Translation Methodologies

Companies that are part of a multinational group generally conduct business in their local currency. When financial statements from all subsidiaries are consolidated into the parent company's statements, these multiple local currencies must be translated into the reporting currency of the parent. Tax Reporting provides currency translations for a multi-currency application.

When a multi-currency application is enabled, you can translate to the application currency (primary reporting currency) and any additional reporting currencies. Additional reporting currencies are translated by triangulation with the application reporting currency unless you have entered the translation rate to the added reporting currency. This currency translation is done using exchange rates that you provide. See Translating Data.

In Tax Reporting, when an application is first created, the system uses the Year-To-Date (YTD) translation method by default. The Periodic translation method is also available to calculate the currency translation. In Tax Settings you can specify the default translation methodology for all flow accounts to be either Periodic or YTD. You can also enable Periodic Currency Translation for P13 and P14 using Tax Settings.

The average rate account used in the calculation remains the same for both the Periodic or YTD translation method.

Also Tax Reporting provides translation methodology overriding on an account-by-account basis. This is available as an Account member attribute PeriodicFXTranslationmethod or YtdFxTranslationMethod.

Understanding Translation Calculation Detail: Terms

- Entity Currency (input currency) = EC

- Parent Currency (translated currency) = PC

- Average Rate = Rate

Using YTD Calculation Method

Year to Date (YTD) uses single average rate for the YTD data entered for the current period selected in the Point-Of-View. This is the default calculation method for Tax Reporting unless otherwise specified globally or on a specific account. The formula for calculating translation using YTD method is (P3 example):

PC->P3 = EC->P3 * Rate->P3 (YTD data * current Average FX Rate)

Using Periodic Calculation Method

Periodic data on the other hand is a weighted calculation where each period applies the change in value for the period to the periods rate. The formula for calculating using Periodic method is (P3 example):

PC->P3 = (EC->P3 – EC->P2) * Rate->P3 + PC->P2 ( (Input currency in current period - input currency in prior period) * Current period rate + prior period translated value)

Note:

- For the first period of the year where there is data and an average foreign exchange (FX) translation rate, the periodic and YTD translation will have the same result (see above table translated value =120)

- P13 and P14 (RTA and Audit) will always be YTD translation method. There are no prior period for P13 and P14. The prior period follows scenario default frequency, which is same as ownership. However, if prior period follows the quarterly scenario frequency, then P3 will be the prior period for P6. See Table on Prior Period in Handling Changes in Ownership.

- f you are using the Periodic Translation Method, you must follow the same scenario default frequency in both Consol as well as CbCR cube.

- NIBT Rate Override and FX Rate Override is not supported in CbCR cube.

- If you are using periodic translation you must have values for all the periods. Enter 0 (zero) if there are periods where no data is available.

Enabling Translation Method for All Flow Accounts

To enable translation method:

- Navigate to the Configuration card.

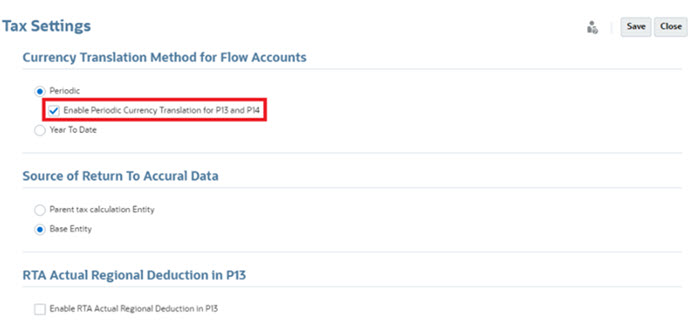

- Select the Tax Settings Screen. Two options are available in the Currency Translation Method for Flow Accounts: Periodic and Year to Date.

- Select the Tax Settings to Periodic and click Save.

- Change the Tax Settings from Periodic to Year to Date to and click Save.

Enabling Periodic Currency Translation for P13 and P14

To enable translation method:

- Navigate to the Configuration card.

- Select the Tax Settings Screen. Under Periodic Currency Translation for

P13 and P14, select Enable Periodic Currency Translation for P13 and P14.

- Click Save.

Note:

Only when you select the Periodic Currency Translation, the checkbox to enable Periodic Currency Translation for P13 and P14 can be seleted, otherwise, this option is disabled and cannot be selected.

Overriding Translation Method for Single Account

If you want a non-flow account (that is, balance) to use Periodic translation method, then you can use the following attribute in the account dimension. Additionally, you can set a flow account to YTD when using Periodic globally. See Account Dimension.