1 Security Management

This topic explains how to define and maintain the security of the banking system in terms of user access and roles.

Table 1-1 Security Management Parameters

| Security Management Parameters | Description |

|---|---|

| Only Authorized Users Access the System | First, only authorized users can access the system with the help of a unique User ID and a password. Secondly, a user should have access rights to execute a function. |

| User Profiles | The user profile of a user contains the User ID, Password, and Functions to which the user has access. |

| Restricted Number of Unsuccessful Attempts | Define the maximum number of unsuccessful attempts after which a User ID should be disabled. When a User ID has been disabled, the administrator should enable it. The password of a user can be made applicable only for a fixed period. This forces the user to change the password at regular intervals thus reducing security risks. Further, define passwords that could be commonly used by a user as Restrictive Passwords at the user, user role, and bank level. A user cannot use any password that is listed as a Restrictive Password at any of these levels. |

| Restricted Access to Branches | Indicate the branches from where a user can operate in the Restricted Access screen. |

| All Activities Tracked | An extensive log is kept of all the activities on the system. The user can generate reports on the usage of the system anytime. These reports give details of unsuccessful attempts at accessing the system along with the nature of these attempts. It could be an invalid password attempt, the last login time of a user, etc. |

| Audit Trail | Whenever a record is saved in the module, the ID of the user who saved the record is displayed in the Input By field at the bottom of the screen. The date and time at which the record is saved are displayed in the Date/Time field. A record that is entered should be authorized by a user, bearing a different login ID, before the EOD is run. Once the record is authorized, the ID of the user who authorized the record will be displayed in the Authorized By field. The date and time at which the record was authorized are displayed in the Date/Time field positioned next to the Authorized By field. The number of modifications that have happened to the record is stored in the field Modification Number. The status of the record whether it is Open or Closed is also recorded in the Open check box. |

Bank Level Parameter Setup

Bank Restriction

Refer to the topic unresolvable-reference.html#GUID-0529571F-0661-4222-BEAD-176E9E31D508 for detailed information.

User Details Modification in Bulk

Refer to the topic unresolvable-reference.html#GUID-EB4FFD47-8DC1-46C7-B29B-347F1B027641 for detailed information.

Common Branch Restrictions

Refer to the topic unresolvable-reference.html#GUID-591E3E80-4310-43D5-B1D8-BE308CCBFA57 for detailed information.

Function Maintenance

Defining Password Restriction

Refer to the topic unresolvable-reference.html#GUID-D1BFF28F-1FE5-4E78-8489-70E6F45EF079 for detailed information.

User Role Maintenance

- unresolvable-reference.html#GUID-C4E7A5A2-8332-4D3B-8F4F-CE0AD4BA538B

- unresolvable-reference.html#GUID-B5A46C1F-3A0C-4FA1-80D8-A9B41760A20C

- unresolvable-reference.html#GUID-E0834A10-845E-4BA6-B2A3-39659FCEAD36

- unresolvable-reference.html#GUID-F142E2A4-3446-4118-8265-C949C5E2CCC2

- unresolvable-reference.html#GUID-9B7F8B34-BDB7-40D1-995B-2967C0E88443

- unresolvable-reference.html#GUID-BDD9829C-2EFD-4A47-83B0-1C26C7CCF5F6

- unresolvable-reference.html#GUID-D1F0A163-90E4-4636-9FC1-911FC774FE6E

- unresolvable-reference.html#GUID-112B9F40-3AB0-402A-9F3C-0B94E79C6ED8

- unresolvable-reference.html#GUID-416E7A1A-E0BF-4DD3-91DB-EF9AAD6A4070

- unresolvable-reference.html#GUID-2C397448-0031-4BF9-A58D-BDA7FC75BDB1

User Holidays Maintenance

User Creation

User Profile Entitlements

- unresolvable-reference.html#GUID-2564DB05-5FC5-4B96-9DBF-A24EDA7EE92E

- unresolvable-reference.html#GUID-82E18AC1-37FC-4609-9A8D-D35DBF811DBE

- unresolvable-reference.html#GUID-95A7151F-C9C4-4CFC-BF0D-1CCDD834E619

- unresolvable-reference.html#GUID-1552CE8F-0005-485A-86D4-8F526CA2E8B0

- unresolvable-reference.html#GUID-719E7C72-9A88-482D-A9D1-3CF930F8EC65

- unresolvable-reference.html#GUID-0D73050D-33EB-4CD8-8A82-328EA8716DBF

- unresolvable-reference.html#GUID-E91B7605-3A6E-4B2A-B91B-0B828A051EB5

- unresolvable-reference.html#GUID-ECA2264D-E3BB-47D8-9D57-FF0018863504

- unresolvable-reference.html#GUID-B4A42FBA-B97C-4F18-BFE5-E9528E4AD0EE

- unresolvable-reference.html#GUID-F02046EC-9DD0-43A2-9A6E-87DED5477E58

- unresolvable-reference.html#GUID-242225F8-64E8-4D68-B3C8-6A2A2ECD8C45

Customer Access Group Maintenance

Refer to the topic unresolvable-reference.html#GUID-9FA6AC0C-B7B1-4147-A6E0-2F705C7CCF7A for detailed information.

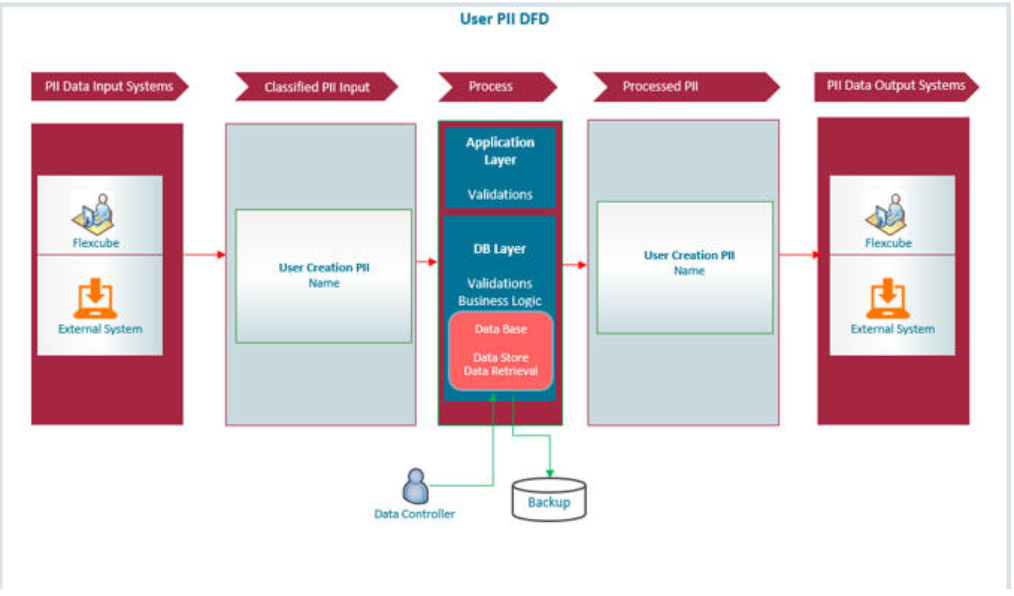

Personally Identifiable Information

Personally Identifiable Information (PII) is information that can be used on its own to identify a person. Any information that is used to distinguish one person from another can be personally identifiable information. It can be any information like Name, Contact Details, Demography Information, Financial Information, SSN, Passport Number, etc. Oracle FLEXCUBE Universal Banking allows masking, forgetting or restricting access to Personally Identifiable Information of a user. It is possible to mask or forget the PII based on the maintenance in Masking Maintenance and Forget Customer PII Maintenance screens.

Figure 1-1 Personally Identifiable Information (PII)

Description of "Figure 1-1 Personally Identifiable Information (PII)"

Table 1-2 Personally Identifiable Information (PII)

| User Personal Information Category | Personal Information Data |

|---|---|

| Customer Name | User Name |

Mask Maintenance

Refer to the topic unresolvable-reference.html#GUID-3712D5BD-4780-4B7A-A088-BFFE0FF4F901 for detailed information.

Forget Customer

- STDCIFCR (External Customer Input)

- STDCRACC (External Customer Account Input)

However, while viewing the details of a customer whose data is forgotten, the system displays a message that says the details of the forgotten customer can’t be viewed.

Log Access

Refer to the topic unresolvable-reference.html#GUID-C7C7F99C-2BBE-42A0-8894-FF7EBD6521C8 for detailed information.

Department Details

Refer to the topic unresolvable-reference.html#GUID-ACD05D79-6297-4F94-B5F4-4E6039A5B63C for detailed information.

Process Codes

Refer to the topic unresolvable-reference.html#GUID-F57FB17F-86BA-49F1-9C3E-08C77F1EE50B for detailed information.

Single Sign On (SSO) Enabled Environment

Refer to the topic unresolvable-reference.html#GUID-B5E38A96-DD02-4607-B062-DAA3143F60A0 for detailed information.

Defining Entity Maintenance

Refer to the topic unresolvable-reference.html#GUID-900EEE9F-40B3-4D82-8C3F-716C56ED94EA for detailed information on entity maintenance.

- Maintain SMS Banks Parameters

This topic explains systematic instructions to maintain SMS bank parameters. - Maintain Password Restriction Details in SMS Banks Parameters

This topic explains systematic instructions to process password restrictions. - Maintain Bank Restriction

This topic explains systematic instructions to maintain bank restrictions. - Maintain User Credential Change Details

This topic explains systematic instructions to process the User Credentials Change screen. - Maintain Branch Restrictions

This topic explains systematic instructions to maintain the branch restrictions. - Maintain Function Description

This topic explains systematic instructions to maintain function descriptions. - Define Menu

This topic describes the process of defining the main and sub-menus for the Oracle FLEXCUBE Universal Banking. - Define Password Restriction

This topic explains systematic instructions to define password restrictions. - Maintain Roles

This topic explains systematic instructions to maintain the role profiles. - Process Role Maintenance Details

This topic explains systematic instructions to process role maintenance details. - Maintain Report Details for Role

This topic provides systematic instructions to maintain report details in the Role Maintenance screen. - Maintain Batch Details for Role

This topic provides systematic instructions to maintain batch details in the Role Maintenance screen. - Maintain Online Details for Role

This topic provides systematic instructions to maintain online details in the Role Maintenance screen. - Maintain Access Rights for Role

This topic explains systematic instructions to maintain access stage rights for the function ID. - Maintain Account Class Restrictions for Role

This topic explains systematic instructions to maintain account class restrictions. - Maintain Branch Restriction Details for Role

This topic explains systematic instructions to maintain branch restrictions for the role profile. - Maintain Rights for Role

This topic explains systematic instructions to process the necessary rights to perform various operations in respect of incoming and outgoing messages. - Define Roles for Oracle FLEXCUBE Universal Banking Branch Users

This topic explains systematic instructions to define roles for Oracle FLEXCUBE Universal Banking branch users. - Maintain User Holidays

This topic explains systematic instructions to maintain user holidays. - Process User Holiday Summary

This topic explains systematic instructions to process user holiday summary details. - Maintain Users

This topic explains systematic instructions to create user profiles. - Maintain Roles for Users

This topic explains systematic instructions to attach a user profile to a role in the Roles screen. - Maintain Rights for Users

This topic explains systematic instructions to maintain rights in the User Maintenance screen. - Maintain Functions for Users

This topic explains systematic instructions to maintain functions in the User Maintenance screen. - Maintain Account Class Restrictions for Users

This topic explains systematic instructions to specify account class restrictions. - Maintain Branch Details for Users

This topic explains systematic instructions to maintain branch details in the User Maintenance screen. - Maintain Product Restrictions for Users

This topic explains systematic instructions to maintain product details in the User Maintenance screen. - Maintain Disallowed Functions for Users

This topic explains systematic instructions to maintain disallowed functions in the User Maintenance screen. - Maintain Centralized Role Details for Users

This topic explains systematic instructions to maintain centralized role details in the User Maintenance screen. - Maintain Dashboard Mapping Details for Users

This topic explains systematic instructions to maintain dashboard mapping details in the User Maintenance screen. - Maintain Access Group Restrictions for Users

This topic explains systematic instructions to maintain the access group restrictions in the User Maintenance screen. - Maintain Customer Access Group

This topic explains systematic instructions to maintain customer access groups for retail and corporate customers. - Maintain Masking Details

This topic explains systematic instructions to maintain masking details. - Maintain Forget Customer Personal Identifiable Information (PII)

This topic explains systematic instructions to maintain the Forget Customer PII Maintenance screen. - Forget Customer Process

This topic explains systematic instructions to forget the specific customer. - Log Access

This topic describes an overview of the different logs and their access. - Maintain Department Details

This topic explains systematic instructions to maintain department details. - Maintain Process Codes

This topic explains systematic instructions to maintain process codes. - Single Sign On Enabled Environment

This topic describes an overview of the Single Sign On enabled environment. - Maintain Entities

This topic explains systematic instructions to maintain entities.