Defining Business Unit Defaults for Individual Business Units

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BUS_UNIT_TBL_AR1 |

Link a PeopleSoft Receivables business unit with a PeopleSoft General Ledger business unit and assign a location code to the unit. You also define the base currency and automatic numbering options for the business unit. |

|

|

BUS_UNIT_TBL_AR2 |

Define the open accounting periods for the business unit, assign a direct journal template to the unit, assign the accounts receivable distribution codes to the unit, and define multicurrency processing options. |

|

|

BUS_UNIT_TBL_AR3 |

Specify the distribution codes used to create accounting entries for draft processing and refund processing. Also, define defaults for direct debit and refund processing. |

|

|

BUS_UNIT_TBL_AR4 |

Specify business unit defaults for due dates that fall on holidays. If you use discounted drafts, specify the default entry type for bank fees. |

|

|

DMS_BU_SEC |

(USF) Map fields and specify outbound and inbound file processing requirements for the Debt Management Service (DMS) interface. |

To define business unit defaults, use the Receivables Definition component.

Use this component to:

Establish the general ledger business unit defaults.

Define multicurrency processing options, distribution codes, and journal templates.

Define additional accounting options.

Select bank and payment interface options.

(USF) Define debt management information.

Important! Changing the GL business unit for a Receivables business unit when open items exist may result in an error during processing. Verify that there are no open items for the Receivables business unit before changing the GL business unit.

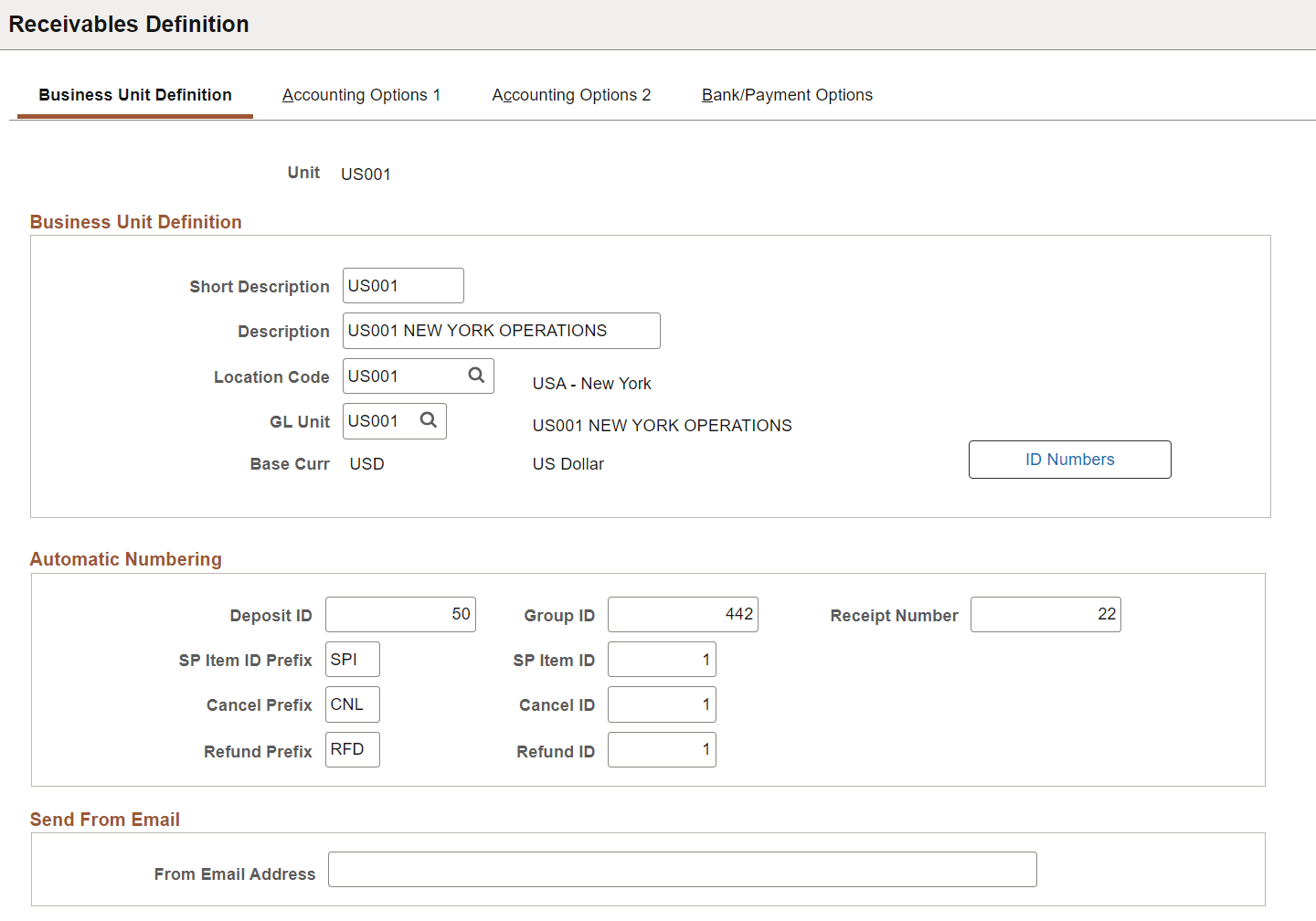

Use the Receivables Definition - Business Unit Definition page (BUS_UNIT_TBL_AR1) to link a PeopleSoft Receivables business unit with a PeopleSoft General Ledger business unit and assign a location code to the unit.

You also define the base currency and automatic numbering options for the business unit.

Navigation:

This example illustrates the fields and controls on the Receivables Definition - Business Unit Definition page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Location Code |

Designate the address of the business unit by selecting a location from the locations that are defined on the Location Definition page. |

GL Unit (General Ledger business unit) |

Select the general ledger business unit to associate with the receivables business unit. Important! Changing the GL business unit for a Receivables business unit when open items exist may result in an error during processing. Verify that there are no open items for the Receivables business unit before changing the GL business unit. |

Base Curr (base currency) |

Displays the base currency of the general ledger business unit that you associated with the receivables business unit. |

ID Numbers |

Click this button to assign the business unit to a reporting entity such as a country registration number. Select from a list of values available for various reporting entities. |

Default InterUnit Doc Type (default interunit document type) |

Select the document type to use for document sequence numbers for interunit accounting entries when you unpost a group. This field is available only if you enabled document sequencing on the Installation Options - Overall page and for the general ledger business unit associated with the receivables business unit. |

Automatic Numbering

Field or Control |

Description |

|---|---|

Deposit ID |

Enter the last number used for deposits. |

Group ID |

Enter the last number used for item and payment groups—items, payments, transfers, maintenance, drafts, and unpost. The number that you enter is one less than the ID that the system assigns to the first deposit or group. During processing, the system displays the ID NEXT until you click Save. Override the automatic numbering by entering your own ID in place of NEXT. |

Receipt Number |

Enter the last number used for cash receipts that you enter for orders in PeopleSoft Order Management. The number is one less than the next number that the system assigns to the next cash receipt when you record a payment for a counter sale in PeopleSoft Order Management. This field is also used for printing miscellaneous cash receipts in PeopleSoft Receivables. See Generating a Miscellaneous Cash Receipt. |

SP Item ID Prefix and SP Item ID; Cancel Prefix and Cancel ID; and Refund Prefix and Refund ID |

Enter the following prefixes to generate Item IDs for the invoices created by PeopleSoft Pension Administration:

The prefixes identify the purpose of items when they are displayed in one of the Worksheets. The initial value for SP Item ID, Cancel ID, and Refund ID can start at 1. |

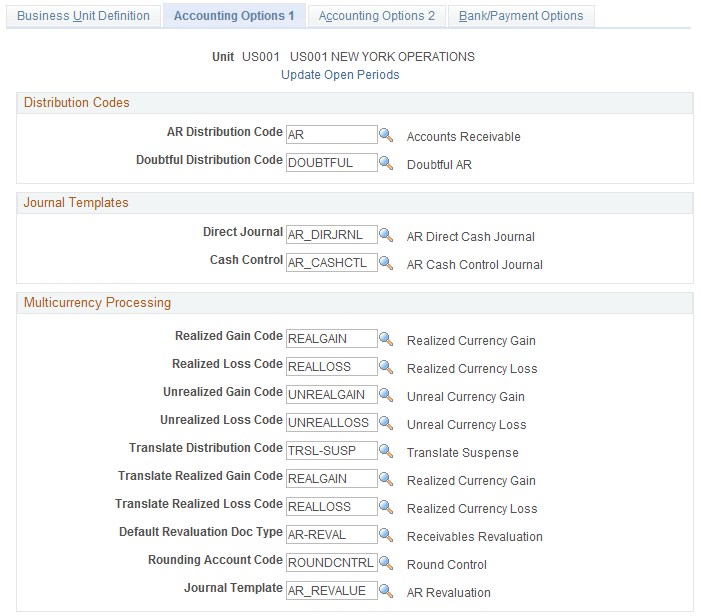

Use the Receivables Definition - Accounting Options 1 page (BUS_UNIT_TBL_AR2) to define the open accounting periods for the business unit, assign a direct journal template to the unit, assign the accounts receivable distribution codes to the unit, and define multicurrency processing options.

Navigation:

This example illustrates the fields and controls on the Receivables Definition - Accounting Options 1 page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Update Open Periods |

Click to access the Open Period Update page, where you update the opening and closing period for a business unit. You can use same period dates for all transactions or use different dates for specific types of transactions. You link the transaction type to group types on the Group Type page. The normal default opening and closing period dates for each PeopleSoft Receivables business unit are the same as the PeopleSoft General Ledger business unit with which it is associated. Use this option when you want an accounting period in PeopleSoft Receivables to close at a different time than an accounting period in PeopleSoft General Ledger. The system automatically issues a warning message if the closing date for an application business unit and transaction type is later than the closing date for the PeopleSoft General Ledger business unit. Note: You receive a warning message if unapplied payments or unposted pending items exist and the accounting date falls in a closed period. See Defining and Updating Open Periods and Adjustment Periods. |

AR Distribution Code (accounts receivable distribution code) |

Enter the default accounts receivable distribution code for the business unit. This code determines the ChartFields that the system uses when generating system-defined accounting entries for pending items. For billing groups, override the default distribution code on the Pending Item 1 page, on the Item Entry Type - Selection page, or on the customer General Information - Bill To Options 1 page. For payment, draft, maintenance, and overdue charge groups, override the business unit default on the Automatic Entry Type - Selection page or on the customer General Information - Bill To Options 1 page. |

Doubtful Distribution Code |

Select a distribution code for items for which you do not expect to receive payments and to transfer those items to the Doubtful Receivable account. |

Direct Journal |

Select the journal generator template that the Journal Generator Application Engine process (FS_JGEN) uses to create journal entries for directly journaled payments. Define the template on the Journal Generator - Defaults page. |

Cash Control |

Select the journal generator template that the Journal Generator process uses to create journal entries for cash control entries. Define the template on the Journal Generator - Defaults page. |

Realized Gain Code |

Enter a distribution code that maintenance and payment worksheets use to create adjusting entries for multicurrency processing. Each business unit can have only one realized gain code. |

Realized Loss Code |

Enter a distribution code that maintenance and payment worksheets use to create adjusting entries for multicurrency processing. Each business unit can have only one realized loss code. |

Unrealized Gain Code |

Enter a distribution code that the Revaluation Application Engine process (AR_REVAL) uses to create revaluation entries for unrealized gain. |

Unrealized Loss Code |

Enter a distribution code that the Revaluation process uses to create revaluation entries for unrealized loss. |

Translate Distribution Code |

Enter a distribution code that the Revaluation process uses to create accounting entries for adjustments to translation ledgers. |

Translate Realized Gain Code and Translate Realized Loss Code |

Enter distribution codes that the system uses to create accounting entries for multibook translation ledgers if there is a translation adjustment. |

Default Revaluation Doc Type (default revaluation document type) |

Enter the default revaluation document type for document sequencing. |

Rounding Account Code |

Enter the distribution code that the Receivable Update process uses when you:

The process posts any leftover amount from the currency conversion to the ChartFields that are assigned to the distribution code. |

Journal Template |

Select the journal generator template that the Journal Generator process uses to create journal entries for the accounting entries that the revaluation process produces. |

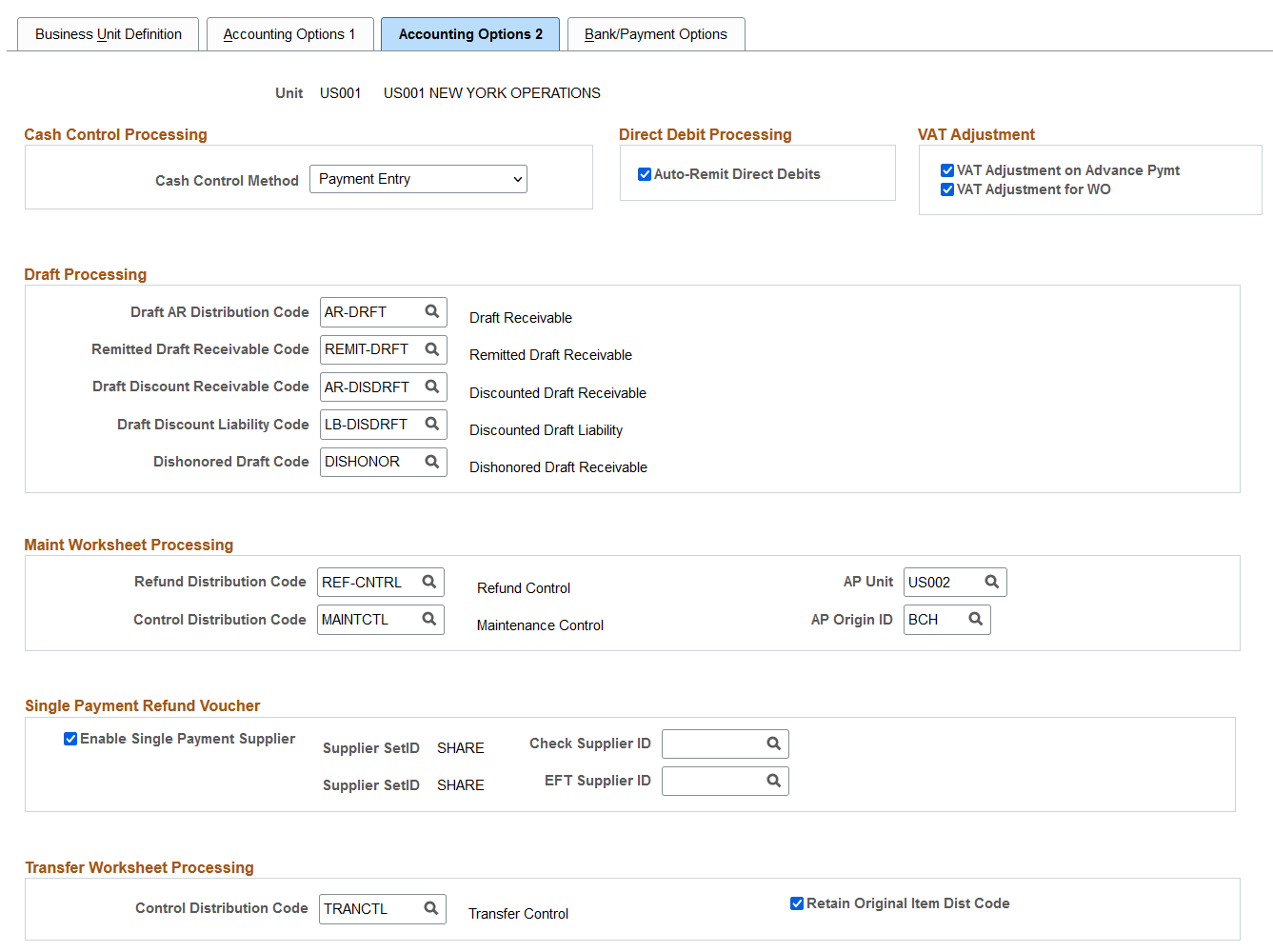

Use the Receivables Definition - Accounting Options 2 page (BUS_UNIT_TBL_AR3) to specify the distribution codes used to create accounting entries for draft processing and refund processing.

Also, define defaults for direct debit and refund processing.

Navigation:

This example illustrates the fields and controls on the Receivables Definition - Accounting Options 2 page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Cash Control Method |

Select a timing method, if you use cash control accounting, which records a debit to cash and a credit to cash control before the receipts are applied to accounts receivable. The methods differ only in the timing of the creation of the initial accounting entry that debits cash. All other aspects of cash control accounting are treated the same way under the methods. Options are: Bank Reconciliation: This method is used primarily in European countries. It requires the creation of the cash control entry when the payment is reconciled on a bank statement. Payment Entry: The preferred method in the U.S. It creates the cash control entry when the payment is received. None: The system always debits the cash account and credits the PeopleSoft Receivables account when you apply the payment. The system does not create cash control entries. |

Auto-Remit Direct Debits |

Select to have the Create Direct Debits Application Engine process (AR_DIRDEBIT) automatically change the status to Remitted for direct debits without exceptions in the run. If any of the direct debits that the process creates contain exceptions, their status is Pending Approval on the direct debit worksheet. Override this selection for each run request on the Request Parameters page. |

VAT Adjustment on Advance Pymt (VAT adjustment on advance payment) |

Select this check box to include the VAT amount of a prepayment in the Accounts Receivable Pre-Paid account. See VAT Adjustment for Advance Payments and On-Account Payments. |

VAT Adjustment for WO (VAT adjustment for write-off) |

Select this check box to specify how accounting entries should be handled when doing a write-off against an item with VAT. This is typically set for French businesses, where the VAT final balance should be zero after a write-off when the write-off is due to bankruptcy. |

GST on Advance Payment |

Select this check box to enable India GST processing on advance payments. (IND) |

Draft AR Distribution Code (draft accounts receivable distribution code) |

Select the distribution code that the system uses to move the draft item from the original PeopleSoft Receivables account to the Draft PeopleSoft Receivables account. |

Remitted Draft Receivable Code |

Enter the distribution code that the system uses to identify the PeopleSoft Receivables account when you remit a draft. |

Draft Discount Receivable Code |

Enter the distribution code that the system uses to identify the PeopleSoft Receivables account for a discounted draft. |

Draft Discount Liability Code |

Enter the distribution code that the system uses to identify the Liability account when you discount a draft with or without recourse. |

Dishonored Draft Code |

Enter the distribution code that the system uses to identify the Dishonored Receivables account when you dishonor a draft. |

Refund Distribution Code |

Enter the distribution code that the system uses to create accounting entries for refunds. Note: If you have PeopleSoft Payables installed, you must complete the Refund Distribution Code, AP Unit, and AP Origin ID fields before you can process refunds. If PeopleSoft Payables is not installed, these fields are optional. |

Control Distribution Code |

Select the default distribution code for the offset entry for transactions in maintenance and transfer groups. You can override the value on maintenance or transfer worksheets. Enter separate codes for maintenance and transfer worksheets. Important! You cannot build the worksheets if you do not assign a default value to the business unit. |

AP Unit (Accounts Payable unit) |

Select the PeopleSoft Payables business unit for which you want to create vouchers for credit items that you refund from the PeopleSoft Receivables business unit. For Payables refund processing, the receivables business unit and associated Payables business unit must share the same PeopleSoft General Ledger business unit. |

AP Origin ID (Accounts Payable origin ID) |

Enter the source of the voucher. Note: Before you can enter values in the AP Unit and AP Origin ID fields, you must select a PeopleSoft General Ledger business unit on the Business Unit Definition page and click Save. |

|

Enable Single Payment Supplier |

Select to enable single payment vouchers for Receivables refunds. With this feature you can create a single payment refund using a one-time supplier. You do not need to define permanent supplier IDs for one-time refund payments. When you select this option, the Check Supplier ID, EFT Supplier ID, and Supplier Set ID fields appear. Use these fields to define two one-time suppliers—one for check refunds and one for EFT refunds. The Receivables refund process automatically creates a single payment voucher using the one-time supplier IDs. It also generates the supplier bank account and address information. See the Invoice Information Page and the Voucher - Single Payment Supplier Page. Note: When you create a single payment voucher using this method, multiple items are grouped into a single voucher. |

|

Supplier Set ID (Associated with Check Supplier ID) |

Displays the supplier set ID associated with the the selected AP unit. This field is only visible when you select Enable Single Payment Supplier. |

|

Check Supplier ID |

Select a one-time supplier for check refunds. This field is only visible when you select Enable Single Payment Supplier. |

|

Supplier Set ID (Associated with EFT Supplier ID) |

Displays the supplier set ID associated with the the selected AP unit. This field is only visible when you select Enable Single Payment Supplier. |

|

EFT Supplier ID |

Select a one-time supplier for EFT refunds. This field is only visible when you select Enable Single Payment Supplier. |

Retain Original Item Dst Code |

Select to retain the Original Item distribution code in the To Item distribution code on the transfer worksheet. This option is used for non-doubtful transfers only. See the Transfer Worksheet - Worksheet2 Page. |

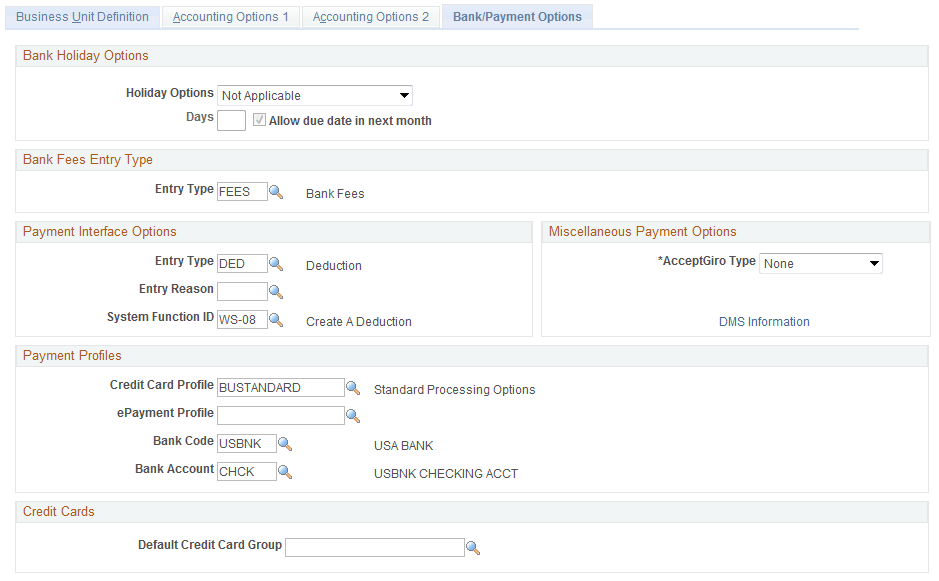

Use the Receivables Definition - Bank/Payment Options page (BUS_UNIT_TBL_AR4) to specify business unit defaults for due dates that fall on holidays.

If you use discounted drafts, specify the default entry type for bank fees.

Navigation:

This example illustrates the fields and controls on the Receivables Definition - Bank/Payment Options page. You can find definitions for the fields and controls later on this page.

The Bank Holiday Options are the same as the ones on the Receivables Options - General 2 page. If you enter values for a specific business unit they override the values for the SetID.

Bank Fees Entry Type

Field or Control |

Description |

|---|---|

Entry Type |

Select the default entry type to use for the bank fees or interest on discounted drafts, if you process discounted drafts. Discounted drafts are drafts for which you receive the funds prior to the due date. Define entry types on the Entry Type page. The Receivable Update process uses the entry type to create accounting entries for the bank fees on the discount date. |

Payment Interface Options

Field or Control |

Description |

|---|---|

Entry Type, Entry Reason, and System Function ID |

Enter the information that provides the default values that the Payment Loader Application Engine process (AR_PAYLOAD) uses for adjustments reason translation. If the process cannot find the adjustment reason code in the lockbox, EDI file, or bank statement in the Adjustment Reason table (ADJ_REASON_TBL), it uses the values that you provide for the business unit for the entry type, entry reason, and system function. |

Miscellaneous Payment Options

Field or Control |

Description |

|---|---|

AcceptGiro Type |

(NLD) Select A/S Contract to print statements and dunning letters on the acceptgiro form. Otherwise, select None. If you select A/S Contract and you enter this business unit on the run control pages, the system prints statements and dunning letters on the A/S Contract Type acceptgiro form. You can choose not to print the statements and dunning letters on the acceptgiro form when you run the Statements Application Engine process (AR_STMTS) or the AR Dunning process (AR_DUNNING). |

Payment Reference Sequence |

(NLD) Enter the payment reference number to print on the acceptgiro form. When you print statements or dunning letters on acceptgiro forms, the process increments this number by one and adds a check digit. The process also adds this reference number, including the check digit, to the Item table (PS_ITEM) for each item on the statement or dunning letter. If the item already has a payment reference number, the process overrides the number. The bank typically sends the payment reference number with the payment. This enables you to apply payments to items using Payment Predictor if you use detail algorithm groups or to match payments to items on the payment worksheet. |

DMS Information (Debt Management Service information) |

(USF) Click this link to access the DMS Definition page, where you map fields and specify the outbound and inbound file processing requirements. This link is available only if you have selected the DMS Interface check box on the Installation Options - Receivables page. |

Payment Profiles

Field or Control |

Description |

|---|---|

Credit Card Profile |

(Optional) Select the profile used to control batch processing of credit card payments. Any profile entered here may be overridden at the customer level on the Bill To Options page of the Customer component. |

ePayment Profile |

Enter a profile used to process and create ePayment worksheets for electronic payments, such as electronic checks and PayPal payments. |

Bank Code and Bank Account |

Identify which bank accounts receive deposits for credit card payments. |

Credit Cards

Field or Control |

Description |

|---|---|

Default Credit Card Group |

Enter a default credit card group to manage the display of credit card types for a specific business unit. If the value is not defined in the business unit definition, the system uses this value. The grouping can be utilized by the Order to Cash applications to limit or control what credit card types and third-party processors are available within their transactions. See documentation for the Credit Card Groups Page. |

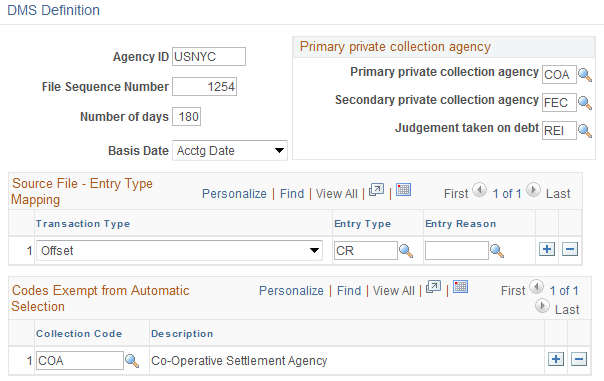

Use the DMS Definition page (DMS_BU_SEC) to map fields and specify outbound and inbound file processing requirements for the Debt Management Service (DMS) interface. (USF)

Navigation:

Click the DMS Definition link on the Receivables Definition - Bank/Payment Options page.

The link is available only if you selected the DMS Interface field on the Installation Options - Receivables page.

This example illustrates the fields and controls on the DMS Definition page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Agency ID |

Enter the agency identifier code assigned by the DMS for the organization. |

File Sequence Number |

Enter the original sequence number for the files that you submit to the DMS. The system increments the number after each successful process. |

Number of days and Basis Date |

Enter the number of days past the date in the Basis Date field that the system uses to determine whether to automatically send the outstanding debt to the DMS. The default is 180 days. Values for the basis date are Accounting Date, As of Date, Due Date, or Item Date. |

Primary private collection agency, Secondary private collection agency, and Judgement taken on debt |

Enter a collection code that you defined on the Collection Code page to identify the collection agencies to which you submit collections for this business unit. If you enter values in these fields, the system sends a supplemental record to the DMS that includes the date and the amount of the debt that was sent to the collection agency. |

Transaction Type, Entry Type, and Entry Reason |

Select each transaction type that you receive in inbound files from the DMS and associate it with the entry type and entry reason that you want used to create items for the transactions in the Pending Item table (PS_PENDING_ITEM). Options are: Adjustment Transaction-Down: Negative adjustment transaction for amounts less than 0. Adjustment Transaction-Up: Positive adjustment transaction that is greater than 0. Offset: An offset that is treated as a payment in PeopleSoft Receivables. Payment: Partial payment that is applied to the net balance. |

Collection Code |

Select the code for the collection agency that you assign to items that you do not send to the DMS. |