Running the Actuals Distribution Process

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_PPFUND |

Runs the Actuals Distribution process (PSPPFUND), which distributes actual earnings, employer deductions, and employer taxes across the funding sources and notifies you when you've exceeded any budget amounts. Before using this page, you must have run a Pay Confirmation process. |

|

|

PY_TL_XTRACT_COST |

Runs the Actuals Distribution process and extracts cost information from Time and Labor to distribute actual earnings, employer deductions, and employer taxes across the funding sources and notifies you when you've exceeded any budget amounts. Before using this page, you must have run a Pay Confirmation process. |

The Actuals Distribution process (PSPPFUND) distributes actual earnings, employer deductions, and employer taxes across the funding sources you've established and notifies you when you've exceeded any budget amounts specified on the Department Budget component or when a transaction lacks funding. If your pay period isn't fully contained within a single accounting period, the process also distributes earnings, employer deductions, and employer taxes across accounting periods using the calendar information on the Detail Calendar.

The Actuals Distribution process allocates transactions without funding sources or adequate funding to the department budget's suspense combination code. View these transactions and specify a new combination code on the Suspense ComboCode Dist component (HP_PYCHK_DIST_SUSP).

The system processes transactions that exceed their budget cap so long as the funding source has the Allow Overspend check box selected on the Department Budget component. The process generates a warning for these transactions.

After running the Actuals Distribution process, modify actuals distribution using the Review Actuals Distribution component (PAYCHECK_DIST).

To post actuals to your general ledger system, including any changes you make on the Review Actuals Distribution component, run the Actuals GL Interface process.

This topic discusses how the system finds funding sources for:

Earnings.

Employer-paid deductions and taxes.

Earnings Funding Sources

Where the system looks for funding information depends on whether you are using PeopleSoft Time and Labor distribution:

|

Customers Using Time and Labor Distribution |

Customers Not Using Time and Labor or Time and Labor Distribution |

|---|---|

|

If you are using PeopleSoft Time and Labor and are using time and labor distribution information when determining actuals funding sources:

|

If your system doesn't find any task information, or if you opt not to use time and labor distribution information:

|

See:

Employer-Paid Deductions and Taxes Funding Sources

For employer deductions and employer taxes, the system looks for a combination code specified on:

The person's Job Data - Payroll page.

If it can't find a combination code there, and a combination code is found on the Paysheet and the default funding option on Department Budget table is either Actuals or Earnings, the process will use the combination code on the Paysheet.

If it can't find a combination code on Job Data and Paysheet, and the default funding option on Department Budget table is either Actuals or Earnings, the process will use the combination code from Dept Budget Earnings page.

If it can't find a combination code there, the process then looks at the Dept Budget Deduction page (DEPT_BUDGET_DED) and Dept Budget Taxes page (DEPT_BUDGET_TAX or DEPT_BUDGET_CTX).

If there is no combination code on the Dept Budget Deduction or Dept Budget Taxes pages, then the Actuals Distribution process can't distribute the actuals and the system will use the suspense account specified on Department Budget Date page.

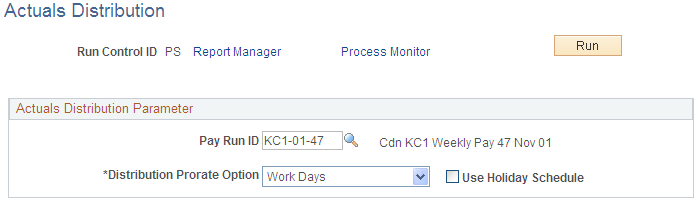

Use the Actuals Distribution page (RUNCTL_PPFUND) to run the Actuals Distribution process (PSPPFUND), which distributes actual earnings, employer deductions, and employer taxes across the funding sources and notifies you when you've exceeded any budget amounts.

Note: Before using this page, you must run a Pay Confirmation process.

Navigation:

This example illustrates the fields and controls on the Actuals Distribution page.

Actuals Distribution Parameter

Field or Control |

Description |

|---|---|

Pay Run ID |

Select the Pay Run ID. |

Distribute Prorate Option |

You must select either of the following options: Calendar Days: The system uses calendar days to calculate prorated amounts across accounting periods Work Days: If you select this and Use Holiday Schedule, the process prorates by work days, excluding holidays. If you select Work Days and do not select Use Holiday Schedule, the process prorates by working days, including holidays. |

Use Holiday Schedule |

Indicate if the process should exclude holidays (based on the holiday schedule) when using Work Days to prorate distribution. |

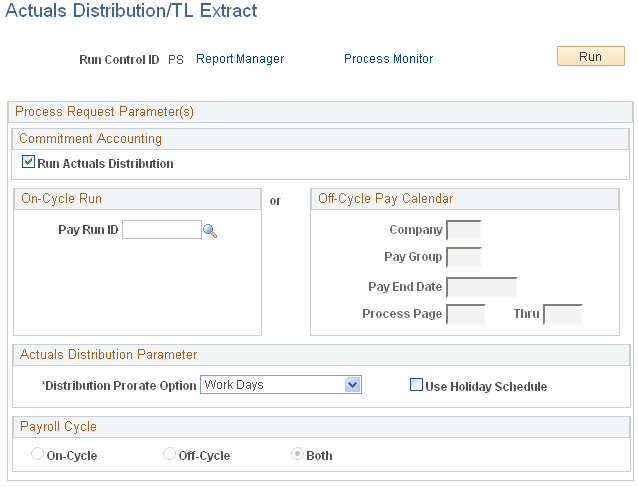

Use the Actuals Distribution/TL Extract page (PY_TL_XTRACT_COST) to run the Actuals Distribution process and extracts cost information from Time and Labor to distribute actual earnings, employer deductions, and employer taxes across the funding sources and notifies you when you've exceeded any budget amounts.

Before using this page, you must have run a Pay Confirmation process.

Navigation:

This example illustrates the fields and controls on the Actuals Distribution/TL Extract page.

Commitment Accounting

Field or Control |

Description |

|---|---|

Run Actuals Distribution |

Select to run the Actuals Distribution process. |

On-Cycle Run

If you are processing an on-cycle run, select the Pay Run ID.

Off-Cycle Pay Calendar

If you are processing an off-cycle run, select the Company, Pay Group, and Pay End Date. Enter the page range in the Page # and Thru fields.

Actuals Distribution Parameter

Field or Control |

Description |

|---|---|

Distribution Prorate Option |

If you are prorating actuals across accounting periods, you can prorate using calendar or work days. Select one of the following options for the prorate option: Calendar Days: The system uses calendar days to calculate prorated amounts across accounting periods Work Days: If you select this and Use Holiday Schedule, the process prorates by work days, excluding holidays. If you select Work Days and do not select Use Holiday Schedule, the process prorates by working days, including holidays. |

Use Holiday Schedule |

Indicate if the process should exclude holidays (based on the holiday schedule) when using Work Days to prorate distribution. |