Bank Transfers in Multi-Book Accounting

Please contact your sales or account representative to find out how to get the Full Multi-Book Accounting feature. The assistance of NetSuite Professional Services or a Multi-Book authorized partner is required to implement this feature. You should consider contacting NetSuite Professional Services or a Multi-Book authorized partner for assistance in setting up the Adjustment-Only Books feature, even though it isn't required.

Multi-Book Accounting, including the Adjustment-Only Books feature, is available only in NetSuite OneWorld.

In NetSuite, you can transfer funds between bank accounts that have the same or different currency using Transactions > Bank > Transfer Funds. When the transfer is between accounts with different currencies, one of the currencies must be the base currency for the company or subsidiary. In Multi-Book Accounting with Foreign Currency Management, bank transfers are book-generic transactions with the book-specific exchange rate attributes for secondary books.

The Exchange Rate field in the transfer record is for the primary book. The values in the Exchange Rate fields for the secondary books are between the transaction currency and the secondary book currency.

When the transfer is between accounts with different currencies, the foreign currency in the primary book is used to determine the exchange rate for any secondary books. The exchange rate always defaults to the system rate. You may override it in the secondary books for currencies other than those used in the primary book transaction.

Sample Calculations

This example uses a subsidiary whose base currency in the primary book is U.S. dollars (USD).

The transfer is 120.00 from an Australian bank account in Australian dollars (AUD) to a U.S. account (USD).

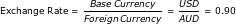

The exchange rate for the primary book is the system rate between the currencies. It's calculated as:

The general ledger impact in the primary book is always the base currency amount, and here it's $108.

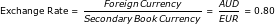

The foreign currency is AUD. To calculate the general ledger impact for a secondary book that uses euros (EUR) as its base currency, first calculate the exchange rate as follows:

The general ledger impact in the secondary book whose base currency is euros is 120 AUD * 0.80 = 96 EUR.