Validating Financial Sanctions

This section provides overviews for financial sanctions screening (FSS) with customer information and FSS setup, lists common elements, and discusses how to review various FSS results.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_CNTL_SCMFSS |

Use this page to the run the Screen For Denied Parties process (SCM_FSS) and perform FSS for customers, orders, MSRs, and invoices. |

|

|

IN_FSS_SEARCH |

Use this page to search for the results of the FSS. |

|

|

CUST_FSS_GRID |

Use this page to view the FSS results for customers. |

|

|

ORD_FSS_GRID |

Use this page to view the FSS results for orders. |

|

|

BI_FSS_GRID |

Use this page to view the FSS results for invoices. |

|

|

General Information |

CUST_GENERAL1 |

Add or review customers' names and level information, and assign associated roles. You can also enter one or more addresses for customers and assign descriptions to each location. You also use this page to manage FSS. |

|

Order Entry Form |

ORDENT_FORM_LINE |

Use this page to enter header and line information for orders and quotes. The component will also validate the customer name and address for FSS processing. |

FSS in the Order to Cash business process is used with PeopleSoft Order Management, Inventory, and Billing. FSS validates customer names and addresses with a variety of national and international security lists. These security lists may include: Specially Designated Nationals, OFAC Sanctioned Countries, FBI Top Ten Most Wanted, European Union Terrorism List, United Nations Consolidated Sanctions List, and more.

For U.S. based companies and their foreign subsidiaries, a federal regulation from the Office of Foreign Assets Control (OFAC) requires that customers be validated against a Specially Designated Nationals (SDN) list. OFAC acts under Presidential wartime and national emergency powers, as well as authority granted by specific legislation, to impose controls on transactions and freeze foreign assets under U.S. jurisdiction. Many of the sanctions are based on United Nations and other international mandates, are multilateral in scope, and involve close cooperation with allied governments.

PeopleSoft provides you the ability to download the list of SDNs from the OFAC, the European Union, as well as enterprise sources. Once installed, you can manually search the list to validate customers. In addition to manual searches, you can enable validation to be performed automatically when processing transactions or adding customers.

PeopleSoft provides validation of your customers against any financial sanctions list at the customer name and address level. The system validates these customer fields:

CUSTOMER

NAME1

NAME2

NAME3

ADDRESS LOCATION

ADDRESS1

ADDRESS2

ADDRESS3

ADDRESS4

CITY

STATE

POSTAL

COUNTRY

Financial sanctions screening is performed within the Order to Cash business process during creation and maintenance of these transactions:

Customers

Sales orders (including making credit card address changes and running the Mark Lines for Billing process).

Quotes

Invoices

External MSRs

VMI Interunit transfers

The Screen for Denied Parties process (SCM_FSS) can be run to screen customers, orders, MSRs, and invoices. You can run it from these menus:

Order Management, Quotes and Orders, Process Orders

Inventory, Fulfill Stock Orders

Billing, Maintain Bills

Use the Search inquiry to review the financial sanctions screening results. A match will prevent the system from shipping an order and from finalizing an invoice. Hold processing can be set up for sales orders to place orders on hold if a match is encountered during order entry.

Customer and Transaction Financial Sanction Screening

When a customer is saved, the name and address are matched against the list that is being used to perform the screening. If the name or address is a match against the list, the customer is returned with a Unconfirmed status. Customer screening is only performed when a customer is added, the name is changed, a location is added or an address is changed.

When a match is made, it is your responsibility to call the agency and discuss your customer with them. If you determine that your customer should not be on the list, you can change the status to Confirmed, enter a reason code, and specify the number of days that you do not want the customer screened again.

If you find that the customer is a valid match with the list, you would leave the status as Unconfirmed. A sales order could be entered for the customer. The order would be held up depending on how you have set up the screening for sales orders.

For sales orders, screening is activated at the time the order is entered, when the address or customer is changed or if the order is run through the Screen for Denied Parties process.

MSRs are only screened when the order is run through the Screen for Denied Parties process.

For invoices, screening is activated during the Finalization process and when the invoice is run through the Screen for Denied Parties process.

When a match is found, sales orders go on hold at the header level. For MSRs, each line of the MSR goes hold. For invoices, the bill status is set to either Hold (HLD) or New (NEW) and the bill FSS status becomes unconfirmed

For all of the transactions, you can remove the hold by confirming the customer and rerun the Screen for Denied Parties process. You can also manually remove the hold. The sections on the sales order, MSR, and invoice discuss the process to manually remove the hold.

Sales Order Financial Sanction Screening

If you intend to have sales order automatically trigger financial sanctions screening, hold processing for financial sanctions screening must be selected on the Hold Processing page. Hold codes can also be set up for the order and customer.

The Customer related hold refers to the Bill-To and Sold-To customers listed on the order header and the Ship-To customers list on the order's schedules. If any of these customers is Unconfirmed, a Customer Hold will be placed on the order. The second type of hold is an Order Hold, which means that an address override or payment address matches a security list entry.

When an order is entered, you will receive a message when you enter an order for a customer that is a match with the financial sanctions screening list. The message is established on the Messages page. You can save the order but it will go on hold at the header level when the order is saved. The actual screening takes place when order header, lines, and schedules are added or when the address of the customer changes on the order. When an address override takes place, the order will be reevaluated to see if the address change triggers a match.

If a customer status is changed to unconfirmed during customer maintenance, the sales order will not be rescreened unless the Denied for Screened Parties process is run. The Do Not Screen for X Number of Days field from the customer does not affect whether the sales order will go on hold or be taken off hold.

A number of ways are present for removing a financial sanctions hold for the sales order.

Inactivate or delete the hold and select a reason code for the change.

Delete the sales order line if the Ship-to customer or address override associated to the line caused the match.

Run the OM Background Hold Check process (OM_HOLD) to reevaluate all holds including FSS holds, assuming the FSS condition no longer applied.

Run the Screen for Denied Parties process (SCM_FSS) and select the rescreen option if the condition is no longer valid.

If an FSS hold is inactivated on the sales order, it will not be reapplied to the order. If the hold is deleted, the hold may be reapplied the next time hold processing occurs.

In the counter sale environment, the system will perform a FSS check when a payment is added and the address is entered on the Additional Information page for a check, credit card, debit card, or a procurement card.

Material Stock Request Financial Sanction Screening

Only external material stock requests (MSR) or VMI intercompany transfers are screened during inventory fulfillment. The hold code that is used for FSS processing in inventory is established on the Inventory Business Unit Options page.

These types of orders are not screened during order entry. They can only be screened through the Screen for Denied Parties process. Material Stock Requests should be run through this process before shipping. Orders that are on hold will not be shipped.

The Inventory FSS hold can be removed using the Cancel/Hold Stock Requests component. Similar to sales orders, if the customer FSS status changes to Unconfirmed, the Screen for Denied Parties process will remove the hold.

Invoice Financial Sanction Screening

When FSS is active for the order to cash business process, the system performs FSS on invoices. An invoice can contain several different types of customers such as Bill-To, Ship-To, and Service-To. Each type of customer name and address is compared to the security lists that are loaded in the system.

When FSS processing finds a potential match between a customer name and address and the security list, it marks the invoice with an error code, sets the bill status to either Hold (HLD) or New (NEW), changes the bill FSS status to unconfirmed (the Confirmed option is not selected), and stores the results in the system.

A user or the system can change the bill FSS status from unconfirmed to Confirmed.

A user can call the appropriate government agency to determine whether the customer match is a true match or a false match, and then the user can take the appropriate action. If the match is false, the user can change the FSS status from unconfirmed to confirmed (the user selects the Confirmed check box), and provides a reason code.

The FSS process can change the FSS status from unconfirmed to confirmed. When this occurs, the system removes the match results that were previously stored in the system.

Financial Sanctions Screening for in the Order to Cash business process is configured at the installation level. Three options are available to choose from.

No Validation - FSS will not be performed.

Enabled at Install - FSS is on for all Order to Cash business units.

Enabled at Business Unit - FSS is governed at the business unit level.

If FSS is controlled at the business unit level, the Order Management business unit governs sales orders, the Billing business unit governs invoices and the Inventory business unit governs external stock requests and VMI interunit orders.

You also determine if you will load the financial sanctions list into the FSCM database or use a third party web service at the installation level. The access to the lists, whether they are downloaded into the FSCM database or through a third party web service, are done using a common application package FSS_SDN_SEARCH.

When specifying that you want the financial sanctions list to be downloaded, you will also establish a threshold that is used by the Search Framework search engine to determine if there is a match against the list. It is important that you test the index against the threshold. The higher the threshold, the more accurate the match has to be with the financial sanctions data. The lower the threshold, the more matches you will receive.

Each of the fields that make up the customer name and address are given a weighted score. When they are screened against the list that you are using for FSS, the cumulative score of customer is tabulated by the system. If the score equals or is higher then the threshold set at installation, the customer will be flagged as being a match.

If you are downloading the list into the FSCM database, you will need to build a search index for the financial sanctions data. Each time you download the financial sanctions data, the index must be rebuilt.

Field or Control |

Description |

|---|---|

Customer ID |

The customer link will potentially take you to two different pages. If there is no address override, then the FSS hold is directly related to the customer. Therefore, the link will take you to the Customer tab which will provide information about the match. However, if this order was put on hold because of an address override, then there may not be any entry for that customer in the customer grid in the inquiry component. Therefore, the link will take you to the customer General Info page. |

Entry ID |

Click the link to access the Financial Sanctions Entry page to view details about the match. |

Sanctions ID |

Displays the ID to identify the list that was used in the validation. Note: It is possible to have multiple lists or old and new versions of the same list used for FSS screening. |

Sanctions List Type |

Lists the name of the list that is used for financial sanctions screening. |

Score |

The fields represents the values that the customer scores when the customer information is screened against the financial sanctions list that you are using. The higher the score, the better the customer is matched against an entry in the list. |

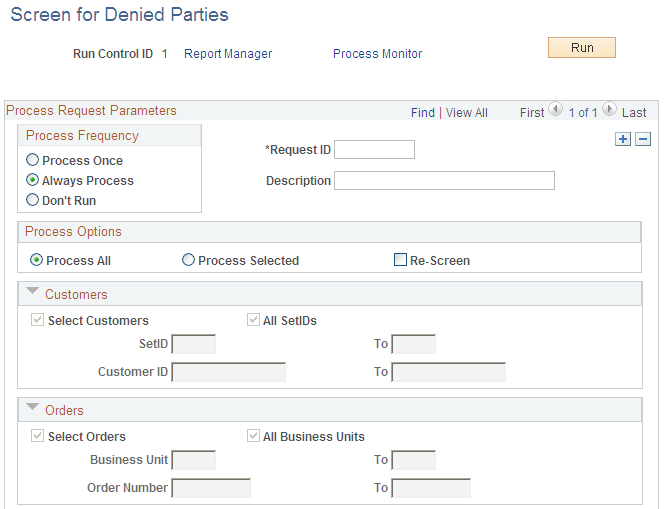

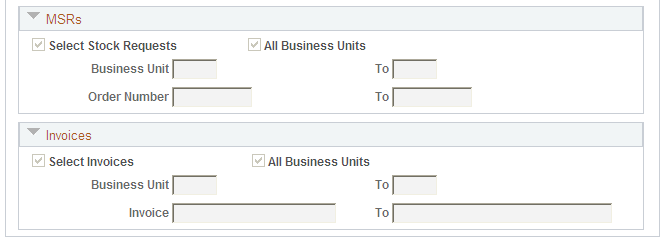

Use the Screen for Denied Parties page (RUN_CNTL_SCMFSS) to run the Screen For Denied Parties process (SCM_FSS) and perform FSS for customers, orders, MSRs, and invoices.

Navigation:

This example illustrates the fields and controls on the Screen for Denied Parties page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Screen for Denied Parties page (2 of 2). You can find definitions for the fields and controls later on this page.

Enter parameters to run the Screen For Denied Parties process (SCM_FSS) to validate customers, orders, MSRs, and invoices.

Note: Sales orders, MSRs, and invoices without address overrides will not be rescreened during the transaction. If there are no overrides, then the status of the customer on the customer table is used regardless of whether a new list has been loaded or not. When a new list is added, Oracle recommends that at a minimum customers be screened using the Screen For Denied Parties process (SCM_FSS) before any orders, invoices, or MSRs are screened against the new list.

Process Options

Field or Control |

Description |

|---|---|

All |

Use this option to validate all of the customers and transactions against the financial sanctions screening list. Use this option if you have loaded a new list. |

Selected |

Use this option to select a range of customers, orders, MSRs, or invoices. |

Re-Screen |

Typically, an existing customer is only screened once per version of the security list. When a security list is downloaded, customers will be screened and typically not screened again until a new list is downloaded. The Re-screen option will force a customer to be screened again even if a new list has not been downloaded. This option might be used if the user has manually changed a customer's Confirmed status and then wants to have the customer screened again. |

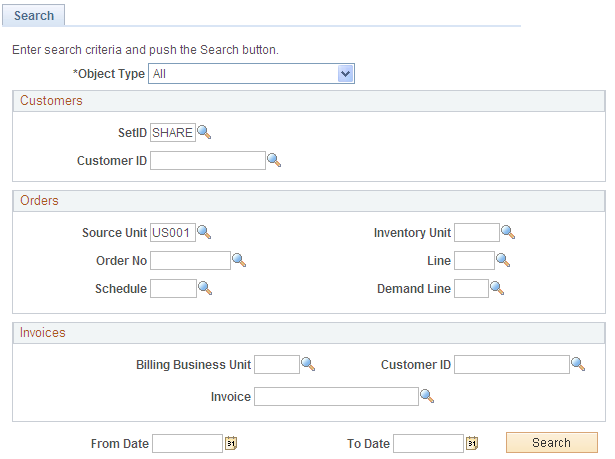

Use the Search page (IN_FSS_SEARCH) to use this page to search for the results of the FSS.

Navigation:

This example illustrates the fields and controls on the Search page. You can find definitions for the fields and controls later on this page.

You can limit your search to customers, invoices, or orders or use All to search for all the transactions that are a match with the FSS. Use additional criteria within each category to limit your search.

Use the Customer page (CUST_FSS_GRID) to use this page to view the FSS results for customers.

Navigation:

This example illustrates the fields and controls on the Customer page. You can find definitions for the fields and controls later on this page.

The page lists the results from the Screen For Denied Parties process (SCM_FSS) for customers.

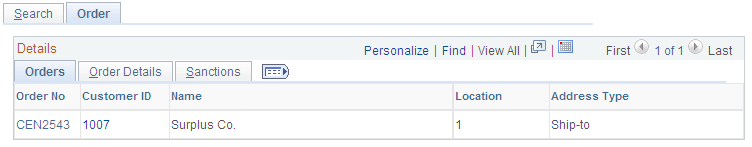

Use the Orders page (ORD_FSS_GRID) to use this page to view the FSS results for orders.

Navigation:

This example illustrates the fields and controls on the Order page. You can find definitions for the fields and controls later on this page.

The page lists the results from the Screen For Denied Parties process (SCM_FSS) for orders, MSRs, and VMI interunit orders.

Orders

Field or Control |

Description |

|---|---|

Order No |

For orders originating from Order Management, click the link to access the Order Entry Form page. For orders originating from Inventory, click the link to access the Cancel/Hold page. In either case, you can work on the hold for the order. |

Order Details

This tab displays additional details about the order. Links are present for the order line, schedule line, and demand line. These links will give you information about any address overrides that may be at these levels. For example, if you have an address override at the schedule level, clicking the link will take you to an inquiry page that would let you see the address information at that level for this line. However, if you had no address override information, then you would see a message stating that, and you would not be transferred to any other page.

Sanctions

This tab displays additional details about the sanctions.

Note: If the Sanctions ID and Sanctions List Type fields are blank, the match was due to the name or address for the customer and not the address override or payment address for the order.

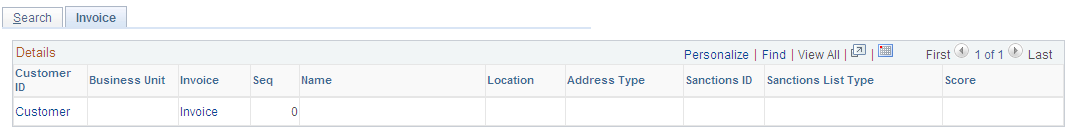

Use the Invoices page (BI_FSS_GRID) to use this page to view the FSS results for invoices.

Navigation:

This example illustrates the fields and controls on the Invoice page. You can find definitions for the fields and controls later on this page.

The page lists the results from the Screen For Denied Parties process (SCM_FSS) for invoices.

Note: If the Sanctions Header ID and Sanctions List Type fields are blank, the match was due to the name or address for the customer and not the payment address entered for the invoice.

Field or Control |

Description |

|---|---|

Business Unit |

Displays the billing business unit for the invoice. |

Invoice |

Click to access the Standard Billing - Header - Misc Info page. This page provides the Financial Sanctions section for the invoice. |

Seq (sequence) |

Displays a value that indicates the line sequence number of the invoice. The value of zero indicates the bill header level. |

Location |

Displays the location ID that is stored in the PeopleSoft Customer Address table. If this field does not have a value, then the customer address was overridden. |

Address Type |

Displays the type of address. Valid values are:

|