5.1 Corporate user as a Viewer

This topic describes the Corporate user as a Viewer functionality.

Corporate user in Viewer role provides the top management of any corporate with a consolidated and easy to understand view of their business immediately after logging in. This helps them to take speedy and accurate decisions to meet their short term and long term business goals.

Dashboard Overview

Icons

The following icons are present on the portal page:

: The logo of the bank.

: The logo of the bank.

: Clicking this icon takes you to the Mailbox screen.

: Clicking this icon takes you to the Mailbox screen.

: Enter the transaction name and click search icon to search the

transactions.

: Enter the transaction name and click search icon to search the

transactions.

: Displays the welcome note, user’s name along with the last log in date and

time. Click this icon to view the logged in user’s profile or log out from the

application.

: Displays the welcome note, user’s name along with the last log in date and

time. Click this icon to view the logged in user’s profile or log out from the

application.

: Click the toggle menu to access various transactions.

: Click the toggle menu to access various transactions.

: Click this icon to close the toggle menu. This icon appears if the toggle

menu is open.

: Click this icon to close the toggle menu. This icon appears if the toggle

menu is open.

Header Menu Options

- Preferred Language :Click on the

, and click Langauge to set your desired language to use the

application.

, and click Langauge to set your desired language to use the

application.

FATCA & CRS link

Click the link to access the FATCA and CRS Self – Certification Forms for Entities so as to capture required information for the purposes of compliance with both FATCA and CRS.

Toggle Menu Transactions

Following items are present on the Toggle Menu:

: This menu consists of sub menu items like Current and Savings account,

Term Deposits and Loans and Finances to navigate to the respective account related

transactions.

: This menu consists of sub menu items like Current and Savings account,

Term Deposits and Loans and Finances to navigate to the respective account related

transactions.

: Click here to access Payments related transactions or setting up of

payments

: Click here to access Payments related transactions or setting up of

payments

: Click here to access the Electronic Bill Payments and Presentment related

transactions.

: Click here to access the Electronic Bill Payments and Presentment related

transactions.

: Click this menu to manage your Letter of Credits (LCs), Bills, Guarantees,

Line Limits and Beneficiary maintenance for trade finance.

: Click this menu to manage your Letter of Credits (LCs), Bills, Guarantees,

Line Limits and Beneficiary maintenance for trade finance.

: Click this menu to view booked forex deals and initiate new forex

deal.

: Click this menu to view booked forex deals and initiate new forex

deal.

: Click this menu to manage the cash flow, credit and working capital.

: Click this menu to manage the cash flow, credit and working capital.

: Click this menu to manage your virtual accounts.

: Click this menu to manage your virtual accounts.

: Click this menu to originate new Credit Facilities and manage existing

Facilities and Collaterals.

: Click this menu to originate new Credit Facilities and manage existing

Facilities and Collaterals.

: Click this menu to view your Supply Chain Finance business and to manage

its activities.

: Click this menu to view your Supply Chain Finance business and to manage

its activities.

: Click this menu to view receivable and payables.

: Click this menu to view receivable and payables.

: Click this menu to get the daily or monthly cash flow forecast and also

the current day snapshot of the finances.

: Click this menu to get the daily or monthly cash flow forecast and also

the current day snapshot of the finances.

: Click this icon to upload files and view the files already uploaded.

: Click this icon to upload files and view the files already uploaded.

: Click this icon to generate the reports and view the generated

reports.

: Click this icon to generate the reports and view the generated

reports.

: Click this menu to set your preferences as well as daily limits and change

password.

: Click this menu to set your preferences as well as daily limits and change

password.

: Click this menu to view the Mails, Alerts and Notifications.

: Click this menu to view the Mails, Alerts and Notifications.

: Click this menu to leave your feedback about the user interaction of the

application.

: Click this menu to leave your feedback about the user interaction of the

application.

: Click to view the address and location of the ATMs and the branches of the

Bank. For more information refer ATM & Branch

Locator section.

: Click to view the address and location of the ATMs and the branches of the

Bank. For more information refer ATM & Branch

Locator section.

-

: Click this menu to launch the online help.

: Click this menu to launch the online help.

: Click this menu to view the information about the application like version

number, copyright etc.

: Click this menu to view the information about the application like version

number, copyright etc.

Financial Overview

The section provides a graphical representation of the distribution of assets and liabilities across the Current and Savings Accounts, Term Deposits & Loans & Finances accounts held with the bank. It also displays the total amount of assets, liabilities and the Net Worth. Account types displayed in the section include CASA, term deposits, and loans & finances.

Position By Currency

The section displays currency wise position of user’s assets and liabilities in the form of a bar graph. Each bar represents one currency.

Credit Line Usage

Credit Facility/Line Usage widget provides a quick understanding of the most and least utilized credit facilities (both in terms of amount and percentage) with their current available and utilized amounts. By looking at this widget the corporate user can quickly assess the facilities that can be utilized more and facilities that need a limit extension.

The bar graph shows the following two values:

- Utilized Amount: The limits utilized by the party from the total set limit.

- Available Amount: The limits remaining from the total set limit.

Click the bar of a particular facility ID to view the utilization details of that facility.

Bill Receivable/ Payable

The section displays the summary of all import and export bills associated with specific party/ parties. The dashboard allows the user to view the total amount receivable and payable with respect to the trade bills (Under LC and standalone) immediately after logging in.

Trade Instruments

Trade Instruments section allows the user to view the summary of all trade instruments (Import-Export LC, outward guarantee) that are going to expire in near future and are associated with specific party/ parties.

The user can view the trade instruments that are going to expire within 10 days, 15 days and 30 days by selecting the option from the drop-down.

Reports

The latest reports mapped and generated under a party/ parties mapped to the logged in user are listed in this section. Click View All to view all the reports generated.

Current and Savings/ Term Deposits/ Loans and Finances

The current and savings/ Term Deposit/ Loan account card displays the count of the account and total balance in these accounts along with the transaction currency. The section below the account card displays the summary of assigned CASAs/ Term Deposit / Loan with below details. Click the particular account number of CASA / Term Deposit / Loan account to go to the account details screen.

- Current and Savings:

- Party Name: Displays the party names linked to the ID and holding the accounts

- Account Number: Displays the Account Number (masked format), account nickname (if any), and the product name. Click the account number to go to the Account Details screen.

- Account Type: Displays the type of account viz., savings or current etc

- Net Balance: The balance amount in the account is displayed

- Term Deposits:

- Party Name: Displays the party names linked to the ID and holding the deposits

- Deposit Number: Displays the TD Account Number (masked format), account nickname (if any) and the product name. Click the account number to go to the Deposit Details screen.

- Interest Rate: shows the applicable rate of interest on the TD

- Maturity Date: shows the date of maturity of deposit

- Principal Balance: shows the amount invested in deposit

- Maturity Balance: shows the amount which would be available on the date of maturity.

- Loans and Finances

- Loan Account Details: Displays the Loans Account Number (masked format), account nickname (if any) and the product name. Click the account number to go to the Loan Details screen.

- Party Name: Displays the party names linked to the ID and holding the loans

- Amount Financed: The loan amount that was initially availed

- Outstanding: Outstanding Amount against the loan

- Maturity Date: The Maturity Date of the Loan account

- Rate: Applicable rate of interest

Using the Search field, the user can search for a specific Current and Savings/ Term Deposit/ Loan account. Click Download to download the account summary of Current and Savings/ Term Deposit/ Loan accounts.

Corporate Limits

The user can view the party cumulative transaction limits for each transaction, along with daily and monthly limits utilized and available for use, from the viewer dashboard. The transaction for which the limits must be viewed can be selected from the dropdown list that is provided.

The user can select the transaction from the drop-down to view the corporate limit of that transaction.

Click View All to access the Limits screen, where the user’s limits and the corporate limits can be viewed. The user can also use the channels list and the transactions list to view limits for a specific transaction originating from a specific channel.

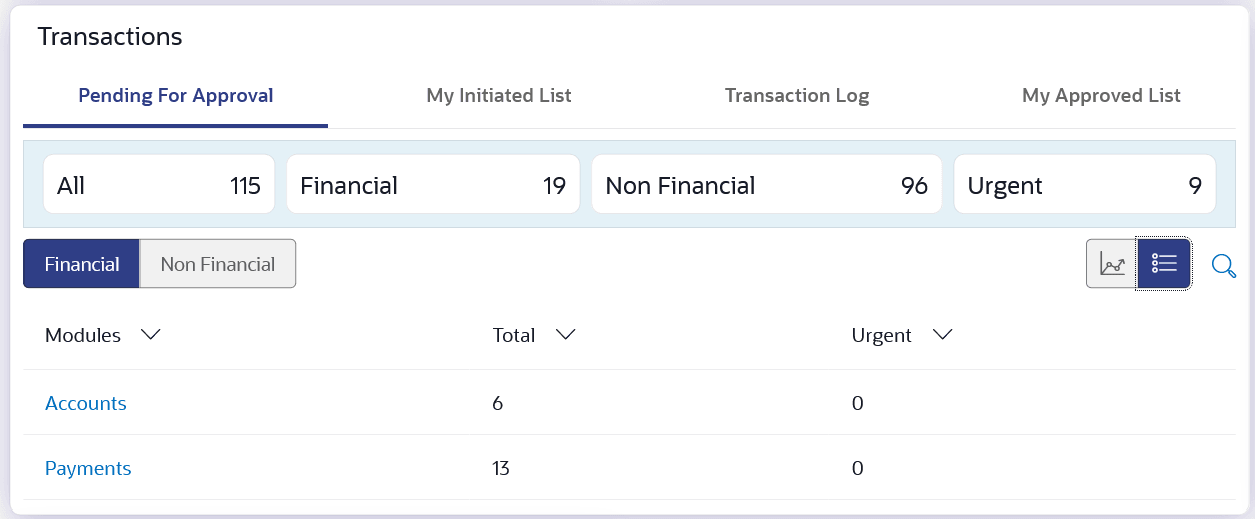

Transactions: This section has the following tabs

- Pending for Approval

- My Initiated List

- Transaction Log

- My Approved List

1) Pending for Approval

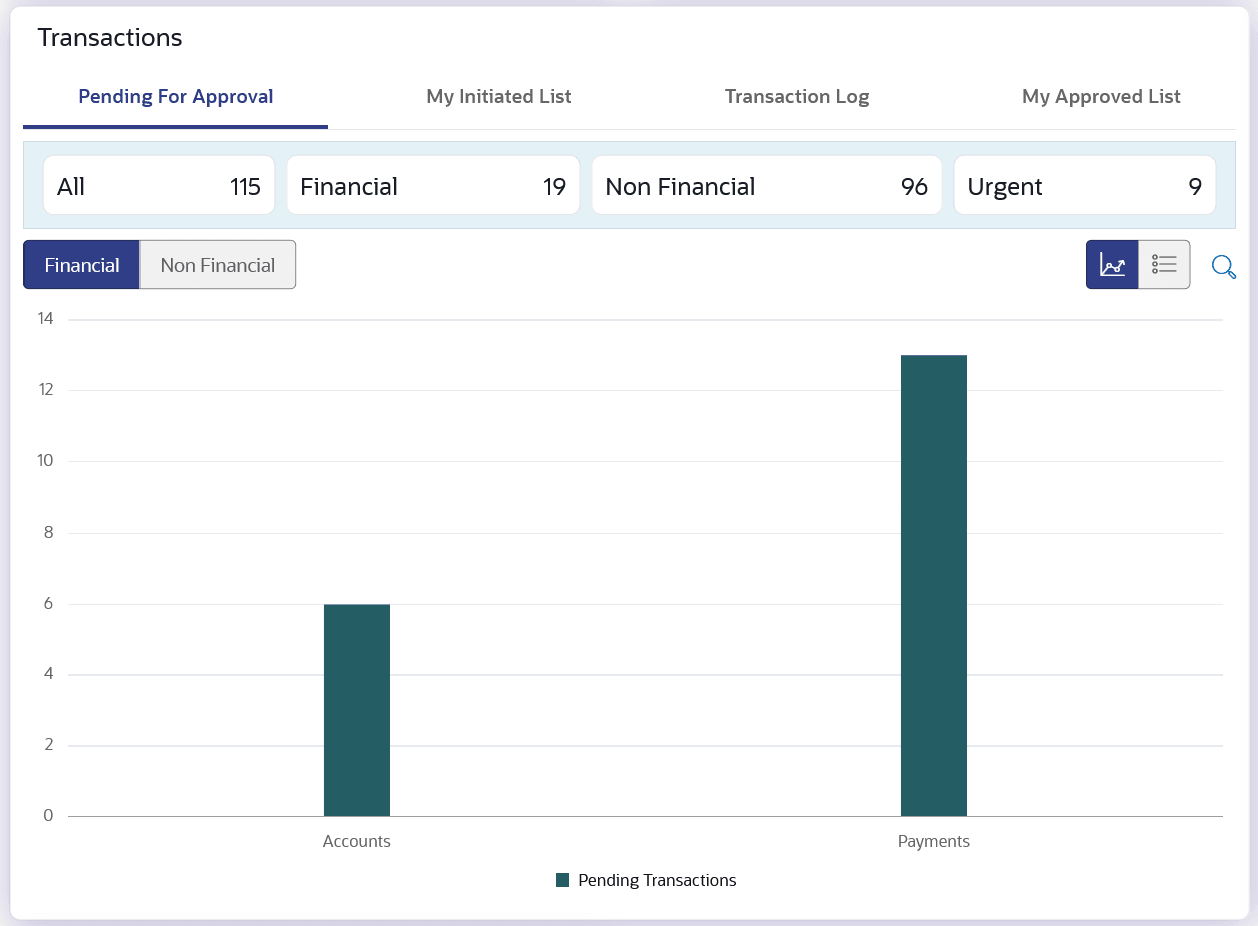

This section displays the details of transactions that are initiated by the maker and are pending for approval. It is briefly classified into two broad categories a) Financial and b) Non-Financial. User can click each tab to view the details of transactions that are pending for approval.

The transactions pending approval within a period can be searched across modules by providing a date range. The financial and non-financial sections display module wise count of transactions which are pending approval. The details can be viewed either in a graphical format or in a list format using a switch option.

Click ![]() on icon to search the transactions based on Date range.

on icon to search the transactions based on Date range.

Note:

- If for any module, the pending approval count is 0, then it will not be shown in the list.

- In the

graph view icon, on clicking the bars in the graph, the user will be

navigated to the transaction listing page.

graph view icon, on clicking the bars in the graph, the user will be

navigated to the transaction listing page.

- In the

list view icon, on clicking the module name link , the list of

transactions pending approval within the module can be viewed.

list view icon, on clicking the module name link , the list of

transactions pending approval within the module can be viewed.

This displays the financial transactions - further categorized into following modules:

Financial: This displays the financial transactions initiated by the maker and further categorized as below:

- Accounts - The details of activity log are:

- Date: Date of the transaction

- Description: Description of the transaction

- Account Number: Account number of the transaction

- Amount: Amount of the transaction

- Initiated By: The user who has initiated the transaction.

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Non Accounts - The details of the activity log are:

- Date: Date of the transaction

- Description: Description of the transaction

- Amount : Amount of the transaction

- Initiated By: The user who has initiated the transaction.

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Payments

- Date: Date of the transaction

- Description: Description of the transaction

- From Account: Source Account number of the transaction

- Amount : Amount of the transaction

- Payee Account Details: Payee’s account number of the transaction

- Initiated By: The user who has initiated the transaction.

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bill Payments

- Date: Date of the transaction

- Description: Description of the transaction

- Biller Name: Name of the biller

- Biller Location: Location of the biller

- Details: Details of bill payment

- From Account: Source Account number of the transaction

- Amount : Amount of the transaction

- Initiated By: The user who has initiated the transaction.

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bulk File

- Date: Date of the transaction

- Description: Description of the transaction

- Transaction Type: Transaction types of the file upload

- File Name: Name of the file uploaded.

- File Amount: Amount to be debited from debit account.

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bulk Record

- Date: Date of the transaction

- Transaction Type: Transaction type of the bulk record

- Debit Account: Account number of the account to be debited.

- Amount: Amount to be debited from debit account

- Payee Account Details: Payee’s account number

- Reference Number No: Reference Number of the transaction.

- Status: Status of the transaction

- Non Account Bulk Record

- Date: Date of the transaction

- Transaction Type: Transaction type of the bulk record

- Amount: Amount of the transaction

- Initiated By: The user who has initiated the transaction.

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Host to Host Bulk Files

- Date: Date of the transaction

- Description: Description of the transaction

- Transaction Type: Transaction type of the bulk record

- File Name: name of the file uploaded

- File Amount : Amount of the transaction

- File Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Host to Host Bulk Records

- Date: Date of the transaction

- Transaction Type: Transaction type of the bulk record

- Debit Account: Account number of the account to be debited.

- Amount: Amount to be debited from debit account

- Payee Account Details: Payee’s account number

- Reference No: Reference Number of the transaction.

- Status: Status of the transaction

- Supply Chain Finance

- Date: Date of the transaction

- Description: Description of the transaction

- Amount : Transaction amount.

- Transaction Type: Transaction type of the bulk record

- Debit Account: Account number of the account to be debited.

- Reference No: Reference Number of the transaction.

- Status: Status of the transaction

Non- Financial: This displays the non- financial transactions initiated by the maker and further categorized as below:

- Accounts

- Date: Date of the transaction

- Description: Description of the transaction

- Account Details: Account number of the transaction

- Initiated By: The user who has initiated the transaction.

- Reference No: Reference Number of the transaction.

- Status: Status of the transaction

- Biller Maintenance

- Date: Date of the transaction

- Description: Description of the transaction

- Biller Name : Name of the biller

- Biller Type: The type of biller

- Category: The category of the biller

- Initiated By: The user who has initiated the transaction.

- Reference No: Reference Number of the transaction.

- Status: Status of the transaction

- Payee and Biller

- Date: Date of the transaction

- Description: Description of the transaction

- Biller Type: Type of the biller

- Biller Category & Sub-category : Biller Category & Sub-category

- Reference No: Reference Number of the transaction.

- Status: Status of the transaction

- Bulk File

- Date: Date of the transaction

- File Identifier: Unique code assigned to the uploaded file.

- Transaction Type: Transaction type of the file upload

- File Name: Name of the file uploaded.

- File Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bulk Record

- Date: Date of the transaction

- File Identifier: Unique code assigned to the record.

- Transaction Type: Transaction type of the bulk record

- File Name : Name of the file uploaded

- Record Reference No: Reference Number of the record.

- Status: Status of the record

- Trade Finance

- Date: Date of the transaction

- Description: Description of the transaction

- Beneficiary Name: Name of the Beneficiary against whom LC is to be created

- Amount: Amount for the Letter of Credit / Bill

- Reference No: Reference Number of the transaction.

- Status: Status of the transaction

- Trade Finance Maintenance

- Date: Date of the transaction

- Description: Description of the transaction

- Reference No: Reference Number of the transaction.

- Status: Status of the transaction

- Forex Deal

- Date: Date of the transaction

- Reference Number: Reference Number of the transaction.

- Description: Description of the transaction

- Deal Type: Type of Deal user wants to initiate that is Spot or Forward

- Currency Combination: List of permissible currency combination for deal booking

- Amount: Amount for the booked forex deal

- Status: Status of the transaction

- Others

- Date: Date of the transaction

- Initiated By: User who has initiated the transaction

- Transaction Type: Type of the transaction initiated

- Description: Description of the transaction

- Reference No: Reference Number of the transaction

- Status: Status of the transaction

- Virtual Account Management

- Date: Date of the transaction

- Description: Description of the transaction initiated

- Initiated By: User who has initiated the transaction

- Reference Number: Reference Number of the transaction

- Status: Status of the transaction

- Liquidity Management

- Date: Date of the transaction

- Transaction Type: Type of the transaction initiated

- Structure Code & Name: Structure ID and description of the transaction

- Initiated By: The user who has initiated the transaction

- Reference Number: Reference Number of the transaction

- Status: Status of the transaction

- Host to Host Bulk Files

- Date: Date of the transaction

- Transaction Type: Transaction type of the bulk record

- File Name: Name of the file uploaded

- File Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Host to Host Bulk Records

- Date: Date of the transaction

- Transaction Type: Transaction type of the bulk record

- File Name: Name of the file uploaded

- Reference No: Reference Number of the transaction.

- Status: Status of the transaction

- Cash Management

- Date: Date of the transaction

- Description: Description of the transaction

- Reference No: Reference Number of the transaction

- Status: Status of the transaction

- Receivable Payables Management

- Date: Date of the transaction

- Description: Description of the transaction

- Reference No: Reference Number of the transaction

- Status: Status of the transaction

- Supply Chain Finance

- Date: Date of the transaction

- Description: Description of the transaction

- Reference No: Reference Number of the transaction

- Status: Status of the transaction

Figure 5-2 Transactions - Pending for Approval (List View)

Figure 5-3 Transactions - Pending for Approval (Graph View)

For more information, refer section Pending for Approval under Approval chapter.

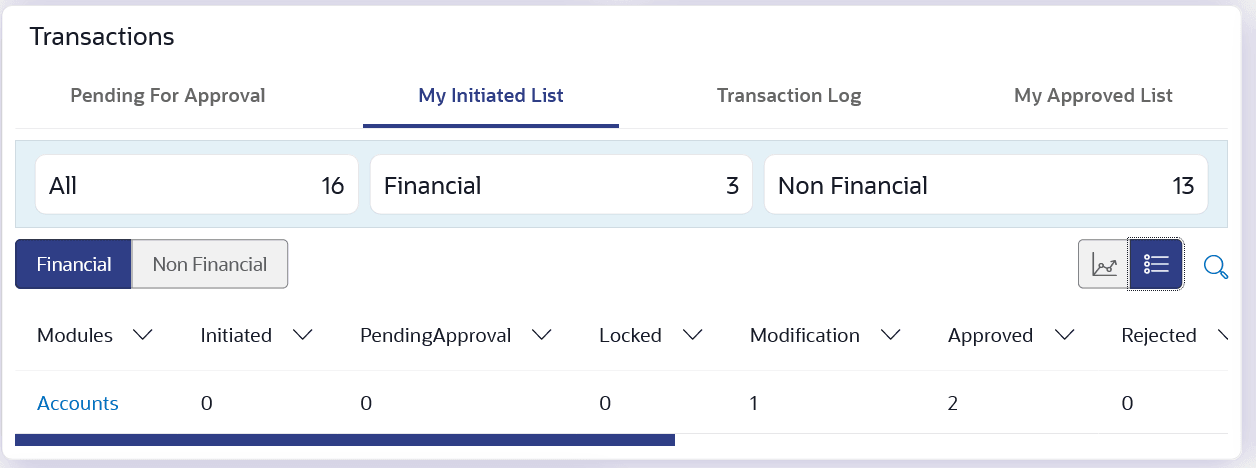

2) My Initiated List

Displays the list of all the transactions initiated by the logged in for different type of transactions like account financial, account non-financial, bulk file, bulk record, payee, biller and payments transactions.

It is divided into two sections broadly; Financial and Non-Financial. The logged in user can view the transaction list with respective statuses and details.

The details can be viewed either in a graphical format or in a list format using a switch option.

Displays the list of all the transactions initiated by the logged in for different type of transactions like account financial, account non-financial, bulk file, bulk record, payee, biller and payments transactions.

It is divided into two sections broadly; Financial and Non-Financial. The logged in user can view the transaction list with respective statuses and details.

The details can be viewed either in a graphical format or in a list format using a switch option.

![]() : Click this icon to search the transactions that are performed on a particular

date.

: Click this icon to search the transactions that are performed on a particular

date.

A date range ( From Date and To Date) can be provided to search the transaction. Each module showcases the number of transactions belonging in each of the following statuses:

- Initiated: The number of transactions that have been initiated but approval workflow is not assigned.

- Pending Approval: The number of transactions that have been initiated, but are pending for approval.

- Locked : The number of transactions that have been locked by the approver

- Pending Modification: The number of transactions that have been sent for modification by the approver to the initiator.

- Approved: The number of transactions that have been approved.

- Rejected: The number of transactions that have been rejected by the approver.

- Expired: The number of transactions that have been that have been initiated but expired.

- Released: The number of transactions that have been released by the releaser.

- Pending Release: The number of transactions that are pending for release by the releaser.

- Release Rejected: The number of transactions that have been rejected by the releaser.

Figure 5-4 Transactions - My Initiated List

For more information, refer section My Initiated List under Approval chapter.

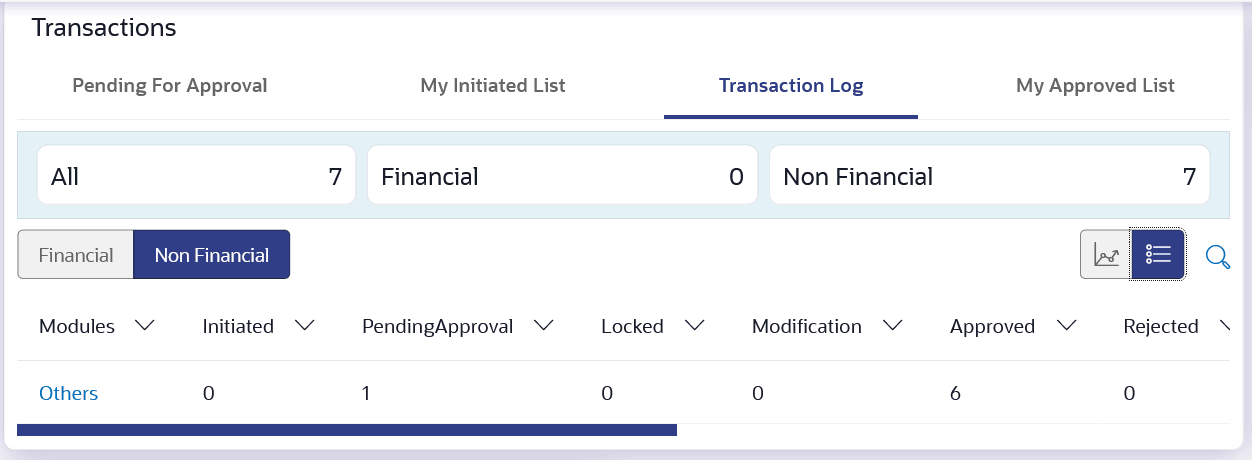

3) Transaction Log

Displays the list of all the different type of transactions like account financial, account non-financial, bulk file, bulk record, payee, biller and payments transactions.

It is divided into two categories broadly; Financial and Non-Financial. The logged in user can view the transaction summary with respective statuses and details.

The details can be viewed either in a graphical format or in a list format using a switch option.

On selecting either the Financial or the Non-Financial option, the modules under the particular option are displayed. Click the Module link to view the list of transactions in it.

Each module showcases the number of transactions present in each of the following statuses:

- Initiated: The number of transactions that have been initiated but approval workflow is not assigned.

- Pending Approval: The number of transactions that have been initiated, but are pending for approval.

- Locked : The number of transactions that have been locked by the approver

- Pending Modification: The number of transactions that have been sent for modification by the approver to the initiator.

- Approved: The number of transactions that have been approved.

- Rejected: The number of transactions that have been rejected by the approver.

- Expired: The number of transactions that have been that have been initiated but expired.

- Released: The number of transactions that have been released by the releaser.

- Pending Release: The number of transactions that are pending for release by the releaser.

- Release Rejected: The number of transactions that have been rejected by the releaser.

![]() : Click this icon to search the transactions that are performed on a particular

date. A date range ( From Date and To

Date) can be provided to search the transaction.

: Click this icon to search the transactions that are performed on a particular

date. A date range ( From Date and To

Date) can be provided to search the transaction.

Financial : On clicking the module name link, the following details are displayed for each category:

- Accounts - The details of transaction log are:

- Date: Date of the transaction

- Description: Description of the transaction

- Account Number: Account number of the transaction

- Amount: Amount of the transaction

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Non Accounts - The details of the activity log are:

- Date: Date of the transaction

- Description: Description of the transaction

- Amount : Amount of the transaction

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Payments

- Date: Date of the transaction

- Description: Description of the transaction

- From Account: Source Account number of the transaction

- Amount : Amount of the transaction

- Payee Account Details: Payee’s account number of the transaction

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bill Payments

- Date: Date of the transaction

- Description: Description of the transaction

- Biller Name: Name of the biller

- Biller Location: Location of the biller

- Details: Details of bill payment

- From Account: Source Account number of the transaction

- Amount : Amount of the transaction

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bulk File

- Date: Date of the transaction

- Description: Description of the transaction

- Transaction Type: Transaction types of the file upload

- File Name: Name of the file uploaded.

- File Amount: Amount to be debited from debit account.

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bulk Record

- Date: Date of the transaction

- Transaction Type: Transaction type of the bulk record

- Debit Account: Account number of the account to be debited.

- Amount: Amount to be debited from debit account

- Payee Account Details: Payee’s account number

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Non Account Bulk Record

- Date: Date of the transaction

- Transaction Type: Transaction type of the bulk record

- Amount: Amount of the transaction

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

Non- Financial: This displays the non- financial transactions initiated by the maker and further categorized as below:

- Accounts

- Date: Date of the transaction

- Description: Description of the transaction

- Account Number: Account number of the transaction

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Payee and Biller

- Date: Date of the transaction

- Payee/ Biller Name: Payee/ Biller name

- Payee Type: Type of the payee

- Category: Payee Category

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bulk File

- Date: Date of the transaction

- File Identifier: Unique code assigned to the uploaded file.

- Transaction Type: Transaction type of the file upload

- File Name: Name of the file uploaded.

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Bulk Record

- Date: Date of the transaction

- File Identifier: Unique code assigned to the record.

- Transaction Type: Transaction type of the bulk record

- Description: Description of the transaction

- Reference Number: Reference Number of the record.

- Status: Status of the record

- Trade Finance

- Date: Date of the transaction

- Description: Description of the transaction

- Beneficiary Name: Name of the Beneficiary against whom LC is to be created

- Amount: Amount for the Letter of Credit / Bill

- Reference Number: Reference Number of the transaction.

- Status: Status of the transaction

- Forex Deal

- Date: Date of the transaction

- Reference Number: Reference Number of the transaction.

- Description: Description of the transaction

- Deal Type: Type of Deal user wants to initiate that is Spot or Forward

- Currency Combination: List of permissible currency combination for deal booking

- Amount: Amount for the booked forex deal

- Status: Status of the transaction

- Others

- Date: Date of the transaction

- Initiated By: User who has initiated the transaction

- Transaction Type: Type of the transaction initiated

- Description: Description of the transaction

- Reference Number: Reference Number of the transaction

- Status: Status of the transaction

- Liquidity Management

- Date: Date of the transaction

- Transaction Type: Type of the transaction initiated

- Structure ID: Structure ID of the transaction

- Structure Description: Description of the transaction

- Reference Number: Reference Number of the transaction

- Status: Status of the transaction

For more information, refer section Transaction Log under Approval chapter.

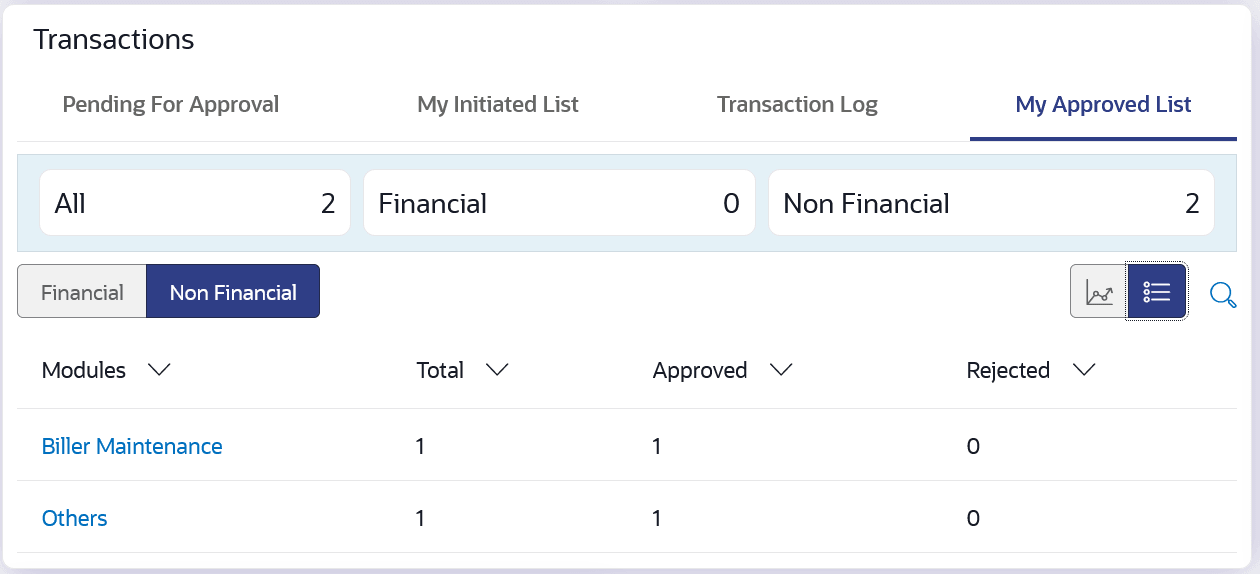

4) My Approved List

This section displays the details of transactions that are approved by the approver user. It is classified into two broad categories; Financial and Non-Financial. Click each tab to view the snapshot of transactions already approved.

The logged in user can view the transaction summary with respective statuses and details. The details can be viewed either in a graphical format or in a list format using a switch option.

On selecting either the Financial or the Non-Financial transaction options, the modules under the particular option are displayed. In the list view, on clicking the module name link, the transaction details within the module can be viewed.

![]() : Click this icon to search the transactions that are approved on a particular

date. . A date range ( From Date and To

Date) can be provided to search the transaction.

: Click this icon to search the transactions that are approved on a particular

date. . A date range ( From Date and To

Date) can be provided to search the transaction.

Figure 5-6 Transactions - My Approved List

For more information, refer section My Approved List under Approval chapter.

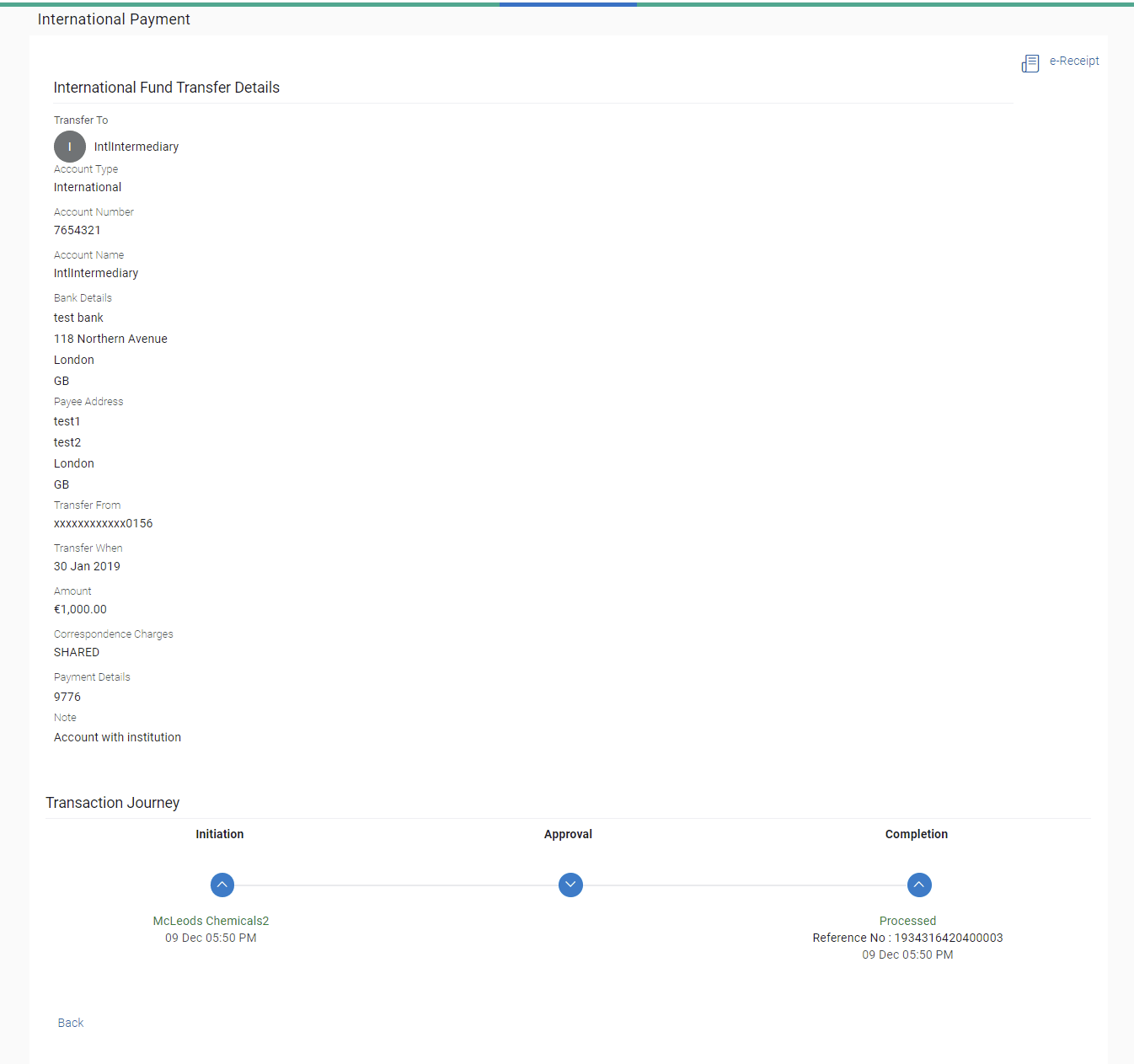

Transaction Journey

Click the reference number link on the description of activity log to view the Transaction Journey

This screen displays the transaction details and transaction journey of a transaction, and the current status of transaction whether it is Initiated, Approved, Locked, Modification Requested or Processed.

When the user selects a transaction in Initiated status, an option to assign approval workflow is available. Click on Assign, and select the approval workflow from the resolved workflows for the Initiated transaction, where transaction approval workflow is not assigned.

Review

The section displays the details of the transaction.

Transaction Journey

This section displays the status of transactions. Transaction journey displays the status as:

- Initiation

- Approval

- Completion

- Request Modification

- Locked

- Click Back to navigate to the

Dashboard.

OR

Click e-Receipt to generate the e-receipt of the transaction.

- Conventional/Islamic Accounts

This topic describes the Conventional & Islamic accounts functionality.

Parent topic: Dashboard