The Australian Suspicious Report (AUS SMR) is a report of when the reporting entity formed a suspicion of a matter that may be related to an offense. Such offenses include money laundering, the financing of terrorism, proceeds of crime, tax evasion, a person is not who they claim to be, or any offense under an Australian Commonwealth, State, or Territory law.

The XML schema for the electronic reporting of suspicious matter reports is based on the design of the data entry SMR form. The overall report and sections of the report are broken down into the various elements outlined in this specification.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) is a Commonwealth government agency that was established in 1989. AUSTRAC plays an important role in the global fight against crime and works to support an Australian community that is hostile to money laundering and the financing of terrorism.

AUSTRAC is Australia's financial intelligence unit, and one of the first such units to be established in the world. AUSTRAC collects financial transaction reports, analyses the information, and disseminates financial intelligence which is used in the investigation of major crime and tax evasion.

The Oracle Financial Services Compliance Regulatory Reporting Cloud Service (OFS CRR CS) AUS SMR Application is used to create, investigate, and take appropriate action on the report for a resolution.

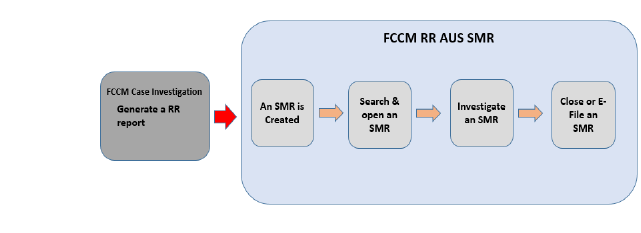

Reports are generated in the OFS CRR CS AUS SMR as a result of the Generate STR action taken on a case or cases in the OFS Case Investigation Cloud Service. The business data (transaction, account, and entity details) and operational data (narratives, documents, and comments) related to the case which led to the creation of a report are available in the OFS CRR CS AUS SMR.

Using this information, authorized users investigate reports and report them to the AUSTRAC or close them by providing appropriate details.

The following image depicts the life cycle of a report.

· Generate a CRR Report: After investigating a suspicious case, if it is required to report to the regulator, you can take action Close SAR Required in the OFS Case Investigation Cloud Service. For more information, see the Acting on Cases chapter in the OFS Case Investigation Cloud Service.

· Create a Report: A report is created in OFS Case Investigation Cloud Service and the related information is passed to the OFS CRR CS AUS SMR using web service. The newly created report is available in the OFS CRR CS AUS SMR and it is assigned to a specific user with a due date to take appropriate action. These parameters are configurable.

· When you identify a report of suspicious behavior that is not reported through the OFS Case Investigation Cloud Service but want to report it to the regulator, you can manually create a new report using the Create New Report option in the OFS CRR CS AUS SMR application. For more information, see Create a Report Manually.

· Search and Open a Report: To investigate the existing reports, you must open reports using basic, advanced, or views search criteria. For more information, see Opening a Report.

· Investigate a Report: To take any kind of action on a selected report, you must thoroughly analyze the details. You must verify the details of the report such as involved accounts, transactions, reporting entity details, related documents, narratives, and audit history. For more information, see Analyzing a Report.

· Act on a Report: Post analyses, you can take action on the selected report based on your privileges. For more information, see Acting on a Report.

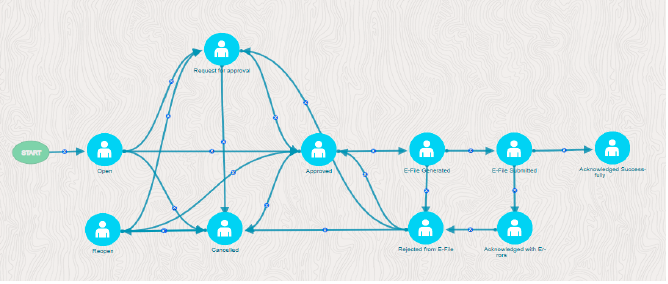

This section explains the workflow of OFS CRR CS AUS SMR for Analyst and Supervisor role.

When a report is created in the OFS CRR CS AUS SMR through the Oracle OFS Case Investigation Cloud Service, the report details are auto-populated with information from the case, which triggered the action to generate the report. Users mapped to the role of Analyst can update a report that is in an Open status and request the report’s details for approval. During the edit and review process, the report is available to be viewed as a draft report.

A Supervisor can approve, rework, or cancel the filing of reports after the Analyst requests for approval. Supervisors can also edit report details and approve reports directly if required.

If the report is approved by the Supervisor, the Regulatory Reporting application generates the report in the final .pdf or .png, format after all the necessary validations. The report is then manually submitted to the Regulator. The submission to the Regulator occurs outside the OFS CRR CS AUS SMR application. The report status can then be marked as Submitted in the OFS CRR CS AUS SMR application.

If required, the Supervisor can send the reports for rework when the report is in Request for Approval status. The Analyst must then rework and re-submit the report for approval. This process continues until the report is approved or canceled.

Authorized users can reopen the canceled reports. The report status then changes to Reopened.

For the complete list of actions the Analyst, Auditor, or Supervisor can perform on various report statuses, see Statuses . For more information on user roles, see User Roles.

A Report has a life cycle that begins with the Open status and ends when it is in the Submitted status.

If the report is already opened by another user, then that report is locked and can only be viewed.

The following table explains the statuses in which an Analyst, Auditor, and Supervisor can edit the report details.