This chapter includes a list of columns required for this processing as well as a list of columns required to run the Oracle Financial Services Analytical Applications (OFSAA) cash flow edits.

Topics:

· Introduction to Cash Flow Dictionary

Cash flow processing is executed from Oracle Asset Liability Management ( ALM) and Oracle Funds Transfer Pricing (FTP). This processing accesses specific fields from instrument tables to perform cash flow calculations.

The OFSAA cash flow edits are executed from either Oracle ALM or Oracle FTP and are used to correct data in the columns used in OFSAA cash flow processing.

NOTE:

Both lists overlap for a majority of the columns.

For OFSAA cash flow processing to generate appropriate results, the data within the accessed instrument tables must be appropriate and consistent. The OFSAA cash flow edits function provides a measure of validation for this data. However, the cash flow edits function cannot ensure that the input data from the instrument tables are correct, and faithfully reflects reality. Therefore, this chapter contains detailed information necessary for the correct data population, including field definitions, formulas used in the cash flow process calculations, and recommended default values for the cash flow processing fields.

Unless otherwise stated, when calculations refer to frequency or term fields in this chapter, the implication is that both the frequency (or term) and its associated multiplier field are used. For example, if PMT_FREQ is used in a formula, it refers to PMT_FREQ and PMT_FREQ_MULT to determine the true payment frequency.

Cash Flow Engine does support off-balance products, but Cash Flow Edits Engine does NOT support off-balance products.

This section describes in detail the cash flow processing and cash flow edit columns for OFSAA.

The OFSAA cash flow columns are listed in table format in this section along with information on whether they are associated with cash flow processing, cash flow edits, or both.

Column Name |

Cash Flow Processing |

Cash Flow Edits |

Usage |

|---|---|---|---|

ACCRUAL_BASIS_CD |

Yes |

Yes |

Input |

ACCRUED_INTEREST |

Yes |

Pending |

Input |

ADJUSTABLE_TYPE_CD |

Yes |

Yes |

Input |

ALL_IN_TP_RATE |

Yes |

No |

Output |

All Leaf Fields |

Yes |

No |

Input/Output |

AMORT_METH_PDFC_CD |

Yes |

Pending |

Input |

AMRT_TERM |

Yes |

Yes |

Input |

AMRT_TERM_MULT |

Yes |

Yes |

Input |

AMRT_TYPE_CD |

Yes |

Yes |

Input |

AS_OF_DATE |

Yes |

Yes |

Input |

AVERAGE_LIFE_C |

Yes |

No |

Output |

BASE_INDEX_VALUE |

Yes |

No |

Input |

BASIS_RISK_CHARGE_CREDIT |

Yes |

No |

Output |

BASIS_RISK_COST_AMT |

Yes |

No |

Output |

BASIS_RISK_COST_RATE |

Yes |

No |

Output |

BEHAVIOUR_SUB_TYPE_CD |

Yes |

Pending |

Input |

BEHAVIOUR_TYPE_CD |

Yes |

Pending |

Input |

BREAKAGE_TYPE_CD |

Yes |

No |

Input |

BREAK_FUNDING_MV |

Yes |

No |

Output |

BREAK_FUNDING_AMT |

Yes |

No |

Output |

BREAK_FUNDING_AMT_CHG |

Yes |

No |

Output |

CAP_PROTECTION_CATEGORY |

Yes |

No |

Input |

CHARGE_CREDIT_OCOST |

Yes |

No |

Output |

CHARGE_CREDIT_OCOST_REM_TERM |

Yes |

No |

Output |

CHARGE_CREDIT_TRATE |

Yes |

No |

Output |

CHARGE_CREDIT_TRATE_REM_TERM |

Yes |

No |

Output |

COMPOUND_BASIS_CD |

Yes |

Yes |

Input |

CONVEXITY_C |

Yes |

No |

Output |

CUR_BOOK_BAL |

Yes |

Yes |

Input |

CUR_GROSS_RATE |

Yes |

Yes |

Input |

CUR_NET_PAR_BAL_C |

No |

Yes |

Input |

CUR_NET_RATE |

Yes |

Yes |

Input |

CUR_OAS |

Yes |

No |

Input/Output |

CUR_PAR_BAL |

Yes |

Yes |

Input |

CUR_PAYMENT |

Yes |

Yes |

Input |

CUR_STATIC_SPREAD |

Yes |

No |

Input |

CUR_TP_PER_ADB |

Yes |

No |

Input |

CUR_YIELD |

Yes |

No |

Output |

DEFERRED_CUR_BAL |

Yes |

Yes |

Input |

DEFERRED_ORG_BAL |

Yes |

Yes |

Input |

DEVOLVEMENT_STATUS_CD |

Yes |

Pending |

Input |

DURATION_C |

Yes |

No |

Output |

DV01_C |

Yes |

No |

Output |

EFF_INTEREST_RATE_C |

Yes |

No |

Output |

EXPECTED_BAL |

Yes |

Pending |

Input |

EXPECTED_BAL_GROWTH_PCT |

Yes |

Pending |

Input |

HISTORIC_OAS |

Yes |

No |

Output |

HISTORIC_STATIC_SPREAD |

Yes |

No |

Output |

HOLIDAY_CALC_OPTION_CD |

Yes |

No |

Input |

HOLIDAY_CALENDAR_CODE |

Yes |

No |

Input |

HOLIDAY_ROLLING_CONVENTION_CD |

Yes |

No |

Input |

INDEX_ADJ_TYPE |

Yes |

No |

Input |

INDEX_ID |

Yes |

No |

Input |

ID_NUMBER |

Yes |

Yes |

Input |

IDENTITY_CODE |

Yes |

Yes |

Input |

INSTRUMENT_TYPE_CD |

Yes |

No |

Input |

INT_TYPE |

Yes |

Yes |

Input |

INTEREST_RATE_CD |

Yes |

Yes |

Input |

ISSUE_DATE |

Yes |

Yes |

Input |

LAST_PAYMENT_DATE |

Yes |

Yes |

Input |

LAST_REPRICE_DATE |

Yes |

Yes |

Input |

LIQUIDITY_PREM_CHARGE_CREDIT |

Yes |

No |

Output |

LIQUIDITY_PREMIUM_AMT |

Yes |

No |

Output |

LIQUIDITY_PREMIUM_RATE |

Yes |

No |

Output |

LRD_BALANCE |

Yes |

Yes |

Input |

LRD_OFFSET_BAL |

Yes |

No |

Input |

MARGIN |

Yes |

No |

Input |

MARGIN_T_RATE |

Yes |

No |

Input |

MARGIN_GROSS |

Yes |

No |

Input |

MARKET_VALUE_C |

Yes |

No |

Output |

MARKET_VALUE_CLEAN_C |

Yes |

No |

Output |

MATCHED_SPREAD_ALT |

Yes |

No |

Output |

MATCHED_SPREAD_C |

Yes |

No |

Input |

MATURITY_AMOUNT |

Yes |

Pending |

Input |

MATURITY_DATE |

Yes |

Yes |

Input |

MAX_INDEX_VALUE |

Yes |

No |

Input |

MINIMUM_BALANCE |

Yes |

Pending |

Input |

MODIFIED_DURATION_C |

Yes |

No |

Output |

NEG_AMRT_AMT |

Yes |

No |

Output |

NEG_AMRT_EQ_DATE |

Yes |

Yes |

Input |

NEG_AMRT_EQ_FREQ |

Yes |

Yes |

Input |

NEG_AMRT_EQ_MULT |

Yes |

Yes |

Input |

NEG_AMRT_LIMIT |

Yes |

Yes |

Input |

NET_MARGIN_CD |

Yes |

Yes |

Input |

NEXT_PAYMENT_DATE |

Yes |

Yes |

Input |

NEXT_REPRICE_DATE |

Yes |

Yes |

Input |

OFFSET_PERCENT |

Yes |

Pending |

Input |

ORG_BOOK_BAL |

No |

Yes |

Input |

ORIG_OFFSET_BAL |

Yes |

No |

Input |

ORG_MARKET_VALUE |

Yes |

No |

Input |

ORG_PAR_BAL |

Yes |

Yes |

Input |

ORG_PAYMENT_AMT |

Yes |

Yes |

Input |

ORG_TERM |

Yes |

Yes |

Input |

ORG_TERM_MULT |

Yes |

Yes |

Input |

ORIGINATION_DATE |

Yes |

Yes |

Input |

OTHER_ADJ_AMOUNT_ALT |

Yes |

No |

Output |

OTHER_ADJ_CHARGE_CREDIT |

Yes |

No |

Output |

OTHER_ADJ_RATE_ALT |

Yes |

No |

Output |

OTHER_ADJUSTMENTS_AMT |

Yes |

No |

Output |

OPTION_RFR_IRC_CD |

Yes |

Pending |

Input |

OPTION_VOL_IRC_CD |

Yes |

Pending |

Input |

OPTION_MARKET_VALUE_C |

No |

No |

Output |

OTHER_ADJUSTMENTS_RATE |

Yes |

No |

Output |

PERCENT_SOLD |

Yes |

Yes |

Input |

PMT_ADJUST_DATE |

Yes |

Yes |

Input |

PMT_CHG_FREQ |

Yes |

Yes |

Input |

PMT_CHG_FREQ_MULT |

Yes |

Yes |

Input |

PMT_DECR_CYCLE |

Yes |

Yes |

Input |

PMT_DECR_LIFE |

Yes |

Yes |

Input |

PMT_FREQ |

Yes |

Yes |

Input |

PMT_FREQ_MULT |

Yes |

Yes |

Input |

PMT_INCR_CYCLE |

Yes |

Yes |

Input |

PMT_INCR_LIFE |

Yes |

Yes |

Input |

PRICING_INC_CHARGE_CREDIT |

Yes |

No |

Output |

PRICING_INCENTIVE_AMT |

Yes |

No |

Output |

PRICING_INCENTIVE_RATE |

Yes |

No |

Output |

PRIOR_TP_PER_ADB |

Yes |

No |

Input |

PMT_SET_LAG |

No |

No |

Input |

PMT_SET_LAG_MULT |

No |

No |

Input |

RATE_CAP_LIFE |

Yes |

Yes |

Input |

RATE_CHG_MIN |

Yes |

Yes |

Input |

RATE_CHG_RND_CD |

Yes |

Yes |

Input |

RATE_CHG_RND_FAC |

Yes |

Yes |

Input |

RATE_DECR_CYCLE |

Yes |

Yes |

Input |

RATE_FLOOR_LIFE |

Yes |

Yes |

Input |

RATE_INCR_CYCLE |

Yes |

Yes |

Input |

RATE_SET_LAG |

Yes |

Yes |

Input |

RATE_SET_LAG_MULT |

Yes |

Yes |

Input |

RESIDUAL_AMOUNT |

Yes |

Pending |

Input |

REMAIN_NO_PMTS_C |

Yes |

Yes |

Input |

REMAIN_TERM_MULT_C |

No |

No |

Input |

REPRICE_FREQ |

Yes |

Yes |

Input |

REPRICE_FREQ_MULT |

Yes |

Yes |

Input |

TEASER_END_DATE |

Yes |

Yes |

Input |

TP_AVERAGE_LIFE |

Yes |

No |

Input/Output |

TP_DURATION |

Yes |

No |

Input/Output |

TP_EFFECTIVE_DATE |

Yes |

Pending |

Input |

TRAN_RATE_REM_TERM |

Yes |

No |

Output |

TRAN_RATE_REM_TERM_ALT |

Yes |

No |

Output |

TRANSFER_RATE |

Yes |

No |

Input/Output |

TRANSFER_RATE_ALT |

Yes |

No |

Output |

DERIVATIVE_ONLY_COLUMNS |

|||

BINARY_RATE |

Yes |

Pending |

Input |

EXCHG_OF_PRINCIPAL |

Yes |

Pending |

Input |

INSTRUMENT_TYPE_CD |

Yes |

Pending |

Input |

LEG_TYPE |

Yes |

Pending |

Input |

MIN_BAL_AMORT |

Yes |

Pending |

Input |

PURCHASE_SALE_LOGIC |

Yes |

Pending |

Input |

SWAP_CLASS_CD |

Yes |

Pending |

Input |

This section describes, in detail, the usage of these columns. For each column, the following information is provided:

· Column name as it appears in the appendix (upper and lower case) and as it appears in the database (upper case with underscores).

· Which OFSAA products are affected (ALM or FTP)?

· Data verification requirements and suggested defaults.

The basis on which the interest accrual is calculated.

Oracle ALM and Oracle FTP cash flow methodologies use ACCRUAL_BASIS_CD for calculating interest income (financial element 430).

The accrual basis values are represented by code values as follows.

Code Value |

Accrual Basis |

|---|---|

1 |

30/360 |

2 |

Actual/360 |

3 |

Actual/Actual |

4 |

30/365 |

5 |

30/Actual |

6 |

Actual/365 |

7 |

Business/252 |

NOTE:

For BUS/252 Accrual Basis: As a prerequisite, a holiday calendar must be defined, so the engine can determine the number of business days for the numerator (BUS). If Holiday calendar is not selected, and accrual basis code is BUS/252, then it defaults to Actual/Actual

Oracle ALM and Oracle FTP cash flow methodologies reference INT_TYPE in determining whether interest payments are made in arrears or in advance.

· If INT_TYPE = 1, the record is considered an interest in arrears. Interest payments are paid at the end of the payment period along with the principal payments. The following calculations assume that the interest is to be calculated as an interest in arrears.

· If INT_TYPE = 2, the record is considered interest in advance.

For calculation purposes, the accrual basis codes can be grouped in the following manner.

NOTE:

The following calculations assume a monthly payment frequency.

· If the ACCRUAL_BASIS_CD is 30/360, 30/365 or 30/Actual, OFSAA uses the following formula to calculate interest income on a payment date:

Previous Period's Ending Balance * Cur Net Rate/100 * PMT_FREQ [number of months] * x * (Next Payment Date - Last Payment Date)/(Next Payment Date - Calculated Last Payment Date)

Replace x with one of the three accrual basis values mentioned earlier.

NOTE:

The actual denominator refers to the actual number of days in the year. Other than leap years, this equals 365 days. Also, note that the Calculated Last Payment Date is the Next Payment Date rolled back by the number of months in PMT_ FREQ.

The final portion of the earlier calculation,

(Next Payment Date - Last Payment Date)/(Next Payment Date - Calculated Last Payment Date)

is a ratio that calculates the percentage of the payment frequency period that should be applied to calculate the Interest Income amount. This adjustment is done for the following use cases:

§ For stub or extended payment at the origination or maturity of a record, where for the first forecasted payment, the Last Payment Date is not necessarily equal to the Calculated Last Payment Date.

§ For Payment dates impacted by Holiday adjustment (when Holiday calculation method is Recalculate Payment).

If the Last Payment Date is precisely equal to the Calculated Last Payment Date, then the ratio is equal to 1 and therefore does not impact the Interest Income calculation.

NOTE:

When interest calculated for days, see following scenarios:

1. Payment period (PMT_FREQ_MULT) is in days

2. Reprice period (REPIRCE_FREQ_MULT) is in days, applicable for adjustable/floating record.

3. Multiple repricing records, where a record reprices multiple times within a payment period, whenever interest calculated for days. For example, interest calculated from 6/30/2017 (NEXT_PAYMENT_DATE) to 7/15/2017 (NEXT_REPRICE_DATE) for 15 days.

4. When the payment/reprice date gets Holiday adjusted with holiday calculation as ‘Recalculate Payment’. Multiple repricing record, where a record reprices/payment dates get Holiday adjusted with holiday calculation as ‘Recalculate Payment’.

5. A record with the accrual basis of 30/360, 30/365, and 30/Actual is converted into Actual/365. A record having 30/365 convention, is converted into Actual/365 multiplied by the ratio of (360/365). For a record with 30/Actual accrual is converted into Actual/365 and is multiplied by the ratio of (360/Actual).

If the ACCRUAL_BASIS_CD is Actual/365, Actual/Actual, or Actual/360, OFSAA uses the following formula to calculate interest income on a payment date:

· Previous Period's Ending Balance * Cur Net Rate/100 * (Next Payment Date - Last Payment Date)/y

· Replace y with the denominator of one of the three accrual basis values mentioned earlier.

The actual numerator refers to the actual number of days in the current month.

The preceding two equations represent Interest in Arrears income calculations. The interest in advance calculations is indicated in the INT_TYPE section.

· If a compounding method has been chosen, OFSAA derives the compounded rate before calculating the preceding interest income amounts.

· If the ACCRUAL_BASIS_CD is Business/252, the following formula is used to calculate interest income on a payment date:

Previous Period's Ending Balance * Cur Net Rate/100* (Next Payment Date-Last Payment Date-y)/(252)

Here, y is the number of holidays/weekend days in the payment period.

Interest cash flow will be paid out on the next payment date. If the next payment turns out to be a holiday and you have selected the option of “Recalculate payment”, then the calculation will use the holiday adjusted next payment date and holiday adjusted last payment date in the calculation and payout on the holiday adjusted next payment date. If you have selected the “Shift Dates only” option, then the calculated interest cashflow will be output to the adjusted payment date with no recalculation of interest income.

· Must be equal to values 1 -7.

· Suggested default depends on the product characteristics of the institution's data. Default to the most common ACCRUAL_BASIS_CD for the product leaf.

· If AMRT_TYPE_CD = 800, 801, or 802 (Schedule) or 1000 to 99999 (Pattern), the ACCRUAL_BASIS_CD cannot equal 1, 4 or 5.

Calculated interest due from the last payment date to the as of date.

For Oracle ALM, this field is used for Non-Maturity Behavior Pattern instruments, instruments that get repriced multiple times within a payment event, and for Annuity instruments.

1. For Non- Maturity Behavior Pattern instrument, Accrued interest provided is used to compute the first interest cash flow on the next_payment_date. If this information is available from the source system, the cash flow engine will be able to more accurately reflect the interest cash flow due to the next interest cash flow date (NEXT_PAYMENT_DATE). The cash flow engine combines the ACCRUED_INTEREST amount (up to the AS_OF_DATE) with a calculated interest from the AS_OF_DATE + 1day to the NEXT_PAYMENT_DATE.

NOTE:

For Non-Maturity Behavior Patterns, the principal payments are determined based on the pattern dates, and the interest payments are determined based on the NEXT_PAYMENT_DATE and PMT_FREQ from the instrument record.

2. When an adjustable Instrument gets repriced more than once from the last payment date to as of date, Engine expects Accrued Interest from LAST_PAYMENT_DATE till as of date to be supplied in the column ACCRUED_INTEREST for a more accurate reflection of Interest cash flow on next payment date.

If an Instrument gets repriced more than once from the last payment date till as of date, there will be multiple repriced rates to consider for that period, and the engine would not be able to go back to historical reprice rates between last payment date and as of date. It will use the current rate (CUR_NET_RATE) of the instrument and calculate interest from the last payment date until the next payment date. This could lead to incorrect initial interest cash flow on the next payment date. As an alternate, for these scenarios, the user can provide Accrued Interest for the period from last payment date till as of date, and the engine will calculate interest from as of date ass till next payment date, and add provided Accrued interest to get total interest cash flow on next payment date.

NOTE:

If Accrued interest is provided, the engine will use it in processing for the above notes scenarios. If the instrument is FIXED RATE (adjustable_type_cd= 0), then Interest is calculated from the Last Payment date till Next Payment Date

3. Annuity instruments (AMRT_TYPE_CD=850) use this field to store the accrued Interest from ORIGINATION_DATE of the instrument to As of Date. For Annuity, interest accumulates from origination date until Maturity.

On each payment date, the balance of the Annuity instrument increases with the payment amount. Also if these instruments are adjustable (ADUSTABLE_TYPE_CD= 250), rates will change from Origination Date to As of Date. The engine would not be able to go back in historical dates to calculate interest, considering the change in balance or rates, from origination.

To obtain proper interest, for both fixed and adjustable rates, it is recommended to provide accrued interest from the Origination date to As of date. When accrued interest is supplied, the cash flow engine would calculate Interest from As of date forward, and add provided accrued interest for proper total Interest cash flow population. The last payment date can be kept as the actual date as the cash flow engine will ignore the Last payment date in this case.

If the accrued interest is not available, and if you want to calculate interest from the Origination date, you can set the Last payment date = Origination date, however, interest will vary based on past payments and or rate changes.

· Should be > 0 for non-maturity behavior pattern instruments.

· For non-maturity behavior pattern instruments, set LAST_PAYMENT_DATE = AS_OF_DATE.

· For non-maturity behavior pattern instruments, set NEXT_PAYMENT_DATE equal to the next expected interest payment date.

· For non-maturity behavior pattern instruments, set PMT_FREQ equal to the interest payment frequency.

Calculated gross interest due from the last payment date to the as of date.

For Oracle ALM, this field is used for Non-Maturity Behavior Pattern instruments, instruments that get repriced multiple times within a payment event.

1. For Non- Maturity Behavior Pattern instrument, Accrued gross amount provided is used to compute the first interest cash flow gross on the next_payment_date. If this information is available from the source system, the cash flow engine will be able to more accurately reflect the interest cash flow gross due to the next interest cash flow date (NEXT_PAYMENT_DATE). The cash flow engine combines the ACCRUED_GROSS_AMT (up to the AS_OF_DATE) with a calculated interest from the AS_OF_DATE + 1day to the NEXT_PAYMENT_DATE.

NOTE:

For Non-Maturity Behavior Patterns, the principal payments are determined based on the pattern dates, and the interest payments are determined based on the NEXT_PAYMENT_DATE and PMT_FREQ from the instrument record.

2. When an adjustable Instrument gets repriced more than once from the last payment date to as of date, Engine expects Accrued gross amount from LAST_PAYMENT_DATE till as of date to be supplied in the column ACCRUED_GROSS_AMT for a more accurate reflection of Interest cash flow gross on next payment date.

If an Instrument gets repriced more than once from the last payment date till as of date, there will be multiple repriced rates to consider for that period, and the engine would not be able to go back to historical reprice rates between last payment date and as of date. It will use the current gross (CUR_GROSS_RATE) of the instrument and calculate interest gross from the last payment date till the next payment date. This could lead to incorrect initial interest cash flow gross on the next payment date. As an alternate, for these scenarios, user can provide an Accrued gross amount for the period from last payment date till as of date, and the engine will calculate interest gross from as of date till next payment date, and add provided Accrued gross amount to get total interest cash flow gross on next payment date.

NOTE:

If an Accrued gross amount is provided, the engine will use it in processing for the above notes scenarios. If the instrument is FIXED RATE (adjustable_type_cd= 0), then the Interest gross is calculated from the Last Payment date till Next Payment Date.

· Should be > 0 for non-maturity behavior pattern instruments.

Calculated interest (transfer) due to the last payment date to the as of date.

For Oracle ALM, this field is used for Non-Maturity Behavior Pattern instruments, instruments that get repriced multiple times within a payment event, and for Annuity instruments.

1. For Non- Maturity Behavior Pattern instrument, Accrued transfer interest provided is used to compute the first interest cash flow transfer (tp) on the next_payment_date. If this information is available from the source system, the cash flow engine will be able to more accurately reflect the interest cash flow tp due to the next interest cash flow date (NEXT_PAYMENT_DATE). The cash flow engine combines the ACCRUED_TRANSFER_AMT (up to the AS_OF_DATE) with a calculated interest from the AS_OF_DATE + 1day to the NEXT_PAYMENT_DATE.

NOTE:

For Non-Maturity Behavior, Pattern fixed records (ADJUSTABLE_TYPEC_D=0), when Accrued Transfer Interest is provided, ensure to provide LAST_PAYMENT_DATE equal to AS_OF_DATE.

For Non-Maturity Behavior Patterns, the principal payments are determined based on the pattern dates, and the interest payments are determined based on the NEXT_PAYMENT_DATE and PMT_FREQ from the instrument record.

2. When an adjustable Instrument gets repriced more than once from the last payment date to as of date, the Engine expects Accrued transfer amount from LAST_PAYMENT_DATE till as of date to be supplied in the column ACCRUED_TRASNFER_AMT for a more accurate reflection of Interest cash flow tp on next payment date.

If an Instrument gets repriced more than once from the last payment date till as of date, there will be multiple repriced rates to consider for that period, and the engine would not be able to go back to historical reprice rates between last payment date and as of date. It will use the current transfer (TRANSFER_RATE) of the instrument and calculate interest tp from the last payment date till the next payment date. This could lead to incorrect initial interest cash flow tp on the next payment date. As an alternate, for these scenarios, user can provide Accrued transfer amount for the period from last payment date till as of date, and the engine will calculate interest tp from as of date till next payment date, and add provided Accrued transfer amount to get total interest cash flow tp on next payment date.

If the Accrued transfer amount is provided, the engine will use it in processing for the above notes scenarios. If the instrument is FIXED RATE (adjustable_type_cd= 0), then Interest tp is calculated from the Last Payment date till Next Payment Date

3. Annuity instruments (AMRT_TYPE_CD=850) use this field to store the accrued Interest from ORIGINATION_DATE of the instrument to As of Date. For Annuity, interest accumulates from origination date until Maturity.

On each payment date, the balance of the Annuity instrument increases with the payment amount. Also if these instruments are adjustable (ADUSTABLE_TYPE_CD= 250), rates will change from Origination Date to As of Date. The engine would not be able to go back in historical dates to calculate interest, considering the change in balance or rates, from origination.

To obtain proper interest, for both fixed and adjustable rates, it is recommended to provide accrued interest from the Origination date to As of date. When accrued interest is supplied, the cash flow engine would calculate Interest from As of date forward, and add provided accrued interest for proper total Interest cash flow population. The last payment date can be kept as the actual date as the cash flow engine will ignore the Last payment date in this case.

If the accrued interest is not available, and if you want to calculate interest from the Origination date, you can set the Last payment date = Origination date, however, interest will vary based on past payments and or rate changes.

· Should be > 0 for non-maturity behavior pattern instruments.

Identifies the repricing method and repricing characteristics of the record.

For Oracle ALM, this field works in conjunction with REPRICE_FREQ to determine the repricing characteristics of an instrument. An ADJUSTABLE_TYPE_CD must be specified if the record is expected to reprice.

Oracle ALM

The code values for this field are as follows:

Code Value |

Definition |

Repricing Frequency |

Repricing Method |

|---|---|---|---|

000 |

Fixed |

0 |

No Repricing |

030 |

Administered Rate |

> 0 |

Reprices when IRC (interest rate code) changes.* |

050 |

Floating Rate |

> 0 |

Reprices when IRC (interest rate code) changes.* |

250 |

Adjustable |

> 0 |

Last Reprice Date + Reprice Frequency.* |

300 |

Tiered Balance Interest Rate |

If using FTP, reprice frequency should be specified for each tier record.FTP requires this information to determine if a tier record is fixed or adjustable-rate |

Depends on Adjustable Type of tier record(s) |

500-99999 |

Reprice Pattern |

> 0 |

Reprices based on pattern definition |

*(if not in tease period)

§ If the ADJUSTABLE_TYPE_CD = 0 and the REPRICE_FREQ = 0, then the record is fixed-rate.

§ If the ADJUSTABLE_TYPE_CD = 30 or 50 and the REPRICE_FREQ > 0, then the reprice dates are driven by forecasted yield curve rate changes rather than by the REPRICE_FREQ. For these codes, Oracle ALM reprices the record by referencing the Forecast Rate Assumption - interest rate code (IRC) when producing cash flow information at the beginning of each bucket. There is one reference to the IRC per modeling bucket.

The database field, NEXT_REPRICE_DATE, is not used when the ADJUSTABLE_TYPE_CD = 30 or 50. The database field, REPRICE_FREQ, is used to determine the yield curve point when the IRC is a yield curve as opposed to a single rate IRC.

NOTE:

Floating/Administered ADJUSTABLE_TYPE_CD should not be used for instruments with periodic caps and/or floors because periodic caps and floors infer a specific repricing frequency.

§ If the ADJUSTABLE_TYPE_CD = 250 and the REPRICE_FREQ > 0, then the repricing frequency of the record is determined by the REPRICE_FREQ and NEXT_REPRICE_DATE. See these fields for further explanations of the repricing process.

NOTE:

Records where REPRICE FREQ is frequent, say 1 DAY, user can either model it using ADJUSTABLE_TYPE_CD of 250 (Adjustable) with REPRICE FREQ as 1 D, or using ADJUSTABLE_TYPE_CD as 50 (Floating Rate). As each modeling time bucket has a single forecasted rate for a specific Interest Rate Term Point, the engine would fetch the same rate for ‘n’ number of repricing falling in that modeling time bucket. Both models are equivalent from a business perspective, but use ADJUSTABLE_TYPE_CD as 50 would provide processing efficiency.

4. The value input into theADJUSTABLE_TYPE_CD overrides the REPRICE_ FREQ value. For instance, even though the REPRICE_FREQ > 0 and if the ADJUSTABLE_TYPE_CD = 0, OFSAA treats the record as a fixed-rate instrument.

5. When an Instrument gets repriced more than once within a payment period, the engine uses the rates for each repricing period within a payment period as prevailing and calculate the interest payment. This is applicable only for Multiple Reprice rates/events in one payment period – Interest in Arrears.

For scenarios where the instrument gets repriced multiple times from LAST_PAYMENT_DATE to as of date, the interest cash flow calculation uses Accrued interest, if provided, and adds it with calculated interest from as of date till next payment date. If accrued interest is not provided, interest is calculated from the last payment date till the Next payment date.

6. ADJUSTABLE_TYPE_CD = 300 is used when a different interest rate is paid/charged for parts of an account balance that fall within set amount ranges. In such a case, additional data for each balance tier is required in table FSI_D_ACCOUNT_RATE_TIERS (sourced from STG_ACCOUNT_RATE_TIERS).For more details, see Tiered Balance Interest Rate.

Oracle Funds Transfer Pricing

Oracle Funds Transfer Pricing references REPRICE_FREQ to determine if the record is an adjustable-rate instrument.

· If the record is a floating rate or administered rate product, ADJUSTABLE_ TYPE_CD = 30 or 50.

· If the record reprices contractually according to NEXT_REPRICE_DATE and REPRICE_FREQ information, ADJUSTABLE_TYPE_CD = 250.

· If the ADJUSTABLE_TYPE_CD > 0, REPRICE_FREQ > 0.

· If the record is fixed, ADJUSTABLE_TYPE_CD = 0.

The Transfer Pricing Engine outputs the All-in transfer rate that includes the base transfer pricing (TP) rate plus any defined transfer rate adjustments. The components of the All-in TP rate are defined in the Standard Transfer Pricing Process, Calculation Elements block.

This field is populated (optionally) by the FTP Process and represents the total of the base transfer rate plus any standard transfer rate adjustments.

None

Code to indicate how the cash flow engine should amortize (or accrete) a discount or premium amount or fee amount. The amount considered for amortization on the instrument record is defined by the DEFERRED_CUR_BAL.

Premium and discount instruments use this field to indicate the method to amortize/accrete. Values are 0=Level Yield, 1=Straight Line. This input is read by the cash flow engine when the DEFERRED_CUR_BAL is > 0. See Deferred Current Balance (DEFERRED_CUR_BAL) for a description of the Level Yield calculation.

If the DEFERRED_CUR_BAL < > 0 then AMORT_METH_PDFC_CD must be populated with 0 (default) or 1.

Defines the method by which an account's principal and interest are amortized.

Oracle ALM and Funds Transfer Pricing cash flow methodologies use AMRT_ TYPE_CD to determine the calculation method of the record's amortization of principal and the resulting calculation of interest. The following are the supported AMRT_TYPE code values.

Conventionally Amortizing |

Description |

|---|---|

100 |

Conventional Fixed |

400 |

Balloon |

500 |

Adjustable Conventional |

600 |

Adjustable Negative Amortizing |

840 |

Lease |

Non Conventionally Amortizing |

Description |

|---|---|

700 |

Simple Interest |

710 |

Rule of 78s |

800 - 802 |

Payment Schedules |

820 |

Level Principal |

850 |

Annuity |

999 |

Default Value |

1000 - 69999 |

User-Defined Payment Patterns |

70000-99999 |

User-Defined Behavior Patterns |

The following are the explanations of each of the amortization type codes.

100, 400, 500, 600, 840 - Conventionally Amortizing AMRT_TYPE_CDs

Description of amortization type codes follows

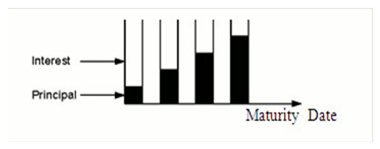

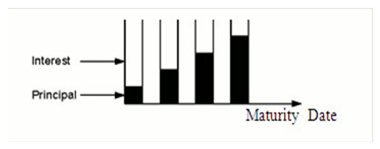

The conventional amortization loan types have loan payments that are unevenly divided between principal balance and interest owed. The total payment amount (principal + interest) is generally equal throughout the life of the loan. The interest portion (non-shaded portion) of each payment is calculated based on the record's interest rate and the remaining balance of the loan. Therefore, close to the loan's origination, a higher portion of the payment consists of interest rather than principal. As the loan is paid down, an increasing portion of each payment is allocated to the principal until a zero balance is reached at maturity.

NOTE:

For Lease amortization, the principal is reduced to the amount defined in the RESIDUAL_AMOUNT column rather than zero.

For these five AMRT_TYPE_CDs, the amount in the CUR_PAYMENT and/or ORG_PAYMENT_AMT fields should equal the principal plus interest.

Following is a breakout of these four conventionally amortizing AMRT_TYPE_CDs:

Conventional Loan Type |

Description |

|---|---|

100 Conventional Fixed |

(Described earlier) |

400 Balloon |

A loan in which the amortization term (AMRT_ TERM) of an instrument exceeds the maturity term (ORG_TERM). For example, a loan with an original term of seven years is amortized conventionally as if it were a 30-year instrument. At the end of the 7th year, there exists a large balloon payment that represents 23 years of the non-amortized loan balance. |

500 Conventional Adjustable |

Repricing instrument with conventional amortization. |

600 Adjustable Neg Am |

In a negatively amortizing instrument, the principal of a loan increase when the loan payments are insufficient to pay the interest due. The unpaid interest is added to the outstanding loan balance, causing the principal to increase rather than decrease, as payments are made. For more details, see Negative Amortization Amount (NEG_AMRT_AMT) |

840 Lease |

A lease instrument amortizes down to the amount specified in the RESIDUAL_AMOUNT column.The CUR_PAYMENT and/or ORG_PAYMENT_AMT for a fixed rate lease should be entered so the instrument will achieve the RESIDUAL_AMOUNT on the MATURITY_DATE of the lease contract.For an adjustable-rate lease, the CUR_PAYMENT will be re-calculated by the cash flow engine considering the MATURITY_DATE, RESIDUAL_AMOUNT, and Current Rate. |

The OFSAA cash flow engine does not treat AMRT_TYPE_CD 100, 400, or 500 differently. For a given record, the use of any of these three types produces identical results. The division is simply for product distinction purposes. For instance, AMRT_TYPE_CD 100 can be used for a fixed-rate, adjustable-rate, or a balloon record. However, only an AMRT_ TYPE 600 record uses the negative amortization fields.

The cash flow engine does not use AMRT_TYPE_CD to identify whether a record is adjustable or not. It instead uses REPRICE_FREQ (and in Oracle ALM, ADJUSTABLE_TYPE_CD) for this purpose. Therefore, any amortization type can be adjustable.

The cash flow engine does not use AMRT_TYPE_CD to determine whether a record is a balloon or not. It instead uses AMRT_TERM and ORG_TERM for this purpose. Therefore, even a level principal AMRT_TYPE_CD could be treated as a balloon instrument.

A record must be AMRT_TYPE_CD 600 for the cash flow engine to process the record using the negative amortization fields.

A record must be AMRT_TYPE_CD 840 for the cash flow engine to process the record using the residual amount field.

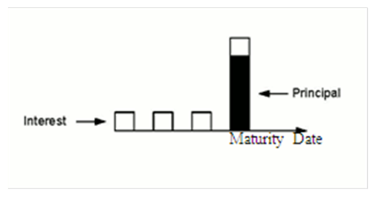

700 Simple Interest (Non-amortizing)

Description of amortization type codes follows

For simple interest amortization type, no principal is paid until maturity. If NEXT_ PAYMENT_DATE < MATURITY_DATE, OFSA calculates interim interest-only payments as shown in the earlier diagram. OFSA pays the entire record's principal balance on the maturity date along with the appropriate interest amount.

For this AMRT_TYPE_CD, the CUR_PAYMENT and/or ORG_PAYMENT_AMT fields should equal 0.

710: Rule of 78s

An amortization type in which the following calculation is used in computing the interest rebated when a borrower pays off a loan before maturity.

For example, in a 12-month loan, the total is 78 (1 + 2 + ... 12 = 78). For the first month, 12/78 of the total interest is due. In the second month, this amount is 11/78 of the total.

For Rule of 78 AMRT_TYPE_CDs, the amount in the CUR_PAYMENT and/or ORG_PAYMENT_AMT field should equal the principal plus interest. For more details, see the Cash Flow Calculation Process

800 - 802: Payment Schedule

The key to matching the instrument record with its corresponding payment schedule record is the INSTRUMENT_TYPE_CD and ID_NUMBER.

800:Conventional Payment Schedule

This AMRT_TYPE_CD conventionally amortizes a record whose cash flows are defined in the PAYMENT_SCHEDULE table. Payment amounts should contain both principal + interest. Engine calculates Interest on provided schedule dates. The principal amount gets calculated as the difference between the Payment amount provided – Interest cash flow calculated on that date.

For example, if for a specific schedule date Payment amount provided is USD 55,000, and Interest calculated by the engine is USD 30,000. For this date, Principal amount populated would be = USD 55,000- USD 30,000= USD 25,000. The interest amount populated would be USD 30,000.

801: Level Principal Payment Schedule

This AMRT_TYPE_CD level principal amortizes a record whose cash flows are defined in the PAYMENT_SCHEDULE table. Payment amounts should contain the principal only. Engine calculates Interest on provided schedule dates.

For example, if for a specific schedule date Payment amount provided is USD 55,000, and Interest calculated by the engine is USD 30,000. For this date, the Principal amount populated would be equal to the payment amount provided, and the Interest amount populated would be USD 30,000.

802: Simple interest Payment Schedule

This AMRT_TYPE_CD simple interest amortizes a record whose cash flow dates are defined in the PAYMENT_ SCHEDULE table. Payment amounts should equal 0 (the engine calculates interest and ignores payment amount in the schedule records). The principal balance is paid on the maturity date as defined in the schedule.

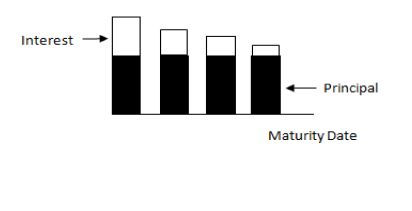

820 Level Principal Payments

Description of amortization type codes follows

The level of principal payment is the amortization type in which the principal portion of the loan payment remains constant for the life of the loan. Interest (non-shaded portion) is calculated as a percentage of the remaining balance, and therefore, the interest portion decreases as the maturity date nears. Because the principal portion of the paymentis constant for life, the total payment amount (principal plus interest) decreases as the loan approaches maturity.

For this AMRT_TYPE_CD, the amount in CUR_PAYMENT and ORG_PAYMENT_AMT fields should equal the principal portion only.

850 Annuities

The Annuity amortization type assumes the payment amount (CUR_PAYMENT and/or ORG_PAYMENT_AMT) will increase the principal balance rather than reduce it.

For this AMRT_TYPE_CD, the amount in the CUR_PAYMENT and/or ORG_PAYMENT_AMT fields should equal the amount of the regular / scheduled principal contribution. The CUR_PAYMENT and/or ORG_PAYMENT_AMT should be expressed as a positive value and the cash flow engine will multiply by -1 to reflect the principal contribution.

Users can also, optionally populate the MATURITY_AMOUNT column. If populated, this amount will be considered as the target amount and the required periodic payment will be calculated to achieve the Maturity Amount at the maturity of the instrument.

Interest from the origination of the annuity instrument is settled on maturity. On each payment date, the balance of the Annuity instrument increases with the payment amount. Also, if the record is adjustable, rates will change from origination to as of date. The engine does not look back to historical dates to calculate interest, considering the change in balance or rates, from origination. To obtain proper interest for both fixed and adjustable rates, we recommend providing accrued interest from the Origination date and keep the actual Last payment date. When accrued interest is supplied, the engine would calculate Interest from as of date forward, and add provided accrued interest for proper total interest cash flow population. If the accrued interest is not available, and if you want to calculate interest from the Origination date, you can set the Last payment date = Origination date, however, interest will vary based on past payments and or rate changes.

1000 - 69999: User-Defined Payment Patterns

Records with this range of AMRT_TYPE_CDs are matched to the user-defined amortizations in the Payment Pattern user interface. The key for matching is the AMRT_TYPE_CD value. These records can only be defined as conventionally amortizing, level-principal, or simple interest.

70000-99999: User-Defined Behavior Patterns

Records with this range of AMRT_TYPE_CDs are matched to the user-defined amortizations in the Behavior Pattern user interface. The key for matching is the AMRT_TYPE_CD value.

You can attach a behavior pattern code to a Behavior Pattern Rule, if you do not want to update BP code at instrument level, and want to have scenario-based BP runoff.

If behavior pattern code is not attached to a Behavior Pattern Rule, then the engine behaves as in an existing manner. That is, the Amortization type of instrument will apply to current business and Behavior Pattern from Product Characteristics to new business.

For more information, see the OFS ALM User Guide.

999: Other Amortization Type

If this value is used, the cash flow engine uses the AMRT_TYPE_CD 700, simple interest amortization method. Using this AMRT_TYPE_CD for product identification purposes is not recommended. This should be reserved for indicating erroneous data extraction.

· All accounts require a valid AMRT_TYPE_CD as listed earlier.

· If the AMRT_TYPE_CD <> 700 or is not a simple interest amortizing schedule or pattern record, CUR_PAYMENT and ORG_PAYMENT_AMT must be valid. If CUR_PAYMENT and/or ORG_PAYMENT_AMT value is too small or equal to 0, the cash flow engine may generate erroneous cash flows, depending on the AMRT_TYPE_CD selected.

· If the record defaults to AMRT_TYPE_CD 999, or if it cannot find a match in PAYMENT_SCHEDULE or PAYMENT_PATTERNS, the cash flow engine processes the record as AMRT_TYPE_CD 700.

· Suggested defaults in the following table are dependent on basic knowledge of product characteristics:

Loan Type |

Suggested AMRT_TYPE_CD |

|---|---|

Non-amortizing, such as Certificates of Deposit |

700 |

Fixed amortizing, such as short term consumer loans |

100 |

Variable-rate amortizing, such as adjustable-rate mortgages |

500 |

· Rule of 78s instruments is implicitly fixed.

· If AMRT_TYPE_CD = 710, REPRICE_FREQ = 0.

Oracle Funds Transfer Pricing

Any invalid AMRT TYPE code will default to 700 (Non-Conventionally amortization value).

The amortization term is used in conjunction with AMRT_TERM_MULT to define the term over which the payment is amortized.

AMRT_TERM is used by Oracle ALM and Funds Transfer Pricing for adjust-able-rate cash flow transfer-priced records.

Amortization Term

Amortization term has two main purposes:

· Identifies whether a record is a balloon and is used in the calculation of payment amounts.

· Used when recalculating payment amounts for User-Defined Payment Pattern records that are defined as % Current Payment and have more than one payment frequency defined in the Payment Pattern user interface.

Balloon Check

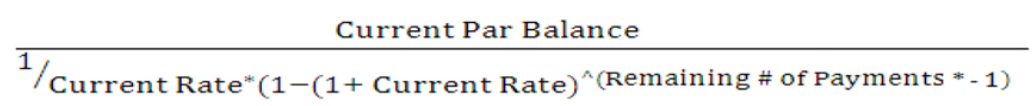

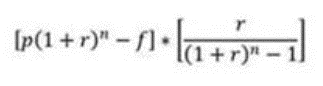

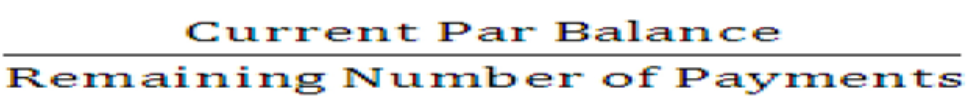

As an initial step before processing a record's cash flows, the cash flow engine compares the record's ORG_TERM with its AMRT_TERM. If AMRT_TERM = ORG_TERM. The cash flow engine then uses the CUR_PAYMENT from the record. When appropriate, the cash flow engine later recalculates the CUR_PAYMENT if 1) The record reprices; 2) The TEASER_END_ DATE is reached, or 3) A negative amortization-related recalculation date is reached.

If the AMRT_TERM > ORG_TERM, the cash flow engine recognizes the record as a balloon and recalculates the payment amount. To perform this calculation, the cash flow engine must derive the remaining number of payments until the end of the amortization term. This is calculated by adding the AMRT_TERM to the ORIGINATION_DATE to determine the amortization end date. The remaining number of payments is calculated by determining how many payments can be made from and including the NEXT_PAYMENT_DATE and this date. Following is the formula used for determining the remaining number of payments:

(((ORIGINATION_DATE - Beginning of Payment Period Date) / 30.41667 + AMRT_TERM) / PMT_FREQ)

Beginning of Payment Period Date refers to the date of the current payment that the cash flow engine is calculating. This would equal the detail record's NEXT_PAYMENT DATE if the engine were calculating the first forecasted cash flow. After the remaining number of payments have been calculated, the cash flow engine derives the CUR_PAYMENT amount and applies it to the record's cash flows. Ignoring repricings and other recalculation events, this payment amount is paid until maturity, at which time the cash flow engine pays the record's balloon payment (the remaining principal portion).

User-Defined Pattern

Records that are defined as % Current Payment in the User-Defined Payment Pattern screen and have more than one payment frequency defined in the Payment Pattern user interface also recalculate the payment amount using the earlier formula.

The remaining number of payments on pattern records is calculated by rounding to the nearest number of payments when the remaining term is not exactly divisible by the payment frequency.

· If the record is a balloon, AMRT_TERM > ORG_TERM.

· If the record is not a balloon, AMRT_TERM = ORG_TERM.

· AMRT_TERM should never be less than ORG_TERM.

· Do not default AMRT_TERM or ORG_TERM to 0. Use 1.

· The validation of AMRT_TERM should always be done in conjunction with AMRT_TERM_MULT.

Used in conjunction with AMRT_TERM to define the term over which the payment is amortized.

This field is the multiplier of the AMRT_TERM field. It is used in conjunction with AMRT_TERM to define the term over which the payment is amortized. Oracle ALM and Funds Transfer Pricing cash flow transfer-priced records reference AMRT_TERM_MULT when recalculating the current payment as defined under the AMRT_TERM section. AMRT_TERM_MULT determines the units (Months, Days, or Years) of AMRT_TERM.

Values are:

D= Days

M= Months

Y= Years

The date that the extracted data represents.

AS_OF_DATE is used for the following purposes:

· Application Preferences filter (Oracle ALM and Oracle FTP)

· Market value calculations (Oracle ALM)

t calculation

The term cash flow from AS_OF_DATE is used for matching cash flow for discounting purposes.

· Payment Schedules and Patterns - used to determine where in the life of the loan the record is.

· Transfer Pricing Remaining Term Pricing Basis

Application Preferences

Oracle ALM and Oracle FTP use AS_OF_DATE as a primary data filter. When executing an ALM or Transfer Pricing processing run, the engines compare the AS_OF_DATE in Application Preferences, against the AS_ OF_DATE field of the detail instrument record. If AS_OF_DATE from the instrument record is the same date as that from Application Preferences, then engines process the instrument record. Otherwise, engines do not process the instrument record.

Market Value Calculations

· When calculating the market valuation of a daily paying record (PMT_FREQ_MULT = D), Oracle ALM uses the AS_OF_DATE when calculating the t period variable.

· For the Oracle ALM Discount Methods - Spot Interest Rate Code and Forecast Remaining Term methods, the AS_OF_DATE is used in calculating the cash flow's discounting term. The cash flow date (the payment date) is subtracted from the AS_OF_DATE to determine this term. This term is then applied to the appropriate discount yield curve in the Oracle ALM Forecast Rates assumption rule to determine the discount rate for the record (after applying the indicated interpolation method).

Payment Schedules and User-Defined Payment Patterns

· Relative Patterns - AS_OF_DATE is used to determine where in the life of a Payment Pattern a record is currently positioned. For relative patterns, the Payment Frequencies specified in the Pattern interface are rolled forward from the ORIGINATION_DATE until the rolled date is greater than the AS_OF_ DATE.

· Absolute Patterns - In determining the first forecasted payment date, the cash flow engine selects the payment date in the pattern that corresponds to the first date after the AS_OF_DATE.

NOTE:

If NEXT_PAYMENT_DATE is different from the next defined payment date in the absolute pattern, the NEXT_ PAYMENT_DATE is used instead. Therefore, the cash flow engine requires that the NEXT_PAYMENT_DATE correspond to the appropriate date in the absolute payment pattern.

· Payment Schedules – the cash flow engine makes the first forecasted payment based on the first date in the payment schedule table after the AS_OF_DATE.

Transfer Pricing Remaining Term Pricing Basis

When the Remaining Term Pricing Basis is selected for Transfer Pricing, transfer rates for the relevant methodologies are calculated from the AS_OF_DATE.

Unless the record has a future ORIGINATION_DATE, the following conditions exist:

· AS_OF_DATE = MATURITY_DATE – REMAIN_TERM_C

· AS_OF_DATE < NEXT_REPRICE_DATE

· AS_OF_DATE < NEXT_PAYMENT_DATE

· AS_OF_DATE < MATURITY_DATE

· AS_OF_DATE >= ORIGINATION_DATE

· AS_OF_DATE >= ISSUE_DATE

· AS_OF_DATE < PMT_ADJUST_DATE

· AS_OF_DATE >= LAST_PAYMENT_DATE

· AS_OF_DATE >= LAST_REPRICE_DATE

Represents the monthly or month to date Average Book Balance of the account.

Average Balance is typically used in Funds Transfer Pricing for calculating instrument level charge/credit amounts by customers who run their FTP process monthly, because it gives the best approximation of the balance over the entire month and will result in a funds charge/credit amount that closely matches the interest income or expense for the account.

Note:The most accurate way to compute funds charges/credits is to run the calculation daily using end of day balances and accrue the charges/credits over the entire month.This approach will exactly match with the interest accruals.Use of Average balance as described above is the next best option.

In Funds Transfer Pricing, when using Average Balance, along with a monthly accrual, the charge/credit calculation is as follows:

AVG_BOOK_BALx TRANSFER_RATE/100 x Monthly Accrual Factor (e.g. ACT/ACT)

None

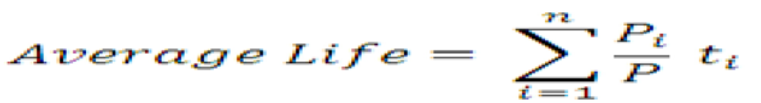

The average life of a loan is the average number of years that the principal is outstanding. The calculated amount represents the time necessary for the principal to be reduced by one half of its current value.

This financial measure is calculated by Oracle ALM when the corresponding Calculation Element is selected and the result is written to FSI_O_RESULT_MASTER and FSI_O_CONSOLIDATED_MASTER. Users can additionally update each instrument record with the calculation result by selecting the related measure in Output Preferences.

Oracle FTP computes the Average Life when the Average Life TP Method is applied to an instrument record. With this TP Method, the user has the additional option to update the instrument record with the calculation results (TP_AVERAGE_LIFE). For more information on the Average Life TP Method, see the Oracle Financial Services Funds Transfer Pricing User Guide.

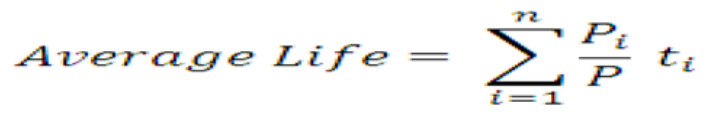

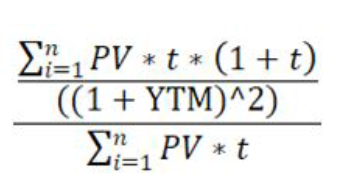

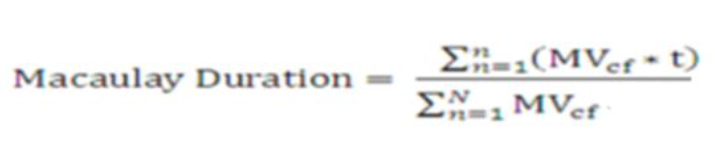

The cash flow engine calculates the average life using the following formula:

Description of the Average Life formula follows

Where:

P is the principal

Pi is the principal repayment in coupon i, hence,

is the fraction of the principal repaid in coupon i and ti is the time from the start of coupon i.

None

Represents Base index value to be provided for Inflation-Indexed Instruments.

Oracle ALM reference BASE_INDEX_VALUE to calculate Index Factor, for the inflation-indexed instrument.

For Index factor calculation, see Inflation-Indexed Instrument.

None

Oracle FTP calculates the funds charge or credit due to basis risk when the user selects the Adjustments, Charge/Credit option in the TP Process – Calculation Elements block.

This field is populated by the FTP process (optionally) if selected in the Calculation Elements block. The TP Engine calculates this amount as follows:

AVG_BOOK_BAL or CUR_BOOK_BAL X BASIS_RISK_COST_RATE/100 X ACCRUAL BASIS

NOTE:

The balance referenced in the preceding calculation is selected in the FTP Application Preferences screen.

None

Oracle Funds Transfer Pricing populates this field (optionally) when the user specifies a Basis Risk Cost amount in the TP Adjustment Rule.

This field is related to FTP Adjustment Rules. When the basis risk adjustment type is defined and included in the TP process, the TP Engine calculates and populates this field according to the amount input by the user through the Adjustment Rule user interface.

None

Oracle Funds Transfer Pricing populates this field (optionally) when the user specifies a Basis Risk Cost rate or defines a formula-based rate in the TP Adjustment Rule.

This field is related to FTP Adjustment Rules. When the basis risk adjustment type is defined and included in the TP process, the TP Engine calculates and populates this field according to the assumption input by the user through the Adjustment Rule user interface.

None

Behavior Type indicates the type of behavior pattern that is mapped to the instrument records.

Oracle ALM uses BEHAVIOUR_TYPE_CD to determine the type of behavior pattern being applied to the instrument record. The following are the supported BEHAVIOUR_TYPE_CODE values.

Code Value |

Behavior Type |

|---|---|

1 |

Non-Maturity |

2 |

Non-Performing |

3 |

Devolvement and Recovery |

NOTE:

Behavior patterns have specific requirements for Accrued Interest depending on the adjustable type (fixed or adjustable) code. For more information, see the ACCRUED_INTEREST section.

· BEHAVIOR_TYPE_CD is mandatory when AMRT_TYPE_CD is populated with a Behavior Pattern code. Example: AMRT_TYPE_CD >= 70000 and <=99999.

· If AMRT_TYPE_CD is not in the Behavior Pattern range, then BEHAVIOR_TYPE_CD can default to NULL.

· If Behavior type code =2, then the MATURITY_DATE of instrument needs to be greater than max Tenor of the behavior pattern.

This field indicates the type of cash flow associated with Non-Performing or Devolvement and Recovery Behavior Pattern instruments.

Oracle ALM uses BEHAVIOUR_SUB_TYPE_CD to determine the SUB type of the behavior pattern being applied to the instrument record. The following are the supported BEHAVIOUR_SUB_TYPE_CODE values.

Code Value |

Behavior Sub Type |

|---|---|

201 |

Substandard |

202 |

Doubtful |

203 |

Loss |

301 |

Sight Devolvement |

302 |

Sight Recovery |

303 |

Usance Devolvement |

304 |

Usance Recovery |

· BEHAVIOR_SUB_TYPE_CD is mandatory when AMRT_TYPE_CD is populated with a Behavior Pattern code. Example, AMRT_TYPE_CD >= 70000 and <=99999 AND the BEHAVIOR_TYPE_CD is 2 (Non-Performing) or 3 (Devolvement and Recovery).

· BEHAVIOR_SUB_TYPE_CD can be NULL when BEHAVIOR_TYPE_CD = 1 (Non-Maturity) or when the AMRT_TYPE_CD is not in the earlier mentioned Behavior Pattern Range.

Acceptable mapping of Behavior Pattern Type to Behavior Pattern Sub Type

BP Type Code Value |

Behavior Type |

BP Subtype Code Value |

Behavior Sub Type |

Devolvement Status Code (Inst Record) |

Notes |

|---|---|---|---|---|---|

1 |

Non Maturity |

101* |

Core |

||

1 |

Non Maturity |

102* |

Volatile |

||

2 |

Non Performing |

201 |

Substandard |

||

2 |

Non Performing |

202 |

Doubtful |

||

2 |

Non Performing |

203 |

Loss |

||

3 |

Devolvement and Recovery |

301 |

Sight Devolvement |

defined bp pattern only, not on instrument record |

|

3 |

Devolvement and Recovery |

302 |

Sight Recovery |

defined bp pattern only, not on instrument record |

|

3 |

Devolvement and Recovery |

303 |

Usance Devolvement |

defined bp pattern only, not on instrument record |

|

3 |

Devolvement and Recovery |

304 |

Usance Recovery |

defined bp pattern only, not on instrument record |

|

3 |

Devolvement and Recovery |

305** |

Usance |

0,1*** |

0 = Not Devolved, 1 = Devolved |

3 |

Devolvement and Recovery |

306** |

Sight |

0,1*** |

0 = Not Devolved, 1 = Devolved |

NOTE:

** Instrument records need subtype value of 305 or 306 for D&R These are referenced against the behavior pattern subtype codes 301-304 in the D&R pattern definition

*** If Devolvement status cd = 0, CFE will process the Pattern with the corresponding devolvement and recovery subtypes

*** If Devolvement status cd = 1, CFE will process the Pattern with the corresponding recovery subtypes only.

For example, if Sub Type=306 and Devolvement Status = 0, then CFE processes the behavior pattern information for Sight Devolvement first followed by the Sight Recovery in the sequence of the tenors i.e, the pattern definition can have D followed by R followed by D followed by R and CFE will process the information in the same sequence. If Sub Type=306 and Devolvement Status = 1, then CFE processes the behavior pattern information for Sight Recovery only and will ignore any Devolevment event in the pattern.

Breakage Type Code indicates the type of Break for the given row of data. This column will exist only tables that hold break events, such as FSI_D_BREAK_FUNDING_CHARGES. This column must be populated for the Economic Loss Breakage Charge calculation to function properly.

Oracle FTP uses BREAKAGE_TYPE_CD to determine the type of break event. The following are the supported BREAKAGE_TYPE_CD values.

Code Value Breakage Type

· Full Break (type 1)

· Partial Break (type 2)

· Change in Attributes Break (type 3)

· Combination of Partial Break and Change in Attributes Break (type 5)

BREAKAGE_TYPE_CD is mandatory for calculating an Economic Loss breakage charge. Values must be 1,2,3 or 5. These values are populated automatically by the Break Identification Process but must be populated manually if break data is being loaded from an external source.

This field is populated by the FTP Standard Process when running with an Adjustment Rule + Breakage Charge – Economic Loss defined. It holds the calculated result of the market value using the selected interest rate of Transfer Rate, Liquidity Premium Rate, Basis Risk Cost Rate, Pricing Incentive Rate, or Other Adjustment Rate as specified by the user during Adjustment Rule definition. This value reflects the net present value of the cash flows calculated from as of date to the maturity date of the instrument (remaining term).

Oracle Funds Transfer Pricing populates this field (optionally), when the user defines the Break Charge – Economic Loss calculation through their Adjustment Rule and enables the Adjustment Calculation in the TP Process. This column only exists in the FSI_D_BREAK_FUNDING_CHARGES table.

None

This field is populated by the FTP Standard Process when running with an Adjustment Rule + Breakage Charge – Economic Loss defined. It holds the calculated result of the Book Value – Break Funding Market Value (for Assets) or Break Funding Market Value – Book Value (for Liabilities). This value reflects the embedded value of the instrument and can be either positive or negative.

Oracle Funds Transfer Pricing populates this field (optionally), when the user defines the Break Charge – Economic Loss calculation through their Adjustment Rule and enables the Adjustment Calculation in the TP Process. This column only exists in the FSI_D_BREAK_FUNDING_CHARGES table.

None

This field is populated by the FTP Standard Process when running with an Adjustment Rule + Breakage Charge – Economic Loss defined. It holds the difference in Break Funding Amount between Prior Record and Current. If the record is a Full Break, then Break Funding Amount and Break Funding Amount Change will be the same. If Partial Break or Change in Attributes Break, then Break Funding Amount Change will show the change in the Break Funding amount (Prior Record – Current Record). This column holds the final result of the Breakage Charge calculation and is the actual “Breakage Charge”. If the value is positive, there is an Economic Gain to the bank, and if Negative, there is an Economic Loss. Both gains and losses are typically allocated to the originating business unit, for profitability reporting. The bank (originating business unit) should charge the customer for Economic Loss.

Oracle Funds Transfer Pricing populates this field (optionally), when the user defines the Break Charge – Economic Loss calculation through their Adjustment Rule and enables the Adjustment Calculation in the TP Process. This column only exists in the FSI_D_BREAK_FUNDING_CHARGES table.

None

The basis on which index factor is determined. Applicable for the inflation-indexed instrument.

Oracle ALM reference CAP_PROTECTION_CATEGORY to calculate Index Factor, for the inflation-indexed instrument.

Capital protection category values are represented by code values as follows.

Code Value |

Capital Protection Category |

|---|---|

0 |

No Floor |

1 |

Floor of 1 |

2 |

Max during life |

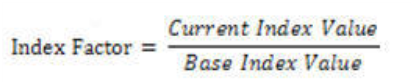

· If Capital Protection Category is ‘0’ (No Floor) then

Description of the Index Factor formula follows

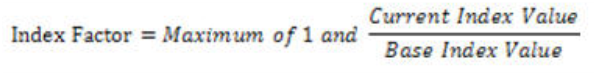

· If Capital Protection Category is ‘1’ (Floor of 1) then

Description of the Index Factor formula follows

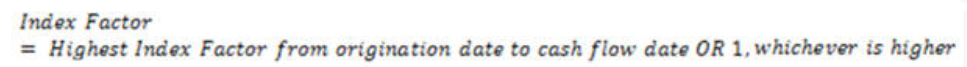

· If Capital Protection Category is ‘2’ (Max during life) then

Description of the Index Factor formula follows

· Must be equal to values 0-2

· Suggested default, if the instrument is not inflation indexed, to keep this value to null or 0.

This field is populated by the FTP Stochastic Process and holds the charge/credit amount for the original term Option Cost.

Oracle Funds Transfer Pricing populates this field (optionally) when the user selects the Option Cost – Charge / Credit option in the Stochastic FTP Process.

AVG_BOOK_BAL or CUR_BOOK_BAL X (HISTORIC_OAS – HISTORIC_STATIC_SPREAD)/100 X ACCRUAL BASIS

None

This field is populated by the FTP Stochastic Process and holds the charge/credit amount for the remaining term Option Cost.

Oracle Funds Transfer Pricing populates this field (optionally) when the user selects the Option Cost – Charge / Credit option in the Stochastic FTP Process.

AVG_BOOK_BAL or CUR_BOOK_BAL X (CUR_OAS – CUR_STATIC_SPREAD)/100 X ACCRUAL BASIS

None

This field is populated by the FTP Standard Process and holds the charge/credit amount for the original term Transfer Rate Charge or Credit.

Oracle Funds Transfer Pricing populates this field (optionally) when the user selects the Transfer Rate – Charge / Credit option in the Standard FTP Process.

AVG_BOOK_BAL or CUR_BOOK_BAL X TRANSFER_RATE / 100 X ACCRUAL BASIS

None

This field is populated by the FTP Standard Process and holds the charge/credit amount for the remaining term Transfer Rate Charge or Credit.

Oracle Funds Transfer Pricing populates this field (optionally) when the user selects the Transfer Rate – Charge / Credit option in the Standard FTP Process.

AVG_BOOK_BAL or CUR_BOOK_BAL X TRAN_RATE_REM_TERM / 100 X ACCRUAL BASIS

None

Indicates the compounding frequency used to calculate interest income.

Oracle ALM and Funds Transfer Pricing cash flow calculations reference the COMPOUND_BASIS_CD field when determining the detailed record's compounding method to be applied during interest income (financial element 430) calculations.

The following table shows the code values for the COMPOUND_BASIS_CD and the interest calculation logic for an annual-paying instrument with a 30/360 accrual basis code.

Code Value |

Description |

Annual Payment Calculation |

|---|---|---|

110 |

Daily |

Balance * [(1 + Rate/365)^365-1] |

120 |

Monthly |

Balance * [(1 + Rate/12)^12-1] |

130 |

Quarterly |

Balance * [(1 + Rate/4)^4-1] |

140 |

Semi-annual |

Balance * [(1 + Rate/2)^2-1] |

150 |

Annual |

Balance * [(1 + Rate/1)^1-1] |

160 |

Simple |

Balance * Rate (no compounding) |

170 |

Continuous |

e(Rate Per Payment) -1 |

200 |

At Maturity |

Balance * Rate (no compounding) |

999 |

Other |

Balance * Rate (no compounding) |

1. The annualized rate that is applied to the record for interest income calculations is compounded according to one of the methods listed earlier.

2. OFSAA cash flow engine compounds the rate on the record at the time of the interest income calculation. If the record has repriced, the cash flow engine calculates the new rate, applies any rounding, caps/floors, or tease periods, and then applies the compounding calculation (COMPOUND_BASIS_CD) before calculating interest income (financial element 430).

3. Simple and At Maturity calculate interest in the same manner. These two codes do not compound the rate.

4. Compounded interest is calculated only when the compounding frequency is less than the PMT_FREQ. If the compounding frequency is greater than the PMT_FREQ, the model assumes simple compounding.

5. Multiple reprice events within a payment event, compounding is applied when:

§ Compounding frequency is same as Repricing frequency

§ Compounding frequency is less than Payment frequency, and Payment frequency is same as Reprice frequency.

For above condition(s), on first payment date, post as of date, if accrued interest (see ACCRUED_INTEREST) is provided as download, interest is calculated on provided accrued interest. In addition, when compound frequency is less than payment frequency, there would be multiple compounding period within a payment event. Interest from last payment event until first compound period is used as an input for calculating interest for next compounding period, till next payment event is reached.

NOTE:

When Compounding frequency is same as Reprice frequency, with same payment and compounding frequency, compounding of interest would not happen.

For below Multiple Repricing use cases Compounding is defaulted to None:

1. When Adjustable type code =500-99999 (repricing patterns), COMPOUND_BASIS_CD defaults to None. An error message is logged "For Multiple Reprice Instruments with repricing patterns, the compounding defaults to None".

2. When Adjustable type =50 (floating-rate), COMPOUND_BASIS_CD defaults to None. An error message is logged "For Floating rate Multiple Reprice Instruments”, the compounding defaults to None”.

When COMPOUND_BASIS_CD is 170 (continuous), it is defaulted to None. An error message is logged “For Multiple reprice instruments when compounding frequency is set as Continuous (170). The compounding is defaulted to None”. This use case is applicable from release 8.1.1.1.0 onwards.

NOTE:

Simple to Annual compounding rate conversion: There are two points to note:

When term of cash flow is less than one year, then simple compounding rate would be used as it is for annual compounding. Because there is no compounding before 1 year.

When cash flow term is more than 1 Year, then the conversion is done by equating (P+I) for simple and annual compoundingSimple Compounding (P+I) Annual Compounding (P+I) 1 + (r*Term in Days/365)

= (1 + R) ^ (Term in Days/365)

R is rate after conversion from Simple to Annual compounding.

A valid COMPOUND_BASIS_CD must be one of the values listed earlier.

Suggested default - If the record's compounding is unknown, default to COMPOUND_BASIS_CD = 160, Simple.

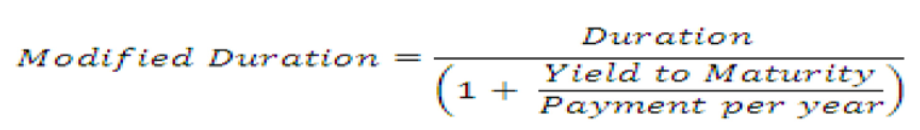

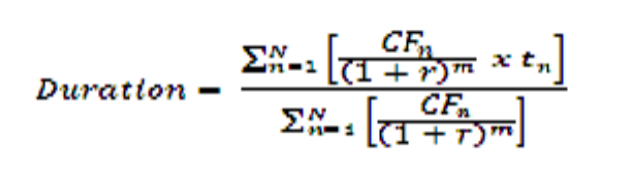

Convexity is a measure of the curvature of 2nd derivative of how the price of an instrument varies with the interest rate, that is, how the duration of an instrument changes as the interest rate changes.

Both the Static Deterministic and Dynamic Deterministic ALM processes will calculate and output convexity when the Market Value option is selected from the Calculation Elements block. This result is written to FSI_O_RESULT_MASTER and FSI_O_CONSOLIDATED_MASTER tables for each scenario defined in Forecast Rates. Additionally, users can choose to update the instrument data with Convexity for each record if the related option is selected on the Output Preferences block. The instrument record will be updated for scenario 1 result only.

The cash flow engine calculates convexity using the following formula:

Description of the Convexity formula follows

None

Current Gross Book Balance.

Oracle ALM

When there is deferred balance (DEFERRED_CUR_BAL), Oracle ALM uses CUR_BOOK_BAL to calculate accretion/amortization (financial element 540) and the deferred ending and average balances (financial element 520, 530).

Oracle Funds Transfer Pricing

Oracle Funds Transfer Pricing uses CUR_BOOK_BAL during calculations for LEDGER_STAT transfer pricing and if selected in Application Preferences, for calculation of Charge / Credit amounts.

When Remaining Term Calculation Mode is selected in the Standard TP Process, and the Target Balance for the subject product leaf is Book Balance (in the TP Rule), Oracle Transfer Pricing Option Cost calculations use CUR_BOOK_BAL as the target balance to which the sum of future discounted cash flows is set equal.

Validate that CUR_BOOK_BAL = CUR_PAR_BAL + DEFERRED_CUR_BAL.

The coupon rate of account expressed in terms of an annualized rate.

When the Model with Gross Rates switches is turned on in the Oracle ALM Product Characteristics rule, or in the Transfer Pricing Rule, CUR_GROSS_ RATE is used to calculate forecasted cash flows. When switched on, the cash flow engine uses the record's CUR_GROSS_RATE for two calculations:

Amortization - When conventionally amortizing a record's balance with the Model with Gross Rates option selected, the cash flow engine uses the CUR_GROSS_RATE as the customer rate. If the option is not selected, then the cash flow engine uses CUR_NET_RATE as the customer rate for amortization calculation.

Prepayments - To determine the rate at which the customer prepays, the current customer rate must be compared to the market rate. If the Model with Gross Rates is switched on, then the customer rate is represented by the CUR_GROSS_ RATE. If the switch is not turned on, the CUR_NET_RATE is used as the current customer rate.

If Model with Gross Rates is used, the Oracle ALM cash flow engine uses the CUR_GROSS_RATE for gross interest cash flow (financial element 435) calculations. This means that the record amortizes and prepays according to the CUR_ GROSS_RATE, but the net cash flows associated interest income (financial element 430) are calculated from the CUR_NET_RATE.

NOTE:

Depending on the NET_MARGIN_CD value, interest income is calculated differently.

Following is an explanation of how Oracle ALM calculates CUR_GROSS_ RATE:

Before the NEXT_REPRICE_DATE, the cash flow engine uses the CUR_GROSS_RATE from the detail record as the gross rate.

At or beyond the NEXT_REPRICE_DATE, the cash flow engine matches the REPRICE_FREQ, INTEREST_RATE_CD, and the reprice date to the information contained in the Oracle ALM Forecast Rates assumption rule. This is to assign a forecasted base rate. The MARGIN_GROSS is then added to this forecasted base rate. Any rounding, rate caps/floors, and tease periods are applied and the resulting rate is applied to the record as the gross rate.

NOTE:

All term accounts require a valid CUR_GROSS_RATE.

· For non-interest earning/bearing accounts, CUR_GROSS_RATE = 0.

· For transaction accounts where the rate changes daily, based upon average balances, CUR_GROSS_RATE should be the spot rate at the time the extract program is run.

· CUR_GROSS_RATE >= 0.

· CUR_GROSS_RATE = MARGIN_GROSS + value of the index (IRC) that the account is tied to (assuming periodic/lifetime caps/floors, tease periods do not apply and rounding is taken into consideration).

· CUR_GROSS_RATE should be validated while validating CUR_PAYMENT.

The interest rate that interest income due to the bank is based upon.

Oracle ALM and Funds Transfer Pricing cash flow calculations reference CUR_NET_RATE for the following purposes:

Interest Income (Financial Element 430) Calculation CUR_NET_RATE is used to derive the interest cash flow (income/expense) that is due to the financial institution (referred to as net). The cash flow engine uses different Interest Income calculations depending on the ACCRUAL_BASIS_CD and INT TYPE. These calculations are presented under the field heading Accrual Basis Code (ACCRUAL_BASIS_CD) and Interest Type Code (INT_TYPE). Interest income is calculated on payment dates or the record's maturity date. As the calculations indicate, after referencing the ACCRUAL_BASIS_CD, the cash flow engine applies the CUR_NET_RATE to the entire payment period (last Previous payment date to the next Current payment date). If any repricing occurred during the payment period, the cash flow engine uses the last repriced rate that occurred immediately before the next Current payment date.

NOTE:

Whether or not the Model with Gross Rates option has been selected in Product Characteristics (ALM) or the Transfer Pricing rule screen (Transfer Pricing), the cash flow engine always calculates the bank's income according to the CUR_NET_RATE.

Prepayments- As defined in the Prepayment rule interface, the cash flow engine compares the customer rate to the market rate when determining the prepayment rate. If the Model with Gross Rates option is not selected, the CUR_NET_RATE is the customer rate and therefore is used for prepayment calculations.

Amortization - When amortizing a record's balance, a key input is the record's customer rate. If the Model with Gross Rates is not selected, then the cash flow engine uses the CUR_ NET_RATE for amortization purposes.

Depending on the NET_MARGIN_CD value, interest income is calculated differently.

Following is an explanation of how Oracle ALM calculates CUR_NET_RATE:

Before the NEXT_REPRICE_DATE, Oracle ALM uses the CUR_NET_RATE from the detail record as the net rate.