Setting Up Tax Rate Types for the United States

The SuiteTax Engine automatically provisions tax rate types. If you create tax codes manually, you'll need to set the tax rate type yourself during tax code creation.

For more information on SuiteTax Engine tax records automated provisioning, see Automatic Tax Records Provisioning for the United States.

To set the tax rate type while creating a tax code:

-

Go to Setup > Tax > Tax Codes > New.

-

In the Name field, enter a name.

-

In the Description field, enter a description.

-

In the Tax Type field, select a tax type. You can create a new tax type at Setup > Tax > Tax Types > New.

-

In the Payables Account and Receivables Account fields, the accounts reflect the account that is defined in the selected tax type.

-

In the Available On field, select a type of transaction.

-

In the Tax Rate Type field, select a tax rate type.

-

Click Save.

Tiered Tax Rates

The SuiteTax Engine supports tiered rate tax codes for the United States. Here are the parameters for tiered rate tax codes:

-

Threshold basis - the amount the SuiteTax Engine uses to decide the right tier. It's based on:

-

Single Item - price of a single item on the transaction line

Note:The price of a single item is calculated as the amount divided by the items quantity on the item line.

Note:When the threshold basis is of type "Single Item Price", some states allow exceptions for items typically sold in bulk or otherwise treated as a single unit. NetSuite can't determine if a set of items meets these state-specific conditions. So, SuiteTax evaluates the tier based on the unit price on the transaction line (amount divided by quantity). If a group of items needs to be evaluated as one unit, it must be configured as Kit Item in NetSuite.

-

Invoice Total - total receipt amount per invoice (before taxes)

-

-

Threshold type - the method the SuiteTax Engine uses to calculate taxes when a tiered rate applies:

-

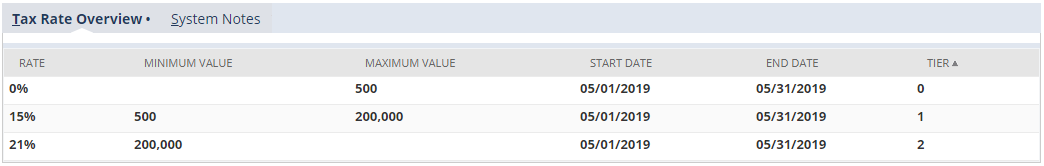

Spread method - based on the amount (either single item or invoice total), SuiteTax Engine finds the right tier, then applies that rate to the whole line. For example, if you invoice one item for $300,000, the whole amount is taxed at 21% based on the parameters shown below.

-

Split method - each tier is applied to a portion of the price. For example, if you sell one item for $300,000, the first $500 is taxed at 0%, the next $199,500 at 15%, and the last $100,000 at 21%, based on the parameters shown below.

Note:If you apply more than one tiered tax code rate (which usually happens with the Split method), SuiteTax uses the average of all tiered tax rates. You can see the average rate in the Tax rate column on the Tax Details subtab on the transaction. Even a 0% (non-taxable) tier counts as a rate. For example, if the first USD 5,000 of USD 10,000 is taxed at 10%, and the rest isn't taxed, the average rate is 5%. For better understanding, look for a note saying 'Tiered tax code is applied' in the Details column on the Tax Details subtab on the transaction.

-