Introduction

Supply Chain Finance (SCF) is a platform that facilitates the corporates to avail short-term credit that optimizes working capital for both the buyer and the seller at a lower cost thereby improving business efficiency. Through SCF, suppliers sell or liquidate their invoices or receivables to banks. This enables them to make liquid money available to proceed with the future orders. Similarly, Buyers avails finance for their payables from banks so that their obligations are timely met at a minimized cost.

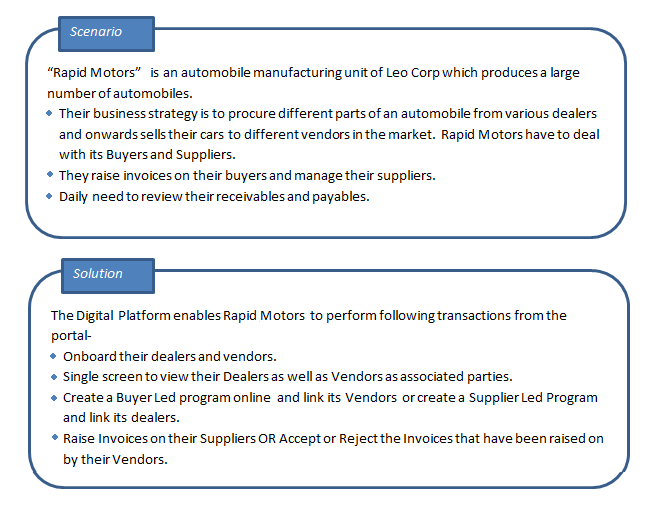

Using the digital platform of SCF, corporates are able to perform SCF transactions from the portal itself, thus resulting in improved business efficiency. The transactions can be executed, viewed and tracked online. No follow-ups required with the bank for the status of the transactions.

Corporates can manage creation of single or multiple Invoice/s. They can also accept or reject invoices online.The Portal also facilitates corporates to introduce their business partners to the bank through the platform. These business partners who play a role of the counterparties in the SCF business may or may not be the customers of the bank. However, each of the counterparty can be on-boarded by the Corporate itself and further link the counterparty to the SCF program and perform SCF business transactions on the Counterparty.

A typical business scenario in SCF parlance -

The features built for the corporate user in the Supply Chain Finance Module are as follows-

- Overview

- On-board Counterparty

- View Associated Party

- Program Management

- Create Program

- Edit Program

- View Program

- Invoice Management

- Create Invoice

- Edit Invoice

- View Invoices

- Accept/ Reject Invoice

Note: Supply Chain Transactions are only supported on Desktop and on Landscape mode of Tablet on its browser.