Defining Foreign Currency Variance Posting Rules

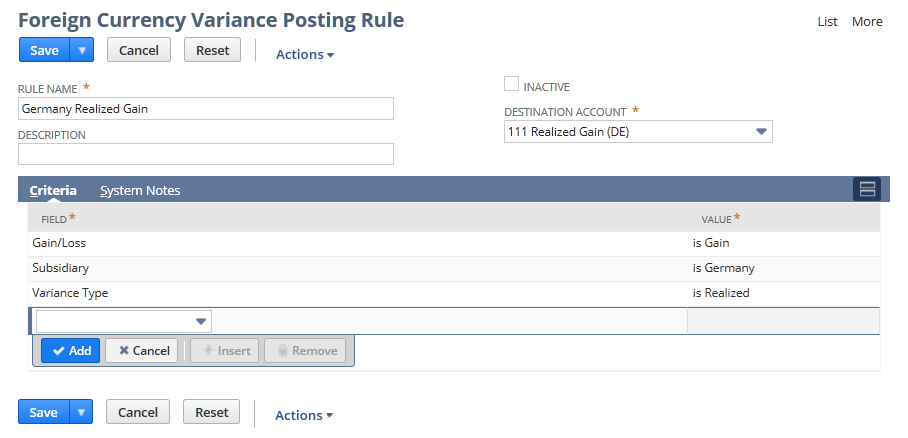

You define foreign currency variance posting rules on the Foreign Currency Variance Posting Rule page. Each rule specifies the account into which gain or loss resulting from foreign currency variances is posted. This account is the Destination Account. The rules consist of a set of source or revaluation transaction criteria that determine the posting account.

If your NetSuite implementation has no variance posting rules, NetSuite posts the gains and losses from fluctuations in foreign exchange rates to default system-generated accounts. The default system-generated accounts are also used if no rules match the transaction. For information about the default accounts, see Foreign Currency Revaluation.

Each variance posting rule must have a unique set of criteria. Each transaction is compared to the foreign currency variance posting rules in the order of rule priority. When a matching rule is found, that rule is used and evaluation ends. Key fields, custom segments, and custom fields that apply to Purchase, Sale, Journal, Customer Payment, Vendor Payment, or Deposit are available as criteria. Custom fields are limited to the following types:

-

Check Box

-

Currency

-

Date

-

Decimal Number

-

Email Address

-

Free-Form Text

-

Integer Number

Adding, modifying, and removing rules doesn't affect transactions for which the foreign currency variances have already been posted.

Make sure you create the posting accounts you want to set as the destination accounts before you create the rules. The destination accounts must be account types Other Income or Other Expense.

To define a foreign currency variance posting rule:

-

Go to Setup > Accounting > Foreign Currency Variance Posting Rules > New.

-

In the Rule Name field, enter a unique name for the rule.

Your rule name should include enough information for you to identify it in a list if you need to change the priority of your rules. You can include symbols in addition to letters and numbers.

-

In the Description field, enter a short description of the rule. The description is optional.

-

Select the Destination Account for the foreign currency variance posting rule.

Foreign currency variances post to this destination account when the source or revaluation transaction matches the rule. Multiple rules can have the same destination account.

The Destination Account list includes all accounts of the Other Income and Other Expense account types.

If you include Subsidiary in your criteria, the Destination Account should be associated with the subsidiary you select.

-

Check the Inactive box if you want to disable the rule.

When the Inactive box is checked, you can inactivate a rule you no longer want or save rules that would be invalid if they were active. For example, you could save a copy of an existing rule as inactive for later editing.

Inactive rules are included on the Foreign Currency Variance Posting Rules page. However, they're ignored during revaluation processing.

-

In the Criteria subtab, select the fields and values for your rule.

Unless you include a field and value, the field isn't considered for matching.

Custom fields and segments appear at the bottom of the Field list with the suffix (Custom). Criteria with custom fields or custom segments apply to source transactions only.

The other available fields are as follows:

-

Account - Multi-select list, searchable by account name. This field refers to the posting account on the source transaction. Use this field, for example, to add criteria to match specific accounts payable accounts on vendor bills.

-

Account Type - Multi-select list. The field refers to the account type of the posting account on the source transaction. Use this field, for example, to add criteria to match all accounts of the account type Accounts Receivable.

-

Accounting Book - Multi-select list. This field refers to the accounting book of revaluation transactions. This field is available only when the Multi-Book Accounting feature is enabled. For information, see Using Multi-Book Accounting.

-

Class - Multi-select list. This field refers to the Class field of source transactions.

-

Country - Multi-select list. This field refers to the Country field of the subsidiary of the source transaction and is available only in NetSuite OneWorld implementations.

-

Currency - Source Transaction - Multi-select list. This field refers to the Currency field of source transactions.

-

Date - Revaluation - Date or date range field. This field refers to the Date field of revaluation transactions.

-

Date - Source Transaction - Date or date range field. This field refers to the Date field of source transactions.

-

Department - Multi-select list. This field refers to the Department field of source transactions.

-

Gain/Loss - Select Gain or Loss. This field indicates whether the revaluation transaction is a gain or a loss.

-

Is Intercompany - Yes or No only. When you select Yes as the value for the field, source transactions match the rule only when the line to be revalued is marked for elimination. This field doesn't apply to revaluation transactions. This field is available only when the Automated Intercompany Management feature is enabled. For information, see Automated Intercompany Management Overview.

-

Location - Multi-select list. This field refers to the Location field of source transactions.

-

Memo - Text entry field. This field refers to the Memo field of source transactions.

-

Nexus - Multi-select list. This field refers to the Nexus field of source transactions.

-

Posting Period - Multi-select list. This field refers to the posting period of payments or credit memos for realized gains. For unrealized gains, this field refers to the posting period of customer invoices or vendor bills. For invoices against revenue commitments, this field refers to the invoice posting period.

-

Subsidiary - Multi-select list. If you use this field, make sure the subsidiaries you select are associated with the Destination Account. This field refers to the Subsidiary field of the source transaction and is available only in NetSuite OneWorld implementations. Full subsidiary access is provided for rule creation.

-

Variance Type - Multi-select list. The options for variance type are Matching, Realized, and Unrealized. For information about the variance types, see Foreign Currency Revaluation.

-

-

When you've added the criteria necessary to direct posting to the destination account, click Save.

If your rules post to an unexpected account, verify that all of the following are true:

-

Destination accounts are all active.

-

Accounts included as criteria are all active.

-

Subsidiaries included as criteria are all associated with the destination accounts for the rules in which they're included.

-

All the rules you want to use are active (the Inactive box is clear).

-

Your rules are prioritized correctly.