Printing Transactions with Tax Information in SuiteTax

SuiteTax provides predefined advanced print templates that you can use for the following supported transactions.

|

Transaction Type |

SuiteTax Advanced PDF/HTML Template |

|---|---|

|

Cash Refund |

Standard Cash Refund PDF/HTML Template (SuiteTax) |

|

Cash Sale |

Standard Cash Sale PDF/HTML Template (SuiteTax) |

|

Credit Memo |

Standard Credit Memo PDF/HTML Template (SuiteTax) |

|

Invoice |

Standard Invoice PDF/HTML Template (SuiteTax) |

|

Estimate |

Standard Quote PDF/HTML Template (SuiteTax) |

|

Purchase Order |

Standard Purchase Order PDF/HTML Template (SuiteTax) |

|

Return Authorization |

Standard Return Authorization PDF/HTML Template (SuiteTax) |

|

Sales Order |

Standard Sales Order PDF/HTML Template (SuiteTax) |

To print transactions with tax information in SuiteTax, you need to enable the Advanced PDF/HTML Templates feature and use custom transaction forms that use the SuiteTax advanced print templates. For information about the Advanced PDF/HTML Templates feature, see Advanced PDF/HTML Templates. You also must have at least the Edit permission for the transactions that you want to print.

To set up custom transaction forms and advanced print templates for SuiteTax, read the following topics:

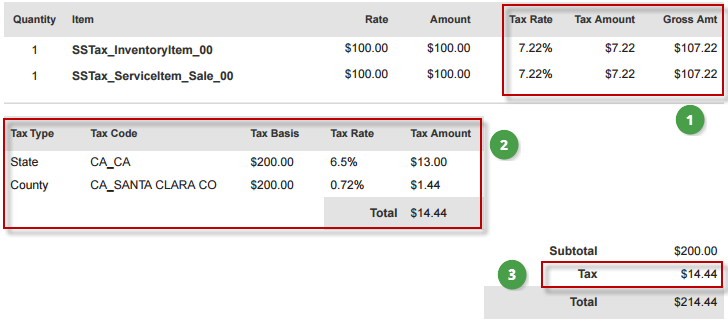

When you use the predefined templates for SuiteTax, transaction printouts display the following tax information.

|

1 |

The Tax Rate, Tax Amount, and Gross Amount columns are added to the item table and expense table (Purchase Order). |

|

2 |

The Tax Summary table is added after the item table and expense table, and shows the following columns: Tax Type, Tax Code, Tax Basis, Tax Rate, and Tax Amount. The Tax Summary table contains summary tax lines from the Tax Details subtab of the transaction. Tax details are grouped by unique tax code and tax rate combinations. The Tax Basis and Tax Amount columns show the calculated total value for each group. At the end of the summary tax lines, you can view the total tax amount. |

|

3 |

The total table also shows the total tax amount from the Tax Summary table. If you want to display the tax total by tax type, you can customize the advanced print template for SuiteTax. For more information, see Customizing the SuiteTax Advanced Print Templates. |

Using the SuiteTax Advanced Print Templates

To print your transactions with tax information, you must set up your custom transaction forms to use the advanced print templates for SuiteTax.

By default, the SuiteTax advanced print templates are set as the preferred templates for new custom transaction forms when the SuiteTax and Advanced PDF/HTML Templates features are enabled in your account.

To set up printing transactions with tax information in SuiteTax:

-

Go to Customization > Forms > Transaction Forms.

-

Click the Customize link for the standard transaction form. If you already have an existing custom transaction form and you want to set it up to use the SuiteTax advanced print template, click the Edit link next to it.

-

For Printing Type, select Advanced.

-

In the Print Template and Email Template fields, select the advanced print template for SuiteTax.

-

Check the Form is Preferred box.

-

Click Save.

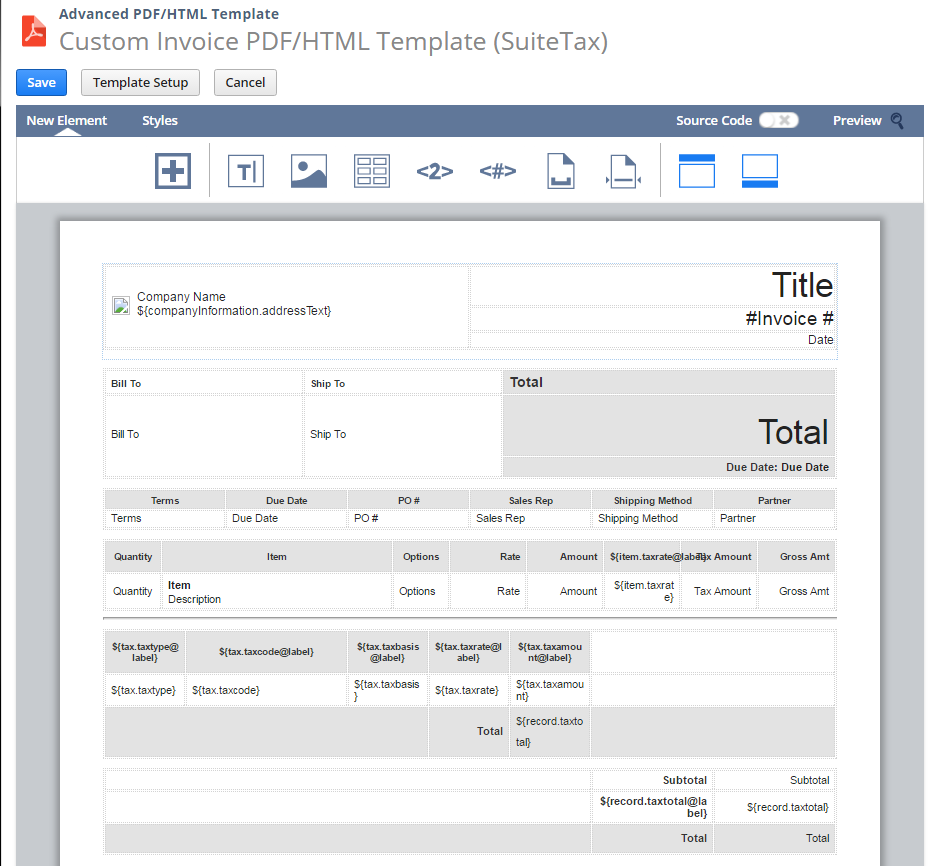

Customizing the SuiteTax Advanced Print Templates

You can customize the predefined advanced print templates for SuiteTax according to your business requirements. You can edit the column names, rearrange or realign the columns, and make other adjustments.

The following table includes a list of tax-related fields that are available for printing.

|

Tax-Related Fields Available for Printing |

Description |

|

|---|---|---|

|

Header Level |

|

Transaction nexus. |

|

|

Tax registration number for the entity associated with the transaction. |

|

|

|

Tax registration number for the transaction nexus (from the subsidiary record). |

|

|

|

Sum of all tax totals on the transaction. |

|

|

Item and Expense Tables |

|

Tax amount attached to the line. |

|

|

Gross amount attached to the line |

|

|

|

Sum of all tax rates attached to the line. |

|

|

List that contains Tax Details ( |

|

Sum of tax amounts with the same tax code and tax rate. |

|

|

Tax rate. |

|

|

|

Sum of tax basis with the same tax code and tax rate. |

|

|

|

Tax type name. |

|

|

|

Tax code name. |

|

To customize the SuiteTax advanced print templates:

-

Go to Customization > Forms > Advanced PDF/HTML Templates.

-

Click the Customize link for the SuiteTax advanced print template of the transaction form.

-

You can customize the templates using the visual template editor or by manually editing the HTML markup source.

-

To adjust the layout and labels in WYSIWYG mode, keep the Source Code toggle off. For more information, see WYSIWYG Editing in the Template Editor.

-

To manually edit the HTML markup source for the template, switch the Source Code toggle on. For more information, see Source Code Editing in the Template Editor.

Warning:Don't modify markup source directly unless you have sufficient CSS and HTML knowledge. NetSuite does not provide support or training in CSS or HTML. Be aware that the template editor may not function properly if you switch back to WYSIWYG mode after edits have occurred in markup source mode. Some template content may not be represented correctly, may not be accessible for editing, or may not be shown at all. If these issues occur, you can preserve template content by not saving the template in WYSIWYG mode and switching back to markup source mode.

For guidance on editing the markup source for SuiteTax advanced print templates, see Samples for Customizing SuiteTax Advanced Print Templates.

-

-

Click Preview to view the PDF printout with the tax information. You can go back to the template editor to make changes or adjustments. For more information about customizing advanced print templates, see Advanced Templates Customization in the Template Editor.

-

When you are done editing, click Save.

-

Use your customized advanced print template on custom transaction forms. For more information, see Using the SuiteTax Advanced Print Templates.

Samples for Customizing SuiteTax Advanced Print Templates

For guidance on editing the markup source for SuiteTax Advanced Print Templates, refer to the following examples:

Example for Displaying the Tax Information in the Item Table

Displaying the tax information headers in the item table:

<th>${item.taxrate@label}</th>

<th>${item.taxamount@label}</th>

<th>${item.grossamt@label}</th>

Displaying the tax information fields in the item table:

<td>${item.taxrate}</td>

<td>${item.taxamount}</td>

<td>${item.grossamt}</td>

Example for Displaying the Tax Summary Table

Displaying the Tax Summary table with summary tax lines and total tax amount:

<table>

<#list record.taxsummary as tax>

<#if tax_index==0><tr>

<th>${tax.taxtype@label}</th>

<th>${tax.taxcode@label}</th>

<th>${tax.taxbasis@label}</th>

<th>${tax.taxrate@label}</th>

<th>${tax.taxamount@label}</th>

</tr></#if>

<tr>

<td>${tax.taxtype}</td>

<td>${tax.taxcode}</td>

<td>${tax.taxbasis}</td>

<td>${tax.taxrate}</td>

<td>${tax.taxamount}</td>

</tr>

</#list>

<tr>

<td>${record.total@label}</td>

<td>${record.taxtotal}</td>

</tr>

</table>

Example for Adding the Total Tax Amount to the Total Table

Displaying the total tax amount header and field in the total table:

<tr>

<td>${record.taxtotal@label}</td>

<td>${record.taxtotal}</td>

</tr>

Displaying the total list in the total table:

When displaying the tax total list, you can remove the existing row for the tax total and replace it with the list that displays the tax total by tax type.

<#list record.taxtypetotals as row>

<tr>

<td>${row.taxtotal@label}</td>

<td>${row.taxtotal}</td>

</tr>

</#list>