Understanding the Payment Process in Financial Gateway

This diagram illustrates the steps involved in payment and payment acknowledgment processing using Financial Gateway. PeopleSoft Treasury Management, PeopleSoft Receivables, PeopleSoft Payables, PeopleSoft Global Payroll, and certain third-party applications import payment requests to the Financial Gateway system, where users can review the payment requests and load any payment exceptions on the Payment Load Exceptions page (see Reviewing the Results of the Payment Load Process). Financial Gateway users review the payments and payment details and the Financial Gateway system dispatches the payments to the bank, which in turn reviews and sends acknowledgement of the receipt and contents of the payment files to the Financial Gateway system.

Steps involved in payment and payment acknowledgment processing using Financial Gateway

In the diagram above, the payment path is represented by the arrows with the dash/dot lines. The payment acknowledgment file path is represented by the arrows with the continuous dotted lines.

Payments are loaded into Financial Gateway from:

PeopleSoft source applications using the delivered integration, which involves the application class component.

See Understanding the Financial Gateway Integration Process.

Third-party applications using a component interface.

Third-party applications using Integration Broker.

Third-party applications sending payments in flat-file format using the Import Payment Flat Files page.

SQL staging tables using the Import Staged Payments page. Users can use a variety of technologies to insert the data into the SQL staging tables.

Regardless of the method used to import payments, the Payment Load Application Engine (PMT_LOAD) process loads payments from source applications into Financial Gateway. If the payments originated from a source application for which financial sanctions validation is required, the system compares the Name and Address fields from the To Account on the payment against the Financial Sanctions list. If a potential match is found, the payment status changes to Flagged for Hold.

Note: The financial sanctions validation service is enabled at the source application level by selecting Require Payee Validation on the Source Registration page.

You can view results of the payment load process on the Review Payment Requests Page. Details of errors that are encountered during the payment load process can be viewed on the Payment Load Exceptions page.

When the payments are in the Financial Gateway tables, you can review them using the Review Payment pages. Here payments can be approved for or held from further processing. Payments flagged by the financial-sanctions, data search are designated as a "Potential Sanction Violation" on the Payment Notes page. Administrators can perform a manual search of the financial sanctions data to verify the accuracy of the held payment, after which they can either cancel the payment or clear the flag on the payment thereby changing the status to "Awaiting Dispatch."

After the optional review process, payments are sent to the bank as payment files using the Dispatch Payment Application Engine. This process can be run manually from the Dispatch Payments page or set up to run automatically using the Schedule Payment Dispatch page.

You can obtain a variety of information using the Payment Files page.

Depending on the bank and whether your system is set up appropriately, you can download files acknowledging that the payment was received, processed, and completed, or that the payment file contained errors that must be corrected. Importing payment acknowledgment files can also be set up to run automatically using the Integration Broker. After the acknowledgment files have been downloaded, they can be reviewed for pertinent information.

If the payment files were imported using flat files, you can import a flat file for payment cancellation and cancel a payment file using the layout file, PAYCANEIP.

See Understanding Electronic Banking.

See Understanding the Financial Gateway Integration Process.

Integration Points

This table lists the integration points that are used in the payment process.

|

Integration Point |

Purpose |

Method of Integration |

|---|---|---|

|

PAYMENT_REQUEST |

Sends a Payment Status request from the source asynchronously. |

Used by all source applications that can integrate with Financial Gateway. |

|

PAYMENT_STATUS_REQUEST |

Used to request the status of payments. |

Used by all source applications that can integrate with Financial Gateway. Message uses the payment ID as defined by the source application or Financial Gateway depending on how it is defined on the Source Registration page. |

|

PAYMENT_RESPONSE |

Used to send the status of payments one-way from Financial Gateway to the source application. |

Can be used by Cash Management, Receivables, Payables, Global Payroll, and third-party source applications that use Integration Broker to integrate with Financial Gateway. Message uses the payment ID and payment sequence number as defined by the source application or Financial Gateway depending on how it is defined on the Source Registration page. |

|

PAYMENT_CANCEL |

Used by Financial Gateway to cancel payments in the source application. Also used when associated with the PAYCANEIP layout to import a flat file for payment cancellation and to perform the cancel action. payment. |

Can be used by Cash Management, Receivables, Payables, Global Payroll, and third-party source applications that use Integration Broker to integrate with Financial Gateway. |

|

PMT_ACKNOWLEDGE |

Used by the bank to send payment acknowledgement status to Financial Gateway. |

Used by all source applications that can integrate with Financial Gateway. Message uses the payment ID and payment sequence number as defined by the source application or Financial Gateway depending on how it is defined on the Source Registration page. |

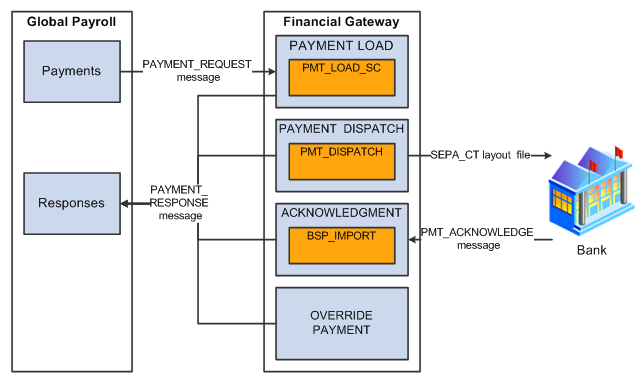

Integration with Global Payroll

This diagram illustrates the steps involved in payment and payment acknowledgment processing using Financial Gateway to process Global Payroll transactions:

Steps involved in payment and payment acknowledgment processing using Financial Gateway to process Global Payroll transactions

Financial Gateway receives a message from Global Payroll, and Financial Gateway then formats the SEPA XML file to send to the bank. The SEPA Credit Transfer (SEPA_CT layout, Pain.001.001.02) is the only payment format supported from Global Payroll through Financial Gateway. After the bank sends a payment acknowledgement status to Financial Gateway, Financial Gateway sends the payment response message to Global Payroll. If Financial Gateway returns an error status for a payment, Global Payroll can change the Error status to Canceled to indicate that no further processing will occur.

ACH Prenotes and Returns

An ACH prenote is a zero-dollar, payment sent to a debtor's bank to test if payments may be made to a creditor's bank account. If no response is sent back to the debtor, within a reasonable amount of time, it is assumed that payments can be made. If an ACH Return file is received from the creditor's bank, it will contain information that the prenote had errors that must be corrected before the creditor will accept payments from the debtor. The creditor should send a new, corrected prenote.

Financial Gateway processes prenotes similar to other ACH payments. However, tracking the status of prenotes between a debtor's bank account and a particular creditor is the responsibility of the source system.

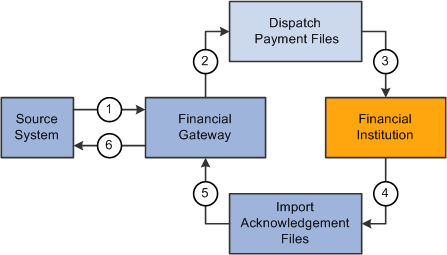

This diagram illustrates the steps involved in the ACH prenote process in which the source system, such as PeopleSoft Payables or Receivables, sends a zero-dollar payment file (prenote) as a test to the Financial Gateway system. The Financial Gateway system dispatches the prenote file to the debtor's Financial Institution. Financial Institution sends acknowledgement that can be imported into the Financial Gateway system. The Financial Gateway system then sends this acknowledgement of payment status to the source system.

Steps involved in the ACH prenote process in which the source system, such as PeopleSoft Payables or Receivables, sends a zero-dollar payment file (prenote) as a test to the Financial Gateway system

These steps correspond to the prenotification process illustrated in the above diagram:

The source system sends a prenote request to Financial Gateway.

Financial Gateway imports the prenote and creates a payment file.

The payment file is dispatched to the bank using the Dispatch Payment Application Engine.

Financial Institution sends an acknowledgement file.

Financial Gateway imports the acknowledgment files.

Financial Gateway transmits the payment status based on acknowledgment file back to the source system. The source system updates the status of the prenote. If the prenote was rejected, the source system can make the changes and resend another prenote.

Note: For prenotes, Financial Gateway only tracks the status of the payment transaction. Financial Gateway does not track the status of a prenote for a customer or vendor. That is the responsibility of the source system.

Payment Statuses

This table lists the various statuses that a payment can have as it moves through the Financial Gateway payment process:

|

Payments Status |

Details |

|---|---|

|

Canceled |

Payment was canceled in Financial Gateway. Can be resent from source application. Note: Global Payroll uses the Canceled status to indicate that no further processing will occur in Financial Gateway. |

|

Error |

An error was encountered when Financial Gateway attempted to process the payment. Details of the error can be viewed on the Payment Load Exceptions page. |

|

Flagged for Hold |

Payment is being held for review and cannot be dispatched. |

|

Awaiting Dispatch |

Payment is loaded into Financial Gateway. If selected, the payment will be dispatched to the bank the next time the Dispatch Payment Application Engine is run. |

|

In Process |

The Dispatch Payment Application Engine is processing the payment. |

|

Dispatched to Bank |

The payment has been sent to the bank by the Dispatch Payment Application Engine. |

|

Received by Bank |

The bank has received the payment and has sent an acknowledgment. |

|

Paid |

The bank has received the payment, processed it, and sent a payment acknowledgment file back to Financial Gateway. |

|

Pending Cancellation |

When the Accounts Payable subsystem sends a transaction to Financial Gateway, the payment status will be Awaiting Dispatch. Financial Gateway will dispatch this transaction and set the payment status to Paid. If Account Payable wants to cancel this transaction, the Accounts Payable subsystem uses the Payables Payment Cancellation process to cancel this transaction and set the payment status to Pending Cancellation in Financial Gateway. |

|

Cancelled with Message |

Once the status is changed to Pending Cancellation in Financial Gateway, Financial Gateway will execute the Payment Cancellation process for this Accounts Payable transaction and set the payment status to Cancelled with Message. Financial Gateway will send cancellation message in compliance with SEPA to the bank. |

|

Pending Reversal |

Similarly when the Accounts Receivable subsystem sends a transaction to Financial Gateway, the payment status will be Awaiting Dispatch. Financial Gateway will dispatch this transaction to the bank and set the payment status is set to Paid in Accounts Receivable. If the Accounts Receivable subsystem reverses this transaction, it sets the payment status to Pending Reversal in Financial Gateway. |

|

Reversed with Message |

Using the Payment Dispatch process, Financial Gateway will execute the Reversal Process for this transaction, generate a reversal message in compliance with SEPA to the bank and set the payment status to Reversed with Message. |

Note: When a layout is not set up to support acknowledgements, the payment status is set to paid when the payment is dispatched.