Processing Encumbrances in Batch

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

HP_RCTL_YE_ENC_CLN |

Run the Fiscal Year End Encumbrance Cleanup process (HP_YEENC_CLN) process to liquidate any unused pre-encumbrances and encumbrances before creating new baseline encumbrance data. This is necessary to prevent double booking of multiyear encumbrances. |

|

|

HP_RUN_CNTL_ENC |

Run the Batch Encumbrance Calculation process (ENC_CALC) to calculate pre-encumbrances and encumbrances in batch, either to create baseline data for a new fiscal year or to calculate updates to the baseline data. |

|

|

HP_ENCERN_SUSP_DST |

View and modify encumbrance transactions that are distributed to the combination code of the suspense account. Redistribute from the suspense account to another valid ChartField combination. |

|

|

ChartField Detail Page |

HMCF_HRZNTL_CFLD |

Select individual ChartField values or search for an existing combination code. |

|

RUNCTL_PRCSDATE |

Run the Encumbrance GL Interface process (PAYGL03) after you run the Batch Encumbrance Calculation process or the Fiscal Year End Encumbrance Cleanup process. The Encumbrance GL Interface process prepares the accounting lines for publishing to PeopleSoft Financials and updates the Budget Actuals table in PeopleSoft HCM. |

This topic describes the batch processes that you use to calculate encumbrances and post encumbrance data to PeopleSoft Financials.

Batch Encumbrance Processing Overview

To process encumbrances in batch, follow these steps:

Use the Fiscal Year End Encumbrance Cleanup process (HP_YEENC_CLN) to liquidate all unused pre-encumbrance and encumbrance amounts.

Use the Batch Encumbrance Calculation process (ENC_CALC) to:

Calculate baseline encumbrances for a fiscal year.

Update encumbrances that reflect subsequent changes to job data and position data.

Liquidate unused pre-encumbrance and encumbrance amount for the pay cycles that have been confirmed.

Review encumbrance transactions that have been assigned to suspense codes, and take appropriate action.

Run the Encumbrance GL Interface process (PAYGL03) to post the results to the general ledger and commitment control tables.

Run this process after each run of the Batch Encumbrance Calculation process and after each run of the Fiscal Year End Encumbrance Cleanup process.

The Fiscal Year End Encumbrance Cleanup Process (HP_YEENC_CLN)

Use the Fiscal Year End Encumbrance Cleanup process (HP_YEENC_CLN) to liquidate all unused pre-encumbrance and encumbrance amounts.

Because the system creates encumbrances through the funding end date for a funding source, some of the encumbrances that you create during one fiscal year can extend into subsequent fiscal years. Therefore, before you create baseline encumbrances for the new fiscal year, you need to liquidate all unused pre-encumbrance and encumbrance amounts for the current and future budget years.

Note: You must run the Fiscal Year End Encumbrance Cleanup process before creating baseline encumbrances for a new fiscal year. Creating new baseline encumbrances without first cleaning up existing encumbrances could result in double-booked encumbrances.

The Batch Encumbrance Calculation Process (ENC_CALC): Baseline Encumbrances

The Batch Encumbrance Calculation process creates baseline pre-encumbrance and encumbrance transactions for the current fiscal year. The encumbrances can extend into subsequent budget years depending on the funding end dates for the funding sources.

If baseline encumbrances already exist for a future fiscal year, then the calculation process only calculates encumbrances and pre-encumbrances for the current fiscal year: no future budget years are considered.

Baseline encumbrance calculations are created for all filled and vacant positions based on data from the Job Data page, the Position Data - Specific Information page (for vacant positions), and the Department Budget component.

The Batch Encumbrance Calculation Process (ENC_CALC): Updated Encumbrances

As you change data in your system, your baseline encumbrance calculations may be impacted. Update the encumbrance calculations by periodically running the Batch Encumbrance Calculation process.

If there are setup table changes, you can run the Batch Encumbrance calculation with table change option, which is driven by the Encumbrance Trigger table (ENCUMB_TRIGGER).

To configure the system to create trigger records, you must enable encumbrance triggers on the Product Specific page of the installation table.

The system creates pre-encumbrance triggers when:

Department budget information is inserted, deleted, or corrected for an entity, and the changes affect the pre-encumbrance calculation for all entities that belong to it and don't have a lower-level budget.

Encumbrance default information is inserted, deleted, or corrected for an entity on the Encumbrance Definition page and the changes affect the pre-encumbrance calculation for all entities that belong to it and don't have lower-level defaults.

The system creates encumbrance triggers when:

Department budget information is inserted, deleted, or corrected for an entity, and the changes affect the encumbrance calculation.

Encumbrance default information is inserted, deleted, or corrected for an entity on the Encumbrance Definition page, and the changes affect the encumbrance calculation for all entities that belong to it.

Contract pay information is added or modified.

Suspense Code Review

When you use batch processing to create and post encumbrance data, the system allocates transactions without funding sources or adequate funding to the department budget's suspense combination code. View these transactions and specify a new combination code on the Encumbrance Suspense ComboCodes component (HP_ENCUMB_SUSPNSE).

The system processes transactions that exceed their budget cap if the funding source has the Allow Overspend check box selected on the Department Budget component. The process generates a warning for these transactions.

The Encumbrance GL Interface Process (PAYGL03)

Run this process after each run of the Batch Encumbrance Calculation process (after calculating baseline encumbrance data and after calculating updates to baseline data).

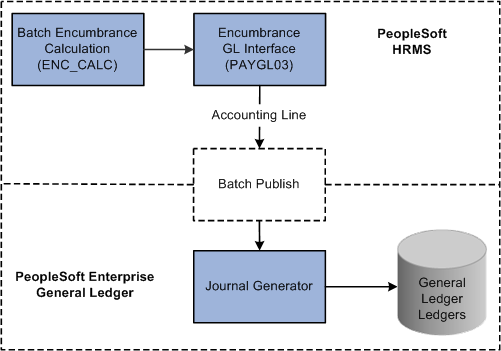

This diagram illustrates how the system transfers encumbrance data to the PeopleSoft General Ledger ledgers.

This diagram illustrates how the system transfers encumbrance data to the PeopleSoft General Ledger ledgers.

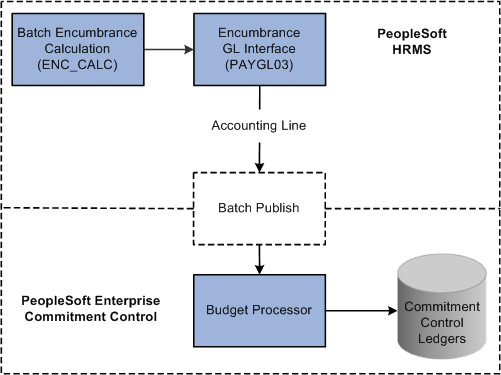

If you are using PeopleSoft Commitment Control, the system transfers encumbrance data to the Commitment Control ledgers, as illustrated in this diagram:

This diagram illustrates how the system transfers encumbrance data to the Commitment Control ledgers in PeopleSoft Commitment Control.

Use the Fiscal Year End Encumbrance Cleanup page (HP_RCTL_YE_ENC_CLN) to run the Fiscal Year End Encumbrance Cleanup process (HP_YEENC_CLN) process to liquidate any unused pre-encumbrances and encumbrances before creating new baseline encumbrance data.

This is necessary to prevent double booking of multiyear encumbrances.

Navigation:

This example illustrates the fields and controls on the Fiscal Year End Encumbrance Cleanup page.

Field or Control |

Description |

|---|---|

Fiscal Year |

Enter the fiscal year whose baseline encumbrances you wish to liquidate. |

Clear Future Fiscal Years |

Select this check box to clear encumbrances for subsequent fiscal years along with the current fiscal year. |

Process All Companies |

Select this check box to cleanup multiyear encumbrances for all companies. If you leave this check box deselected, use the Companies grid to enter specific companies to process. |

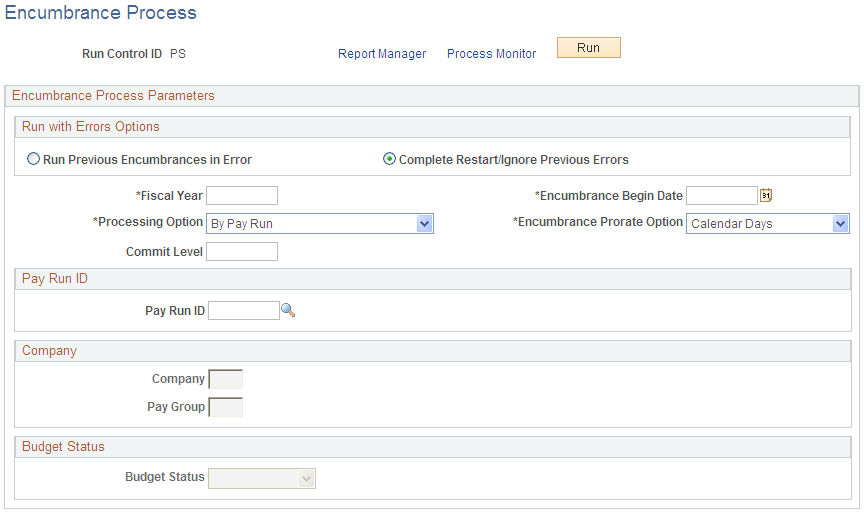

Use the Encumbrance Process page (HP_RUN_CNTL_ENC) to run the Batch Encumbrance Calculation process (ENC_CALC) to calculate pre-encumbrances and encumbrances in batch, either to create baseline data for a new fiscal year or to calculate updates to the baseline data.

Navigation:

This example illustrates the fields and controls on the Encumbrance Process page.

Note: After running fiscal year encumbrances, run the Encumbrance GL Interface process (PAYGL03) to post the encumbrances.

Run With Errors Options

Field or Control |

Description |

|---|---|

Run Previous Encumbrances in Error |

Select to restart a previous process that contained errors. The system reprocesses only those records containing errors. Use this option after you have addressed the errors from the previous run. When you select this option, the system populates the rest of the fields on the page with the settings from the instance that you are reprocessing, and all fields become read-only. |

Complete Restart/Ignore Previous Errors |

Select this option if you want to restart the Batch Encumbrance Calculation process and ignore errors from previous runs. When you select this option, you select processing settings using the rest of the fields on this page. |

Additional Encumbrance Process Parameters

Field or Control |

Description |

|---|---|

Fiscal Year |

Enter the fiscal year for which you want to create pre-encumbrance and encumbrance transactions. Encumbrances and pre-encumbrances can extend into subsequent fiscal years when they are associated with a funding end date that is after the end of the specified fiscal year. However, if the Batch Encumbrance Calculation process finds existing encumbrances for subsequent fiscal years, it will not create encumbrances for these subsequent fiscal years. |

Encumbrance Begin Date |

Enter the date that you want the system to start calculating encumbrances. For example, if your fiscal year runs from April 1 to March 31, and you specify May 1 as the Encumbrance Begin Date, the encumbrance calculations are prorated to 335 days (rather than 365). When you create baseline encumbrances, the Encumbrance Begin Date is generally the same as the Fiscal Year Begin Date. However, if you need to recalculate the encumbrance after you have confirmed one or more pay cycles for the fiscal year, the system will determine the encumbrance begin date. This date is the greater of either the last pay confirm date plus one day or the encumbrance begin date entered in the run control. |

Encumbrance Prorate Option |

If you are prorating encumbrances across accounting periods, you can prorate using calendar or work days. Indicate if the encumbrance prorate option is Calendar Days or Work Days. |

Processing Option |

Select from the following options:

|

Pay Run ID

Field or Control |

Description |

|---|---|

Pay Run ID |

If your processing option is Pay Run, enter a specific pay run ID here. |

Company

Field or Control |

Description |

|---|---|

Company and Pay Group |

If your processing option is Company, enter a specific company here. To further limit processing to a specific pay group, select a pay group as well. Note: When processing pre-encumbrances, the entire company is processed regardless of the specified pay group. |

Budget Status

Field or Control |

Description |

|---|---|

Budget Status |

If your processing option is Budget, the system processes the employees or positions with the budget check status you select. The options are Invalid or Pending. |

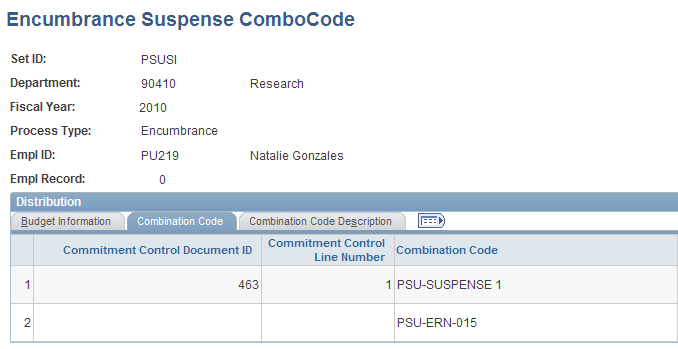

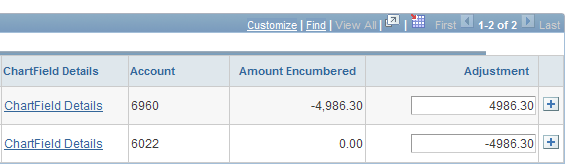

Use the Encumbrance Suspense ComboCode page (HP_ENCERN_SUSP_DST) to view and modify encumbrance transactions that are distributed to the combination code of the suspense account. Redistribute from the suspense account to another valid ChartField combination.

Navigation:

This example illustrates the fields and controls on the Encumbrance Suspense Combo Code (1 of 2).

This example illustrates the fields and controls on the Encumbrance Suspense Combo Code (2 of 2).

When the Batch Encumbrance Calculation process encounters transactions without sufficient funding for the current fiscal year, it posts the transactions to the department budget suspense combination code. Use the Encumbrance Suspense ComboCode page to view the transactions and to redistribute to another valid ChartField combination before you run the Encumbrance GL Interface process (PAYGL03).

To view and modify suspense combination code encumbrance transactions:

Review the transaction.

The Encumbrance Suspense ComboCode page displays all the information about the transaction, including the person name and ID, the fiscal year, the original combination code (the combination code that did not have enough to fund this transaction), and the encumbered amount.

Enter a new combination code to fund the transaction.

Enter a new combination code in the ChartField Detail page to fund the encumbrance transaction. You can redistribute the amount to multiple ChartField combinations.

Note: Select the Edit ChartFields link to search for an existing combination code or select a unique combination of ChartFields on the ChartField Detail page.

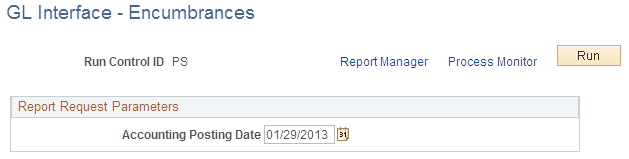

Use the GL Interface - Encumbrances page (RUNCTL_PRCSDATE) to run the Encumbrance GL Interface process (PAYGL03) after you run the Batch Encumbrance Calculation process or the Fiscal Year End Encumbrance Cleanup process.

The Encumbrance GL Interface process prepares the accounting lines for publishing to PeopleSoft Financials and updates the Budget Actuals table in PeopleSoft HCM.

Navigation:

This example illustrates the fields and controls on the GL Interface - Encumbrances page.

Run the Encumbrance GL Interface process (PAYGL03) whenever you run the Batch Encumbrance Calculation process, run the Fiscal Year End Encumbrance Cleanup process, or make changes to the suspense combination code transactions. The Encumbrance GL Interface process creates accounting lines for publishing to PeopleSoft Financials, and it updates the Budget Actuals table in PeopleSoft HCM.

Note: Changes to Suspense ChartField Combinations must be made before you run the Encumbrance GL Interface process.

Field or Control |

Description |

|---|---|

Accounting Posting Date |

The date you enter is used to determine the applicable effective-dated row in some setup tables like the journal ID, conversion rate, and offset account tables in PeopleSoft Human Resource system. If you are not using commitment control, the accounting posting date is used as the budget date in the accounting lines for both current and future fiscal year entries |