Setting Up IRAS Reporting

Use the IRAS Employer SG (GPSG_IRAS_CPY), IRAS Tax Forms SGP (GPSG_IRAS_CATEGORY), and IRAS Benefit Rates SGP (GPSG_APP_RATE) components to set up IRAS reporting.

This topic discusses how to set up IRAS reporting.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPSG_IRAS_CPY |

Enter the IRAS company (employer) tax details and CPF employer reference number. |

|

|

GPSG_IRAS_CATEGORY |

Define the elements that are to appear in each category on the IRAS tax forms. |

|

|

GPSG_APP_RATE |

Enter the rates that are to be applied in calculating the value of benefits in kind for the Appendix 8A and IR21 forms. |

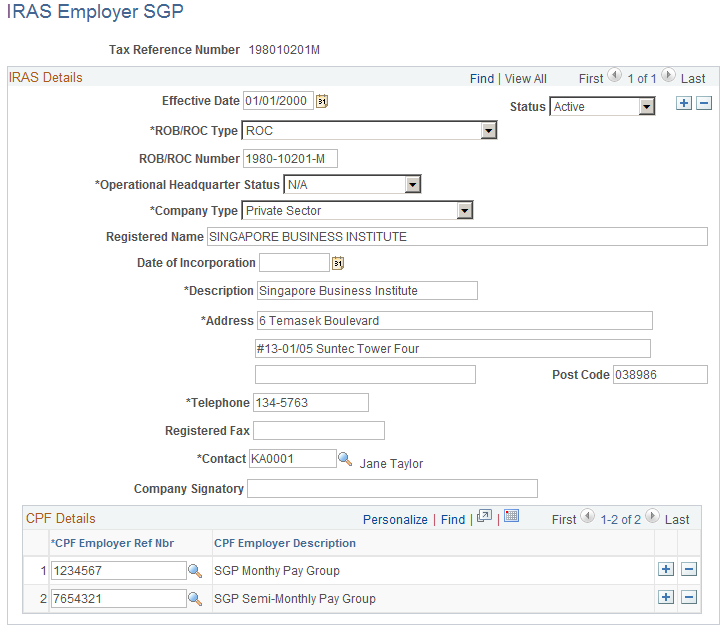

Use the IRAS Employer SGP page (GPSG_IRAS_CPY) to enter the IRAS company (employer) tax details and CPF employer reference number.

Navigation:

This example illustrates the fields and controls on the IRAS Employer SGP page.

IRAS Details

Field or Control |

Description |

|---|---|

ROB/ROC Type (registry of business/registry of companies type) |

The Registry of Business number (ROB) designates a limited company, and the Registry of Companies number (ROC) identifies a partnership. These are unique company identifiers, similar to Australia's company number (ACN). A company will have either an ROB or a ROC, not both. Select from the following:

|

ROB/ROC Number (registry of business/registry of companies number) |

You must enter the ROB or ROC number when the ROB or ROC type is ROB or ROC. |

Operational Headquarter Status |

On the Appendix 8A Forms component, you can enter the company tax reference number, total cost of home leave passages and incidental amounts only if you identify on the IRAS Employer SGP page that the operation is considered to be an overseas headquarters. The number of passages for the employee, spouse, and children fields on the Appendix 8A Forms - Others page are available if you select Yes here as theoperational headquarter status. Select No when the company provides the home leave passages, but the operation is not considered to be an overseas headquarters. If you select NA (not applicable) in this field, the related fields are unavailable for input. You must enter cost of home leave and at least one of the number of passages fields (self, spouse, or children) when the status is NA. |

Telephone and Contact |

For computer-printed IR8A and Appendix 8A forms, a signature is not necessary. However, the name of an authorized contact person and a telephone number must be included. This must be the company secretary or director, precedent partner, sole proprietor, manager, honorary secretary or treasurer, representative of a nonresident company, or any person who is authorized by the employer. |

CPF Details

Field or Control |

Description |

|---|---|

CPF Employer Ref Nbr (central provident fund employer reference number) |

Each Singapore company is given one or more CPF reference numbers. The CPF number is assigned by using a variable (CPF VR EMPLR REF) that you can set at pay group level by using the CPF Details group box on the Pay Groups SGP The CPF reference number is used as user key 1 on the CPF accumulators. Since it is necessary to include CPF information on the IRAS reports, you need to be able to associate the company tax reference number with its CPF numbers. So, each company tax reference also has a list of CPF numbers that you must maintain. |

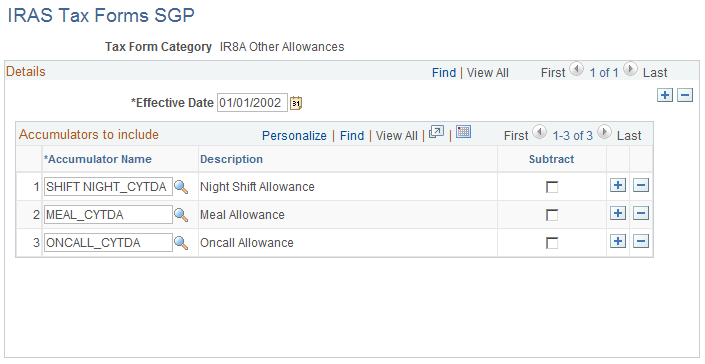

Use the IRAS Tax Forms SGP page (GPSG_IRAS_CATEGORY) to define the elements that are to appear in each category on the IRAS tax forms.

Navigation:

This example illustrates the fields and controls on the IRAS Tax Forms SGP page.

For IRAS reporting, all accumulators are categorized. You can define and allocate these categories on this page. The system uses the categorized set of accumulators to calculate specific values for the same category on the IR8A and Appendix 8A forms. For example, on the Appendix 8A Forms component, the amounts in the fields, representing 4b to 4k on the tax form, appear as values that are associated with the categories and their elements that you set up for the Appendix 8A Form. If you create a category of car benefit and select specific accumulators, the values that are associated with these elements are used by the system to calculate and populate values in the Car Benefit field on the Appendix 8A Forms - Others page.

Note: Before creating Appendix 8A and IR8A forms, ensure that you set up correctly the tax form categories that appear on the forms. This ensures that all of the calculations for the categories on the forms are accurate.

Accumulators to include

Field or Control |

Description |

|---|---|

Accumulator Name |

Select the elements (YTD Accumulators) for the year-end balances that need to be reported. You can use accumulators that are related to individual earnings and deductions, or to a collection of earnings or deductions. If you make any manual changes to the tax form categories or to the values in the IR8A or Appendix 8A pages, recalculate the data before creating the IR8A forms. This ensures that the data on your forms is current and incorporates your changes. To display and recalculate the tax form data or values in the IR8A pages, use the Create IR8A/IR8S Form page. To display and recalculate the tax form data or values in the Appendix 8A tables, use the Calc.Appendix 8A page. |

Subtract |

If you select the Subtract check box, the value of the accumulator is subtracted from the total amount instead of being added. For example, subtract deductions because they're stored as positive amounts. |

Use the IRAS Benefit Rates SGP page (GPSG_APP_RATE) to enter the rates that are to be applied in calculating the value of benefits in kind for the Appendix 8A and IR21 forms.

Navigation:

This example illustrates the fields and controls on the IRAS Benefit Rates SGP page.

Field or Control |

Description |

|---|---|

Benefit Rate |

Enter the monthly rates for each of the benefits items that appear in the Appendix 1 and 8A reports. The system uses these effective-dated rates to calculate the taxable value of the employee's benefits in kind items when generating Appendix 1 and 8A details. These rates reflect the rates that are detailed in section B and C of the IR21 Appendix 1 form as well as in Section 2 and 3 of the Appendix 8A form. Many of the benefits that are included on the Appendix 1 and Appendix 8A form have specific rates that IRAS defines to be used in the calculation of their value. |