Loading Payable Time into Paysheets

This topic provides overviews of processing steps and guidelines, run control options, and consolidation, lists prerequisites, and discusses how to:

Select processing parameters.

Filter the load processing.

Select earnings for on-cycle separate checks.

Use the following guidelines to ensure an accurate transfer of time and labor data to Payroll for North America paysheets.

Processing Steps

To process a payroll in Payroll for North America using time and labor data:

Load time and labor data into paysheets.

Review results and correct errors.

Start the pay calculation processing and the remaining phases of the payroll cycle.

Payroll Processes That Load Time and Labor Time

The following Payroll for North America processes load payable time from Time and Labor:

Load Time and Labor COBOL SQL process (PSPLDTL1).

Pay Calculation.

Online Check.

Final Check.

Iterative Processing

Initiate the loading of the time and labor data from the Load Time and Labor component (PY_LDTL_RC), where you specify the pay run ID and additional criteria to filter data you want to load. Based on the options that you select in this component, the process selects appropriate payable time from Time and Labor records. You can also identify which data should be loaded to separate checks.

You can run and rerun the update process on an iterative basis. The first time that you run the update process, the system updates all time and labor earnings on the paysheets for the employees selected by the run parameters. Then, any subsequent load runs under the same parameters update only data that needs to be updated, such as earnings for employees who have a Job change or whose time and labor earnings have changed since the last pay update process was run. Data is also updated if there are new rows of time and labor data that are eligible to be transferred to paysheets.

Running the Load Time and Labor process iteratively makes sense if you administer a salaried group of employees who have a very low exception rate. In this situation, you can run the Load Time and Labor process after you create time at the beginning of a pay period, then run a preliminary pay calculation and do some cleanup. Then, at the end of the pay period, you can run the Load Time and Labor process again to select only those employees who have reported exceptions during the period, such as the odd vacation or sick leave. Even with the odd exception time, remember that the Load Time and Labor process performs a complete reupdate of the employee's time to ensure that the time is properly summarized.

Time and Labor as Other Earnings

After selecting payable time, the Load Time and Labor process consolidate the payable time and creates or updates the appropriate paysheets. It loads time and labor data into the paysheets as Other Earnings and marks the paysheets as Other Earnings. After processing is complete, the system identifies the time and labor data in Pay Other Earnings by selecting the TL Records (time and labor records) check box on the parent Pay Earnings record.

Additional paysheet transactions, unique other earnings lines on the paysheet, are generated for time and labor data based on any of the following information in effect for the employee during the pay period:

Tax distribution.

Earnings distribution.

Prior period adjustments.

Task element overrides to paysheets.

(USA) Fair Labor Standards Act (FLSA) adjustments.

Job change (pay group, department, rate change, and so on).

If a paysheet already exists for the employee, that paysheet is updated. If the paysheet does not exist for the employee, the Create Paysheet COBOL SQL process (PSPPYBLD) creates one for both on-cycle and off-cycle runs.

Hourly and Exception Hourly Employees

For hourly or exception hourly employees, any regular hours that are created by the Create Paysheet process, posted in the Reg Hrs (regular hours) field on the paysheet, are set to zero during the loading of time and labor payable time to paysheets.

You should report the hours, units, or dollars that represent regular time through Time and Labor.

Salaried Employees

Because salaried employees are not paid on an hourly basis, it is not appropriate to pay them based on the number of regular hours that are reported in Time and Labor. In this case, the Load Time and Labor process does not set to zero any regular earnings that are created by the Create Paysheet process, nor does it load paysheets with any time and labor earnings mapped to the default regular earnings code for the salaried employee's pay group. Salaried employees are paid the amount that is posted in the Reg Salary (regular salary) field on the paysheet earnings line. However, the payroll costs for salaried employees can be distributed in Time and Labor.

Holiday Hours

Prior to loading time and labor earnings through the Load Time and Labor process, the system removes any holiday hours that are created by the Create Paysheet process, regardless of employee type. It is expected that all holiday time be reported through Time and Labor or created by Time and Labor system processes.

Prior Period Adjustments

The Load Time and Labor process automatically updates prior period adjustments in Time and Labor. The process populates the paysheet with both the negative and positive hours, amounts, or unit in Other Earnings. It summarizes all negative and positive adjustment entries by date and by earnings code.

The Load Time and Labor process creates a new earnings entry for each prior period adjustment and sets the pay earning's begin/end dates equal to the prior period adjustments date under report.

(CAN) EI Prior Period Corrections

The system does not determine whether prior period time is a prior period correction for EI (employment insurance) purposes or a prior period adjustment. After loading prior period time from Time and Labor, you must select the EI Period Correction check box on the paysheet only for pay corrections, not for pay adjustments.

Use these definitions to determine whether the prior period time is a pay adjustment or pay correction for EI purposes:

Pay adjustments are situations where there has been a delay in recognizing, implementing, or processing a change in an employee's pay.

For example, an increase in wages under a union contract, agreed to three months after the end of the previous contract, gives rise to a retroactive pay increase or adjustment.

Pay corrections involve errors such as hours missed when a previous pay period was processed, incorrectly keyed pay rates affecting previous pay periods processed, or back wages paid to an employee who was wrongfully dismissed.

The insurable earnings and hours for pay corrections must be allocated to the prior pay periods for which they are paid, not the pay periods in which they are paid.

Single Online Check

When you request a single online check, you first see a message box that asks if you want to use the Create Paysheet process. If you answer Yes, and the Time and Labor application is installed, you get a second message box that asks if you want the process to retrieve available time and labor data. If you answer Yes to this message, the system displays the Filter Options page where you can filter available time by earnings code or date range.

Final Check

You can use an existing on-cycle calendar to run the Final Check process. The Final Check process takes any existing paysheets, including Time and Labor, and copies them to an off-cycle paysheet. Then it marks the source paysheets as Not OK to Pay. In effect, the Final Check process generates an off-cycle request for one employee. It uses the same logic as the final check currently uses to determine the pay end date to use for the creation of the Time and Labor paysheets. The system always asks if you want to use existing paysheets or create new ones.

The Request Final Check page includes the Include T&L Payable Time check box which you select if you want to include time and labor payable time in the Final Check Paysheet Creation process. This option brings a separate Pay Other Earnings Rows sourced from Time and Labor.

Pay Unsheet

If you run the Payroll Unsheet SQR Report process (PAYUNSHT) after loading payable time from Time and Labor, the system sets the payable status to Rejected with a reason of Cancelled.

Time and Labor maintains employee time information at the work day and task levels to meet a variety of requirements such as project costing and various accounting functions. However, this level of detail is not required for payroll processing. Because such detail is not necessary, and to minimize payroll processing time, the Load Time and Labor process selects and consolidates time and labor data to load into paysheets.

Consolidation of Time and Labor Data for Paysheets

The system uses the Time and Labor date under report (the date for which time was reported) and pay calendar pay begin and end dates to identify which daily time transactions to select for consolidation to the paysheets. Any current period information that has been paid in a previous off-cycle pay run is not included in an on-cycle pay run for the current period.

Only daily Time and Labor time records with the following criteria are selected:

A payable status of Estimate, Approved, Rejected by Payroll, Taken by Payroll, Paid-Labor Distributed, or Paid-Labor Diluted.

Prior period adjustments that have a date under report less than the pay begin date.

Payable status of Sent to Payroll or Closed and payroll request number is zero (time has not already been paid) and record-only adjustment is "N" (No).

Both the corresponding adjustment amounts for prior period adjustments and any offsets are updated to the paysheets.

Consolidation Criteria

Time and Labor selects the appropriate payable time and transfers the data to Payroll for North America and consolidates the data. Consolidation of data entries takes place when the following criteria are met:

The date under report (the date for which time was reported) is the same for multiple rows of payable time (the rows are consolidated).

The employee's Job information has not changed during the pay period.

The earnings codes are the same.

The payment types for the earnings code match (Either Hours or Amount OK; and Hourly Only).

The state, locality, override rate, and compensation rate code, if entered for the payable time, match.

The account code, business unit, department, job code, and position number, if entered for the payable time, match.

Payroll for North America only checks these five task-related elements if they have been defined on the Pay Group Table - Time and Labor page. For example, if Entry 1 has an account code of 123, and Entry 2 has an account code of 456, the system combines these entries if all of the other consolidation requirements are met, unless account code has been defined on the Pay Group Table - Time and Labor page.

Prior period adjustments are consolidated separately from current period earnings. In addition, positive and negative prior period adjustments are consolidated separately.

Prior period adjustments are always consolidated one day at a time, so the earnings begin and end dates in Payroll for North America are always equal to the adjustment's date under report in Time and Labor. This provides Payroll for North America with enough information to recalculate FLSA rates.

Consolidated Entries Linked to Original Entries

The system keeps track of how it consolidates payable time and informs Time and Labor which entries are combined by passing back a set of sequence and cross-reference numbers for each time entry. This information is important to the labor distribution process.

The Load Time and Labor page enables you to specify parameters that determine:

Whether to load time to an on-cycle or off-cycle pay run.

Whether to load all available time, only prior period time, or to filter time by:

Employee

Use this filter if, for example, you must process a time adjustment for a single employee after the regular payroll is loaded.

Earnings code

You can use earnings code filters in conjunction with all other filters.

Pay group

Use this filter if you must resolve issues with particular pay groups but not all.

Date range

Use this filter if, for example, the regular payroll is loaded but new time adjustments are required. You can load the adjustments without picking up any new time.

Whether to load time to a separate check:

Use the On-Cycle Separate Check page to select up to three sets of earnings codes grouped for separate checks in an on-cycle pay run.

Use the Load Time to Separate Check indicator with on-cycle or off-cycle pay runs to load all prior period time for all employees in the pay run to a separate check or to load all filtered time for the designated filters in the pay run to a separate check.

Some of these options are mutually exclusive.

Availability of Options

This table summarizes the availability of the Load Time to Separate Check field, the Filter page, and the On-Cycle Separate Check page in the Load Time and Labor run control component under various conditions:

|

Pay Run |

Processing Option |

Load to Separate Check field |

Filter page |

On-Cycle Separate Check page |

|---|---|---|---|---|

|

On-Cycle |

All Time |

Unavailable |

Hidden |

Visible |

|

On-Cycle |

Filtered Time |

Available |

Visible |

Hidden if Load to Separate Check is selected. Visible if Load to Separate Check is deselected. |

|

On-Cycle |

Prior Period |

Available |

Visible |

Hidden if Load to Separate Check is selected. Visible if Load to Separate Check is deselected. |

|

Off-Cycle |

All Time |

Unavailable |

Hidden |

Hidden |

|

Off-Cycle |

Filtered Time |

Unavailable |

Visible |

Hidden |

|

Off-Cycle |

Prior Period |

Unavailable |

Visible |

Hidden |

On-Cycle Separate Check Page Usage

This table provides examples of how the On-Cycle Separate Check page might be used for some of the load processing options:

|

Processing Option |

Example of On-Cycle Separate Check Page Usage |

|---|---|

|

Load All Time |

Indicate that overtime is to be paid on a separate check, but all other time is paid on the regular check. |

|

Load Filtered Time |

Load only one employee for only one earnings to a separate check. |

Understanding Refresh Request

A refresh request is a method of recapturing lost data. It is not generally a normal stage in the regular processing cycle.

A refresh request enables you to reselect all of the data that was passed in the original request, current and prior period adjustments, plus any new unclaimed payable time entries (where payable status is set to Estimate, Closed, Sent to Payroll, or Rejected by Payroll).

Use the Review Time and Labor Load component (PY_LDTL_TBL) to determine the correct run to refresh prior to running the refresh process.

The selection process for refresh requests is the same as an original request. The only difference is that prior to the loading of data, a process runs that performs the following functions:

Deletes the payroll request number and pay system value on the Payable Time record.

Deletes all applicable transactions in Pay Earnings and Pay Other Earnings.

Resets payable status.

In addition to other setup steps previously discussed, you must define the pay run ID and pay calendars prior to running the Load Time and Labor process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PY_LDTL_RC |

Select processing options then run the Load Time and Labor process to load payable time from Time and Labor into Payroll for North America paysheets for processing. |

|

|

PY_LDTLEMP_RC |

Select employees, earnings codes, pay groups, or range of dates to load payable time from Time and Labor into Payroll for North America paysheets for processing. |

|

|

PY_LDTL_SEP_CHK_RC |

Select up to three groupings of earnings codes for separate checks. |

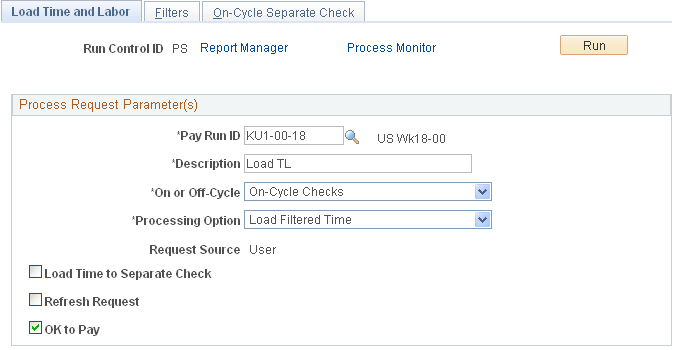

Use the Load Time and Labor page (PY_LDTL_RC) to select processing options then run the Load Time and Labor process to load payable time from Time and Labor into Payroll for North America paysheets for processing

Navigation:

This example illustrates the fields and controls on the Load Time and Labor page.

Field or Control |

Description |

|---|---|

Pay Run ID |

Select the pay run ID that identifies the pay calendars that you want to process. Each pay calendar identifies a company, pay group, and the start and end dates of the pay period. This selects employees that have been active any time during the pay period. |

Description |

Use this field to discriminate between multiple instances of loading time and labor data when using the Review Time and Labor Load - Load Time Labor page and Review Time and Labor Load - Off-Cycle Data page. |

On or Off-Cycle |

Values are: On-Cycle: Select to process a regularly scheduled pay run. Off-Cycle: Select to process a payroll outside the pay group's normal pay period schedule. |

Processing Options |

Select the processing option:

Note: (CAN) After loading prior period time from Time and Labor, you must select the EI Period Correction check box on the paysheet only for pay corrections, not for pay adjustments. |

Request Source |

This is a display-only field. It displays the source of the request: Pay Calc (pay calculation), Final Calc (final calculation), Online Check, or User. It indicates whether you or someone else generated the loading of time and labor data or if the system did it automatically through the Pay Calculation, final Pay Calculation, or Online Check process. |

Load Time to Separate Check |

Select to load all prior period time or filtered time to a separate check for all employees included in the selection criteria. This field is not available for off-cycle runs or if the on-cycle processing option is Load All Time. |

OK to Pay |

Select if you want all time and labor earnings to be marked as OK to Pay on the paysheet. If you do not select this check box, you must manually mark every paysheet as OK to Pay on the Paysheet page. |

Refresh Request |

Select to restart the selection process for all employees in the pay run. This should be used only when you must recover data if paysheets have been corrupted. This option should not be used on a normal rerun of the Load Time and Labor process, when more time is to be updated. A refresh request enables you to reselect all of the data that was passed in the original request, current and prior period adjustments, plus any new unclaimed payable time entries (where payable status is set to Estimate, Closed, Sent to Payroll, or Rejected by Payroll). |

Note: If you do not want to run labor distribution and dilution and do not select these options on the Pay System page in Time and Labor, then when the Load Time and Labor process runs to completion, it sets the payable status to Closed in Payable Time. When time is set to Closed, it can be published to PeopleSoft Projects as actuals.

Use the Load Time and Labor -Filters page (PY_LDTLEMP_RC) to select employees, earnings codes, pay groups, or range of dates to load payable time from Time and Labor into Payroll for North America paysheets for processing.

Navigation:

This example illustrates the fields and controls on the Load Time and Labor - Filters page.

Note: This page is not visible if you select Load All Time in the Processing Option field on the Load Time and Labor page. It is visible for off-cycle runs only if you select Load Filtered Time in the Processing Option field on the Load Time and Labor page.

Field or Control |

Description |

|---|---|

Employees |

Enter the employee ID for the employees that you want to process. The employee must be in a company and pay group within the selected pay run ID. Paysheets are created only for employees who have available payable time. The employee record number value is set by default to 0 (zero). If the employee has multiple jobs within the company, and you want to load time and labor data for that employee for a particular job, enter the employee record number corresponding to that job. |

Earnings Codes |

Enter earnings codes to load data for a special payment, such as a bonus run. If no earnings codes are selected, the system assumes that you want to load data for all earnings codes. |

Paygroups |

Select pay groups if you want to restrict the load by company and pay group. If no pay groups are selected, the system assumes that you want to load data for all pay groups. |

Field or Control |

Description |

|---|---|

Date Range |

Select dates to restrict the load to a date range. To load all time prior to a particular date, enter only an end date and leave the from date blank. If you enter a from date but leave the through date blank, the system enters the pay end date as the default through date. |

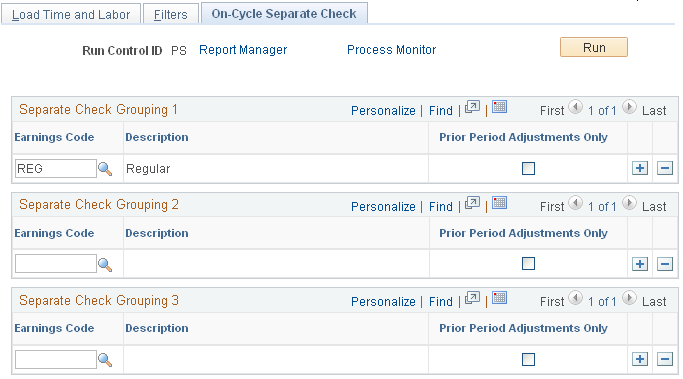

Use the On-Cycle Separate Check page (PY_LDTL_SEP_CHK_RC) to select up to three groupings of earnings codes for separate checks.

Navigation:

This example illustrates the fields and controls on the On-Cycle Separate Check page.

Note: This page is not visible for off-cycle pay runs or if Load to Separate Check is selected on the Load Time and Labor page.

You can select up to three sets of earnings codes to group onto separate checks.

Field or Control |

Description |

|---|---|

Earnings Code |

Select the group of earnings codes that you want to pay on each separate check. |

Prior Period Adjustments Only |

Select to load the selected earnings code to a separate check only for prior period time. This field is not available for data entry if you select the Load Prior Period Time processing option. Note: If you select the Load Prior Period Time processing option and want to load prior period time to separate checks, use the Load Time to Separate Check option on the Load Time and Labor page. |