The C&C Monitors

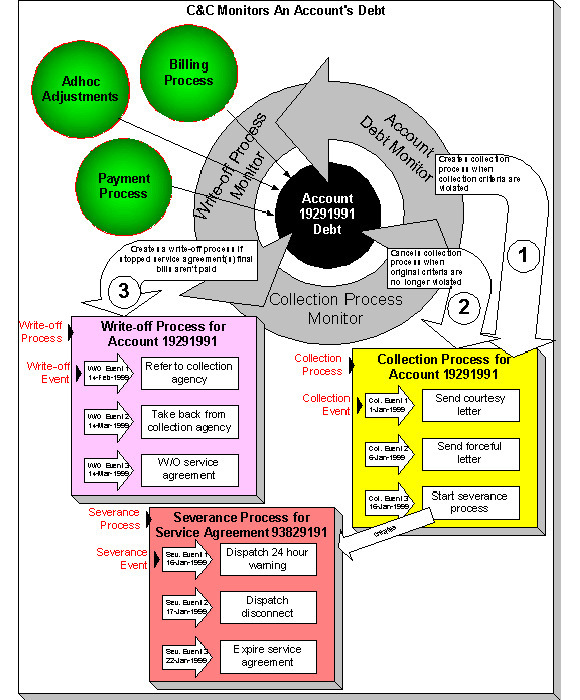

Your collection and write-off criteria described in the previous section exist to support the processes that manage the collection activities. The following diagram illustrates, at a high level, the major processes that manage the collection of overdue debt:

| Statements | Meaning |

|---|---|

| Bills, payments and adjustments affect an account's debt | An account's debt is the accumulation of all bills, payments and adjustments. |

| The Account Debt Monitor creates a collection process when an account violates collection criteria | Periodically, a background process referred to as the Account Debt Monitor (ADM and ADM2) determines if an account's debt violates your collection criteria. If so, a collection process is created using the violated criteria's collection process template. Refer to When Is An Account's Debt Monitored? for a description of when an account's debt is compared against collection criteria. |

| A collection process contains one or more collection events | The collection process contains a series of collection events. These events correspond with the collection event types associated with the collection process template. The initial collection events are typically letters. |

| The Collection Process Monitor cancels a collection process when warranted | The Collection Process Monitor cancels a collection process when its contracts satisfy your cancellation criteria (e.g., when the contracts have less than $10 of debt older than 20 days). Refer to How Are Collection Processes Cancelled for more information about the cancellation process. |

| The Write-Off Monitor creates a write off process to collect stopped, unpaid debt |

The Write-Off Monitor reviews stopped and reactivated contracts after their closing bill's due date (plus grace period). The Write-Off Monitor attempts to reduce the contract's debt to zero using all of the following methods:

If the system is unsuccessful in reducing the account's debt to zero, a write-off process will be created using the appropriate write-off process template. Refer to The Big Picture Of Write Off Processing for more information about the write-off process. |

| A write-off process contains one or more write-off events | The write-off process contains a series of write-off events. These events correspond with the write-off event types associated with the write-off process template. The initial write-off events are typically collection agency referrals and/or letters. If payment is not received as a result of such efforts, the last write-off event typically writes off the customer's debt. |

| The system cancels a write-off process when warranted | The system cancels a write-off process when its contracts no longer have debt (i.e., they become closed). |

| Another write-off process will be created if a closed contract ever reactivates | If a contract becomes reactivated (e.g., because the final payment bounces), the contract will be processed by the Write-Off Monitor and the whole write-off process starts again. |

Note:

Checkpoint. At this point, you should be familiar

with the concept that a collection process will be created for an

account that violates collection criteria. The collection process

consists of a series of events that typically generate letters and

/ or To Do entries. If the customer doesn't pay the final bill, a

write-off process will be created for each type of unpaid debt. The

write-off process consists of a series of events that ultimately result

in the write-off of the customer's debt. When debt is written-off,

the system creates a write-off contract and transfers the outstanding

debt to it. This means the debt stays with the account for life (because

the write-off contract is linked to the account) and will have to

be paid off if the customer ever returns.