Setting Inventory Costing Preferences

When you use the Inventory feature, the inventory preferences help you control the way inventory costing runs.

The preferences you see on the Inventory Costing Preferences page depend on the features and preferences you use.

To set inventory costing preferences:

-

Go to Setup > Accounting > Inventory Costing Preferences.

-

In the Scheduling Inventory Costing field, choose when to start inventory costing:

-

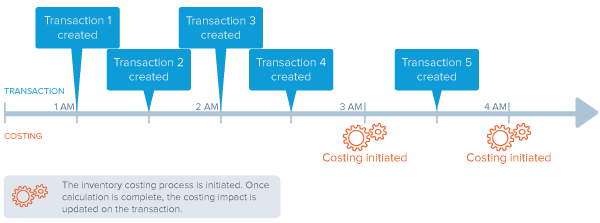

Based on custom schedule - After each transaction successfully saves, NetSuite processes the inventory costing impact for these transactions only according to a customized schedule.

Note:

Note:With this setting, when you enter and save a transaction, the item uses average costing at that moment. Later, when costing runs according to the custom schedule, NetSuite updates the cost on that transaction.

When you choose this setting, you'll see these fields to set the costing schedule:

-

Earliest Custom Schedule Start Time - The earliest time to start the inventory costing process

-

Latest Custom Schedule End Time - The latest time to start the inventory costing process

-

Respect Inventory Costing Time Restrictions on Weekends - Set this preference if you don't want the costing process to run during weekends.

-

-

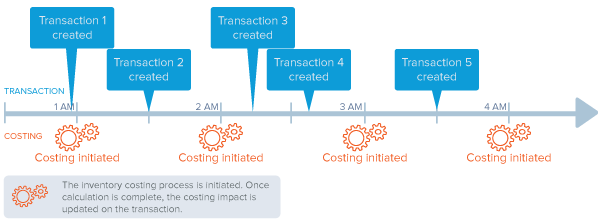

Every hour - After each transaction successfully saves, NetSuite processes the inventory costing impact for these transactions one time per hour.

-

-

In the Use Cost Estimate for Negative Inventory field, select how you want to calculate the item cost for inventory with levels below zero:

-

Last Purchase Price - In a negative inventory scenario, NetSuite uses the last purchase price for calculations.

-

Zero - In a negative inventory scenario, NetSuite posts an amount of zero for inventory depletions.

-

Average Cost - In a negative inventory scenario, NetSuite posts the average cost for inventory depletions.

Important:Your choice for the Use Cost Estimate for Negative Inventory preference only applies to items using FIFO, LIFO, Specific and Lot-Numbered costing. This inventory costing preference doesn't apply to items that use Average costing. Average costing items use the most recent above-water average for cost estimates. This preference doesn't apply to items that use Standard costing. Standard costing items always use Standard costing.

-

-

To display the Use Exact Cost on Linked Returns option, check the Use Exact Cost on Linked Returns box.

Here's what each option for the Use Cost Estimate for Negative Inventory preference means:

Last Purchase Price

In a negative inventory scenario, NetSuite uses the last purchase price for calculations.

In row 4, when you ship 10 units, the on-hand quantity goes below zero. For that transaction, NetSuite estimates the cost using the most recent purchase price, which is $5 per unit. Later, when you receive 100 units in row 5, the cost is $25 per unit, and NetSuite posts adjustment amounts to correct the previous entry.

|

1 |

6/7/2021 Receive 25 units at $15 each |

Last Purchase Price = $15 Average Cost = $15 On Hand = 25 |

DR Asset account $375 CR Accrual account $375 |

|

2 |

6/8/2021 Receive 25 units at $5 each |

Last Purchase Price = $5 Average Cost = $10 On Hand = 50 |

DR Asset account $125 CR Accrual account $125 |

|

3 |

6/10/2021 Ship 50 units |

Last Purchase Price = $5 Average Cost = $10 On Hand = 0 |

CR Asset account $500 DR COGS $500 |

|

4 |

6/11/2021 Ship 10 units |

Last Purchase Price = $5 Average Cost = $0 On Hand = 0 |

CR Asset account 10 x $5 (estimated Last Purchase Price) DR COGS 10 x $5 (estimated Last Purchase Price) |

|

5 |

6/12/2021 Receive 100 units at $25 each |

Last Purchase Price = $25 Average Cost = $25 On Hand = 90 |

DR Asset account $2500 CR Accrual account $2500 CR Asset $200 (adjustment entry) DR COGS Adjustment $200 (adjustment entry) |

Zero

In a negative inventory scenario, NetSuite posts an amount of zero for inventory depletions.

In row 4, when you ship 10 units, the on-hand quantity goes below zero. For that transaction, NetSuite estimates the cost as $0 per unit. Later, when you receive 100 units in row 5, the cost is $25 per unit, and NetSuite posts adjustment amounts to correct the previous entry.

|

1 |

6/7/2021 Receive 25 units @ $15 |

Last Purchase Price = $15 Average Cost = $15 On Hand = 25 |

DR Asset account $375 CR Accrual account $375 |

|

2 |

6/8/2021 Receive 25 units @ $5 |

Last Purchase Price = $5 Average Cost = $10 On Hand = 50 |

DR Asset account $125 CR Accrual account $125 |

|

3 |

6/10/2021 Ship 50 units |

Last Purchase Price = $5 Average Cost = $10 On Hand = 0 |

CR Asset account $500 DR COGS $500 |

|

4 |

6/11/2021 Ship 10 units |

Last Purchase Price = $5 Average Cost = $0 On Hand = 0 |

CR Asset account $0 (estimated as zero) DR COGS $0 (estimated as zero) |

|

5 |

6/12/2021 Receive 100 units @ $25 |

Last Purchase Price = $25 Average Cost = $25 On Hand = 90 |

DR Asset account $2500 CR Accrual account $2500 CR Asset $250 (adjustment entry) DR COGS Adjustment $250 (adjustment entry) |

Average Cost

In a negative inventory scenario, NetSuite posts the average cost for inventory depletions.

In row 4, when you ship 10 units, the on-hand quantity goes below zero. For that transaction, NetSuite estimates the cost as the average cost of the item at that time. Later, when you receive 100 units in row 5, the cost is $25 per unit, and NetSuite posts adjustment amounts to correct the previous entry.

|

1 |

6/7/2021 Receive 25 units @ $15 |

Last Purchase Price = $15 Average Cost = $15 On Hand = 25 |

DR Asset account $375 CR Accrual account $375 |

|

2 |

6/8/2021 Receive 25 units @ $5 |

Last Purchase Price = $5 Average Cost = $10 On Hand = 50 |

DR Asset account $125 CR Accrual account $125 |

|

3 |

6/10/2021 Ship 50 units |

Last Purchase Price = $5 Average Cost = $10 On Hand = 0 |

CR Asset account $500 DR COGS $500 |

|

4 |

6/11/2021 Ship 10 units |

Last Purchase Price = $5 Average Cost = $0 On Hand = 0 |

CR Asset account 10 x $10 (estimated average cost) DR COGS 10 x $10 (estimated average cost) |

|

5 |

6/12/2021 Receive 100 units @ $25 |

Last Purchase Price = $25 Average Cost = $25 On Hand = 90 |

DR Asset account $2500 CR Accrual account $2500 CR Asset $150 (adjustment entry) DR COGS Adjustment $150 (adjustment entry) |

Related Topics

- Costing Methods

- Selecting a Default Cost of Goods Sold (COGS) Account

- Inventory Costing and Assembly Items

- LIFO/FIFO Inventory Costing and Advanced Receiving

- System Cost of Goods Sold Adjustments

- Viewing Inventory Reports

- Inventory Costing Recalculations

- Troubleshoot Inventory Costing

- Cost Accounting Status on Item Records

- Item Return Costing

- Group Average Costing

- Standard Costing

- Item Costing