10Setting Up Charge Codes, Taxes, and Service Charges

Setting Up Charge Codes, Taxes, and Service Charges

This chapter describes how to associate charge codes, taxes, and service charges with a property. It includes the following topics:

About Hospitality Charge Codes, Taxes, and Service Charges

In Siebel Hospitality, taxes are associated with properties because different properties have different taxes that are regulated by geographic location. However, taxes might also be shared by multiple properties in the same vicinity. Taxes are associated with service charges because some service charges might be subject to federal, state, or county tax. Charge codes are the mechanism by which taxes and service charges are associated with products. Each charge code consists of a group of taxes, service charges, or both that are applied to a product based upon the revenue subcategory of the product and the type of the event.

Charge codes can be associated with multiple taxes and multiple service charges. Service charges can also be associated with multiple taxes and multiple properties. Taxes, in turn, can be associated with multiple properties.

The process of defining charge codes, taxes, and service charges makes it possible for an event manager to choose a product for an event and have charge codes, taxes, and service charges automatically assigned to the line items. For example, a charge code can be associated with two taxes (one for Berkeley and one for Los Angeles) and with two service charges (one that is taxable and one that is not).

An administrator can define taxes with their applicable properties, set up service charges and the taxes and properties that are applicable to them (a service charge might be taxed), and create charge codes using a set of administrative screens and views.

Process of Setting Up Charge Codes, Taxes, and Service Charges

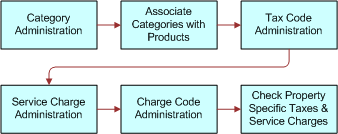

The following list shows the procedures that administrators typically perform to set up charge codes, taxes and service charges using Siebel Hospitality. Your company might follow a different process according to its business requirements.

The following image illustrates the process flow for the tasks administrators typically perform to set up charge codes, taxes, and services charges.

To set up charge codes, taxes, and services charges, perform the following tasks:

Administering Revenue Categories

During revenue category administration, the administrator defines parent categories, categories, and subcategories. Revenue category administration consists of the following tasks:

Creating Revenue Parent Categories

Creating Revenue Categories

Creating Revenue Subcategories

For more information on these tasks, see Process of Creating the Hospitality Revenue Category Hierarchy.

Associating Revenue Categories with Products

After parent revenue categories, revenue categories and revenue subcategories are defined, the administrator can associate the categories with hospitality products and charge codes.

This task is a step in Process of Setting Up Charge Codes, Taxes, and Service Charges.

To associate revenue categories with products

Navigate to the Administration - Product screen, then the Products view.

In the products list, query for and select the required product.

In the product record, select the appropriate value in the Revenue Subcategory field.

The Revenue Category and Revenue Parent Category fields are automatically populated.

Save the product record.

Administering Service Charges

This topic covers the following subjects, and is a step in Process of Setting Up Charge Codes, Taxes, and Service Charges.

About Administering Service Charges

Service charges are associated with a specific property, and they are only included in the calculation for a product if the following conditions exist:

The service charge is associated with both a charge code linked to the Business Type (local or group) of an event quote and the revenue subcategory of the product.

The service charge is applicable at the property where the event is being held.

Service charges and taxes are time-dependent; both have a start date and an end date. Service charge and tax date applicability is based on when the function with which the line item is associated occurred. Because multiple functions can be associated with each order and these calculations are performed on an order basis, service charges and taxes might be different for different functions on one order. For example, one function occurs on 12/31/08 and another occurs on 1/1/09. A new set of taxes and service charges become effective at the beginning of the new year. If a function spans two days, then the tax applicability date is the first day.

A service charge is a fee applied to a product or service. An administrative fee is a type of service charge specific to a property. For example, an energy fee is an administrative fee that is added to a room charge. Service charges can be taxable, depending on the tax regulations for the property. Taxes are usually associated with service charges at the time the service charge is defined, although the tax can be added a later date.

There are two levels of visibility for Service charges as follows:

All Service Charges. This view is used to manage all service charges for a particular property. This view would be used by a property revenue manager at a specific property to manage the service charges for the property with which the user is associated.

All Service Charges Across Properties. This view is used to manage all service charges for all properties in the chain of properties belonging to your organization. This view would be used by a corporate property revenue manager to manage service charges for all properties.

Creating a Service Charge

Use the following procedure to define service charges for the property.

This task is a step in Administering Service Charges.

To create a service charge

Navigate to the Tax Service Admin screen, then the Service Charges List view.

In the Service Charges list, create a new record and complete the fields.

Some of the fields are described in the following table.

Note: You can enter data in either the Amount or Percent field, but not both.Field Comments Name

The name of the service charge.

Description

The description of the service charge.

Percent

Service charge expressed as a percentage. The service charge amount is calculated from this percent value multiplied by the price for the line item.

Amount

Service charge expressed as a flat fee. The flat fee is a preset amount.

Start Date

Date the service charge becomes active.

End Date

Date the service charge becomes inactive.

Currency

The monetary unit of measure.

Taxable

Check box that indicates whether or not the service charge is taxable.

City

City in which the service charge applies. A service charge might apply in many different cities, depending on the associated properties.

State

State in which the service charge applies. This field is automatically populated when the City field is completed.

Save the record.

If the service charge is taxable, click the link in the Name field, and select the Taxes view tab.

In the Taxes list, create a new record, and from the Add Taxes dialog box, select the tax, and then click OK.

Note: The Taxable flag is for informational purposes only.

Associating a Service Charge with a Property

Use the following procedure to associate a service charge with a property.

This task is a step in Administering Service Charges.

To associate a service charge with a property

Navigate to the Tax Service Admin screen, then the Service Charges List view.

In the Service Charges list, query for the required service charge.

Click the link in the Name field, and select the Properties tab.

In the Properties list, create a new record.

In the new record, click the single select button in the Name field, select a property, and save the record.

The remaining fields are automatically populated with the property information.

Administering Tax Codes

This topic covers the following subjects, and is a step in Process of Setting Up Charge Codes, Taxes, and Service Charges.

About Administering Tax Codes

Taxes on a hospitality product can be a flat amount (for example, $5) or a percentage, and have defined effectivity dates. Taxes are defined on a global basis and are later associated with individual properties. Using charge codes, the calculation of taxes is based on the products associated with an order. When a flat tax is calculated during the Trial Check or Post Check process, the flat amount (for example, $2) is applied to each quantity of the product used. For more information about event checks, see Generating Event Checks.

An occupancy tax is a flat tax assessed for room usage. For example, if a group uses Salon C, then a tax of $100 is levied regardless of the size of the group.

Service charges and taxes are time-dependent; both have a start date and an end date. Service charge and tax date applicability is based on when the function with which the line item is associated occurs. Because multiple functions might be associated with each order and these calculations are done on an order basis, service charges and taxes might be different for different functions on one order.

For example, a function might be held on 12/31/08 and another on 1/1/09, and a new set of taxes and service charges are effective on 01/01/09. If a function spans two days, then the tax applicability date is the first day. For more information about setting up service charges, see Administering Service Charges.

Taxes must be defined before they can be associated with charge codes, service charges, and properties. There are two levels of visibility for taxes:

All Taxes. This view is used to manage all taxes for a particular property. This view would be used by a property revenue manager at a specific property to manage the taxes for the property with which the user is associated.

All Taxes Across Properties. This view is used to manage all taxes for all properties in the chain of properties belonging to the organization. This view would be used by a corporate property manager to manage taxes for all properties.

Creating a Tax Code

Use the following procedure to create tax codes.

This task is a step in Administering Tax Codes.

To create a tax code

Navigate to the Tax Service Admin screen, then the Tax List view.

In the Taxes list, create a new record, and complete the fields.

Some of the fields are described in the following table.

Note: You can enter data in either the Amount or Percent field, but not both.Field Comments Name

The name of the tax.

Percent

The tax defined as a percentage. The amount of tax charged is the percent value multiplied by the price for the line item.

Amount

Tax defined as a flat fee. The flat fee is a preset amount.

Start Date

The date the tax becomes active.

End Date

The date the tax becomes inactive.

Currency

The currency of the tax. Default value is the default currency of the application.

City

City in which the tax applies. A tax might apply in many different cities depending on the associated properties.

State

State in which the tax applies. This field is automatically populated when the City field is completed.

Associating a Tax Code with a Property

Use the following procedure to associate a tax code with a property.

This task is a step in Administering Tax Codes.

To associate a tax code with a property

Navigate to the Tax Service Admin screen, then the Tax List view.

In the Taxes list, query for the tax code, and click the link in the Name field.

In the Properties list, create a new record.

In the Add Properties dialog box, select the property to associate with the tax, and then click OK.

The remaining fields are automatically populated with the property information.

Repeat Step 3 through Step 4 of this procedure until all applicable taxes are associated.

Associating Tax Codes with Service Charges

If service charges are taxable, the administrator must associate the service charge codes with the tax codes.

This task is a step in Administering Tax Codes.

To associate a tax code with a service charge

Navigate to the Tax Service Admin screen, then the Service Charge List view.

In the Service Charges list, query for the required service charge record,

Click the link in the Name field, and then click the Taxes view tab.

In the Taxes list, click New, select the tax code, and save the record.

The remaining fields are automatically populated with the tax code information.

Repeat this task for each tax code that must be associated with the service charge.

Administering Charge Codes

This topic covers the following subjects, and is a step in Administering Tax Codes.

About Administering Charge Codes

Charge codes are collections of tax codes and service charges. A charge code is an identifier that links taxes and service charges to products and can be used to distinguish between group and local business. For more information about tax codes, see Administering Tax Codes. For more information about service charges, see Administering Service Charges.

For each charge code, there is an associated business type. The business type is selected at the event/quote level. The predefined business types are:

Group. Overnight stays for event participants are included with the event.

Local. Overnight stays for event participants are not included with the event.

Charge codes are associated with subcategories, rather than categories, and can be used for calculation and analysis purposes. When defining charge codes, the Revenue Category field is automatically populated when the Revenue Subcategory field is specified.

Additional charge codes can be defined by extending the List of Values (LOV). For more information about working with the LOV, see Siebel Applications Administration Guide.

Defining Charge Codes

Perform the steps in the following procedure to define charge codes.

This task is a step in Administering Charge Codes.

To define a charge code

Navigate to the Tax Service Admin screen, then the Charge Code List view.

In the Charge Codes list, create a new record, and complete the required fields.

In the More Info form, complete additional fields, and then save the record.

The following table describes some of the fields.

Field Comments Revenue Category

A group of related products. This field is automatically populated when you enter the Revenue Sub Category.

Business Type

The type of business of the customer organization. Choices are group and local.

End Date

The date the charge code becomes inactive.

General Ledger Number

An identifier that maps the charge code to the general ledger.

Revenue Subcategory

A revenue subcategory allows you to group products more precisely within a larger revenue category and assign different taxes to each revenue subcategory. For example, Appetizers can be a revenue subcategory of the revenue category Food.

Start Date

The date the charge code becomes active.

Repeat Step 2 through Step 3 for each charge code.

Associating Charge Codes with Tax Codes

Perform the steps in the following procedure to associate a charge code with a tax code.

This task is a step in Administering Charge Codes.

To associate a charge code with a tax code

Navigate to the Tax Service Admin screen, then the Charge Code List view.

In the Charge Codes list, query for and select the required charge code.

Click the Taxes view tab.

In the Taxes list, click New.

In the Add Taxes dialog box, select the tax to associate with the charge code, and click OK.

Save the record.

The remaining fields are automatically populated with the property information. Repeat Step 4 through Step 5 for each service charge to associate with the charge code.

Associating Charge Codes with Service Charges

Perform the steps in the following procedure to associate a charge code with a service charge.

This task is a step in Administering Charge Codes.

To associate a charge code with a service charge

Navigate to the Tax Service Admin screen, then the Charge Code List view.

In the Charge Codes list, query for and select the required charge code.

Click the Service Charges view tab.

In the Service Charges list, click New.

In the Add Service Charge dialog box, select the service charge to associate with the charge code.

The remaining fields are automatically populated with the property information. Repeat Step 4 through Step 5 for each tax to associate with the charge code.

Reviewing Charge Codes for a Revenue Category

After setting up all the charge codes, perform the following steps to view the charge code associations to each category using the Revenue Category Administration view.

This task is a step in Administering Charge Codes.

To review charge codes for a revenue category

Navigate to the Revenue Category Administration screen, then the Category Admin List view.

In the Category Admin list, query for and select the required revenue parent category, and then click the link in the Name field.

Scroll down, and select the required revenue category in the Revenue Categories list.

Scroll down, and click the Charge Codes tab.

The Charge Codes list displays all the charge codes associated with the revenue category record.

Viewing Property-Specific Taxes and Service Charges

Users can view property-specific taxes and service charges after completing the procedures described in the image in Process of Setting Up Charge Codes, Taxes, and Service Charges.

This task is a step in Administering Charge Codes.

To view property-specific taxes

Navigate to the Property screen, then the Properties view.

In the Properties list, query for and select the required property record.

Click the link in the Property Name field.

Click the Taxes view tab.

The Taxes list displays all the taxes associated with the property record. This is a read-only view.

To view property-specific service charges

Navigate to the Property screen, then the Properties view.

In the Properties list, query for and select the required property record.

Click the link in the Property Name field.

Click the Service Charges tab.

The Service Charges list displays all the service charges associated with the property record. This is a read-only view.