Entering Labor Proceeding Information

This topic discusses how to enter labor proceeding details and associated tax information.

Use Assign Labor Proceedings BRA component pages to enter labor proceeding-related information for employees. Information is submitted to the Government using the S-2500 event in eSocial.

Use the Labor Proceeding Tax page to enter amounts of income tax and social security contributions, and incidents on calculation bases in labor proceedings reported in the S-2500 event. Information is submitted to the Government using the S-2501 event in eSocial.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_LBR_PROC_HDR |

Enter labor proceeding details. |

|

|

GPBR_LBR_PROC_CNTR |

Enter employee contract information of the labor proceeding. |

|

|

GPBR_LBR_PROC_C_AD |

Enter additional employment contract information of the labor proceeding. |

|

|

GPBR_LBR_PROC_PYMT |

Enter detailed information about calculation bases of FGTS and INSS values. |

|

|

GPBR_LABOR_PRC_TAX |

Enter employee's IRRF and INSS tax information for a labor proceeding. |

|

|

GPBR_LPT_REV |

Enter income tax and other information for a labor proceeding as decided from court. |

|

|

GPBR_LPT_REV_RRA |

Enter accumulated income amounts received for previous years. |

|

|

GPBR_LPT_COMP_INFO |

Enter employee's dependent information. |

|

|

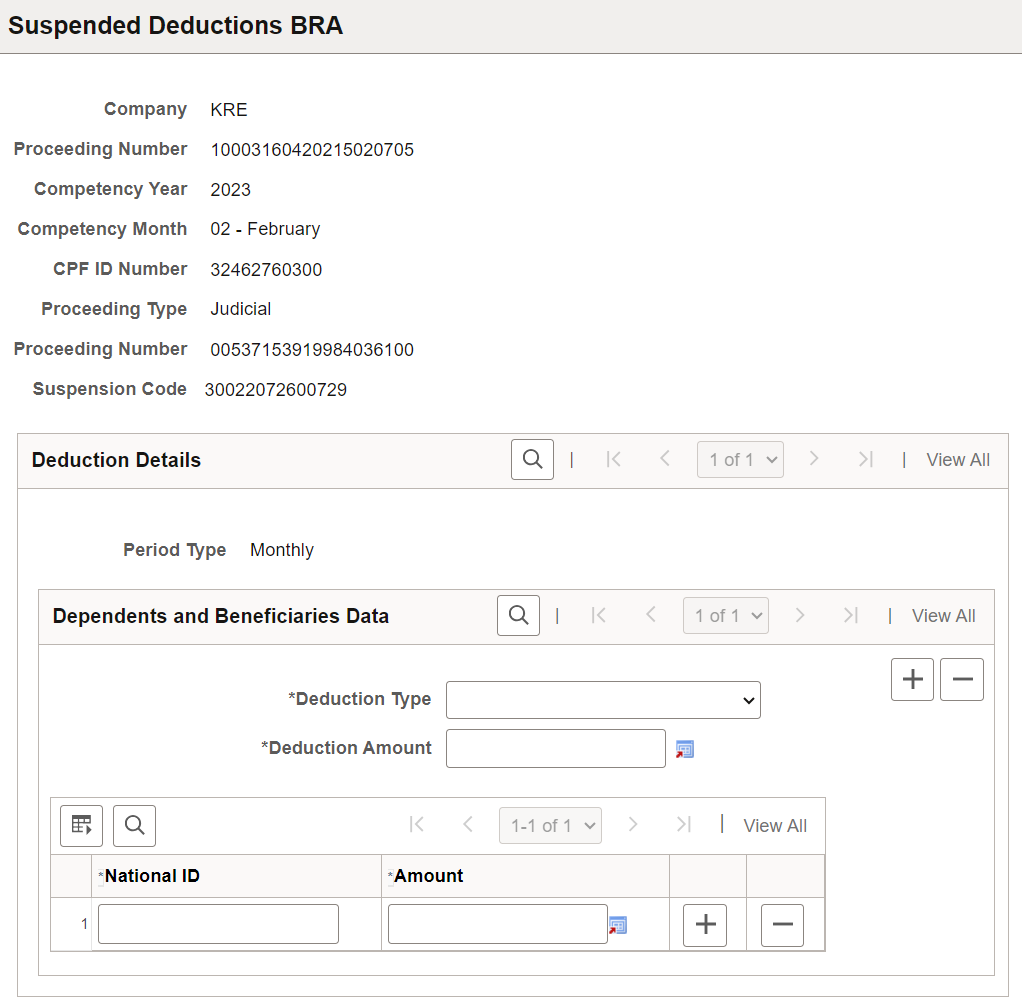

GPBR_LPT_SUSP_DED |

Enter details for deductions with suspended liability. |

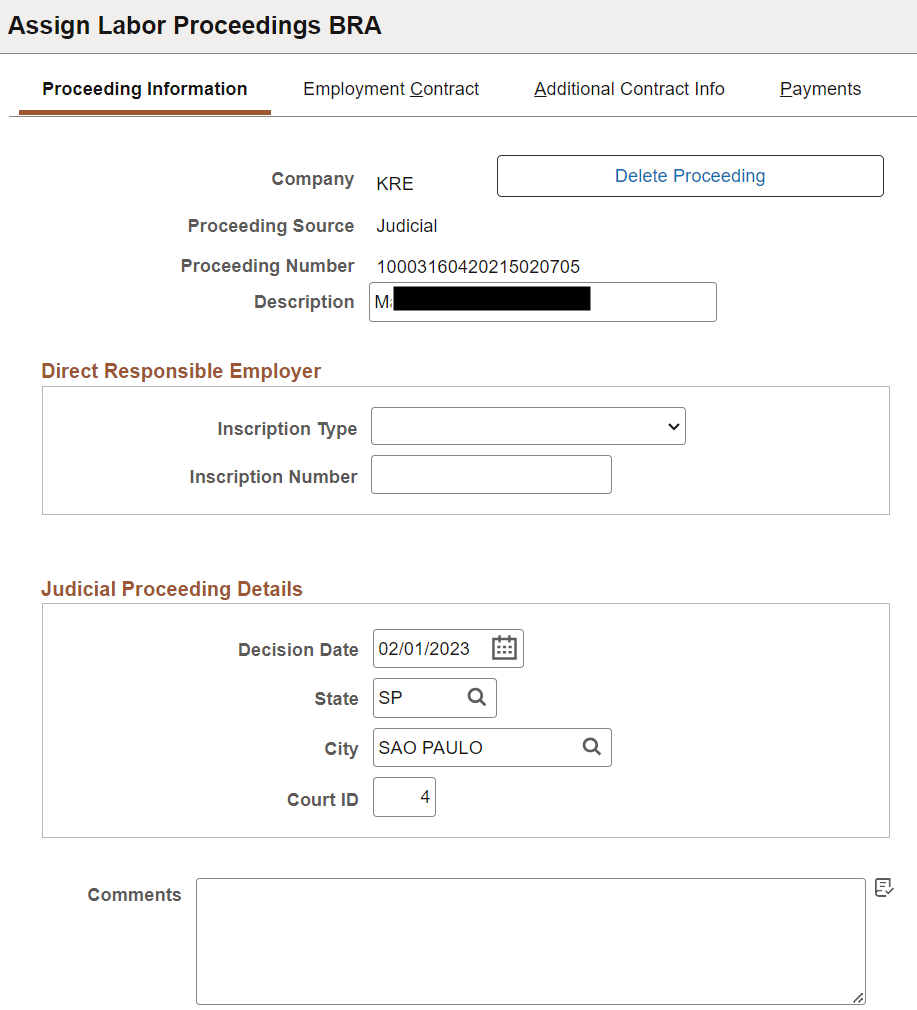

Use the Proceeding Information page (GPBR_LBR_PROC_HDR) to enter labor proceeding details.

Navigation:

This example illustrates the fields and controls on the Proceeding Information page.

|

Field or Control |

Description |

|---|---|

|

Delete Proceeding |

Select to remove the labor proceeding record from the system and the government (if applicable). |

|

Company |

Displays the company associated with the labor proceeding. This information is required when you add a labor proceeding in the system. |

|

Proceeding Source |

Displays the source of the labor proceeding: Judicial Submitted to CCP or NINTER. This information is required when you add a labor proceeding in the system. |

|

Proceeding Number |

Displays the ID of the labor proceeding. This information is required when you add a labor proceeding in the system. The length of the proceeding number is 20 digits if the selected source is Judicial. The length of the proceeding number is 15 digits if the selected source is Submitted to CCP or NINTER. |

|

Description |

Displays or enter the description of the labor proceeding. |

Direct Responsible Employer

Specify the company's HR and/or payroll representative (direct responsible).

Complete this section only if the company is mentioned in the proceeding as co-responsible.

|

Field or Control |

Description |

|---|---|

|

Inscription Type |

Values are CNPJ and CPF. |

|

Inscription Number |

Enter the inscription ID of the company. |

|

Comments |

Enter any comment for this labor proceeding, if applicable. |

Judicial Proceeding Details

This section appears if the selected source is Judicial.

|

Field or Control |

Description |

|---|---|

|

Decision Date |

Specify the date when the decision of this labor proceeding was made. |

|

State, City, and Court ID |

Specify the court location where this labor proceeding took place. |

CCP/NINTER Proceeding Details

This section appears if the selected source is Submitted to CCP or NINTER.

|

Field or Control |

Description |

|---|---|

|

Date of Conciliation |

Specify the conciliation date of the CCP or NINTER proceeding. |

|

Ambit of Agreement |

Select the information provider. Values are: CCP Company CCP Union NINTER |

|

Union CNPJ Number |

Enter the registration number of the union that represented the worker. This is required if the Ambit of Agreement field value is CCP Company or CCP Union. |

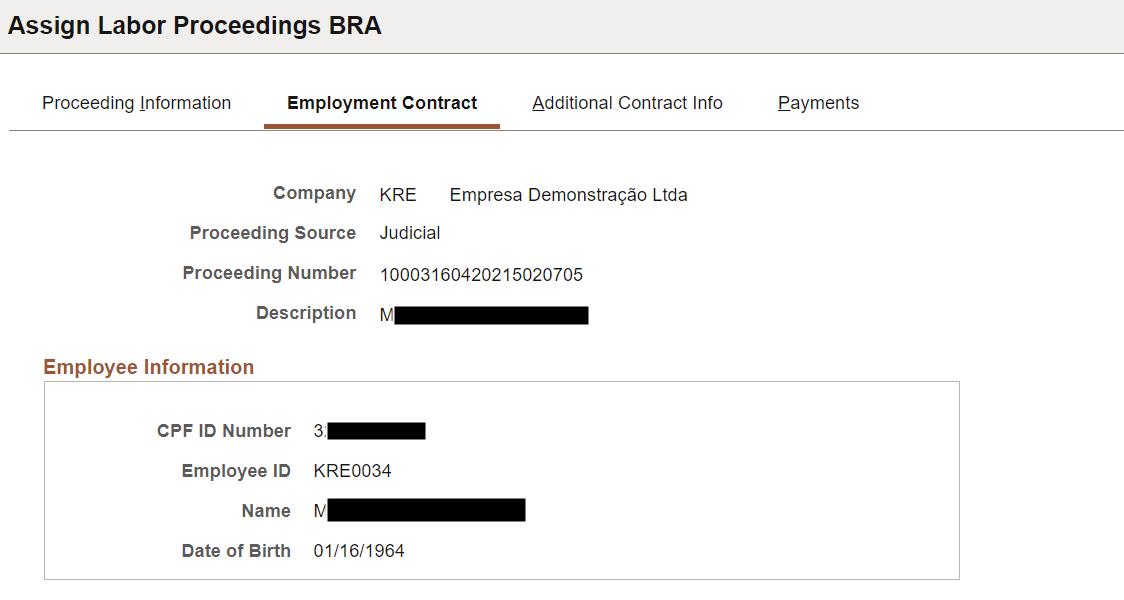

Use the Employment Contract page (GPBR_LBR_PROC_CNTR) to enter employee contract information of the labor proceeding.

Navigation:

This example illustrates the fields and controls on the Employment Contract page (1 of 2).

This example illustrates the fields and controls on the Employment Contract page (2 of 2).

|

Field or Control |

Description |

|---|---|

|

Company |

Displays the company associated with the labor proceeding. This information is required when you add a labor proceeding in the system. |

|

Proceeding Source |

Displays the source of the labor proceeding. |

|

Proceeding Number |

Displays the number of the labor proceeding. |

|

Description |

Displays or enter the description of the labor proceeding. |

Employee Information

This section displays basic personal information of the worker to whom the labor proceeding pertains.

|

Field or Control |

Description |

|---|---|

|

CPF ID Number |

Displays the claimant's national identification number. This information is required when you add a labor proceeding in the system. If a labor proceeding involves multiple claimants, each of them needs to be registered separately in the system. |

|

Employee ID, Name and Date of Birth |

The system prepopulates these fields automatically, if the entered CPF ID already exists. Specify this information for the worker, if the entered CPF ID doesn't exist in the system. |

Employment Contract Information

Use this section to enter the worker's contract data at the time of the labor proceeding resolution. Add new rows to capture the contract information in situations where multiple jobs are cited in the labor proceeding, or when the worker has multiple employee records (empl_rcd) even if they do not happen simultaneously.

|

Field or Control |

Description |

|---|---|

|

eSocial Reg. Number |

Select (if CPF ID exists) or enter the worker's eSocial registration number. |

|

Employee Labor Category Code |

Select the worker's category code. |

|

Hire TSV Date |

(For non-employee) Select the worker's date of admission if the worker is a non-employee (the selected employee labor category code is 721, 722, or 901) and their eSocial registration number has not yet been sent to the Government using the S-2300 event. The system does not validate this value. |

|

Contract Type |

Select the applicable contract type for the worker. |

|

Original Hire Date |

(For employee) Select the worker's date of admission if the worker is an employee (the selected employee labor category code is not 721, 722, or 901) and their eSocial registration number has not yet been sent to the Government using the S-2300 event. The system does not validate this value. |

|

Sent to eSocial |

Indicate if the worker's admission information has been submitted to the Government using any of these events: S-2190, S-2200 or S-2300. |

|

Reinstatement |

Indicate if there was a request for the reinstatement of the worker in the labor proceeding. |

|

Employee Category Changed |

Indicate if there was a request to change the worker's labor category in the labor proceeding. |

|

Nature of Activity Changed |

Indicate if there was a request to change the nature of the worker's activity in the labor proceeding. |

|

Reason for Termination Changed |

Indicate if there was a request for a change in the worker's termination reason in the labor proceeding. |

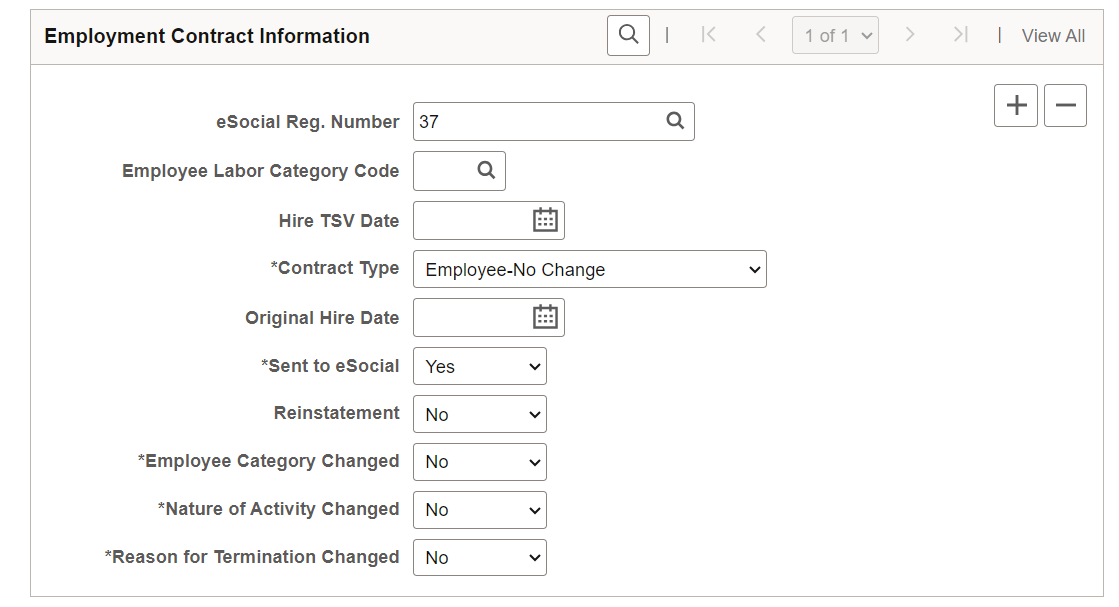

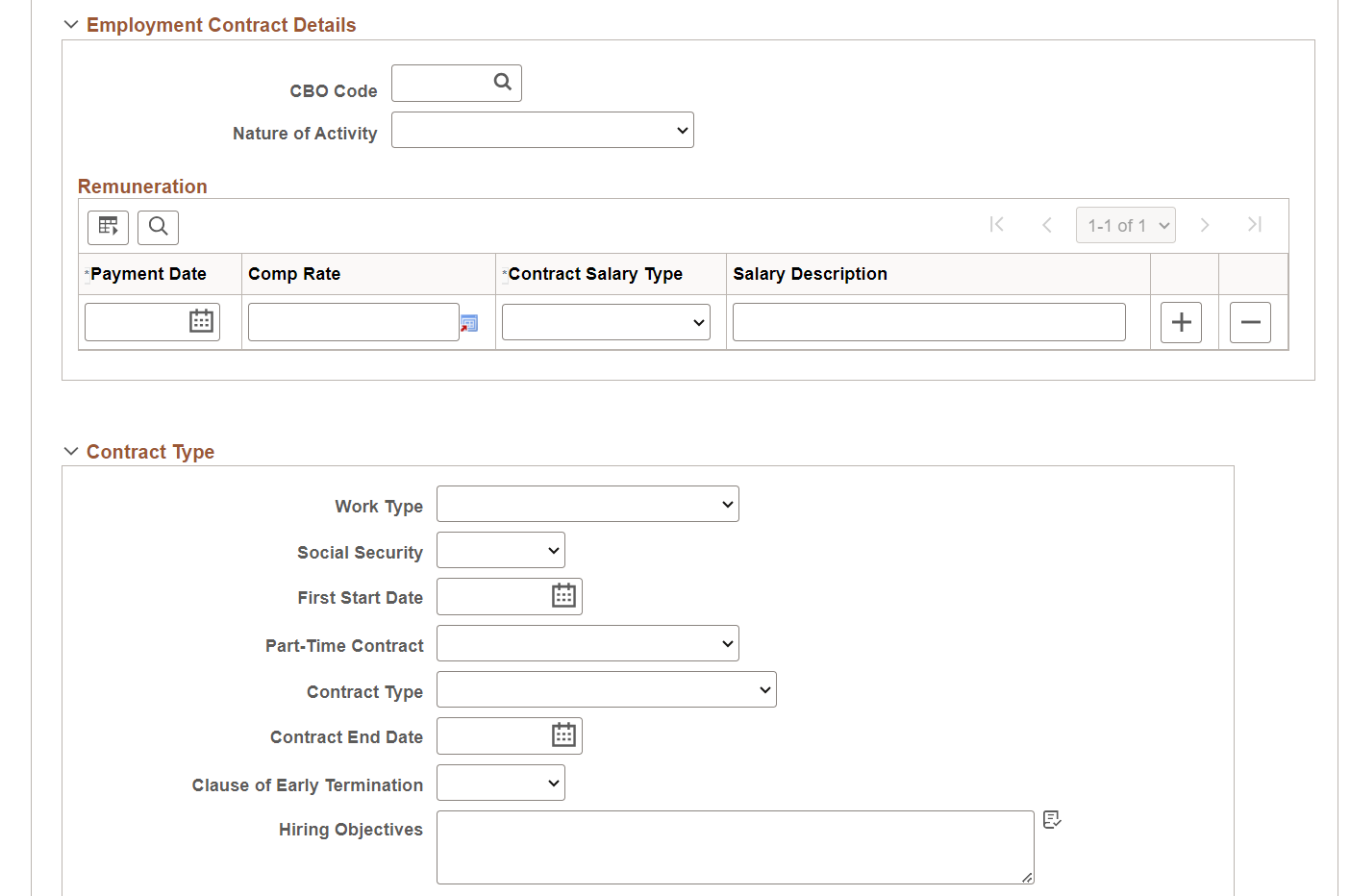

Use the Additional Contract Info page (GPBR_LBR_PROC_C_AD) to enter additional employment contract information of the labor proceeding.

Navigation:

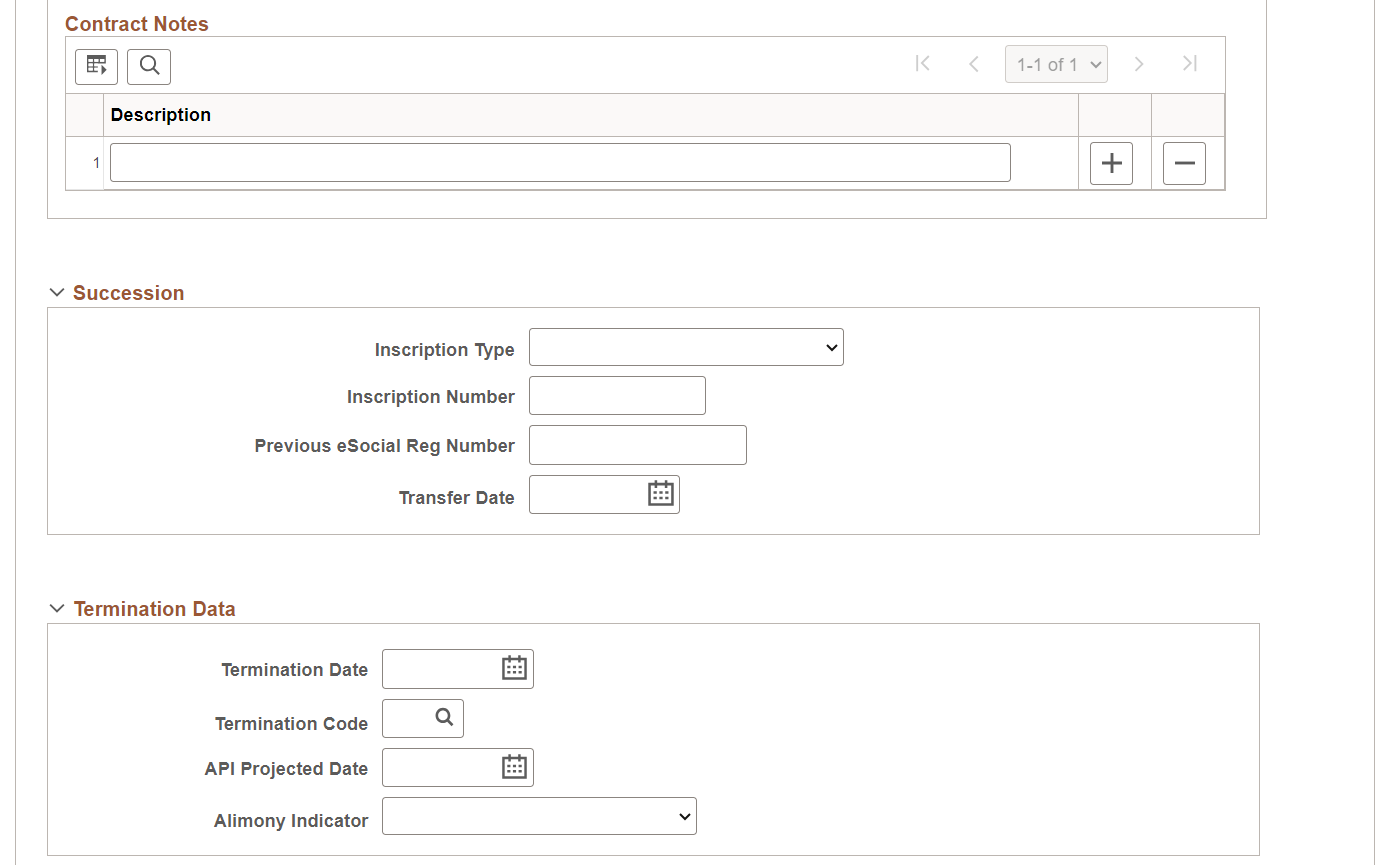

This example illustrates the fields and controls on the Additional Contract Info page (1 of 4).

This example illustrates the fields and controls on the Additional Contract Info page (2 of 4).

This example illustrates the fields and controls on the Additional Contract Info page (3 of 4).

This example illustrates the fields and controls on the Additional Contract Info page (4 of 4).

|

Field or Control |

Description |

|---|---|

|

Company |

Displays the company associated with the labor proceeding. This information is required when you add a labor proceeding in the system. |

|

Proceeding Source |

Displays the source of the labor proceeding. |

|

Proceeding Number |

Displays the number of the labor proceeding. |

|

Description |

Displays or enter the description of the labor proceeding. |

Employee Information

This section displays basic personal information of the worker to whom the labor proceeding pertains.

|

Field or Control |

Description |

|---|---|

|

CPF ID Number |

Displays the claimant's national identification number. This information is required when you add a labor proceeding in the system. If a labor proceeding involves multiple claimants, each of them needs to be registered separately in the system. |

|

Employee ID, Name and Date of Birth |

The system prepopulates these fields automatically, if the entered CPF ID already exists. Specify this information for the worker, if the entered CPF ID doesn't exist in the system. |

Employment Contract Information

|

Field or Control |

Description |

|---|---|

|

eSocial Reg. Number |

Displays the worker's eSocial registration number if available. |

|

Employee Labor Category Code |

Displays the worker's category code if available. |

|

Hire TSV Date |

Displays the worker's date of admission if available. |

Employment Contract Details

|

Field or Control |

Description |

|---|---|

|

CBO Code |

Specify the applicable Brazilian Occupation Classification code for the contract. |

|

Nature of Activity |

Select the nature of activity for the contract, Not Applicable, RURAL, or URBAN. |

Remuneration

Use this section to record salary changes.

|

Field or Control |

Description |

|---|---|

|

Payment Date |

Specify the salary change date. |

|

Comp Rate |

Enter the compensation rate. |

|

Contract Salary Type |

Select the applicable salary type, for example, monthly, by task, or commission-based. |

|

Salary Description |

Enter a short description about the salary if the selected salary type is by task or commission-based. |

Contract Type

Complete this section only if the worker's admission information has not been submitted to the Government using any of these events: S-2190, S-2200 or S-2300.

|

Field or Control |

Description |

|---|---|

|

Work Type |

Select the applicable labor regime type. |

|

Social Security |

Select the applicable social security system. |

|

First Start Date |

Select the worker's original hire date. |

|

Part-Time Contract |

Select the appropriate part-time nature of the contract. |

|

Contract Type |

Select the appropriate contract type for the worker. |

|

Contract End Date |

Select the end date of the contract for the worker. |

|

Clause of Early Termination |

Indicate if the contract has an assurance clause. |

|

Hiring Objectives |

Enter the objectives for hiring the position to which this contract pertains. |

Contract Notes

Enter remarks about the contract, if applicable.

Succession

Complete this section if the worker transferred to this company from another company in the same socio-economic sector.

|

Field or Control |

Description |

|---|---|

|

Inscription Type and Inscription Number |

Specify the inscription type and number of the company before the transfer. |

|

Previous eSocial Reg Number |

Enter the worker's eSocial registration number in the company before the transfer. |

|

Transfer Date |

Specify the date of transfer. |

Termination Data

Enter the worker's termination information, if applicable.

|

Field or Control |

Description |

|---|---|

|

Termination Date |

Specify the worker's termination date. |

|

Termination Code |

Select the reason code for the termination. |

|

API Projected Date |

Specify the projection date of the indemnified prior notice. |

|

Alimony Indicator |

Specify if the worker is responsible for alimony payment and payment type. The information is used for FGTS withholding purposes. Values are: Amount No Alimony Percentage Percentage and Amount |

|

Deduction Amount |

Specify the amount of the worker's alimony payment. This field appears if Amount or Percentage and Amount is selected. |

|

% Deduction |

Specify the percentage of the worker's pay that is allocated to alimony. This field appears if Percentage or Percentage and Amount is selected. |

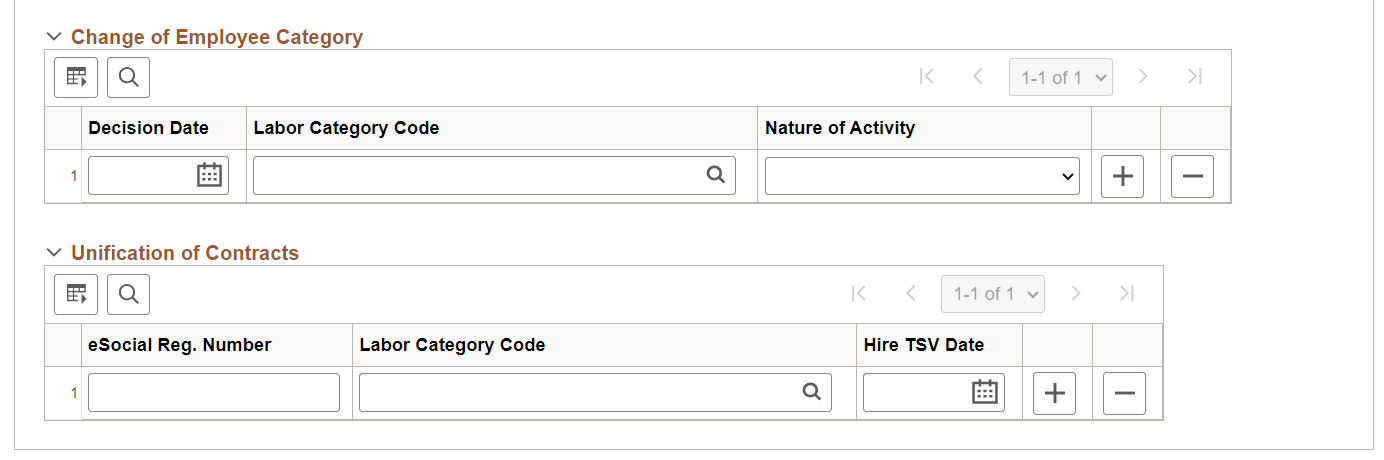

Change of Employee Category

If the worker had a change in the employee category,, enter the information in this section.

|

Field or Control |

Description |

|---|---|

|

Decision Date |

Specify the date when the new labor category became effective. |

|

Labor Category Code |

Specify the new labor category. |

|

Nature of Activity |

Select the nature of activity for the contract, Not Applicable, RURAL, or URBAN. |

Unification of Contracts

|

Field or Control |

Description |

|---|---|

|

eSocial Reg. Number |

Enter the worker's eSocial registration number from the contract that needs to be unified with this contract. |

|

Labor Category Code |

Specify the worker's labor category code from the contract that needs to be unified with this contract. |

|

Hire TSV Date |

(For non-employee) Select the worker's date of admission if the worker is a non-employee (the selected employee labor category code is 721, 722, or 901) and their eSocial registration number has not yet been sent to the Government using the S-2300 event. |

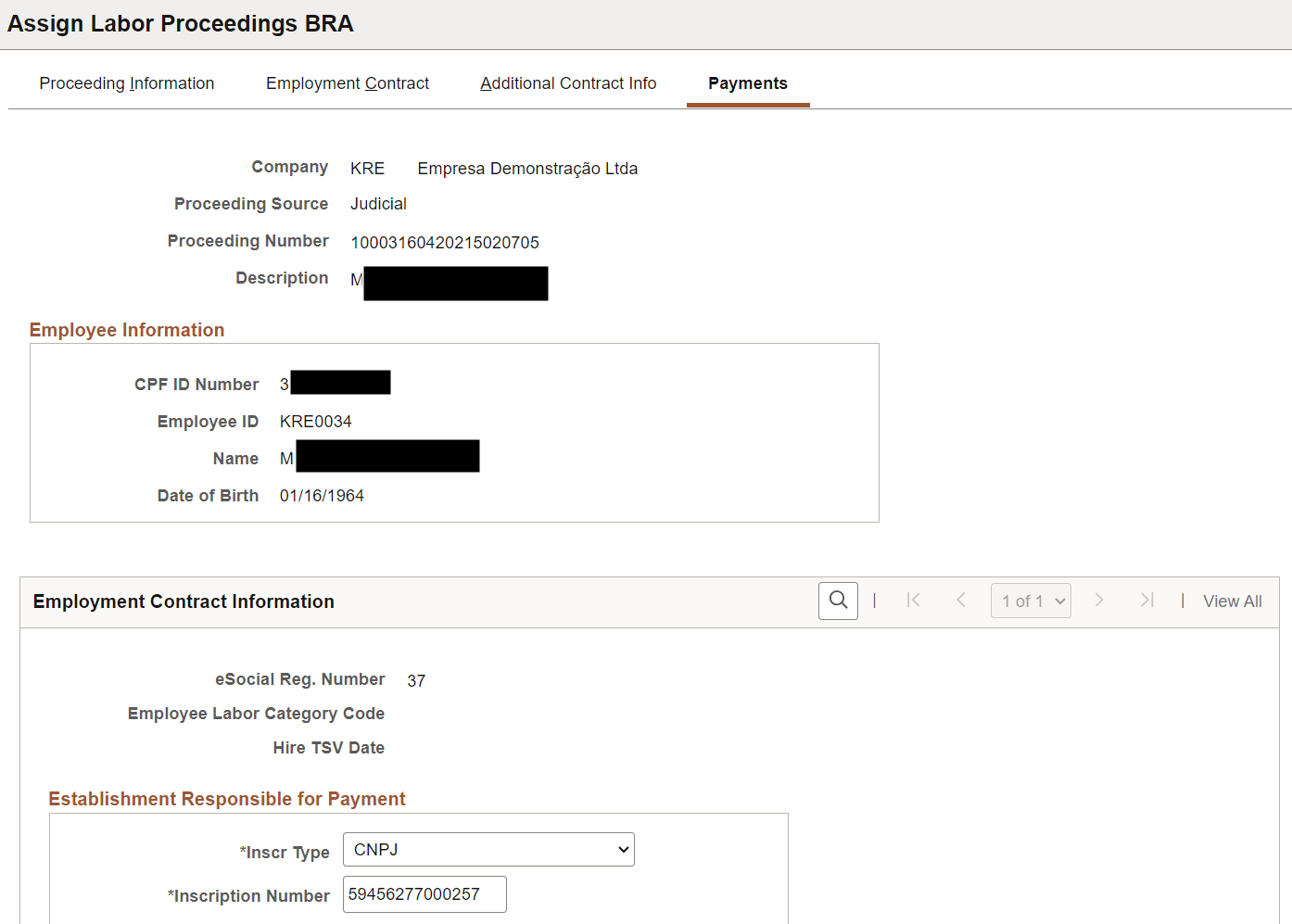

Use the Payments page (GPBR_LBR_PROC_PYMT) to enter detailed information about calculation bases of FGTS and INSS values.

Navigation:

This example illustrates the fields and controls on the Payments page (1 of 2).

This example illustrates the fields and controls on the Payments page (2 of 2).

|

Field or Control |

Description |

|---|---|

|

Company |

Displays the company associated with the labor proceeding. This information is required when you add a labor proceeding in the system. |

|

Proceeding Source |

Displays the source of the labor proceeding. |

|

Proceeding Number |

Displays the number of the labor proceeding. |

|

Description |

Displays or enter the description of the labor proceeding. |

Employee Information

This section displays basic personal information of the worker to whom the labor proceeding pertains.

|

Field or Control |

Description |

|---|---|

|

CPF ID Number |

Displays the claimant's national identification number. This information is required when you add a labor proceeding in the system. If a labor proceeding involves multiple claimants, each of them needs to be registered separately in the system. |

|

Employee ID, Name and Date of Birth |

The system prepopulates these fields automatically, if the entered CPF ID already exists. Specify this information for the worker, if the entered CPF ID doesn't exist in the system. |

Employment Contract Information

|

Field or Control |

Description |

|---|---|

|

eSocial Reg. Number |

Displays the worker's eSocial registration number if available. |

|

Employee Labor Category Code |

Displays the worker's category code if available. |

|

Hire TSV Date |

Displays the worker's date of admission if available. |

Establishment Responsible for Payment

|

Field or Control |

Description |

|---|---|

|

Inscr Type (inscription type) and Inscription Number |

Specify the inscription type and number of the establishment that is responsible for paying the indemnified amounts to the worker. |

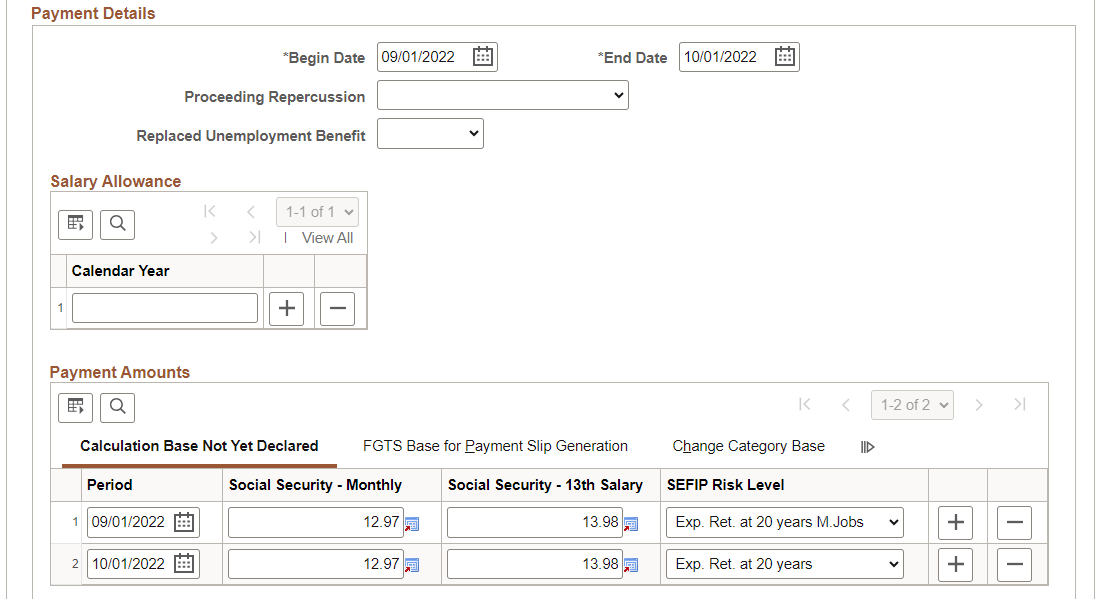

Payment Details

|

Field or Control |

Description |

|---|---|

|

Begin Date and End Date |

Enter the start and end date of the labor proceeding. |

|

Proceeding Repercussion |

Specify the result or conclusion of the labor proceeding. Values are: Exclusive for Income Statement With Tax Impact and/or FGTS Without Tax Impact or FGTS |

|

Replaced Unemployment Benefit |

Select if a decision was made to pay the unemployment insurance replacement compensation. |

Salary Allowance

|

Field or Control |

Description |

|---|---|

|

Calendar Year |

Specify the years in which there was a compensation that replaced the salary allowance, if applicable. Salary allowance is an annual benefit that is paid to workers who satisfy certain criteria, for example:

|

Payment Amounts

Use this section to enter social security and FGTS calculation base amounts to be used for specified periods.

Calculation Base Not Yet Declared

|

Field or Control |

Description |

|---|---|

|

Period |

Specify the date period the amount values became effective. |

|

Social Security - Monthly |

Specify the monthly social security calculation base amount. |

|

Social Security - 13th Salary |

Specify the 13th salary social security calculation base amount. |

|

SEFIP Risk Level |

Select the level of exposure to harmful agents for the period. |

FGTS Base for Payment Slip Generation

|

Field or Control |

Description |

|---|---|

|

Labor Proceeding |

Specify the FGTS calculation base amount that is not yet declared in SEFIP or eSocial, including the amounts recognized in the labor process. |

|

Declared in SEFIP only |

Specify the FGTS calculation base amount declared only in SEFIP but not in eSocial, and is not yet collected. |

|

Declared before eSocial |

Specify the FGTS calculation base amount declared in eSocial previously and is not yet collected. |

Change Category Base

|

Field or Control |

Description |

|---|---|

|

Labor Category Code |

Specify the worker's new employee labor category for the period, if applicable. |

|

Declared Value in GFIP |

Enter the amount, which is already declared in GFIP or the S-1200 event, to be considered for social security purposes. |

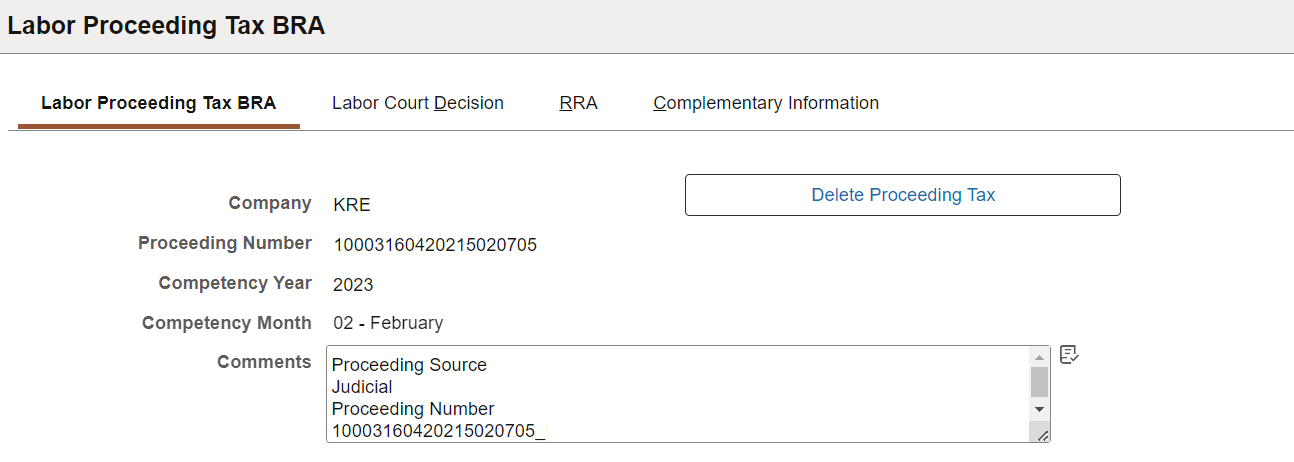

Use the Labor Proceeding Tax BRA page (GPBR_LABOR_PRC_TAX) to enter employee's IRRF tax information for a labor proceeding.

Navigation:

This example illustrates the fields and controls on the Labor Proceeding Tax BRA page (1 of 2).

This example illustrates the fields and controls on the Labor Proceeding Tax BRA page (2 of 2).

|

Field or Control |

Description |

|---|---|

|

Delete Proceeding Tax |

Select to remove the labor proceeding tax record from the system and the government (if applicable). |

|

Company, Proceeding Number,Competency Year and Competency Month |

Displays the selected company, proceeding number, competency year and month when you add the labor proceeding tax record. |

|

Comments |

Enter any comment for this labor proceeding tax record, if applicable. |

Employee Information

|

Field or Control |

Description |

|---|---|

|

CPF ID Number |

Select the CPF ID of the claimant. Only CPF IDs that are associated with the selected proceeding number are available for selection. |

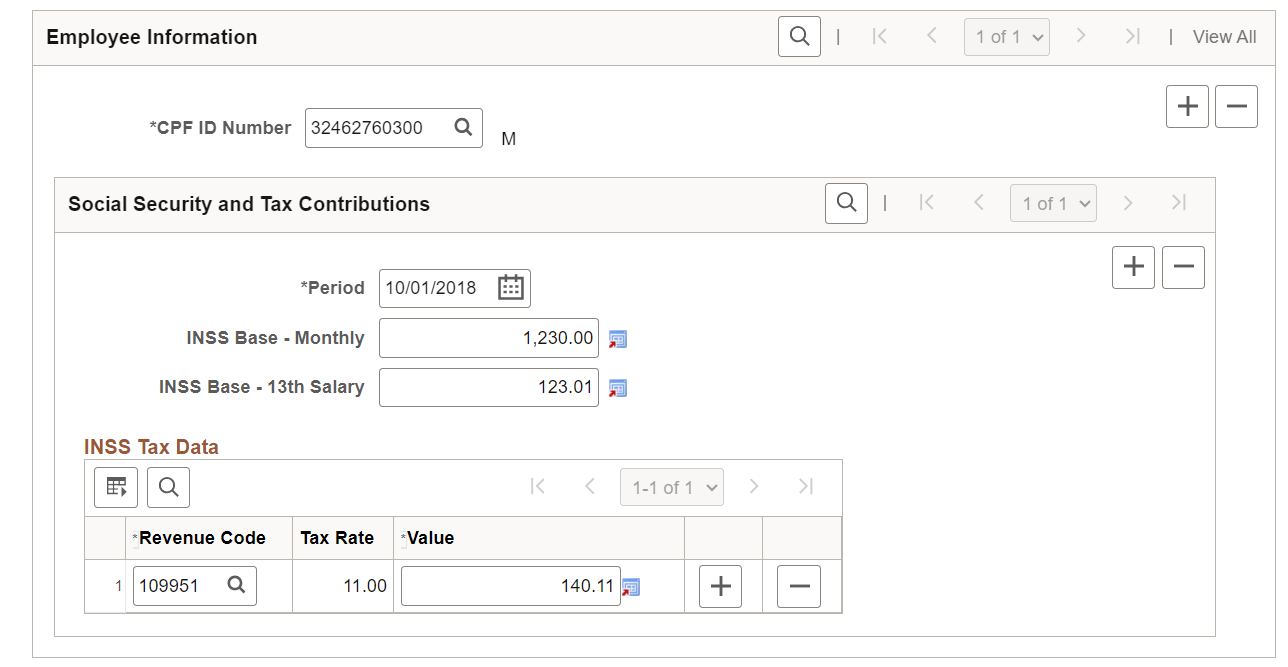

Social Security and Tax Contributions

|

Field or Control |

Description |

|---|---|

|

Period |

Specify the date the amount values became effective. |

|

INSS Base - Monthly and INSS Base - 13th Salary |

Enter the monthly and 13th salary Social Security calculation base amounts for the specified period. |

INSS Tax Data

|

Field or Control |

Description |

|---|---|

|

Revenue Code |

Select the INSS revenue code for the labor processing tax. Revenue codes are defined on the Revenue Code Page. |

|

Tax Rate |

Displays the tax rate of the specified revenue code. |

|

Value |

Enter the amount for the specified revenue code. |

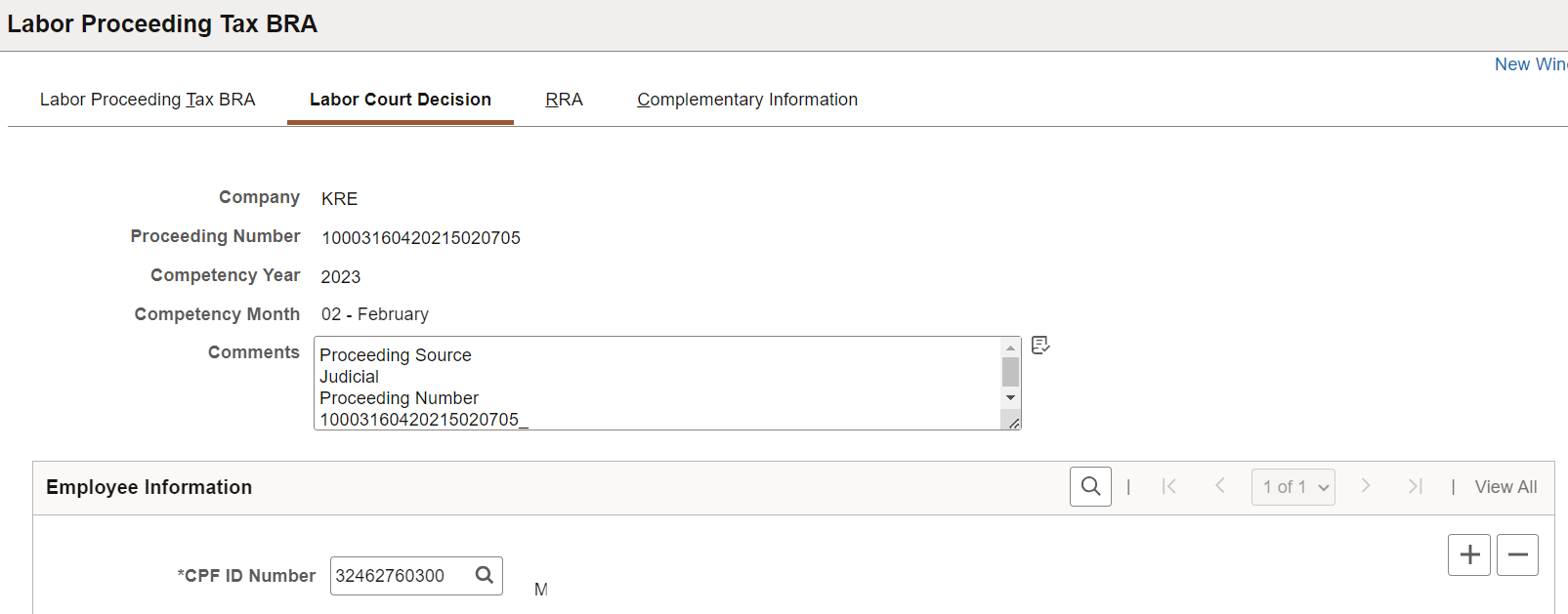

Use the Labor Court Decision page (GPBR_LPT_REV) to enter income tax and other information for a labor proceeding as decided from court.

Navigation:

This example illustrates the fields and controls on the Labor Court Decision page (1 of 3).

This example illustrates the fields and controls on the Labor Court Decision page (2 of 3).

This example illustrates the fields and controls on the Labor Court Decision page (3 of 3).

This page captures income tax information for:

The 593656 (IRRF - Labor Court Decision) revenue code if the selected proceeding source is Judicial, or

The 056152 (IRRF - CCP/NINTER) revenue code if the selected proceeding source is Submitted to CCP or NINTER,

as well as information on processes related to non-withholding of taxes or judicial deposits.

|

Field or Control |

Description |

|---|---|

|

Company, Proceeding Number,Competency Year and Competency Month |

Displays the selected company, proceeding number, competency year and month when you add the labor proceeding tax record. |

|

Comments |

Enter any comment for this labor proceeding, if applicable. |

Employee Information

|

Field or Control |

Description |

|---|---|

|

CPF ID Number |

Select the CPF ID of the claimant. Only CPF IDs that are associated with the selected proceeding number are available for selection. |

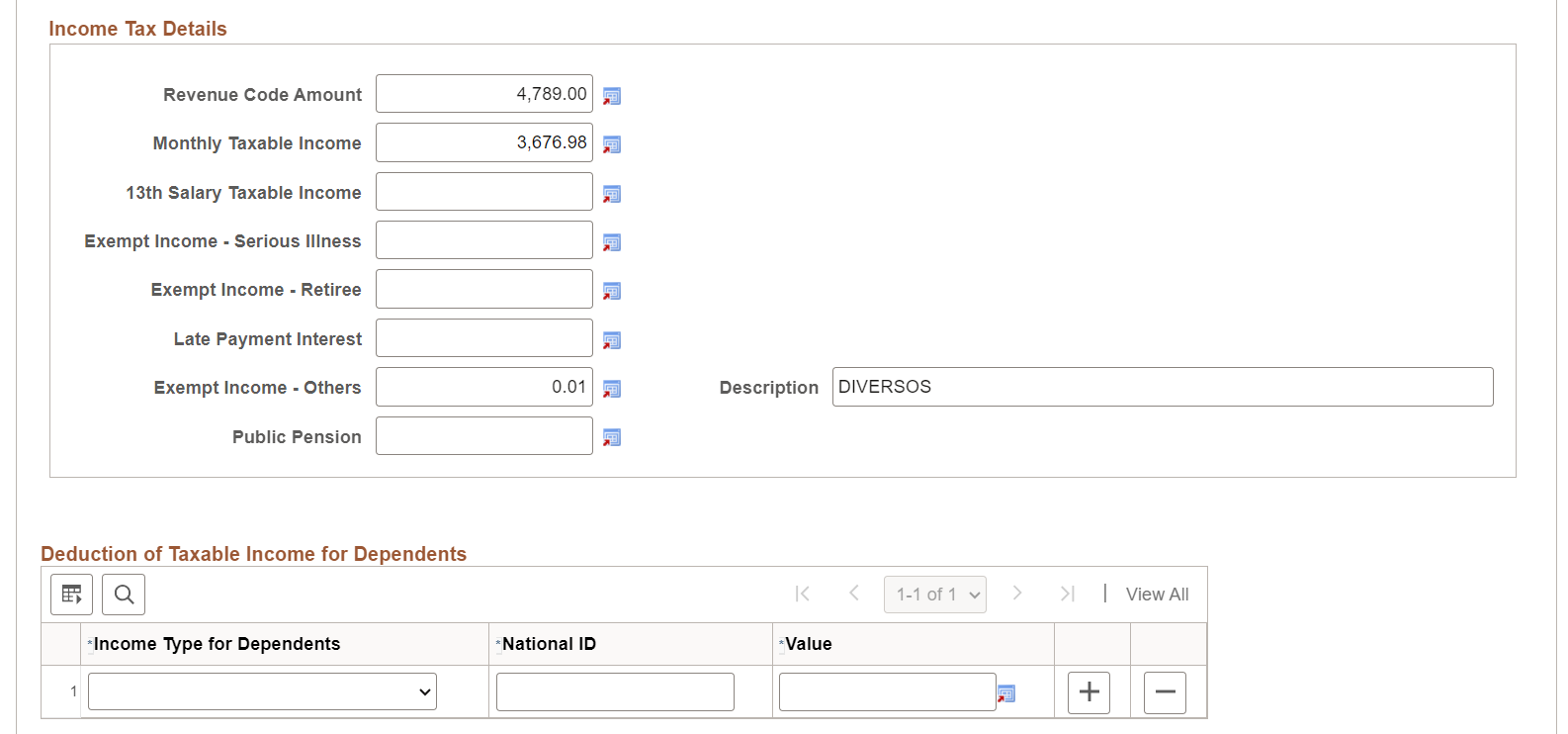

Income Tax Details

|

Field or Control |

Description |

|---|---|

|

Revenue Code Amount |

Enter the amount of the 593656 revenue code. |

|

Monthly Taxable Income |

Enter the monthly taxable income for income tax. |

|

13th Salary Taxable Income |

Enter the 13th salary taxable income for income tax. |

|

Exempt Income - Serious Illness |

Enter the exempt income for having a serious illness certified by a medical report. |

|

Exempt Income – Retiree |

Enter the exempt portion of retirement benefits for beneficiaries aged 65 or higher. |

|

Late Payment Interest |

Enter the late payment interest received due to a delay in payment of remuneration for carrying out a job, position or function. |

|

Exempt Income – Others and Description |

Enter any other exempt or non-taxable income, and its description. |

|

Public Pension |

Enter any mount that is related to official pension. |

Deduction of Taxable Income for Dependents

|

Field or Control |

Description |

|---|---|

|

Income Type for Dependents |

Select the applicable income type for the dependent deduction. Values are: 13th Salary Monthly Salary |

|

National ID |

Enter the CPF of the dependent. |

|

Value |

Enter the deduction amount from the calculation base for the specified income type and dependent. |

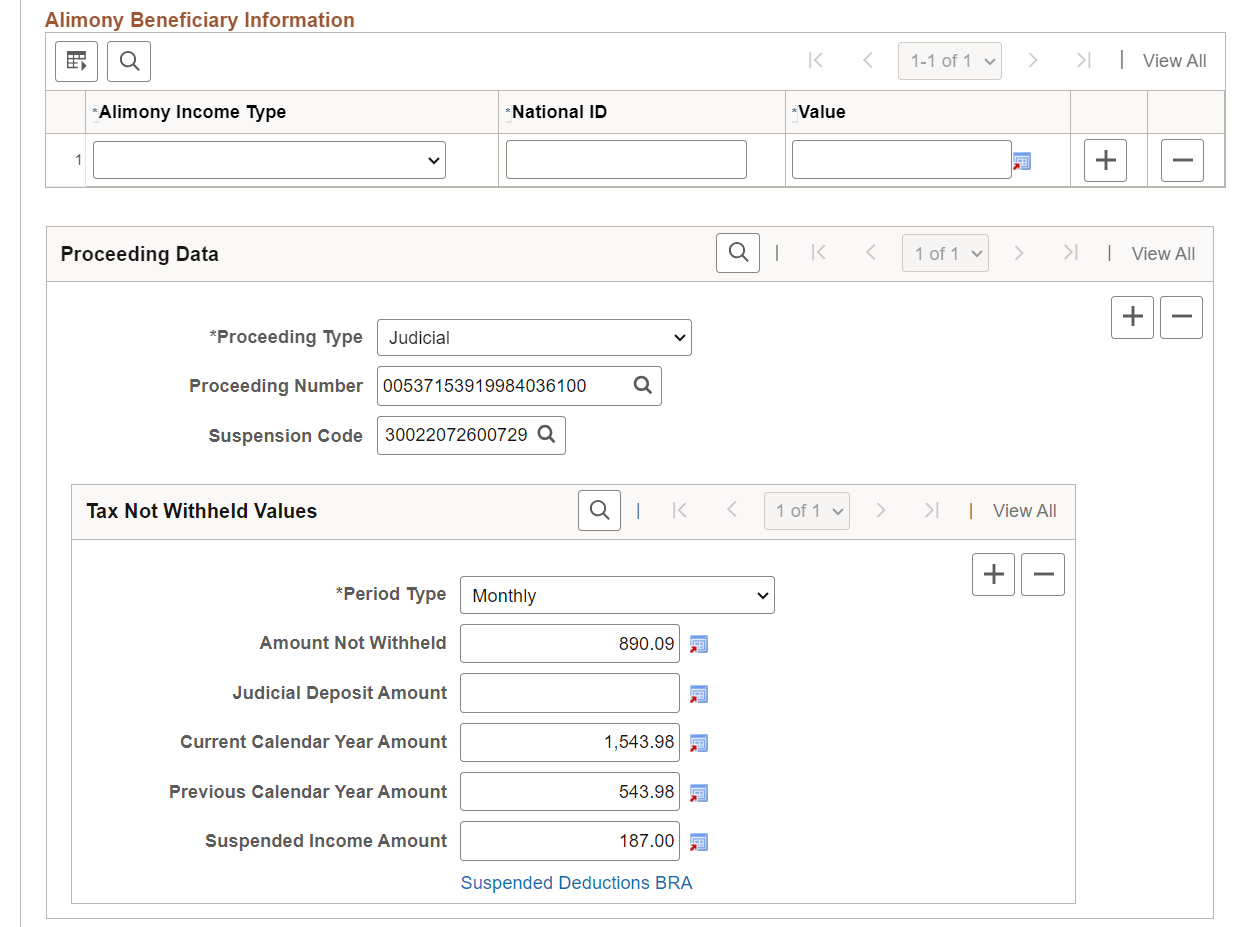

Alimony Beneficiary Information

|

Field or Control |

Description |

|---|---|

|

Alimony Income Type |

Select the applicable income type for the alimony deduction. Values are: 13th Salary Monthly Salary Nontaxable income |

|

National ID |

Enter the CPF of the alimony beneficiary. |

|

Value |

Enter the deduction amount from the calculation base for the specified income type and alimony beneficiary. |

Proceeding Data

|

Field or Control |

Description |

|---|---|

|

Proceeding Type |

Enter the government proceeding type. Values are: Administrative Judicial |

|

Proceeding Number |

Enter the proceeding number, or select the proceeding number if the option for proceedings parameters is enabled on the Adm/Legal Proceedings Parameters BRA Page. Proceedings are defined on the Administrative/Legal Proceedings BRA Page. |

|

Suspension Code |

Enter the suspension code, or select the suspension code if the option for proceedings parameters is enabled on the Adm/Legal Proceedings Parameters BRA Page. |

Tax Not Withheld Values

|

Field or Control |

Description |

|---|---|

|

Period Type |

Select the calculation period. Values are: Annual (13th Salary) Monthly |

|

Amount Not Withheld |

Enter the withholding amount that is no longer made to the government due to the specified proceeding. |

|

Judicial Deposit Amount |

Enter the judicial deposit amount for the specified proceeding. |

|

Current Calendar Year Amount |

Enter the compensation amount received for the current calendar year due to the specified proceeding. |

|

Previous Calendar Year Amount |

Enter the compensation amount received for previous years due to the specified proceeding. |

|

Suspended Income Amount |

Enter the income amount with suspended liability. |

|

Suspended Deductions BRA |

Select to provide more details for the suspended deduction on the Suspended Deductions BRA Page. |

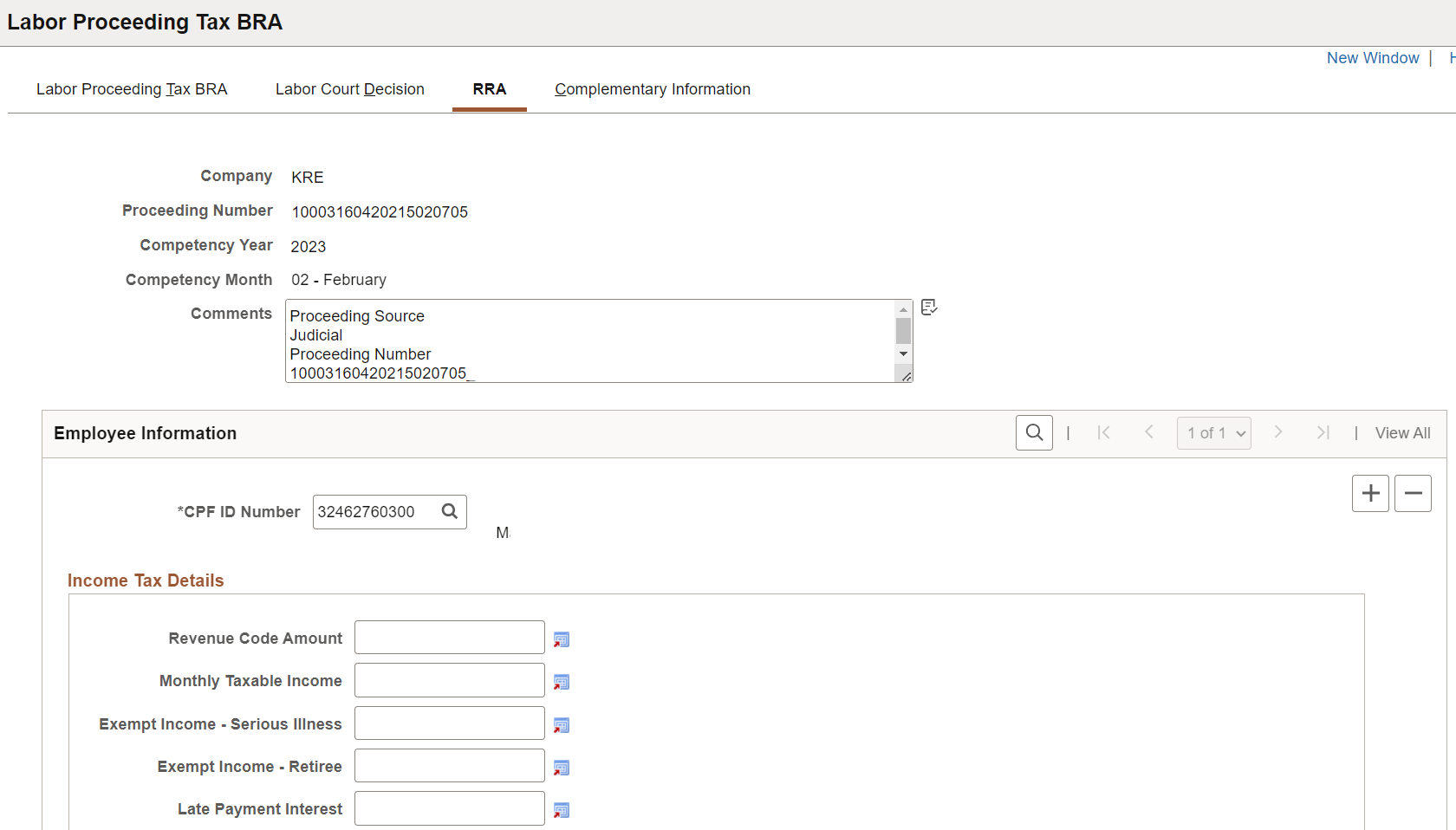

Use the RRA page (GPBR_LPT_REV_RRA) to enter accumulated income amounts received for previous years.

Navigation:

This example illustrates the fields and controls on the RRA page (1 of 2).

This example illustrates the fields and controls on the RRA page (2 of 2).

This page captures the accumulated income amounts that the employee received in the current year for previous years. Because these amounts pertain to previous years, they have different taxation treatment from the current taxation.

|

Field or Control |

Description |

|---|---|

|

Company, Proceeding Number,Competency Year and Competency Month |

Displays the selected company, proceeding number, competency year and month when you add the labor proceeding tax record. |

|

Comments |

Enter any comment for this labor proceeding, if applicable. |

Employee Information

|

Field or Control |

Description |

|---|---|

|

CPF ID Number |

Select the CPF ID of the claimant. Only CPF IDs that are associated with the selected proceeding number are available for selection. |

Income Tax Details

|

Field or Control |

Description |

|---|---|

|

Revenue Code Amount |

Enter the amount of the 188951 revenue code. |

|

Monthly Taxable Income |

Enter the monthly taxable income for income tax. |

|

Exempt Income - Serious Illness |

Enter the exempt income for having a serious illness certified by a medical report. |

|

Exempt Income – Retiree |

Enter the exempt portion of retirement benefits for beneficiaries aged 65 or higher. |

|

Late Payment Interest |

Enter the late payment interest received due to a delay in payment of remuneration for carrying out a job, position or function. |

|

Exempt Income – Others and Description |

Enter any other exempt or non-taxable income, and its description. |

|

Public Pension |

Enter any mount that is related to official pension. |

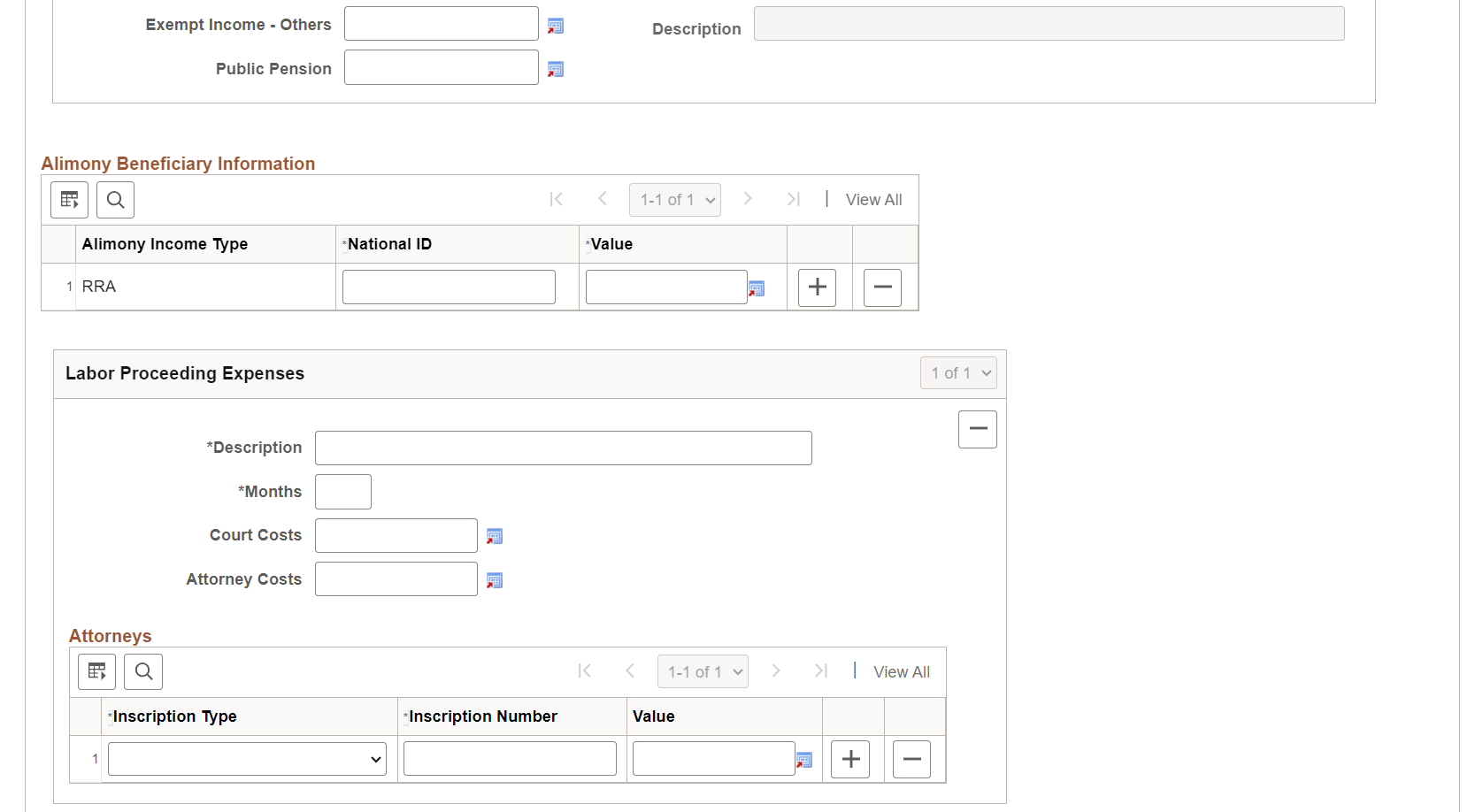

Alimony Beneficiary Information

|

Field or Control |

Description |

|---|---|

|

Alimony Income Type |

Displays the RRA type by default. |

|

National ID |

Enter the CPF of the alimony beneficiary. |

|

Value |

Enter the deduction amount from the calculation base for the specified income type and alimony beneficiary. |

Labor Proceeding Expenses

|

Field or Control |

Description |

|---|---|

|

Description |

Enter the description of the accumulated income received. |

|

Months |

Enter the number of months related to RRA. |

|

Court Costs |

Enter the total amount of expenses incurred for the use of the court, for example, court filing fees, photocopying costs, postage and so on. |

|

Attorney Costs |

Enter the total amount of attorney fees. |

Attorneys

|

Field or Control |

Description |

|---|---|

|

Inscription Type and Inscription Number |

Specify the inscription type and number of each attorney involved in the labor proceeding. |

|

Value |

Enter the amount of attorney fees paid to the attorney. |

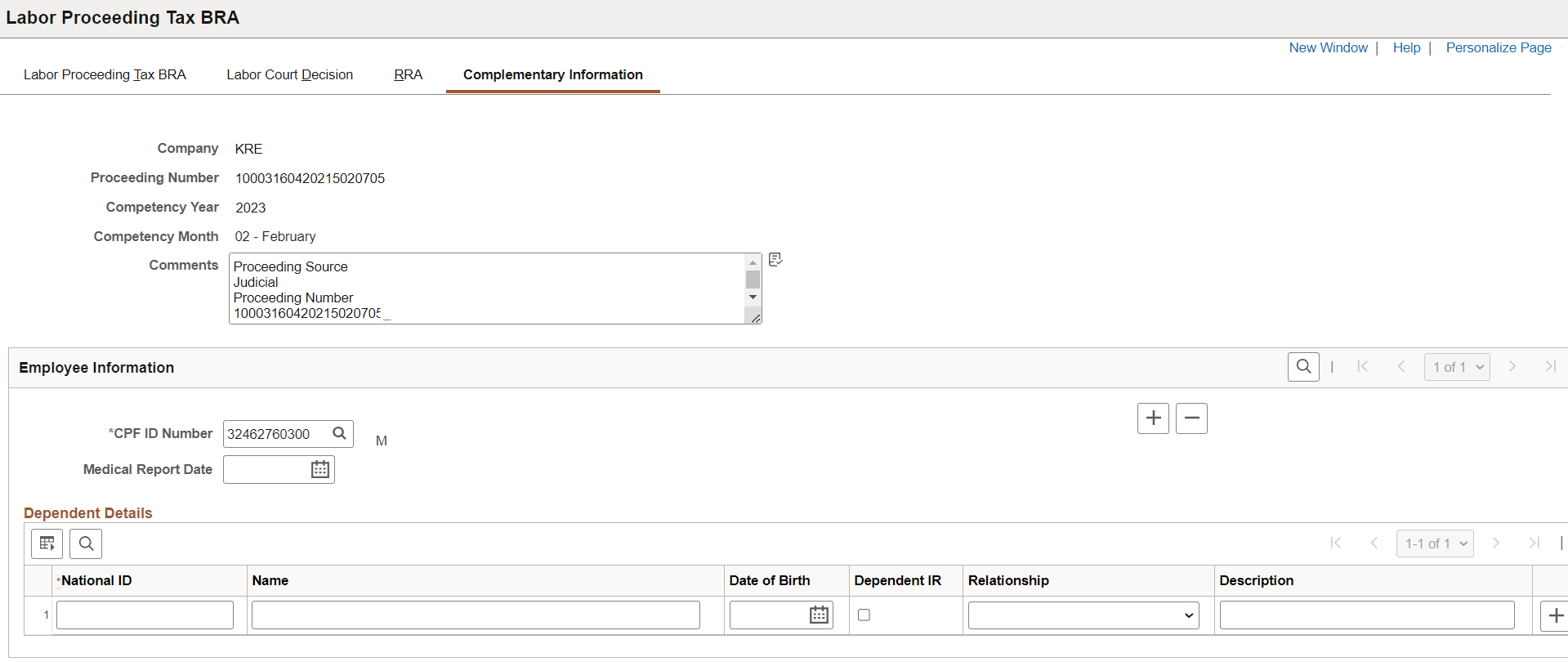

Use the Complementary Information page (GPBR_LPT_COMP_INFO) to enter employee's dependent information.

Navigation:

This example illustrates the fields and controls on the Complementary Information page.

|

Field or Control |

Description |

|---|---|

|

Company, Proceeding Number,Competency Year and Competency Month |

Displays the selected company, proceeding number, competency year and month when you add the labor proceeding tax record. |

|

Comments |

Enter any comment for this labor proceeding, if applicable. |

Employee Information

|

Field or Control |

Description |

|---|---|

|

CPF ID Number |

Select the CPF ID of the claimant. Only CPF IDs that are associated with the selected proceeding number are available for selection. |

|

Medical Report Date |

Specify the date that the serious illness was reported. |

Dependent Details

|

Field or Control |

Description |

|---|---|

|

National ID and Name |

Enter the national ID and name of the dependent. |

|

Date of Birth |

Specify the birth date of the dependent. |

|

Dependent IR |

Select to indicate that the dependent is eligible for income tax deduction. |

|

Relationship |

Select the dependent's relationship to the employee. |

|

Description |

(Optional) Enter additional comment about the dependent's relationship to the employee. |

Use the Suspended Deductions BRA page (GPBR_LPT_SUSP_DED) to enter details for deductions with suspended liability.

Navigation:

Select the Suspended Deductions BRA link on the Labor Court Decision Page.

This example illustrates the fields and controls on the Suspended Deductions BRA page (Labor Court Decision).

If the key information of the proceeding (such as the proceeding type, proceeding number, suspension code, or period type) is modified in the Proceeding Data section of the Labor Court Decision Page, the system deletes the associated suspended deduction information automatically. You need to reenter the information.

|

Field or Control |

Description |

|---|---|

|

Deduction Type |

Select an applicable type for the deduction with suspended liability. Values are: Alimony Dependents Public Pension |

|

Deduction Amount |

Enter the amount of deduction from the income tax calculation base with suspended liability. |

|

National ID and Amount |

Enter the CPF of the dependent or alimony beneficiary, and their deduction amount with suspended liability. |