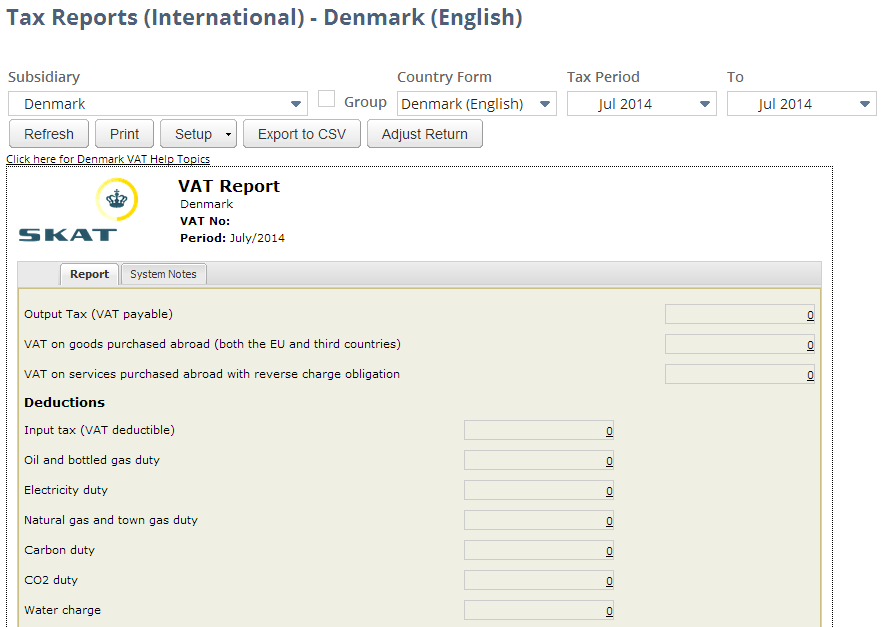

Denmark VAT Report

If you have a Denmark subsidiary and nexus and you have the International Tax Reports SuiteApp installed in your NetSuite account, you can generate the Denmark VAT Report, in English or Danish, from Reports > VAT/GST > Tax Reports (International).

To generate the tax report for Denmark, use the tax code properties provided by the International Tax Reports SuiteApp. See Denmark Tax Codes.

NetSuite gets the values in the report from your transactions, but some boxes in the form may require you to enter data manually. It's important that you save a PDF file of the report for your own records because NetSuite can't audit manually entered data. For information, see Generating VAT/GST Reports.

You should review all the values in the report. You can click the values in the boxes of the VAT report to view drilldown details. To understand how NetSuite uses the tax codes to get the values for the Denmark VAT report, see What goes into each box - Denmark VAT Report.

The NetSuite VAT/GST tax form is designed to look like the official tax form for ease of use, but it isn't intended to be printed out for submission to the tax agency. For Denmark, NetSuite provides a CSV file that you can manually upload to the tax agency portal for online filing. You should still review all the values in the report prior to submission.

VAT Report Online Filing

The CSV file generated by NetSuite complies with the specifications of the tax authority in Denmark. You can manually upload it to the tax agency portal for online filing. To generate a report, see Generating VAT/GST Reports. When the Denmark VAT report is displayed, click Export to CSV.

The System Notes subtab lists all the Denmark VAT Report CSV files generated for the selected subsidiary. The list also shows the user name, date, reporting period, and a link to the file for downloading.

Before generating a report to be used for online filing, be sure to complete the Tax Filing Setup page. For information, see Setting Up Tax Filing for Denmark.

You should review all the values in the report prior to submission.

You can also use customizable saved reports provided by the International Tax Reports SuiteApp to view both detail and summary reports for purchases or sales, grouped by tax code. For more information, see Sales and Purchase Reports Grouped by Tax Code. For EU sales list and Intrastat reports, see EU Sales List (ESL) Report and EU Intrastat Report.