Indonesia VAT Report

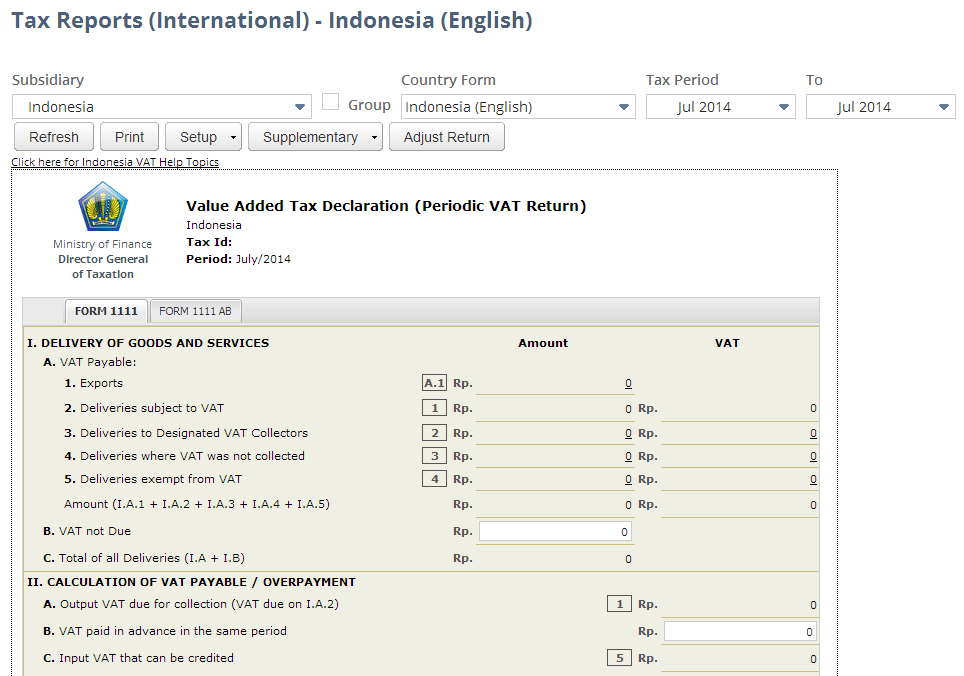

If you have an Indonesia subsidiary and nexus, and the International Tax Reports SuiteApp is installed, you can generate the VAT Declaration Form 1111 and its attachments in English or Bahasa Indonesia from Reports > VAT/GST > Tax Reports (International).

To generate the VAT report for Indonesia, use the tax code properties provided by the International Tax Reports SuiteApp. See Indonesia Tax Codes.

NetSuite gets the values in the report from your transactions, but some boxes in the form may require you to enter data manually. It's important to save a PDF copy of the report for your records, since NetSuite can't audit manually entered data. For information, see Generating VAT/GST Reports.

Review all the values in the report. YYou can click the values in the VAT report boxes to see more details. To see how NetSuite uses tax codes to get values for VAT Declaration Form 1111 and 1111AB, see What goes into each box - Indonesia VAT report.

The NetSuite VAT/GST tax form looks like the official tax form for user convenience, but it's not meant to be printed and submitted to the tax agency.

To generate the Form 1111 VAT Declaration and attachments:

-

Go to Reports > VAT/GST > Tax Reports (International).

-

If you're using OneWorld, select the Indonesian subsidiary. In the Country Form field, select either the English VAT form or the Bahasa Indonesia VAT form.

-

Select a tax period for the report.

-

Click Refresh to generate the report.

Important:Each time you change a subsidiary or tax period, click Refresh.

-

Click Print to save a PDF file of Form 1111: Value Added Tax Declaration Form (Periodic VAT Return) and Form 1111 AB (Summary of Deliveries and Acquisitions for the Period).

-

Click the following to generate the supplementary reports:

-

A1 - to download Form 1111 A1: List of Exports whether Tangible or Intangible Goods (BKP) and/or Services (JKP)

-

A2 - to download Form 1111 A2: List of Output VAT from Domestic Deliveries with Tax Invoice

-

B1 - to download Form 1111 B1: List of Creditable Input from Importation of Tangible Goods (BKP) or Consumption of Intangible Goods (BKP) and/or Services (JKP) from Outside the Customs Area

-

B2 - to download Form 1111 B2: List of Creditable Input VAT from the Domestic Acquisitions of Goods and/or Services from Outside the Customs Area

-

B3 - to download Form 1111 B3: List of Non-creditable Input VAT or Facilitated Acquisitions

-

The system provides fields for Luxury Sales Tax (PpnBM), but it doesn't calculate them automatically right now.

You can also use customizable saved reports provided by the International Tax Reports SuiteApp to view both detail and summary reports for purchases or sales, grouped by tax code. For more information, see Sales and Purchase Reports Grouped by Tax Code.