No |

Yes |

No |

No |

No |

Auto CF Collection - Update PTP Data Process |

No |

Yes |

No |

No |

No |

Auto CF Repossession Approval Request Process |

Yes |

No |

No |

No |

No |

Auto CF Repossession Approved Process |

Yes |

No |

No |

No |

No |

Auto CF Repossession Denied Process |

Yes |

No |

No |

No |

No |

Auto CF Repossession Package Sent Process |

Yes |

No |

No |

No |

No |

Auto CF Skip Impound Activity Process |

No |

No |

No |

Yes |

Yes |

Auto CF Update Follow-up Date Process |

Yes |

Yes |

Yes |

No |

No |

Creating Assignment Rules for Collection Assignments

Within the Siebel application, the financial account is one of the data elements used to identify a lease or loan relationship with a customer. When a financial account becomes delinquent it becomes the responsibility of a collections agent. Administrators set up a workflow to calculate the total days due based in the financial account information and assign those accounts to a specific queue or agent. For more information about setting up workflows, see Siebel Business Process Framework: Workflow Guide.

All changes to accounts can be done in real-time by using Assignment Manager. The Siebel administrator can set up different criteria, for example Days Past Due, that is then used for assigning financial account information to a collector. Administrators first create assignment rules and then verify the rules in Collections - Assignments view. For more information about assignment rules, see Siebel Assignment Manager Administration Guide.

To create assignment rules, first you must activate the financial account, then you create the rule criterion for when an account is past due and so on. Perform the following procedures to create assignment rules for collection assignments.

To add assignment rules

Navigate to Administration - Assignment, then the Territories view.

To add a territory, in the Territories list, click New and complete the necessary fields.

Some fields are described in the table that follows.

Field Comments Territory Name

Name of the territory assignment rule. For example, Rule1_AutoCF

Objects to be Assigned

Financial Account

Activation

Set this to the current date of activation

To associate criteria to the rule, in the Criteria list, select New and complete the necessary fields.

Some fields are described in the table that follows.

Field Comment Rule Criterion

For example, Days Past Due or Related Financial Accounts Days Past Due

Inclusion

Include

Score

For example: 100, 0, or 80

Based on scores, financial accounts are assigned to different collection agents. For more information about scores, see Siebel Assignment Manager Administration Guide.

To associate values to the past due rule, in the Values list, click New and complete the necessary fields.

Some fields are described in the table that follows.

Field Comment Days Past Due Low

Enter the minimum amount of days that the financial account is past due, for example: 30.

Days Past Due High

Enter the maximum amount of days that the financial account is past due, for example: 45.

To associate positions to the rule, in the Positions list, click New.

In the Add Positions dialog box, select the employee you want to associate with the past due rule.

To view assignment rules

Navigate to Administration - Collections, then the Collections Assignment view.

In the Collections Assignments list, click Query.

In the Assignment field, query for the Territory name you previously created. For example, Rule1_AutoCF

If the record is present, your assignment rule is created.

You can modify the assignment rules at this time.

Note: You must be logged in as a collections manager or administrator to verify the rules created in the Assignment Administrator view.

Using Assignment Rules

After you have created the assignment rules, you must release them by performing the procedure that follows. Releasing assignment rules activates the rules and makes them usable. The assignment rules will not assign accounts based on rules however. For more information on assignment rules, see the Siebel Assignment Manager Administration Guide.

To release assignment rules

Navigate to Administration - Collections, then the Collections Assignments view.

In the Collections Assignments list, click Query.

In the Assignment field, query for the Territory name you want to use. For example, Rule1_AutoCF.

Click the Release button on the Collections Assignments applet

This rule is now activated. The rule can also be released from the Administration - Assignment, then the Territories view where it is created.

To assign accounts according to active assignment rules

Using the start task command, enter the following command to assign accounts according to the rules created:

"start task for comp AsgnBatch with AsgnMode="MatchAssign", AsgnObjName="Financial Account", ObjWhereClause="where ASSET_NUM LIKE '<ACCOUNT NAME>'"

where the <ACCOUNT NAME> is the name of the financial account.

If you want to assign all financial accounts which have names like "Collections1", "Collections2", "Collections3", and so on, the command would be as follows:

Start task for comp AsgnBatch with AsgnMode="MatchAssign", AsgnObjName="Financial Account", ObjWhereClause="where ASSET_NUM LIKE 'Collections%'"

This assigns all accounts selected by the query in the statement based on all current active assignment rules.

To verify that the financial accounts are assigned

Navigate to Administration - Collections, then the Collections Reassignment view.

In the Employee list, Position field query to find the position.

For example, Managing Collections - Managing Collections Preferences

Verify the First Name and Last Name field.

When you select the record in the Employee list, the accounts that are associated with the positions appear at the end of the screen.

Managing Collections Preferences

Siebel administrators use this screen to define and update factors that determine how the collections process is executed, for example promise-to-pay preferences, PTP excluded dates, PTP followup dates, and default followup activities.

The following table describes the types of information, that is Preferences, PTP Follow-Up, PTP Excluded Dates, and Activity Follow-Up, that appears in the Collection Summary view.

Table Collection Preferences View

| Summary | Comments |

|---|---|

Preferences |

Describes the promise to pay preferences, for example dollar amount and time tolerance for the financial account. |

PTP Follow-Up |

Defines the followup days for broken PTP by method of payment. |

PTP Excluded Dates |

Lists the promise to pay excluded dates. Administrators can add dates to define their companies collections preferences. |

Activity Follow-Up |

Describes the followup activities, for example Inbound or Outbound Call. |

To set up a promise-to-pay tolerance amount

Navigate to the Administration - Collections, then the Collections Preferences view.

In the Preferences form, complete the necessary fields.

Some fields are described in the following table.

Field Comments Tolerance Amount

The Tolerance Amount is the least amount of payment that the collection agent will tolerate from the customer. How much Tolerance (in Amount & %) can be given for a Promise to Pay for various accounts. Based on this tolerance, promise-to-pays can be broken if the amount received is in the limits of the tolerance on promised date. Therefore, the Tolerance Amount is a check to evaluate if PTP records are broken or not. The amount is the limit of tolerance.

Maximum Days in Future

10 (Promise-to-Pay Due Date Validation)

Not Today, Not on Sunday, Not on Saturday check boxes

Promise-to-Pay Due Date Validation

Min Days before Cure

Cure Process, Cure Duration (Days)

For example 55

Wait before follow up

Repossession

For example 2

Replace existing position

Manual Assignment Preferences

Checked

To view system preferences for the Collections processes

Navigate to Application - Administration, then the System Preferences view.

In the System Preferences list, query for *CF*.

Collections Processes that have already been set up appears as described in the following table.

System Preference Name System Preference Value CF_CURE_DURATION

10

CF_CURE_TOLERANCE_DAYS

55

CF_PTP_FUTURE_DAYS_MAX

10

CF_PTP_NOT_SATURDAY

Y

CF_PTP_NOT_SUNDAY

Y

CF_PTP_NOT_TODAY

Y

CF_PTP_TOLERANCE_AMNT

1.00

CF_REPLACE_EXIST_POS

Y

CF_REPO_FOLLOW_UP

2

To set up PTP excluded dates

Navigate to the Administration - Collections, then the Collections Preferences view.

In the PTP Excluded Dates list, create a new record and complete the necessary fields.

Some fields are described in the following table.

Field Example Name

Christmas

Excluded Date

12/25/05

To set up a promise to pay followup definition

Navigate to the Administration - Collections, then the Collections Preferences view.

In the PTP Follow-Up list, create a new record and complete the necessary fields.

Some fields are described in the following table.

Field Examples Method of Payment

Western Union, Cheque by Phone, Mail, Overnight Mail.

Number of Days

The default is set to 1.

To set up an activity followup definition

Navigate to the Administration - Collections, then the Collections Preferences view.

In the Activity Follow-Up list, create a new record and complete the necessary fields.

Some fields are described in the following table.

Field Examples Activity Type

Call - Inbound, Call Outbound, and so on

Activity Disposition

Left Message, No Answer, PTP, or Other.

Number of Days

The default is set to 1.

Managing Collection Correspondence Administration

The information captured in the Correspondence Administration view can be used to automate the cure process. Associated with the financial account, the Collections Correspondence Administration view provides the ability to select and automatically generate predefined correspondence utilizing defined templates and selection criteria.

To set up correspondence rules

Navigate to Administration - Collections, then the Correspondence Administration view.

In the Correspondence list, click New and complete the necessary fields.

Some fields are described in the following table.

Fields Example Name

CA_Rule1

State

CA

Type of Letter

Cure

Asset Finance

Select any value from the pop up applet

Cure Length

15

Cure Comments

Letter sent only once

Bankruptcy

Active

Recipient

Holder

Template

Template for Cure

Automating the Cure Process

Letters can be generated for Cure and Notification of Sales (NOS) events. Triggering letter generation through a button click initiates the business service method to call the cure letter generation. Administrators create the correspondence template and define rules before generating the cure letter and then they monitor accounts that meet cure conditions.

Administrators send cure letters to customers who are in default, typically these type of letters explain that their account is delinquent before initiating a vehicle repossession process. In addition to this type of generic letter, administrators can also send letters for notice of sale after repossessing a car from a customer. Administrators first create a correspondence template for these types of letters using Word. Next they add the template to the Correspondence Templates view and then associate the template to existing rules. To select the appropriate template and generate the letter, perform the procedures that follow.

To add correspondence templates

Navigate to Administration - Document, then the Correspondence Templates view.

In the Templates list, click New File.

In the Choose File dialog, select the template file and click Open.

Repeat the previous steps for each template you want to add.

To associate correspondence templates to rules

Navigate to Administration - Collections, then the Correspondence Administration view.

Query for the rule that you want to associate the template with, for example Auto_CF*.

Select the record, in the Template field, click the multiple select button to select the correspondence template.

Repeat the previous steps for each correspondence template you want to associate to a rule.

End-User Procedures for Collections

Collection agents, managers, or end-users review, understand, and act in the context of controlled, closed loop processes, capturing action and followup dates for each step in the process, compiling a full history of collections interaction with the customer. Because collection agents work with many accounts, they need to be able to quickly review summary account information about a financial account’s collection status and contextual access to the appropriate next steps.

The collection agent can then make sure that all delinquent financial accounts for a given customer are assigned to the same collections agent, avoiding misinformation, confusion, and redundant customer contact.

For example, if a customer with multiple accounts appear on two different lists or is assigned to two different positions then the assignment of the second account, the account in the lower bucket is assigned to the collector responsible for the customer’s account that falls in the higher bucket.

The following end-user procedures are described in this topic:

Reviewing Account Summary and Related Account Information

Before calling an account in a collection task, agents use the Collection Summary list view to review historical information about an account. After logging in to the application, agents go to Work Summary list to check current status and see if it is correct. Likewise, managers review the Manager Work Summary list view to see which accounts have already been assigned and which accounts remain unassigned by agent.

To view work summaries

Navigate to the Financial Accounts, then the Work Summary view.

The following table describes the types of information appearing in the Manager Work Summary view.

Summary Comments Accounts Assigned

Total number of accounts assigned to the collection agent.

Accounts Worked

Number of accounts the collection agent has worked on so far. For example, created PTPs for some accounts, leaves messages for another account, and so on.

Accounts Remaining

Number of accounts remaining to be worked on.

Messages Left

Total number of messages that the collection agent leaves for all accounts that they have worked on so far.

Promises Made

Total number of promise-to-pay records created by the collection agent for all the accounts worked on so far.

Click Refresh to get the most up-to-date work summary information.

To view manager work summaries

Navigate to the Financial Accounts, then the Manager Work Summary view.

In the Employees list, select the collection agent you wish to view the work summary for.

The following table describes the types of information appearing in the Manager Work Summary view.

Summary Comments Accounts Assigned

Total number of accounts assigned to the selected collection agent.

Accounts Worked

Number of accounts the selected collection agent has worked on so far. For example, created PTPs for some accounts, leaves messages for another account, and so on.

Accounts Remaining

Number of accounts remaining to be worked on by the selected collection agent.

Messages Left

Total number of messages that the selected collection agent leaves for all accounts that they have worked on so far.

Promises Made

Total number of promise-to-pay records created by the selected collection agent for all the accounts worked on so far.

Click Refresh to get the most up-to-date work summary information.

To view related accounts

Navigate to the Financial Accounts, then the Financial Account List view.

Drill down on the Account # field link of the selected record.

Click the Collections view tab, and then click the Related Accounts link.

Scroll down to the end of the page to see the Related Accounts list.

To view the related account, drill down on the Financial Account # field link.

Managing Collection Reassignments

Collection managers use this screen to select and reassign financial accounts in real time.

Workload and skills in the collection department are dynamic. It is often necessary for the manager to reassign one or more financial accounts from one collection agent to another on a temporary or permanent basis, and therefore overriding prior rules based assignment.

To reassign a financial account

Navigate to the Administration - Collections, then the Collections Reassignment view.

In the Account # list, select the records you want to reassign.

Click Reassign.

In the Pick Position dialog box, select the employee you would like to reassign the records to, and then click OK.

Executing Collection Tasks

After agents have reviewed background information about a financial account, they can start the collection tasks by calling the customer. For more information on viewing collection summaries, see Reviewing Account Summary and Related Account Information and Managing Collection Reassignments.

To view delinquent accounts

Navigate to the Financial Account, then the Delinquent Title List view.

To execute collection tasks

Navigate to the Financial Accounts, then the Financial Accounts list view.

Drill down on the Account # field link, and then click the Collection view tab.

In the Activities list, create an activity record to record the customer’s response to the collection call.

If the customer makes a payment promise, enter this information.

For more information about capturing a promise to pay, see Capturing Promise-to-Pay Records.

Capturing Promise-to-Pay Records

One of the important events in the collections process is capturing a promise to pay (PTP) for delinquent accounts. A PTP is a trackable promised amount of money to be paid by the customer. It includes a planned date of payment, in addition to the expected mode of payment. Breaking a promise represents a breach of trust, and is a flag for immediate escalation of collections activity.

The Siebel Automotive application supports the process of capturing a customer’s PTP, recording the detail, and ensuring follow up to determine whether the promise is kept or broken. Through a workflow in the Siebel application, the application can also determine if a particular promise is broken or not. This requires that payment transactions exist in the Siebel application or are brought into the Siebel application.

Perform the following procedures to a capture promise-to-pay records.

To record call activities

Navigate to the Financial Accounts, then the Financial Account List view.

Drill down on the Account # field link, and then click the Collection view tab.

In the Activities list, click New and complete the necessary fields.

Some fields are described in the table that follows.

Field Examples Type

Call-Outbound

Description

Enter a description for the activity, for example Call to Adrian Monk for PTP

Sub-Type

Select Left Message

To record a promise to pay

Navigate to the Financial Accounts, then the Financial Account List view.

Drill down the Account # field link, and then click the Collections view tab.

In the Collection Summary list, click New and complete the necessary fields.

Some fields are described in the table that follows.

Verify that a new activity record is created in the Activities list applet on saving the PTP record in the Collection Summary applet.

The fields for this are automatically created activity as described in the following table:

Field Comments Type

Call-Inbound or Call-Outbound based on the value selected for the new PTP

Sub-Type

PTP taken

Status

Done

To record multiple promise-to-pay records, repeat the previous two steps for each record.

To capture a transaction for promise-to-pay records

Navigate to the Financial Accounts, then the Financial Account List view.

Drill down on the Account # field link, and then click the Transaction Detail view tab.

Click New, and then complete the necessary fields.

Some fields are described in the following table.

Field Example Amount

Enter the amount the customer has agreed to pay

Post Date

Current Date

Item Type

How the customer as agreed to pay, for example Check

Item

The Item # is used to identify the transaction in the transaction details view. The Item # is the actual Item # of the Item Type and it needs to be manually entered.

When the transaction is collected that Status changes from Active to Inactive. If the customer only paid a partial amount, the Status stays Active.

To view an account’s promises summary information

Navigate to the Financial Accounts, then the Financial Account List view.

Drill down on the Account # field link, and click the Promises Summary view tab to view more detailed collection information.

Managing the Cure Process

Companies send cure letters to a customer who is in default, that is their account is delinquent, before initiating vehicle repossession process. In addition to this letter, companies also send a letter for notice of sale after repossessing a car from the customer. The requirement for sending the different types of letters is driven by state government legislations. Through a letter administration view, Siebel collection agents can provide a captive to capture the rules and templates for these letters.

Through parameters set in Collections Administration, time fences and activities which vary state by state are defined. Correspondence is then initiated by the collection agent, triggering a business process that validates applicability, timing, selection of the proper template, and generation of the letter.

To generate the cure process

Navigate to the Financial Accounts, then the Financial Account List view.

Drill down on the Account # field link for the selected record.

Click the Collections view tab, and then click the Correspondence link.

In the Correspondence list, select the record and click Generate Cure Letter.

A letter is generated and a record is created in the Correspondence.

To generate notice of sale letter

Navigate to the Financial Accounts, then the Financial Account List view.

In the Financial Accounts list, query for the account for whom the letter for notice of sale needs to be generated, and then drill down on the Account # field link.

Click the Collections view tab, and then click the Correspondence link.

In the Correspondence list, select the record and then click Generate NOS Letter.

Managing the Repossession Process

A vehicle is repossessed when it is determined that due payments cannot be recovered from a customer. A collection agent first determines if repossession should happen. Before repossession is initiated, multiple steps of promise to pay (PTP) and Cure Letter generation must have been executed. A senior collection agent or collection manager must approve the repossession process. An external agency executes the repossession of vehicles.

To add repossession partners

Navigate to the Partners, then the Partner List view.

In the My Partners list, click new and complete the necessary fields.

To verify that the partner was added, navigate to Repossession, then the Repossession Agencies view, and in the My Agencies list, query for the Repossession partner created in the previous step.

To add an agency employee

Navigate to the Repossessions, then the Repossessions Agencies view.

In the My Agencies list, select or query for the agency for which you need to add an employee to.

Drill down on the Agency Name field link, and then click the Agency Employees view tab.

Click new and complete the necessary fields.

To add repossession SRs

Navigate to the Financial Accounts, then the Financial Account List view.

Drill down on the Account # field link, and then click the Collections view tab.

Click the Repossessions SR link.

In the Repossessions SR list, click new and complete the necessary fields.

Some fields are described in the following table.

Field Example Send to For Approval

Login Person's Manager

Repossession Agency

The name of the agency

Area

Rep Vehicle

Sub Area

Rep Vehicle

Asset # / VIN

This is a vehicle identification number (VIN) that is populated from the financial account record.

To view the Repossessed Vehicle, drill down on the SR # field link.

To create another activity to continue repossession for the SR

Navigate to the Service Request, then the Service Requests List view.

Drill down on the SR # field link, and then click the Repossess Vehicle view tab.

In the Activities list, query for Sub-Type: Rep Denied and Type: Request for Repossession.

Click New, and complete the necessary fields.

Some fields are described in the following table.

Field Example Type

RepApproval Request

Description

Continuing repossession after reviewing account again... please approve this time!

Priority

1-High

Owner

Collection Manager

To record details about the repossession service request

Navigate to the Service Request, then the Service Requests List view.

In the My Service Request list, query for the SR #, account, summary that you want to approve.

For example, in the Summary field query for *Rep* to find accounts that have been repossessed.

Drill down on the SR # field link, and then click the Repossess Vehicle view tab.

In the Activities list, in the Type field query for type of detail you want to record.

To approve, in the Sub-Type field, select Repossession Approved.

To deny the Approval Request, change Sub-Type field to Denied.

To send a package, the Sub-Type field, select Package Sent.

To complete the repossession process

Navigate to the Activities, then the Activities List view.

In the Type field, query for Follow-Up.

In the Status drop-down list, select Done.

Navigate to Financial Accounts, then the Financial Account List view.

Drill down on the Account # field link for the account you wish to view.

Click Collections, then the Repossession SRs.

In the Repossessions SRs list, click New and complete the necessary fields.

Some fields are described in the following table.

Field Example Repossession Fee

$2902

Repossessed Date

Current date

Managing Skip Trace and Impound Service Requests

Collection agents can use the following view tabs to record skip trace, bankruptcy, and legal information:

Skip Trace. Companies who are unable to contact or locate a delinquent customer, rely on a skip trace agency to track down a customer. End users can use the Skip Trace view tab to record the results of skip trace report.

Skip Trace has been created with an associated template for capture of details required to initiate skip trace activities internally or externally. Association with Siebel Activity Plans enables automatic creation of default activities associated with the Skip Trace process. Assignment Manager operates on Skip Trace SR and associated activities to assign the appropriate Internal or external resources.

Impound.Occasionally an government agency seizes a vehicle for various reasons, for example if a vehicle is used for illegal purposes. At other times a customer may abandon a vehicle somewhere or not pick up a vehicle from a repair shop. During this time, the government agencies or repair shop informs the finance company (legal owner of vehicle when a vehicle is leased) and the finance company then manages the process of securing the vehicle.

Bankruptcy. If a customer files for bankruptcy, end users can use the Bankruptcy view tab to track bankruptcy information.

Legal. If a customer account becomes delinquent, end users can use the Legal view tab to track information about delinquent accounts.

Most delinquent account situations are resolved through initial contact with the customer, acceptance and fulfillment of a promise to pay (PTP). However seriously delinquent accounts present additional challenges to companies and often require legal or outside-party involvement. There are four primary directions to take as follows:

Referral to an outside collections agency. For more information, see the procedure on how to assign a service request to a outside partner that follows.

Initiation of skip trace activities. An example of a skip trace activity is trying to locate a debtor who cannot be reached through existing contact information. For more information, see the procedure on record skip trace information that follows.

Processing impound notifications. Often impound notifications arise when physical possession of a vehicle against which collections activities are in process, for example abandonment at a repair facility or impound by police. For more information about impound service requests, see the procedure on how to add impound service requests that follows.

Repossession of the vehicle from the debtor. For more information about repossessing vehicles, see Managing the Repossession Process.

To record skip trace information

Navigate to the Financial Accounts, then the Financial Accounts List view.

In the Financial Accounts list, query to find the account you want to record skip trace information.

Drill down on the Account # field link, and then click the Collections view tab, then the Skip Trace SRs link.

In the Skip Trace list, click New and complete the necessary fields.

To record impound information

Navigate to the Financial Accounts, then the Financial Accounts List view.

In the Financial Accounts list, query to find the account you want to record skip trace information.

Drill down on the Account # field link, and then click the Collections view tab, then the Impound SRs link.

In the Impound SR list, click New and complete the necessary fields.

Some fields are described in the table that follows.

Field Comments Summary

Add a summary for the Impound SR, for example Impound initiated for customer ABC.

Asset #

The Serial # of the selected record that appears in the field.

Select the appropriate Asset #.

To enter vehicle information, drill down on the SR # field link.

In the Auto CF Impound Vehicle Request form, complete the necessary fields.

Some of the fields might already be filled, in that case, verify that the vehicle information is correct.

To record legal information related to a delinquent account

Navigate to the Financial Accounts, then the Financial Accounts List view.

In the Financial Accounts list, drill down on the Account # field link you want to view.

Click the Legal view tab.

In the Legal form, complete the necessary fields.

Managing Insurance Information

Companies must track the insurance policy associated with the vehicle. Absence of a valid insurance policy triggers activity, often thought the collections organization, to contact the customer and secure proof of insurance, or ultimately to secure insurance of the customer’s behalf at the customer’s expense. Using the Siebel Automotive application, collection agents keep track of a customer’s insurance policy by associating the insurance policy to a financial account.

To associate insurance policies with financial accounts

Navigate to the Financial Accounts, then the Financial Accounts List view.

In the Financial Accounts list, drill down on the Account # field link you want to view.

Click the Collection view tab, and then click the Insurance link.

In the Insurance list, create a new record and complete the necessary fields.

Some of the fields are described in the table that follows.

Field Comments Start Date

Enter the current date and time.

Expiration Date

Enter a future date.

Has Needed Coverage

Checking this check box indicates that the account has needed coverage.

Deductible Below Maximum

Checking this check box indicates that the account deductible is less than the maximum.

Number

Example Potter1213

Company Name

Select the company name of the insurance company for the account.

To add insurance contact information to financial accounts

Navigate to the Financial Accounts, then the Financial Accounts List view.

Select the financial account you which you add insurance contact information to.

In the Financial Accounts form, click New and complete the necessary fields.