Spain VAT Report

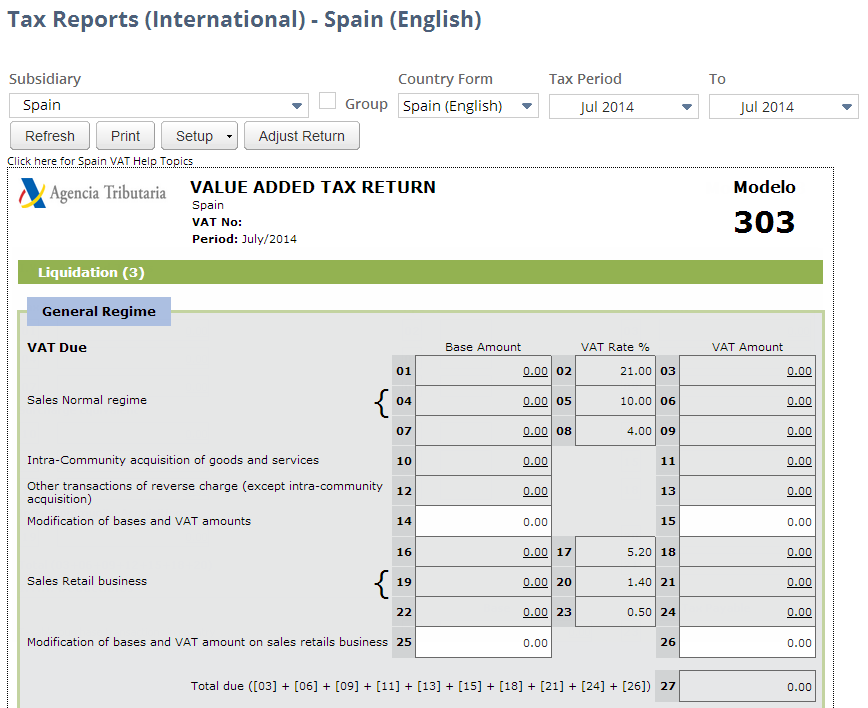

If you have an Spain subsidiary and nexus and you have the International Tax Reports SuiteApp installed in your NetSuite account, you can generate the Modelo 303 Quarterly VAT Return for Spain, English or Spanish, from Reports > VAT/GST > Tax Reports (International).

To generate the tax report for Spain, use the tax code properties provided by the International Tax Reports SuiteApp. See Spain Tax Codes.

NetSuite gets the values in the report from your transactions, but some boxes in the form may require you to enter data manually. It's important that you save a PDF file of the report for your own records because NetSuite can't audit manually entered data. For information, see Generating VAT/GST Reports.

You should review all the values in the report. You can click the values in the boxes of the VAT report to view drill-down details. To understand how NetSuite uses the tax codes to get the values for the Modelo 303 Quarterly VAT Return, see What goes into each box - Spain VAT report.

The NetSuite VAT/GST tax form is designed to look like the official tax form for ease of use, but it's not intended to be printed out for submission to the tax agency.

You can also use customizable saved reports provided by the International Tax Reports SuiteApp to view both detail and summary reports for purchases or sales, grouped by tax code. For more information, see Sales and Purchase Reports Grouped by Tax Code. For EU sales list and Intrastat reports, see EU Sales List for Spain and EU Intrastat Report.