Running Statutory Reports

You can run reports that meet European statutory reporting requirements. If you are not located in Europe, you can also benefit from these reports, for example, by printing the balance by account or vendor information. Each time you run the reports, specify the information to include in the report. The default is to print the reports in the ledger base currency.

If you have both PeopleSoft Billing and PeopleSoft Receivables installed, remember to select and print transactions from both products onto one single report to see complete balances by customer or by Receivables account.

Note: You can use regular or alternate accounts when running many of these reports.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_LC_CNTL |

Creates a file consisting of a list of domestic vendors and customers with whom your company conducted transactions greater than a specified value for the Spanish authorities. A company has to declare transactions larger than 3.005,06 Euros. |

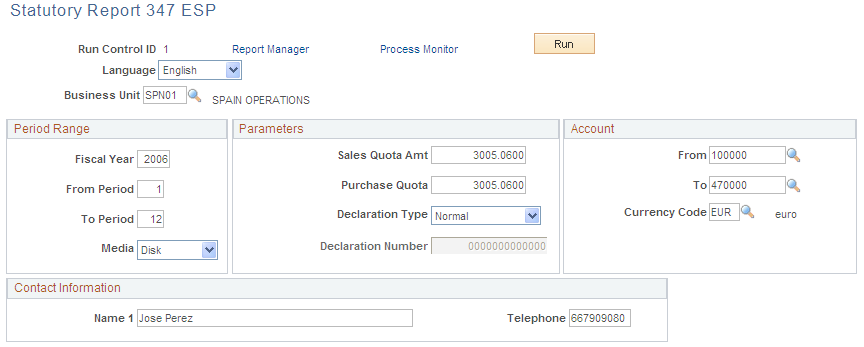

Use the Statutory Report 347 ESP page (RUN_LC_CNTL) to creates a file consisting of a list of domestic vendors and customers with whom your company conducted transactions greater than a specified value for the Spanish authorities.

A company has to declare transactions larger than 3.005,06 Euros.

Navigation:

,

This example illustrates the fields and controls on the Statutory Report 347 ESP page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Business Unit |

Select the appropriate business unit that contains the transactions required for this report. |

Fiscal Year |

Select the fiscal year that corresponds to the Declaration Fiscal Year of the report. |

From Period and To Period |

Select a beginning and ending period to apply to the transactions for this report. |

Media |

Select the type of media for delivering this report: Disk, Tape, or Electronic Transmission. |

Sales Quota Amt (sales quota amount) |

Specify a minimum amount. The file includes a list of customers with whom the selected business unit conducts transactions greater than this value. |

Purchase Quota |

Specify a minimum amount. The file includes a list of vendors with whom the selected business unit conducts transactions greater than this value. |

Declaration Type |

Select one of the following:

|

From and To |

Enter account numbers that apply to the report's transactions. |

Currency Code |

Enter the currency for the submitted amount. |

Contact Information |

Enter one or more names and telephone numbers for the individuals in your organization responsible for submitting the report. |

Spain Online VAT Register

Starting July 1st, 2017, Spanish tax authorities require electronic delivery of VAT Register Information via a pre-defined xml format and up to 4 days post issuance or reception date; PeopleSoft satisfies this legal requirement in Spain.

Note: Before you use the Spanish Online VAT Register feature, you must set up the Local VAT ID on the VAT Entity Identification page, in addition to the VAT Registration Number. You must also set up Spanish Fiscal Identifiers in the Customer Master and Supplier Master General Information pages, in the ID Number grid.

All invoice and ticket information is therefore sent to the tax authorities; late delivery carries a penalty. The system selects invoices from PeopleSoft Billing post finalization and currency conversion, to process. In case of invoices from Payables and Receivables the system selects after you post them.

When you create a VAT register file, the system also allows you to enter a different reporting period and year if different from the transaction date on the invoice.

Note: This feature uses DEIU to export data. You may therefore modify or expand a DEIU map as necessary.

Response Message from Spanish Tax Authorities

Once the Spanish Tax Authorities process the VAT Register files you sent, they return Response Messages for each register and for each of its specific invoice transaction. Response messages detail the list of invoices accepted, rejected, and accepted with errors.

You can use the Upload Return Message run control component to update the Status and Error Code in the VAT Register Management, directly from the response message XML file. Subsequently you can view the status and errors on the VAT Register Management Page and then take appropriate action.

Pages Used to Submit and Manage the Spain Online VAT Register

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VAT Register Submission Page |

SII_VAT_REQUEST |

Create a VAT Register File. |

|

VAT Register Management Page |

SII_VAT_REG_MGT |

Manage and track VAT Register status. |

|

Upload Return Message Page |

SII_RTN_MSG |

Update the Status and Error Code in the VAT Register Management page from the Response Message file sent by the Spanish tax authorities. |

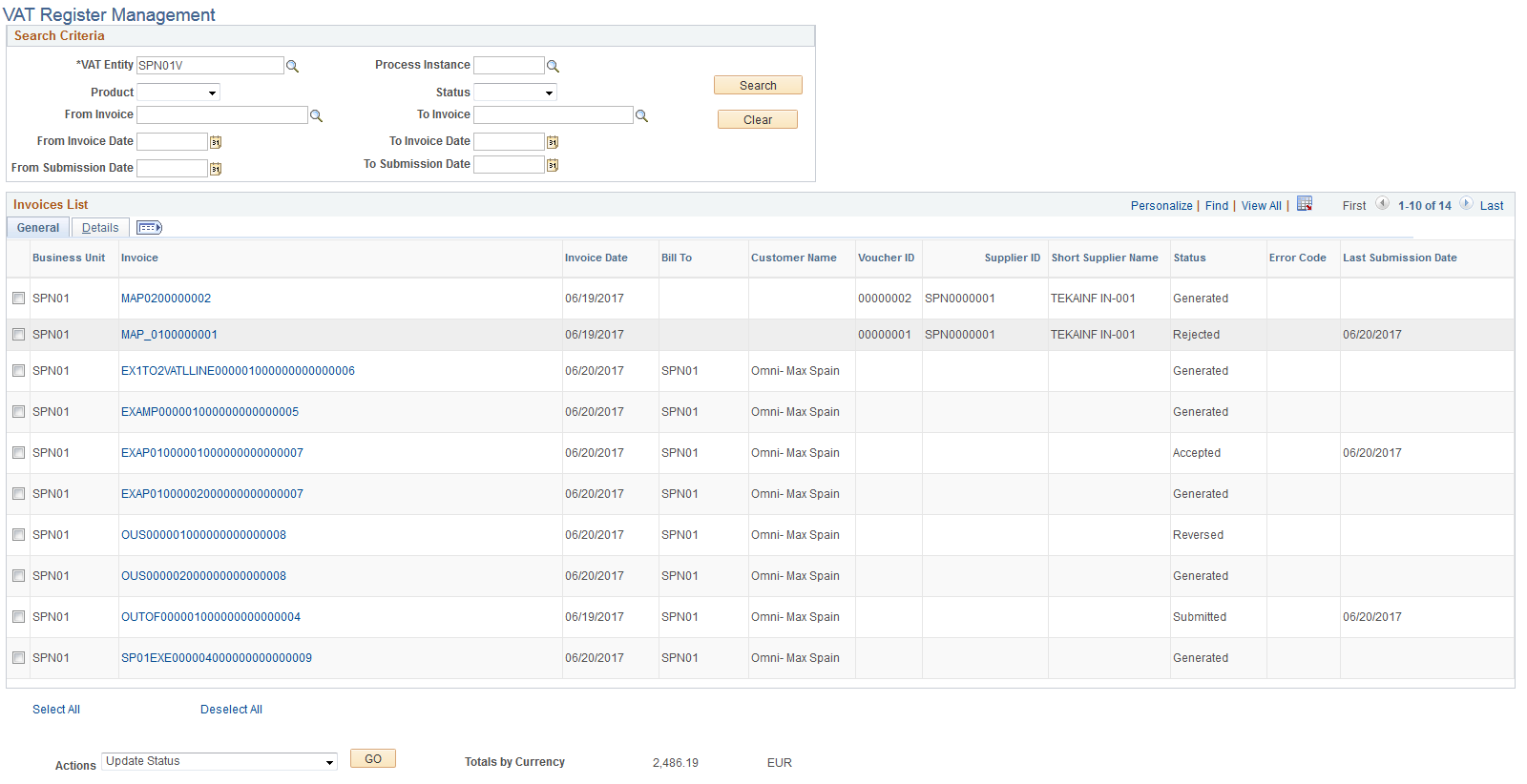

VAT Register Management Page

Use the VAT Register Management page (SII_VAT_REG_MGT) to manage and track VAT Register status.

Navigation:

This example illustrates the fields and controls on the VAT Register Management Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

VAT Entity |

Enter the VAT entity to manage and track. |

Status |

View the status displayed. |

Error Code |

View the error code displayed |

Action |

Select an invoice to update error code or status. |

Update Error Code |

Select an error code from the large list available. |

Change Status |

Select a status. The available options are:

|

Note: If you want to regenerate a file, as a modification (A1) change status to Ready or as an addition (A0) change status to Reversed. If you want to submit a rejected or erroneous transaction to the tax agency portal directly, change status to Manual in PeopleSoft.

Italy Trading Partner Declaration Report Files

Italian tax authorities require all taxable Italian subjects identified for VAT to provide an electronic file listing of issued and received invoices. The listing must be in xml format in accordance with specified technical standards. This electronic transmission must be made on a quarterly basis except for the year 2017. You must make half yearly submissions in 2017:

January to June by September 16th, 2017

July to December by February 28th, 2018

The xml file so created makes the following declarations:

Payables Invoice Listing

Receivables Invoice Listing

Note: All amounts reported in the Italian Trading Partner Declaration Report must be in Euro, without decimals and rounded to the nearest Euro.

Transactions included for consideration are:

B2B [Business to Business] are those with a VAT Registration ID.

B2C [Business to Consumer], are all those without a VAT Registration ID.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ITA_VAT_TRTMNT_PG |

Enter VAT Treatments to be excluded from reports. |

|

|

VAT Transaction Loader Rqst Page |

VAT_UPD_REQUEST |

Run the VAT Transaction Loader Request process on posted payables, receivables and billing transactions. |

|

Transaction Loader Page |

ITA_VAT_TXN_RQST |

Run the Transaction Loader process to extract data from VAT transactions. |

|

ITA_RPT_EXCEP_PG |

Mark one or more transactions as exceptions and exclude from reporting. |

|

|

ITA_RPT_EXTRACT |

Extract data into Reporting Tables. |

|

|

ITA_RPT_RQST |

Generate the Italian Trading Partner Declaration Report |

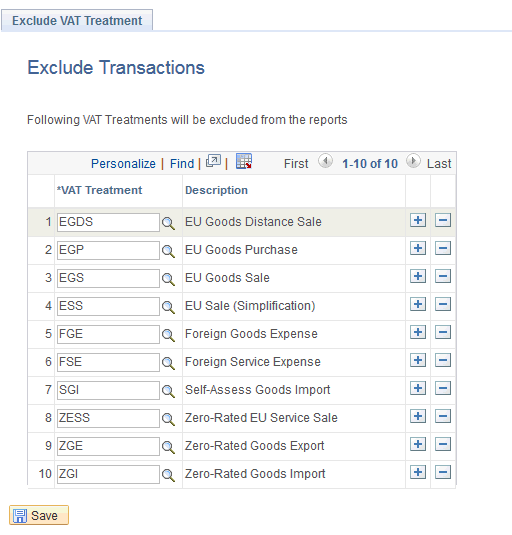

Use the Exclude Transactions page (ITA_VAT_TRTMNT_PG) to enter VAT Treatments to be excluded from reports.

Navigation:

This example illustrates the fields and controls on the Exclude Transactions Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

VAT Treatment |

Select a VAT treatment to exclude. |

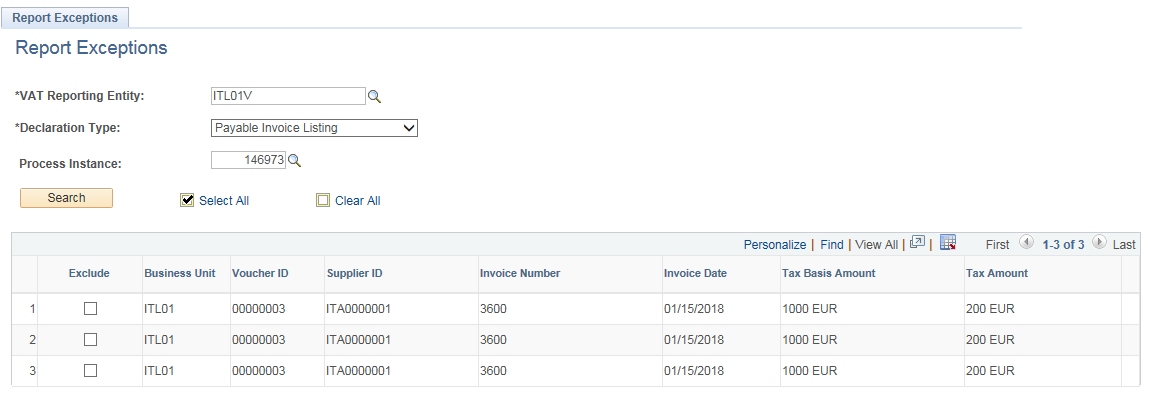

Use the Report Exceptions page (ITA_RPT_EXCEP_PG) to mark one or more transactions as exceptions and exclude from reporting.

Navigation:

This example illustrates the fields and controls on the Report Exceptions Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

VAT Reporting Entity |

Select the Italian VAT reporting entity. |

Declaration Type |

Select the declaration type. The available options are:

|

Process Instance |

Select a process instance for the given reporting entity. |

Exclude |

Select a transaction to exclude from reporting. |

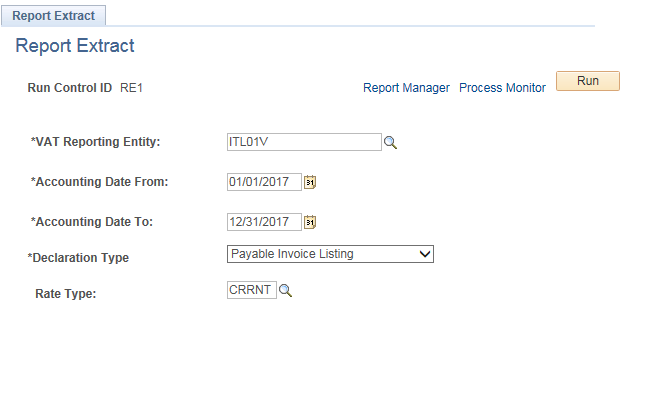

Use the Report Extract page (ITA_RPT_EXTRACT) to extract data into Reporting Tables.

Navigation:

This example illustrates the fields and controls on the Report Extract Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

VAT Reporting Entity |

Select the Italian VAT reporting entity for which data should be extracted. |

Accounting Date From |

Select the accounting start date from which the report needs to be extracted. |

Accounting Date To |

Select the accounting end date until which the process needs to retrieve the data. Note: According to Italian Legislative standards, Accounting From and To dates are on quarterly basis, but user can select dates based on the requirement. |

Declaration Type |

Select the declaration type. The available options are:

|

Rate Type |

Select the appropriate rate type. |

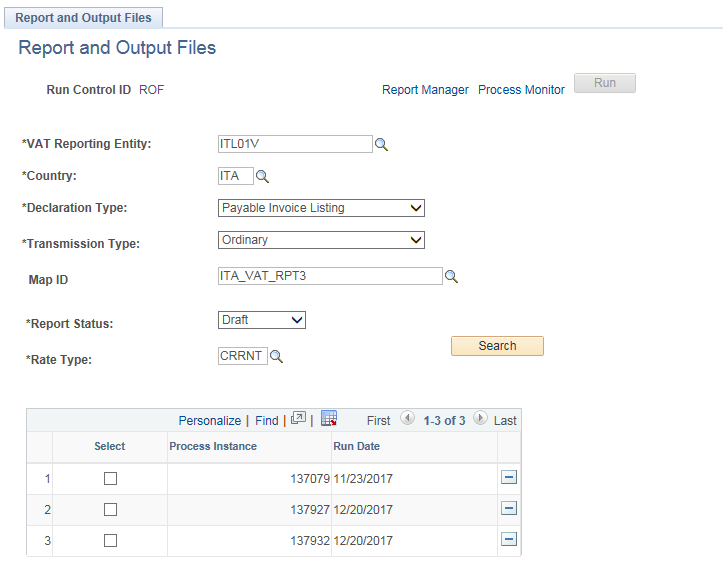

Use the Report and Output Files Page (ITA_RPT_RQST) to generate the Italian Trading Partner Declaration Report.

Navigation:

This example illustrates the fields and controls on the Report and Output Files Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

VAT Reporting Entity |

Select the Italian VAT reporting entity. |

Country |

Select the country of taxation. |

Declaration Type |

Select the declaration type. The available options are:

|

Transmission Type |

Select the transmission type. The available options are:

|

MAP ID |

Select the associated MAP ID |

Report Status |

Select the report status. The available options are:

|

Rate Type |

Select the associated rate type |

Search |

Click to search for available process instances and select one to process. |

Secure Payment System (SPS) Formats

PeopleSoft supports two Secure Payment System (SPS) formats; for both Government Wide Account (GWA) and non-GWA reporters in the US. For GWAs PeopleSoft also supports componentized TAS/BETC structure for all SPS type EFT file formats.

Note: SPS processing is different for Agency Location Codes (ALC) that are GWA and those that are non-GWA reporters. If the Agency is a GWA Reporter TAS/BETC is required for SPS payments. TAS/BETC values are determined from the fund that is present on the voucher distribution. For SPS payments made through the Accounts Payable system, TAS/BETC will be defaulted and required. For Agencies that are not GWA Reporters, TAS/BETC is not required and will not be part of the SPS payment.