Defining Student Costs

To set up student costs, use the Job Code Salary Costs (TRN_JOB_SLR_COST) and the Trainees Salary Costs (TRN_EE_SALARY_COST) components.

These topics provide as overview of student costs and discuss how to:

Identify the training compensation cost by job.

Identify the training compensation cost by employee.

Process salary costs for a group.

To track the total cost of an employee who is taking a training course, you need to record:

The costs that are associated with the course, such as the price of materials and instructors.

The cost to the organization of the employee's lost work time.

For example, if employees typically bill their time to clients, then they cannot bill time while they are in training. This represents an additional training expense.

To track payroll costs that are associated with training, you can specify compensation costs at the job code level and at the individual employee level. To associate payroll costs with a group of similar job codes or a group of employees, use the Update Salary Costs page to perform a mass update of the system.

Note: When the system processes training costs for an employee, and no employee training cost is specified on the Employee Training Cost table, the system uses the job code salary cost. If you've specified training costs at both levels, the employee-level cost takes priority.

(FRA) Importing Salary Costs from Payroll

(FRA) If your organization uses PeopleSoft Global Payroll for France, you can extract costs from the payroll system and apply the costs to employees in a specified group ID.

Source of Default Costs for Job Code and Employees

Before you begin entering costs that are associated with job codes and employees, it's important to understand how the system determines the default training cost values that it displays on the system pages where you track training costs. The following chart explains the training cost defaults in the Budget Training business process:

|

Page Name |

Default Comes From |

|---|---|

|

Job Code Salary Cost |

No default. |

|

Trainees Salary Costs |

Job Code Salary Cost page. |

|

Employee Demand |

|

|

General Demand |

Default values are set to blank; however, when a profile is used as a template, the training cost is computed with the employees and job codes that are included in the profile. Click the Compute button to compute the training cost with the job codes that are listed on the page. |

|

Department Demand |

No default. |

|

Employee Demand by Course |

Same as the Employee Demand page. |

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRN_JOB_SLR_COST |

Identify the compensation cost of having an employee in this job code in training. |

|

|

TRN_EE_SALARY_COST |

Identify the cost of having an employee in training. |

|

|

RUNCTL_TRN006 |

Process training costs for a group of job codes or employees. |

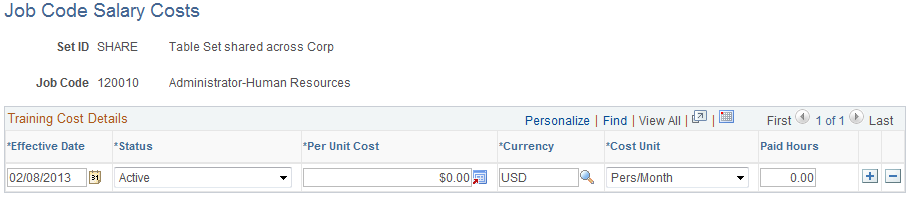

Use the Job Code Salary Costs page (TRN_JOB_SLR_COST) to identify the compensation cost of having an employee in this job code in training.

Navigation:

This example illustrates the fields and controls on the Job Code Salary Costs page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Per Unit Cost and Cost Unit |

Enter the per unit cost for the job code and the unit cost. Because the Per Unit Cost and Cost Unit fields are effective-dated, you can enter standard training costs for job codes, which can change over time. |

Paid Hours |

Displays the total number of hours worked by an employee for which they are paid. If you select Apply on Jobcodes or Apply on Employees in the Populate Process Mode group box on the Update Salary Cost-Learning, Define Budget, Update Salary Costs page, you may manually enter the hours that the employee works. If you select Load from Global Payroll in the Populate Process Mode group box on the Update Salary Cost-Learning, Define Budget, Update Salary Costs page, the system gets the value for Paid Hours from payroll and is deactivated for manual entry. Note: The system derives this value from payroll. Paid Hours calculates how many hours the employee works for the related cost unit, that is, if the cost unit is Pers/Month, then the number of hours is related to one month. |

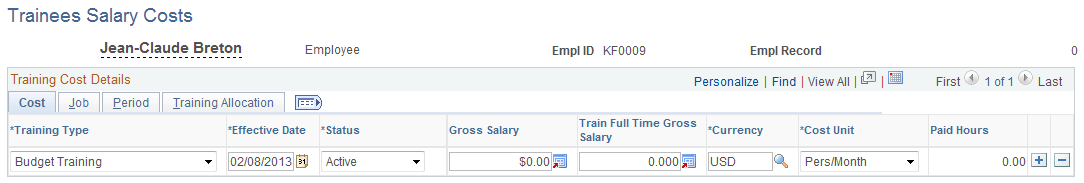

Use the Trainees Salary Costs page (TRN_EE_SALARY_COST) to identify the cost of having an employee in training.

Navigation:

This example illustrates the fields and controls on the Trainees Salary Costs page. You can find definitions for the fields and controls later on this page.

Common Page Information

Field or Control |

Description |

|---|---|

Training Type |

Select one of these options:

|

Gross Salary |

Enter the employee's gross salary before deductions. |

Train Full Time Gross Salary |

If the employee works full time for the training department, enter the gross salary. If you select the Full-Time Instructor check box on the Instructor page, the payroll system considers that instructor full-time. |

Paid Hours |

Enter the total number of hours the employee works for the related cost unit. For example, if the cost unit is Pers/Month, then the number of hours is related to one month. If you selected Apply on Jobcodes or Apply on Employees enter the number of hours that the employee worked. If you selected Load from Global Payroll the system displays the value that is retrieved by the Salary Cost Mass Update process. You cannot change the value here. |

Job tab

Field or Control |

Description |

|---|---|

Job Code |

Displays the employee's job code from the Job Data table. |

Period tab

Field or Control |

Description |

|---|---|

Period Begin Date |

This field is used for the effective date and the effective date is always equal to the period begin date. |

Period End Date |

Enter the end of the period in which the cost that you specified becomes effective. If you have separate costs for Administer Training and Budget Training, the period over which costs apply varies. Administer Training costs cover pay periods, whereas Budget Training costs apply to budget periods, which normally cover a year. Be sure that all these periods are contiguous to ensure accuracy in total compensation. |

Calc. Flag (calculate flag) |

This field identifies the source of the cost information: Manually, indicates that the employee's cost data was manually entered on this page. Job Code, Employee, or Payroll, indicate that the data was loaded by the Salary Cost Mass Update process that you run from the Update Salary Costs page. |

Company |

Select the employee's company. |

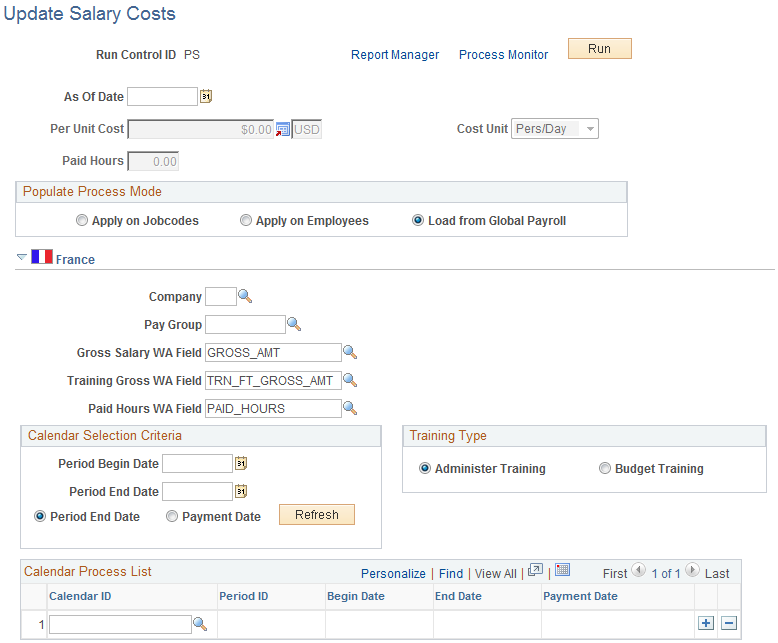

Use the Update Salary Costs page (RUNCTL_TRN006) to process training costs for a group of job codes or employees.

Navigation:

This example illustrates the fields and controls on the Update Salary Costs page. You can find definitions for the fields and controls later on this page.

Note: The Job Code Salary Costs and Trainees Salary Costs pages enable you to associate payroll costs with a job code and by employees one at a time. Use the Update Salary Cost process to specify a per cost figure and a cost unit metric to apply on the specified effective date to a group of job codes or employees.

Field or Control |

Description |

|---|---|

As Of Date |

Enter the effective date for this process. This date is used to Effective Date and Period Begin Date. |

Per Unit Cost |

Enter the cost to use for processing the cost per job or cost per employee. (FRA) Selecting Load from Global Payroll disables this field. |

Populate Process Mode

Field or Control |

Description |

|---|---|

Apply on Jobcodes |

Select to apply the cost to employees with a specified job code. |

Apply on Employees |

Select to apply the cost to given employees. |

(FRA) Load from Global Payroll |

Select to apply costs from Global Payroll for France to a group of employees. The system displays the France group box. |

Set ID and Job Code

This group box appears when you select Apply on Job Code or Apply on Employees. Select the set ID and job code to which you want to apply the selected cost. Add as many setIDs and job codes as necessary.

(FRA) France

This section becomes available when you select Load from Global Payroll.

In Global Payroll for France, writable array elements are used to store payroll results. The payroll system computes the salary and paid hours for training, and uses the writable array, FOR WA 2483, to store the results in the GPFR_TRN_WA record. When you run the Update Salary Costs process, salaries and paid hours are imported from the writable array.

This is a single table which interfaces between the payroll system and the training business process. When using a payroll system other than PeopleSoft, the table can be used to import salaries into the training business process.

Calendar Selection Criteria

In this group box, define the criteria for selecting the payroll calendars

Field or Control |

Description |

|---|---|

Period Begin Date |

Select the period begin date for salary training costs, usually the beginning of the fiscal year. |

Period End Date |

Select the period end date for salary training costs, usually the end of the fiscal year. |

Period End Date and Payment Date |

Select the date thatAccruals signifies the end of the period. |

Refresh |

Click to have the system insert all payroll calendars that occur within the specified period into the Calendar Process List |

Calendar Process List

Field or Control |

Description |

|---|---|

Calendar ID |

Select a Calendar ID that defines the time range in which salary costs are being defined. |

Period ID |

The system enters a Period ID for the salary costs being calculated during this time range. |

See PeopleTools: Process Scheduler.