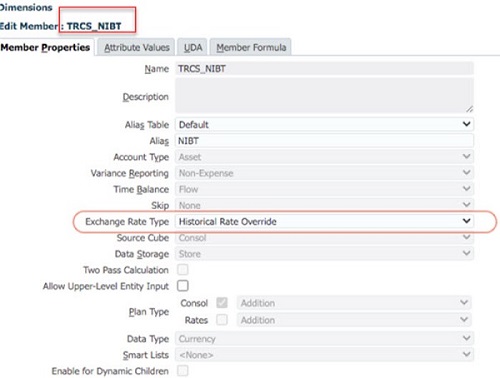

Example: Configuring FX Rate Override for Tax Account

The example below illustrates how to setup a FX Rate Override for NIBT account:

Note:

This example assumes that Montreal(CAD) entity is rolling up to a US parent entity.- Navigate to Dimension library. See Account Dimension in Administering Tax Reporting.

- Select TRCS_NIBT account and click on Edit

icon.

icon.

- Select the Exchange Rate Type as Historical Rate Override and save.

- Refresh the database.

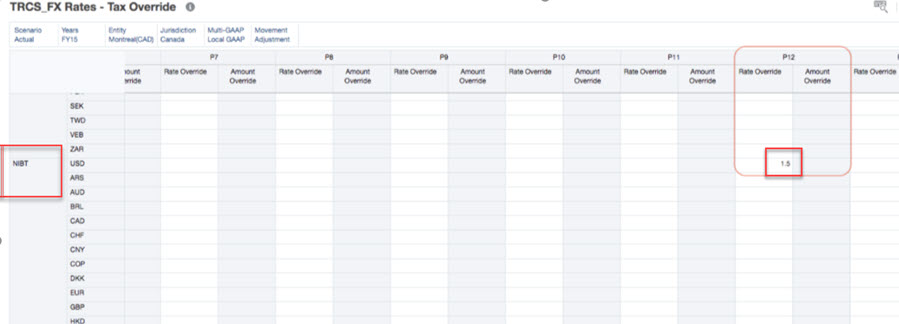

- Navigate to Library.

- Expand Tax Administration folder.

- Open TRCS_FX Rates - Tax Override form. The form will automatically shows the NIBT account.

- Enter the FX Rate Override value for the period, submit data. Here in the example, you enter 1.5.

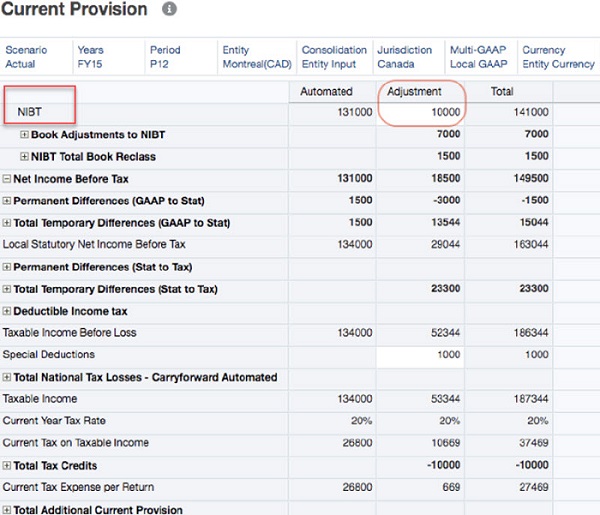

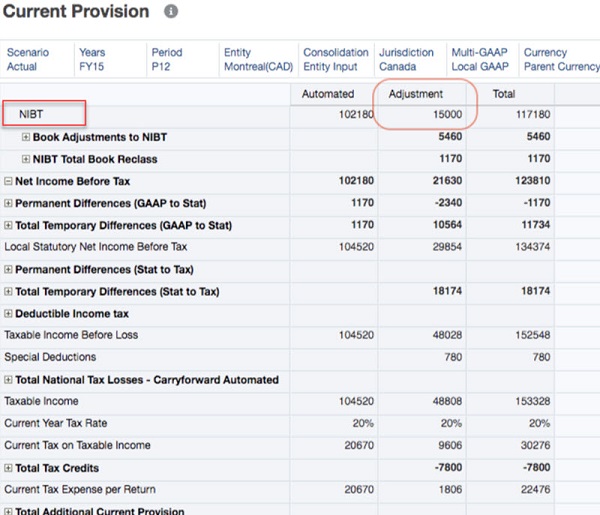

- Run Consolidate/Translate to notice the rate being applied for the NIBT Account.

- Open current provision form to notice the translated data. The screenshots below show TRCS_NIBT/Entity currency for Adjustment has 10000 and Parent Currency is 10000 * 1.5 = 15000.

Note:

Both pre-tax, tax data source members for the NIBT account will use the same FX override rate.