Example: Configuring FX Amount Override for Tax Account

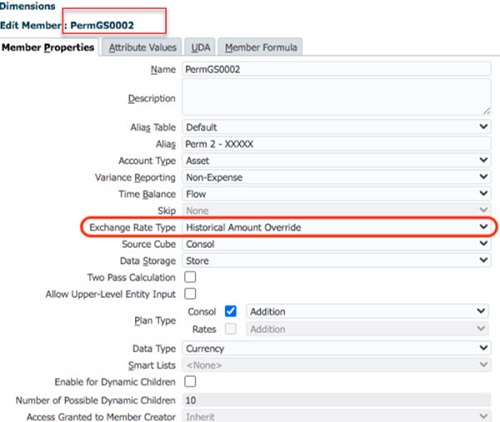

The example below illustrates how to setup a FX Amount Override for PermGS0002 account:

Note:

PermGS0002 is an example account.- Navigate to Dimension library. See Account Dimension in Administering Tax Reporting.

- Select PermGS0002 account and click on Edit

icon.

icon.

- Select the Exchange Rate Type as Historical Amount Override and save.

- Refresh the database.

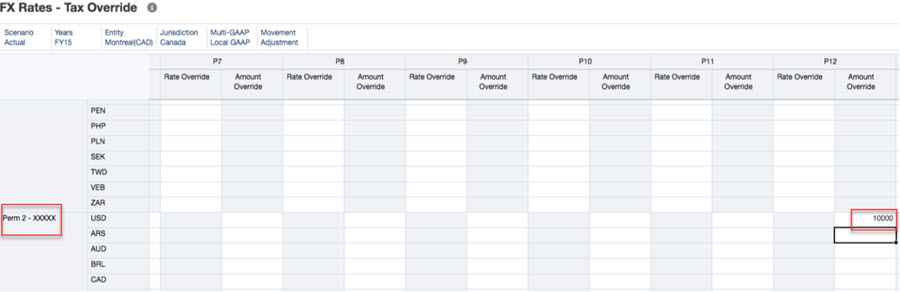

- Navigate to Library.

- Expand Tax Administration folder.

- Open TRCS_FX Rates - Tax Override form. The form will automatically shows the PermGS0002 account.

- Enter the FX Amount Override value for the POV, submit data. Here in the example, you enter 10000.

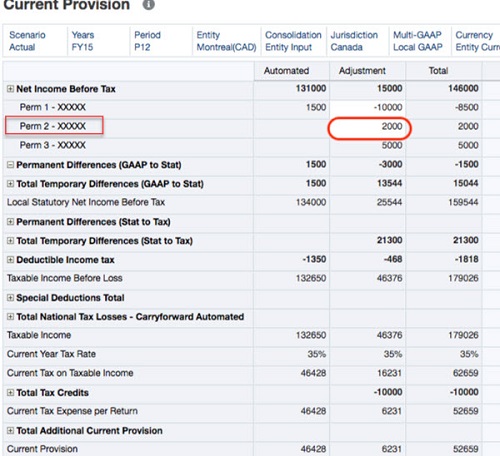

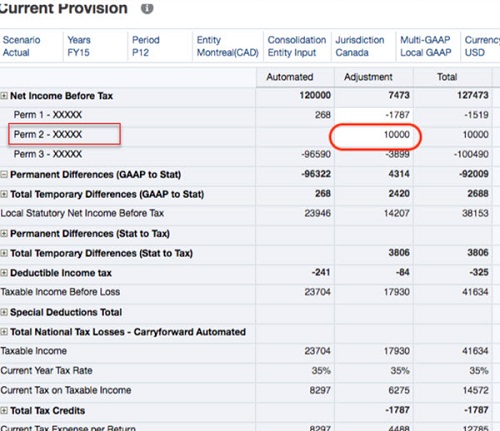

- Run Consolidate/Translate to notice the amount being applied for the PermGS0002 Account.

- Open current provision form to notice the translated data. The screenshots below show PermGS0002/Entity currency for Adjustment has 2000 and USD is 10000.

Note:

Amount override only applies on pre-tax input member. Other data source members use calculated FX rate based on the FX override amount provided divided by entity currency value. For example:- PermGS002, Entity Currency, Pre Tax Input → 2,000

- PermGS002, Entity Currency, Tax → 700 (2,000 * .35)

Below are the numbers when translated:

- PermGS002, USD, Pre Tax Input → 10,000 (Based on the Amount override provided)

- PermGS002, USD, Tax → 3500 (700 * (10,000 / 2000))