Automatic Mapping of Jurisdiction with Entity

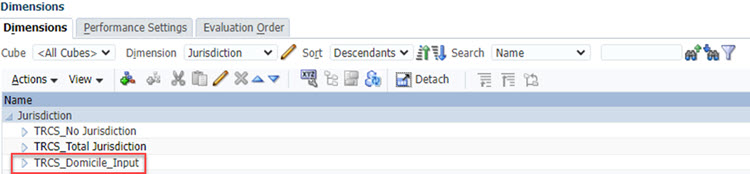

In Tax Reporting, you can specify the TRCS_Domicile_Input Jurisdiction member when importing data via data import, Data Exchange, or Supplemental Data Management. Using TRCS_Domicile_Input allows you to import data without specifying the correct national Jurisdiction (domicile) for each entity.

Post data import, the system automatically identifies the national Jurisdiction (level 0 descendant of All National) for each Entity based on the Entity's Domicile attribute configuration. The system then routes the data to the appropriate national Jurisdiction.

Note:

However, there are some limitations with default jurisdiction member, see Limitations.Example

- Import below data file from Application → Overview → Import

Data (See: Creating the Data Import File)

Account, LE101, Point-of-View, Data Load Cube Name

11102, 9099, "P1, FCCS_Entity Input, FCCS_No Intercompany, TRCS_TBClosing, FCCS_No Multi-GAAP, TRCS_Domicile_Input, Plan, FY24, FCCS_Periodic, Entity Currency, FCCS_Data Input", ConsolNote:

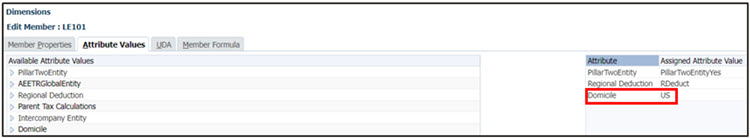

Here instead of Domicile of LE101 entity, you can use default jurisdiction TRCS_Domicile_Input to load data. - Post data load, the system automatically identifies the jurisdiction of

LE101 entity in the record based on its domicile attribute value

which is US as shown in below screenshot.

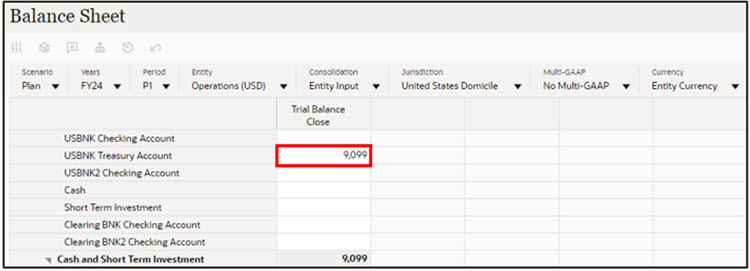

- System then appropriately saves data to the LE101 entity and US

Jurisdiction for the Balance Sheet form.